Preview text:

1 CHAPTER 3 Balance Sheet I/ Key Things to Know

Accounts Receivable: Amounts customers owe the company for goods or services

provided; normally collected in 30 to 90 days

Inventory: Items held only for sale to the customer

Prepaid Expenses: Paid in advance before the service is provided;

gives future benefit (rent, insurance)

Supplies: Items that are used up in day to day operations

Notes Receivable: Amounts owed to the company; normally interest is

charged and the note is repaid in longer than 3 months

Investments: The company takes their excess cash and invests it

in stocks or bonds to earn a return.

Investments can be short term or long term

Property/Plant/Equipment: Assets used long-term to generate revenues; they have physical substance

(Buildings, Equipment, Autos, Land, Computers)

- Accumulated Depreciation: The total amount for all prior years (cumulative) of

depreciation expense for all prior periods. This is a

contra account subtracted from plant, and equipment

Intangible Assets: No physical substance - used long-term to generate revenues

The company has the exclusive right to do something;

Includes trademarks, copyrights, patents, franchises, goodwill

Cash paid to purchase a company

less Fair market value of net assets acquired = Goodwill PHD.NGUYEN THANH NAM 2

Accounts Payable: Amounts owed to suppliers, normally paid in 30-60 days

Suppliers are those who provide inventory or goods and services over and over again

Accrued Expense: Both of these are expenses that have not yet been paid

Accrued Liabilities: that the company owes – examples are: employee taxes,

legal, advertising, bonuses, retirement plans

_________ Payable: Expenses incurred that have not yet been paid

(Salaries, Rent, Interest, Taxes)

If an amount is large enough, it gets its own line. If it is not

large enough it will be included in accrued expenses.

Unearned Revenues: Cash received from customers before the good or service is

provided. The company owes the customer a good/service

Current Maturities of The portion of long –term debt that will be repaid

Long Term Debt: within 1 year

L/T Notes Payable and Amounts owed to banks and other financing companies

Long-term Debt: that will be paid later than one year from now

Amounts due within a year are reported as current maturities of long term debt

Bonds Payable: Amounts borrowed from investors; normally long-term

Common Stock or: Funds received from investors in exchange for

Contributed Capital: ownership – common stock is reported at par value

Additional Paid in Capital: Amounts over and above par raised from investors

from the sale of stock (ownership)

Retained Earnings: Total of all (cumulative) profits and losses less dividends paid to owners PHD.NGUYEN THANH NAM 3

Treasury Stock: The company buys and holds its own stock

Operating cycle the time it takes a company to spend cash to do business and get

the cash back again (buy inventory, pay expenses, sell to

the customer and collect from the customer). Usually less than one year.

The balance sheet is listed in the order of liquidity – how soon it will impact cash

Current means the cash is expected to be collected or paid in 1 year or less

Long term/Non-current means the cash is expected to be collected or paid in longer than 1 year

The balance sheet is reported at historical cost; fair market value on the date of

the transaction (buy the asset or borrow money)

Assets are not reported at fair market value - unless fair market value is reliable

(investments) or there has been a permanent decrease in value

Internally generated goodwill is not reported on the balance sheet (i.e. a good

management team, a good location, name brand recognition developed over time.)

It is too difficult to determine a reliable value so it is not reported.

The Format of the Balance Sheet: Assets: Liabilities: Current: Current: Cash Accounts Payable

Accounts Receivable Accrued Expenses (Liabilities) Inventory Unearned Revenues

Prepaid Expenses “_______” Payables

Short-term Investments Income Taxes Payable

Short-term Notes Receivable Short-term Notes Payable

Supplies Current Portion of Long-term Debt

Total Current Assets Total Current Liabilities

Long-term Investments Bonds Payable PHD.NGUYEN THANH NAM 4

Long-term Notes Receivable Long-term Debt Long term Notes Payable Total Liabilities

Property/Plant/Equipment (P/P/E): Land Building Equipment

Less Accumulated Depreciation

Net P/P/E Stockholder’s Equity:

Intangible Assets Common Stock

Goodwill Additional Paid in Capital

Patents, net Retained Earnings

Trademarks, net less Treasury Stock Copyrights, net

Total Intangible Assets Total Stockholder’s Equity Other Assets

Total Assets must = Total Liabilities & Stockholder’s Equity

Common Accounts and What They Are Common Asset Accounts: Common Liability Accounts: Current Assets: Current Liabilities: Cash Accounts payable Accounts receivable Accrued expenses Inventory Accrued liabilities

Prepaid expense - insurance, Short term notes payable rent Short term investments Rent payable Short term notes receivable Salaries payable Supplies Interest payable Taxes payable Long Term Assets: Unearned revenues PHD.NGUYEN THANH NAM 5 Long term investments

