Preview text:

Chapter 1

Introduction to management accounting 1 Learning Objectives

Identify the features of managerial accounting and the (1) functions of management.

Describe the classes of manufacturing costs and the (2)

differences between product and period costs.

Explain and illustrate the concept of cost objects, cost (3) units and cost centers.

Distinguish between cost, profit, investment and (4) revenue centers. 2 2 1 MANAGERS

Require regular management information For: Planning Control Decision making 3 Decision Making Process

• Identify goals, objectives or problems. Step 1

• Identify alternative solutions. Step 2 Planning

• Collect and analyze relevant data. Step 3

• Make the choice/decision. State the expected outcome. Step 4 • Implement the decision. Step 5

• Obtain data about actual results. Step 6 Control

• Compare actual results with the expected outcome. Step 7 Evaluate achievements. 4 2

Managerial Accounting & Financial Accounting Managerial accounting Financial accounting provides information provides information for managers inside an to stockholders, organization who creditors and others direct and control who are outside its operations. the organization. 5 Management accounting Financial Accounting Nature of the Tend to be general Tend to be specific purpose reports produced purpose Level of detail Often very detailed Usual y broad overview Usual y subject to Regulations Unregulated accounting regulation As short as required by Usual y annual or bi- Reporting interval managers annual Often based on projected Time orientation future information as well as Almost always historical past information Tend to contain financial and Focus on financial Range and quality non-financial information, information, great of information often use information that emphasis on objective, cannot be verified verifiable evidence 6 3 Financial information Management accounting information Non- financial information 7

