Preview text:

lOMoARcPSD|44744371 lOMoARcPSD|44744371

CHAPTER 3: FINANCIAL STATEMENTS, CASH FLOW, AND TAXES

Multiple Choice: True/False

1. The annual report contains four basic financial statements: the income statement, the

balance sheet, the cash flow statement, and statement of stockholders’ equity. a. True b. False ANSWER: True

2. The primary reason the annual report is important in finance is that it is used by investors

when they form expectations about the firm’s future earnings and dividends, and the riskiness of those cash flows. a. True b. False ANSWER: True

3. Companies typically provide four basic financial statements: the fixed income statement,

the current income statement, the balance sheet, and the cash flow statement. a. True b. False ANSWER: False

4. On the balance sheet, total assets must always equal the sum of total liabilities and equity. lOMoARcPSD|44744371 a. True b. False ANSWER: True

5. Assets other than cash are expected to produce cash over time, but the amount of cash they

eventually produce could be higher or lower than the amounts at which the assets are carried on the books. a. True b. False ANSWER: True

6. The amount shown on the December 31, 2013, balance sheet as “retained earnings” is

equal to the firm’s net income for 2013 minus any dividends it paid. a. True b. False ANSWER: False

7. The income statement shows the difference between a firm’s income and its costs—i.e., its

profits—during a specified period of time. However, not all reported income comes in the form

of cash, and reported costs likewise may not be consistent with cash outlays. Therefore, there

may be a substantial difference between a firm’s reported profits and its actual cash flow for the same period. lOMoARcPSD|44744371 a. True b. False ANSWER: True

8. If we were describing the income statement and the balance sheet, it would be correct to say

that the income statement is more like a video while the balance sheet is more like a snapshot. a. True b. False ANSWER: True

9. EBIT stands for earnings before interest and taxes, and it is often called “operating income.” a. True b. False ANSWER: True

10. EBITDA stands for earnings before interest, taxes, debt, and assets. a. True b. False ANSWER: False lOMoARcPSD|44744371