Current maturities of L/T debt or L/T notes payable Long term notes receivable

Property, Plant & Equipment: Long Term Liabilities: Land Long term debt Buildings Long term notes payable Equipment Bonds payable Autos Mortgage payable Computer Equipment less accumulated depreciation Common Owner's Equity: Intangible Assets: Goodwill Common stock Trademarks Contributed capital Copyrights Additional paid in capital Patents Retained Earnings Franchises less Treasury Stock

Common Revenue Accounts Common Expense Accounts: Sales Cost of goods sold Fee revenue Wages or salary expense Interest revenue Rent expense Dividend revenue Advertising expense Rent Revenue Utility expense Service Revenues Depreciation expense Interest expense Income tax expense Maintenance / repair expense I/ PRACTICE

Balance Sheet – Practice Problem 1 – Classification of accounts

For each of the following accounts, indicate where the account is reported on the balance sheet.

CA Current asset LTA Long term asset SE Stockholder’s Equity

CL Current liability LTL Long term liability N Not reported ______1. retained earnings ______2. supplies PHD.NGUYEN THANH NAM 6 ______3. land ______4. trademarks ______5. cash ______6. accounts receivable ______7. unearned revenue ______8. accrued expenses ______9. prepaid expenses _____10. contributed capital

_____11. long term debt due in less than 1 year _____12. salaries payable

_____13. accumulated depreciation _____14. inventory _____15. depreciation expense _____16. bonds payable

_____17. notes payable due in 5 years

_____18. notes receivable due in 6 months

_____19. investments to be sold in 3 months

_____20. amount paid above net assets when purchasing a company

Q2. For each of the following accounts, indicate where the account is reported on

the balance sheet as of December 31st.

CA Current asset LTA Long term asset SE Stockholder’s Equity

CL Current liability LTL Long term liability N Not reported

________a. accounts receivable ________b. accounts payable ________c. treasury stock ________d. sales ________e. supplies ________ f. patents ________ g. accrued expenses ________ h. common stock ________ i. bonds payable

________ j. accumulated depreciation PHD.NGUYEN THANH NAM 7

________ k. cost of inventory sold ________ l. unearned revenues

Q3. The following items were taken from the records of a company as of December 31st. Accounts Payable 27,000 Long-term Notes Receivable 15,000 Accounts Receivable 22,000 Patent, net 36,000 Building 201,000 Accrued Expenses 6,000 Cash 15,000 Long Term Debt 120,000 Equipment 76,000 Common Stock 50,000 Retained Earnings ?? Inventory 26,000 Prepaid Expenses 8,000

Accumulated depreciation 42,000 Long term Investments 100,000 Treasury Stock 5,000

Prepare a balance sheet in proper format for the company as of December 31st

Q4. HPG Inc. had the following transactions occur during the month of January:

_______1. Borrow money from the bank

_______2. Pay cash for inventory to sell to the customers

_______3. Issue common stock to investors

_______4. Purchase a truck for company use, agree to a notes payable

_______5. Pay employees who worked this week

_______6. Receive the utility bill – it will be paid later

_______7. Sell goods to a customer on account

_______8. Pay for insurance for the next 6 months

_______9. Use cash to make an investment to be held long term

______10. Purchase the company’s own stock from investors required: PHD.NGUYEN THANH NAM 8

a./ Double entry transactions occur during the month of January in Prepaid Legal, Inc.

b./ Review each of the following transactions and determine if the transaction will

increase (I) decrease (D) or have no effect (NA) on TOTAL LIABILITIES of the company.

Q5. The following items were taken from the accounting records of a company as of December 31st. Building 209,000 Accrued Expenses 9,000 Cash 35,000

Short term notes payable 135,000 Computer Equipment 26,000 Common Stock 200,000 Retained Earnings ?? Bonds Payable 75,000 Prepaid Expenses 12,000

Accumulated depreciation 72,000 Sales 123,000 Dividends paid 10,000 Depreciation Expense 18,000 Unearned Revenue 8,000 Accounts Payable 47,000 Long-term Notes Receivable 35,000 Interest Payable 1,000 Long Term Debt 100,000 Cost of Goods Sold 75,000 Goodwill 125,000 Long term Investments 80,000 Treasury Stock 15,000 Inventory 56,000 Short Term Investments 50,000 Accounts Receivable 42,000 Trademark, net 6,000

Prepare a balance sheet in proper format for the company as of December 31st

Q6. FPT Inc. had the following transactions occur during this month :

1) issued stock to investors for $100,000

2) purchased inventory on account for $35,000

3) sold inventory that cost $29,000 to customers on account for $45,000 PHD.NGUYEN THANH NAM 9

4) workers will be paid $10,000, they are paid the first of the following month

5) received the utility bill for $225

6) loaned a customer $10,000 to be repaid in 2 years

7) paid $30,000 for the inventory purchased on account

8) purchased computer equipment for $2,000 cash – recorded depreciation expense of $56 for the month required

a./ Review each of the following transactions and determine if the transaction will increase

(I) decrease (D) or have no effect (NA) on TOTAL ASSETS of the company:

b./Prepare a balance sheet in proper format as of January 31st.

