Preview text:

MINISTRY OF EDUCATION AND TRAINING FOREIGN TRADE UNIVERSITY

SUBJECT: PRINCIPLES OF MARKETING MID-TERM REPORT

TOPIC: VIETNAM AIRLINES Instructor : NGUYỄN THỊ THU THẢO Group members : ĐINH LÊ HOÀNG NGỌC ĐÀM QUYẾT CHIẾN TRẦN XUÂN NHI HUỲNH NGUYÊN KHÁNH LINH TIÊU HUỲNH TÂN Class : K61MJ2 Course 61

Ho Chi Minh City, October 2023

MINISTRY OF EDUCATION AND TRAINING FOREIGN TRADE UNIVERSITY

SUBJECT: PRINCIPLES OF MARKETING MID-TERM REPORT

TOPIC: VIETNAM AIRLINES Instructor : NGUYỄN THỊ THU THẢO Group members : ĐINH LÊ HOÀNG NGỌC ĐÀM QUYẾT CHIẾN TRẦN XUÂN NHI HUỲNH NGUYÊN KHÁNH LINH TIÊU HUỲNH TÂN Class : K61MJ2 Course 61

Ho Chi Minh City, October 2023

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................. I

LIST OF FIGURES, TABLES .................................................................................................... IV

LIST OF ACRONYMS ................................................................................................................. V

ACKNOWLEDGEMENT ............................................................................................................... i

EXECUTIVE SUMMARY............................................................................................................. 1

CHAPTER 1: SITUATION ANALYSIS ...................................................................................... 2

1. Market summary ...................................................................................................................... 2

2. Market growth .......................................................................................................................... 2

2.1. Market share .................................................................................................................... 3

3. Market trend ............................................................................................................................. 4

3.1. Strong recovery in domestic demand ............................................................................... 4

3.2. Growth in low-cost carriers .............................................................................................. 4

3.3. Expansion of international routes .................................................................................... 4

3.4. Focus on sustainable aviation .......................................................................................... 5

4. Demographics .......................................................................................................................... 5

5. Macro environment (PESTEL model) ..................................................................................... 5

5.1. Political ............................................................................................................................ 5

5.2. Economic ......................................................................................................................... 6

5.3. Social ............................................................................................................................... 6

5.4. Technological ................................................................................................................... 6

5.5. Environmental .................................................................................................................. 7

5.6. Legal ................................................................................................................................ 7

6. Competitive environment (5 Forces framework) ..................................................................... 7

6.1. Threat of new entrants ..................................................................................................... 7

6.2. Bargaining power of supplier ........................................................................................... 8 I

6.3. Bargaining power of buyer .............................................................................................. 8

6.4. Threat of substitute products ............................................................................................ 8

6.5. Rivalry among existing competitors ................................................................................ 8

CHAPTER 2: COMPANY INTRODUCTION .......................................................................... 10

1. Overview ................................................................................................................................ 10

1.1. Main business sectors .................................................................................................... 10

2. Mission .................................................................................................................................. 11

3. Vision ..................................................................................................................................... 11

4. Business situation ................................................................................................................... 11

4.1. In 2019 ........................................................................................................................... 12

4.2. In 2020 ........................................................................................................................... 12

4.3. In 2021 ........................................................................................................................... 13

4.4. In 2022 ........................................................................................................................... 13

4.5. In 2023 ........................................................................................................................... 14

CHAPTER 3: MARKETING STRATEGY ............................................................................... 15

1. Target market ......................................................................................................................... 15

1.1. Customer portrait ........................................................................................................... 15

1.2. Paint points .................................................................................................................... 15

2. Critical success factors ........................................................................................................... 17

2.1. Safety and security ......................................................................................................... 17

2.2. Customer satisfaction: .................................................................................................... 17

2.3. Route network and connectivity: ................................................................................... 17

2.4. Employee engagement and training ............................................................................... 17

3. Value chain ............................................................................................................................ 17

3.1. Inbound logistic ............................................................................................................. 17

3.2. Operations ...................................................................................................................... 18

3.3. Outbound logistic ........................................................................................................... 19 II

3.4. Marketing and sales ....................................................................................................... 19

3.5. Service ........................................................................................................................... 20

3.6. Technology development (Support activities) ............................................................... 20

3.7. Core competence ............................................................................................................ 21

3.8. Competitive advantages ................................................................................................. 22

4. Positioning ............................................................................................................................. 24

4.1. Points of parity ............................................................................................................... 24

4.2. Points of differences....................................................................................................... 25

4.3. Value proposition ........................................................................................................... 26

4.4. Perceptual map ............................................................................................................... 26

4.5. Brand mantra ................................................................................................................. 27

5. Marketing mix ........................................................................................................................ 27

5.1. Product ........................................................................................................................... 27

5.2. Price ............................................................................................................................... 29

5.3. Place ............................................................................................................................... 30

5.4. Promotion....................................................................................................................... 30

5.5. People ............................................................................................................................ 30

5.6. Process ........................................................................................................................... 31

5.7. Physical evidence ........................................................................................................... 31

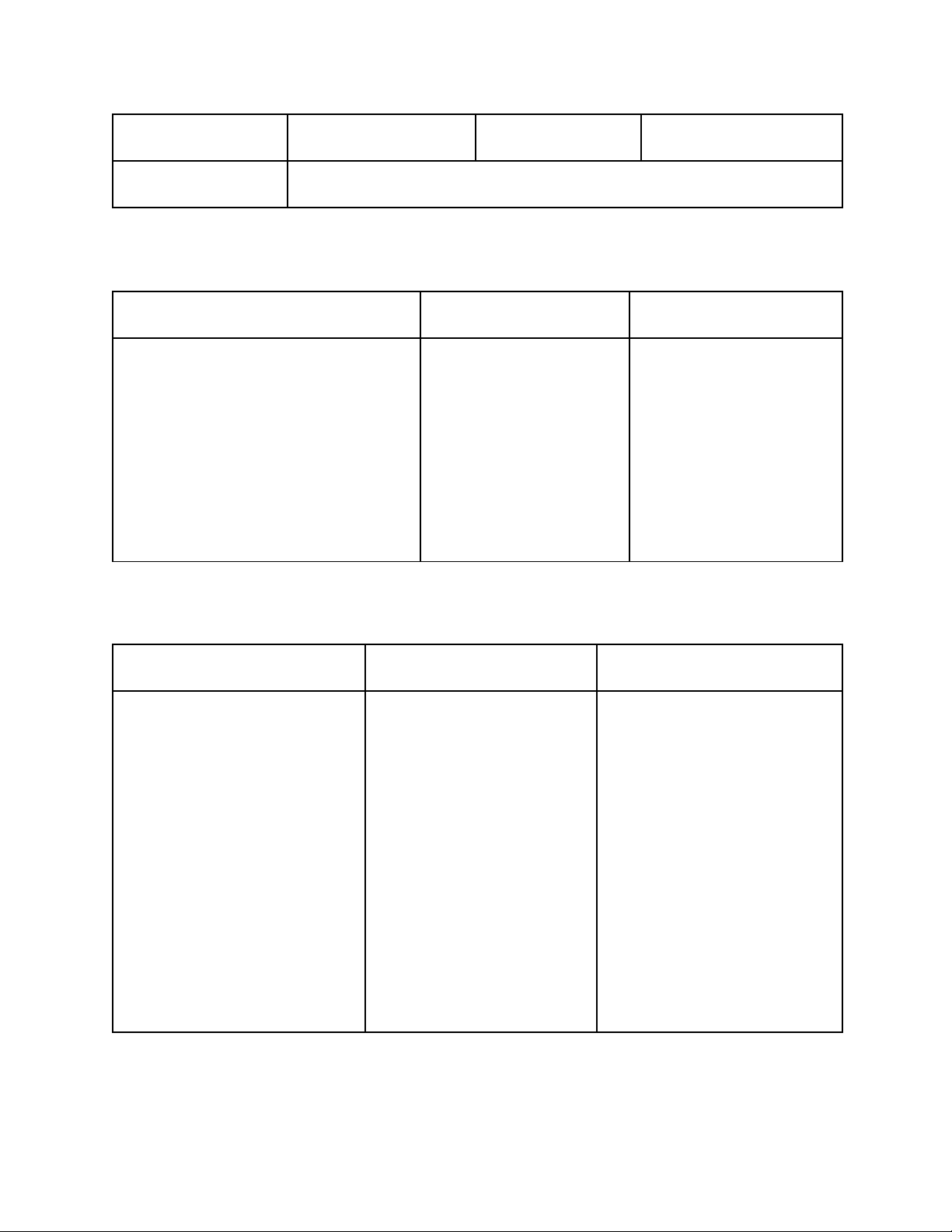

5.8. Compare with Vietjet Air and Bamboo Airways ........................................................... 31

6. Conclusion ............................................................................................................................. 34

REFENRENCE ................................................................................................................................ I III

