Preview text:

Renewable Energy 143 (2019) 974 984 e

Contents lists available at ScienceDirect Renewable Energy

j o u r n a l h o m e p a g e : w w w . e l s e v i e r . c o m / l o c a t e / r e n e n e

Can green financial development promote renewable energy

investment efficiency? A consideration of bank credit

Lingyun He a, Rongyan Liu a, Zhangqi Zhong b, *, Deqing Wang a, Yufei Xia c

a School of Management, China University of Mining and Technology, Xuzhou, Jiangsu, 221116, China

b School of Economics, Zhejiang University of Finance and Economics, Hangzhou, 310018, China

c Business School, Jiangsu Normal University, Xuzhou, Jiangsu, 221116, China a r t i c l e i n f o a b s t r a c t Article history:

Taking 141 listed renewable energy enterprises in China as a sample, the Richardson model is adopted to Received 18 September 2018

measure their investment efficiency in this paper. On this basis, an intermediary effect model of panel Received in revised form

data is constructed to empirically analyze the intermediary effect of green financial development on 14 March 2019

renewable energy investment efficiency through bank loans, short-term loans, and long-term loans. We Accepted 14 May 2019

find that China’s green financial development has a negative impact on bank loan issuance in general, Available online 17 May 2019

and inhibits the improvement of renewable energy investment efficiency to a certain extent, with an

effect degree of 0.0017. Besides, the short-term loan has few intermediate effect on investment efficiency, Keywords:

while there is no intermediary effect of long-term loans. Moreover, as for the over-investment renewable Green finance Bank credit

energy enterprises, intermediary effect of bank loans exists. Green financial development can inhibit Investment efficiency

over-investment in renewable energy by reducing bank credit issuance; for renewable energy companies Renewable energy investment

of under-investment, on the contrary, it aggravates the under-investment to a certain extent. This paper

suggests that the government should both construct and consummate the green financial system

through policies and regulation. Financial institutions should actively produce innovative green financial

products and support the development of renewable energy enterprises and the renewable energy

enterprises should strengthen their internal management and develop financing channels.

© 2019 Elsevier Ltd. All rights reserved. 1. Introduction

in the world. China’s renewable energy investment is growing

rapidly, and some issues must be addressed. On the one hand, the

In October 2015, the Chinese government put forward the

government needs to pay more attention to the quality and benefits

concept of “Green Development” and advocated development of a

of growth. On the other hand, the development of a renewable

low-carbon economy. In practical terms, under the growth model

energy industry and the promotion of economic and industrial

that the economy is driven by the consumption of energy resources,

structure transformation must, ultimately, be implemented at the

developing a renewable energy industry is an important route for

level of the microcosmic subject, specifically, at the level of enter-

promoting the transformation of energy provision and industrial

prises. Investment efficiency is an important issue in respect of

structure and developing a sustainable economy. “The 13th Five -

enterprises. According to the “financing investment chain, e ”

Year Plan for Renewable Energy Development” of China proposes to

financing is one of the important factors affecting investment ef-

adhere to a clean, low-carbon, safe, and efficient development

ficiency. “The 2017 Statistical Data Report on the Scale of Social

policy and promote the development of the renewable energy in-

Finance”, released by the People’s Bank of China, shows that loans

dustry. According to “The 2018 Global Renewable Energy Invest-

granted by Chinese financial institutions accounted for 69.6% of the

ment Trend Report”, China’s renewable energy investment reached

social financing scale in 2017, which indicates that bank credit is the

126.6 billion US dollars in 2017, showing an increase of 31% over

most important source of external financing for Chinese enter-

2016, and China has become the largest renewable energy investor

prises. Therefore, bank credit will have an important impact on

enterprise investment through the “financing-investment” chain.

Further, at the G20 summit in 2016, the concept of “Green

Finance” received extensive attention from all of society. In practice, * Corresponding author.

E-mail address: zzhongz@zufe.edu.cn (Z. Zhong).

as early as the 1990s, China began to lay out plans for green

https://doi.org/10.1016/j.renene.2019.05.059

0960-1481/© 2019 Elsevier Ltd. All rights reserved.

L. He et al. / Renewable Energy 143 (2019) 974e984 975

financial development. In 1995, the People’s Bank of China issued a

for Zhai and Gu’s conclusion is that the existence of soft budget

notice on implementing credit policies and strengthening envi-

constraints weakens the easing effect of financial development on

ronmental protection, which was the first attempt to develop green

the financing constraints of state-owned enterprises, which brings

finance in China. Since then, the State Environmental Protection

about over-investment and efficiency losses. Further, Shen et al.

Administration, the People’s Bank of China, and other agencies have

[30] and Li et al. [31] think that, for state-owned enterprises, the

issued several policies and measures. In 2015, “The Overall Plan for

financial development level is negatively related to investment

Ecological Civilization System Reform” was released, and the Chi-

efficiency. For non-state-owned enterprises, the improvement of

nese government proposed establishing of a green financial system

financial development level can alleviate financing constraints and

for the first time. In 2016, the People’s Bank of China etc. issued

improve investment efficiency. It is worth mentioning that other

“Guidance on Building a Green Financial System”, indicating that

scholars indicate that financial development plays an adjusting role

green finance had entered a stage of rapid development. There are

in the relationship between enterprise financing and investment

various aspects to this. On the one hand, green financial develop-

efficiency. Some empirical research shows that, the higher the

ment can improve the macro-financial environment and impel

financial development level, the stronger the negative relationship

micro-economic entities to pay more attention to environmental

between bank loans and over-investment; that is, financial devel-

benefits. On the other hand, green financial development has

opment has a positive adjustment effect on the relationship be-

changed the traditional “financing investment e ” channel and has

tween bank loans and investment efficiency [11].

had a complicated impact on enterprise investment. In view of this,

Overall, scholars have conducted studies on financial develop-

based on the general relationship between financial development

ment and the relationship between enterprise financing and in-

and economic development, this paper intends to study the

vestment efficiency. Most of them have affirmed the influence of

renewable energy investment efficiency from the perspective of

financial development and different financing channels on enter-

microcosmic subject, and then analyze how green finance in-

prise investment efficiency, but conclusions are inconsistent. Under

fluences renewable energy investment efficiency through bank

the background of sustainable economic development, green credit channels.

finance plays an important role in affecting renewable energy in-

From the research perspective, existing research mainly focuses

vestment. How about the green finance development in China? Is

on the relationship between financing channels and investment

the effect of green finance on renewable energy investment posi-

efficiency. As to the enterprise financing channels, it encompasses

tive or negative? Through what channels? Will financing policy

three aspects: internal financing, debt financing, and equity

preferences improve renewable energy investment efficiency?

financing. As to internal financing. Deng and Zhang [1] think that

What should the government, financial institutions, and enter-

internal financing can reduce the investment efficiency of enter-

prises do in order to improve the positive promotion effect of green

prises. Xiong et al. [2] show that free cash flow is positively related

financial development on renewable energy investment efficiency?

to enterprise investment. Yang and Hu [3]; Xiao [4]; Zhang et al. [5];

In view of these problems, this paper tries to do some in-depth

and Chen et al. [6] indicate that excessive free cash flow of enter-

research from the above aspects. We try to further clarify and

prises will lead to over-investment, while shortage of free cash flow

quantitatively analyze the transmission channels among financial

will lead to under-investment. As to debt financing, Jensen [7]

development, enterprise financing, and investment efficiency from

points out that debt has a camera governance function, which can

“green development” perspective, and finally put forward some

reduce the agency cost between shareholders and managers and

suggestions on how to develop green finance and then promote

improve investment efficiency. And banks holding companies with

renewable energy development. The second part of this paper ex-

higher investment efficiency can obtain more debt financing [8]. On

plains the theoretical relationship between green financial devel-

the one hand, debt financing can increase enterprises” cash flow

opment, bank credit, and renewable energy investment. The third

and alleviate under-investment [9]. On the other hand, debt

part presents variables, the sample, and basic model construction.

financing has a controlling effect on over-investment [10e12].

