Preview text:

2015-2024 FDI OUTFLOW FROM SOUTH KOREA AND

LESSONS FOR VIETNAM INTERNATIONAL ECONOMICS

Assos. Prof. TS. Nguyễn Thường Lạng Student: Nguyễn Tuyết Nhi CONTENTS

1. Theoretical Framework

5. South Korea’s Outward of FDI

Foreign Direct Investment 2. Impacts of FDI (OFDI) 6. Overview of South

3. Overview of South Korea’s Korean FDI in Vietnam (2015–2024)

7. Policy Implications and

4. South Korea’s Outward Recommendations for FDI Policy Korean FDI in Vietnam

Assos. Prof. TS. Nguyễn Thường Lạng Student: Nguyễn Tuyết Nhi

1. THEORETICAL FRAMEWORK OF FDI Concept of FDI

FDI is a form of investment where foreign investors directly

participate in management and operation of business

activities in the host country.

It aims to create tangible and intangible assets, enhance

production capacity, generate employment, and promote

long-term economic development.

FDI includes inward FDI (into a country) and outward FDI (from a country).

Assos. Prof. TS. Nguyễn Thường Lạng Student: Nguyễn Tuyết Nhi

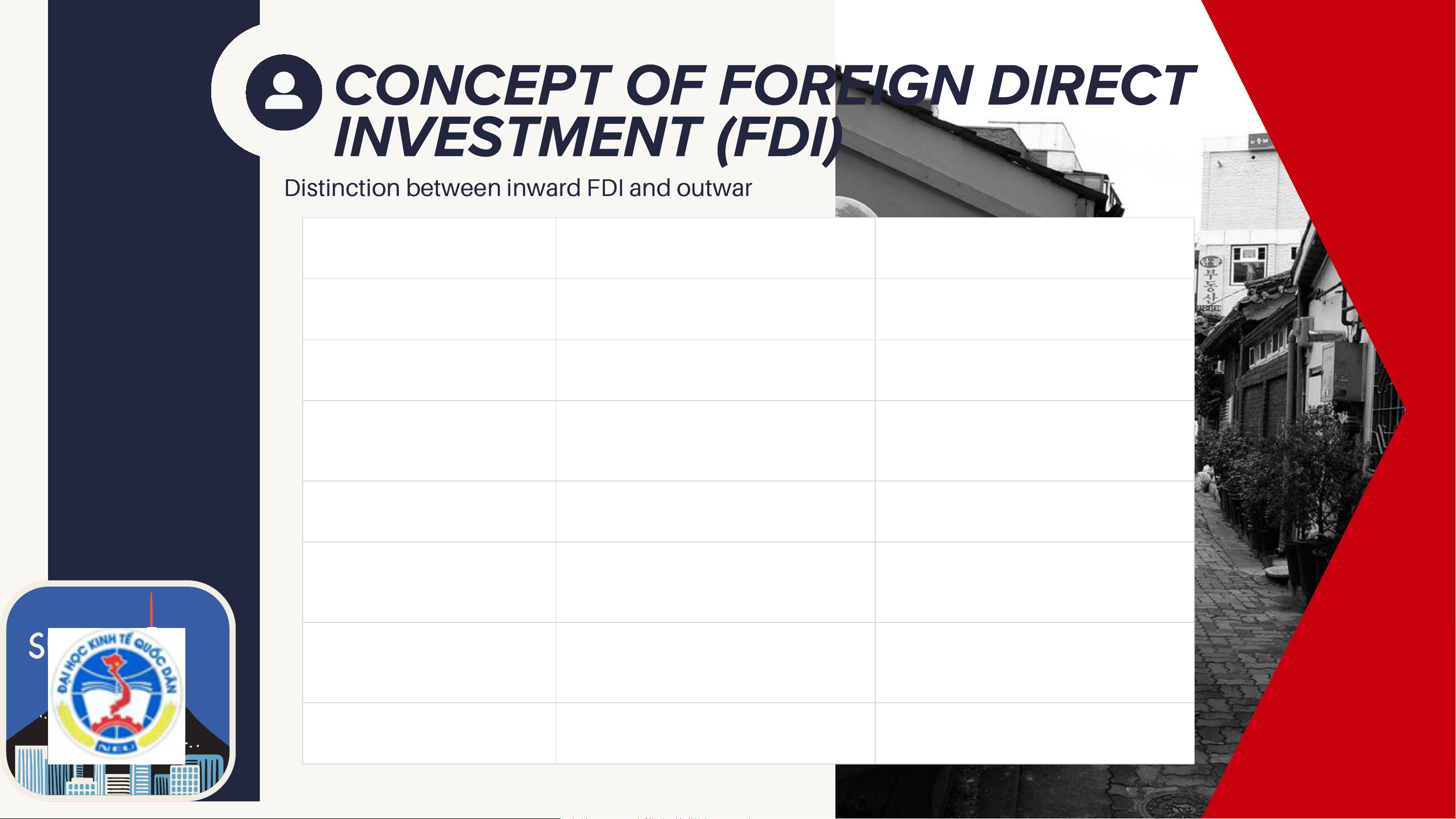

CONCEPT OF FOREIGN DIRECT INVESTMENT (FDI)

Distinction between inward FDI and outward FDI Aspect Inward FDI Outward FDI Definition

Foreign direct investment entering Foreign direct investment made by a country domestic firms abroad Perspective

Viewed from the host country

Viewed from the home country

Attract capital, technology, jobs,

Expand markets, reduce costs, Main Objective

and management expertise

access resources, and enhance global competitiveness Key Actors

Foreign investors operating in the

Domestic firms investing in domestic economy overseas markets

Boosts domestic production,

Supports firm internationalization Economic Impact

exports, employment, and

and global value chain integration industrial development

Investment incentives, regulatory

Financial support, investment Typical Policy Focus

facilitation, infrastructure

promotion, risk insurance, and tax development incentives

Example (Vietnam–Korea)

Korean firms investing in Vietnam’s Korean firms investing in the U.S., manufacturing sector Vietnam, and Europe

