Preview text:

Chapter 5. RAISING CAPITAL

Module: Specialized Corporate Finance Outlines 1. Roles of capital 2. Sources of funding Chapter 5. Raising capital

3. Decision to go public - Initial public offerings

4. Seasoned equity offerings Outlines 1. Roles of capital 2. Sources of funding Chapter 5. Raising capital

3. Decision to go public initial public offerings

4. Seasoned equity offerings 1. Roles of capital

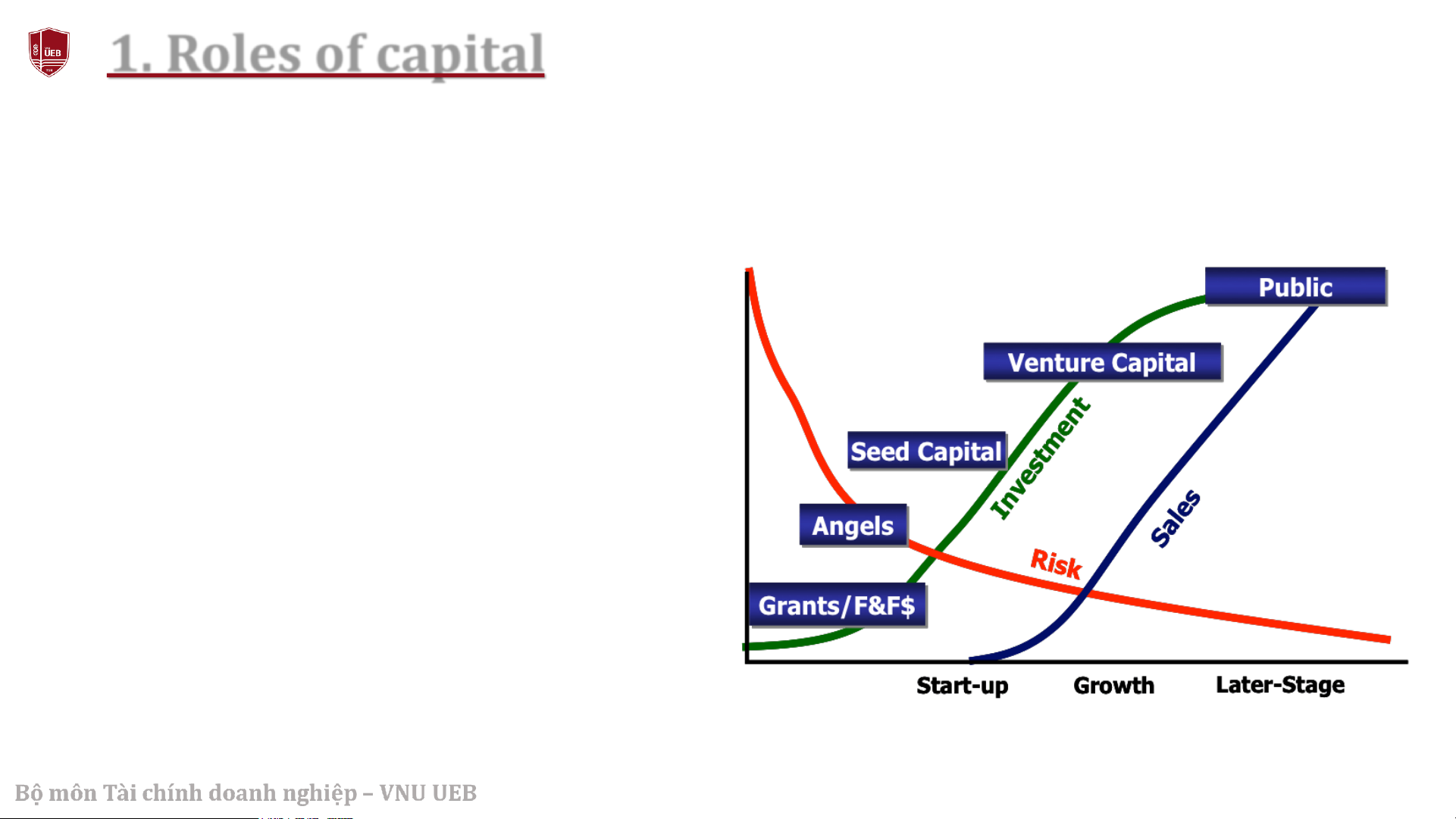

• All firms must, at varying times, obtain

capital. To do so, a firm must either borrow

the money (debt financing), sell a portion of

the firm (equity financing), or both.