LIST OF FIGURES, TABLES

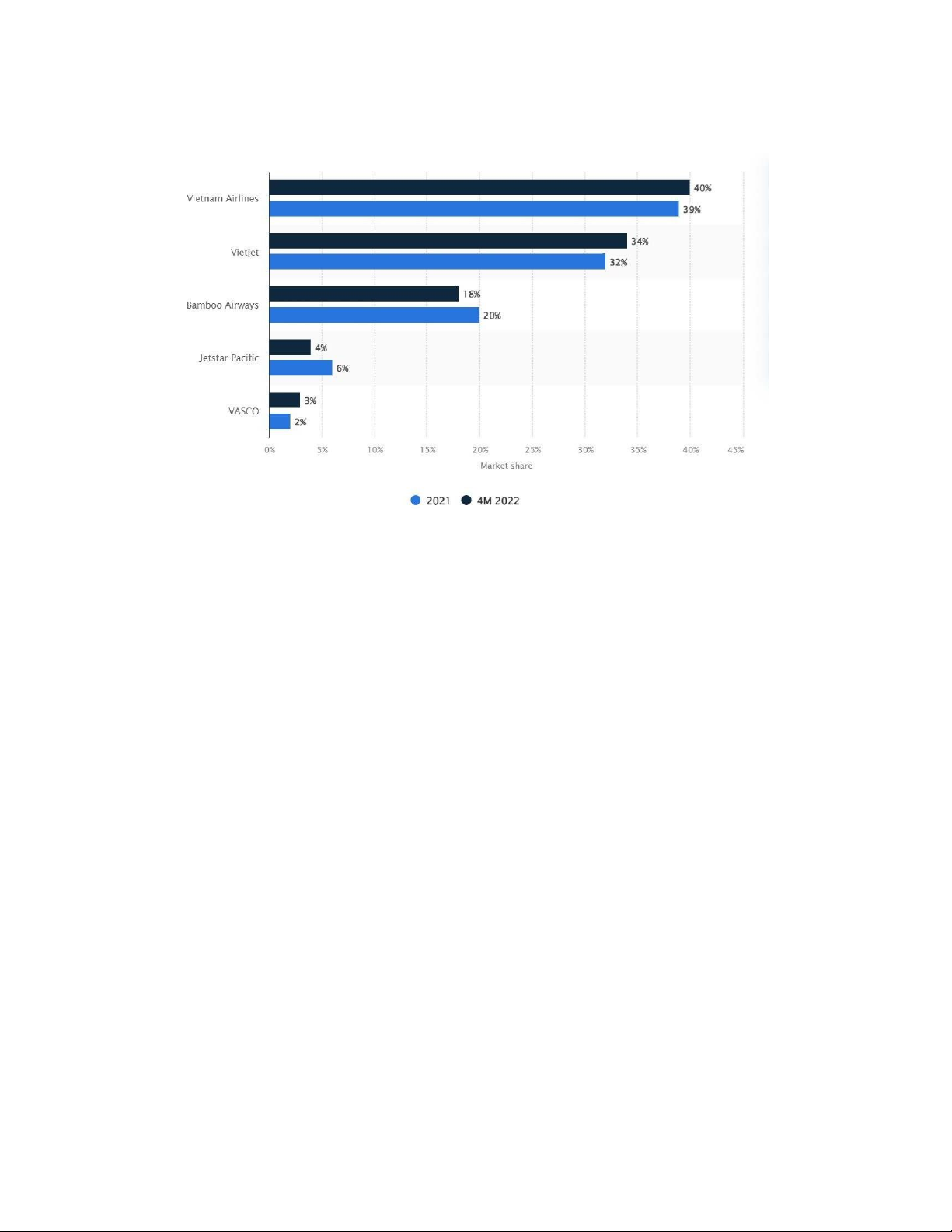

Figure 1.1. Aiation market share based on number of flights in Vietnam from 2021 to the first 4

months of 2022 .............................................................................................................................................. 2

Figure 2.1. Logo of Vietnam Airlines ............................................................................................... 9

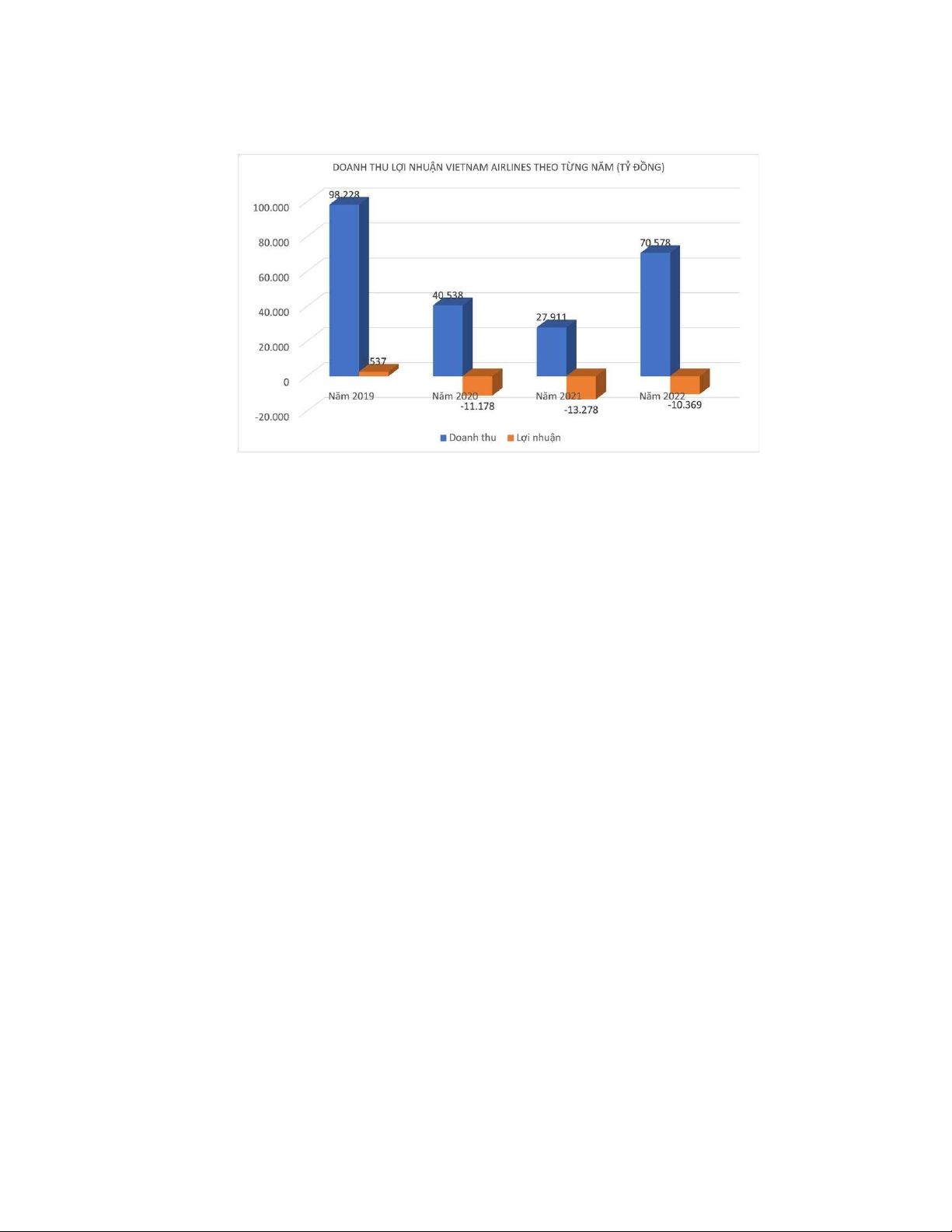

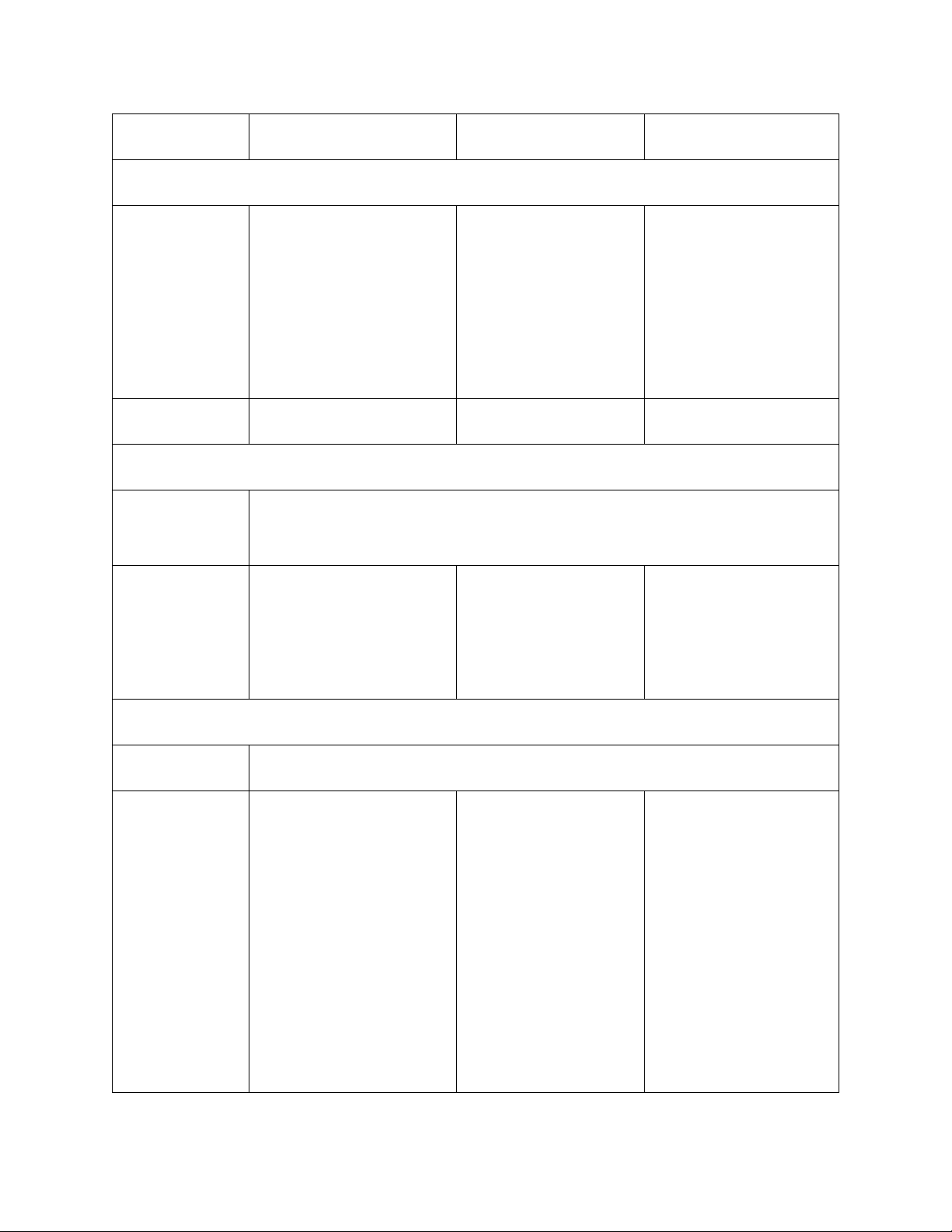

Figure 2.2. VNA revenue and profit by year (billion VND) ........................................................... 10

