Preview text:

Introduction Dear Friends,

I am proud to release the fourth instalment in the new mentorship series. The

aim of this tutorial is to make you master risk, trade and personal routine

management to the standard of a professional trader. If you read this slowly

and with time, you would have mastered all of the skills after practising for

a while. Remember to read the references in the links if you are not familiar

with it. Additionally, improvement in one aspect of life spills over to all others

and when I became disciplined as a trader and documented everything, I didn’t stop.

My aim after the release of this chapter is to provide cost free and open to

use best trading tutorials which can be used practically to trade, make the

money and also beat the market at times.

The inspiration to share this tutorial is from my trading mentor who had the

quote, “If you don’t track, you don’t care.”

PS: I was late in publishing the tutorial because of some restructuring within

the team, the mentorship will carry on at lightning pace from now on.

Please share the doc if you like it and take care. Love, EmperorBTC Effective Risk Management

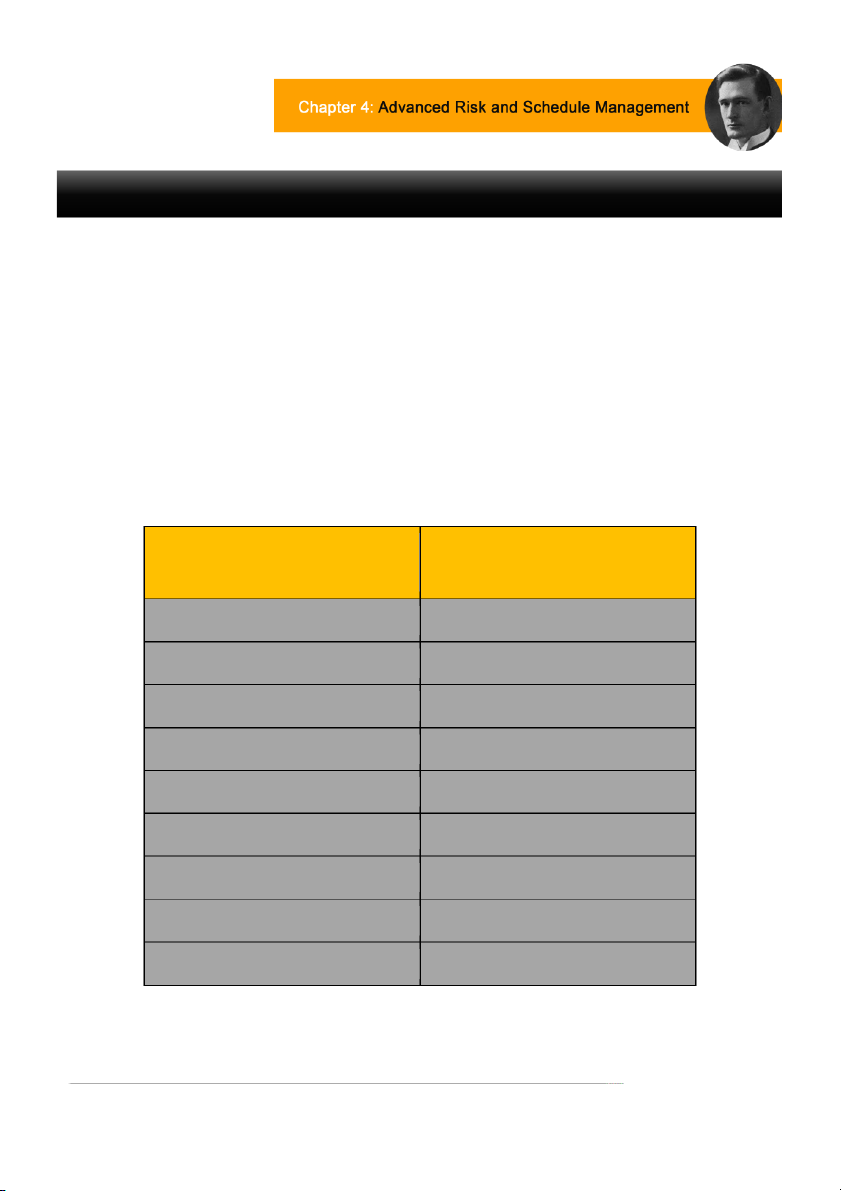

What should be the size of your account as a new trader?

Without a doubt, it is important not to invest all of your money into your

trading account. Instead, it should be substantial enough that losing the

entire account would have a significant impact, yet not so substantial that

it would lead to financial ruin. The table below shows how much profit is

needed to recover your losses during a drawdown. Therefore, it’s

important to cut your losses. For example, if you lose 80% of your capital,

you need to make 400% just to breakeven.

