Preview text:

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market QUIZ 5 (Chapter 13) Multiple Choice

Instructions: Read the following questions carefully and choose the answer that best

describes. There are 40 questions in total and each question has 2.5 points (100 points in

total). This is an open-book test. The given time for this quiz is 60 minutes. Question 1 Multiple Choice Exchange rates affect: Answer a. international trade flows.

b. international investment flows. c. corporate earnings. f the above are affected. Question 2 Multiple Choice

The price of a foreign currency expressed in terms of the home currency is cal ed: Answer exchange rate. b. the rate of depreciation. c. the dol ar/yen ratio. d. the opportunity cost. Question 3 Multiple Choice

Normal y, exchange rates are expressed as: Answer

a. the number of units of the currency per one ounce of gold.

b. the GDP of one nation as a percentage of the GDP of the other.

of one unit of foreign currency expressed in terms of the domestic currency.

d. ratios of the value of one nation's wealth compared to the other. Question 4 Multiple Choice

To keep things straight and avoid confusion, it is important to: Answer

ctly what the exchange rate signifies in terms of which currency is the denominator.

b. watch for ways the currency might lose value.

c. learn about recent behavior of the exchange rate.

d. know exactly what the rate is at any moment in time. Question 5 Multiple Choice

The notation for the euro/dol ar exchange rate is:

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market Answer a. FX €/$. b. FX $/€. d. E$/€. Question 6 Multiple Choice

General y, exchange rates are quoted as a single price of a unit of foreign currency rather than a ratio because: Answer

a. the ratio of the units of home currency to units of foreign currency is always equal to one.

nominator is always equal to 1.

c. the price is fixed by the government.

d. the rate is adjustable in increments of 25 basis points. Question 7 Multiple Choice

The equation E$/£ = 2 means that: Answer a. 1 dol ar buys 2 pounds.

1 dol ar buys 1/2 of a pound. c. 2 pounds buy 1 dol ar. d. 1 dol ar buys 1 pound. Question 8 Multiple Choice

If the dol ar-euro exchange rate on June 30, 2010, is $1.225 per euro, then the euro-dol ar exchange rate would be: Answer a. €2.45 per dollar. €0.816 per dollar. c. €1.225 per dollar. d. €1 per dollar. Question 9 Multiple Choice

The equation E¥/£ = 10 means that: Answer a. 1 yen buys 10 pounds. b. 0.1 yen buys 1 pound. yen buy 1 pound. d. 0.01 yen buys 1 pound. Question 10 Multiple Choice

If we compare the exchange rate between two nations, expressed in the domestic currency

with the same rate expressed in units of the foreign currency, it wil be obvious that:

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market Answer a. they are both equal to 1.

b. they cancel each other out.

is always the reciprocal of the other. d. they can never coexist. Question 11 Multiple Choice

If, in 2000, $1 = 1.5 euro, and in 2007, $1 = 0.9 euro, which of the fol owing statements would be true? Answer

a. More American tourists wil find it cheaper to travel to Europe.

b. More Europeans wil stay home as visits to the United States become more expensive.

c. Europeans wil import fewer products from the United States.

ans wil import fewer products from Europe. Question 12 Multiple Choice

A dining table costs $3,000 in New York and the same table costs 5,000 euros in Rome. Thus, $1 is equal to: Answer a. 1 euro. b. 2 euros. uros. d. 0.6 euro. Question 13 Multiple Choice