Q7. A company had the following transactions during the first month of the

year. a.recorded depreciation expense of $800 for this month

b.received a bill for utilities for this month for $1,200

c.paid the utility bill for last month for $550.

d.paid $17,000 in wages incurred during the month

e.sold $100,000 of goods that cost $48,000

f.collected $69,000 from customers

g.paid $900 for rent for this month and the next two months

h.received $100 for interest earned last month Requied:

Review each of the following transactions and determine if the transaction will increase (I)

decrease (D) or have no effect (NA) on TOTAL ASSETS of the company: PHD.NGUYEN THANH NAM 10

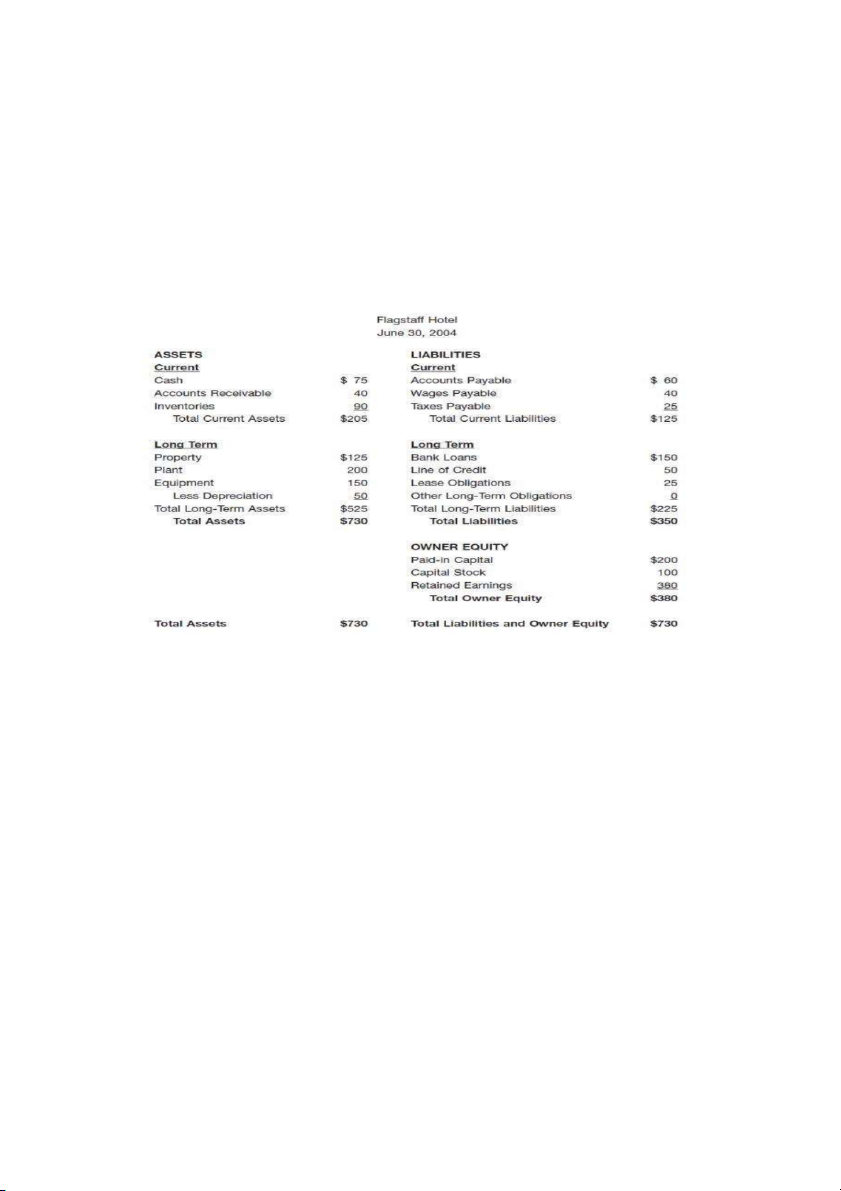

Q8: Financial statements for Flagstaff Hotel follow: Required:

a./ Analysis vertical common and comment

b./ Prepare a trend analysis and comment. c./ Analysis liquid Ratio

Q9: Financial statements for East and West company follow: PHD.NGUYEN THANH NAM