• Corresponding to each development stage,

the decision will be made regarding the type

of investor suitable for the enterprise. • 2 main stages:

► Initial stage (early-stage financing)

► Public issuance stage (Public) 4 Outlines 1. Roles of capital 2. Sources of funding Chapter 5. Raising capital

3. Decision to go public initial public offerings

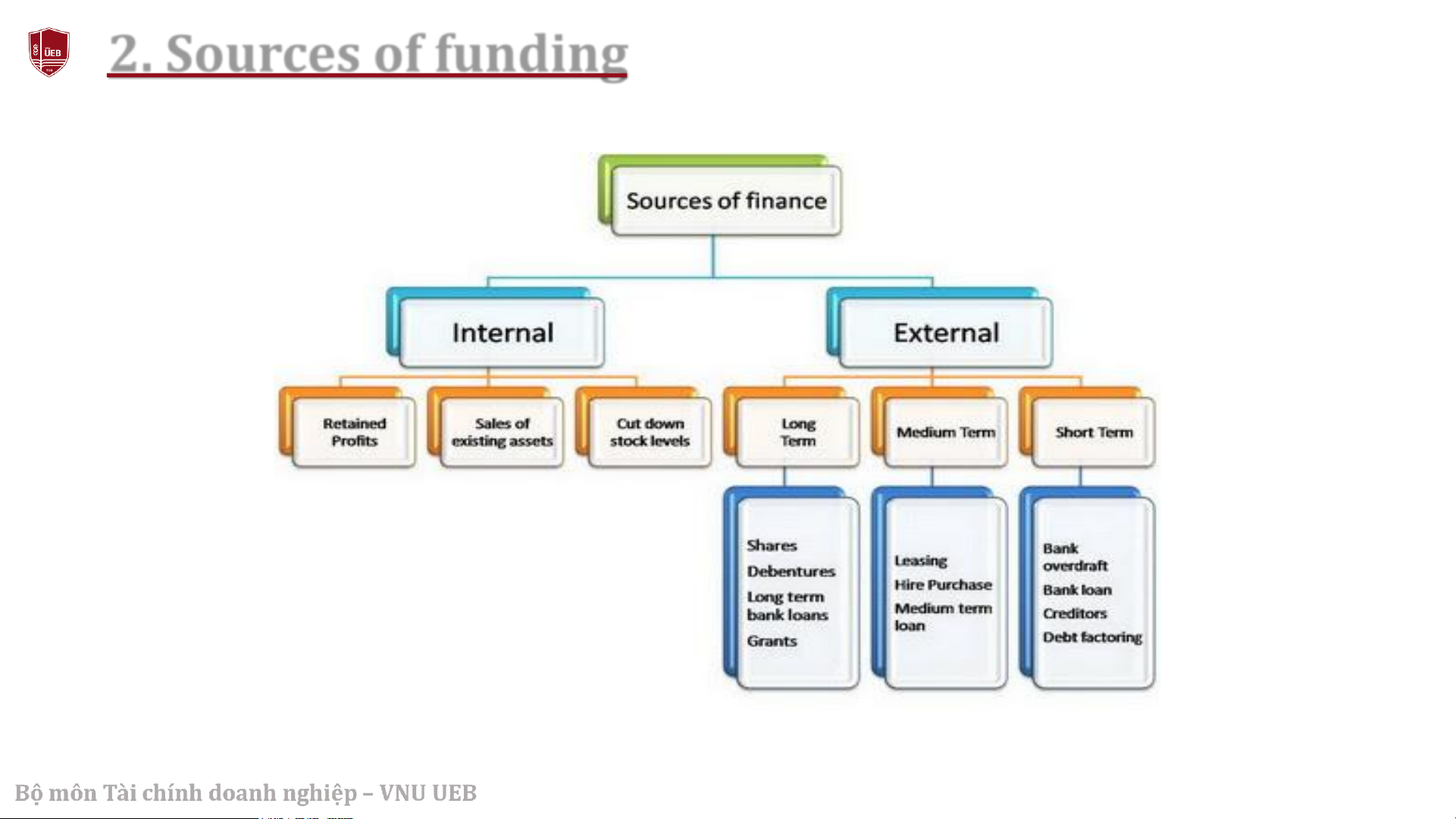

4. Seasoned equity offerings 2. Sources of funding 2. Sources of funding Internal sources Retained profit/earning

• The profit that has been generated in previous years and not distributed to owners is

reinvested back into the business

• This is a cheap source of finance, as it does not involve borrowing and associated interest and arrangement fees

