Preview text:

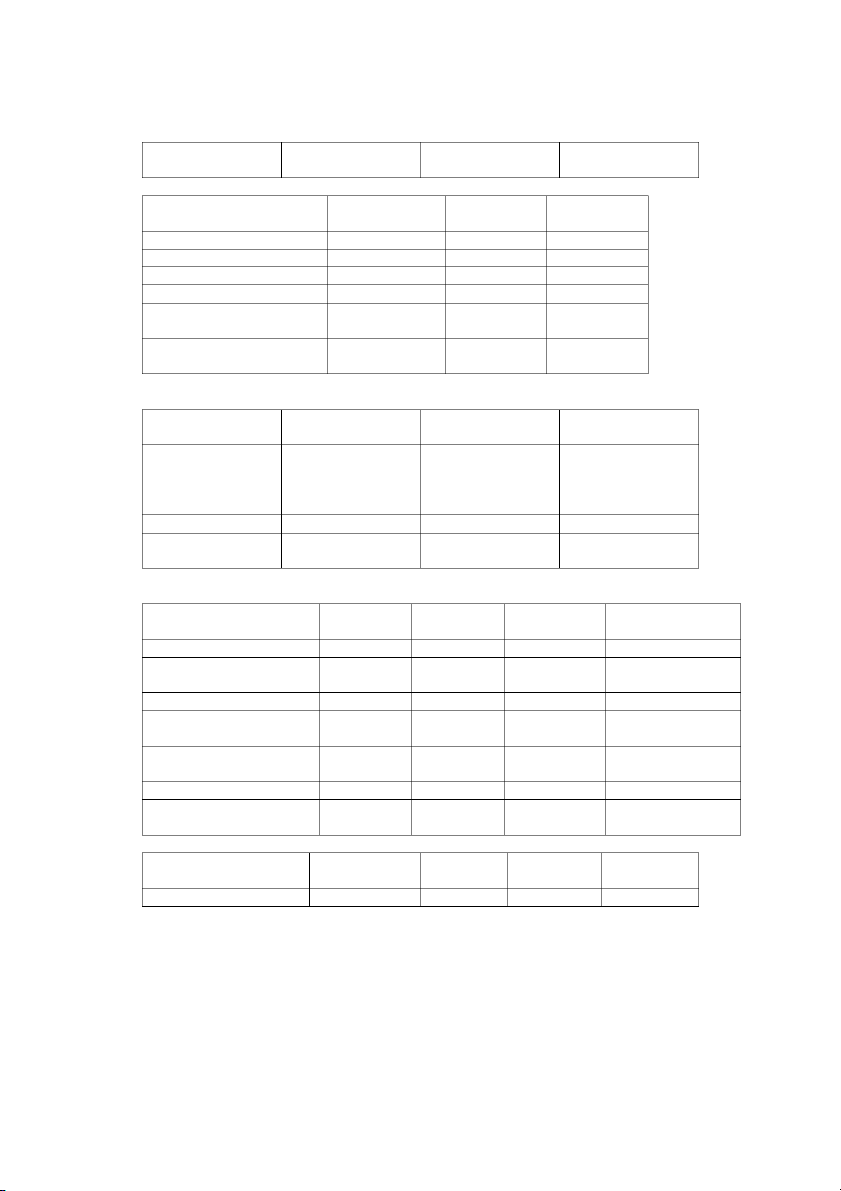

Chapter 17 17-16 Flow of production Physical units Direct materials Conversion costs WIP, begining 0 Started during curent 10,000 period To account for 10,000 Completed and 9,000 9,000 9,000 transferred out during current period WIP,ending 1,000 (1,000x100%; 1,000 x 1,000 500 50%) Accounted for 10,000 Equivalet units of 10,000 9,500 work done in current period Total production cost Direct material Conversion costs Cost added during 1,548,000 750,000 798,000 february Divide by equivalent 10,000 9,500 units of work done in current period Cost per equivalent 75 84 unit 17-17 1. Work in Process–– 750,000 Assembly Accounts Payable To record $750,000 of 750,000 direct materials purchased and used in production during February 2012 2. Work in Process–– 798,000 Assembly Various accounts To record $798,000 of 798,000 conversion costs for February 2012; examples include energy, manufacturing supplies, all manufacturing labor, and plant depreciation

