Preview text:

Vietnam National University – HCMC CAPM International University SCHOOL OF BUSINESS

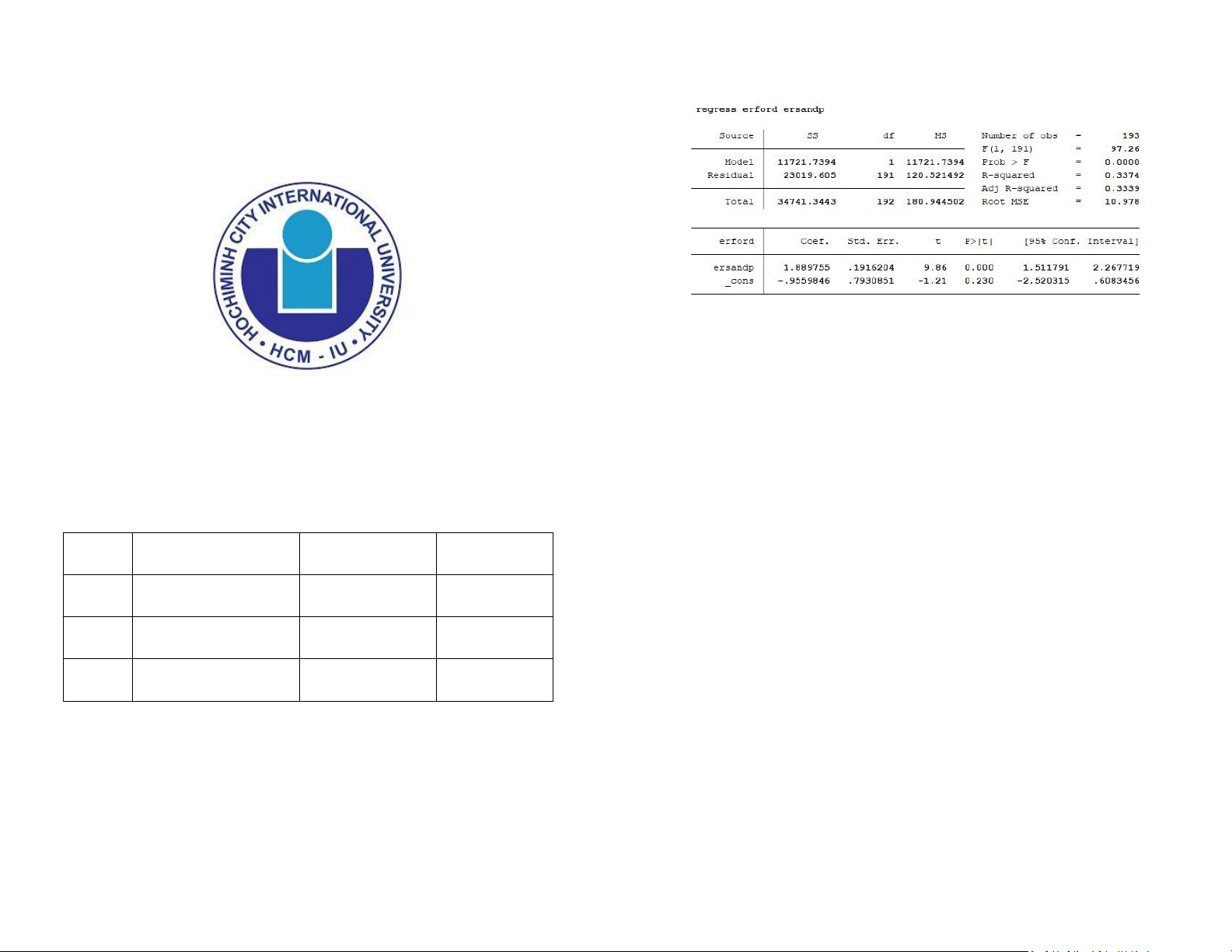

The term "sum of squares" or "SS" is used to denote variation. The target variable's

variance is made up of the model's (explainable variance) and the residuals' (unexplainable

variance) variances. The target variable's entire variation from its mean is what is meant

by the term total SS. From the output, we can see that out of a variation of 34,741.3443 in

the dependent variable, 11,721.7394 is explainable by the model, while the remaining 23,019.605 is unexplainable.

Econometrics with Financial Application_S2_2022-

The degree of freedom (df) connected to a variance is called df. The number of

independently variable values is referred to as the degree of freedom. The output shows 23_G01

that the residuals and model degrees of freedom are 1 and 191 respectively, while the

overall degree of freedom is 192. Dr Nguyen Phuong Anh

The square root of the mean value is ms. It is the sum of squares divided by the degree of

freedom, or the sum of squares per unit of freedom. The mean sum of squares for the

model, residual, and total are, according to the output, 11,721.7394, 120.521492, and 180.944502, respectively. Seq. Full name Student ID Contribution

Number of obs is simply the number of observations used in the regression. Since the data

has 193 observations, Number of obs is equal to 193. 1 Trương Phúc An BABAIU20526 100%

F(1, 191) is the F-statistics of an ANOVA test run on the model. The F-statistics is the ratio

of the mean sum of squares (ms) of the model to that of the residual. It measures how the 2 Nguyễn Hoàng Bảo Hân BAFNIU19077 100%

ratio of the explainable mean variance to the unexplainable mean variance is statistically

greater than 1. The 1 and 192 simply represents the model’s and residual degrees of 3

freedom respectively. To know how well the predictors (taken together as a group) reliably Hồ Thế Phong BAFNIU19141 100%

predicts the dependent variable, Stata conducts a hypothesis test using the F-statistics. Homework

The null hypothesis is that the mean explainable variance is same as the mean unexplainable variance.