The fourth part describes the measurement of green financial

However, Zhang et al. [13] and Zhang et al. [14,15] find that, due to

development level and renewable energy investment efficiency.

the existence of “soft budget constraints”, the overall effect of debt

The fifth part analyzes the direct and indirect effects of green

management is uncertain. Specifically, the governance effect of

financial development, bank credit, and renewable energy invest-

business credit is significant, which can effectively improve enter-

ment efficiency. The sixth part concludes and suggests.

prise investment efficiency, but the governance effect of bank loans

and corporate bonds varies according to the research industry. The

2. Theoretical relationships among green financial

effect of short-term creditor’s rights governance is significant,

development, bank credit, and renewable energy investment

while the governance effect of long-term creditor’s rights is insig- efficiency

nificant [1,14e17]. As to equity financing, the low-cost nature of

equity financing can increase the free cash flow of enterprises,

There is no uniform definition of green finance in academia.

improve under-investment, and aggravate over-investment, which

Referring to the existing research [32e34], this paper holds that

decreases investment efficiency [18,19].

green finance is a financial form that can effectively allocate

As far as financial development, financing channels, and in-

financial resources and guide the capital flow to low-energy con-

vestment efficiency are concerned, the existing research analyzes

sumption, low-pollution, and high-efficiency industries through

that financial development can affect investment efficiency by

green financial products such as green credit, green securities,

financing channels, which indicates that financial development can

green insurance, green investment and carbon finance whose

promote investment efficiency by easing corporate financing con-

objective is to promote the optimization of economic structures

straints and reducing agency costs [3,20 26 e ]. Mallic and Yang [2 ] 7

and realize the win-win situation between environment and

believe that the investment efficiency of enterprises is relatively

economy. In terms of “renewable energy investment”, there are two

low for countries with a low financial development level. Kong et al.

kinds of definition. The first is enterprises’ investment in the

[28] point out that financial development has a “crowding out”

renewable energy field. For example, Xu and Bai [35] believe that

effect on enterprise investment, but a high level of financial

renewable energy investment is enterprises’ investment in

development will improve the investment efficiency of enterprises.

renewable energy in a given year. The second is the investment of

Zhai and Gu [29] come to the opposite conclusion. The main reason

renewable energy enterprises. Zhang et al. [14,15] point out that 976

L. He et al. / Renewable Energy 143 (2019) 974e984

renewable energy investment is the cash used by renewable energy

“finance”, which will have complex impacts on the investment of

enterprises to construct fixed assets, intangible assets, and other

renewable energy enterprises. First, the “finance” attribute has

long-term assets. He et al. [36] have a similar definition. In general,

such functions as capital support, resource allocation, and enter-

the current research mainly defines renewable energy investment

prise supervision. Capital support means that, through absorbing

from the perspective of investment subjects. In summary, this pa-

idle funds from the society, the financial system can provide

per defines “renewable energy investment efficiency” as the in-

financing services to enterprises and improve the financing envi-

vestment efficiency of renewable energy enterprises from the

ronment. The resource allocation function means that the financial

perspective of microeconomic agencies.

system can guide the flow of financial resources from inefficient

The Pecking Order Theory of Myers [37] indicates that, with the

industries to high-efficiency industries, realizing the effective

existence of asymmetric information and agency problems, man-

allocation and maximum utilization of resources. The enterprise

agers’ financing preferences are endogenous financing, debt

supervision function refers to the financial system providing

financing, and equity financing. As far as the economic reality of

financing services for enterprises, which makes them responsible

China is concerned, bank credit accounts for the largest proportion

for supervising and controlling enterprises. From the perspective of

in debt financing. Therefore, based on the perspective of the

credit support, financial institutions supervise the financial oper- “financing investment e

” chain, this paper attempts to study the

ation of enterprises in the pre-loan, in-loan, and post-loan process,

influence of bank credit on renewable energy investment efficiency.

which improves investment efficiency and increases enterprise

Moreover, due to the existence of agency conflicts, asymmetric

value. However, on the one hand, the renewable energy industry

information, financing constraints, and soft budget constraints,

has such characteristics as high initial investment requirements

enterprises’ investment will deviate from the optimal investment

and a long time for recuperation; on the other hand, as “economic

amount, which will result in low investment efficiency, while debt

man”, the aim of a bank is interest maximization. Therefore, in the

has contingent governance function [7,38]. As the main source of

early stage of renewable energy development, financing constraints

corporate debt financing, bank credit can, through four internal are inevitable.

mechanismsddelivering important information, reducing agency

Second, the “green” attribute requires that the green financial

costs, easing financing constraints, and hardening budget con-

development not only focuses on environmental protection, energy straintsdalleviate investment shortage and control over-

conservation, clean energy, green transportation, and green

investment and thus improve renewable energy investment

buildings but also fully considers corporate social responsibility and efficiency.

environmental performance in investment and financing services

Dealing with these mechanisms in order: First, convey impor-

to promote green industry development. This attribute aims to

tant information. Information asymmetry is one of the important

promote renewable energy development from both the source and

reasons for the low investment efficiency of enterprises. Compared

the terminus of the industrial chain and then improve investment

with general creditors, bank institutions have information advan-

efficiency of renewable energy enterprises through financing re-

tages and can obtain important private information of enterprises.

striction and final demand of industry change. Third, theoretically,

Therefore, bank credit issuance plays an important signaling role

green financial development plays a positive role in promoting

for external investors. Second, reduce agency costs. The principal-

enterprise investment efficiency, but the influences of “green” and

agent problem mainly stems from the separation of enterprises’

“finance” attributes on financing are opposite under certain cir-

ownership and control power. Due to the interest conflicts between

cumstances. In the early stage of renewable energy industry

managers and shareholders, managers deliberately invest in low-

development, the credit constraint caused by the “finance” attri-

income projects to avoid returning free cash flow to shareholders,

bute may offset the improvement effect of its “green” attribute on

which leads to over-investment. However, bank credit has a con-

renewable energy investment efficiency. Therefore, green finance

trolling function, which can constrain adverse selection and moral

has an uncertain influence on the investment efficiency of renew-

hazard behaviors of managers to a certain extent. Third, ease

able energy enterprises. Fig. 1 shows the theoretical relationship

financing constraints. Due to the information asymmetry between

between green financial development, bank credit, and renewable

the investing and financing parties and the blocking of financing energy investment efficiency.

channels in the financial market, most enterprises are facing

financing constraints [39,40]. Bank credit provides enterprises with 3. Model, variables and data

investment funds, easing financing constraints and improving their

under-investment. Fourth, harden budget constraints. Before the 3.1. Basic model

transformation of economic development model, the state-owned

bank credit is interfered with by the administrative instructions

Based on the theoretical analysis, bank credit plays an inter-

of government, resulting in soft budget constraints of enterprises,

mediary role in the impact of green financial development on

especially state-owned enterprises [41]. With the transformation

renewable energy investment efficiency. In view of this, this paper

and development of economic model, the degree of soft budget

intends to establish a recursive model to analyze whether green

constraint has been reduced, which will harden the budget

financial development can affect renewable energy investment

constraint of state-owned banks on enterprises, especially state-

efficiency and then test the existence of a bank credit intermediary

owned enterprises [42]. The hardening of budget constraints will

effect. In addition, the bank credit channel includes short-term and

strengthen the supervision and control function of banks, restrain

long-term channels. To test the differences of credit channel func-

over-investment, and improve investment efficiency.

tions, models are established respectively, as shown in (1) (3).