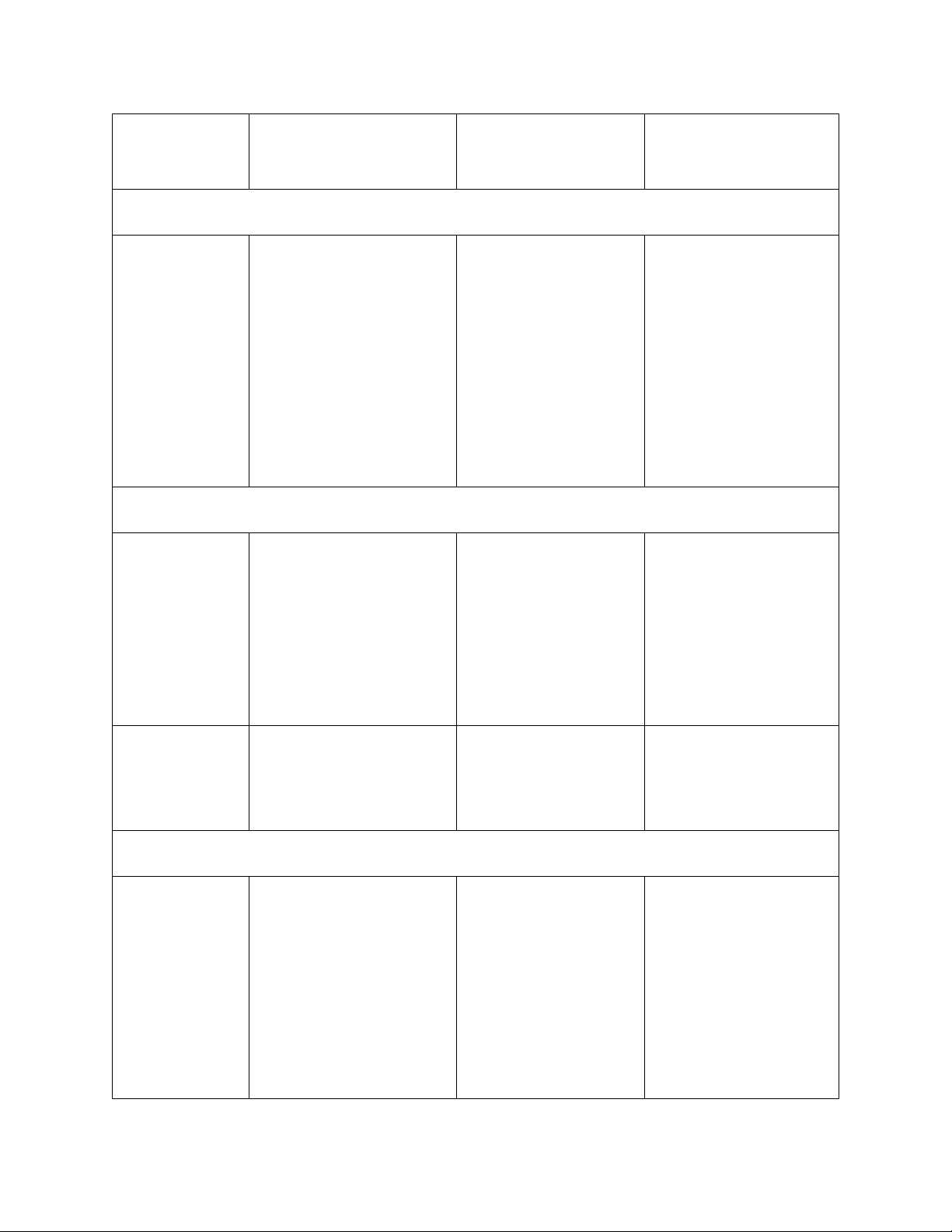

Table 3.1. Inbound logistic in the value chain of VNA, VJA, and BBA ........................................ 17

Table 3.2. Operations in the value chain of VNA, VJA, and BBA ................................................. 18

Table 3.3. Outbound logistic in the value chain of VNA, VJA, and BBA ...................................... 18

Table 3.4. Marketing and sales in the value chain of VNA, VJA, and BBA .................................. 19

Table 3.5. Service in the value chain of VNA, VJA, and BBA ...................................................... 19

Table 3.6. Technology development area in the value chain of VNA, VJA, and BBA .................. 19

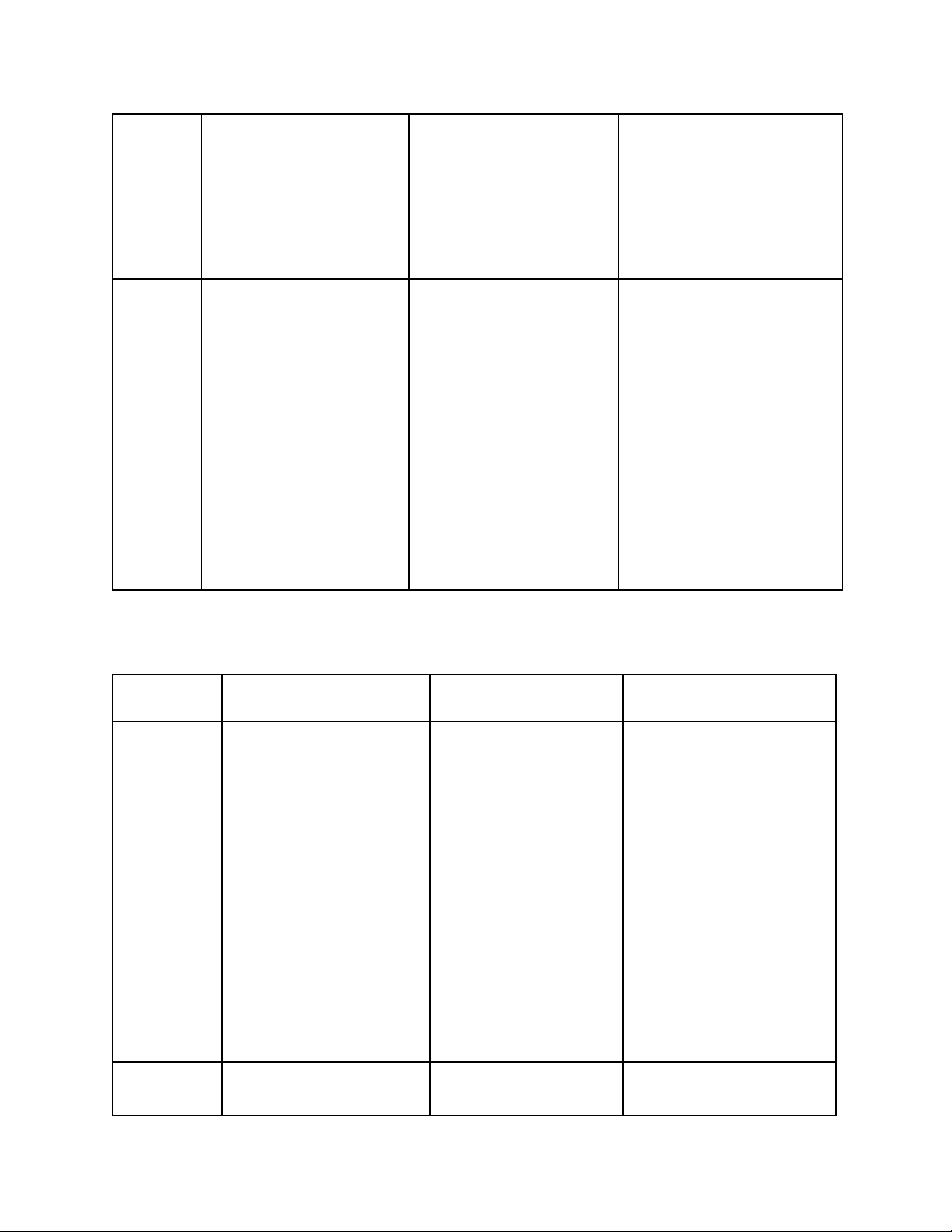

Table 3.7. Vietnam Airlines' value proposition in terms of price and benefit ................................. 25

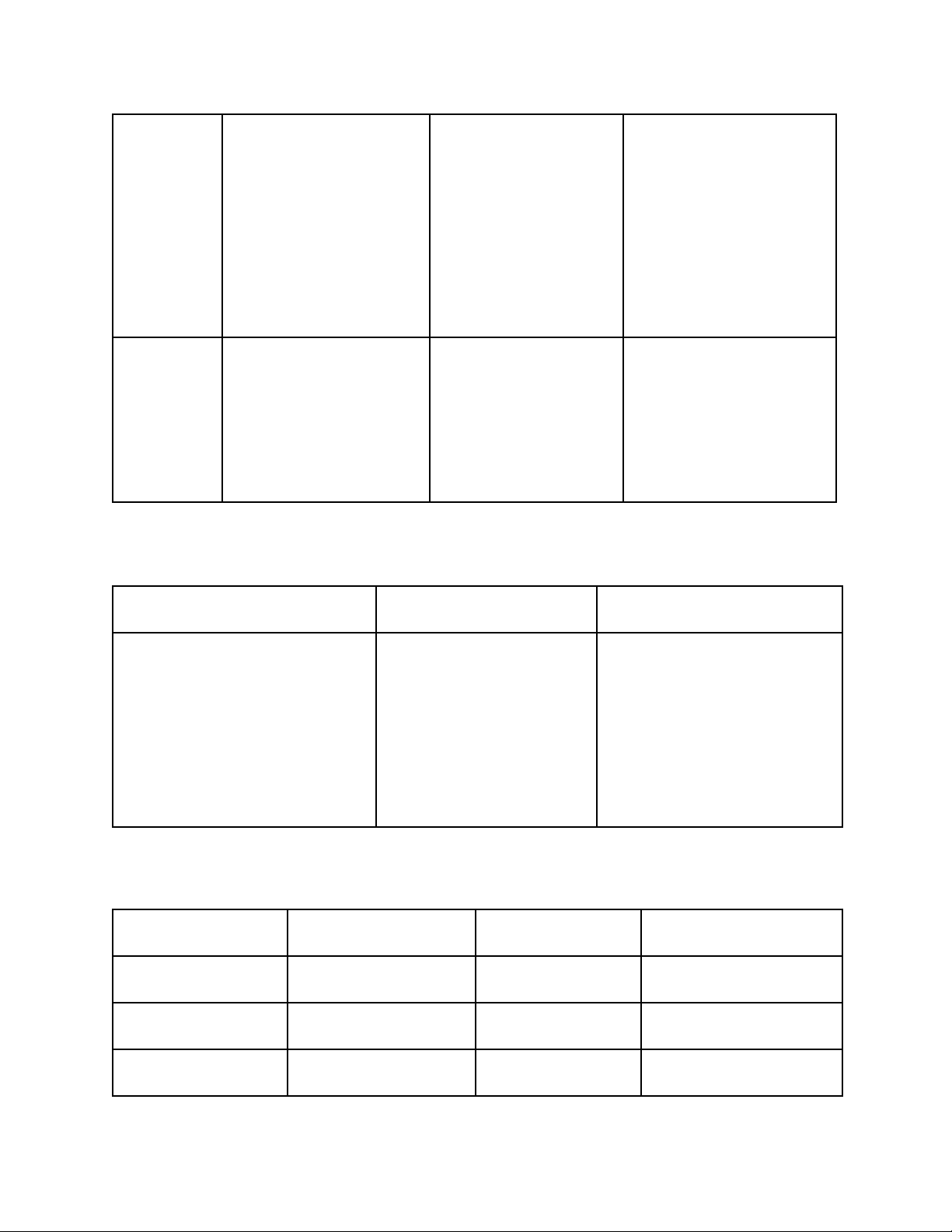

Table 3.8. Perceptual map of three airlines (Vietnam Airlines, VietJet Air and Bamboo Airways)

..................................................................................................................................................................... 26

Table 3.9. Compared 7Ps between 3 brand (VNA, VJA, BBA) ..................................................... 33 IV

LIST OF ACRONYMS No. Abbreviations Full writing 1 VNA Vietnam Airlines 2 VJA VietJet Air 3 BBO Bamboo Airways 4 IT Information technology 5 ACV

Airports Corporation of Vietnam 6 RPK/FT index

Revenue Passenger Kilometers per Flight Time index 7 GDP Gross Domestic Product V ACKNOWLEDGEMENT

Primarily, we wish to convey our utmost appreciation to all individuals who have played a vital

role in the creation of this report. Your incredible support and contributions have been essential to the

successful completion of this report.