The Prob > F is the probability of obtaining the estimated F-statistics or greater (the

pvalue). For a typical alpha level of 0.05, a p-value lesser than 0.05 like we have in

our output, means that we have evidence to reject the null hypothesis and accept

the alternate hypothesis that the ms of the model is significantly greater than that

of the residual. Hence, the predictors of our model reliably predict the target variable.

R-squared is the coefficient of determinant and it represents the goodness of fit. It

is numerically the fraction of the variation in the dependent variable that can be

accounted for (explained) by the independent variables. From the output, 33.74%

of the variation in the dependent variable are explainable by the model.

Adj R-squared: Since the addition of more and more predictors tend to increase the

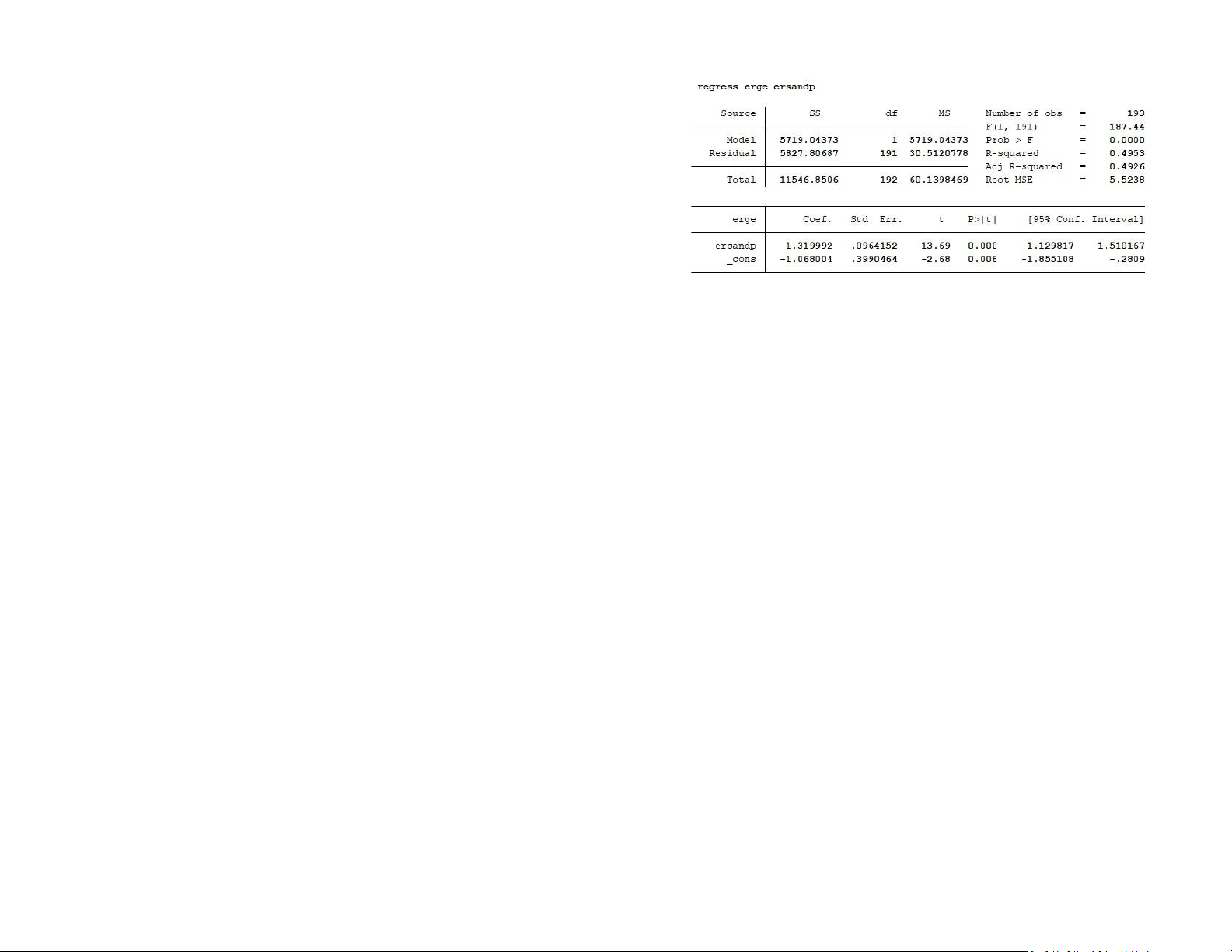

The term "sum of squares" or "SS" is used to denote variation. The target variable's