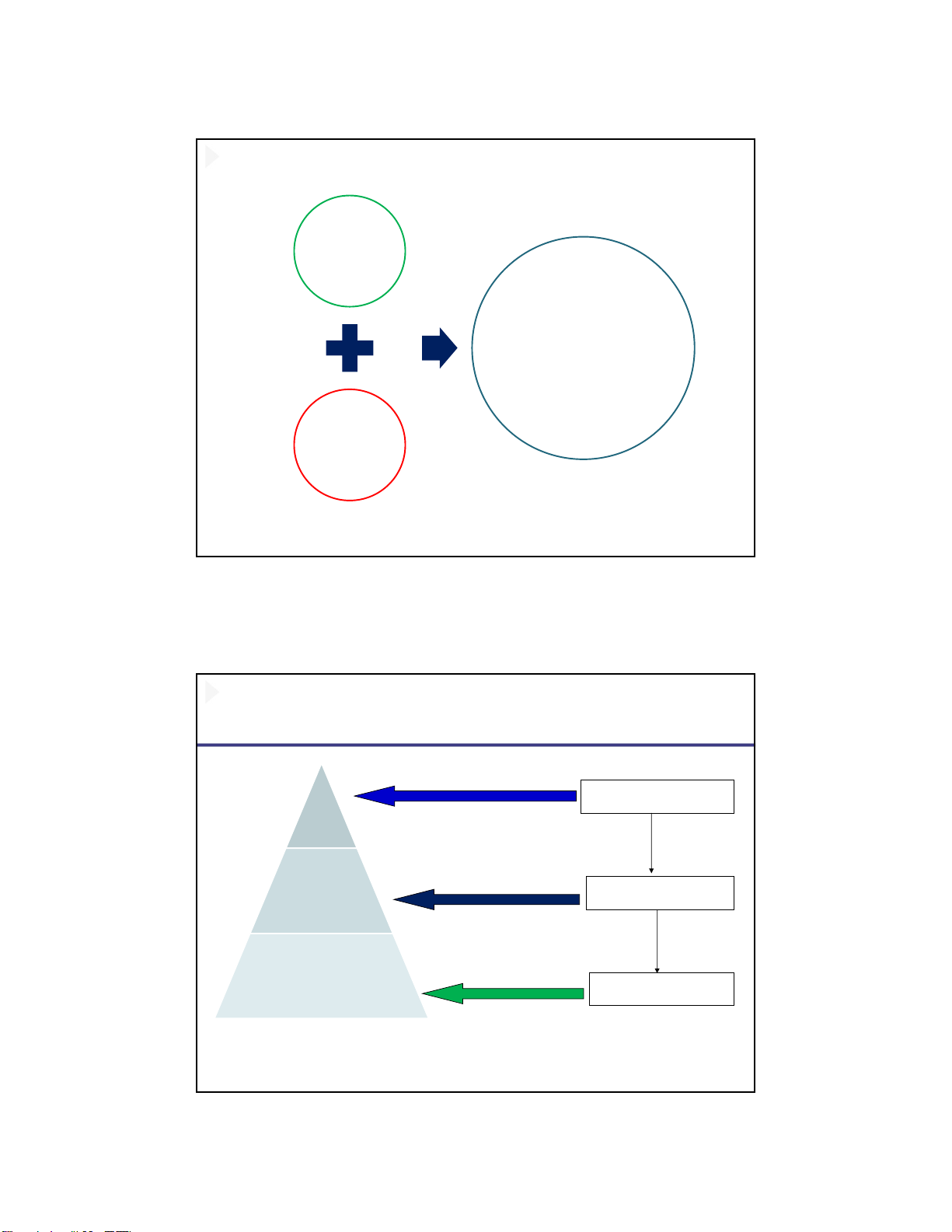

Management activity and management information Forward-looking, Senior management Strategic planning external focus, non-financial Tactical planning

Medium-term, linked to budgets, Middle management (management control) forecasts and resources Operational planning Day-to-day, internal, detailed (operational control) Front-line managers often transactional level 8 4 Quality of good information Relevant Communi Complete cated Timely Cost Accurate Volume Clear Confident 9 Data vs. Information Data Information Raw material for Processed Data processing Should be meaningful Relate to facts, events, transactions etc. 10 5 Quick check 01

The fol owing assertions relate to financial accounting and to cost accounting:

(i) The main users of financial accounting information are external to an organisation.

(i ) Cost accounting is that part of financial accounting

which records the cash received and payments made by an organisation.

Which of the fol owing statements are true? A

Assertions (i) and (i ) are both correct. B Only assertion (i) is correct. C Only assertion (i ) is correct 11 Quick check 02

The fol owing statements refer to strategic planning:

(i) It is concerned with quantifiable and qualitative matters.

(i ) It is mainly undertaken by middle management in an organisation.

(i i) It is concerned predominantly with the long term.

Which of the statements are correct? A (i) and (i ) only B (i) and (i i) only C (i ) and (i i) only D (i), (i ) and (i i) 12 6 Basic Cost Terminology

Cost – sacrificed resource to achieve a specific objective

Actual cost – a cost that has occurred

Budgeted cost – a predicted cost

Cost object – anything of interest for which a cost is desired

Cost unit - is a unit of product or service to which costs may be ascertained.

Cost centre - is a location, function or item of equipment in

respect of which costs may be ascertained and related to

cost units for control purposes. 13 Cost unit

Costs unit - is a unit of product or service in relation to which

costs are ascertained - a basic control unit for costing purposes Industry sector/ Activity Cost unit Brick-making 1,000 bricks Electricity Megawatt-hour (MwH) Professional service Chargeable hour Education Enrol ed student Hotel Bed night Bus company Passenger mile Hospital In-patient day Credit control Account maintained Sel ing Customer cal 14 14 7

Production and non-production costs Costs associated with the Production

production of goods and services, costs

from the supply of raw materials

up to the end of the production process Total costs Non-production

All other costs incurred in the costs business 15

Production and non-production costs Materials Cost of materials used in the making of the product/services Production costs Labour Cost of the workforce used in making the product

Cost of any overheads required Overheads to support the production process 16 8

Production and non-production costs Administration All other costs incurred in managing the organisation All costs incurred in Sel ing promoting retaining Non- customers Production costs All costs incurred in making Distribution the packed product ready for the despatch and delivery to the customer Finance All costs incurred to finance the business 17

Direct Costs vs. Indirect Costs Direct costs Indirect (production) costs Costs that can be traced Costs are incurred in the in ful to the product, course of making a service or department that product/service but which is being costed. cannot be identified with a E.g. direct materials, particular cost unit. direct labour, direct E.g. production overhead expenses 18 9 Direct materials

Materials that are incorporated into the finished product

or used in providing a service.