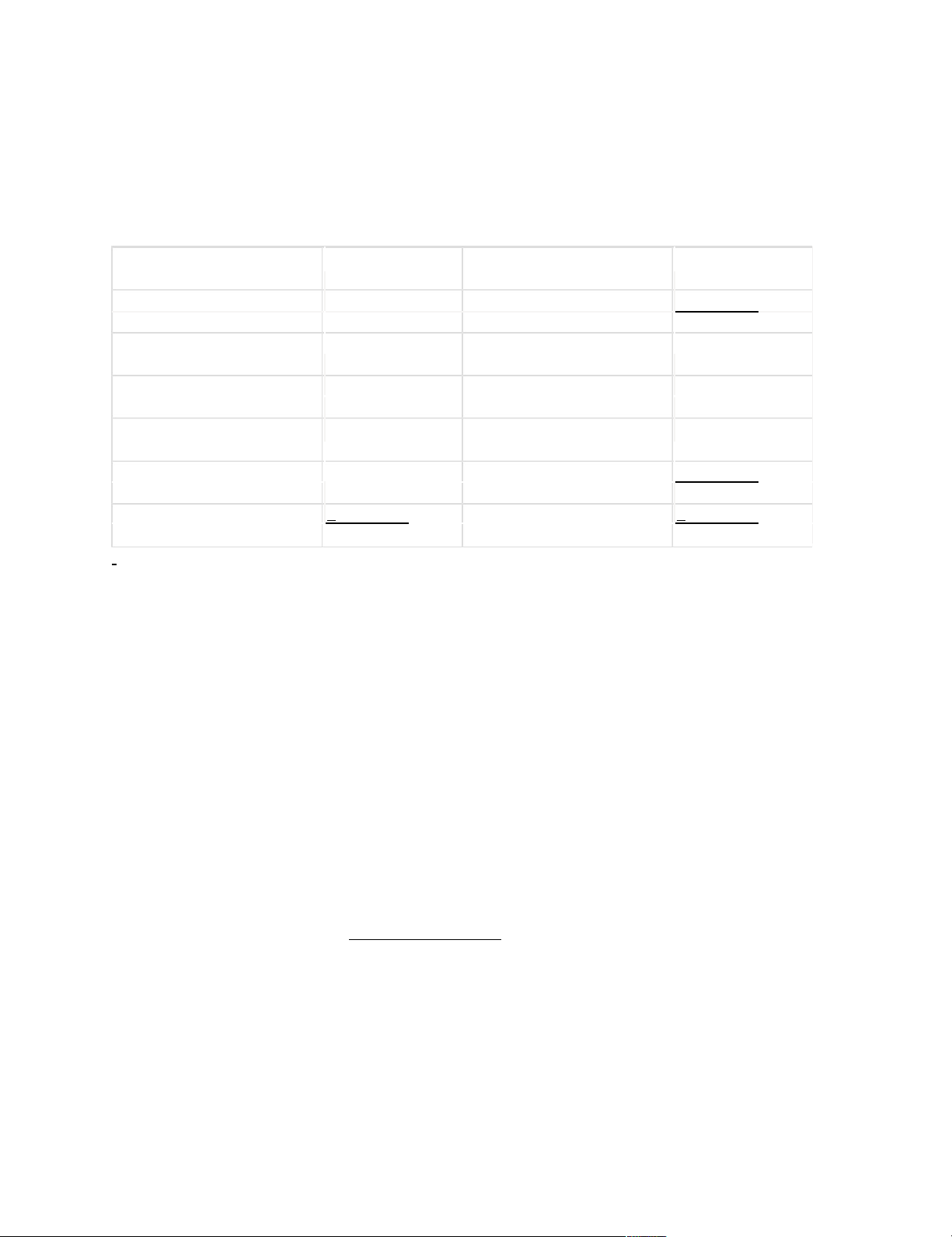

11. Consider the following balance sheet, for Games Inc. Because Games has $800,000 of

retained earnings, we know that the company would be able to pay cash to buy an asset with a cost of $200,000. Cash $ 50,000 Accounts payable $ 100,000 Inventory 200,000 Accruals 100,000 Accounts receivable 250,000 Total CL $ 200,000 Total CA $ 500,000 Long-term debt 200,000 Net fixed assets $ 900,000 Common stock 200,000 Retained earnings 800,000 Total assets $1,400,000 Total L & E $1,400,000 a. True b. False ANSWER: False

RATIONALE: Note that the firm has only $50,000 of cash. It would have to either sell assets

or borrow $150,000 to pay cash for the new asset. That might not be possible.

12. Typically, the statement of stockholders’ equity starts with total stockholders’ equity at the

beginning of the year, adds net income, subtracts dividends paid, and ends up with total

stockholders’ equity at the end of the year. Over time, a profitable company will have earnings

in excess of the dividends it pays out, and will result in a substantial amount of retained earnings shown on the balance sheet. a. True b. False lOMoARcPSD|44744371 ANSWER: True

13. Free cash flow (FCF) is, essentially, the cash flow that is available for interest and

dividends after the company has made the investments in current and fixed assets that are

necessary to sustain ongoing operations. a. True b. False ANSWER: True

14. The value of any asset is the present value of the cash flows the asset is expected to provide.

The cash flows a business is able to provide to its investors is its free cash flow. This is the

reason that FCF is so important in finance. a. True b. False ANSWER: True

15. If a firm is reporting its income in accordance with generally accepted accounting principles,

then its net income as reported on the ome statement should be equal to its free cash flow. a. True b. False ANSWER: False

RATIONALE: There is no reason to think that net ome would be equal to FCF. For example,

a company that is not growing might report zero net income yet have high FCF because of depreciation. lOMoARcPSD|44744371

16. The fact that 70% of the interest income received by corporations is excluded from its

taxable income encourages firms to finance with more debt than they would in the absence of this tax law provision. a. True b. False ANSWER: False

17. Both interest and dividends paid by a corporation are deductible operating expenses,

hence they decrease the firm’s taxes. a. True b. False ANSWER: False 18.

18. The balance sheet measures the flow of funds into and out of various accounts over

time, while the income statement measures the firm’s financial position at a point in time. a. True b. False ANSWER: False

19. Assume that two firms are both following generally accepted accounting principles. Both

firms commenced operations two years ago with $1 million of identical fixed assets, and neither

firm sold any of those assets or purchased any new fixed assets. The two firms would be

required to report the same amount of net fixed assets on their balance sheets as those statements are presented to investors. lOMoARcPSD|44744371 a. True b. False ANSWER: False

RATIONALE: One firm might choose to use straight-line depreciation, the other an

accelerated method, and this would lead to differences in reported depreciation and therefore reported net fixed assets.