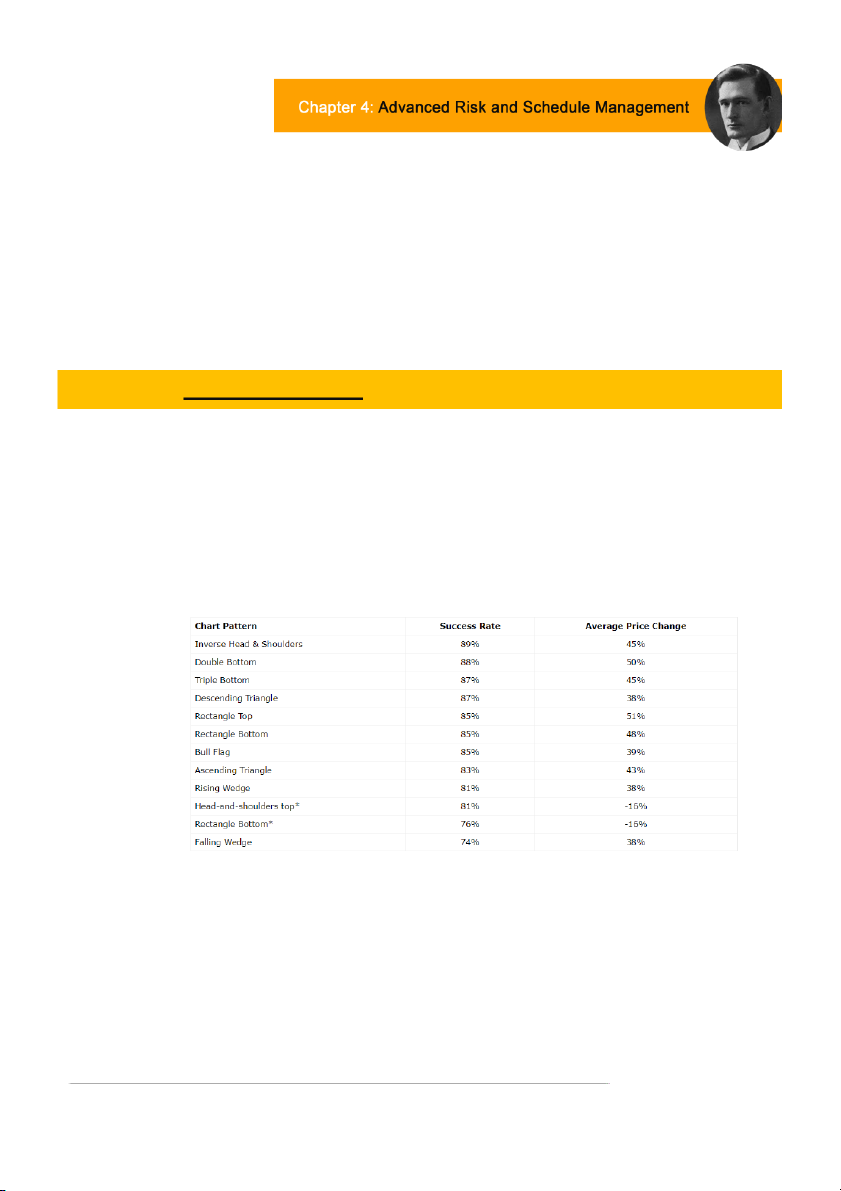

Table 1.1 : Risk Management

PERCENTAGE (%) REQUIRED LOSS OF CAPITAL

TO GET BACK TO BREAKEVEN 10% 11% 20% 25% 30% 43% 40% 67% 50% 100% 60% 150% 70% 233% 80% 400% 90% 900%

How much should you risk per trade?

The standard advice handed out to beginners is to risk 3 percent or less

for each trade. Well, if you’ve read chapters 1-3 diligently, then you know

that this doesn’t make a lot of sense. What you risk per trade should be dependent on three factors: 1. Expectancy from the trade 2. Hit rate of the trade

3. Frequency of the particular set-up

As we have now covered the basics, it is important for you to start some

serious journaling. Even as a discretionary trader, you should have a set

timeframe, set way of analysing and a set entry criteria. Alongside this,

there is extra documentation that needs to be maintained as shown above.

1. Expectancy of the trade

Not all set-ups are equal. The R:R of a trade will depend on the

set-up that you pick and will be very varying. However, when you

have defined rules, you know the probability of how often a set-up

reaches TP1 (Take Profit level) or TP2. How often does it reach TP1 but does not reach TP2?

Let’s take a simple well known set-up I used to swing trade with for example: Entry Conditions:

a. Breakout from resistance and flip and retest EMA to support.

b. Breakdown from support and flip and retest EMA to resistance. Stop Loss:

Below the resistance/support level. Targets:

a. Last low/high that was broken to break into downtrend/uptrend before reversal.

b. The high/low before range breakdown/breakout took place.