Further, green finance has the dual attributes of “green” and

IE it¼ b0 þ b1GFit þ b2ROEit þ b3Size it þ b4CFit þ b5Ageit þ b6ADMit þ b7Majorit X X (1) þb Year Ind 8Growth it þ þ þ w

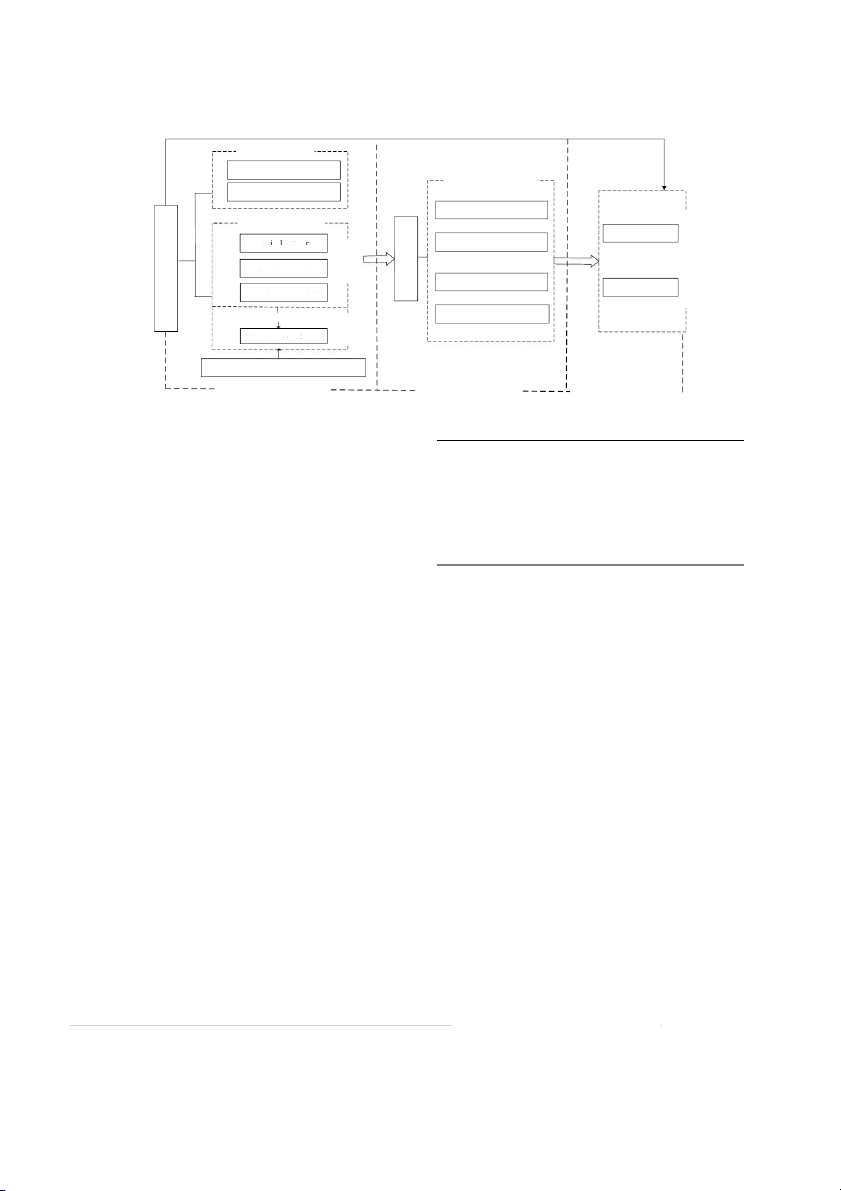

L. He et al. / Renewable Energy 143 (2019) 974e984 977 ĀGreenāat ribute Supportgreenindustry Contingentgovernance Eliminate inefficientindustry Deliverimportantinformation G i r n e ĀFinanceāattribute v R e e e n Under-investment s n f B t i L m e n a Capi tal supp ort Reduceagencycosts w a o n e n n k a n g b c t e - c l t e e d r e e f e e R esour ce alloc ation r d f n v m i ic e e t i r l e g o Easefinancingconstraints n y p c m Over-investment y En terp r ri se supervi sion ent ĀEconomicmanā S Hardenbudgetconstraints te h r o m rt Financing c onst rain t s -

Characteristics ofrenewable energy industry Macro-financialenvironment Creditfinancingchannels Microscopiceconomicsubject

Fig. 1. Theoretical relationship between green financial development, bank credit, and renewable energy investment efficiency.

DEBTitðorSTLitorLTLitÞ ¼ c0 þ c1GF X it þ c2 ROE

Xit þ c3 Sizeit þ c4CFit þ c5 Ageit (2)

þc 6Growthit þ c7 Tangibleitþ Year þ Ind þ s

IEit ¼ 40 þ 4 1 GFit þ 4 2Debt itðorSTLitorLTLitÞ þ 43ROEit þ 4 4Sizeit þ 45CFit X X (3)

þ46Ageit þ 4 7ADMit þ 4 8Majorit þ 4 9Growthit þ Year þ Ind þ m

where i is the enterprise, t is the year, IE is renewable energy in-

vestment efficiency, GF is green financial development level. DEBT,

OVERIEit ðorUNDERIEitÞ ¼ h0 þ h1 GFit þ h2ROEit þ h3 Sizeit

STL, and LTL are total bank loans, short-term bank loans, and long-

þh 4CFit þ h5 Ageit þ h6 ADMit þ h7Majorit þ h8 Growthit X X (4)

term bank loans, respectively. Referring to the research of He et al. þ Year þ Ind þ z

[43]; Jiang et al. [44]; this paper introduces the rate of return on

equity, ROE, enterprise scale, SIZE, cash flow, CF, listed years, AGE,

management expense ratio, ADM, major shareholder control,

DEBTitðorSTLitorLTLitÞ ¼ g0 þ g1 GFit þ g2ROEit þ g3Sizeit X

Major, enterprise growth, Growth, and tangible, Tangible, as control

þg4CFit þ g5 Ageitþg6 Growthit þ g7 Tangibleit þ Year (5)

variables. Year and Ind represents the year and industry, respec- X þ Ind þ 6

tively. According to the recursive intermediary effect test method

proposed by Baron and Kenny [45] and Wen et al. [46]; we first

estimate model (1). If the coefficient b1 is significant, it shows that

OVERIEit ðorUNDERIEitÞ ¼ t0 þ t1GF it þ t2Debtitðor STL itorLTLitÞ

green financial development has an influence on investment effi-

þt 3ROEitþt4 Sizeit þ t5CFit þ t6Age it þ t7 ADMit þ t8 Majorit

ciency. Then we estimate model (2). If the coefficient c X X 1 is signifi- þt Year Ind

cant, it shows that green financial development can impact bank 9Growthit þ þ þ n

credit. In addition, we estimate model (3). If the coefficients 41 and (6)

42 are both significant and the absolute value of 41 is smaller than

b1, this shows that the partial intermediary effect of bank credit

channels exists. If the coefficient 41 is insignificant, while the co-

efficient 42 is significant, this indicates that bank credit channels

3.2. Variables and data selection

have full intermediary effect. Further, considering the existence of

under-investment and over-investment, the original sample is

Variables and indicators in this paper are shown in Table 1.

divided into an over-investment group and an under-investment

This paper takes renewable energy enterprises in the Chinese A

group according to whether investment efficiency is either

share market as a sample, with the sample range being from 2011 to

greater or less than 0. Based on these, Models (4)e(6) are estab-

2016. Due to the lack of an accurate definition of the renewable

lished, where OVERIE and UNDERIE represent over-investment and

energy industry in the Chinese listed enterprises” categories, we

under-investment, respectively.

take enterprises whose main business is related to renewable en-

ergy as samples. According to “The Industry Classification Guide-

lines” issued by China Securities Regulatory Commission in 2012,

we choose the “Electricity, Heat, Gas, and Water Production and 978

L. He et al. / Renewable Energy 143 (2019) 974e984 Table 1

Definition and description of variables. Symbol Variables Definition Inew New investment

(cash paid for the purchase and construction of fixed assets, intangible assets and other long-term assets - cash recovered from

disposal of fixed assets, intangible assets and other long-term assets)/total assets at the beginning of the year Q Investment opportunity

