Preview text:

”La Salle Matrix Thinking” – A structured approach to Innovation –

“Opportunity Capture” and Systematic Thinking

Authors Name: Roger John La Salle

Managing Director: La Salle Matrix Thinking Melbourne - Australia

Abstract— Creativity is quite an abstract terms, more the generic term for the opportunity to think differently.

Unfortunately, creativity in itself does not present a methodology for “outside the box” thinking, innovation or opportunity capture.

What is presented in this paper is a structured approach to innovative and opportunistic thinking that is

represented by several purpose built thinking platforms (Matrices) that have been developed into complete learning

modules delivered through agents in more than 26 countries and more recently licensed to Deloitte, one of the

world’s largest consulting firms for e-learning.

The matrices presented provide more than 100 such thinking stimuli in a structured matrix format that gets

everybody “on the same page” and all making innovative contributions to the problem at hand.

Key Words: Innovation, Opportunity, Business Plan, Market Risk, Matrix, Thinking. INTRODUCTION

The pursuit of knowledge has many motives, some purely altruistic, some more personal such as

with genealogy, others in the development of the pure or applied sciences. However, it would not

be unreasonable to suggest that by and large the pursuit of knowledge is for commercial gain, for

business and enterprise growth.

No doubt the fuels that underpin this search for new frontiers and new ways of doing business are

embodied in thinking tools and methodologies that have been tried over many years in many

different environments. However, all too often these tools are abstract in nature and lack the

discipline to achieve certain outcomes in that they ask “open questions” that do not demand answers.

Innovation of course is the most common generic term of outside the box thinking, but a new

thinking paradigm is also possible in what we refer to as “Opportunity Capture”

The material presented in this paper is the original work of the author and presents insights into

business, innovation, opportunity capture and the mitigation of the single biggest risk in most new business endeavors. THE BUSINESS PLAN

Whenever anybody has a new idea or initiative, before investment dollars are won, the necessary

prerequisite of a business plan is demanded, as it should be. This task is usually given to the very

same people that conceived the idea, and thus they are positively biased even before they start.

The final page of most business plans is usually a spread sheet that quantifies the opportunity.

But look at what happens if when the numbers are “run”, the outcome is not quite as good as was

expected … easy, change the numbers to get the result you always knew would be correct.

Unfortunately the above scenario occurs all too often.

Thus, not surprisingly most new ventures are usually supported by a ‘winning business plan’ that

too often fails to be played out in reality. 1

MARKET FAILURE IS THE BIGGEST RISK

Further, if we examine the reason for such failures, by far the single biggest risk is that of market

failure – you just don’t sell as many widgets as originally forecast.

WHY BOTHER WITH A BUSINESS PLAN?

A valid question at this point may be to ask; “Why bother with the business plan at all?” Or

perhaps still better, “How can we reduce the risks in writing business plans?”

Business plans start you on the journey and are usually demanded, especially by astute investors as

a test of your commitment and competence. It is often said, investors invest in people more so than

the opportunity. Hence the necessary test of your capability in developing a logical business plan

that presents a good business case.

At this point, perhaps we should dispel the common myth that if we persist we will succeed. This

is nonsense as no amount of persistence will turn a “dog” into a “star”. This is best summed up in the following:

Persistence is an important element of success

Persistence is an essential element of failure.

The business plan is the first step that wins funding, allows you to assemble a competent team and

commence the journey. Few people who take this first step towards a goal actually end up where

they expected. Indeed the astute entrepreneur will most often find that the real “pay dirt” differs

from the original target but they are astute enough to recognize this and refocus.

In other words, you have to know when something is not working, stop and find the real opportunity. Key Learnings:

Business plans are an essential starting point but seldom play out unchanged, be alert to

change direction when required.

MAKING A PURCHASE DECISION - OR ANY DECISION

Turning now to the question of reducing the risk in writing business plans, the answers lie in

understanding the market, the value proposition, the value chain and the real meaning of innovation?

In simplistic terms people only purchase things for one reason, they see value for money. Be it a power tool or a ROLEX watch.

The value proposition simplified says:

If I invest A$ to get B

I will only do so if I believe that B is at least equal to or greater than A$.