Now that we have these criteria’s listed, we can find our

expectancy of the trade. How often does target 1 get hit but not

target 2. How often does target 1 get hit and then we get stopped

out. These are alternate probabilities that I have learnt to

document in order for me to be able to improve my trading. This

means that every time you trade a certain set-up, you need to fine

tune all these criteria’s and then update your probability readings

when it is done, this is why it is important to only focus on a few

strategies that work for you and stick to them until it is proven by

numbers that they do not work.

However, the formal definition of expectancy is different. Contrary

to common beliefs, neither win rates nor being ‘right’ nor perfect

entries give you an edge. The only way for you to know if your

strategy has an edge and wil be profitable in the long run is to

calculate the strategy’s expectancy.

Expectancy is defined as how much money, on average, we

can expect to make or lose for every dollar/euro/pound we risk.

The formula for expectancy is

E(R) = ((1+WIN/LOSS) x WIN RATE)-1 Where: R = Risk on each trade Win= Average winner Loss = Average loser

Win rate = Probability of winning

Let's put this formula to work in a game that we are all familiar

with: a coin toss. With a fair coin, there is a 50/50 chance that it will

land on heads. Let's assume you are wagering $1 with a pay-off

such that if the coin lands on heads you win $1, but if the coin

lands on tails you lose the wagered amount.

Putting this in the expectancy formula we get: E(R)=((1+1/1)0.5)-1=0

Your expectancy for this game of coin toss is 0; thus if you repeat

this game many times, you will neither make nor lose money.

Let's say you are offered two games with the following probabilities

Game A gives a 95% probability to win $10 but a 5% probability of losing $1,000.

Game B gives a 5% probability to win $1,000 but 95% probability of losing $10.

Which game would you play?

Most people would choose Game A because it gives an almost certain win of $10.

However, Game A has negative expectancy and will cause you to

lose money over time. This is a very popular way for beginner

traders to be lured into following strategies that have negative

expectancy. These strategies often have negative skew, which

means that they win small amounts very often but lose big when

they are wrong. Beginner traders love seeing a lot of winners – so

it's an easy sell. It can be many months and even years before a

negatively skewed strategies blow up - so for the untrained eye, it’s not easy to spot them.

The correct game to choose is Game B as it has an excellent

expectancy of 4.05 and you should play this game as many times as you possibly can.

Professional traders understand expectancy and when they trade

they make sure that their wins are much larger than their losses, a

strategy we refer to as having positive skew - where a large gain is

more likely to happen than a large loss.

This is how you see whether your trading set-up is worth taking or

not. For a beginner trader, it is essential to pick and trade those

set-ups that will give you higher return on average and ignore

those with less even though they have a high hit rate. The reason

is simple, position sizing, if you only have $1000 to trade with and

you are risking $10 per trade while trading Bitcoin, to scalp, you

might need 30X leverage and even after that you will not be able to

take another trade until this is done with. This is why you should

always go for high expectancy set-ups in general and even when

you’re trading regularly even if the hit rate is lower than some other set-ups.

2. Hit Rate of the Trade

This is fairly simple and well known. How often is a trade not

stopped out. You can define it as how often a trade is successful

but as we have learnt, successful trade is an ambiguous phrase,

as we don’t know whether success means final target was

reached, etc. There will also be trades where you will move your

stop to entry or higher and the target will not be hit, how do you

quantify those? You have to document everything based on what you do.

Above are some popular trading patterns. However, every trader

trades based on their own rules and manages trades in their own

style, thus, you wil have to recreate these. Average price change

will depend on the timeframe you’re trading on. Hence, using my

statistics or anyone else’s for that matter will not help you improve

your trading. Effective risk management is where you analyse

every single aspect of your trading and try to fine tune it as per

your style and the assets that you are trading. I personally have

separate statistics for Bitcoin as well as Ethereum as I’ve found

different hit rates when scalping with the same set-up on both the assets.

3. Frequency of the Set up

It is important to take more risk on high expectancy set-ups that

occur less frequently. For example, your SFP set-up on the daily

timeframe that we discussed in chapter 3 would occur with a much

lower frequency than a range trading strategy on the one-minute

timeframe. If you take let’s say 5 percent risk on the range trading

strategy and it occurs 3-5 times a day. One losing streak could

deprive you of 25% of your account.