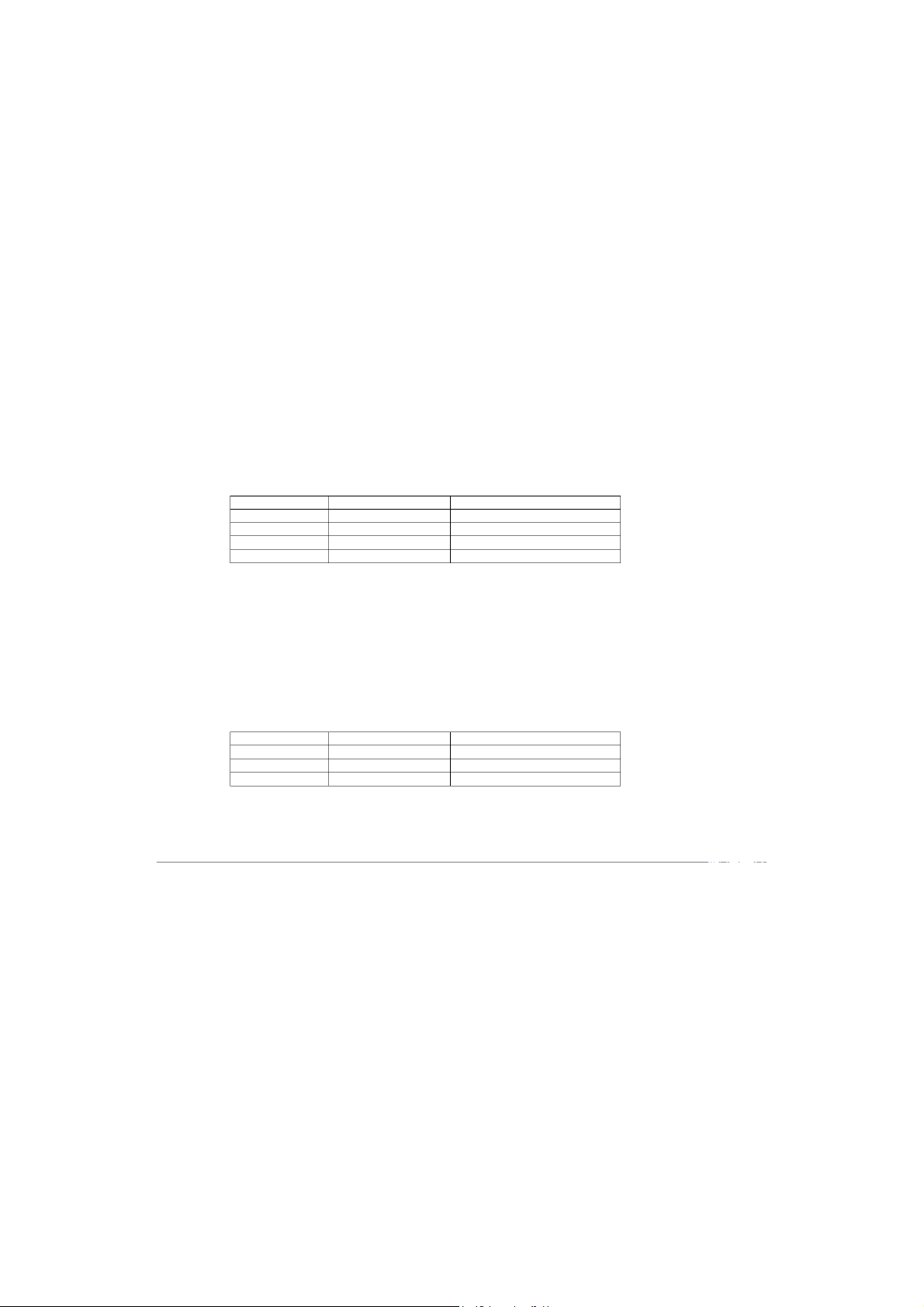

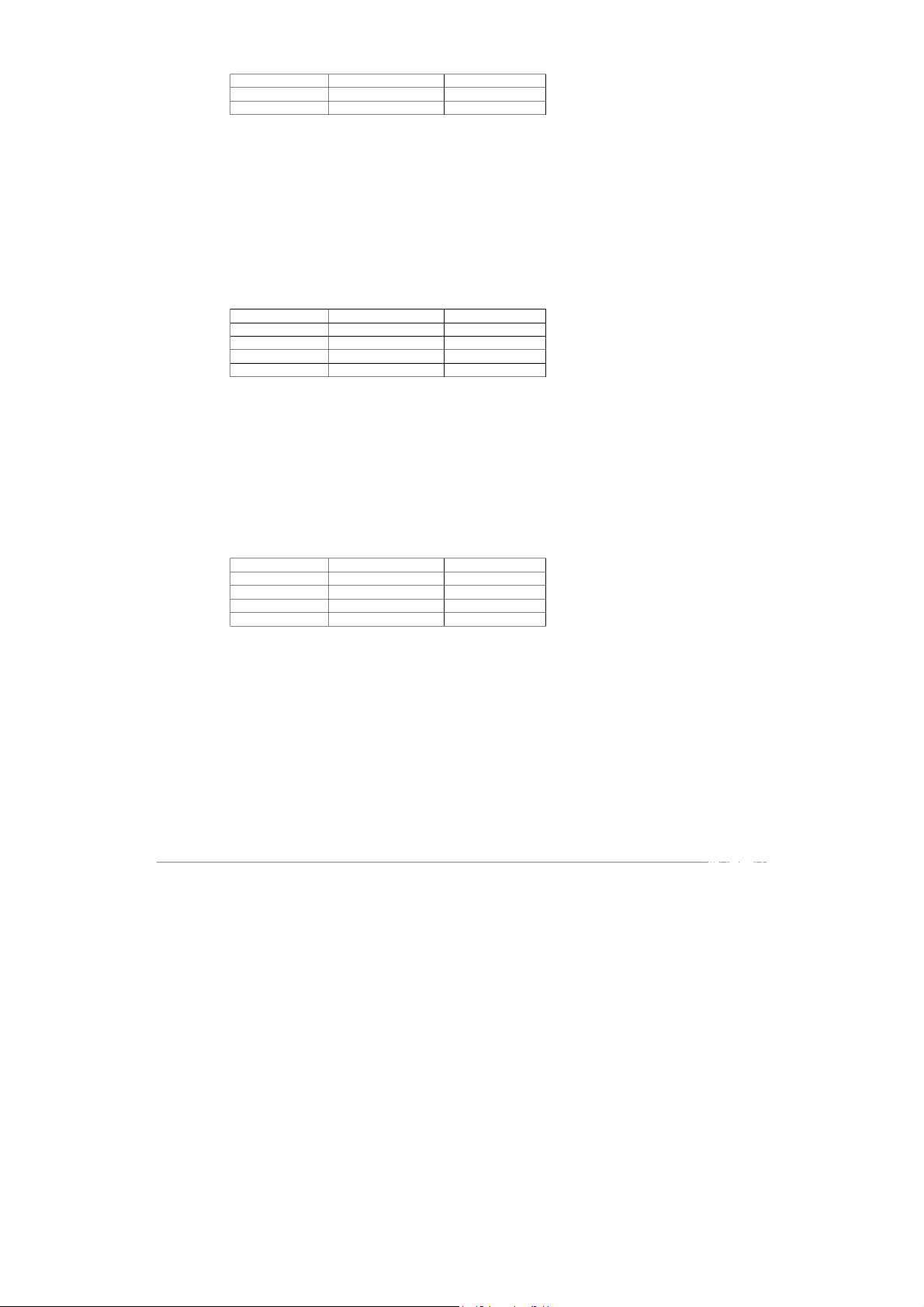

Table: Exchange Rates across Currencies Country

Price per dol ar (January 1, 2006) Canada $1.2 Japan 120 yen Mexico 12 pesos India 45 rupees Reference: Ref 2-1

(Table: Exchange Rates across Currencies) If the exchange rate on January 1, 2007, is $1 = 144 yen, then: Answer

a. the dol ar has appreciated 10% against the yen.

b. the dol ar has depreciated 24% against the yen.

c. the yen has depreciated 12% against the dol ar.

has depreciated 20% against the dol ar. Question 14 Multiple Choice

Table: Exchange Rates across Currencies Country

Price per dol ar (January 1, 2006) Canada $1.2 Japan 120 yen Mexico 12 pesos

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market India 45 rupees Reference: Ref 2-1

(Table: Exchange Rates across Currencies) Based on the information provided, which of the fol owing statements is true? Answer = 10 yen. b. 1 rupee = 10 yen. c. 1 peso = 3 rupees. d. $1 Canadian = 35 rupees. Question 15 Multiple Choice

Table: Exchange Rates across Currencies Country

Price per dol ar (January 1, 2006) Canada $1.2 Japan 120 yen Mexico 12 pesos India 45 rupees Reference: Ref 2-1

(Table: Exchange Rates across Currencies) Based on the information provided, 1 Canadian

dol ar is equal to _____ Mexican pesos and _____ Indian rupees. Answer a. 12; 73.5 ; 37.5 c. 12; 37.5 d. 12; 45 Question 16 Multiple Choice

If a nation's currency buys fewer units of a foreign currency today than yesterday, we say the value of its currency has: Answer a. appreciated. eciated. c. stagnated. d. become inverted. Question 17 Multiple Choice

If today €1 exchanges for ¥135, and tomorrow €1 exchanges for ¥150, we say the euro has: Answer appreciated. b. depreciated. c. stagnated. d. become inverted. Question 18 Multiple Choice