We need to understand this value equation and relate it to the venture on which we are about to

embark. In addition we need to consider the participants in the chain of events that will get a

product to the market. This is commonly referred to as the “value chain” and includes all the

players from the inventor or creator to the purchaser, the user and now even the disposer. 2

All players in the value chain need to have a positive value proposition. Even in the case of “loss

leader” items, the sums have been very carefully done to ensure the ultimate value to the loss

leader provider is a net positive return on the investment.

Notice also that in some cases the user is not the purchaser. Such cases need special consideration

as to what value the purchaser gains. This case may apply to purchases of special treats or toys for

children. But there are also examples of industrial products that have failed in the market because

of a failure to understand that the purchaser was not the one deriving the ultimate value.

UNDERSTANDING MARKET RISK

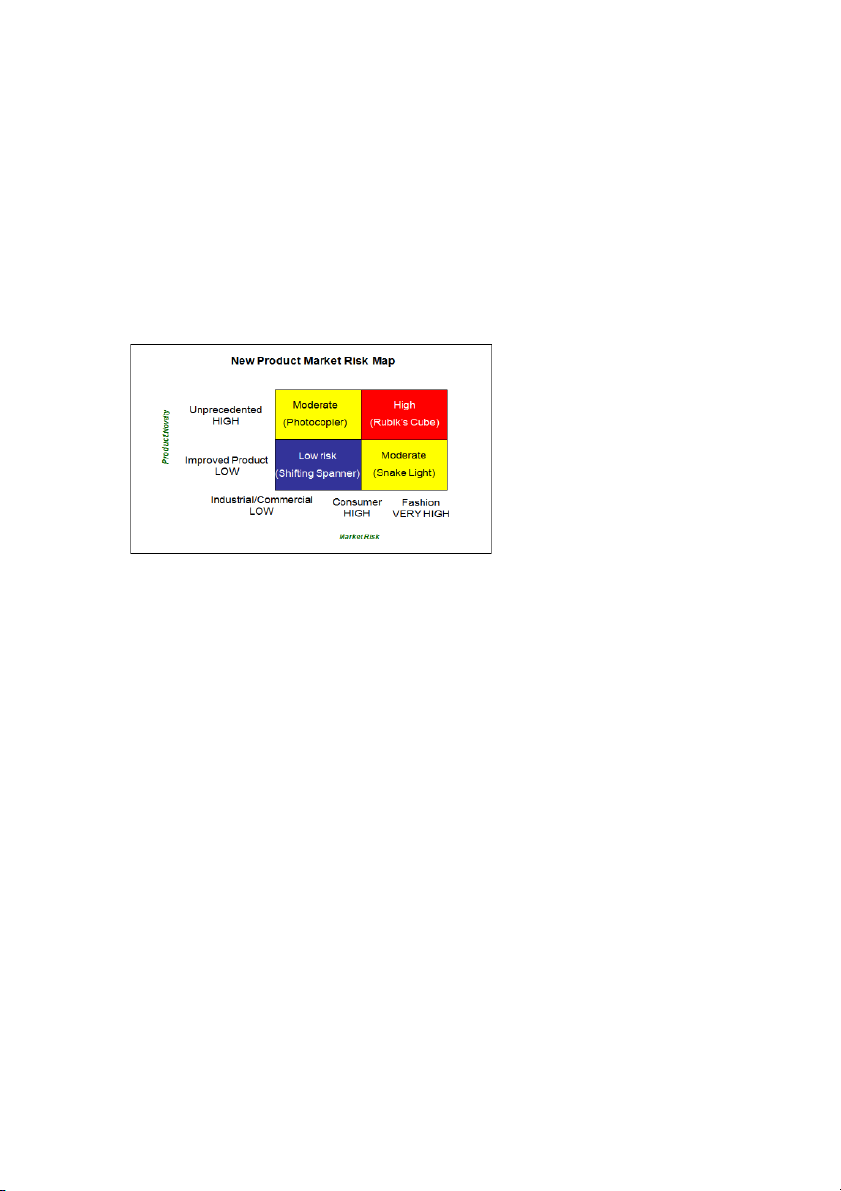

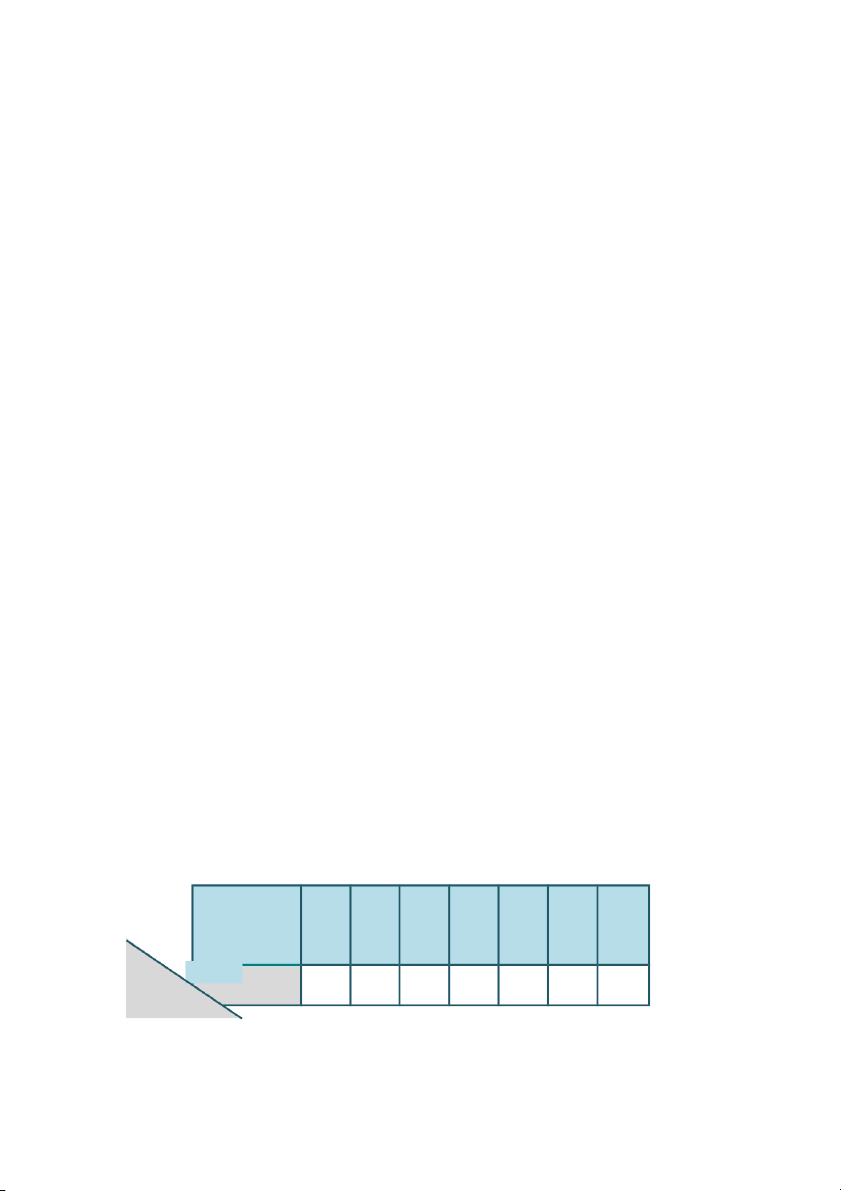

To gain a snap shot of market risk consider the following diagram that can be representative of any product or service. Figure 1

On the horizontal axis are the sectors that characterize all types of products, these being

Industrial/Commercial, Consumer and finally Fashion and products and services.

In the case of industrial/commercial products such as power tools, fax machines, and high speed

photocopiers etc the value proposition can usually be easily quantified and a rational purchase decision reached.

In the case of consumer products, advertising is what attempts to establish a value proposition,

such as “this brand tooth paste cleans whitest of all” etc. People who are not moved by this type of

argument often purchase lower priced home brand items.

Finally are the fashion items where the value propositions are so abstract they beggar belief.

Fashion companies spend many millions of dollars establishing their “Brand” as their value proposition.

On the vertical axis is the degree of novelty. In other words, how new is the product, as newness often spells high risk.

It is important to understand where any offering fits on this map.

The blue area is the ideal place to be because items in this area usually have a quantifiable value

propositions together with low novelty that allows people to relate to and understand what they are

purchasing. Any mechanic will instantly relate to the benefits of a double ended spanner compared with a single ended one. 3

The top left hand yellow area represents products that when introduced were completely novel.

These include such things as the photocopier, the fax machine, the PC and even the internet. What

these all had in common was a high degree of novelty and consequently all had long and difficult

gestation periods. People simply could not relate to them or how they could be best used. Indeed

many of these products took decades to pervade the market.