Example: seats instal ed in a car made by Toyota. 19 19 Direct labour

Wages paid to those workers who make

products in a manufacturing business or perform

the service in a service business.

Example: wages paid to automobile assembly workers at Toyota. 20 20 10 Direct expenses

Expenses that have been incurred as a direct

consequence of making a product, or providing a service.

E.g. patent royalties payable to the inventor of a new product or process. . 21 21 Direct Direct Prime cost Direct labour materials expenses 22 11 Indirect costs Indirect materials

Materials that are used in the production process but not incorporated into the product.

Insignificant costs that are attributable to each unit are sometimes

included in indirect materials for convenience. Indirect labour

Wages and salaries of the other staff, such as supervisors,

storekeepers and maintenance workers. Indirect expenses

Expenses that are not spent on individual units of production (e.g.

rent and rates, electricity and telephone). 23 23 Quick check 3

Which of the fol owing should be classifed as indirect labour?

A Machine operators in a factory producing furniture B Lawyers in a legal firm

C Maintenance workers in a power generation organization

D Lorry drivers in a road haulage company 24 12 Quick check 4

A manufacturing organization incurs costs relating to the fol owing:

(i) Commission payable to salespersons (i ) Inspecting al products

(i i) Packing the products at the end of manufacturing process prior to moving them to the warehouse

Which of these costs are classified as production costs? A (i) and (i ) only B (i) and (Ii ) only C (ii) and (i i) only D (i), (ii) and (i i) only 25

Cost Classifications by Behaviors

Behavior of Cost (within the relevant range) Cost In Total Per Unit Variable Total variable cost changes Variable cost per unit remains as activity level changes. the same over wide ranges of activity. Fixed Total fixed cost remains Fixed cost per unit goes the same even when the

down as activity level goes up. activity level changes. 26 13 Cost Behavior (cont’d) Variable costs

Costs that vary in total directly and

proportionately with changes in the activity level. t s o c le b ria l va ta o T

Volume of output (level of activity) 27 27 Cost Behavior (cont’d) Fixed costs

Costs that remain the same in total regardless of

changes in the activity level within a relevant range. st o c ed l fix ta To Volume of output 28 28 14 Cost Behavior (cont’d)