For strategy deployment on a live account, first thoroughly test that

strategy 1000 times to know the above metrics about the trade and

then execute it live. To grow your account, take high expectancy

set-ups and size up on infrequent high expectancy set-ups and

size down on frequent but high expectancy set-ups. While growing

the trading account, it is important to do away with low expectancy

set-ups at all times even if they have a high hit rate. All of this

answers the question of how much you should risk per trade if you

want to manage risk in your trading in an effective manner. Evolving R:

Trader Dante popularised this concept and we have talked about it many

times in price updates and also during risk management masterclasses

alongside the first trading mentorship. The simple concept behind

evolving R is that your risk:reward ratio is not static during the course of your trade. For Example:

This is a swing trade you could have actually taken. Reasons for entry:

1. Breakout from important resistance.

2. Retest of level with bul ish pinbar.

3. Entry after the pinbar close. Stop:

1. Below the breakout candle for some leeway. Target:

1. Last significant swing high.

Now, from a fresh perspective, this trade is even less than 1 R:R and does not look very appealing.

However, we could have just bought the 2-touch level blindly if we had some divergence confluence.

This new trade set-up would have given up some more confidence when

placing a trade as it has almost a 2 R:R ratio. A significantly larger

percentage of traders would have taken this set-up while being hesitant to take the first one.

Now think of it this way, even if you would have taken the second set-up,

after the candle close, your new R:R would have been less than one as

the first R:R. So if you take the second set-up, you automatically take the

first set-up at some point of time, this is if you think of current price to be

entry price because at any given point of time, your risk on the table

remains the same but your reward keeps changing depending on

whether the trade is in some unrealised profit or some unrealised loss.

This is the exact reason why concepts like laddering, early cutting of

losing trades and early TPing of profitable trades exist. The perfect

trader is not one with the perfect entry, but one with the perfect trade

management, who knows when to interfere with his position and when to not touch it.

Novice traders are fearful when they’re in profit (they want to bank profit

as soon as possible) and hopeful when they’re in the red (Unrealised

loss makes them hope that the trade still works out). Again, psychology

is very important for trade management, you want to do the inverse of novices.

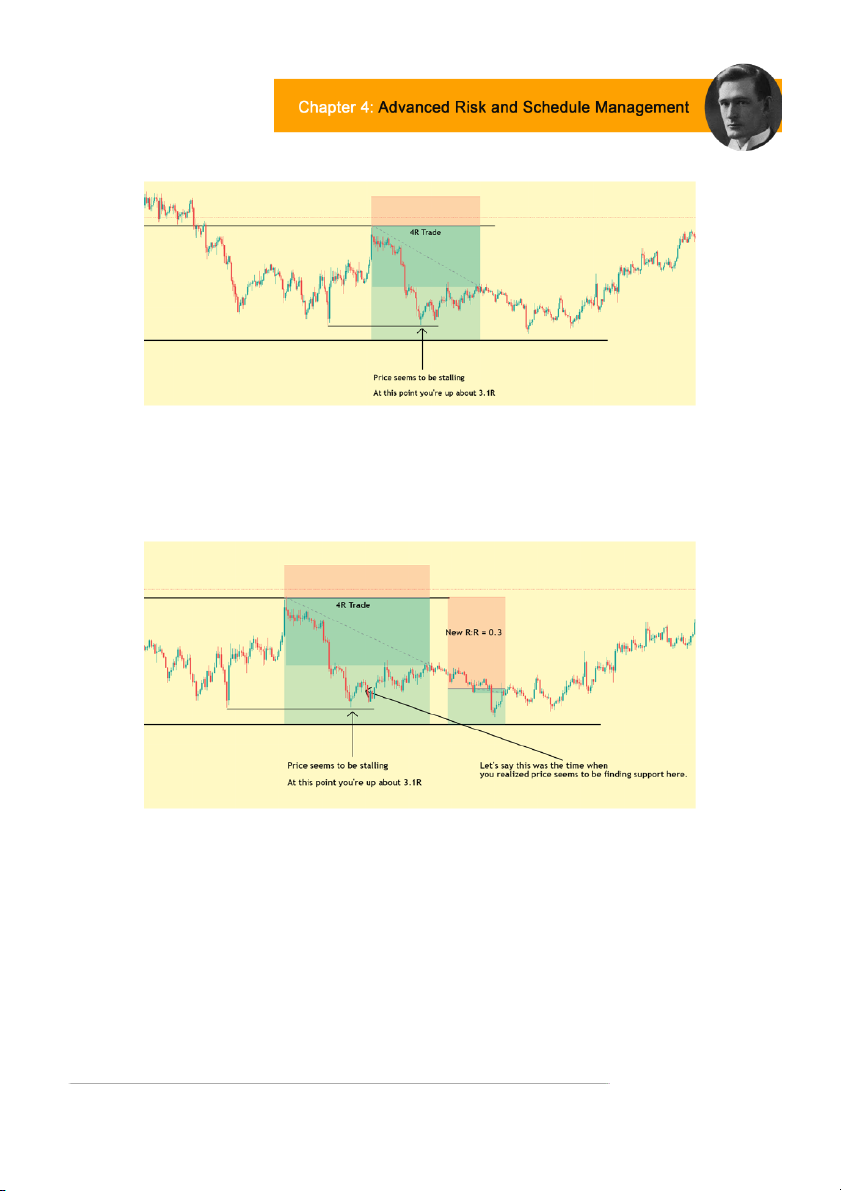

Consider this sample trade:

In these scenarios, traders move their stops to entry and then sit on their

hands hoping for 1 more R. The thinking is that it is a free trade now.