Moving to the top right hand corner, it is virtually impossible to make even the vaguest estimate of

the likely sales volume of such an abstract product where the value is virtually impossible to

understand. True the Rubik’s Cube was a remarkable success, but who could have confidently forecast that in advance?

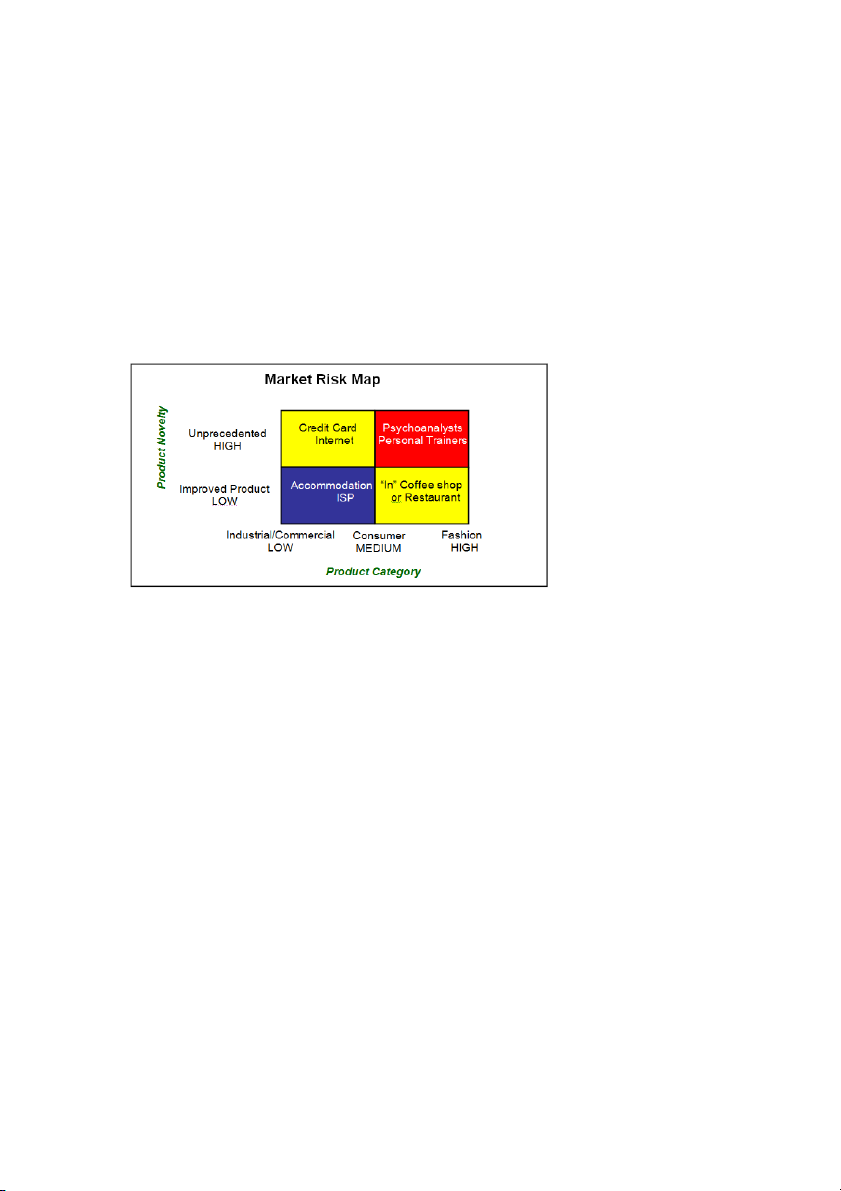

The same sort of thinking can be applied to intangible products, such as services as represented in

the Market Risk Map shown in Fig 2. Figure 2

On the top right hand corner may be the psychoanalysts and perhaps personal trainers. When these

services were first introduced they were high novelty, certainly in the fashion space, ultimately

moving to the consumer space. In the lower right hand corner there may be “in” restaurants, bars

and coffee shops. How they became “in” is an interesting question worthy of exploration, though

not in this paper. The fact is, once an ‘in place’ has the name as ‘somewhere to be seen’ its stocks rise dramatically.

In the bottom left hand corner are industrial/commercial services of low novelty. In this area we

may identify much of the accommodation industry, hotels, motels and the like.