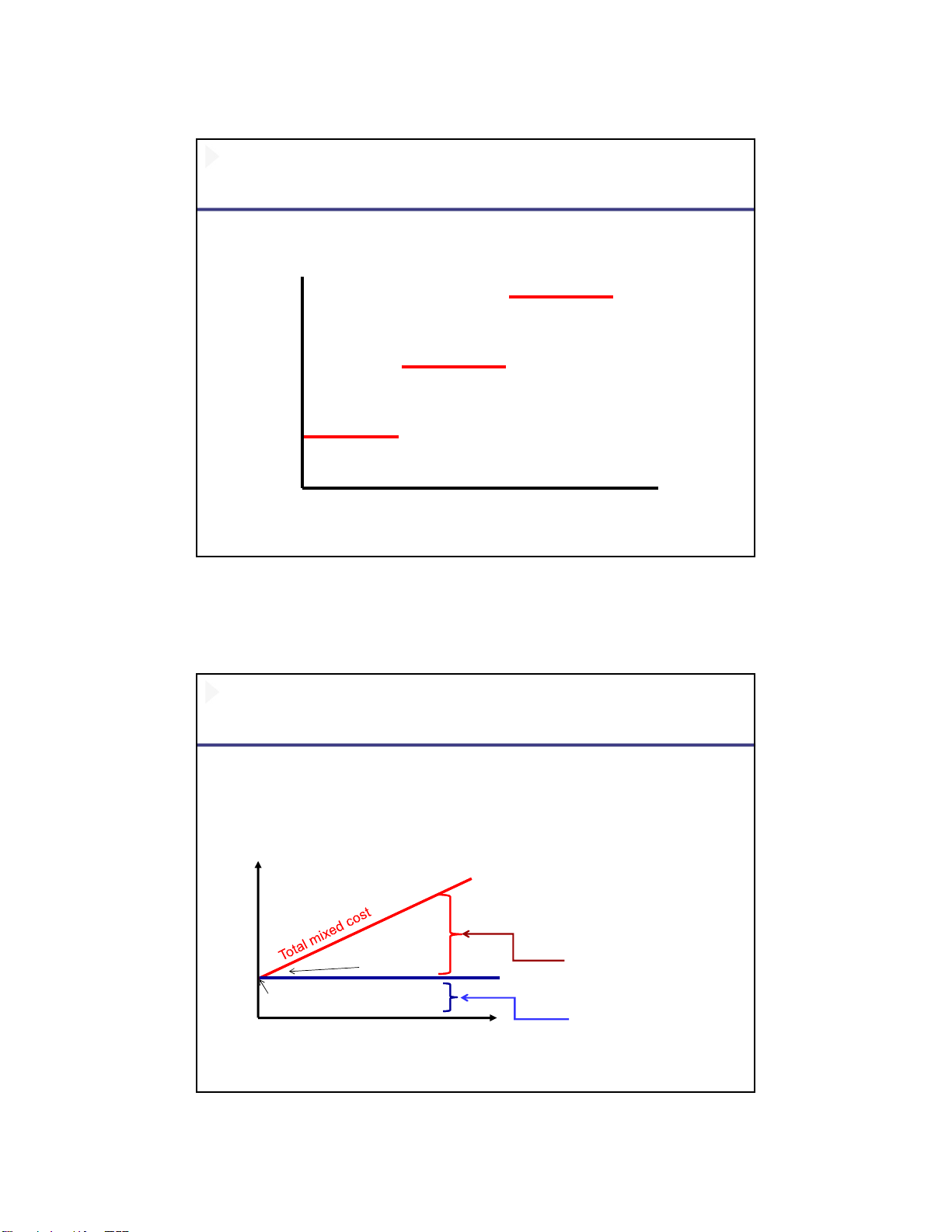

Stepped fixed costs: is a cost which is fixed in

nature but only within certain levels of activity. 90 f s o d n sa Relevant u 60 o h rs Range T lla o D st in o 30 t C n e R 0 0 1,000 2,000 3,000 Rented Area (Square Feet) 29 29 Cost Behavior (cont’d)