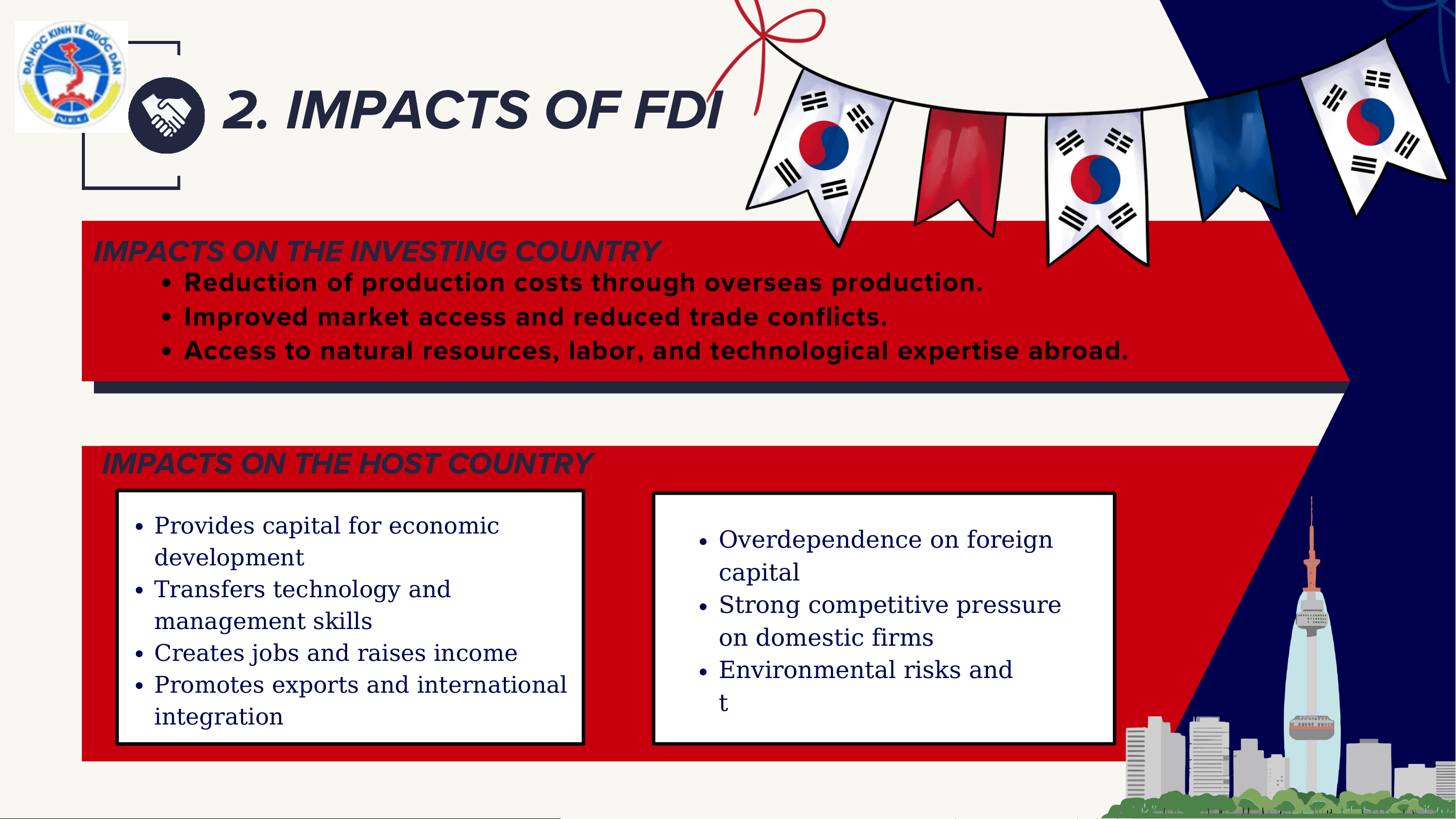

2. IMPACTS OF FDI

IMPACTS ON THE INVESTING COUNTRY

Reduction of production costs through overseas production.

Improved market access and reduced trade conflicts.

Access to natural resources, labor, and technological expertise abroad.

IMPACTS ON THE HOST COUNTRY Provides capital for economic Overdependence on foreign development capital Transfers technology and Strong competitive pressure management skills on domestic firms Creates jobs and raises income Environmental risks and

Promotes exports and international transfer pricing practices integration

Assos. Prof. TS. Nguyễn Thường Lạng Student: Nguyễn Tuyết Nhi 3. OVERVIEW OF SOUTH KOREA’S ECONOMY (2015– 2024) `

Assos. Prof. TS. Nguyễn Thường Lạng Student: Nguyễn Tuyết Nhi

Source: MINISTRY OF ECONOMY AND FINANCE

CHAPTER II: KOREA’S OUTWARD FDI AND `

KOREAN FDI IN VIETNAM (2015–2024)