20. Net operating working capital is equal to current assets minus the difference between

current liabilities and notes payable. This definition assumes that the firm has no “excess” cash. a. True b. False ANSWER: True

21. The next-to-last line on the income statement shows the firm’s earnings, while the last

line shows the dividends the company paid. Therefore, the dividends are frequently called “the bottom line.” a. True b. False ANSWER: False

22. The statement of cash flows has four main sections, one each for operating, investing, and

financing activities, and one that shows a summary of the cash and cash equivalents at the end of the year. a. True b. False lOMoARcPSD|44744371 ANSWER: True

23. An increase in accounts payable represents an increase in net cash provided by operating

activities just like borrowing money from a bank. An increase in accounts payable has an effect

similar to taking out a new bank loan. However, these two items show up in different sections of the

statement of cash flows to reflect the difference between operating and financing activities. a. True b. False ANSWER: True

24. An increase in accounts receivable represents an increase in net cash provided by

operating activities because receivables will produce cash when they are collected. a. True b. False ANSWER: False

25. The first major section of a typical statement of cash flows is “Operating Activities,” and

the first entry in this section is “Net Income.” Then, also in the first section, we show some

items that represent increases or decreases to cash, and the last entry is called “Net Cash

Provided by Operating Activities.” This number can be either positive or negative, but if it is

negative, the firm is almost certain to soon go bankrupt. a. True b. False lOMoARcPSD|44744371 ANSWER: False

RATIONALE: Rapidly growing firms often require additions to inventory and receivables that

are larger than net income, with the deficit being made up by borrowings and/or the sale of new stock.

26. To estimate the cash flow from operations, depreciation must be added back to net

income because it is a non-cash charge that has been deducted from revenue in the net income calculation. a. True b. False ANSWER: True

27. Two metrics that are used to measure a company’s financial performance are net income

and cash flow. Accountants emphasize net income as calculated in accordance with generally

accepted accounting principles. Finance people generally put at least as much weight on cash

flows as they do on net income. a. True b. False ANSWER: True

28. Its retained earnings is the actual cash that the firm has generated through operations less the

cash that has been paid out to stockholders as dividends. If the firm has sufficient retained

earnings, it can purchase assets and pay for them with cash from retained earnings. a. True b. False lOMoARcPSD|44744371 ANSWER: False

29. The retained earnings account on the balance sheet does not represent cash. Rather, it

represents part of the stockholders’ claims against the firm’s existing assets. Put another

way retained earnings are stockholders’ reinvested earnings. a. True b. False ANSWER: True

30. In finance, we are generally more interested in cash flows than in accounting profits.

Free cash flow (FCF) is calculated as after-tax operating income plus depreciation less the

sum of capital expenditures and changes in net operating working capital. a. True b. False ANSWER: True

31. Free cash flow is the amount of cash that if withdrawn would harm the firm’s ability

to operate and to produce future cash flows. a. True b. False ANSWER: False lOMoARcPSD|44744371

32. If the tax laws were changed so that $0.50 out of every $1.00 of interest paid by a

corporation was allowed as a tax-deductible expense, this would probably encourage

companies to use more debt financing than they presently do, other things held constant. a. True b. False ANSWER: False

33. Interest paid by a corporation is a tax deduction for the paying corporation, but dividends

paid are not deductible. This treatment, other things held constant, tends to encourage the use

of debt financing by corporations. a. True b. False ANSWER: True

34. Because the U.S. tax system is a progressive tax system, a taxpayer’s marginal and

average tax rates are the same. a. True b. False ANSWER: False

35. The alternative minimum tax (AMT) was created by Congress to make it more difficult

for wealthy individuals to avoid paying taxes through the use of various deductions. a. True b. False lOMoARcPSD|44744371 ANSWER: True

36. The time dimension is important in financial statement analysis. The balance sheet shows

the firm’s financial position at a given point in time, the income statement shows results over a

period of time, and the statement of cash flows reflects specific changes in accounts over that period of time. a. True b. False ANSWER: True

Multiple Choice: Conceptual

Please note that some of the answer choices, or answers that are very close, are used in

different questions. This has caused us no difficulties, but please take this into account when you make up exams.