• The opportunity cost of investing the money back into the business is that shareholders do not

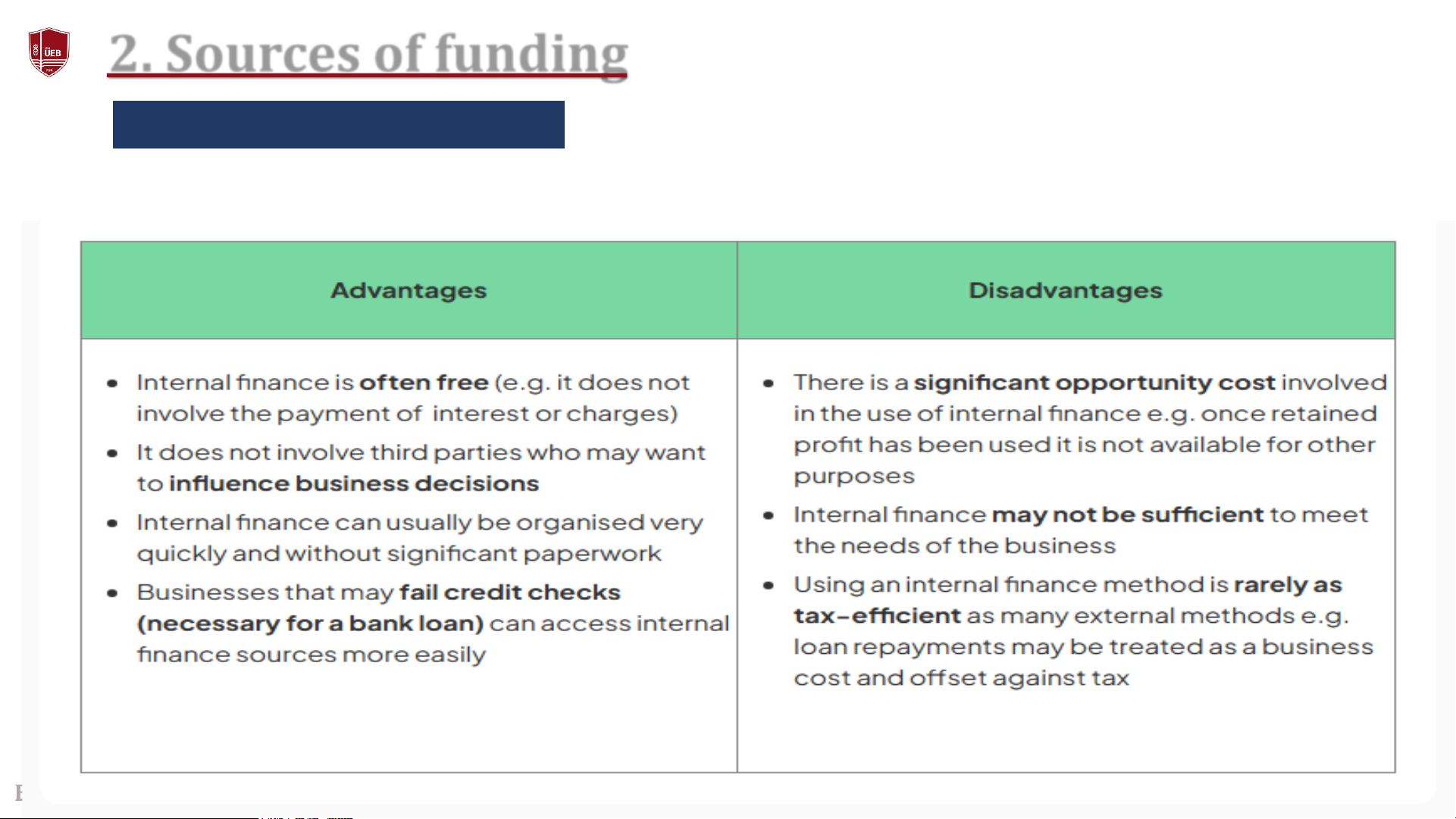

receive extra profit for their investment 2. Sources of funding Internal sources

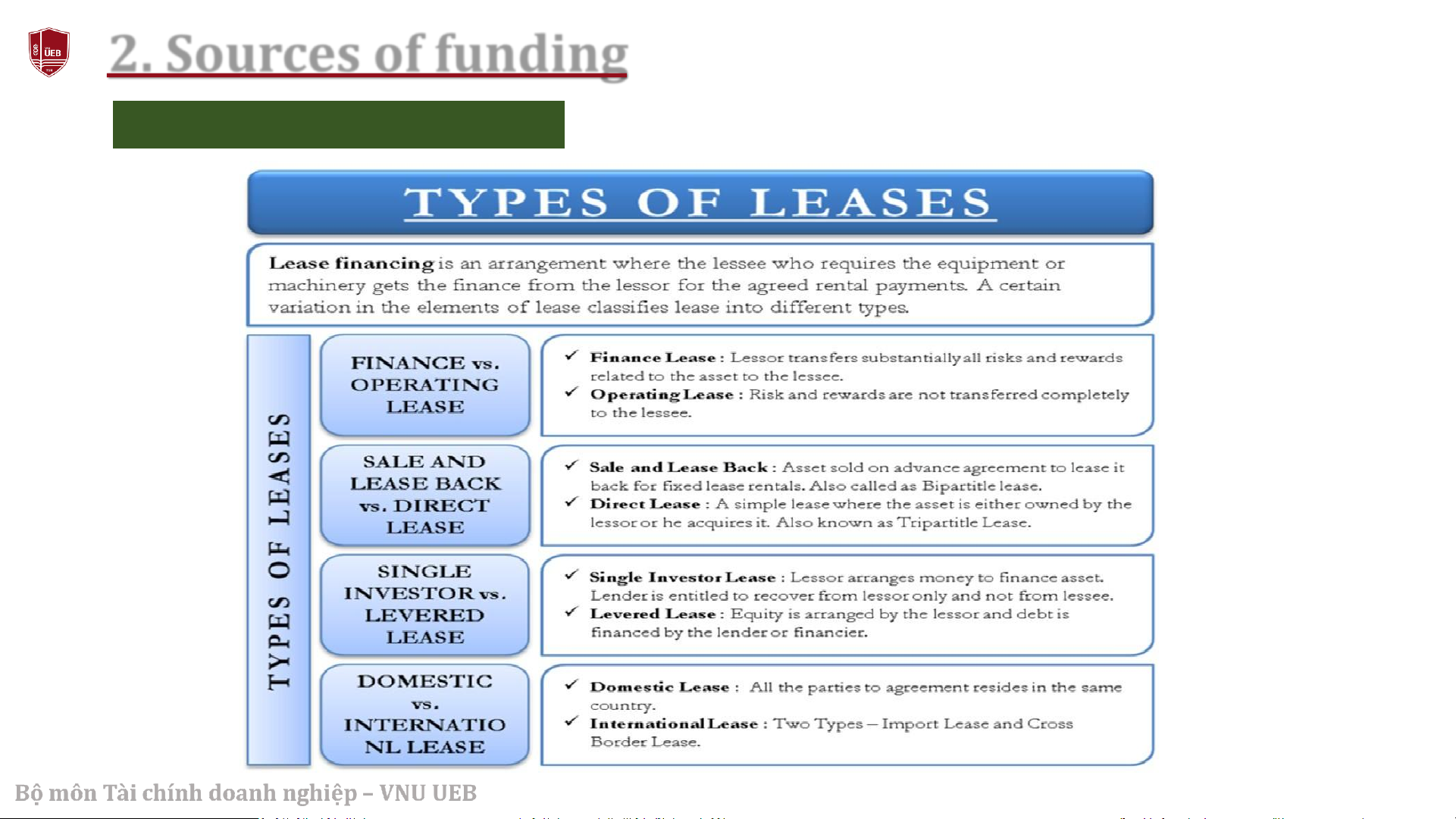

The Benefits & Drawbacks of Using Internal Finance 2. Sources of funding External sources Equity Financing Debt Financing Alternative Sources

Issue Shares (IPO/SEO): Raise

Bank Loans: Flexible but require

Leasing: Finance assets without

capital by selling ownership to

collateral and regular repayments. heavy upfront investment. public or existing investors.