1. South Korea’s Outward Foreign Direct Investment (OFDI)

1. SOUTH KOREA’S OUTWARD FOREIGN

DIRECT INVESTMENT (OFDI) v

Source: MINISTRY OF ECONOMY AND FINANCE

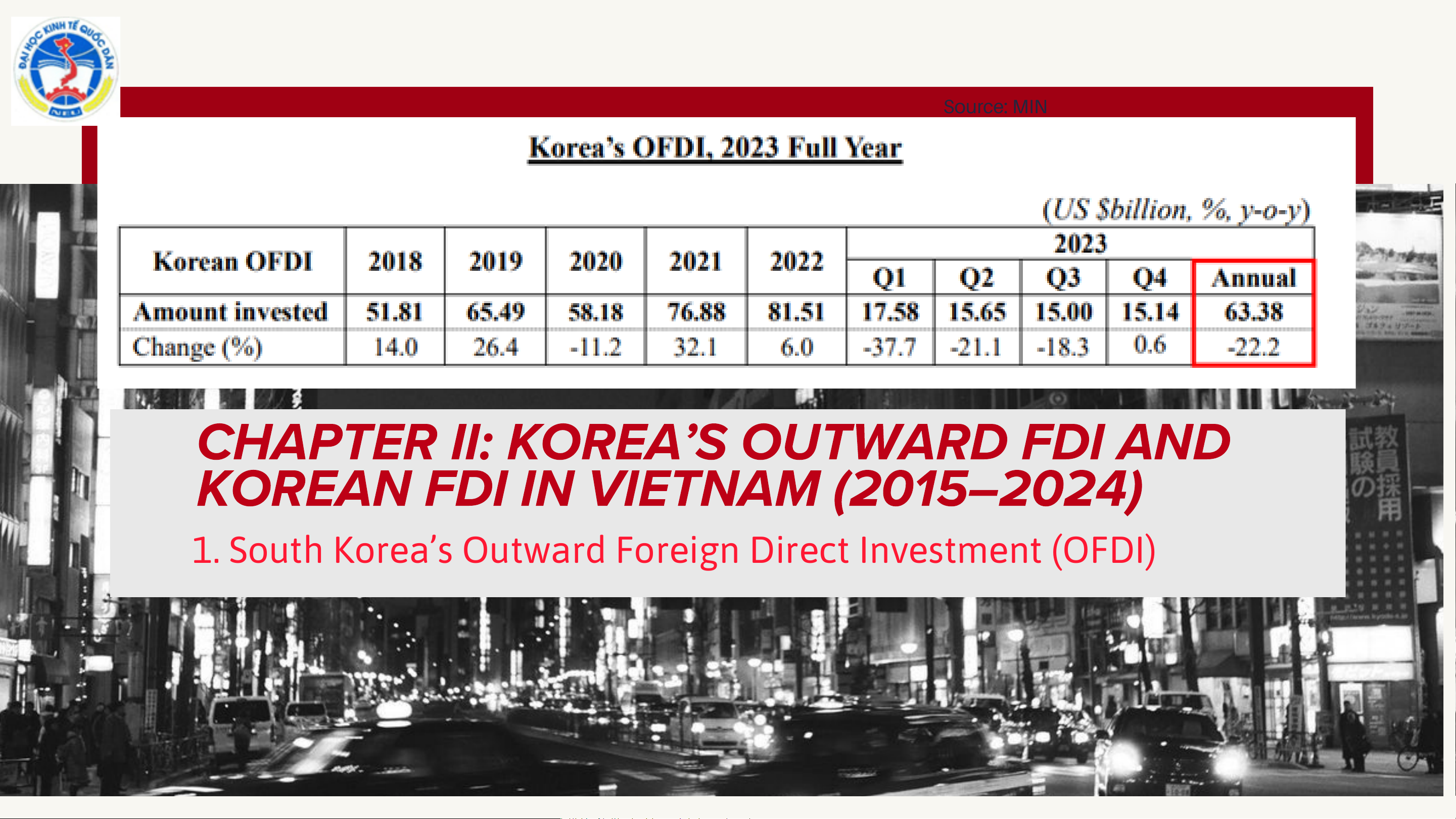

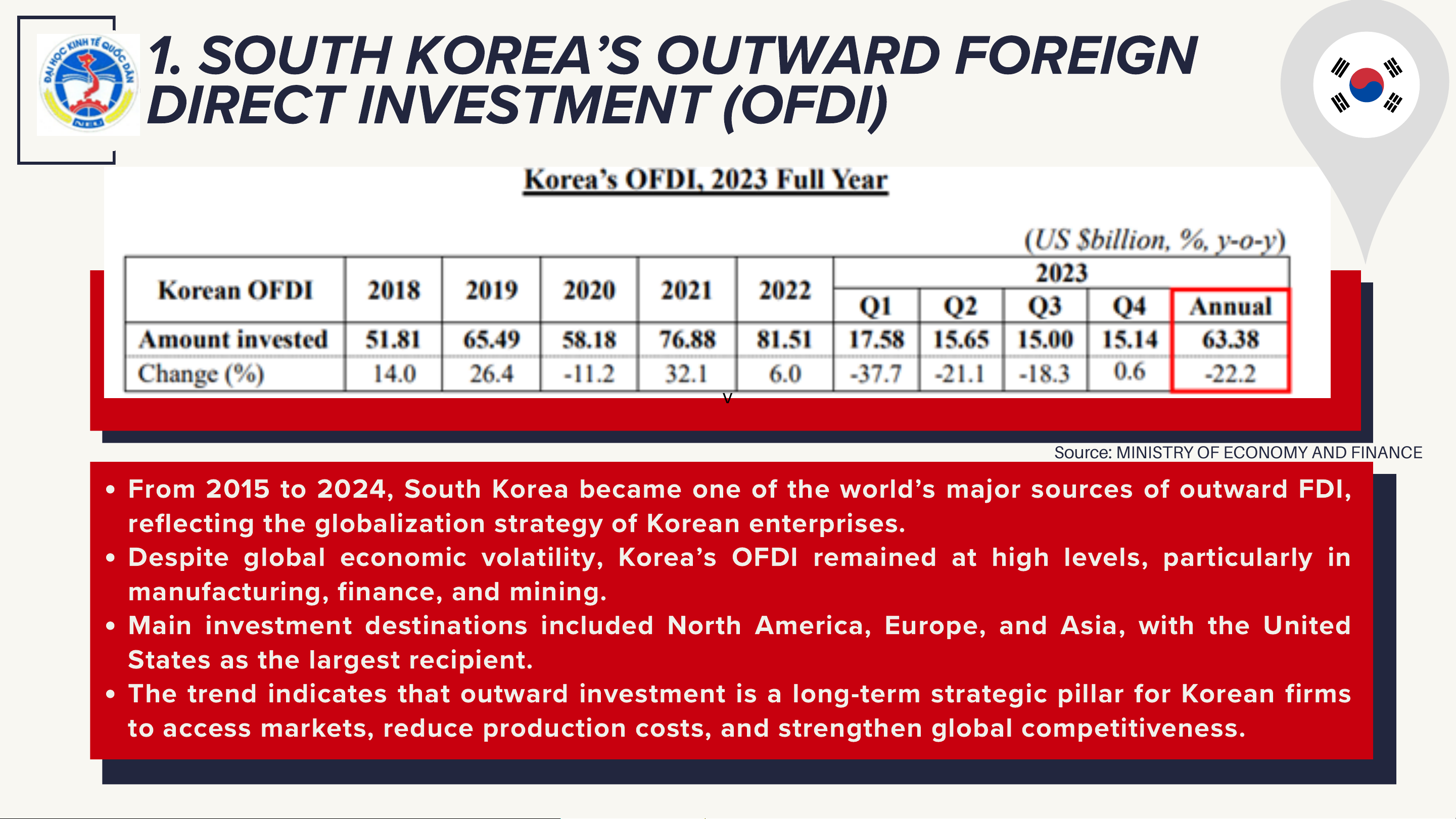

From 2015 to 2024, South Korea became one of the world’s major sources of outward FDI,

reflecting the globalization strategy of Korean enterprises.

Despite global economic volatility, Korea’s OFDI remained at high levels, particularly in

manufacturing, finance, and mining.

Main investment destinations included North America, Europe, and Asia, with the United

States as the largest recipient.

The trend indicates that outward investment is a long-term strategic pillar for Korean firms

to access markets, reduce production costs, and strengthen global competitiveness.