Evolving R is a concept that explains that your Risk:Reward ratio is

always changing when you’re in a position.

Evolving R visualised for you. If you risked 2% on the trade, you’re up

6% and you’re now risking that 6% to make <2% more. This is when you

place a market order and get out while booking great profits.

When taking a trade, there’s a certain amount of planning involved

beyond just entry, target and stop loss. Evolving R concept doesn’t

mean you get out of all your trades early the moment you’re in slight

profit. When the trade seems to be slowly reversing on you and the

evolving R is less than 0.5, that’s when you START TO CONSIDER an

early exit and secure profits.

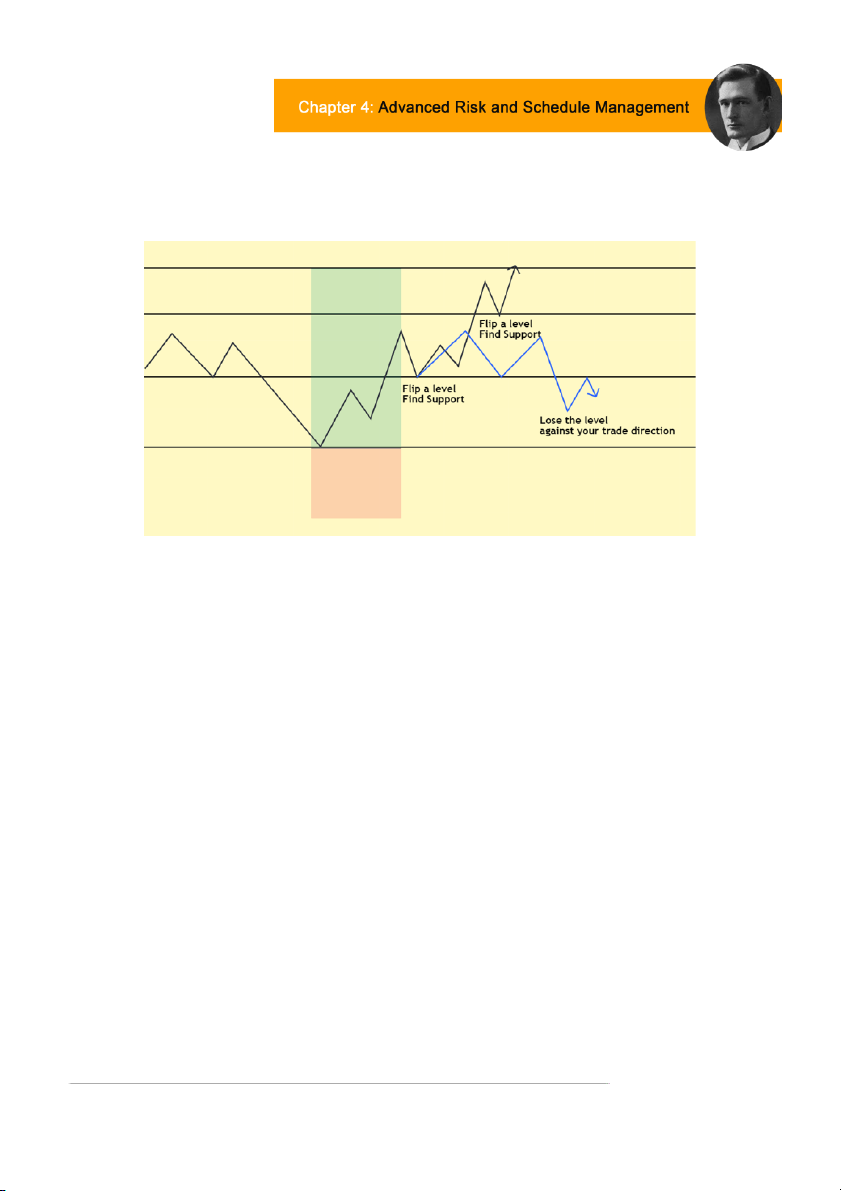

Illustration for a plan when trading levels:

Black: keep holding your trade

Blue: Consider getting out or securing some profit

NOTE: When Price moves as illustrated in Black. You can choose to

keep moving your stop up. Example: Move stop to slightly below a level once it is flipped.