Tobin Q, Tobin Q¼(total stock market value þ total debt at the end of the year)/total assets at the end of the year Lev Asset-liability ratio

Total debt at the end of the year/total assets at the end of the year, which also indicates the financing structure. Cash Cash

(Cash at the end of the year þ short-term investment)/total assets at the end of the year Age Listed years

Natural logarithm of the enterprises’ listing age of at the end of the year Size Enterprise scale

Natural logarithm of the enterprises’ total assets at the end of the year Ret Stock yield

Annual return on enterprises’ stock IE

Renewable energy investment Difference between actual newly increased investment and reasonably expected investment, namely, the residual of model (1). efficiency OVERIE Over-investment

The amount that actual newly increased investment exceeds reasonably expected investment, which means that the residual of model (1) is greater than 0. UNDERIE Under-investment

The amount that actual newly increased investment is lower than reasonably expected investment, which means that the

residual of model (1) is less than 0. GF

Green financial development Calculated according to the measurement system of China’s green finance development degree level Debt Loan ratio

(Short-term loans at the end of the year þ non-current liabilities due within one year þ long-term loans)/total assets at the end of the year STL Short-term loan ratio

(Short-term loans at the end of the year þ non-current liabilities due within one year)/total assets at the end of the year LTL Long-term loan ratio

long-term loans/total assets at the end of the year ROE The rate of return on equity Net income/ownership interest CF Cash flow

Net operating cash flow/total assets at the beginning of the year ADM Management expense ratio

Management expenses/main business income Major Major shareholder control

The shareholding ratio of the largest shareholder Growth Growth

Sales growth rate¼(Operating income of this year - operating income of last year)/operating income of last year Tangible Tangible

Net fixed assets at the end of year/total assets at the end of year Year Year Annual dummy variable Ind Industry

Industrial dummy. According to the main businesses of renewable energy listed enterprises, renewable energy industry is

divided into wind energy, solar energy, water energy, geothermal energy, biomass energy and other industries.

Supply Industry (Industry codes are D44, D45, and D46, respec-

4. Measurement of green financial development degree and

tively)” and the “Ecological Protection and Environmental Man-

renewable energy investment efficiency

agement Industry (Industry code is N77)” and select sample

enterprises in accordance with the following principles: (1) Include

4.1. Measurement of green financial development degree

enterprises that were listed in Chinese A share market before

December 31, 2010. (2) Exclude enterprises that belong to special

According to the definition of green finance in this paper, from

treatment and particular transfer categories. (3) To avoid the in-

the perspective of financial institutions, the Chinese green financial

fluence of issuing either domestic foreign capital stocks or overseas

development degree is measured on the basis of green credit, green

shares on enterprises” investment behavior, the sample does not

securities, green insurance, green investment, and carbon finance.

contain enterprises that issue B, H, and N shares. (4) Remove some

Referring to the Chinese green financial development measure-

enterprises with incomplete sample data. Based on the above

ment system established by Zeng et al. [32] and considering the

principles, 141 enterprises were selected. Further, 5% Winsorization

validity and availability of data, the index system is constructed as

is applied to all continuous variables of enterprises to reduce the shown in Table 3.

impact of outliers. Data come from the CSMAR database and the

In Table 3, the first-class index equals to the arithmetic average

CCER database. Table 2 shows a statistical description of the original

value of the corresponding second-class index. data of variables.

Specifically, (1) green credit, which is measured from two Table 2

Descriptive statistics of variables. Variables Mean Median Maximum Minimum Std. Dev. Observations Inew 0.0833 0.0526 2.6154 0.1357 0.1318 910 Q 3.5635 1.6797 53.5115 0.3705 5.4449 910 Lev 0.5264 0.5336 3.2619 0.0123 0.23399 910 Cash 0.2042 0.1312 3.4970 0.0457 0.2791 910 Age 2.2678 2.4849 3.2958 0.0000 0.7370 910 Size 22.4607 22.2575 26.4580 19.6255 1.3387 910 Ret 0.1369 0.0295 2.6574 0.6899 0.4768 910 Debt 0.2619 0.2485 1.3093 0.0000 0.1911 829 STL 0.1502 0.1348 1.3093 0.0000 0.1193 829 LTL 0.1117 0.0475 0.7297 0.0000 0.1473 829 ROE 0.0167 0.0602 1.8771 20.7367 0.7763 829 CF 0.0400 0.0512 0.7425 7.1302 0.2777 829 ADM 0.0857 0.0715 5.2077 0.0022 0.1896 829 Major 35.0742 33.2300 85.2300 6.6100 15.9321 829 Growth 18.1821 0.0702 14883.0600 0.9167 516.9037 829 Tangible 0.3170 0.2456 1.4650 3.77E-05 0.2222 829

L. He et al. / Renewable Energy 143 (2019) 974e984 979 Table 3

Measurement system of green financial development degree in China. The first-class index The second-class index Calculation description and the weight Green credit (45%) Ratio of green credit

Total green credit of five representative banksa/Total loans of five representative banks

Ratio of interest expense in high energy-consumption industries Interest expense of six high energy-consumption industries/Total interest expense of industries

Green securities (25%) Ratio of environmental protection companies’ market value

Total market value of environmental protection companies/Total market value of A-shares

Ratio of high energy-consumption companies’ market value

Total market value of six high energy-consumption industriesb/Total market value of A-shares

Green insurance (15%) Ratio of agricultural insurance scale

Agricultural insurance expenditure/Total insurance expenditure

Loss ratio of agricultural insurance

Agricultural insurance expenditure/Agricultural insurance income Green investment

Ratio of environmental protection public expenditure

Fiscal expenditure of energy-saving and environmental-protection industries/ (10%) Total fiscal expenditure

Ratio of foreign direct investment (FDI) of energy-saving and

Foreign direct investment of energy-saving and environmental-protection

environmental-protection industries

industries/Total foreign direct investment

Ratio of investment governing environmental pollution

Investment of governing environmental pollution/GDP Carbon finance (5%)

Ratio of trading volume of Clean Development Mechanism

Percentage of Chinese Clean Development Mechanism project transactions in all project

Clean Development Mechanism projects

a The representative banks are the five biggest banks with total asset in China. They are Industrial and Commercial Bank of China, the Bank of China, the China Construction

Bank, the Bank of Communications, and the China Development Bank. These banks’ assets account for more than 40% of the banking industry; thus, the five banks are relatively representative.

b According to the “Chinese 2010 National Economic and Social Development Statistics Report”, the six major high energy-consumption industries include the chemical

industry of raw materials and chemical products manufacturing; the non-metallic mineral products industry; the ferrous metal smelting and rolling processing industry; the

non-ferrous metal smelting and rolling processing industry; the oil processing; coking, and nuclear fuel processing industry; and the electricity and heat production and supply industry.