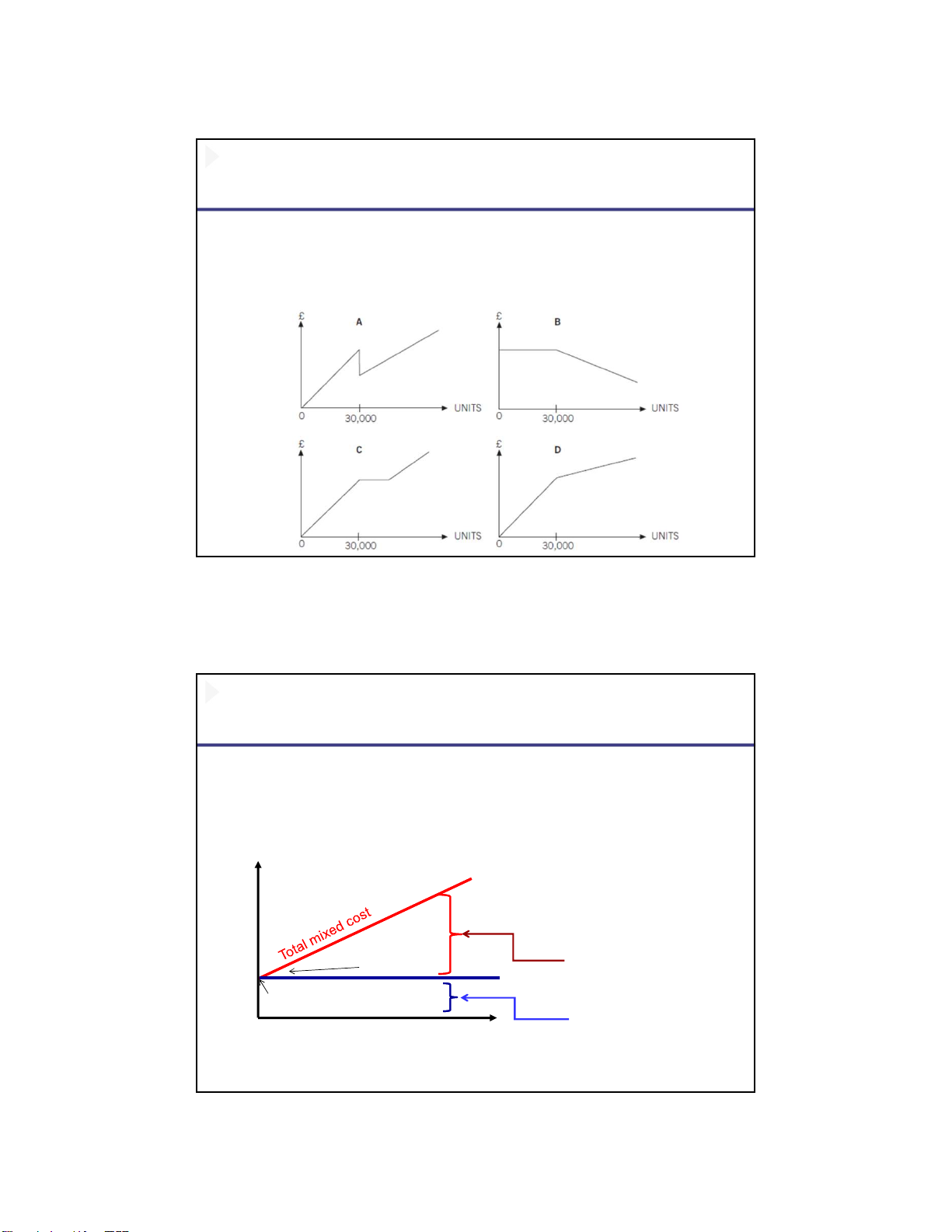

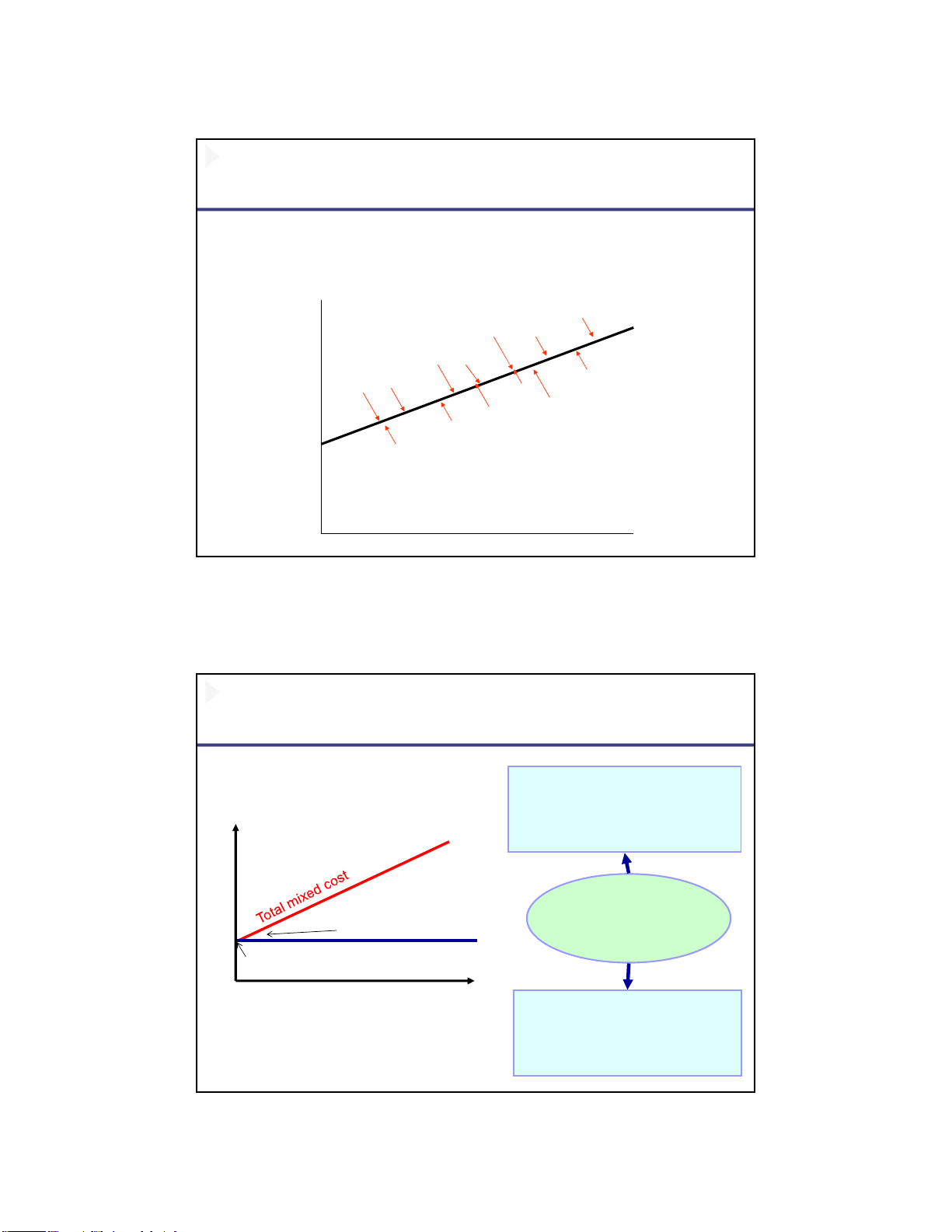

Mixed costs (Semi-variable/Semi-fixed costs)

Costs that have both a variable element and a fixed element. Y = a + bX Y: Total cost Y X: Activity level a: Fixed cost st b: Variable cost per unit o tility C l U slope b Variable Cost ta To a X Fixed Cost Activity (Kilowatt Hours) 30 30 15 Quick check 5