Things you should always keep in mind when taking a trade beyond, Entry, SL and TP are: 1) Trouble areas 2) Early Invalidation Areas

3) Trouble areas eliminated (levels flipped) to move stops. R Ree fifi nn i i n n g g S S e e t t u-u p p s s:

This section is about improving known set-ups as you go on to trade them more often.

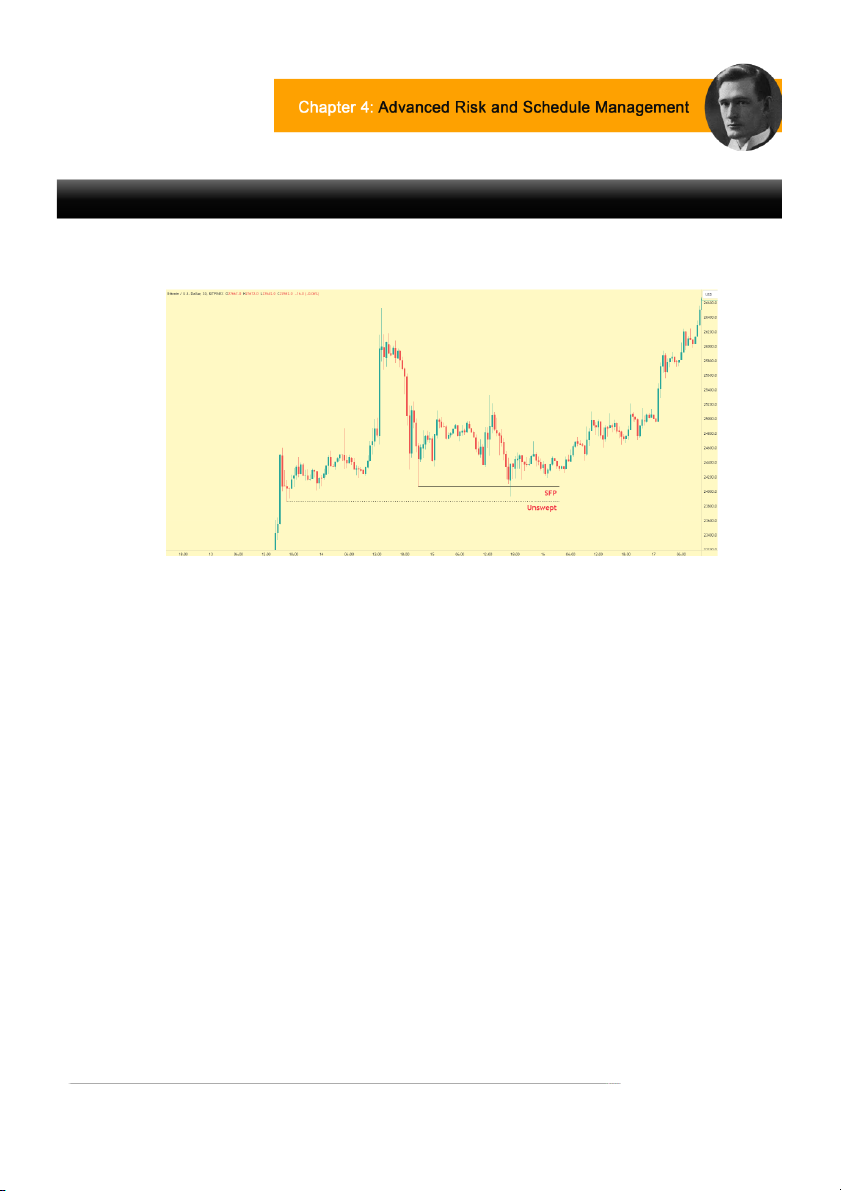

One thing I’ve learnt about SFPs is that if there is a sweep of a

significant low but there is another low as shown in the figure which

remains unswept then it more than likely goes for another sweep.

In such cases, I will take only 1% risk instead of the usual 2% I take

for such set-ups. I can always add to position to get a better entry if it

goes lower or I can add when I have more confidence in the trade

after it holds the SFP candle close as support.

These are all caveats that you will figure out via journaling your trades and conducting reviews. Let’s take another example:

In the above example, price spikes up violently to close the month. After

that, attempts to break above that level were rejected. Hence, sellers are

protecting that level but we still did not break the range low, so there is

untapped liquidity at the range lows.

The second attempt to break above the range had a bearish engulfing

candle as marked. As such, now we have a massive uptrend but price is

stalling at strong resistance. Now we also have a 4-Hour level for a clear

downside objective as range low is untapped. Hence, we have a strong HTF bias for downside.

Now we look at the zoomed in image on our execution time frame for the above set-up.

We have a resistance zone on the hourly chart, we also have a

breakdown of our marked levels.