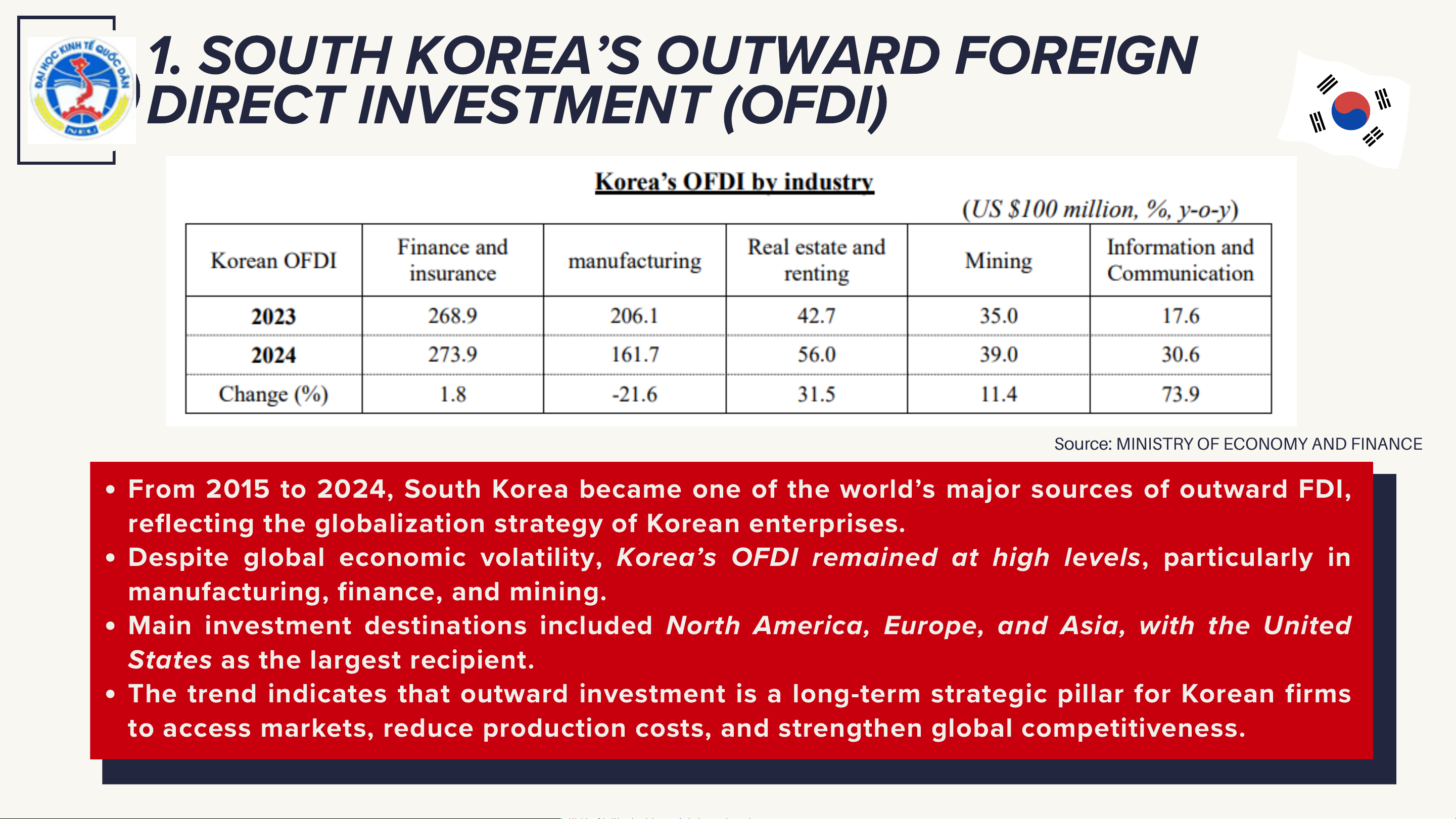

1. SOUTH KOREA’S OUTWARD FOREIGN

DIRECT INVESTMENT (OFDI)

Source: MINISTRY OF ECONOMY AND FINANCE

From 2015 to 2024, South Korea became one of the world’s major sources of outward FDI,

reflecting the globalization strategy of Korean enterprises.

Despite global economic volatility, Korea’s OFDI remained at high levels, particularly in

manufacturing, finance, and mining.

Main investment destinations included North America, Europe, and Asia, with the United

States as the largest recipient.

The trend indicates that outward investment is a long-term strategic pillar for Korean firms

to access markets, reduce production costs, and strengthen global competitiveness.

2.Foreign Direct Investment into Vietnam

FDI inflows in 2024: Total newly registered, adjusted, and

contributed foreign investment capital amounted to USD 38.23

billion, reflecting a 3% decline compared with 2023.

FDI disbursement: Implemented FDI capital reached USD 25.35

billion, representing a 9.4% year-on-year increase, indicating

improved investment implementation efficiency.

Cumulative FDI performance: By the end of 2024, Vietnam had

attracted approximately 42,002 FDI projects, with total registered

capital of USD 502.8 billion and implemented capital of USD 322.5 billion.

South Korea remained the largest foreign investor in Vietnam, with

cumulative registered capital exceeding USD 92 billion, accounting for

17.9% of total accumulated FDI. Korean investments are largely large-scale

projects concentrated in manufacturing and processing industries.

Major investment partners in 2024: Investors from 114 countries and

territories were present in Vietnam. Singapore ranked first with USD 10.21

billion , followed by South Korea with USD 7.06 billion, and then China, Hong Kong (China), and Japan.