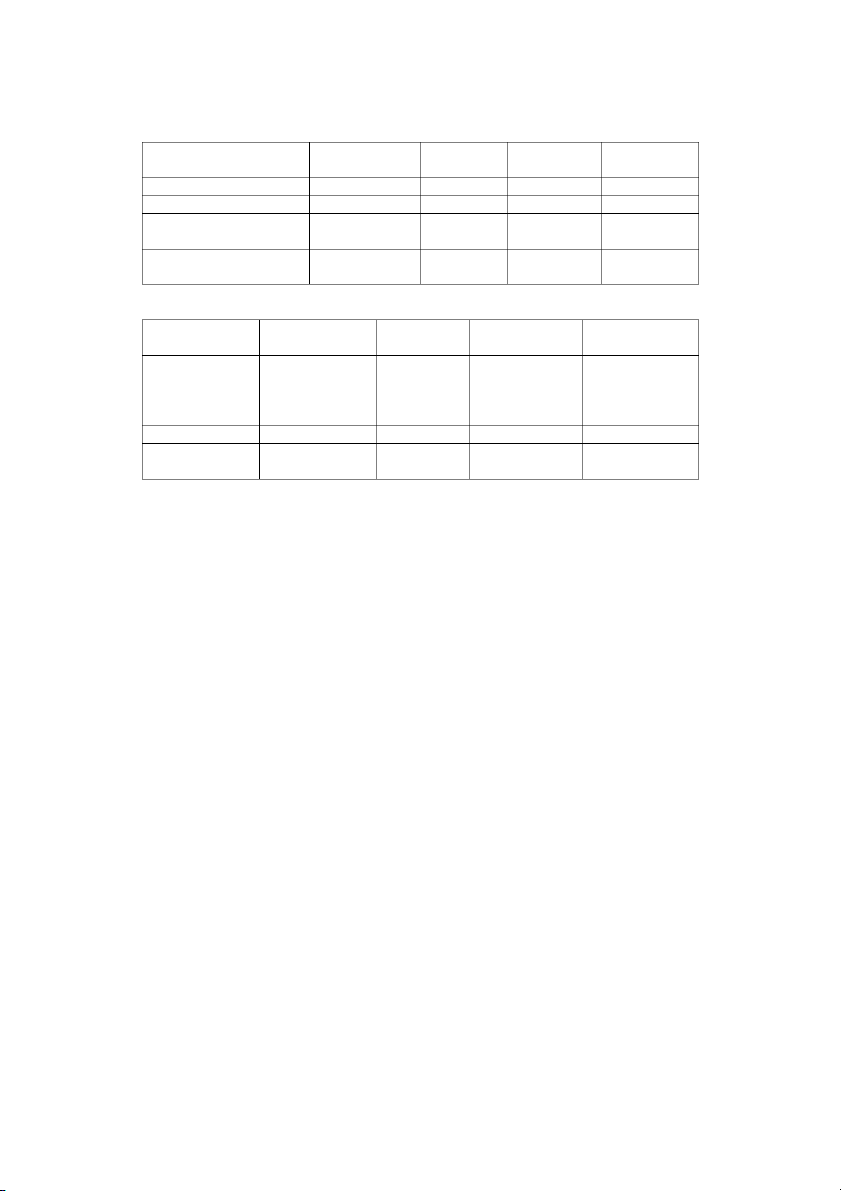

3. Work in Process––Testing 1,431,000 Work in Process–– Assembly 1,431,000 To record 9,000 units completed and transferred from Assembly to Testing during February 2012 at $159 9,000 units = × $1,431,000 17-19 Flow of production Physical units Direct materials Conversion costs WIP, begining 80 Started during curent 500 period To account for 580 Completed and 460 460 460 transferred out during current period WIP,ending 120 (120x60%; 120 x 72 36 30%) Accounted for 580 Equivalet units of 532 496 work done in current period 17-20 Total production Direct material Conversion costs costs WIP, beginning 584,400 493,360 91,040 Cost added in current period 4,612,000 3,220,000 1,392,000 Total costs to account for 5,196,400 3,713,360 1,483,040 Cost incurred to date 3,713,360 1,483,040 Divide by equivalent units of 532 496 work done to date Cost per equivalent unit of 6,980 2,990 work done to date Assignment of cost: Total production Direct materials Conversion cost costs Completed and 4,586,200 6,980 x 460 = 2,990 x 460 = transferred out 3,210,800 1,375,400 (460) WIP, ending (120) 610,200 72 x 6,980 = 36 x 2,990 = 502,560 107,640 Total costs 5,196,400 3,713,360 1,483,040 accounted for 17-21 Flow of production Physical units Direct material Conversion costs WIP, begining 80 Started during 500 current period To account for 580 Completed and transferred out during current period: From beginning 80 work in process 80 x (100%-90%); 8 48 (100% - 40%) Started and 380 completed 380 x 100% , 100% 380 380 WIP, ending 120 120 x 60%; 30% 72 36 Accounted for 580 Equivalent units of 460 464 work done in current period 17 – 24 Flow of production Physical units Direct material Conversion costs WIP, begining 8,500 8,500 1,700 Started during 35,000 current period To account for 43,500 Completed and 33,000 33,000 33,000 transferred out during current period WIP, ending 10,500 (10,500 x 100%, 10,500 6,300 10,500x 60%) Accounted for 43,500 Equivalent units of 43,500 39,300 work done in current period Total production Direct material Conversion costs costs WIP, beginning 108,610 63,100 45,510 Cost added in current period 769,940 284,900 485,040 Total costs to account for 878,550 348,000 535,550 Cost incurred to date 348,000 535,550 Divide by equivalent units of 43,500 39,300 work done to date Cost per equivalent unit of 8 13.5 work done to date Assignment of cost: Total production Direct materials Conversion cost costs Completed and 709,500 33,000 x 8 = 264,000 33,000 x 13,5 = transferred out 445,500 (33,000) WIP, ending (10,500) 169,050 10,500 x 8 = 84,000 6,300 x 13,5 = 85,050 Total costs 878,550 348,000 530,550 accounted for 17-27 Flow of production Physical units Transferred Direct material Conversion costs in cost WIP, begining 75 Started during current 135 period To account for 210 Completed and transferred 150 150 150 150 out during current period WIP, ending 60 (60 x 100%; 0; 75%) 60 0 45 Accounted for 210 Equivalent units of work 210 150 195 done in current period Total production Transferred Direct Conversion costs in cost material costs WIP, beginning 105,000 75,000 0 30,000 Cost added in current 595,000 142,500 37,500 78,000 period Total costs to account for 700,500 217,500 37,500 108,000 Cost incurred to date 217,500 37,500 108,000 Divide by equivalent units 210 150 195 of work done to date Cost per equivalent unit 1,035.71 250 553.85 of work done to date Assignment of cost: Total production Transferred Direct materials Conversion cost costs in cost Completed and 275,934 155,356.5 37,500 83,077.5 transferred out (150) WIP, ending (60) 87,006 62,142.6 0 24,885 Total costs 362,961.6 217,499.1 37,500 107,962.5 accounted for