Clearly there is a need for accommodation for executives and travellers going back for centuries.

The opportunity to provide better, different or innovated accommodation arrangements is obvious

and has spawned a vast market today ranging from budget motels, through hotels to five, six and

even seven star accommodation and more recently the strong growth in serviced apartments.

This is a classic example of an innovation in a service enterprise where changes are constantly

being made to win new customers.

In the top left hand corner we may position the credit card when it was originally introduced. The

credit card took more than a decade to really become popular, thus eventually moving from the top

of the diagram to the bottom. For most people the credit card may seem to be a consumer service,

but for the vendor, eager to find an easier trouble free way of winning your purchase, the credit

card may be a commercial service. 4

It is also worthy of note that Diners Club was the first credit card and was essentially a market

failure for more than ten years before American Express and then VISA entered the market as

followers. Today both VISA and MasterCard have overtaken Diners Club in popularity and acceptance.

Once again when we look at the market risk one may seriously query whether it’s a good idea to

be first or it’s a better idea to be second or third and simply innovate the offering of the first into

the market and do it better. This is a valid and significant way to do business and it’s all based on

the premise of innovation; that is changing what is already in the market to add value and go back

to the market with a better offering at perhaps even a better price. It is a very low risk way of

doing business and is almost bound to succeed.

The credit card, from its shaky beginnings with just 20,000 users after its first introduction has

now grown to be one of the worlds most used financial transaction instruments. People carry

multiple credit cards because of their security, convenience, the ability they afford to purchase

virtually anything at a whim, as well as removing the need to carry excess cash.

Once the widespread acceptance of the credit card was achieved, the card business became very

competitive forcing the card companies to innovate their original offering to provide value added

services in the hope of winning customers from competitors, as well as attracting new users.

Innovated benefits of the credit card now include airline points, monthly statements acceptable to

taxation authorities as valid receipts, deferred payments (of course incurring huge interest rates)

and instant cash. Credit cards are now even seen as status symbols and a sign of financial standing

to anybody interested enough to observe, with Gold, Platinum or even Diamond cards now available.

A final example of a service with a slow beginning that has now overtaken the world and spawned

a host of new consequential businesses is the internet and the creation of the Internet Service

Provider (ISP), a term barely thought of just 20 years ago. Today the internet is ubiquitous and has

had world changing effects with large numbers of ISP’s now available all offering some form of

special attraction to have us use their services.

The idea of a connection of computers enabling easy and rapid communication is credited to

Vinton Cerf as part of a project sponsored by the USA Defence Department in the early 1970’s.

The creation of the World Wide Web in 1989 is attributed to English computer scientist Timothy

Berners-Lee for the European Organization for Nuclear Research (CERN).

From relatively slow beginnings in the 1970’s the internet would now rate as one of the standout

inventions of the 20th century. Again, with this novel technology we see a relatively slow gestation

period before acceptance, much like the credit card, then explosive growth.

Notice also that once the internet and interconnectivity had become an accepted part of everyday

life. The internet has thus repositioned itself in the eyes of the market from the high novelty

industrial commercial space to that of low novelty in both the industrial commercial and the consumer space.

Clearly, if you can relate an offering to its location on the market risk map a much clearer

understanding of the possible risks in the business can be realized, and efforts made to find ways

to move the offering to the lower left hand sector.