Project structure: China led in the number of newly registered projects, while

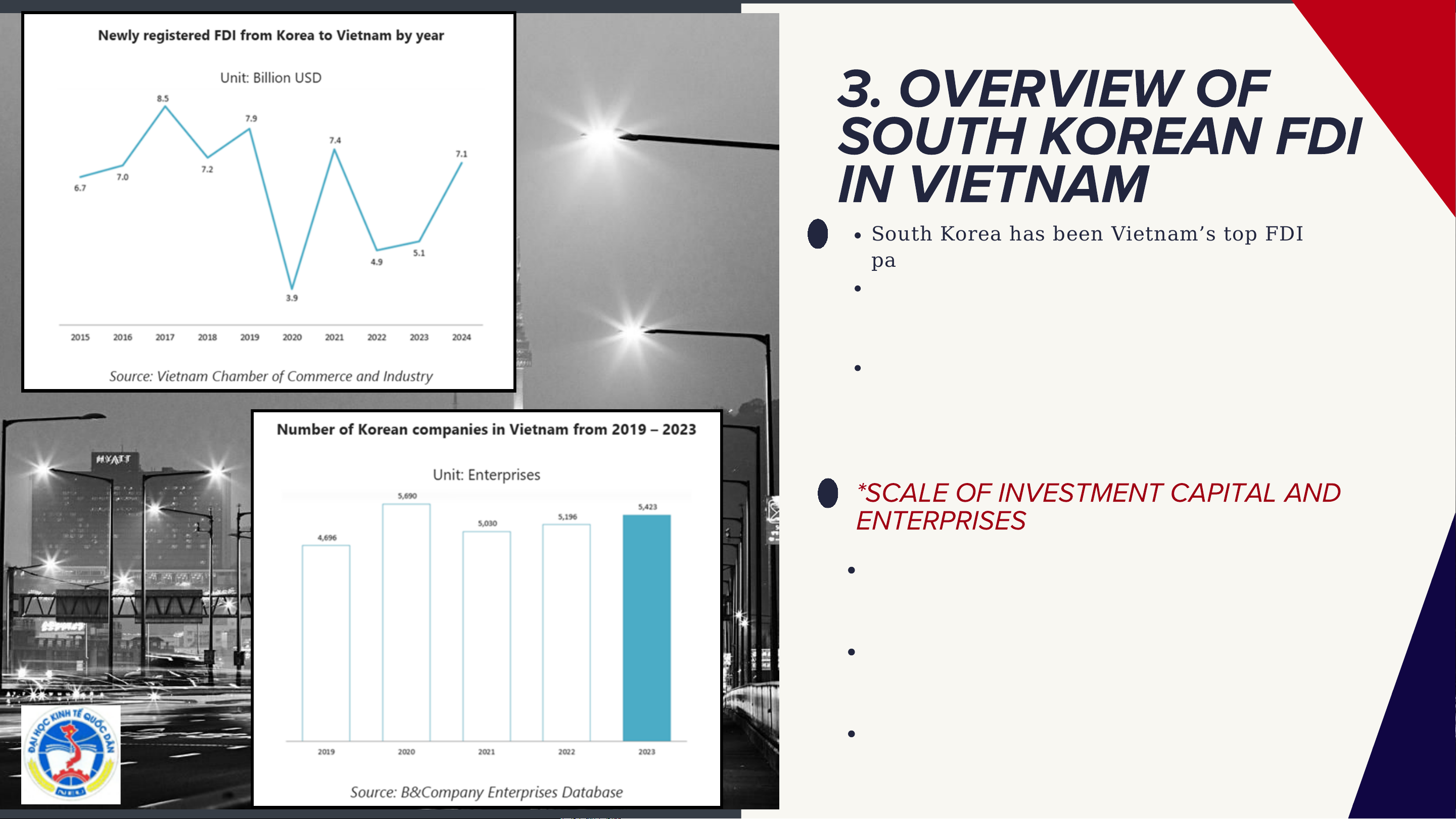

South Korea ranked first in capital adjustments and capital contributions and share acquisitions. 3. OVERVIEW OF SOUTH KOREAN FDI IN VIETNAM

South Korea has been Vietnam’s top FDI partner since the mid-2010s.

New Korean FDI declined in 2020 due to

COVID-19 but recovered strongly from 2022 onward.

In 2024, newly registered Korean FDI

reached USD 7.06 billion, increasing 37.5% year-on-year. `

*SCALE OF INVESTMENT CAPITAL AND ENTERPRISES

Korean FDI stock (2024): ~USD 92 billion

(≈18% of total FDI), making Korea Vietnam’s largest investor

Trend since 2015: New FDI fluctuated, with

a sharp drop in 2020 (≈USD 4 billion) due to COVID-19

Recovery phase: From 2022, Korean FDI

rebounded strongly, reaching ~USD 7

billion in 2024 (CAGR ≈ 20%) South Korea from Investing FDI in Vietnam Enhanced Economic Efficiency and Benefits for Market Expansion Strengthening Competitiveness within Global South Korea Lower labor and Value Chains Technology and production costs Management enhance firm- Major Spillover Effects level efficiency conglomerates (at the Regional (Samsung, LG, Level) Vietnam serves as a strategic Hyundai) export base to strengthen ASEAN and global competitiveness Diffusion of management markets through offshore production hubs practices and Reduced exposure production to trade and standards geopolitical risks within regional through production networks diversification