Rsquared, Adj R-squared tells us how much of the variation of the dependent

variance is made up of the model's (explainable variance) and the residuals' (unexplainable

variable is determined by the addition of the independent variables. Adj R-squared

variance) variances. The target variable's entire variation from its mean is what is meant

is the R-squared controlled for by the number of predictors. From the output, we

by the term total SS. From the output, we can see that out of a variation of 11,546.8506 in

can say that after adjusting for the degree of freedom, the coefficient of the

the dependent variable, 5,719.04373 is explainable by the model, while the remaining determinant is 33.39% 11,546.8506 is unexplainable.

Root MSE is simply the standard deviation of the residuals (error term). From the

The degree of freedom (df) connected to a variance is called df. The number of

output, we can say that the measure of the spread of the residuals is 10.978

independently variable values is referred to as the degree of freedom. The output shows

that the residuals and model degrees of freedom are 1 and 191 respectively, while the

The beta coefficient (the slope coefficient) estimate is 1.89 with a t-ratio of 9.86 and

overall degree of freedom is 192.

a corresponding p-value of 0.000. This suggests that the excess return on the market

proxy has highly significant explanatory power for the variability of the excess return

The square root of the mean value is ms. It is the sum of squares divided by the degree of of Ford stock.

freedom, or the sum of squares per unit of freedom. The mean sum of squares for the

model, residual, and total are, according to the output, 5,719.04373, 30.5120778, and

Let us turn to the intercept now. The α estimate is –0.96 with a t-ratio of –1.21 and 60.1398469, respectively.

a pvalue of 0.230. Thus, we cannot reject that the α estimate is different from 0,

indicating that the Ford stock does not seem to significantly outperform or

Number of obs is simply the number of observations used in the regression. Since the data

underperform the overall market.

has 193 observations, Number of obs is equal to 193.

F(1, 191) is the F-statistics of an ANOVA test run on the model. The F-statistics is the ratio

of the mean sum of squares (ms) of the model to that of the residual. It measures how the

ratio of the explainable mean variance to the unexplainable mean variance is statistically

greater than 1. The 1 and 192 simply represents the model’s and residual degrees of

freedom respectively. To know how well the predictors (taken together as a group) reliably

predicts the dependent variable, Stata conducts a hypothesis test using the F-statistics.

The null hypothesis is that the mean explainable variance is same as the mean unexplainable variance.

The Prob > F is the probability of obtaining the estimated F-statistics or greater (the

pvalue). For a typical alpha level of 0.05, a p-value lesser than 0.05 like we have in

our output, means that we have evidence to reject the null hypothesis and accept

the alternate hypothesis that the ms of the model is significantly greater than that

of the residual. Hence, the predictors of our model reliably predict the target variable.

R-squared is the coefficient of determinant and it represents the goodness of fit. It

is numerically the fraction of the variation in the dependent variable that can be

accounted for (explained) by the independent variables. From the output, 49.53%

of the variation in the dependent variable are explainable by the model.

Adj R-squared: Since the addition of more and more predictors tend to increase the

Rsquared, Adj R-squared tells us how much of the variation of the dependent

variable is determined by the addition of the independent variables. Adj R-squared

The term "sum of squares" or "SS" is used to denote variation. The target variable's

is the R-squared controlled for by the number of predictors. From the output, we

variance is made up of the model's (explainable variance) and the residuals' (unexplainable

can say that after adjusting for the degree of freedom, the coefficient of the

variance) variances. The target variable's entire variation from its mean is what is meant determinant is 49.26%