We are particularly grateful for the unwavering guidance and mentorship provided by Ms. Thu

Thao throughout the duration of this course. Her invaluable support and constructive feedback have

served as a catalyst in motivating us to delve deeper into our research. We express our deepest gratitude

for her expertise and keen insight, which have allowed us to approach this work from a broader

perspective, infused with critical analysis.

Furthermore, we would like to acknowledge and express our thanks to the authors of the research

materials referenced within this report. Your commendable work has bestowed upon us an abundance of

knowledge and inspiration. We are truly appreciative of the opportunity to build upon the foundation

established by your insights, thereby contributing novel findings within our field of study.

Finally, we would also like to acknowledge the support and assistance of colleagues who research

intensively to provide the valuable information for this report.

Once again, we offer our heartfelt thanks to everyone who has supported and contributed to this

report. We trust that this report will serve as an invaluable source of information for future research. i

EXECUTIVE SUMMARY

The aviation sector is an integral part of Vietnam's transportation industry and is among the

fastest-growing ones in the world.Currently, the sector is divided into several segments, including full-

service carriers, low-cost carriers, hybrid carriers, and cargo carriers, each served by specific airlines.

This report aims to provide an in-depth analysis of the first three categories.

According to the Civil Aviation Administration of Vietnam, the domestic aviation market

comprises three major airlines: Vietnam Airlines, VietJet Air, and Bamboo Airways. Amid profound

economic and social changes, these airlines have undergone significant developments in recent years,

experiencing considerable impacts. To offer an overview of these airlines, this report will provide

comprehensive insights, with a primary focus on Vietnam Airlines.

In line with the aforementioned objective, this report will present diverse information categorized into four parts: - Part 1: Situation analysis - Part 2: Company introduction - Part 3: Marketing strategy - Part 4: Conclusion

In part 1, the report will provide a general overview of the aviation industry. Subsequently, part 2

will introduce the selected airlines for investigation by offering concise information about each. part 3

will delve into Vietnam Airlines, comparing it with the other two companies. Finally, the report will

conclude with assessments of Vietnam Airlines' business model and suggestions to address the challenges it faces.

Secondary research will serve as the primary method for collecting information for this report.

Various sources, including academic literature, industry reports, market research, and other available

resources, will be consulted to ensure comprehensive and reliable data 1

CHAPTER 1: SITUATION ANALYSIS

1. Market summary

The number of tourists visiting Vietnam has increased significantly. According to data from the

Airports Corporation of Vietnam (ACV), the number of passengers reached 56,891,590, accounting for

48.2% of the 2023 plan, a 29.2% increase compared to the same period in 2022. Among them,

international passengers reached 14,492,730, accounting for 45.3% of the annual plan, a 493.5% increase

compared to the same period in 2022. Meanwhile, domestic passengers reached 42,398,861, accounting

for 49.3% of the annual plan, a 2% increase compared to the same period in 2022.

The cargo market has been growing at an average rate of about 5-6% per year, with some years

reaching 9-10%. The value of goods transported accounts for 25% of Vietnam's total export value, with

an average volume of about 1.4 million tons per year. However, the market share of domestic airlines in

the air transport sector is only 12%, with the majority held by foreign airlines.

Airline companies are facing the issue of high fuel prices due to global economic and political

factors. Conflicts, wars, and separatism in Ukraine, Russia, and the Middle East have caused a significant

increase in global oil prices, leading to higher operating costs and difficulties for businesses in cost

reduction, resulting in higher passenger and cargo transportation fares.

The Vietnamese government plans to build more new civil airports in various regions across the

country. In addition to the existing 22 airports with a capacity of serving 100 million passengers per year,

it is projected that in the next 10 years, the number of passengers will reach 300 million. Therefore, the

Ministry of Transport has proposed the construction of 6 new airports by 2030 and an additional 3 by 2050.

2. Market growth

Vietnam now leads the world's fastest recovering domestic aviation sector and is the world's fifth

fastest growing aviation market, with 150 million air transport passengers expected by 2035, according to

the International Air Transport Association (IATA). According to the Civil Aviation Administration of

Vietnam (CAAV), the agency under the Ministry of Transport (MOT) that regulates the aviation industry,

Vietnam's airports served 40.7 million passengers and 765,000 tons of cargo during the first six months of

2022, up 56.8 percent and 30.6 percent, respectively, over the same period last year. According to the

CAAV, airports in the United States will service roughly 87.8 million people and 1.5 million tons of

cargo in 2022, representing increases of 190 percent and 5%, respectively, over 2021. 2

2.1. Market share

Figure 1.1. Aiation market share based on number of flights in Vietnam from 2021 to the first 4 months

of 2022

Travel restrictions and border closures had a significant impact on Vietnam's tourist and aviation

industries during the first two years of the pandemic. Nonetheless, Vietnam continues to have one of the

largest airline travel markets, with over 31 million passengers boarding domestically registered airlines in

2020. Since the country reopened its borders to international tourism on March 15, the Vietnamese

aviation industry has also begun to show indications of recovery. The number of airline passengers in

Vietnam topped that of the entire 2021 year in the first four months of 2022, indicating a stronger future.

Vietnam Airlines

Vietnam Airlines had a stunning turnaround in the first quarter of 2023, earning a pre-tax profit of

over 19 billion dong, up from a loss of over 2,600 billion VND in the same period last year. This was

driven by a more than doubling of revenue from air transportation, to 23,640 billion VND. Total revenue

and other income increased by roughly 114%, to 33,240 billion VND, with revenue from aviation

industry services increasing by more than 9,500 billion VND. Vietnam Airlines' overall cost in the first

quarter of 2023 was around 7,300 billion VND, a 67% increase over the same period the previous year.

With such strong revenue and low costs, Vietnam Airlines' gross profit has exceeded 1,500 billion VND,

while its after-tax loss has fallen by 2,300 billion VND over the same period. 3

Vietjet Air

VietjetAir made a large profit in the first quarter of 2023, despite having a lower revenue than

Vietnam Airlines. The airline safely completed 31,300 flights and transported 5.4 million passengers, up

57% and 75%, respectively, from the same period last year. VietjetAir achieved a revenue of 12,880

billion VND in air transport activities in the first four months of 2023, and its after-tax profit reached 168

billion VND during the same period. Both figures have more than tripled from the same time last year.

Vietjet's consolidated business results show a revenue of 12,898 billion VND, up 185% from the same

period in 2022. Profit after tax was 173 billion VND in the first quarter of 2023.

Bamboo Airways

According to the carrier's audited financial report for 2022, net revenue climbed by 3.3 times,

from 3.557 trillion VND in 2021 to12.018 trillion VND in 2022. However, the company suffered a gross

loss of 3.209 trillion VND. The cost of corporate governance increased from 158 billion VND in 2021 to

12.75 trillion VND in 2022, resulting in a 17.619 trillion VND loss last year. This was a record-breaking

loss, well exceeding Vietnam Airlines' loss of VND 2.625 trillion and Vietjet Air's loss of 1.993 trillion

VND. Bamboo Airways' shareholder equity had fallen to minus 835 billion VND by the end of 2022. 3. Market trend

3.1. Strong recovery in domestic demand

In the first half of 2022, domestic passenger traffic increased by 56.1% over the same period in

2021, reaching 51.5 million passengers. This was driven by pent-up demand for travel after the pandemic,

the government's promotion of domestic tourism, and the increasing affordability of air travel.

3.2. Growth in low-cost carriers

Low-cost carriers, such as Vietjet Air and Bamboo Airways, have played a major role in the

growth of the Vietnamese aviation industry. In 2021, low-cost carriers accounted for 52.5% of domestic

passenger market share. This is expected to increase to 60% by 2025.

3.3. Expansion of international routes

Vietnamese airlines are expanding their international networks to meet the growing demand for

international travel. In 2021, Vietnamese airlines launched new routes to destinations in North America,

Europe, and Australia. The number of international routes operated by Vietnamese airlines increased by 12% in 2021. 4

3.4. Focus on sustainable aviation

Vietnamese airlines are increasingly focusing on sustainable aviation practices. This includes

investing in fuel-efficient aircraft, exploring alternative fuels, and implementing green initiatives

throughout the entire aviation ecosystem. For example, Vietnam Airlines has committed to reducing its

carbon emissions by 10% by 2030. 4. Demographics

Vietnam, with a population of approximately 99.5 million, ranks as the 15th most populous nation

worldwide and the third most populous country in Southeast Asia.

In 2021, it is estimated that there will be around 67 million individuals in Vietnam's workforce,

constituting about 67% of the total population.

Over the period from 2000 to 2019, Vietnam experienced a consistent national population growth

rate of about 1% for many years. However, in recent times, factors such as the pandemic and the ongoing

implementation of a two-child policy to restrict births have resulted in a decline of the population growth

rate, falling below 1%. As of 2021, it stands at 0.8%, equivalent to the average level seen in middle- income countries.

As fertility rates continue to decline while life expectancy rises, Vietnam is projected to have an

older population representing 10% to just under 20% of its total population by 2035. The average life

expectancy of Vietnamese citizens stands at approximately 75 years, which is notably high for a middle-

income nation. Consequently, Vietnam confronts the challenge of an aging society, with the prospect of

becoming old before reaching economic prosperity.

Vietnam's per capita GDP currently stands at 40% of the global average, indicating a certain gap

between its current economic status and that of middle-to-high income levels. Moreover, the accelerated

pace of population aging means that Vietnam will have less time to adapt to the demands of an aging

society compared to many advanced economies. A report from the World Bank predicts that Vietnam's

old-age dependency ratio, representing the proportion of the population over 65 to the working-age

population, will rise from 13% in 2021 to 22% in 2039, approaching the 26% observed in high-income

countries like the United States.