aspects, the proportion of green credit and the interest expenditure

in high energy-consumption industries. (2) The green securities 107.00 106.58

index reflects the financial support effect of the capital market for 106.00

environmental protection and high energy-consumption enter- 105.47

prises. (3) Green insurance. The environmental protection liability 105.00

insurance for Chinese enterprises has been implemented since 104.59 104.32

2013, which means that there is a lack of reliable data. Thus, the 104.00

agricultural insurance development is used to measure approxi- 103.00

mately the development of green insurance. (4) Green investment

development is measured from three aspects: public expenditure 102.00

on energy conservation and environmental protection, foreign

direct investment (FDI), and investment in governing environ- 101.00 100.68

mental pollution. While the classification of environmental pro- 100.00 100.00

tection enterprises lacks industry standards, this paper selects the 2011 2012 2013 2014 2015 2016 Year

ecological protection and environmental governance enterprises in

the China Securities Regulatory Commission Industry Classification

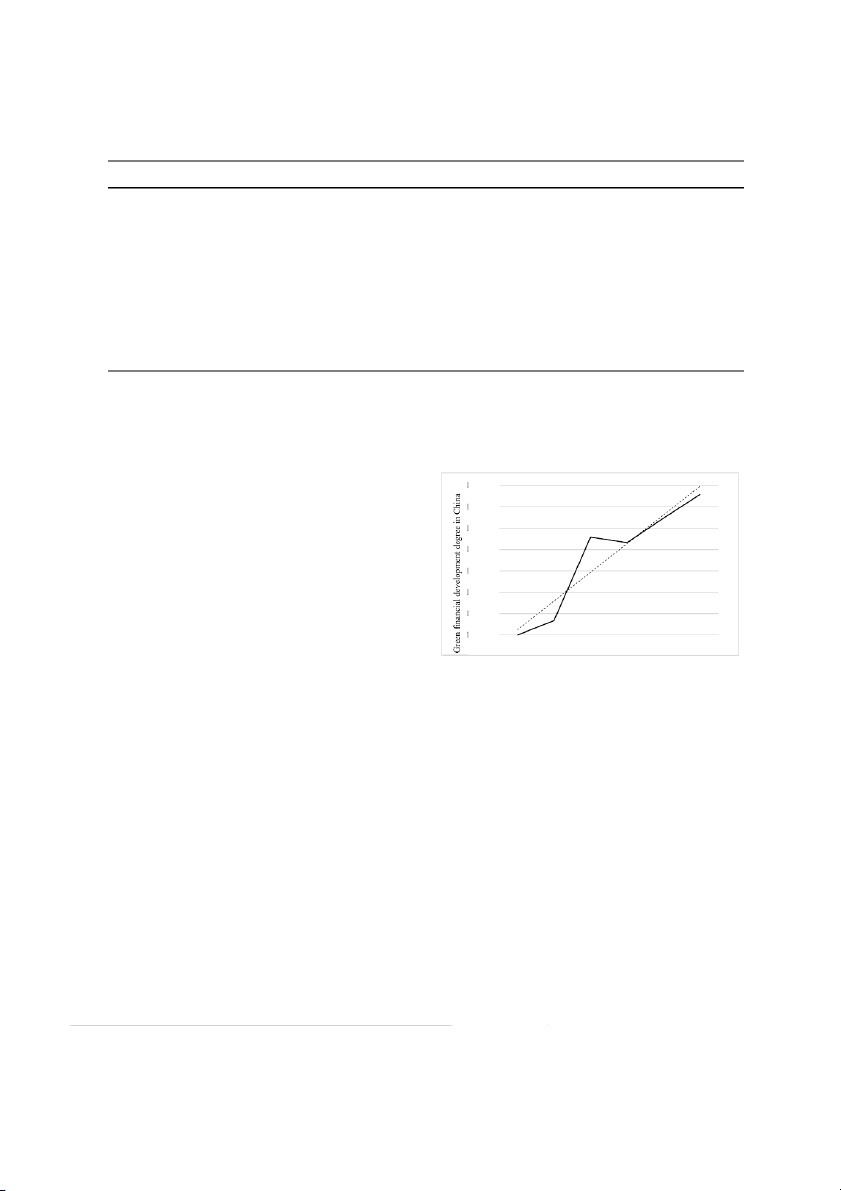

Fig. 2. Green financial development degree in China in 2011e2016.

for measurement. As FDI in energy-saving and environmental

protection industries lacks corresponding caliber data, this paper

uses FDI of water conservancy, environment, and public facilities

approximately 4%, entering a rapid growth phase. However, in

management industries released by Chinese National Bureau of

2014, the green financial development degree declined slightly.

Statistics as a substitute. (5) Carbon finance represents the inter-

This may be due by market adjustments and other reasons, such as

national influence of Chinese green financial development.

changes of the green credit cycle and the green securities market. In

Overall, while, on the one hand, it difficult to accurately measure

2014e2016, the annual growth rate of Chinese green financial

green financial development degree because of the development of

development index was around 1%, which represents a decline.

various green financial markets is not mature and relevant data are

Overall, the degree of green financial development in China is

lacking, on the other hand, the relevant statistical data cover a short

relatively low at present. From the practical point of view, this may

period of time. Based on the actual situation of China, considering

be mainly due to the uncertain development prospect of green

the availability of data, we determined 2011 as the base year, and

securities, green investment, and other markets; the low level of

our sample range was 2011e2016. The data come from the website

government support; and the corresponding adjustment of finance

of National Bureau of Statistics of China, the website of China Clean

development due to the economic structure adjustment.

Development Mechanism, the CCER database, and annual reports

and social responsibility reports of the banks mentioned above.

Based on these data, we have calculated the Chinese green financial

4.2. Measurement of renewable energy investment efficiency

development index from 2011 to 2016, as shown in Fig. 2.

It can be seen that green financial development in China has

Referring to the investment efficiency model proposed by

generally increased, while the growth rate is relatively slow. In

Richardson [47] this paper quantifies enterprise’s annual over- 2011

investment and under-investment levels. Yu et al. [48] improved

e2012, the annual growth rate was approximately 1%, which is relatively low. In 2012

this model and used a panel data fixed effect model to estimate the e2013, the annual growth rate was

optimal investment level of enterprises. The residual in model (7) 980

L. He et al. / Renewable Energy 143 (2019) 974e984 Table 4

generally low in the research period, while there is obvious fluc-

Regression results of renewable energy investment efficiency model.

tuation, with the main range of changes being 0.190 to 0.340. Variables Coef

Moreover, the gap of investment ef ficient Standard deviation T value P value

ficiency between enterprises is remarkable. Intercept 0.0591 0.0466 1.2682 0.2051 Qit1 0.0005 0.0006 0.8763 0.3811 Lev 0.0189 0.0115 1.6471 0.0999* it1

5. Estimation and results analysis Cash 0.0310 0.0149 2.0780 0.0380** it1 Ageit1 0.0099 0.0032 3.0744 0.0022***

To analyze the intermediary paths along which green financial Size 0.0014 0.0021 0.6758 0.4993 it1

development affects renewable energy investment ef Ret 0.0050 0.0055 0.9167 0.3596 ficiency it1 Inew 0.4884 0.0365 13.3879 0.0000***

through bank credit, models (1) it1

e(3) are estimated based on the R-squared 0.3486 Sum squared resid 1.7401

total sample of renewable energy investment efficiency, the over- F-statistic 24.4886 Durbin-Watson stat 1.9474

investment group, and the under-investment group, respectively. Prob (F-statistic) 0.0000 S.E. of regression 0.0473

The regression results are shown in Tables 6e8.

Note: *, **, and *** indicate significance levels of 0.1, 0.05, and 0.01, respectively (the As can be seen from Table 6: same below).

1) The impact of bank loans on renewable energy investment ef-

indicates enterprises” investment efficiency. If the residual is

ficiency is insignificant (column 3); thus the intermediary effect

greater than 0, enterprises are over-investing. When the residual is

is untenable. Meanwhile, the direct effect of green financial

less than 0, enterprises are underinvesting.

development on renewable energy investment efficiency is

significant, and the coefficient is 0.0017, which shows that green Inew

financial development increases the fluctuation of renewable

it ¼a 0þa 1Q it1 þa 2Levit1þ a3Cashit1 þ a4 Ageit1 X X

energy investment efficiency and reduces renewable energy

þ a5 Sizeit1þ a6Retit1þ a7 Inewit1 þ Year þ Indþ ε

investment efficiency to some extent. In addition, the coefficient (7)

of green financial development on bank loans is 0.0146, which

indicates that green financial development inhibits the bank

where i represents the renewable energy listed enterprises, t

credit investment in renewable energy enterprises in the

represents the year, and ε is the random disturbance term. The

research period. The reason lies in the fact that, as pointed out in

definitions of related variables are shown in Table 1. Based on the

the theoretical analysis, renewable energy enterprises have

above analysis, a unit root test was conducted, and the results show

financing constraints in the early development stage, and the

that the series are stationary at 1% of the significant level. According

financing constraints caused by the “finance” attribute of green

to the co-integration test results, there is a long-term equilibrium

financial development may offset the improvement effect of its

relationship among related variables. Besides, Hausman test results

“green” attribute on renewable energy investment efficiency,

show that a random effect panel model should be adopted. Then,

which has a generally inhibiting effect on renewable energy

the model (7) was estimated using the Least Square Regression investment efficiency.

method. The regression results are shown in Table 4.