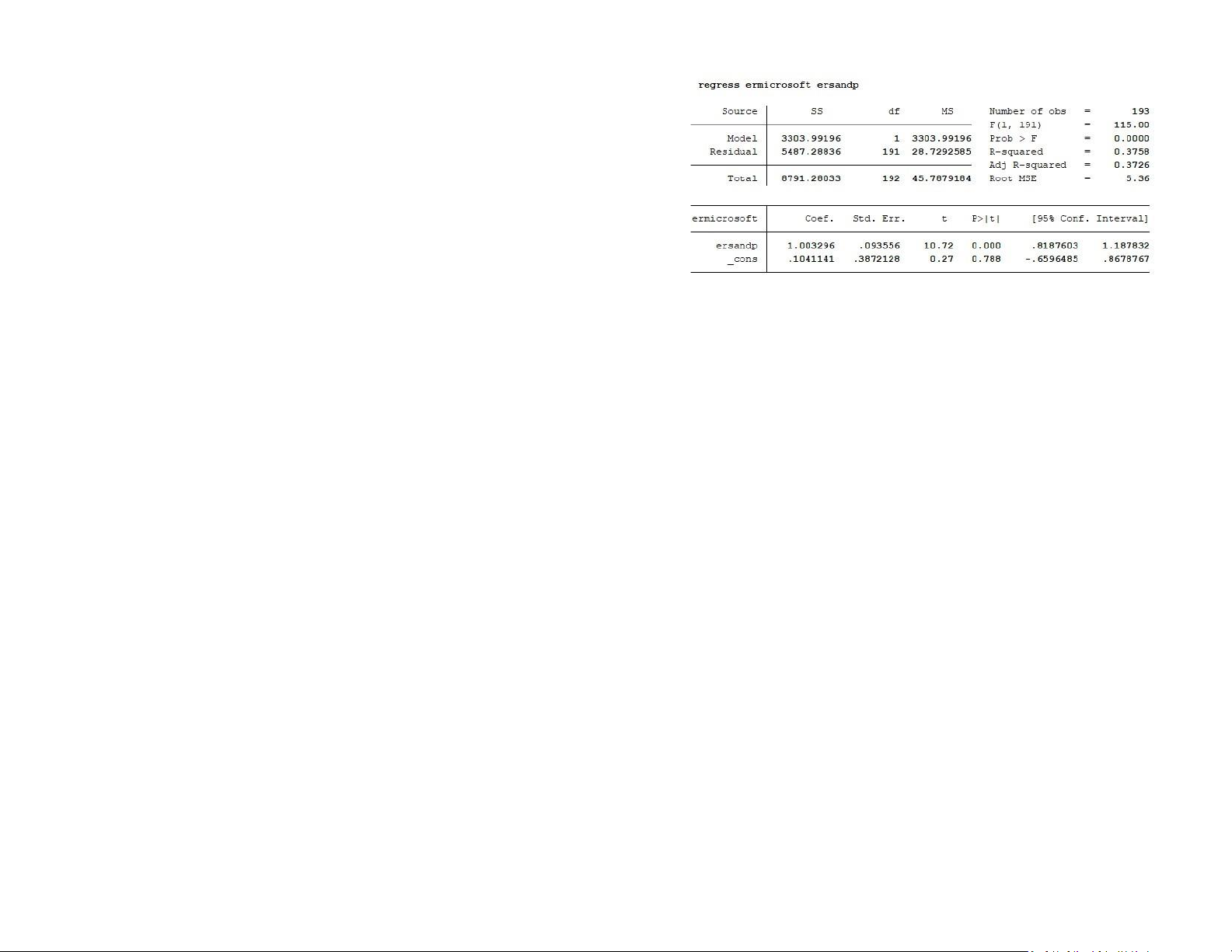

by the term total SS. From the output, we can see that out of a variation of 8,791.28033 in

Root MSE is simply the standard deviation of the residuals (error term). From the

the dependent variable, 3,303.99196 is explainable by the model, while the remaining

output, we can say that the measure of the spread of the residuals is 5.5238 5,487.28836 is unexplainable.

The beta coefficient (the slope coefficient) estimate is 1.32 with a t-ratio of 13.69

The degree of freedom (df) connected to a variance is called df. The number of

and a corresponding p-value of 0.000. This suggests that the excess return on the

independently variable values is referred to as the degree of freedom. The output shows

market proxy has highly significant explanatory power for the variability of the

that the residuals and model degrees of freedom are 1 and 191 respectively, while the excess return of GE stock.

overall degree of freedom is 192.

Let us turn to the intercept now. The α estimate is –1.07 with a t-ratio of –2.68 and

The square root of the mean value is ms. It is the sum of squares divided by the degree of

a pvalue of 0.008. Thus, indicating that the GE stock has significantly underperform

freedom, or the sum of squares per unit of freedom. The mean sum of squares for the the overall market.

model, residual, and total are, according to the output, 3,303.99196, 28.7292585, and 45.7879184, respectively.

Number of obs is simply the number of observations used in the regression. Since the data

has 193 observations, Number of obs is equal to 193.

F(1, 191) is the F-statistics of an ANOVA test run on the model. The F-statistics is the ratio

of the mean sum of squares (ms) of the model to that of the residual. It measures how the

ratio of the explainable mean variance to the unexplainable mean variance is statistically

greater than 1. The 1 and 192 simply represents the model’s and residual degrees of

freedom respectively. To know how well the predictors (taken together as a group) reliably

predicts the dependent variable, Stata conducts a hypothesis test using the F-statistics.

The null hypothesis is that the mean explainable variance is same as the mean unexplainable variance.

The Prob > F is the probability of obtaining the estimated F-statistics or greater (the

pvalue). For a typical alpha level of 0.05, a p-value lesser than 0.05 like we have in

our output, means that we have evidence to reject the null hypothesis and accept

the alternate hypothesis that the ms of the model is significantly greater than that

of the residual. Hence, the predictors of our model reliably predict the target variable.