5. Macro environment (PESTEL model) 5.1. Political

Government regulation

The Vietnamese government regulates the airline industry closely. This regulation can be

burdensome and costly for airlines. 5

Geopolitical instability

Vietnam is located in a relatively volatile geopolitical region. This instability can pose risks to the

airline industry, such as airspace closures and travel disruptions. 5.2. Economic

Economic growth

Vietnam's economy is expected to grow at an annual rate of 6.8% in 2023, according to the World

Bank. This strong economic growth will drive demand for air travel, both domestic and international.

Government investment

The Vietnamese government is investing heavily in the aviation sector (the Vietnamese

government's investment in the aviation sector is estimated to be around US$16 billion for the period

2021-2030. This investment is being used to develop new airports, upgrade existing airports, and

purchase new aircraft for Vietnam Airlines and other domestic airlines). This investment is expected to

help the industry grow and meet the increasing demand for air travel. 5.3. Social

Population growth

Vietnam's population is expected to grow from 98.2 million in 2023 to 101.3 million in 2027,

according to the United Nations. This population growth will also contribute to increased demand for air travel.

Rising middle class

Vietnam's middle class is growing rapidly. In 2023, it is estimated that 48% of Vietnam's

population will be considered middle class, according to the Asian Development Bank. This rising middle

class is expected to drive demand for leisure travel, including air travel.

5.4. Technological

New aircraft technologies

New aircraft technologies, such as more fuel-efficient engines and lighter materials, are helping to

reduce the operating costs of airlines.

Digital technologies

Digital technologies, such as online booking and mobile boarding passes, are making it easier and

more convenient for passengers to travel by air. 6

Big data analytics

Airlines are using big data analytics to better understand their customers' needs and preferences.

This information is then being used to improve the customer experience and develop new products and services.

5.5. Environmental

Rising fuel costs

The rising cost of fuel is a major challenge for airlines. Fuel costs account for a significant portion

of an airline's operating costs. According to forecasts of the International Energy Agency (IEA), crude oil

prices for the aviation industry will average 101 USD/barrel in 2023, an increase of 22% compared to 2022.

Carbon emissions

Airlines are under increasing pressure to reduce their carbon emissions. This is due to the growing concern about climate change. 5.6. Legal

Aviation safety regulations

The Vietnamese government has recently implemented new aviation safety regulations. These

regulations are designed to improve the safety of air travel in Vietnam. However, some airlines have

complained that these new regulations are too burdensome and costly.

Consumer protection laws

Consumer protection laws are becoming increasingly important in the airline industry. These laws

are designed to protect the rights of passengers. For example, some countries have laws that require

airlines to compensate passengers for delayed or canceled flights.

6. Competitive environment (5 Forces framework)

6.1. Threat of new entrants

The Vietnamese airline industry needs substantial capital investment to enter, as well as

specialized knowledge and expertise upon its players, which is an obstacle. Furthermore, the airline

industry capitalizes on efficiencies and synergies from economies of scale, so entry barriers are high. For

example, the Vietnamese government requires new airlines to have a minimum capital of 3 trillion VND

(130 USD million). We discover that airlines face substantial entry and exit barriers, indicating that the

effect of this element is very large. 7

6.2. Bargaining power of supplier

Factors affecting the power of suppliers in the airline industry would be fuel and aircraft, which

are all affected by the external environment. Firstly, the price of aviation fuel is influenced by changes in

the global oil market, which can fluctuate wildly due to geopolitical and other factors.Secondly, the

airline industry needs aircraft either outright or on a temporary lease basis, which means that airlines must

rely on the two powerhouses, Airbus and Boeing, for their aircraft requirements. Hence, the supplier's

strength in terms of the three inputs needed for them is classified as strong.

6.3. Bargaining power of buyer

With Vietnam regarded as one of the world's fastest expanding aviation markets, the number of

potential customers has increased dramatically, with an estimated 150 million passengers by 2035 (Pham

2020) In 2022, Vietnamese customers spent an average of $100 per round-trip domestic flight. This is

relatively low compared to other countries in Southeast Asia, such as Thailand and Singapore. Since the

expense and commitment needed to switch from one carrier to another is negligible, these consumers

possess tremendous negotiating power over airlines.Furthermore, the advent of third-party trip-booking

websites and mobile applications exacerbates the airlines' challenge. Travelers will use websites or

applications to compare fares for all airlines, register their trip itineraries, and then pick the cheapest price that suits their schedules.

6.4. Threat of substitute products

Developing countries such as Vietnam can choose to travel by train, bus or car and they often

prefer these approaches due to the minimal expenses, which raises the threat of substitutes. For example,

the train ride from Hanoi to Ho Chi Minh City takes about 30 hours, while the flight takes about 2 hours.

However, when it comes to time, convenience, and occasionally service, airlines outperform all other

means of transportation. Hence, until new inventions replace air transport as the cheapest and most

affordable way to travel long distances, the airline industry faces low to medium threat from substitutes.

6.5. Rivalry among existing competitors

For a variety of reasons, rivalry among major domestic airlines is fierce.The current industry

seems to be in a state of maturity. In the long term, the number of players remains constant, and it does

not seem to be under or overcapitalized. In this sector, operating costs are incredibly high. This makes

leaving the industry difficult since they are most often in long-term debt negotiations in order to remain in

operation. The processes involved are extremely complex, which adds to the rivalry.The competition

between existing players and the power of suppliers are the most important factors in this industry.

Established firms are fiercely competitive and can drive out any firm that lacks sufficient resources. 8

Since planes are too expensive to manufacture, suppliers are powerful powers. Even a minor

improvement in credit terms by the vendors may result in a major loss for the company. The other powers

involved, on the other hand, seem to pose a minor threat. Entering the market is expensive and time

intensive, which limits the probability of entry. Buyers have a weak force because switching costs are

low, and replacements have a weak force because they are typically too expensive.In addition, some

airplane makers have been producing eco-friendly planes (Bamboo Airways 2019), resulting in a shift in

supplier bargaining power. This will distinguish the materials, posing a challenge to suppliers. 9

CHAPTER 2: COMPANY INTRODUCTION 1. Overview

Figure 2.2. Logo of Vietnam Airlines

Vietnam National Airlines - Vietnam Airlines began operations in January 1956. This time also

marked the birth of the civil aviation industry in Vietnam. The first domestic flight was operated by the company in September 1956. -

In April 1993, Vietnam Airlines was officially formed in the market as a state-owned enterprise

specializing in air transport business. -

June 10, 2010, Officially became the 10th member of the Skyteam airline alliance.

(The Skyteam airline alliance is the world's second-largest global airline alliance. SkyTeam

provides passengers with consistent service from member airlines with a wider choice of destinations and

flight frequencies. globally. To date, this alliance has a total of 19 members.) -

In 2015, Vietnam Airlines became a joint-stock company, and its relationship with shareholders

has been crucial to its sustainable development. The airline is committed to transparency,

communication, and balancing shareholders' interests with Vietnam's economic development. -

July 2016, Officially recognized as a 4-star international airline according to Skytrax standards. -

Vietnam Airlines has become the leading airline in Vietnam after two decades of growth at a high

annual rate. The airline is recognized as a symbol of national pride and has a global network.

Vietnam Airlines is a dynamic and modern airline that proudly embodies the cultural spirit of

Vietnam. For more than twenty years, it has been a leader in the thriving aviation industry of Vietnam,

which is experiencing remarkable growth. With its strong reputation as a contemporary airline deeply

connected to its cultural roots, Vietnam Airlines aims to establish itself as a top-tier 5-star airline in Asia.

1.1. Main business sectors

The aviation industry encompasses various activities, including air passenger transport, air cargo

transport, and direct support services for air transportation. These services involve general aviation

activities such as aerial photography, geological surveys, calibration of air navigation stations, and

maintenance of power lines. They also include services for oil and gas, afforestation, environmental

testing, search and rescue, medical emergencies, and tasks related to politics, economy, society, security, 10

and defense. Additionally, specialized aviation services are provided, along with commercial, tourism,

hotel services, and duty-free sales at quarantine areas in international border gates, airports, and

provinces. Ground commercial technical services, passenger terminal services, cargo terminal services,

and apron services at airports and airfields are also part of the industry. Moreover, the industry involves

the repair and maintenance of aircraft, engines, spare parts, aviation equipment, and commercial ground

service equipment. The production of measuring, testing, navigation, and control equipment, as well as

the provision of technical services and spare parts for domestic and foreign airlines, are also included. 2. Mission

The mission of Vietnam Airlines is to be a leading airline that connects Vietnam to the world,

with a commitment to delivering excellent and safe air travel experiences for passengers. Their mission

extends beyond transportation, as they strive to uphold the Vietnamese cultural essence and promote the

country's image globally. Vietnam Airlines aims to achieve consistent growth, provide exceptional

customer service, maintain operational excellence, and contribute to the development of the aviation

industry in Vietnam. Additionally, they prioritize sustainability and social responsibility in their

operations, seeking to minimize their environmental impact and actively engage in community initiatives. 3. Vision

Vietnam Airlines endeavors to maintain its dominant position as the foremost aviation group in

Vietnam. It aspires to emerge as a premier choice for customers in the Asian region, aiming to be

recognized as a leading airline in terms of customer preference. Additionally, Vietnam Airlines aims to

continue serving as the primary transportation provider for Vietnam, upholding its role as the national flag carrier. 11

4. Business situation

Figure 2.3. VNA revenue and profit by year (billion VND)

4.1. In 2019

Vietnam Airlines Corporation has recently released its consolidated financial report for the fourth

quarter and the full year of 2019. In the fourth quarter, the airline recorded a revenue of 23,000 billion

VND, showing a decrease of approximately 800% compared to the same period. The revenue per

kilometer also declined by more than 1,000%, dropping from 2,490 billion VND to 1,402 billion VND.

While the financial revenue decreased by 335 billion VND, the financial costs also decreased

significantly by over 1,000% compared to the fourth quarter of 2019. Excluding sales and management

costs, Vietnam Airlines faced a loss of -134 billion VND from its business activities. However, the airline

managed to maintain a pre-tax profit of 78 billion VND for the last quarter, largely due to an additional

profit of 202 billion VND from Sales and leaseback activities.

Looking at the overall performance in 2019, Vietnam Airlines experienced a slight increase in

revenue from nearly 96,800 billion VND to almost 98,200 billion VND. The pre-tax profit also saw a

marginal growth of 2%, rising from 3,312 billion VND to 3,370 billion VND. These figures represent the

highest recorded revenue and profits in the history of the company.