2) The effect of green financial development and short-term loans

As can be seen from Table 4, Levit1, Cash it1, Ageit1, and

on renewable energy investment efficiency is significant (col-

Inewit1 are all significant at the 10% level, and the model is sig-

umns 4e6); this shows that a partial intermediary effect exists.

nificant. Therefore, we use the residual value of the investment

According to the estimation method of [46], the intermediary

efficiency model to represent renewable energy investment effi-

effect of a short-term loan is 0.00030 (0017e0.0014), which

ciency, IE. If the residual value is greater than 0, it indicates

accounts for 17.65% (0.0003/0.0017) of the total effect. The

renewable energy over-investment, expressed as OVERIE. The

specific path is that green financial development reduces the

greater the positive value, the more serious the over-investment.

short-term loan amount for renewable energy enterprises,

When the residual value is less than 0, enterprises are under-

which reduces the power of the contingent governance function

investing, expressed as UNDERIE. The smaller the negative value,

of short-term loans for renewable energy investment, thus

the more serious the under-investment. Due to the missing values

inhibiting renewable energy investment efficiency. In practice,

of enterprises in the research period, there are missing residual

the “green” attribute of green finance is mainly embodied in two

values, and we finally obtain 796 samples of 141 enterprises in

aspects: supporting green industries and eliminating inefficient

2011e2016. Table 5 is a statistical description of investment effi-

industries. Renewable energy enterprises belong to green in-

ciency. As can be seen from Table 5, the proportion of renewable

dustry, but the industry characteristics hinder short-term effi-

energy under-investment is 62.81%, which is a relatively large, and

ciency and lack market competitiveness. Moreover, green

which shows that Chinese renewable energy enterprises are

financial development in China is still in its initial stage, with a

generally underinvesting. This result is consistent with the findings

relatively slow development speed and a limited guiding role in of Wu et al. [49].

resource allocation. This results in negative effects on short-

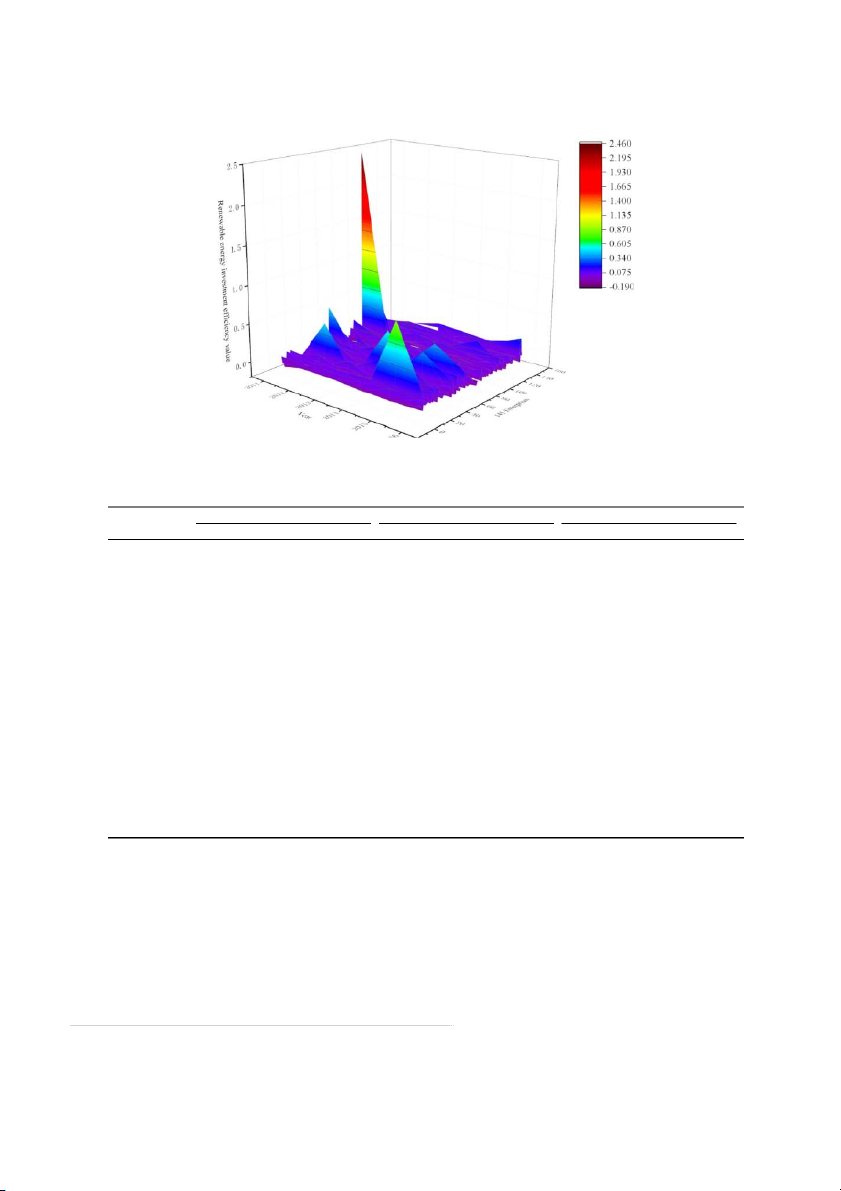

Furthermore, Fig. 3 is the change of renewable energy invest- term loans.

ment values for 141 enterprises in 2011e2016. It can be seen that

3) The effect of a long-term loan on renewable energy investment

investment efficiency of 141 renewable energy listed enterprises is

efficiency is insignificant (column 9); thus the intermediary Table 5

Descriptive statistics of renewable energy investment efficiency. Variables Mean Median Maximum Minimum Std. Dev. Observations IE 0.0000131 0.0157088 2.455006 0.1836559 0.1200028 796 OVERIE 0.0720604 0.0379021 2.455006 0.0003358 0.1703705 296 UNDERIE 0.0426389 0.0379549 0.0001873 0.1836559 0.0296862 500

Note: The renewable energy investment efficiency value is generally small; thus, we choose 7 digits after the decimal point for measurement.

L. He et al. / Renewable Energy 143 (2019) 974e984 981

Fig. 3. The renewable energy investment efficiency value in China in 2011e2016. Note: the number on the Y axis indicates 141 listed renewable energy enterprises. Table 6