R-squared is the coefficient of determinant and it represents the goodness of fit. It

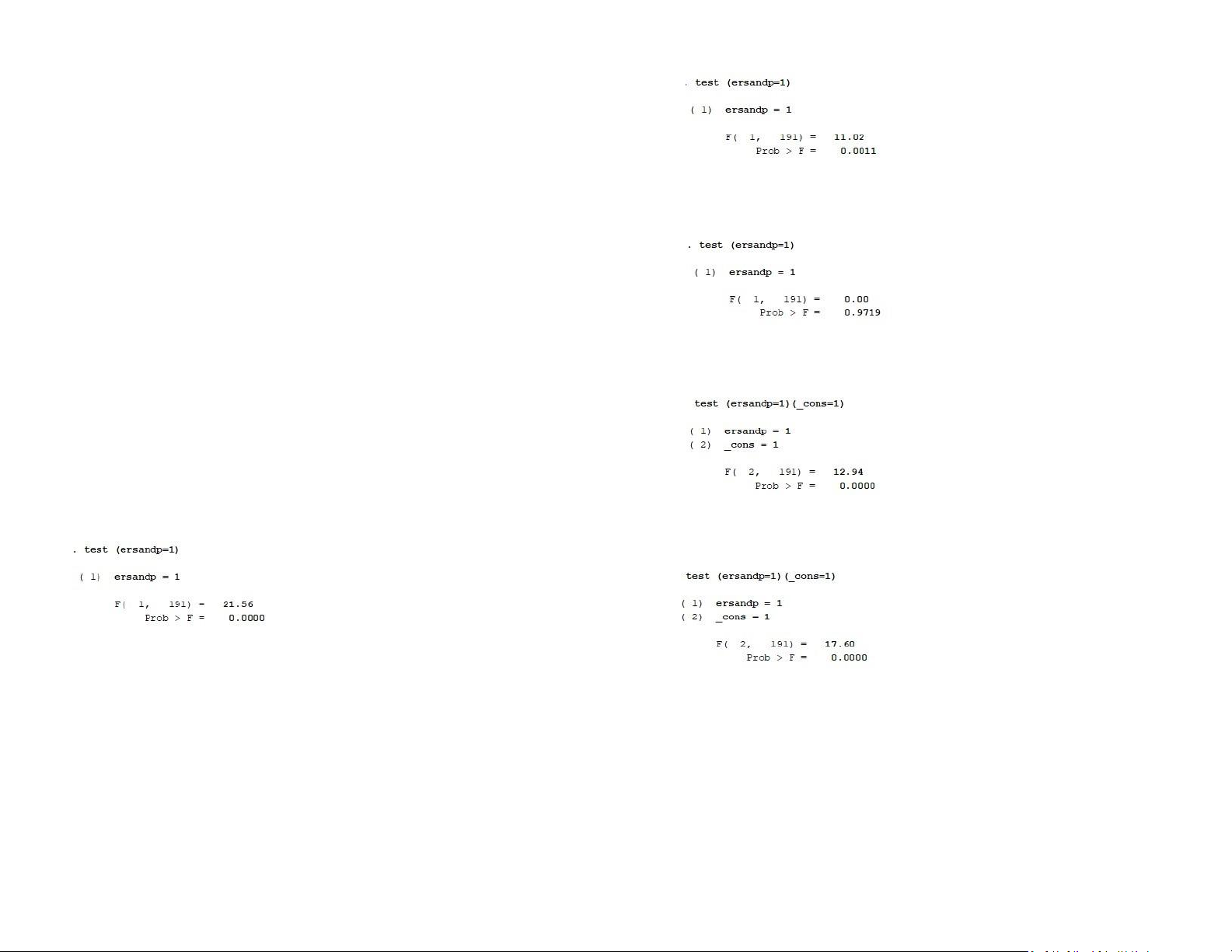

The F-statistic of 11.02 with a corresponding p-value of 0.0011 implying that the null

is numerically the fraction of the variation in the dependent variable that can be

hypothesis that the CAPM beta of GE stock is 1 is convincingly rejected and hence the

accounted for (explained) by the independent variables. From the output, 37.58%

estimated beta of 1.32 is significantly different from 1.31

of the variation in the dependent variable are explainable by the model.

Adj R-squared: Since the addition of more and more predictors tend to increase the

Rsquared, Adj R-squared tells us how much of the variation of the dependent

variable is determined by the addition of the independent variables. Adj R-squared

is the R-squared controlled for by the number of predictors. From the output, we

can say that after adjusting for the degree of freedom, the coefficient of the determinant is 37.26%

The F-statistic of 0 with a corresponding p-value of 0.9719 implying that the null hypothesis

Root MSE is simply the standard deviation of the residuals (error term). From the

that the CAPM beta of Microsoft stock is 1 is convincingly not rejected and hence the

output, we can say that the measure of the spread of the residuals is 5.36

estimated beta of 1 is not different from 1

The beta coefficient (the slope coefficient) estimate is 1 with a t-ratio of 10.72 and a

corresponding p-value of 0.000. This suggests that the excess return on the market

proxy has highly significant explanatory power for the variability of the excess return of Microsoft stock.