Private Placement: Direct share

Corporate Bonds: Raise large funds Government Grants/Subsidies:

sale to strategic investors, faster

from multiple investors with fixed

Non-repayable funding for specific and less regulated. interest. projects.

Venture Capital / Angel Investors:

Strategic Alliances / Joint

Syndicated Loans: Multiple banks

Provide capital, expertise, and

Ventures: Share resources and

jointly fund large-scale projects. networks. capital with partners.

Preference Shares / Convertible

Bonds: Equity-linked securities

Mezzanine Financing: High-risk

Crowdfunding: Online fundraising

offering dividends or conversion

debt with equity-like features. from many small investors. rights. 2. Sources of funding External sources Advantages Disadvantages

Provides access to large amounts of capital for

May increase financial risk due to repayment expansion and investment.

obligations (debt) or loss of ownership (equity).

Helps companies pursue growth opportunities faster

Cost of financing can be high (interest payments,

than relying on internal funds.

dividend commitments, issuance costs).

Can diversify funding sources, reducing dependence

Dilution of control and decision-making when issuing on internal cash flows. new shares.

Improves credibility and visibility (e.g., IPO or bond

Strict compliance, disclosure, and regulatory issuance). requirements.

Attracts strategic investors who bring expertise and

Potential pressure from external stakeholders (banks, networks. investors, regulators). 2. Sources of funding External sources Financial lease/ capital lease 1. Roles of capital

Early Stages and Venture Capital Investment Early stage Stage 4: Exit (or Stage 3: Growth Bridge Funding) Funding Rounds Stage 2: Seed Capital Stage 1: Pre-seed Capital Investors: Investors: Venture Angel Investors Venture Capitalists. Capitalists. Investors: Individuals, Family, Friends, and Relatives 12 1. Sources of funding Angel Investors

▪ Individual Investors who buy equity in small private firms

▪ Finding angels is typically difficult. Venture capital •

Venture capital is equity provided by individuals or organizations, such as investment funds, to

startups in their early stages that have highly competitive potential and rapid growth. ➢

Venture capital funds are particularly interested in investment opportunities with exceptionally

high growth potential, capable of yielding financial returns and an exit within the required

timeframe (typically 3-7 years). ➢

They focus on high-risk, innovative industries such as information technology, pharmaceuticals, media, etc. ➢

A unique aspect of venture capital is that, in addition to providing funds, investors also use their

experience, knowledge, and long-standing networks to support enterprise management teams. 13 Outlines 1. Roles of capital 2. Sources of funding Chapter 5. Raising capital

3. Decision to go public initial public offerings

4. Seasoned equity offerings

3. Decision to go public initial public offerings

Steps in Issuing Securities to the Public

Step 1: Board & Shareholder Approval • Board approves issuance.

• Shareholder vote if new shares must be authorized.

Step 2: Registration with SEC

• File registration statement.

• Exceptions: short-term loans (<9 months) & small issues (<$5M, Reg A).

Step 3: SEC Review & Waiting Period

• SEC reviews filing (20-day waiting period).

• Distribute preliminary prospectus (“red herring”).

• Price set near the end of review period.

Step 4: Offers During Waiting Period

• Only oral offers allowed (no sales).

Step 5: Effective Date & Sale

• Registration becomes effective.

• Price finalized, securities sold.

• Final prospectus delivered with securities/confirmation.

3. Decision to go public initial public offerings Definition Types of offerings

▪ Primary Offerings: New shares available in a public offering that raise new capital - IPO

▪ Secondary Offerings: Shares sold by existing shareholders in an equity offering

3. Decision to go public initial public offerings IPO

Public company: owning more than 100 shareholders

Note: Only businesses that have never been

listed on a stock exchange will be considered for the IPO market.