4.2. In 2020

Considering the cumulative results for the entire year 2020, Vietnam Airlines generated a net

revenue of nearly 40,613 billion VND, marking a 59% decline compared to 2019. The airline experienced

a significant negative profit after tax, reaching nearly 11,098 billion VND, whereas it had achieved a

profit of 2,537 billion VND in the same period of the previous year. 12

It is worth noting that this loss is considerably lower than the projected estimate announced by

Vietnam Airlines' board of directors during the extraordinary general meeting of shareholders on

December 29, 2020, which was expected to reach 14,445 billion VND.

By the end of December 31, 2020, Vietnam Airlines' total assets amounted to 62,967 billion

VND, reflecting a decline of 17.6% compared to the beginning of the year. The airline's cash and cash

equivalents decreased by nearly half, amounting to 1,647 billion VND. Short-term financial investments

also witnessed a sharp decline from 3,579 billion VND to 494 billion VND. In contrast, short-term

financial debt increased by 72% to 11,187 billion VND. Additionally, the equity of Vietnam Airlines

decreased from 18,507.55 billion VND to nearly 6,141 billion VND.

According to statistics released by Vietnam Airlines, the year 2020 saw a notable decrease in

operational metrics due to the impact of the COVID-19 pandemic. The airline operated approximately

96,500 flights, reflecting a decline of over 48% compared to the previous year. The passenger output was

estimated at 14.23 million, a 51% decrease, and the cargo transportation reached nearly 195,000 tons,

down by 47% compared to the figures recorded in 2019.

4.3. In 2021

As of June, Vietnam Airlines' total assets amounted to 61,255 billion VND, which was a decrease

of more than 1,300 billion VND compared to the same period last year. On the other hand, liabilities

increased by 14%, reaching 64,005.6 billion VND, resulting in negative capital of 2,750 billion VND for

the owners. Financial debt also experienced a slight increase, totaling 34,462 billion VND.

The company's inventories in warehouses saw a significant increase from 1,849 billion VND to

2,580 billion VND, primarily consisting of goods and raw materials. Although the static cash flow from

business activities remained negative at 723.9 billion VND, it showed notable improvement compared to

the same period in the previous year.

In the third quarter of 2021, Vietnam Airlines' static revenue reached over 4,735 billion VND,

representing a 60% decrease compared to the same period last year, resulting in a loss of more than 3,000

billion VND. After deducting all expenses, the company's pre-tax income was 3,460 billion VND, with a

net loss of 3,369 billion VND attributed to the parent company's shareholders.

Vietnam Airlines explained that the parent company's after-tax profit experienced a loss of nearly

2,773 billion VND, which marked a 12.4% increase compared to the same period the previous year (-

2,466 billion VND). The consolidated after-tax loss of 3,531 billion VND, an increase of 17.1%

compared to the previous year (-3,017 billion VND), was primarily attributed to the impact of the fourth

wave of the Covid-19 epidemic, which occurred during the summer peak period and significantly affected

the company's business performance. 13

4.4. In 2022

Vietnam Airlines has released its consolidated financial report for Q4 2022, revealing that its sales

and service revenue almost doubled compared to the same period in 2021, reaching 19,573 billion VND.

However, due to the higher cost of goods sold, the airline reported a gross loss of 827 billion VND, up

from 634 billion VND in the previous year.

The increase in financial expenses was mainly due to higher loan interest and an exchange rate

loss of 538 billion VND. The airline's affiliated companies also suffered losses, contributing to an after-

tax loss of 2,585 billion VND for Vietnam Airlines in Q4 2022.

For the whole year of 2022, the airline reported a net loss of 10,400 billion VND, despite a 2.5

times increase in revenue. This marks the third consecutive year of losses for Vietnam Airlines, with an

accumulated loss of 34,199 billion VND, negative equity of 10,199 billion VND, and huge liquidity

pressures with only 3,400 billion VND in cash.

4.5. In 2023

In the first half of 2023, Vietnam Airlines reported a significant increase in revenue, reaching

44,336.3 billion VND, a 47% increase compared to the same period last year. The gross profit on sales

and service provision also improved, reaching 2,888 billion VND, compared to 1,963 billion VND in the

first half of 2022. After deducting sales and management costs, the net profit from business activities for

Vietnam Airlines in the first half of 2023 was -1,070 billion VND, an improvement from -5,204 billion

VND in the same period last year.

Overall, the airline achieved a profit after corporate income tax of -1,331 billion VND in the first

half of 2023, compared to -5,237 billion VND in the same period last year.

The decrease in losses can be attributed to increased revenue and other income, particularly from

the recovery of European, Australian, and American markets. Although expenses also increased, the

growth rate of revenue outpaced the growth rate of costs, resulting in a gross profit on service provision

for the parent company and a decrease in after-tax losses compared to the same period last year. 14

CHAPTER 3: MARKETING STRATEGY

1. Target market

1.1. Customer portrait Demographic

The target customer segment of Vietnam Airlines comprises individuals aged 25-60,

encompassing both males and females. This segment consists of individuals who are single, married, or

married with children. Notably, they possess a high income level, with a minimum threshold of 835 USD

or more. Occupation-wise, they primarily hold positions as officials, managers, and professionals in high-

paying roles. Furthermore, this segment boasts a higher educational attainment, with most individuals

being graduates or possessing higher degrees. From a religious standpoint, customers in this segment

exhibit a range of beliefs, including irreligion, Buddhism, and Catholicism. It is also worth noting that the

majority of customers within this segment belong to the Kinh ethnic group. Geographically, they can be

found primarily in urban areas, such as Ha Noi, as well as in foreign countries. Psychographic

Customers within this segment demonstrate a keen preference for quality and prioritize safety and

comfort when selecting airlines. Their personalities reflect a practical and fact-minded approach while

engaged in their professional endeavors. However, they exhibit dedicated and warm qualities when

enjoying leisure time with loved ones. In terms of hobbies and activities, they engage in frequent

traveling and undertake business trips. Behavioral

The online platform serves as the preferred channel for this customer segment, encompassing

websites, apps, and social media. They display a purchase frequency of 1-2 times per month for business

trips; whereas for tourist purposes, the frequency exceeds 2 times per year. Moreover, this customer

segment exhibits a high level of engagement with promotional activities, actively participating through

actions such as liking, sharing, and commenting.

1.2. Paint points

Pain points refer to particular issues or challenges encountered by prospective customers. In the

aviation sector, customers confront numerous concerns when considering airlines as their preferred mode

of travel. This report identifies only five key pain points affecting customers in the aviation industry,

acknowledging that the dynamic nature of the market may lead to the elimination of certain factors. 15

Flight delays and cancellations

The majority of Vietnamese passengers encounter issues such as flight delays and cancellations

when utilizing various airlines, particularly with low-cost carriers like VietJet Air. With increasing market

demand and improved living standards, many customers seek out airlines with higher fares to ensure a

better travel experience. However, even major airlines like Vietnam Airlines still face a significant rate of

flight delays. Consequently, airlines are striving to enhance personnel and aircraft operations procedures

to achieve optimal efficiency and address this situation. Among these carriers, Bamboo Airways has

emerged as an airline with the highest on-time performance in the industry, presenting fierce competition to other remaining airlines.

Digital adoption and accessibility

According to technical data from Google, as of the beginning of 2023, Vietnam has 77.93 million

internet users, accounting for 79.1% of the total population. Furthermore, the number of social media

users also reached 70 million, equivalent to 71% of the total population. Based on the aforementioned

statistics, it can be observed that Vietnam has a comparatively high level of internet accessibility.

However, due to the rapid development of the internet and the emergence of numerous artificial

intelligence technologies, a significant portion of older internet users with limited knowledge of

cybersecurity face increasing challenges in accessing the digital transformation trends of airlines.

Therefore, for a successful digital transformation, airlines also need to take appropriate steps to provide

users with synchronized and user-friendly approaches while maintaining effectiveness.

Customer service experience

The airline services in Vietnam lack synchronization and exhibit significant differences between

low-cost carriers and full-service carriers. Low-cost carriers are characterized by low service quality, with

issues such as flight delays and cancellations being prevalent. Therefore, when opting for low-cost

airlines, users have to endure subpar service quality.

Limited airline options (Route network)

Vietnam Airlines is the airline with the largest number of domestic and international routes.

However, this also poses challenges for customers as it is a high-priced airline. Therefore, the emergence

of low-cost carriers such as VietJet Air and Bamboo Airways partially addresses the transportation needs

of customers with lower budgets. However, achieving the extensive network and connectivity of routes

like Vietnam Airlines requires a considerable amount of time, and the lack of diversity in airline choices will continue to persist. 16

Cost of air travel

According to the General Statistics Office, the average monthly income of workers is 7.0 million

Vietnamese dong (290 USD), representing a 6.8% increase compared to the same period last year.

Despite the improved income of the population, the impact of inflation and unemployment still poses a

significant barrier for the majority of Vietnamese citizens to allocate a considerable amount of funds for

air travel. In the near future, any airline with the capability to maximize operational efficiency and reduce

costs will possess a significant competitive advantage in the market. Currently, some low-cost carriers

such as VietJet Air and Bamboo Airways are offering competitive prices.

2. Critical success factors

There are four factors affecting the success of airlines, including safety and security, customer

satisfaction, route network and connectivity, and employee engagement and training.

2.1. Safety and security

Regular maintenance of aircraft, effective security measures

2.2. Customer satisfaction:

Punctuality, facilities, service (catering, in-flight entertainment), ground service (baggage

handling, passenger check-in), effective cost management to provide customer with a competitive price,

application of AI and technology in operation (AI, self-service options)

2.3. Route network and connectivity:

Having extensive and well-connected route network to offer customers with wider range of options

2.4. Employee engagement and training:

Vietnam's airline industry is experiencing rapid growth and fierce competition, which places a

premium on providing high-quality service to gain a competitive edge and increase customer satisfaction.