Let us turn to the intercept now. The α estimate is 0.104 with a t-ratio of 0.27 and a

p-value of 0.788. Thus, we cannot reject that the α estimate is different from 0,

indicating that the Microsoft stock does not seem to significantly outperform or

Looking at the value of the F-statistic of 12.94 with a corresponding p-value of 0.0000, we

underperform the overall market.

conclude that the null hypothesis, H0: β1 = 1 and β2 = 1, is strongly rejected at the 1% significance level.

The F-statistic of 21.56 with a corresponding p-value of 0 (at least up to the fourth

decimal point) implying that the null hypothesis that the CAPM beta of Ford stock is

1 is convincingly rejected and hence the estimated beta of 1.89 is significantly different from 1.

Looking at the value of the F-statistic of 17.6 with a corresponding p-value of 0.0000,

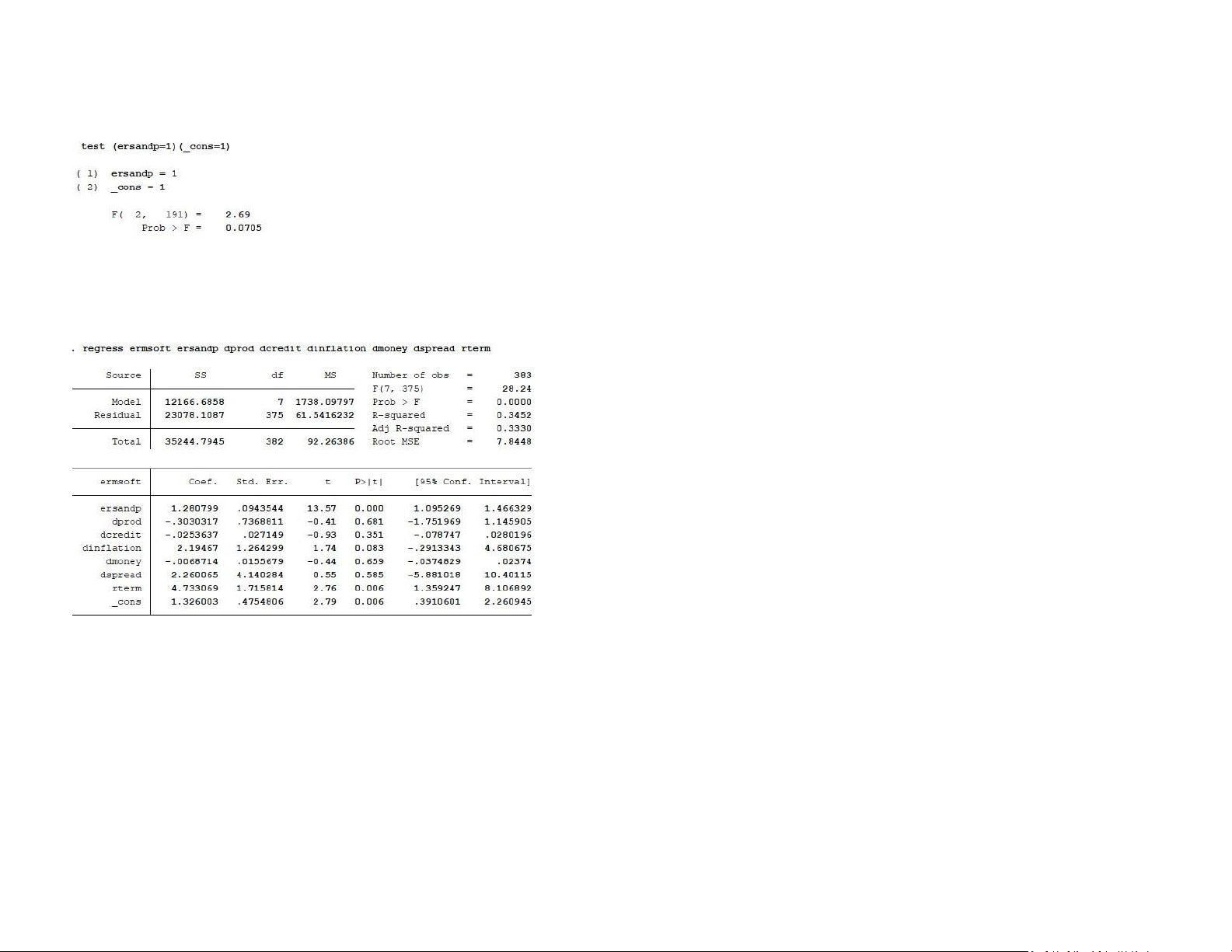

The degree of freedom (df) connected to a variance is called df. The number of

we conclude that the null hypothesis, H0: β1 = 1 and β2 = 1, is strongly rejected at

independently variable values is referred to as the degree of freedom. The output shows the 1% significance level.

that the residuals and model degrees of freedom are 7 and 375 respectively, while the

overall degree of freedom is 382.

The square root of the mean value is ms. It is the sum of squares divided by the degree of

freedom, or the sum of squares per unit of freedom. The mean sum of squares for the

model, residual, and total are, according to the output, 1,738.09797, 61.5416232, and 92.26386, respectively.