REPOSITIONING YOUR OFFERING TO REDUCE RISK

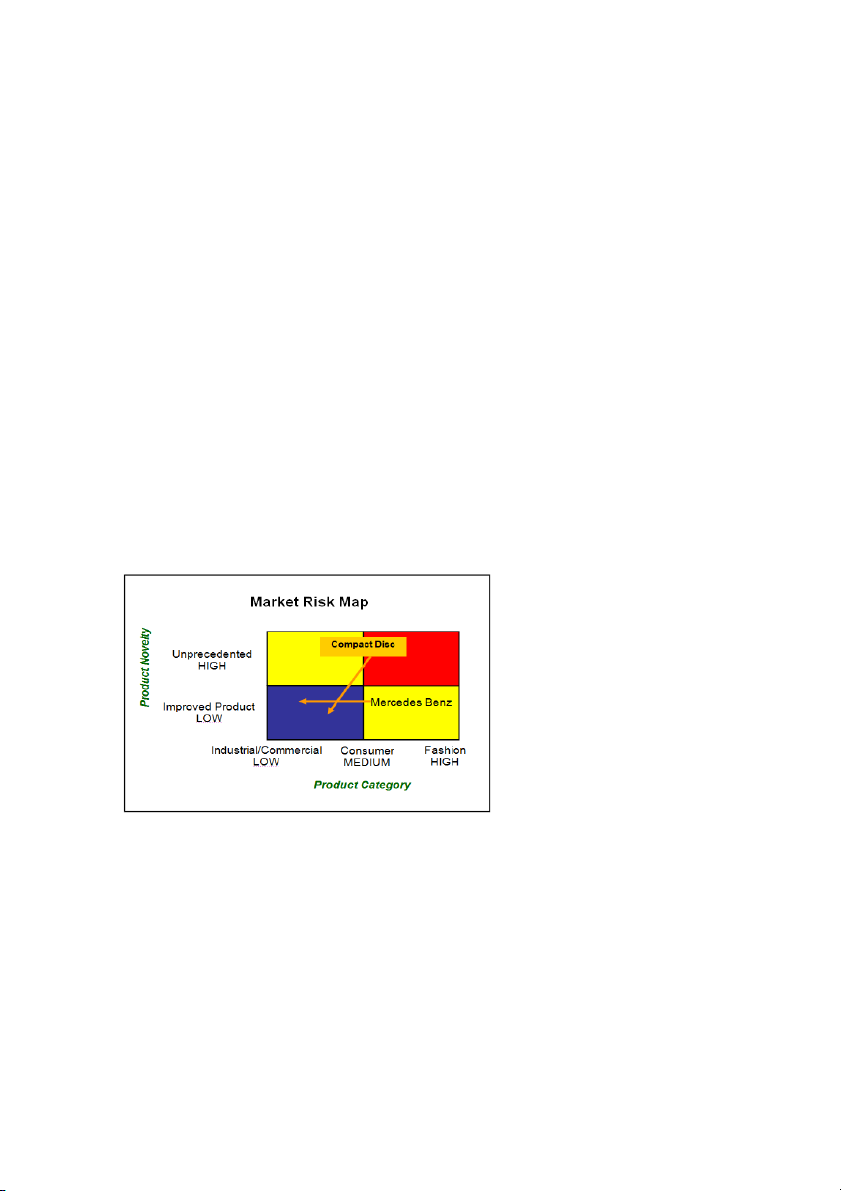

Another clear inference that can be drawn from an understanding of this diagram is the benefit in

trying to find ways to reposition your offering and move it to the lower left hand corner in the 5

mind of your market. In other words to try and find the customer “touch point” that would see

your offering as providing some sort of realizable value that can be understood. In some cases this

is difficult, especially in the world of fashion, but it is still not impossible.

For example, why would anybody buy a Mercedes Benz car for say, $160,000 when they could

purchase a Korean car with a longer time and unlimited kilometer warranty for a tenth of the

price? Many people may buy a Mercedes because they believe in its extra safety features and good

German technology, and that’s fine. But if you are an investment advisor or business coach, then

the fact of driving a Mercedes Benz sends a message to a customer that you are successful, and

thus are likely to know what you are talking about. Hence in this regard as a Mercedes sales

person, I would be playing that card in the sales conversation, thus moving the car, or more

correctly its badge, to the left of the diagram. This is clearly a very sensible approach and presents

the Mercedes Benz to these markets as a must have item, not a mere luxury.

A further example of repositioning comes from looking at the introduction of the compact disc. In

fact the CD is touted as one of the most successful technology products ever launched. Yet one

could well argue that the CD may be positioned at the top of the diagram in perhaps the consumer,

even fashion space. Whilst at first glance this may be so, in fact the CD was introduced not as

some technology novelty, with the risk of a long lead time to market, but as a simply a better vinyl

record, simply a better way of storing and playing music than we had before.

Thus we can see the value in this market risk map in looking to position offerings as low as

possible and as far to the left as possible as shown in Fig 3.

If we accept that pioneering may be a risky place to be, it is possible that there is some merit in

being a follower, not bringing too much novelty to the market. Figure 3

FAST SECOND CAN BE A GREAT STRATEGY

The strategy of following is called “fast second” and is founded on the strong belief in the

definition of innovation, and many companies have successfully exploited that model to great advantage.