Engaged employees who are properly trained and equipped to provide excellent service will be more

effective in meeting these expectations, generating positive customer experiences, and promoting loyalty towards the airline. 3. Value chain

3.1. Inbound logistic

Vietnam Airlines VietJet Air Bamboo Airways 17 - Airbus and Boeing - Airbus and Boeing - Airbus and Boeing - 105 Airbus aircraft (2.3- - 76 Airbus aircraft (From - 21 Airbus aircraft Airline 12.2 years) 2.7 years) - 3 Boeing aircraft fleet - 50 Boeing 737 Max - 5 Embraer aircraft aircraft (US$ 10 billion) - Vietnam Air Petrol - Petrolimex Aviation Fuel - Petrolimex Aviation Fuel Company Limited JSC JSC (SKYPEC) - One of the two biggest - One of the two biggest - Biggest aviation fuel aviation fuel suppliers in aviation fuel suppliers in Aviation suppliers in Vietnam Vietnam Vietnam fuel - Eight fuel depots - Four fuel depots - Four fuel depots - Complete infrastructure

and fuel storage facilities at all 18 civil airports nationwide

Table 3.1. Inbound logistic in the value chain of VNA, VJA, and BBA 3.2. Operations

Vietnam Airlines VietJet Air Bamboo Airways - Vietnam Airlines - ST Engineering - Air France Industries KLM Engineering Company (Singapore) Engineering & (VAECO) - LaoAirlines (Laos) Maintenance - 6 hangars at Tan Son Nhat airport and Noi Bai Aerospace airport engineering - 20 aircraft parking positions - Repair workshops and warehouse facilities for equipment and systems Food - VACS (Vietnam Airlines - Fee-based service - Fee-based/free service 18 Caterers Limited - Less diverse menu - Less diverse menu Company) - Noi Bai Catering Joint catering Stock Company (NCS) - VACS has 400 chefs - Fee-based/ free service - Diverse menu - More options (Press - Less options (Film, - Less options (Bamboo Inflight reader, film, music, game, music) Sky) entertainmen wireless IFE) - Being updated regularly t - Top Asia airline for in- flight magazine

Table 3.2. Operations in the value chain of VNA, VJA, and BBA

3.3. Outbound logistic

Vietnam Airlines VietJet Air Bamboo Airways

- Vietnam Airport Ground Services - Check-out service - Check-out service Company Limited (VIAGS) - Arrival and connecting

- Arrival and connecting service - Check-out service service - Baggage service

- Arrival and connecting service - Baggage service - Air ticket service - Baggage service - Air ticket service - Air ticket service

Table 3.3. Outbound logistic in the value chain of VNA, VJA, and BBA

3.4. Marketing and sales

Vietnam Airlines VietJet Air Bamboo Airways Website vietnamairlines.com vietjetair.com bambooairways.com Facebook (Followers) Vietnam Airlines (2.1M) Vietjet (5.5M) Bamboo Airways (410K) TikTok (Follower) Vietnam Airlines (140K) Vietjet (892K) Bamboo Airways (410K) 19 Application Vietnam Airlines (+1M) VietJet Air (+1M) Bamboo Airways (+100K) Others

Air ticket agent and retail unit

Table 3.4. Marketing and sales in the value chain of VNA, VJA, and BBA 3.5. Service

Vietnam Airlines VietJet Air Bamboo Airways

- Top Asia airline for economy class seats - Check-in and check-out - Check-in and check-out

- Top Asia airline for cabin crew - Arrival and connecting - Arrival and connecting

- Pioneer in telephone check-in - Baggage - Baggage - Check-in and check-out - Air ticket - Air ticket - Arrival and connecting - Baggage - Air ticket

Table 3.5. Service in the value chain of VNA, VJA, and BBA

3.6. Technology development (Support activities)

Vietnam Airlines VietJet Air Bamboo Airways - Technology Research Center - Aviation Technology Center

- Passenger Service System – - New CLM Air Traffic - Flight data analysis system PSS Management system - Safety Management System - Flight data analysis system - Human resource management (SMS) - Safety Management System software (HRMS) - Aviation operations and (SMS) - Business process automation management applications - Aviation operations and software (BPM) (AMOS, AIMS, AirFase, management applications - Shared database (Data SFCO2, Intellysis) (AMOS, AIMS, AirFase, Warehouse) SFCO2, Intellysis)

- Utilizing Airbus' (Skywise) Big Data platform

Table 3.6. Technology development area in the value chain of VNA, VJA, and BBA 20

3.7. Core competence

Core competence is a set of power tools that serves as key to successfully survive in any market.

In a magazine published by C.K. Prahalad and Gary Hamel on Harvard Business Review in 1990, they

concluded that company only obtain core competence as it meet the following conditions: -

The activity must provide superior value or benefits to the consumer. -

It should be difficult for a competitor to replicate or imitate it. - It should be rare.

Based on the aforementioned criteria, the three companies possess distinct core competencies that

enable them to effectively compete with one another.Vietnam Airlines, known as a flag carrier, is a well-

established company with the widest range of advantages, including

A biggest fleet of aircraft

On average, Vietnam Airlines boasts the largest fleet of aircraft, consistently maintaining a fleet

size of over 100 planes. This figure surpasses VietJet Air's fleet by 10 to 20 aircraft. The significant

magnitude of Vietnam Airlines' fleet grants it a crucial competitive edge, as it can accommodate a greater

number of passengers simultaneously. In the domestic market, Vietnam Airlines stands alone in operating

such a sizable fleet. From an economic perspective, replicating this advantage poses a formidable

challenge for VietJet Air and Bamboo Airways, as it necessitates substantial capital resources and

strategic partnerships, which are typically prioritized by national brands.

Fuel and engineering supply

Vietnam Airlines excels in fuel and engineering supply. Upon examining the value chain of

Vietnam Airlines, it becomes evident that the company possesses a network of subsidiaries that provide

vital fuel and related services. These subsidiaries, such as VACS and NCS, serve as purveyors of the

highest-quality services in the domestic market. Consequently, Vietnam Airlines can offer superior

quality to its customers without being encumbered by third-party concerns, courtesy of its trusted and controlled supply chain. Infrastructure

As fuel and engineering supply, Vietnam Airlines currently boasts the most comprehensive and

advanced infrastructure across all domestic airports. This achievement is the culmination of over 60 years

of establishment and progressive development. Presently, this extensive infrastructure facilitates the

seamless operation of Vietnam Airlines' business operations. Moreover, it contributes to customer

satisfaction by expediting the processing of demands and providing comfortable spaces for passengers. 21 Technology

With respect to technology, Vietnam Airlines, along with VietJet, maintains research and

development centers. Nevertheless, owing to its substantial financial and human resources, Vietnam

Airlines possesses more cutting-edge technologies. These advanced technologies are deemed crucial

resources in the digital era, as they significantly impact the sustainable progression of the overall business.

Conversely, VietJet Air is positioned as a low-cost carrier, leveraging a well-defined targeting

strategy and distinct competencies. While it can be favorably compared to Vietnam Airlines, which

possesses exceptional competencies throughout the entire market, VietJet Air still dominates the lower-

tier segment with its abundant fleet of young aircraft and ongoing technological advancements that

enhance the overall quality of its services.

Given the identical circumstances, Bamboo Airways cannot contend with the advantages boasted

by Vietnam Airlines. Nonetheless, being a hybrid carrier confers upon Bamboo Airways a distinctive

attribute. As the population and demand continue to expand, Bamboo Airways, with its youthful and

expanding fleet of aircraft, will acquire a pivotal competency to vie against the other two companies.

On the whole, owing to its substantial capital resources and extensive developmental history,

Vietnam Airlines truly distinguishes itself as the entity possessing core competencies that pose challenges

for other competitors to duplicate. Across the entire market, the competencies exhibited by VietJet Air

and Bamboo Airways fall short of acquiring core status, as Vietnam Airlines has already surpassed them

in performance. However, these two companies may emerge as potential contenders in the foreseeable

future if market conditions and demands undergo changes. Presently, VietJet Air and Bamboo Airways

are experiencing rapid growth, strategically seizing additional market share within the domestic market of

Vietnam. Consequently, a period of time will be required for these two companies to elevate their

competencies to core status—competencies that are clearly discernible, exceptional, and arduous to imitate.

3.8. Competitive advantages

Vietnam Airlines has established its competitive advantages thanks to focusing on four key

factors and making them superior to that of competitors. 22

3.8.1. Exceptional performance and productivity Workforce

It has implemented a salary reform program that links salary with business efficiency.

This has motivated the workforce, improved job productivity, and attracted skilled employees to the company.

The company reorganized its labor force, maintained stability, and provided training to develop special labor roles.

Despite the increasing number of flights and passengers, there has been no increase in the labor force. -

The productivity of the labor force has increased consistently over the years. -

In 2017, labor productivity was 5.15 million passengers based on the RPK/FT index. -

In 2018, labor productivity increased by 7.6% compared to 2017 based on the RPK/FT index. -

In 2019, labor productivity increased by 4% compared to 2018 based on the RPK/FT index. Technology

Vietnam Airlines prioritizes the use of advanced and modern technology to develop its operations.

The company focuses on developing e-commerce and customer support technology. By

implementing IT applications, Vietnam Airlines improves productivity and eliminates unnecessary tasks.

The integrated operating system for business production optimizes operations.

Electronic flight logs eliminate paperwork and reduce the likelihood of errors.

Software systems for pilots and flight attendants streamline their tasks.

Mobile applications reduce operating costs and improve efficiency.

3.8.2. Superior quality

Superior quality products and services differentiate and increase the value of products based on customer feedback.

High-quality products help eliminate service product defects and reduce cost structures.

Vietnam Airlines focuses on maintaining and improving the quality of ground services by

applying technological solutions.

The airline introduces new innovations for air travel, including enhancing its culinary offerings

and providing varied entertainment options.

Vietnam Airlines has perfect safety and air service ratings according to the Civil Aviation Administration of Vietnam. 23

High quality products will allow Vietnam Airlines to charge higher prices and keep its cost structure low.

3.8.3. Innovative solutions

Vietnam Airlines has pioneered the use of wireless streaming, WiFi, and entertainment apps for

its air services. These features have helped Vietnam Airlines differentiate itself from its competitors in

Vietnam and potentially increase profit margins.

Vietnam Airlines has introduced Family check-in services to simplify procedures and save time at the airport.

→ These innovations have made Vietnam Airlines a digital technology pioneer in its service offerings.

3.8.4. Outstanding customer response

Vietnam Airlines continuously improves the passenger experience and provides services of

similar quality to major airlines worldwide.

Vietnam Airlines invests in specialized equipment to serve passengers with mobility limitations attentively.

Vietnam Airlines offers a Special Economy Class (Premium Economy) with a spacious

environment and similar meal offerings to business class.

Vietnam Airlines provides preferential policies and free service programs for passengers with mobility limitations.

Vietnam Airlines is responsive to feedback and uses world-class information technology to reduce

response times and labor costs.

NPS scores for Vietnam Airlines have continuously improved in 2020. 4. Positioning

4.1. Points of parity

The Vietnam domestic market exhibits certain similarities among its airlines, which prove advantageous for customers.

First and foremost, there exists a uniformity in terms of safety and security standards among all

airlines. Each airline is subjected to strict control and regulations, mandating compliance with the

requirements set forth by the Civil Aviation Authority of Vietnam prior to commencing operations.