Number of obs is simply the number of observations used in the regression. Since the data

has 383 observations, Number of obs is equal to 383.

Looking at the value of the F-statistic of 2.69 with a corresponding p-value of 0.0705,

we conclude that the null hypothesis, H0: β1 = 1 and β2 = 1, is not rejected at the

F (7, 375) is the F-statistics of an ANOVA test run on the model. The F-statistics is the ratio 1% significance level.

of the mean sum of squares (ms) of the model to that of the residual. It measures how the

ratio of the explainable mean variance to the unexplainable mean variance is statistically Macro

greater than 1. The 7 and 375 simply represents the model’s and residual degrees of

freedom respectively. To know how well the predictors (taken together as a group) reliably

predicts the dependent variable, Stata conducts a hypothesis test using the F-statistics.

The null hypothesis is that the mean explainable variance is same as the mean unexplainable variance.

The Prob > F is the probability of obtaining the estimated F-statistics or greater (the pvalue).

For a typical alpha level of 0.05, a p-value lesser than 0.05 like we have in our output,

means that we have evidence to reject the null hypothesis and accept the alternate

hypothesis that the ms of the model is significantly greater than that of the residual. Hence,

the predictors of our model reliably predict the target variable.

R-squared is the coefficient of determinant and it represents the goodness of fit. It is

numerically the fraction of the variation in the dependent variable that can be accounted

for (explained) by the independent variables. From the output, 34.52% of the variation in

the dependent variable are explainable by the model.

Adj R-squared: Since the addition of more and more predictors tend to increase the

Rsquared, Adj R-squared tells us how much of the variation of the dependent variable is

determined by the addition of the independent variables. Adj R-squared is the R-squared

controlled for by the number of predictors. From the output, we can say that after

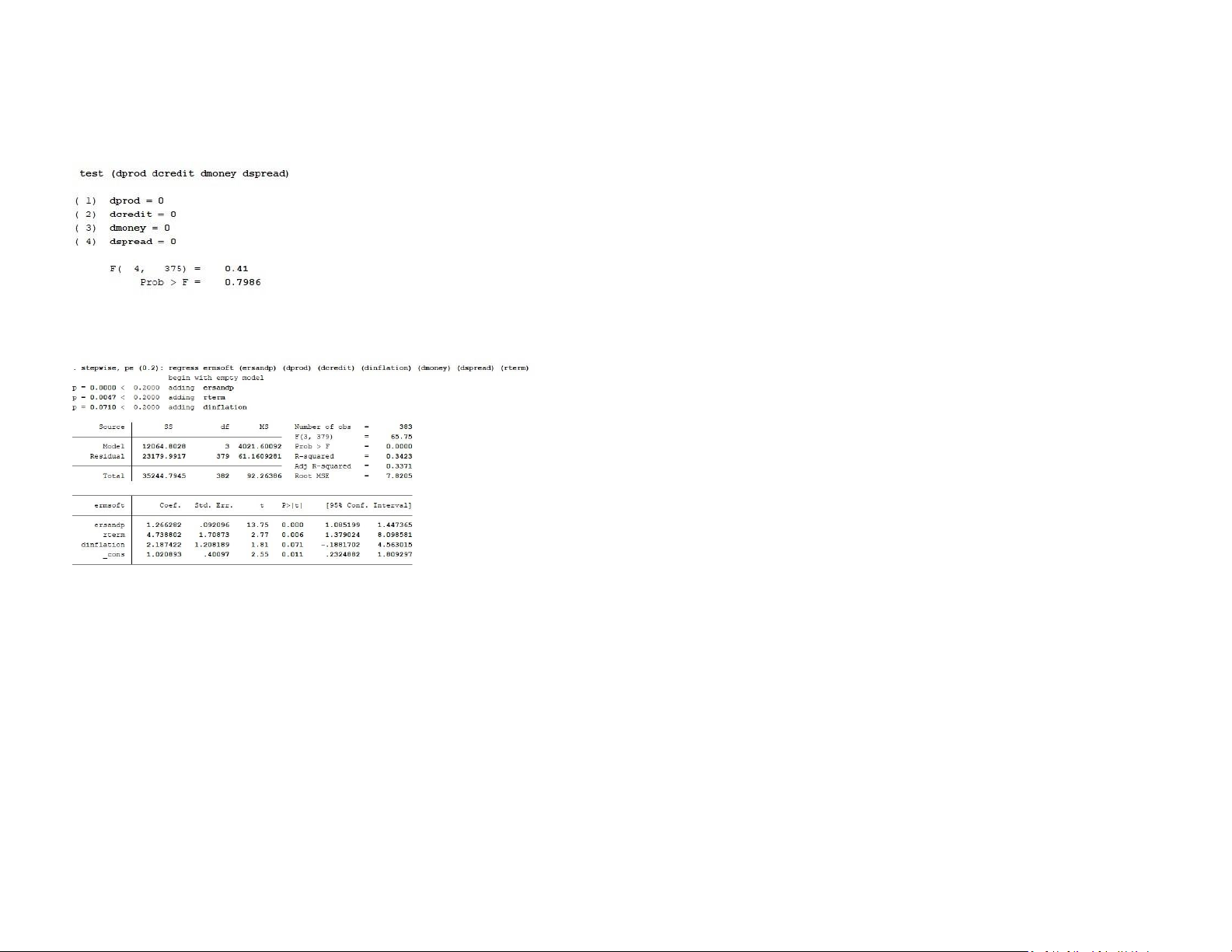

The term "sum of squares" or "SS" is used to denote variation. The target variable's