What is important here is to look back at old set-ups. I normally limit

short resistance zones in a strong trending environment but right now we

have a ranging market. In such conditions, I’ve noticed that we have a

deviation of a high or an SFP as can be seen from the second sweep

into the resistance zone, thus we can use that for a better entry and more confirmation.

We can take some profit at the target 1 level. If we break down from a

level that is important as per our system described in chapter 2, then we

can always re-enter and compound at that level.

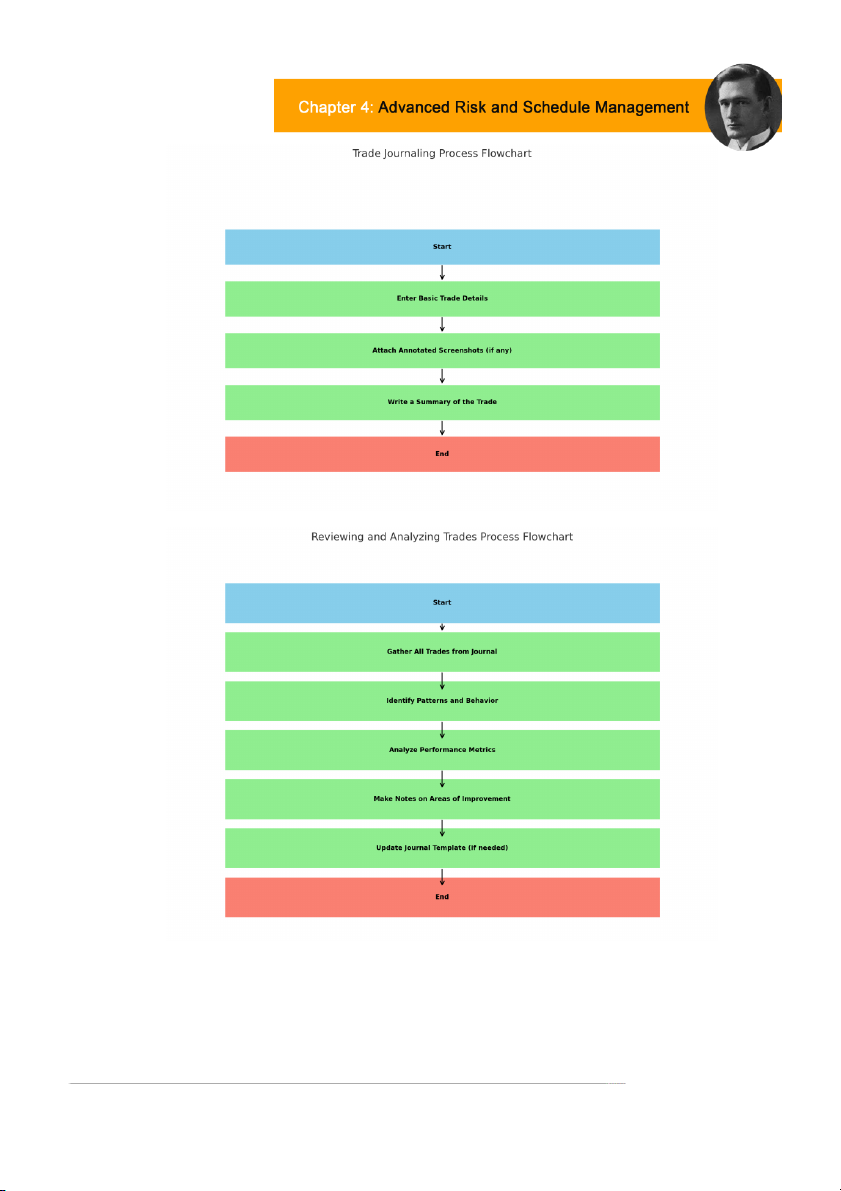

Journaling Trades and Reviewing Them:

If you ever want to be a successful or professional trader then you

need to make sure you are scheduling your entire life. Discretionary

traders don’t make it simply because they aren’t disciplined enough.

Discipline isn’t about sitting in front of a screen for 16 hours a day, it’s

about documenting your trading set-ups, and then reviewing them

every weekend. It is about getting up early before the market and

having a plan at the beginning of every day.

Creating your personal method of journaling trades is a multi-faceted

task that involves understanding different journaling methods, and

discussing how reviewing trades can help in becoming a better trader.

Below is a detailed guide based on the gathered information based

on my experience as well as observing other master traders over the years:

1. Understanding the Importance of Trade Journaling: -

Self-Evaluation: Trade journaling serves as an objective tool for

evaluating your performance as a trader. By documenting your

trading activities, you can track your system's performance and your

adherence to your trading plan.

Insight and Improvement: Analyzing a trading journal helps in

thoroughly reviewing your trade data, including the strategies

employed, reasons behind trades, and prevailing market conditions.