Rather than the questionable so called advantage of being, “first mover”; in many cases being

second is better, and certainly carries a lot less risk.

Just observe history to see examples of this fast second strategy in play as second market entrants

move to become the big winners. 6

Henry Ford did not invent the motor car, but when he saw the market opportunity afforded by the

first clumsily built and expensive cars, he “innovated” the process for making them and thus brought cars to the masses.

The ill fated COMET jet passenger airliner, a revolution in its day, plagued with technology

problems created an opportunity for Boeing, untarnished by the pioneering COMET failures.

Boeing won the world market for passenger jets from second place.

Concorde is another example of a technology before its time. Ultimately supersonic passenger

transport will become commonplace, but not to the benefit of the Concorde pioneers.

The fax machine invention was credited to Scotsman Alexander Bain before the turn of the 20th

century. However, it was not until the Japanese, as late comers, developed and used this

technology within their own businesses that led the facsimile machine to popular use, and the

success of these second comers.

The electric light when finally brought to market suffered enormous resistance, especially from the

gas companies. In supplying power to the “new fangled” electric light Thomas Edison chose to use

Direct Current (DC) and was a brave pioneer, but ultimately it was the vastly superior second into

the market alternating current method that won the race.

Even with the ubiquitous personal computer, an invention commonly credited to Steve Jobs who

was first to the market with the Apple Mac, the rich rewards went to the second comer, IBM.

When IBM realized the market potential of the first personal computers it quickly moved into the

market, as a fast second. In doing so IBM virtually stole the business, making IBM and the IBM

compatible the industry standard. Clearly, one can see the advantage of a fast second strategy and

the benefit of seeing what is working and innovating the offering and moving in to the market to

take advantage of what is clearly an emerging paradigm.

Further, as computer technology became commonplace and PC’s became a commodity that could

be built by almost any technology company, including the low labour cost third world

manufacturers, IBM exited the market for desktop PC’s.

However, IBM did for a time remain in the laptop market, as the market entry price for this

business is far higher than for larger tower and desktop models. Ultimately and quite recently, as

laptop technology became commonplace and the laptop moved to become a commodity product,

IBM also exited that business.

In the case of IBM, their “play” in the personal computer market was a classic “fast second”

strategy. Get into the business early, an exit before the business is commoditized.

City based convenience stores are also a striking example. The early ones were amazing success

stories charging exorbitant prices for “must have” conveniences. Look now and you will find most

cities saturated with these shops all fighting for a share of a now much diluted market. Video rental shops are another example.

Clearly, being first to market carries its own special risk; whereas the fast follower or second to

market carries far less risk. Further, before your offering becomes truly commoditized with too

many new players entering the market, consider and exit strategy, while profits are still high.

Great successes have come at minimal risk by those that saw a market opportunity based on an

emerging product or technology and then innovated or changed it and went back to the market 7

with a newer and perhaps better product at maybe even a better price. There are very few product,

processes or services that cannot be innovated.

If one wishes to challenge the proposition that an existing product or business cannot be innovated

to provide a better market offering, or that some things cannot be innovated or improved in some

way then consider the alternative argument. This view would hold that whatever you are

considering, product, process or service will remain the same, indefinitely – this is a highly unlikely proposition.

Thus we need to consider the strong argument for coming second in the race, in fact “fast second”

and of course innovation is the key to doing just that.

Based on the foregoing it may now be appropriate to coin a definition of innovation. The word

innovate literally means “change” thus a good definition of innovation is “Change that adds

Value”. © La Salle 1992 Key Learnings:

Innovation is best defined as “change that adds value”

People purchase thing because they believe they are getting value for money.

No amount of persistence will turn a “dog” product into a “Star”

Market risk is the single biggest risk in a new venture

Almost every product, process or service can be innovated

Being first has special risks, fast second is a good strategy

The secret of success is to find something already a success in the market place and innovate it to do it better.

DOING INNOVATION- THE PRODUCT INNOVATION MATRIX

It is with this definition as a firm starting point that we can now progress the systematic growth of

knowledge, innovation and opportunity capture, in the main targeted at commercially focused

outcomes. Innovation is a systematic process, so too is the sourcing of infinite opportunities, it just

needs some structure. This is not black magic or science fiction, but engineering at its best.

Thinking Matrices have been developed for the innovation of: Products

Services, that is, the way you do business

Processes, that is, how the business operates.