adjusting for the degree of freedom, the coefficient of the determinant is 33.3%

variance is made up of the model's (explainable variance) and the residuals'

Root MSE is simply the standard deviation of the residuals (error term). From the output,

(unexplainable variance) variances. The target variable's entire variation from its

we can say that the measure of the spread of the residuals is 7.8448

mean is what is meant by the term total SS. From the output, we can see that out

of a variation of 35,244.7945 in the dependent variable, 12,166.6858 is explainable

The beta coefficient (the slope coefficient) estimate with corresponding p-value of 0.000

by the model, while the remaining 23,078.1087 is unexplainable.

or less than 0.05. This suggests that the excess return on the market proxy has highly

significant explanatory power for the variability of ersandp, rterm. However, there

shows that the residuals and model degrees of freedom are 3 and 379 respectively, while

are no significant explanatory for dprod, dcredit, dinflation, dmoney, and dspread.

the overall degree of freedom is 382.

Let us turn to the intercept now. The α estimate is 1.33 with a t-ratio of 2.79 and a

The square root of the mean value is ms. It is the sum of squares divided by the degree of

p-value of 0.006. Thus, Thus, indicating that the Microsoft stock has significantly

freedom, or the sum of squares per unit of freedom. The mean sum of squares for the

overperform the overall market.

model, residual, and total are, according to the output, 4,021.60092, 61.1609281, and 92.26386, respectively.

Number of obs is simply the number of observations used in the regression. Since the data

has 383 observations, Number of obs is equal to 383.

F (7, 375) is the F-statistics of an ANOVA test run on the model. The F-statistics is the ratio

of the mean sum of squares (ms) of the model to that of the residual. It measures how the

ratio of the explainable mean variance to the unexplainable mean variance is statistically

greater than 1. The 3 and 379 simply represents the model’s and residual degrees of

freedom respectively. To know how well the predictors (taken together as a group) reliably

The F-statistic value is 0.41 with p-value 0.7986, suggesting that the null hypothesis

predicts the dependent variable, Stata conducts a hypothesis test using the F-statistics.

cannot be rejected. The parameters on ‘rterm’ and ‘dinflation’ are significant at the

The null hypothesis is that the mean explainable variance is same as the mean

10% level. Hence, they are not included in this F-test and the variables are retained. unexplainable variance.

The Prob > F is the probability of obtaining the estimated F-statistics or greater (the pvalue).

For a typical alpha level of 0.05, a p-value lesser than 0.05 like we have in our output,

means that we have evidence to reject the null hypothesis and accept the alternate

hypothesis that the ms of the model is significantly greater than that of the residual. Hence,

the predictors of our model reliably predict the target variable.

R-squared is the coefficient of determinant and it represents the goodness of fit. It is

numerically the fraction of the variation in the dependent variable that can be accounted

for (explained) by the independent variables. From the output, 34.23% of the variation in

the dependent variable are explainable by the model.

Adj R-squared: Since the addition of more and more predictors tend to increase the

Rsquared, Adj R-squared tells us how much of the variation of the dependent variable is

determined by the addition of the independent variables. Adj R-squared is the R-squared

The term "sum of squares" or "SS" is used to denote variation. The target variable's

controlled for by the number of predictors. From the output, we can say that after

variance is made up of the model's (explainable variance) and the residuals'

adjusting for the degree of freedom, the coefficient of the determinant is 33.71%

(unexplainable variance) variances. The target variable's entire variation from its

mean is what is meant by the term total SS. From the output, we can see that out

Root MSE is simply the standard deviation of the residuals (error term). From the output,

of a variation of 35,244.7945 in the dependent variable, 12,064.8028 is explainable

we can say that the measure of the spread of the residuals is 7.8205

by the model, while the remaining 23,179.9917 is unexplainable.

The beta coefficient (the slope coefficient) estimate with corresponding p-value of 0.000

The degree of freedom (df) connected to a variance is called df. The number of

or less than 0.2. This suggests that the excess return on the market proxy has highly

independently variable values is referred to as the degree of freedom. The output

significant explanatory power for the variability of ersandp, rterm, dinflation. If any other

variable is in the 20% significant or higher, we should add that variable.

Let us turn to the intercept now. The α estimate is 1.02 with a t-ratio of 2.55 and a

p-value of 0.011. Thus, Thus, indicating that the Microsoft stock has slightly

overperform the overall market.