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market

When a nation's currency appreciates, it purchases _____ units of a foreign currency and it is said to _____. Answer a. fewer; strengthen ore; strengthen c. fewer; weaken d. more; weaken Question 19 Multiple Choice

If one nation's currency strengthens against a foreign currency, the other nation's currency

must _____ against the domestic currency. Answer a. strengthen b. equalize aken d. appreciate Question 20 Multiple Choice

When the dol ar declines in value against a foreign currency, it is cal ed: Answer a. an appreciation. epreciation. c. an inflation. d. a deflation. Question 21 Multiple Choice

In European terms, when the exchange rate for the U.S. dol ar increases: Answer e dol ar has appreciated.

b. the dol ar has depreciated. c. the euro has appreciated. d. the dol ar has weakened. Question 22 Multiple Choice

Which of the fol owing statements are equivalent to an appreciation of the dol ar relative to the euro? Answer

a. The dol ar buys more euros now.

b. The euro buys fewer dol ars now.

e dol ar buys more euros now, and the euro buys fewer dol ars now.

d. The euro buys more dol ars now. Question 23 Multiple Choice

Ironically, when the dollar “cost” of a unit of foreign currency falls, the dollar is actually _____ against the foreign currency.

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market Answer a. depreciating preciating c. equalizing d. holding its own Question 24 Multiple Choice

If a euro costs $1.25 today, and it costs $1.50 tomorrow, what has happened to the dol ar- euro exchange rate? Answer

a. The dol ar has depreciated and the euro has depreciated.

b. The dol ar has appreciated and the euro has depreciated.

ol ar has depreciated and the euro has appreciated.

d. The dol ar has appreciated and the euro has appreciated. Question 25 Multiple Choice

It is customary to express changes in the exchange rates of two currencies over time as: Answer

a. the loss of purchasing power of one currency divided by the loss of purchasing power of the other currency.

percentage change expressed as an appreciation or depreciation of one against the other.

c. a ratio of the absolute values (without signs).

d. a ratio of the price of gold in each nation. Question 26 Multiple Choice

In general, the percentage of appreciation of one nation's currency is equal to: Answer

a. its rate of growth of real GDP. b. its purchasing power. c. its population growth.

e percentage of depreciation of the foreign nation's currency. Question 27 Multiple Choice

Slight discrepancies in the rates of appreciation versus depreciation of two currencies are related to: Answer

athematical quirk that percentage increases are always larger than percentage

decreases because in the first case the denominator is smal er.

b. the imprecise nature of the calculations.

c. the lack of reliable information.

d. the volatile nature of exchange rates. Question 28 Multiple Choice

Changes in exchange rates are usual y expressed in percentage terms. The percentage rate

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market

of appreciation for one currency wil be close to the rate of depreciation for the other nation whenever: Answer

e change in the rate is very smal .

b. the exchange rates are very different in quantitative terms.

c. the change in the rate is very large.

d. one exchange rate is 50% more than the other one at the time of the change. Question 29 Multiple Choice

If E$/£ moves from 2 to 3, this is a percentage change of: Answer b. 33.3%. c. –33.3%. d. –50%. Question 30 Multiple Choice