Finding Opportunities – That is - how does one walk down the street and find an opportunity?

Generating your specialized Innovation matrix

For example, innovation of products can leverage from four fundamentals, called “Seeds” as

representations of what can be done when a product is to be innovated”. The seeds are:

Change or add value to your product in some way. - No product is immune from change

for the better. If you disagree with this you are essentially saying that any product will remain

unchanged for eternity, a highly unlikely proposition.

Add Accessories to your products - Many companies today exist just by selling

accessories, just look at the chains of shops selling auto accessories, to cite just one example.

Add Complementary Products - When somebody is about to make a purchase, you

should take advantage of the mindset they have by offering them complementary items, such as fries with a hamburger. 8

Enhance the Sales Channel -The existing channel or the access you have to your

customer is a valuable asset that can be leveraged. - This is like the petrol station being certain that

you will come into their shop to pay the fuel bill, so they also offer extremely high priced commodities.

Once you realize the business building opportunities afforded by embracing these seeds, the next

thing to do is find ways to stimulate your mind in developing ideas based on the seeds. Catalysts

are the fuel for this thinking and twelve key ones have been identified.

Some of the catalysts include:

Tracking - Follow your product through its life and you will find a multitude of

opportunities. Such as putting honey into squeeze containers as a result of observing the frustration of users with messy jars.

I Wish - Like making a wish about your product, such as a glass that never gets empty

and solving this with a pressure sensor and miniature radio transmitter that signals a drink waiter.

Frustration – this may well be the biggest source of business opportunities. Listen for

somebody cursing and you may well have an instant opportunity for innovation.

By arranging both seeds and catalysts in a rectangular grid, a matrix results for thinking. Each

intersection of Seed and Catalyst creates a stimulus for creativity. The difference with this

innovation matrix, unlike most other way to stimulate thinking, is that the thinking is immediately

and directly applicable to your products. See Fig 4 for the product innovation matrix. ing az ton erial ersion nsfer ucton I wish Tracking Inv Tra Red Future g Re-ques New functon IYFIHYDIW* New design Catalysts New technology New mat Change Seeds Accessories (add-ons) Complementary products (goes with) Channel enhancement (same outlet) Consequential Change

*If you find it hard you’re doing it wrong Figure 4 9

At the bottom of all thinking matrices is the catalyst of Consequential Change. This is the trigger

to think of the consequences of what you are about to initiate, and moreover, perhaps create a

consequence for your business that will have a positive effect. For example, finding a way to

deliver a strong word of mouth message to a customer, this is possibly the most powerful means of

promotion, far more so than advertising.

The important thing to remember is that getting started in business is the hard part. After that,

moving to the next level is a systematic process of innovation based leverage and, if done properly, it can be virtually risk free.

In the case of services and service companies a similar innovation approach is employed; only in

this case the seeds are a little different.

In the case of processes, a Process Innovation Matrix is used; again in this case the seeds and

catalysts are quite different. A similar approach is used to identify new business opportunities using an Opportunity Matrix. Key Learnings:

Almost any product can be improved or innovated

There are four Seeds and twelve Catalysts for product innovation

Innovation is best inspired by asking closed questions that demand an answer

Before you implement an innovation consider the consequences or “downstream” effects,

this is referred to as “Consequential Change” THE OPPORTUNITY MATRIX

With the knowledge of seeds and catalysts for each particular situation and their application to any

business, breakthrough thinking can be developed as it applies directly to your products, processes and services.

The generic term for this type of structured thinking is referred to as “La Salle Matrix Thinking”.

The fundamentals are clearly quite simple and universally applicable.

Opportunities can be found in a similar manner if we start by first defining the word opportunity

and then building a purpose built opportunity search matrix.

A dictionary definition of the word opportunity is something like, “an opportunity is a fortunate

intersection of events”, however this definition falls short as it provides no insight as to how one may find an opportunity.

However, if we use the definition of opportunity as “An observed fortunate set of circumstances”

© LaSalle 2000 the opportunity search horizon broadens considerably.

With this definition in mind an opportunity search matrix has been developed that identifies the

five fundamental things that should be observed. The opportunity matrix is shown below. ing az ton nsfer I wish IYFIHYDIW* Future g Re-ques Technology Tracking Tra Catalyst Predictable actvity Seeds 10