Rigorous inspections of aircraft are conducted to ensure their optimal condition. Furthermore, airlines

consistently prioritize the privacy and possessions of their customers by providing necessary services. 24

Consequently, customers can place their trust in airlines to deliver flights that prioritize safety and security.

Additionally, the quality of service on short-haul flights has experienced a progressive

standardization trend. Presently, Vietnam Airlines is gradually discontinuing the provision of in-flight

meals on its short-haul flights as a means to enhance price competitiveness relative to VietJet Air and

Bamboo Airways. As a result, the service quality across these airlines operating domestic short-haul

routes is considered quite comparable. Consequently, customers benefit from a wider range of airline

choices, as these companies actively participate in price reductions to vie for market share.

4.2. Points of differences

Vietnam Airlines stands out in the Vietnam domestic market with various relating to its services

and options for customers to choose. These are punctuality, facility, route network, in-flight and ground

service, application of technology and digital transformation. Punctuality

Punctuality is a crucial factor in operations as it determines the level of satisfaction and long-term

loyalty towards an airline. Unlike low-cost carriers such as VietJet Air and Bamboo Airways, Vietnam

Airlines must maintain a higher on-time performance rate due to its 4-star airline status. According to

statistics from the Civil Aviation Authority of Vietnam, Vietnam Airlines' on-time departure rate (OTP)

stands at 89.4%, surpassing VietJet Air by 4.6% and lagging behind Bamboo Airways by 6.2%. Based on

this data, it is evident that Vietnam Airlines has not yet achieved optimal operational efficiency, resulting

in inconvenience for many passengers. If Vietnam Airlines fails to implement effective measures to

address this issue in the near future, the airline will face intense competition from Bamboo Airways.

From a market perspective, customers are increasingly concerned about comfort and convenience when

choosing an airline. Therefore, punctuality should be given particular attention by airlines to maintain

customer trust and satisfaction.

Modern facilities

In addition to services, the consistent provision of equipment throughout the customer's flight

experience is of utmost importance, especially during long-haul and international flights. As a full-service

airline, Vietnam Airlines offers modern entertainment facilities on board. Unlike low-cost carriers that

maximize profit by installing additional seats, Vietnam Airlines reduces the number of seats on its

aircraft, resulting in wider seat spacing and a more comfortable seating experience. 25 Service

Vietnam Airlines has consistently been regarded as one of the top airlines offering exceptional

service quality in Vietnam. In 2023, it stands as the sole Vietnamese airline to secure a position among

the world's top 50 airlines. Throughout its developmental journey, Vietnam Airlines has prioritized

customer experience through the delivery of high-quality services. In 2021, the Net Promoter Score

(NPS), a measure of customer satisfaction, reached 51%, marking a 17-point increase compared to the

same period in 2020. Achieving an NPS above 50% signifies the trust, preference, and continued

patronage of customers towards Vietnam Airlines.

Digital transformation and IIoT (automation and data exchange)

Vietnam Airlines has implemented robust IT solutions to progress towards its goal of becoming a

digital airline. Extensive research has been conducted to apply intelligent IT solutions across all domains,

optimizing workflow processes, cost savings, revenue growth, and delivering a customer experience that

aligns with the demands of the Fourth Industrial Revolution. In 2021, Vietnam Airlines achieved

significant milestones, including the successful implementation of the customer experience management

system and the development of a shared Data Warehouse throughout the entire corporation. Effective data

utilization has been realized through intelligent reporting and analytics systems (Business Intelligence),

demonstrating the company's commitment to technological advancement.

4.3. Value proposition

Vietnam Airlines is renowned for its provision of premium aviation services, catering to the

diverse needs of customers at the utmost level. Opting for Vietnam Airlines guarantees customers an

expectation of unparalleled service from a reputable 4-star airline, presenting an extensive array of

options. Indeed, patronizing these airlines bestows customers with a multitude of choices, including an

extensive selection of destinations, comprehensive in-flight services, and expedited ground services. It is

important to note that selecting Vietnam Airlines over competing carriers entails a higher ticket price,

which is justified by the enhanced service offerings. Thus, Vietnam Airlines effectively establishes itself

as a prominent purveyor of top-tier services, delivering superior benefits and commanding a premium in the market (Figure 1.1). 26

Table 3.7. Vietnam Airlines' value proposition in terms of price and benefit

4.4. Perceptual map

Vietnam Airlines is widely regarded as a premium airline renowned for its exceptional customer

service and higher-priced tickets. In sharp contrast, customers perceive VietJet Air as a budget carrier,

offering standard service and relatively affordable fares. Positioned strategically between Vietnam

Airlines and VietJet Air, Bamboo Airways occupies a middle ground, catering to a diverse range of

passengers with a balanced offering of service quality and ticket affordability.

Table 3.8. Perceptual map of three airlines (Vietnam Airlines, VietJet Air and Bamboo Airways)

4.5. Brand mantra

Vietnam Airlines defines its brand mantra as "Reaching further," a philosophy that aligns closely

with its overarching vision and mission. This principle embodies the airline's relentless dedication to

elevating its services in order to accommodate the evolving demands of its esteemed clientele. In order to

effectively realize this objective, Vietnam Airlines recognizes the need to establish a broader network of 27

destinations, thus affording its customers a wider array of choices and ultimately enhancing their

satisfaction levels. By continuously expanding its reach and offering an extensive range of travel options,

Vietnam Airlines endeavors to provide an unparalleled level of service, thereby ensuring the utmost

satisfaction of its esteemed clientele.

5. Marketing mix 5.1. Product

Routes and airlines:

The network of operational routes comprises 49 airports to 26 countries, more than 50 routes with

a total of more than 360 flights per day. Vietnam Airlines also signed a joint venture with 23 airlines to

provide a network of routes across Asia, Europe, Africa, Australia, and North America.

As the leading air force in Southeast Asia, it currently operates over 97 routes to 18 domestic and

35 international destinations with an average of 400 flights per day.

As of September 2021, the VNA has a total of 100 aircraft. In addition to passenger

transportation, the company operates an air transportation division, transporting goods in Asia, Europe,

North America, and the Oceans, using its own and its partners' passenger aircraft.

Airline Classes

First Class: The highest class of seats on the flight. Not every airline has a first-class seat. Mostly

served on long cross-continental flights.

Business Class: very special seat class, equipped with a variety of amenities and services on the

plane. Often served on long-haul flights. For the airline Vietnam Airlines is also served on flights such as

Hanoi – Da Nang, Hanoi – Saigon...

Premium Class, Deluxe Economy Class, Comfort Class: A middle class with standard and service

quality between Business Class and Economy class. Currently, special-class air tickets are sold mainly on some international routes.

Economy Class: The most common and also the most popular type of seat on flights. And of

course, the flight prices for this class are at the lowest level.

Currently, Vietnam Airlines' domestic flight categories include eight categories: Business (Active

- J, Standard - C, Savings - D); Universal (active - M, K, standard - L, Q, saving - N, R, T); Special

Savings (U, E, P); Super Savings (P). Regardless of seat class, route, and plane, passengers can always

expect a warm welcome and attentive attention from Vietnam Airlines. 28 Utilities

Information service: ticket prices, flight schedules, entertainment centres, hotels... Reservation

service, ticket dealers; Passenger shuttle service from the transfer station to the airport and vice versa;

Service for take-off and landing procedures; Service on the plane: attendants, entertainment, dining... The

higher the ticket level, the more varied the service.

Product Quality Policy

Vietnam Airlines puts the safety of its customers first with its policies and strictly performs

maintenance services to ensure absolute safety for its customers.

The VNA's specialty is timeliness. On an average of 100 flights, there are about 15 flights delayed

(up to 85%). The cause of international delays is mainly influenced by the advance (60%), the influence

of authorities, flight regulators, governments (17%), aircraft engineering (12%), and other factors.

Team: VNA owns a young fleet, with the most modern aircraft like the Boeing 787, and Airbus

A350; there are currently 104 aircraft (2021) including 11 B787, 12 A350, and the A330, A321.

Service criteria: including criteria related to check-in time, lost luggage, language, radio, food,

and beverages. Some criteria are underestimated: entertainment on the flight, telephone reservations,

willingness to help guests, and the host's foreign language.

On July 12, 2016, VNA was officially recognized by Skytrax as a four-star airline and awarded certification to VNA.

New Product Development Policy

Joining the aviation alliance has spread the VNA network around the world to 1,052 destinations

in 177 countries. In addition, VNA has additional products such as connectivity services, regular

customer service, telecommunications services, and banking systems. 5.2. Price

Overall, Vietnam Airlines prices are 5-20% higher than other domestic airlines, but compared to

international airlines the prices are in line with the services offered by Vietnam Airlines. However, there

are many different prices and the corresponding quality depending on the ticket category to meet the

needs of every customer segment.

Vietnam Airlines' seasonal and flight time pricing policy to optimize its transfer operating capacity -

During peak seasons (June-August and December-February of the following year) and peak hours

(6:00-9:00 and 5:00-8:00 PM) the travel demand of passengers increases, and flight prices are

usually higher than in the low season. 29 -

Low season (September to November and March to May) and low time (9h AM to 5h PM and 8h

PM - 6h AM) passenger travel needs decrease, so the flight prices are usually lower than in the peak season.

In addition, Vietnam Airlines also applies a number of different price policies: -

1-2% discount policy for dealers -

Promotional Tickets: Vietnam Airlines regularly launched promotional air ticket programs with

promotional prices such as monthly offers or payment through payment apps in partnership with VNA such as Momo, VNPAY... -

Group Tickets: Discounted Tickets for Groups of 10 and more. -

Price for children: 90% of the price for adults (Vietnamese territory) and 75% (international) -

Senior and disabled passengers: Customers are Vietnamese citizens who are 60 years of age or

older, with a 15% discount from the general ceiling price for domestic flights regulated by the State.

Expand cooperation to reduce prices for joint ventures and international routes, e.g. Hanoi-

Singapore, TP.HCM – Singapore,... 5.3. Place

10,240 ticket offices (as of December 2016), with 31 branches and representative offices in 20

countries and all four continents to meet the long-distance mobility needs of customers worldwide.

Domestic: Vietnam Airlines is headquartered in Hanoi and has 25 branches and 5 subsidiaries

operating in 20 major provinces/cities in Vietnam.

Vietnam Airlines has developed a distribution system via the Internet and has partnered with a

number of travel agencies such as Traveloka, Booking, Agoda,... With this system, the company can save

a lot of money compared to opening a branch and at the same time reach more customers. 5.4. Promotion