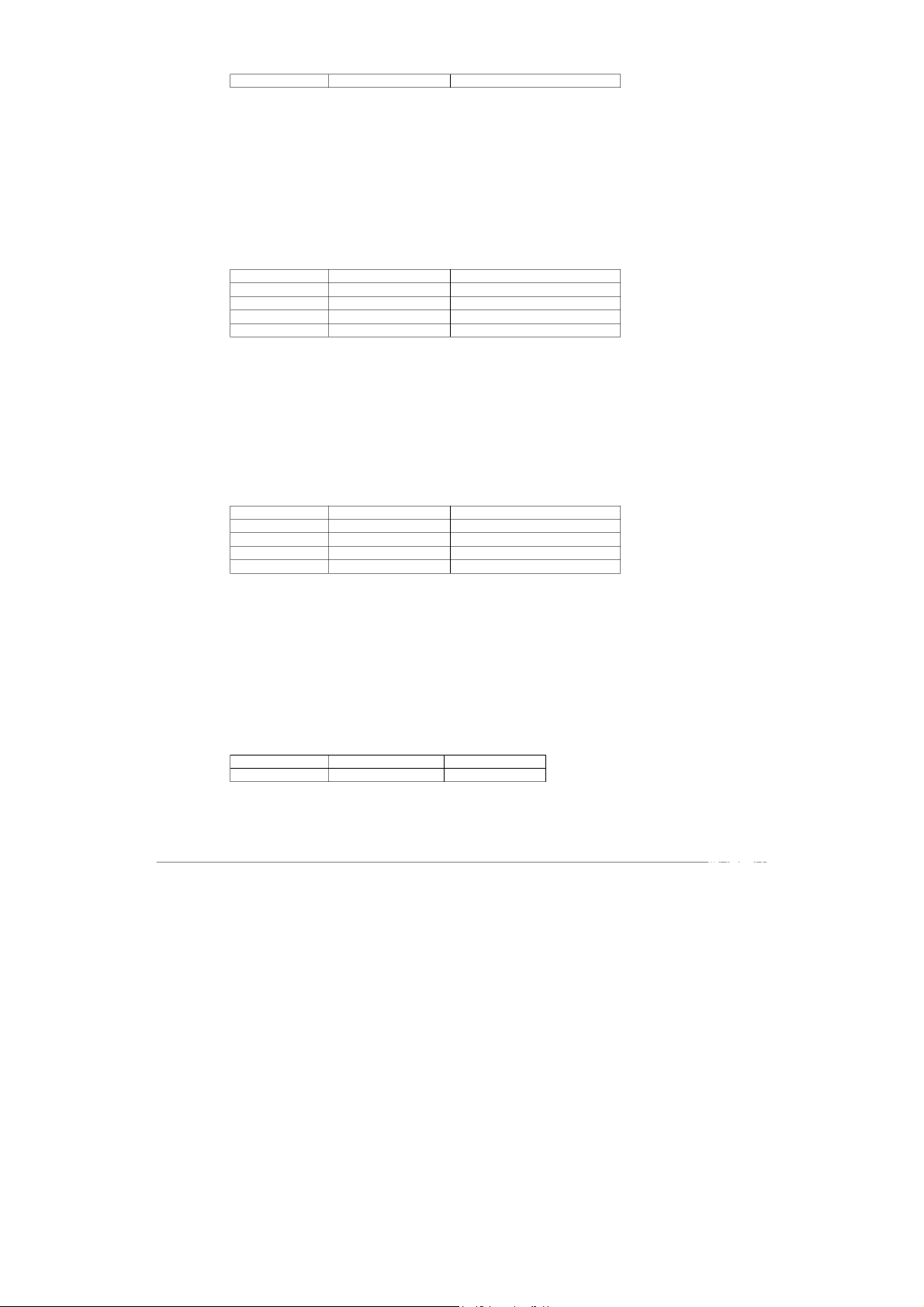

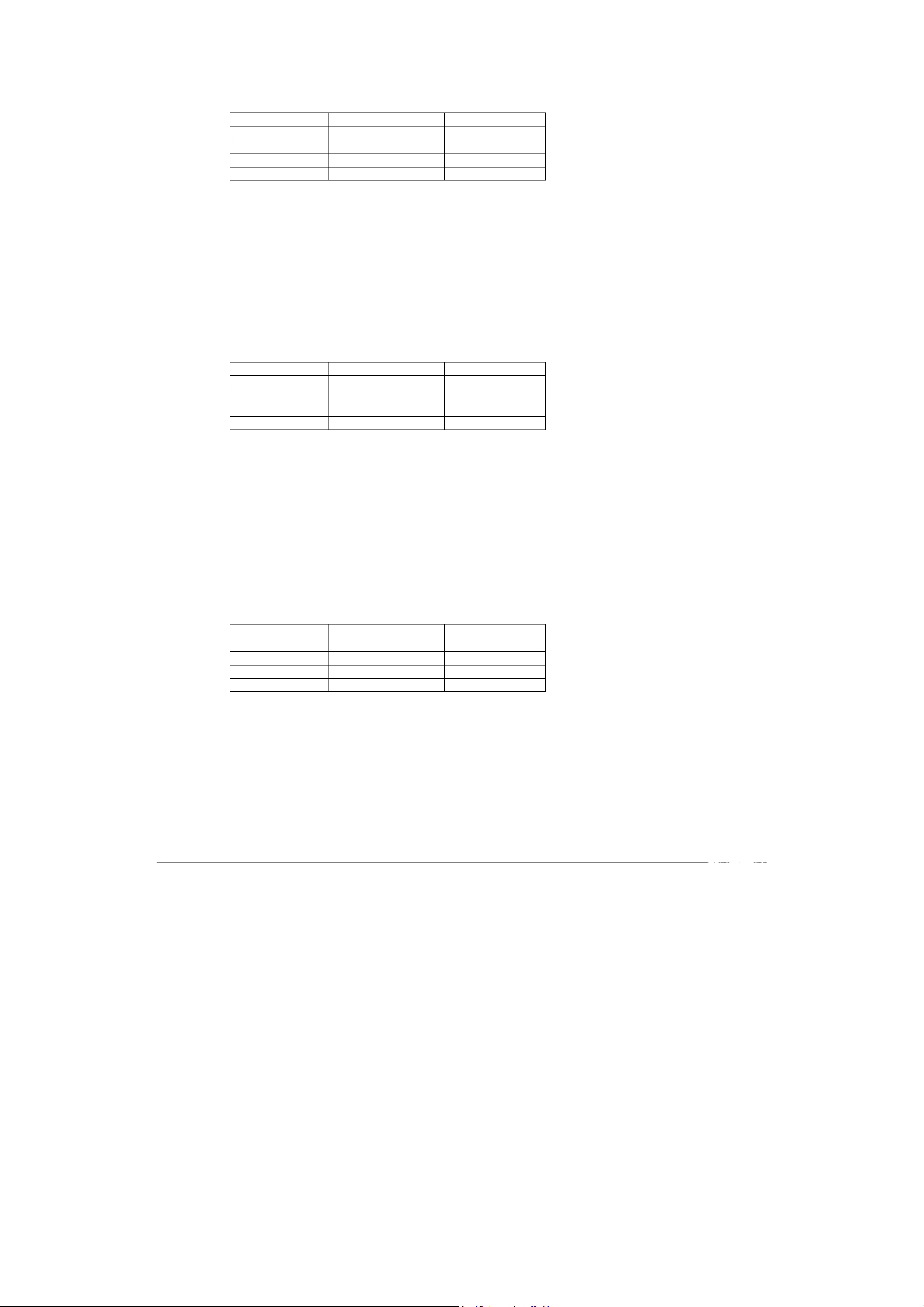

If E$/£ increases by 20%, this is consistent with: Answer a. an increase from 4 to 5. b. an increase from 4 to 6. rease from 5 to 6. d. an increase from 4 to 7. Question 31 Multiple Choice Table: Currency Values I Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-2

(Table: Currency Values I) The U.S. dol ar appreciated against the _________. Answer ican peso and Japanese yen.

b. Mexican peso and Indian rupee. c. euro and Japanese yen. d. euro and the Indian rupee. Question 32 Multiple Choice Table: Currency Values I Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-2

(Table: Currency Values I) The U.S. dol ar depreciated against the _________ and the ________. Answer o; Indian rupee b. Indian rupee; Japanese yen c. Mexican peso; Japanese yen d. euro; Japanese yen Question 33 Multiple Choice Table: Currency Values I Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-2

(Table: Currency Values I) The U.S. dol ar appreciated against the peso by _____. Answer a. 2.4% c. 10% d. 12.4% Question 34 Multiple Choice Table: Currency Values I Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-2

(Table: Currency Values I) The U.S. dol ar depreciated against the euro by ______. Answer a. 0.6% b. 1% % d. 100% Question 35 Multiple Choice