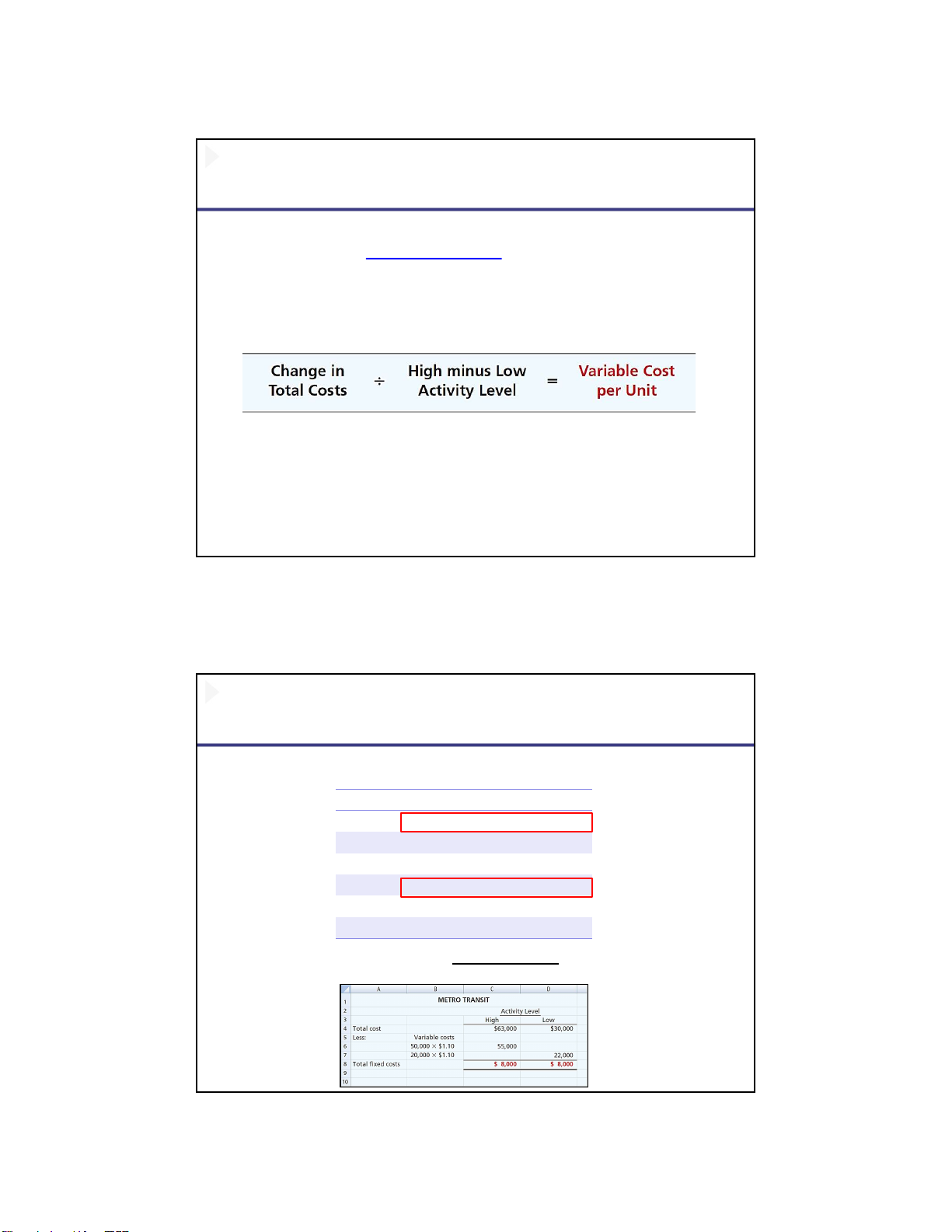

When total purchases of raw material exceed 30,000 units in any one period

then al units purchased, including the initial 30,000, are invoiced at a lower cost per unit.

Which of the following graphs is consistent with the behavior of the total materials cost in a period? 31 31 Cost Estimation Y = a + bX Y: Total cost X: Activity level a: Fixed cost Y b: Variable cost per unit st o tility C l U slope b Variable Cost ta To a X Fixed Cost Activity (Kilowatt Hours) 32 32 16 The High-Low Method

The high-low method uses the total costs incurred at the

high and the low levels of activity to classify mixed costs

into fixed and variable components.