37. Which of the following statements is CORRECT?

a. The four most important financial statements provided in the annual report are the balance

sheet, income statement, cash budget, and the statement of stockholders’ equity.

b. The balance sheet gives us a picture of the firm’s financial position at a point in time.

c. The income statement gives us a picture of the firm’s financial position at a point in time.

d. The statement of cash flows tells us how much cash the firm must pay out in interest during the year.

e. The statement of cash needs tells us how much cash the firm will require during some

future period, generally a month or a year. ANSWER: b lOMoARcPSD|44744371

38. Which of the following statements is CORRECT?

a. Assets other than cash are expected to produce cash over time, and the amounts of cash

they eventually produce should be exactly the same as the amounts at which the assets are carried on the books.

b. The primary reason the annual report is important in finance is that it is used by investors

when they form expectations about the firm’s future earnings and dividends, and the riskiness of those cash flows.

c. The annual report is an internal document prepared by a firm’s managers solely for the use of its creditors/lenders.

d. The four most important financial statements provided in the annual report are the

balance sheet, income statement, cash budget, and statement of stockholders’ equity.

e. Prior to the Enron scandal in the early 2000s, companies would put verbal information in

their annual reports, along with the financial statements. That verbal information was often

misleading, so today annual reports can contain only quantitative information: audited financial statements. ANSWER: b

39. Which of the following statements is CORRECT?

a. The balance sheet for a given year is designed to give us an idea of what happened to the firm during that year.

b. The balance sheet for a given year tells us how much money the company earned during that year.

c. The difference between the total assets reported on the balance sheet and the liabilities

reported on this statement tells us the current market value of the stockholders’ equity,

assuming the statements are prepared in accordance with generally accepted accounting principles (GAAP).

d. If a company’s statements were prepared in accordance with generally accepted accounting

principles (GAAP), the market value of the stock equals the book value of the stock as reported on the balance sheet. lOMoARcPSD|44744371

e. The assets section of a typical company’s balance sheet begins with cash, then lists the

assets in the order in which they will probably be converted to cash, with the longest lived assets listed last. ANSWER: e

40. Other things held constant, which of the following actions would increase the amount of

cash on a company’s balance sheet?

a. The company repurchases common stock.

b. The company pays a dividend.

c. The company issues new common stock.

d. The company gives customers more time to pay their bills.

e. The company purchases a new piece of equipment. ANSWER: c

41. Which of the following items is NOT normally considered to be a current asset? a. Accounts receivable. b. Inventory. c. Bonds. d. Cash.

e. Short-term, highly-liquid, marketable securities. ANSWER: c lOMoARcPSD|44744371

42. Which of the following items cannot be found on a firm’s balance sheet under current liabilities? a. Accounts payable.

b. Short-term notes payable to the bank. c. Accrued wages. d. Cost of goods sold. e. Accrued payroll taxes. ANSWER: d

43. Which of the following statements is CORRECT?

a. The focal point of the income statement is the cash account, because that account cannot be

manipulated by “accounting tricks.”

b. The reported income of two otherwise identical firms cannot be manipulated by

different accounting procedures provided the firms follow generally accepted accounting principles (GAAP).

c. The reported income of two otherwise identical firms must be identical if the firms

are publicly owned, provided they follow procedures that are permitted by the Securities and Exchange Commission (SEC).

d. If a firm follows generally accepted accounting principles (GAAP), then its reported net

income will be identical to its reported cash flow.

e. The income statement for a given year is designed to give us an idea of how much the firm earned during that year. ANSWER: e

44. Below are the 2012 and 2013 year-end balance sheets for Tran Enterprises: lOMoARcPSD|44744371 Assets: 2013 2012 Cash $ 200,000 $ 170,000 Accounts receivable 864,000 700,000 Inventories 2,000,000 1,400,000 Total current assets $3,064,000 $ 2,270,000 Net fixed assets 6,000,000 5,600,000 Total assets $9,064,000 $ 7,870,000

Liabilities and equity: Accounts payable $1,400,000 $ 1,090,000 Notes payable to bank 1,600,000 1,800,000 Total current liabilities $3,000,000 $ 2,890,000 Long-term debt 2,400,000 2,400,000 Common stock 3,000,000 2,000,000 Retained earnings 664,000 580,000 Total common equity $3,664,000 $ 2,580,000 Total liabilities and equity $9,064,000 $ 7,870,000

The firm has never paid a dividend on its common stock, and it issued $2,400,000 of 10-year,

non-callable, long-term debt in 2012. As of the end of 2013, none of the principal on this debt

had been repaid. Assume that the company’s sales in 2012 and 2013 were the same. Which of

the following statements must be CORRECT?

a. The firm increased its short-term bank debt in 2013.