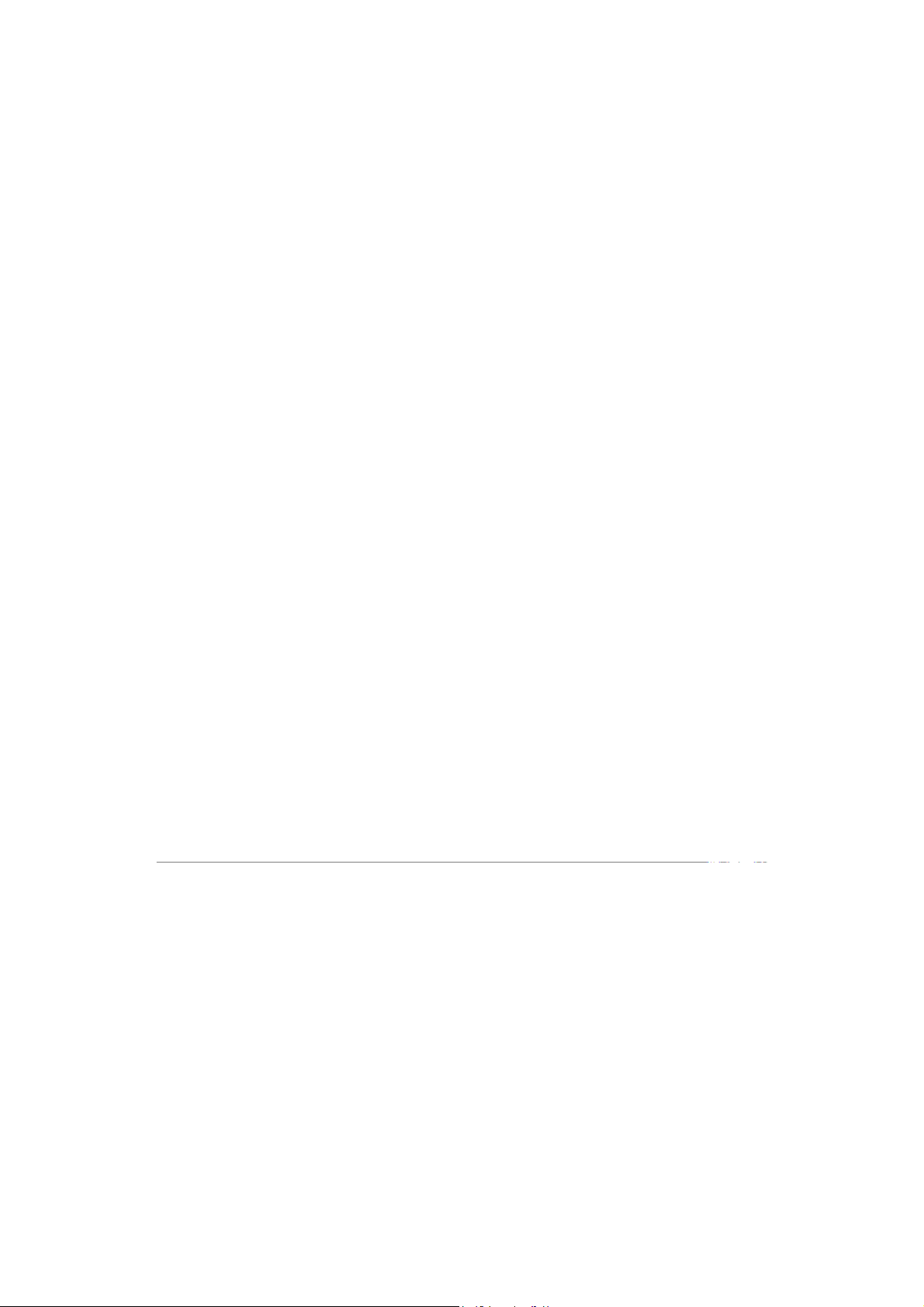

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) The dol ar appreciated against which currencies? Answer a. the euro b. the real pound and the rupee d. the euro and the pound Question 36 Multiple Choice

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) The dol ar depreciated against which currencies? Answer a. the euro b. the real c. the pound euro and the real Question 37 Multiple Choice

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) The dol ar rose against the rupee by _____. Answer a. 111% c. 1% d. –1% Question 38 Multiple Choice

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) The dol ar depreciated against the euro by ______. Answer a. –33% b. 3% c. d. 50% Question 39 Multiple Choice

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) In 2007, how many euros would it take to buy 1 pound? Answer b. 1.33 c. 1.5 d. 3 Question 40 Multiple Choice

Table: Currency Values II: How Much 1 U.S. Dol ar Wil Buy of Other Currencies in 2007 and 2008 Currency 2007 2008 $1 1.5 euros 1 euro $1 2 Brazilian reais 1.5 Brazilian reais $1 2 British pounds 3 British pounds $1 45 Indian rupees 50 Indian rupees Reference: Ref 2-3

(Table: Currency Values II) Between 2007 and 2008, how did the euro do against the British pound? Answer

Chapter 13 Introduction to Exchange Rates and the Foreign Exchange Market reciated. b. It held steady. c. It depreciated.

d. Not enough information is provided to know how wel the euro did. The End.