Step 1: Determine variable cost per unit

Step 2: Determine Total fixed cost = Total cost – Variable cost 33 33

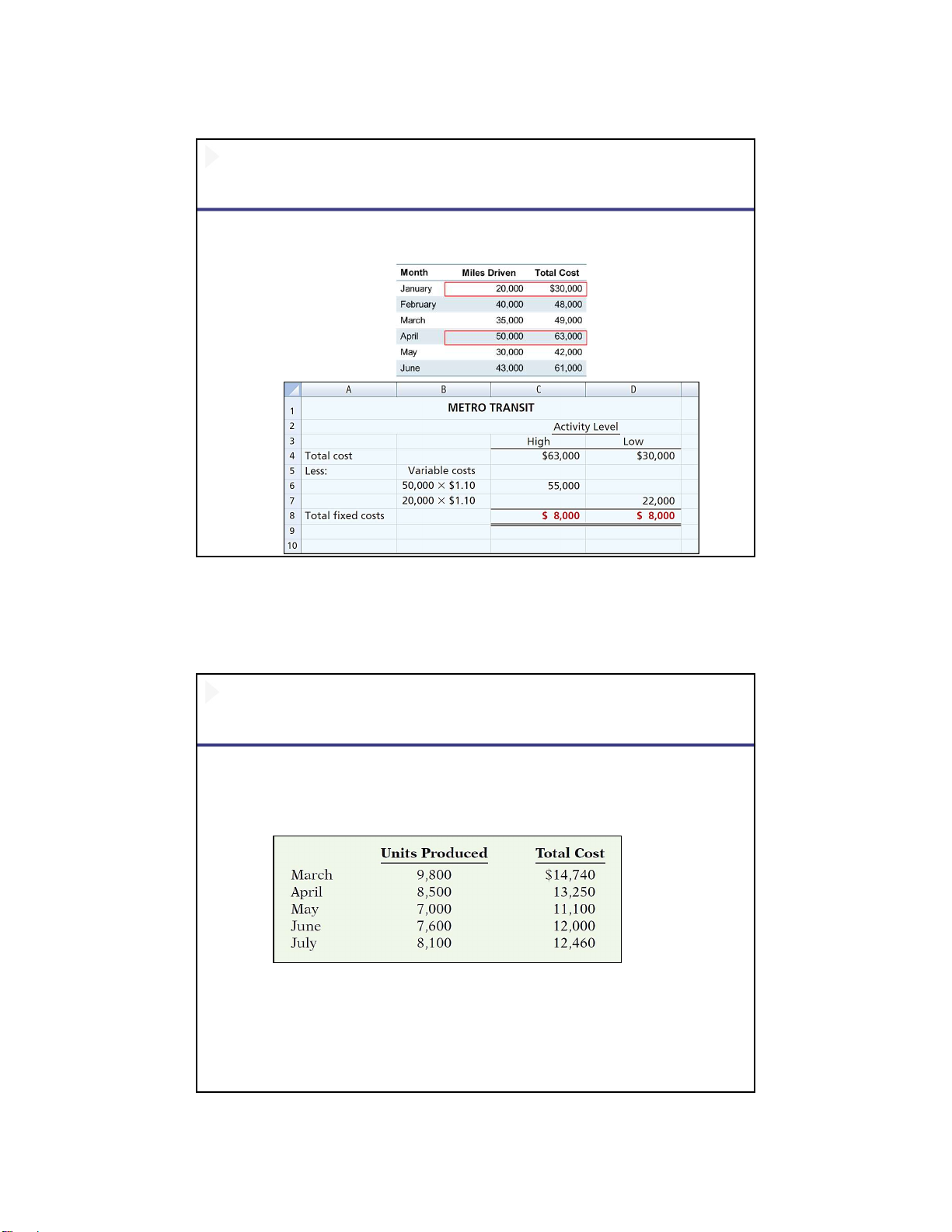

The High-Low Method Illustration

Metro Transit Company has the fol owing maintenance costs and

mileage data for its fleet of buses over a 6-month period. Month Miles Driven Total Cost January 20,000 $30,000 February 40,000 48,000 March 21,000 29,000 April 50,000 63,000 May 30,000 42,000 June 43,000 61,000 Variable costs per unit (63,000 - 30,000) = (50,000 - 20,000) = $1.10 34 34 17 The High-Low Method (cont’d)

STEP 2: Determine the fixed cost by subtracting the total variable

cost at either the high or the low activity level from the total cost at that activity level. • Example: 35 35 Quick check 6

Byrnes Company accumulates the fol owing data

concerning a mixed cost, using units produced as the activity level.

a) Compute the variable- and fixed-cost elements using the high-low method.

b) Estimate the total cost if the company produces 8,000 units. 36 36 18 Quick check 7

The fol owing information for advertising and sales has been established over the past six months: Month Sales revenue Advertising exp. $’000 $’000 1 155 3 2 125 2.5 3 200 6 4 175 5.5 5 150 4.5 6 225 6.5

Using the High – Low method which of the fol owing is correct equation for linking

advertising and sales from the above data?

A. Sale revenue = 62,500 + (25 x advertising expenditure)

B. advertising expenditure = -2,500 + (0.04 x Sale revenue)

C. Sale revenue = 95,000 + (20 x advertising expenditure)

D. advertising expenditure = -4,750 + (0.05 x Sale revenue) 37 37 Scatterplot Method X X X X X X X X X X X X andling Cost X X X X X aterial H M Number of Moves 38 19 Method of Least Squares

The best-fitting line is the line with the smal est sum of squared deviations

Regression analysis determines the linear function with

the minimum sum of squared deviationsX X X X X X X X X X X X andling Cost X X X X X aterial H M Number of Moves 39 Method of Least Squares n∑XY -∑X∑Y b = ----------------- Y st n∑X2 – (∑X)2 o C d ixe Y l M 1 = a + bx1 ta --- To slope b Yn = a +bxn a X Volume of output a = (∑y - b∑x)/n 40 20