Risk of Reduced Domestic Investment

01 Partial relocation of capital and production capacity abroad

Dependence on External Investment Environments Risks and

02 Increased exposure to Vietnam’s

regulatory, labor, and policy environment Costs for South Korea Risks Associated with

Globalization and Trade Conflicts

Vulnerability to tariffs and international

03 trade disputes affecting exports from Vietnam Benefits for Vietnam

Economic Growth and Export Expansion

Largest FDI partner: Over USD 92 bil ion in from

cumulative FDI (~18% of total FDI stock)

Growth and exports: Strong contribution to

01 manufacturing, GDP growth, and exports Receiving FDI Industrial upgrading: Expansion of

processing and manufacturing industries from South

Job Creation and Human Capital Development Korea

Employment creation: Over 1 mil ion jobs 02 generated

Human capital development: Exposure

to international standards and modern skil s

Industrial Spillovers and

Structural Transformation

03 Value chain integration: Deeper

participation in global value chains Limitations and Costs for Vietnam Low Domestic Dependence on a Value Added Limited Number of Large Corporations Concentration in assembly rather Heavy dependence than R&D and on large innovation conglomerates (e.g., Samsung) Environmental Regional and Labor Development Pressures DisparitiesFern andes Rising FDI concentration environmental in developed risks and job- regions widens quality concerns regional gaps

Cost-based investment structure:

Korean firms mainly use Vietnam for large-scale, export-oriented 01

manufacturing, while R&D and high-

tech activities remain concentrated in advanced economies. Causes of

Institutional and policy constraints:

Incentive frameworks favor manufacturing

expansion over R&D; limitations in IP 02 the

protection, administrative procedures, and

initial costs reduce the attractiveness of high-technology investment. Limitations?

Global supply chain strategies: To

optimize costs and manage risks, Korean

conglomerates separate production and

innovation, locating manufacturing in

03 Vietnam and R&D in South Korea or other developed countries. CHAPTER III: Policy

1. Key Considerations in Attracting Korean FDI Implications

During 2015–2024, Korean FDI became a

major driver of Vietnam’s economic growth. and

However, Vietnam needs a more strategic 01

approach, focusing on quality, sustainability,

and long-term value creation rather than Recommendations capital volume alone. for Korean FDI in

2. Focus on Quality over Quantity Vietnam

In 2024, Korean registered FDI reached USD 7.06

bil ion, accounting for 18.5% of total FDI. 02

Most investment remains concentrated in large-

scale manufacturing and assembly.

Limited investment in high-tech, R&D, and

innovation-based sectors reduces value-

added and technology spil overs.

3. Strategic Positioning in Global Value Chains

Korean FDI has formed major production clusters across key industrial regions.

However, R&D and high-value activities remain marginal. 03

Current investment strategy is mainly market- and

efficiency-seeking, not strategic asset–seeking.

Vietnam should aim to attract higher segments of the global value chain.

4. Institutional Environment and Human Capital

Administrative procedures, shortages of

skil ed labor, and limited technological

infrastructure remain constraints.

Improving the business environment and CHAPTER III: Policy 04

institutional quality is critical to retaining Korean strategic investors. Implications

5. Policy Recommendations for the Government and

Target high-value FDI: Provide selective incentives for R&D, technology transfer, and advanced Recommendations 05 manufacturing.

Ensure policy stability and transparency to retain long- term investors. for Korean FDI in

Invest in strategic infrastructure: logistics, high-tech

industrial parks, and innovation hubs.

Leverage FTAs (CPTPP, EVFTA) to strengthen Vietnam’s Vietnam

role as a regional production and export base.

6. Recommendations for Vietnamese Enterprises

Enhance competitiveness: improve management,

quality standards, and production capacity.

Integrate into supply chains of Korean conglomerates such as Samsung and LG. 06

Invest in human capital, especial y technical and managerial skil s.

Adopt digital transformation and innovation to meet international standards. REFERENCES

B&Company. (2024). Overview of Korean companies in Vietnam

CEIC Data. (2024). Korea: Outward direct investment by region and country.

Charting the Globe. (2024). South Korea: Foreign direct

investment outflows (2014–2024 `

Foreign Investment Agency – Ministry of Finance of Vietnam.

(2024). Foreign direct investment information and policy updates

Korea Economic Institute of America (KEIA). (2023). South

Korea’s important role in Vietnam’s rapid development. THANK YOU