This review process provides valuable insights which, in turn, help

improve your trading skills and decision-making abilities.

Long-Term Success: A trading journal offers an unbiased review of

your trades and performance, touching on essential keys to long-term

success including education, strategy, discipline, and practice.

2. Creating a Sample Excel Trading Journal: - Basic Structure:

● Date when the trade opened and closed.

● Stock, futures, or currency pair contract.

● Direction of the trading bet (long/short). ● Position size ● entry price, ● profit target, ● stop loss ● exit price. ● Risk and reward ratio ● win or loss

● profit percentage and size ● loss percentage and size.

● Comments on errors, emotions, and market conditions

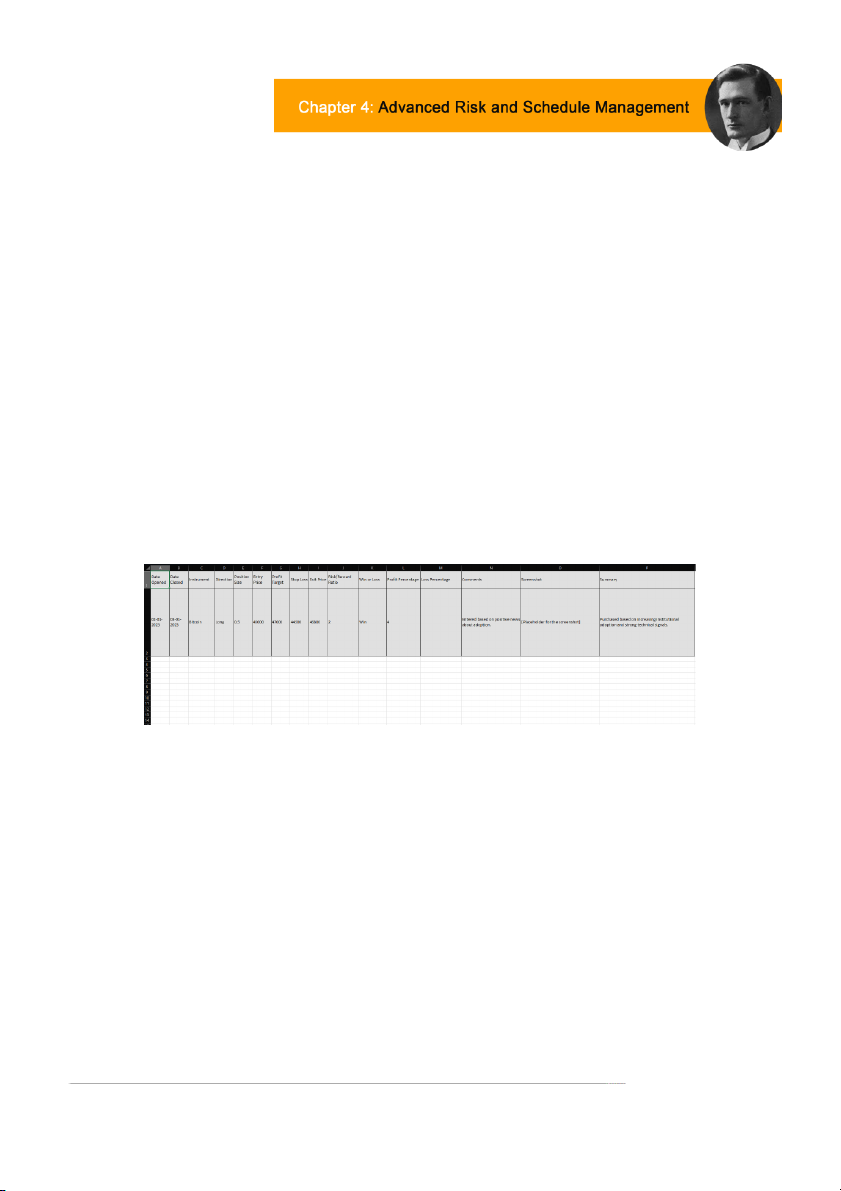

Figure: My sample Bitcoin/Ether trading journal. Yes I do it all on excel as a caveman. Additional Features: -

● Annotated screenshots of charts to provide visual references.

● Separate sections for different topics to organise information efficiently.

● Summaries of trades in your own words to capture the essence of

each trade and the rationale behind them.

Figure: Excel screenshot of the additional feature list I use currently.

3. Utilizing Journaling and Reviewing Trades: -

Regular Review: Conducting a thoughtful review of your trades at the

end of each quarter or annual y can teach volumes about how to

profit from adjustments in behaviour.

Pattern Recognition: By tracking your trades, you can identify

patterns in your behaviour and make more informed decisions in the

future, also refine set-ups as already discussed.