Intermediary effect test results of green financial development, bank credit, and renewable energy investment efficiency. Dependent variable Bank loan Short-term loan Long-term loan (1)IE (2)Debt (3)IE (4)IE (5)STL (6)IE (7)IE (8)LTL (9)IE Intercept 0.5990*** (0.0000) 0.5839*** 0.5923*** 0.5990*** (0.0000) 0.8783*** 0.5573*** 0.5990*** (0.0000) 0.4142*** 0.5884*** (0.0030) (0.0000) (0.0000) (0.0000) (0.0014) (0.0000) GF 0.0017*** (0.0003) 0.0146*** 0.0016*** 0.0017*** (0.0003) 0.0080*** 0.0014*** 0.0017*** (0.0003) 0.0071*** 0.0021*** (0.0000) (0.0004) (0.0000) (0.0025) (0.0000) (0.0000) Debt 0.0097 (0.3398) STL 0.0478** (0.0361) LTL 0.0514 (0.1143) ROE 0.0040 (0.9012) 0.2510*** 0.0002 0.0040 (0.9012) 0.1734*** 0.0078 0.0040 (0.9012) 0.1180** 0.0151 (0.0000) (0.9935) (0.0000) (0.6291) (0.0200) (0.4889) Size 0.0182*** (0.0000) 0.0394*** 0.0186*** 0.0182*** (0.0000) 0.0024 0.0181*** 0.0182*** (0.0000) 0.0500*** 0.0158*** (0.0000) (0.0000) (0.6449) (0.0000) (0.0000) (0.0000) CF 0.1678*** (0.0000) 0.1500** 0.1684*** 0.1678*** (0.0000) 0.1750*** 0.1606*** 0.1678*** (0.0000) 0.0575*** 0.1551*** (0.0140) (0.0000) (0.0001) (0.0000) (0.0021) (0.0000) Age 0.0081 (0.2485) 0.0600*** 0.0076 0.0081 (0.2485) 0.0381*** 0.0067 0.0081 (0.2485) 0.0168* 0.0093 (0.0000) (0.2979) (0.0001) (0.3728) (0.0992) (0.1673) ADM 0.2557*** (0.0000) 0.2479*** 0.2557*** (0.0000) 0.2374*** 0.2557*** (0.0000) 0.2772*** (0.0000) (0.0000) (0.0000) Major 0.0002* (0.0776) 0.0002*** 0.0002* (0.0776) 0.0002*** 0.0002* (0.0776) 0.0002** (0.0074) (0.0070) (0.0105) Growth 0.0146** (0.0332) 0.0047 0.0144* 0.0146** (0.0332) 0.0026 0.0146* 0.0146** (0.0332) 0.0004 0.0151** (0.6482) (0.0587) (0.7342) (0.0550) (0.9443) (0.0303) Tangible 0.2853*** 0.0665*** 0.2028*** (0.0000) (0.0098) (0.0000) R 2 0.1601 0.2651 0.1606 0.1601 0.1289 0.1655 0.1601 0.3375 0.1655 F-value 8.7259 18.3030 8.2562 8.7259 7.5120 8.5631 8.7259 25.8563 8.5614

effect is untenable. Meanwhile, the direct effect coefficient of As can be seen from Table 7:

green financial development on renewable energy investment

efficiency is 0.0021, which increases the fluctuation of renew-

1) Only the effect of green financial development on renewable

able energy investment efficiency. Additionally, green financial

energy investment efficiency is insignificant, and the complete

development inhibits the long-term loans of renewable energy

intermediary effect of bank loans exists (column 3). Green

enterprises to a certain extent, with a coefficient of 0.0071. The

financial development reduces the amounts of bank loans for

reason for this is the same as with the short-term mediation

renewable energy enterprises, which eases the renewable en- effect. ergy over-investment. 982

L. He et al. / Renewable Energy 143 (2019) 974e984 Table 7

Intermediary effect test results of green financial development, bank credit, and renewable energy over-investment. Dependent variable Bank loan Short-term loan Long-term loan (1)OVERIE (2) (3)OVERIE (4)OVERIE (5) (6)OVERIE (7)OVERIE (8) (9)OVERIE Debt STL LTL Intercept 0.0099 0.9719***(0.0022) 0.0347 0.0099 1.0643*** 0.0543* 0.0099 0.0542 0.0027 (0.7310) (0.7737) (0.7310) (0.0000) (0.0527) (0.7310) (0.8667) (0.9841) GF 0.0006* 0.0188*** 9.67E-05 0.0006* 0.0099*** 0.0002 0.0006* 0.0085*** 0.0004 (0.0785) (0.0000) (0.9331) (0.0785) (0.0000) (0.5387) (0.0785) (0.0017) (0.7491) Debt 0.0315* (0.0559) STL 0.0356* (0.0977) LTL 0.0267 (0.2455) ROE 0.0377 0.2695** 0.0186 0.0377 0.1647** 0.0250 0.0377 0.0871 0.0287 (0.3416) (0.0192) (0.6498) (0.3416) (0.0129) (0.5354) (0.3416) (0.3492) (0.5040) Size 0.0056*** 0.0437*** 0.0034 0.0056*** 0.0009 0.0049** 0.0056*** 0.0382*** 0.0036 (0.0004) (0.0000) (0.1582) (0.0004) (0.8907) (0.0037) (0.0004) (0.0000) (0.2045) CF 0.0775* 0.0777 0.0649* 0.0775* 0.1499*** 0.0743* 0.0775* 0.0501 0.0654 (0.0692) (0.4831) (0.0853) (0.0692) (0.0016) (0.0886) (0.0692) (0.5006) (0.1185) Age 0.0105*** 0.0334* 0.0086** 0.0105*** 0.0010 0.0086* 0.0105*** 0.0327* 0.0087* (0.0069) (0.0682) (0.0488) (0.0069) (0.1915) (0.0757) (0.0069) (0.0601) (0.0610) ADM 0.1154* 0.1782** 0.1154* 0.1529** 0.1154* 0.1497* (0.0525) (0.0191) (0.0525) (0.0186) (0.0525) (0.0790) Major 0.0003** 0.0003* 0.0003** 0.0003** 0.0003** 0.0003* (0.0325) (0.0572) (0.0325) (0.0269) (0.0325) (0.0655) Growth 0.0113 0.0092 0.0123* 0.0113 0.0140 0.0110 0.0113 0.0050 0.0128* (0.2521) (0.6181) (0.0893) (0.2521) (0.3204) (0.2562) (0.2521) (0.7065) (0.0895) Tangible 0.3089*** 0.0792** 0.1885*** (0.0000) (0.0152) (0.0000) R2 0.1186 0.3966 0.1353 0.1186 0.1545 0.1306 0.1186 0.3885 0.1296 F-value 2.3453 11.4624 2.4088 2.3453 3.1852 2.3117 2.3453 11.0791 2.2923 Table 8

Intermediary effect test results of green financial development, bank credits and renewable energy under-investment. Dependent variable Bank loan Short-term loan Long-term loan (1)UNDERIE (2) (3) (4) (5) (6) (7) (8) (9) Debt UNDERIE UNDERIE STL UNDERIE UNDERIE LTL UNDERIE Intercept 0.5086*** 0.1730 0.4869*** 0.5086*** 0.7591*** 0.4719** 0.5086*** 0.6334*** 0.5058*** (0.0000) (0.5242) (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) (0.0001) (0.0000) GF 0.0032** 0.0112*** 0.0027*** 0.0032** 0.0071*** 0.0029*** 0.0032** 0.0057*** 0.0031*** (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) (0.0000) Debt 0.0315*** (0.0000) STL 0.0462*** (0.0000) LTL 0.0107 (0.4044) ROE 0.0083 0.2379*** 0.0064 0.0083 0.1775*** 0.0038 0.0083 0.1350*** 0.0057 (0.5413) (0.0009) (0.6555) (0.5413) (0.0000) (0.7943) (0.5413) (0.0007) (0.7047) Size 0.0055*** 0.0426*** 0.0068*** 0.0055*** 0.0006 0.0054*** 0.0055*** 0.0536*** 0.0059*** (0.0000) (0.0000) (0.0000) (0.0000) (0.9238) (0.0001) (0.0000) (0.0000) (0.0001) CF 0.0422*** 0.2036** 0.0440*** 0.0422*** 0.1830*** 0.0346** 0.0422*** 0.0458 0.0461*** (0.0072) (0.0194) (0.0063) (0.0072) (0.0025) (0.0349) (0.0072) (0.3405) (0.0067) Age 0.0070*** 0.0594*** 0.0093*** 0.0070*** 0.0331*** 0.0086*** 0.0070*** 0.0204** 0.0074*** (0.0016) (0.0004) (0.0001) (0.0016) (0.0000) (0.0002) (0.0016) (0.0466) (0.0016) ADM 0.0536 0.0283 0.0536 0.0361 0.0536 0.0493 (0.1016) (0.4062) (0.1016) (0.2992) (0.1016) (0.1650) Major 0.0001 0.0002* 0.0001 0.0001 0.0001 0.0001 (0.1266) (0.0915) (0.1266) (0.1572) (0.1266) (0.1381) Growth 0.0064** 0.0005 0.0057* 0.0064** 0.0066 0.0061** 0.0064** 0.0007 0.0063** (0.0322) (0.9736) (0.0651) (0.0322) (0.6117) (0.0441) (0.0322) (0.9322) (0.0420) Tangible 0.3435*** 0.0802* 0.2117*** (0.0000) (0.0515) (0.0000) R2 0.3922 0.3014 0.4142 0.3922 0.1335 0.4141 0.3922 0.3978 0.3907 F-value 18.2974 13.0243 18.8931 18.2974 4.6523 18.8860 18.2974 19.9429 17.1349