b. The firm issued long-term debt in 2013. lOMoARcPSD|44744371

c. The firm issued new common stock in 2013.

d. The firm repurchased some common stock in 2013.

e. The firm had negative net income in 2013. ANSWER: c

45. On its 12/31/13 balance sheet, Barnes Inc showed $510 million of retained earnings, and

exactly that same amount was shown the following year. Assuming that no earnings

restatements were issued, which of the following statements is CORRECT?

a. If the company lost money in 2013, it must have paid dividends.

b. The company must have had zero net income in 2013.

c. The company must have paid out half of its 2013 earnings as dividends.

d. The company must have paid no dividends in 2013.

e. Dividends could have been paid in 2013, but they would have had to equal the earnings for the year. ANSWER: e

46. Below is the common equity section (in millions) of Timeless Technology’s last two year-end balance sheets: 2013 2012 Common stock $2,000 $1,000 Retained earnings 2,000 2,340 Total common equity $4,000 $3,340 lOMoARcPSD|44744371

The firm has never paid a dividend to its common stockholders. Which of the

following statements is CORRECT?

a. The company’s net income in 2013 was higher than in 2012.

b. The firm issued common stock in 2013.

c. The market price of the firm’s stock doubled in 2013.

d. The firm had positive net income in both 2012 and 2013, but its net income in 2013 was lower than it was in 2012.

e. The company has more equity than debt on its balance sheet. ANSWER: b

47. Which of the following statements is CORRECT?

a. Typically, a firm’s DPS should exceed its EPS.

b. Typically, a firm’s net income should exceed its EBIT.

c. If a firm is more profitable than average, we would normally expect to see its stock

price exceed its book value per share.

d. If a firm is more profitable than most other firms, we would normally expect to see its book

value per share exceed its stock price, especially after several years of high inflation.

e. The more depreciation a firm has in a given year, the higher its EPS, other things held constant. ANSWER: c

48. Which of the following statements is CORRECT?

a. The more depreciation a firm reports, the higher its tax bill, other things held constant. lOMoARcPSD|44744371

b. People sometimes talk about the firm’s cash flow, which is shown as the lowest entry on

the income statement, hence it is often called “the bottom line.”

c. Depreciation reduces a firm’s cash balance, so an increase in depreciation would

normally lead to a reduction in the firm’s cash flow.

d. Operating income is derived from the firm’s regular core business. Operating income is

calculated as Revenues less Operating costs. Operating costs do not include interest or taxes.

e. Depreciation is not a cash charge, so it does not have an effect on a firm’s reported profits. ANSWER: d

49. Which of the following factors could explain why Michigan Energy’s cash balance

increased even though it had a negative cash flow last year?

a. The company sold a new issue of bonds.

b. The company made a large investment in new plant and equipment.

c. The company paid a large dividend.

d. The company had high depreciation expenses.

e. The company repurchased 20% of its common stock. ANSWER: a

50. Analysts who follow Howe Industries recently noted that, relative to the previous year,

the company’s net cash provided from operations increased, yet cash as reported on the

balance sheet decreased. Which of the following factors could explain this situation?

a. The company cut its dividend.

b. The company made large investments in fixed assets.

c. The company sold a division and received cash in return. lOMoARcPSD|44744371

d. The company issued new common stock.

e. The company issued new long-term debt. ANSWER: b

51. Austin Financial recently announced that its net income increased sharply from the

previous year, yet its net cash provided from operations declined. Which of the following could explain this performance?

a. The company’s dividend payment to common stockholders declined.

b. The company’s expenditures on fixed assets declined.

c. The company’s cost of goods sold increased.

d. The company’s depreciation expense declined.

e. The company’s interest expense increased. ANSWER: d

52. Which of the following statements is CORRECT?

a. The statement of cash flows reflects cash flows from operations, but it does not reflect

the effects of buying or selling fixed assets.

b. The statement of cash flows shows where the firm’s cash is located; indeed, it provides

a listing of all banks and brokerage houses where cash is on deposit.

c. The statement of cash flows reflects cash flows from continuing operations, but it does

not reflect the effects of changes in working capital.

d. The statement of cash flows reflects cash flows from operations and from borrowings, but it

does not reflect cash obtained by selling new common stock.

e. The statement of cash flows shows how much the firm’s cash, the total of currency, bank

deposits, and short-term liquid securities (or cash equivalents), increased or decreased during a given year.