2) Short-term loans have a full intermediary effect (column 6). The

with the intermediary effect of bank loans. By contrast, the

results suggest that green finance curbs renewable energy

intermediary channel of a short-term loan is more effective in

overinvestment by reducing short-term loans. This is consistent

inhibiting renewable energy over-investment (columns 3 6). e

L. He et al. / Renewable Energy 143 (2019) 974e984 983

3) The effect of long-term loans on renewable energy over-

extent. The full intermediary effect of bank loans and short-term

investment is insignificant (column 9), and the intermediary loans is significant.

effect is untenable. Meanwhile, as can be seen from columns (7)

In practice, to improve the positive promotion effect of green

and (8), the direct effect of green financial development on

financial development on renewable energy investment efficiency,

renewable energy over-investment is significant, and the coef-

the government, financial institutions, and enterprises must coor-

ficient is 0.0099. The results reveal that green financial

dinate with each other. The key point is to give play to the guiding

development can reduce renewable energy over-investment to

role of green finance in resource allocation. The government should

a certain extent and improve renewable energy investment ef-

both construct and consummate the green financial system and

ficiency. Moreover, green financial development can reduce the

actively promote green financial development. On the one hand,

long-term loans of renewable energy enterprises with over-

through legislative means to build a green financial system through

investment problems. This is in line with the theoretical

legislation; on the other hand, to support the green industry expectation.

through Financial, Monetary and Environmental Policies or Green

funds, and then to promote green finance through green industry. As can be seen from Table 8:

Financial institutions should actively produce innovative green

financial products and support the development of renewable en-

1) The coefficients of green financial development and bank loans

ergy enterprises in multiple ways. In addition to green credit, green

on investment efficiency are all significant (columns 1e3), and

bonds, green insurance and specific financing tools for renewable

the partial intermediary effect of bank loans exists. The inter-

energy enterprises should be vigorously developed. Besides, policy

mediary effect is 0.0005 (0.0032e0.0027), which accounts for

financial institutions should also give full play to their supporting

15.63% (0.0005/0.0032) of the total effect. Specifically, green

role in renewable energy enterprises development. As for renew-

financial development reduces bank loans for renewable energy

able energy enterprises, they should strengthen their internal

enterprises, while bank loans have a negative effect on renew-

management, improve competitiveness in the financing market;

able energy under-investment. Therefore, green financial

especially for enterprises under-investment, developing financing

development cannot alleviate under-investment of renewable

channels is the key to improve investment efficiency.

energy. This is similar to the results in the whole sample.

2) The coefficients of green financial development and short-term Conflicts of interest

loans are significant (columns 4e6), which indicates that a

partial intermediary effect of short-term loans exists. Green

The authors declare no conflicts of interest.

financial development has a positive effect on the investment

shortage by reducing the short-term loan amount of renewable Acknowledgments

energy enterprises. The intermediary effect of bank loans is

0.0003 (0.0032e0.0029), which accounts for 9.38% (0.0003/

The authors are grateful for the National Natural Science

0.0032) of the total effect. In contrast, the partial intermediary

Foundation of China (Grant No.71874185), the Ministry of Educa-

effects of bank loans are greater than are those of short-term

tion of Humanities and Social Science Project of China (Grant No.

loans. Specifically, the effect of green finance development on

16YJAZH015) and the National Natural Science Foundation of China

bank loans is greater than is its effect short-term loans. More- (Grant No. 41801118).

over, the negative effect of bank loans on renewable energy

under-investment is greater than is that of short-term loans. References

3) The effect of long-term loans on renewable energy under-

investment is insignificant (column 9); thus the intermediary

[1] X.-R. Deng, J.-M. Zhang, Financing methods, financing constraints and enter-

effect of long-term loans is untenable. Meanwhile, the positive

prise investment efficiency-based on the empirical study of Chinese

manufacturing enterprises, J. Shanxi Univ. Fin. Econ. 38 (12) (2016) 29

effect of green financial development on renewable energy in- e40.

[2] T. Xiong, B. Cheng, J. Wang, Free cash flow, debt contract and enterprise in-

vestment efficiency is significant, and the coefficient is 0.0032.

vestment efficiency: an empirical analysis based on China’s real estate listed

This reveals that green financial development exacerbates

enterprises, J. Guizhou Univ. Fin. Econ. 31 (6) (2013) 59e70.

[3] H.-J. Yang, Y.-M. Hu, Institutional environment and excessive investment of

renewable energy under-investment (columns 7e9). Moreover,

free cash flow, Manag. World (09) (2007), 99-106þ116þ172.

green finance development reduces the long-term loans of

[4] M. Xiao, Cash dividend, internal cash flow and investment efficiency, J. Financ. renewable energy enterprises. Res. (10) (2010) 117e134.

[5] D. Zhang, H. Cao, D.G. Dickinson, et al., Free cash flows and overinvestment:

further evidence from Chinese energy firms, Energy Econ. 58 (2016) 116e124.

[6] X. Chen, Y. Sun, X. Xu, Free cash flow, over-investment and corporate 6. Conclusions and suggestions

governance in China, Pac. Basin Finance J. 37 (2016) 81e103.

[7] M.C. Jensen, Agency costs of free cash flow, corporate finance, and takeovers,

Am. Econ. Rev. 76 (2) (1986) 323e329.

This paper measures the degree of green financial development

[8] S.-P. Wang, Z.-J. Li, Bank shareholding, investment efficiency and corporate

and the investment efficiency of 141 listed renewable energy en-

debt financing, J. Financ. Res. (05) (2011) 184e193.

[9] X.-F. Zhou, Y.-Z. Lan, The effect of debt

terprises of China. The results show that within the study period,

financing on inefficient investment

behavior: an empirical study based on China’s private listed enterprises, Jinan

green financial development reduces the bank credit of renewable

J. (Philosophy and Social Science Edition) 33 (03) (2011) 23e30þ207.

energy enterprises and has a negative influence on renewable en-

[10] X.-S. Tang, X.-S. Zhou, R.-J. Ma, Empirical study on over-investment behavior

ergy investment efficiency. The partial intermediary effect of short-

of listed enterprises and its restrictive mechanism, Acc. Res. (7) (2007) 44e52.

[11] W. Jiang, Financial development, bank loans and corporate investment,

term loans is significant. Besides, for renewable energy enterprises

J. Financ. Res. (04) (2011) 113e128.

that are overinvesting, green financial development reduces

[12] L.-F. Li, Y.-H. Ye, J. Sun, Market competition, debt financing and over-invest-

renewable energy investment by reducing bank credit distribution,

ment, China Soft Sci. Mag. (11) (2013) 91e100.

[13] Y.-L. Zhang, Y. Tan, F. Xia, Is investment efficiency tied to “debt financing”?

in which the full intermediary effect of bank loans and short-term

Res. Econ. Manag. (02) (2011) 46e55.

loans is significant; for renewable energy enterprises that are

[14] Y.-C. Zhang, W.-C. Li, J. Peng, Research on the effect of creditor’s power

underinvesting, green financial development cannot alleviate

governance on enterprise investment efficiency-empirical evidence from

China’s listed enterprises, J. Financ. Res. (07) (2015) 190 203

under-investment. However, green financial development can e .

[15] D.Y. Zhang, H. Cao, P. Zou, Exuberance in China’s renewable energy invest-

restrain bank credit for renewable energy enterprises to some

ment: rationality, capital structure and implications with firm level evidence,