3. Decision to go public initial public offerings IPO

Advantages and Disadvantages of IPOs

Advantages of Going Public:

Disadvantages of Going Public

▪ Can raise additional funds in the

▪ Significant legal, accounting, and

future through secondary offerings

marketing costs arise, many of which are ongoing

▪ Attracts and retains better

management and skilled employees

▪ Increased time, effort, and attention through liquid stock equity

required of management for reporting participation (e.g., ESOPs)

▪ There is a loss of control and stronger ▪ IPOs can give a company a agency problems

lower cost of capital for both equity and debt

3. Decision to go public initial public offerings IPO

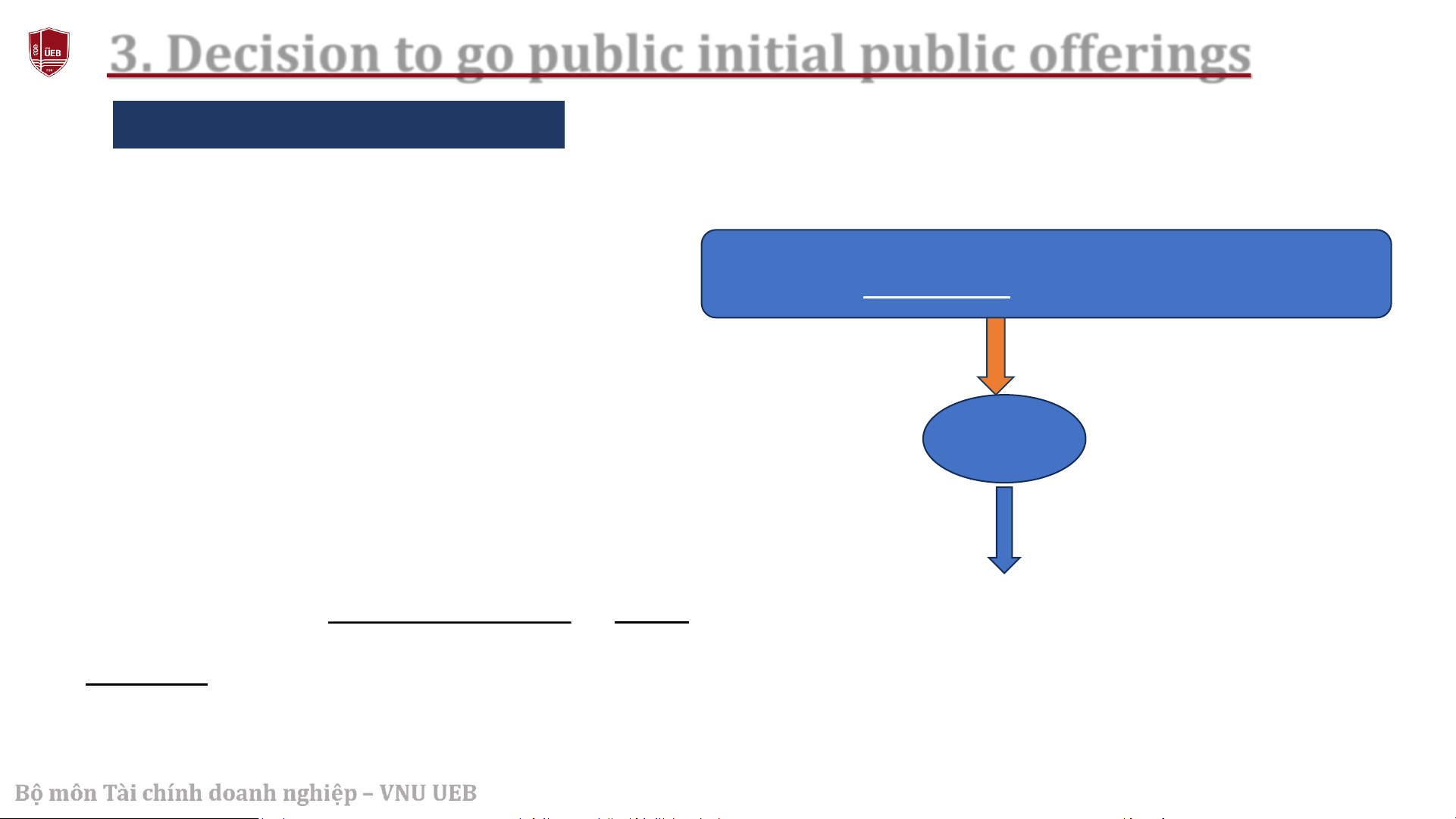

How an Initial Public Offering (IPO) Works:

IPO shares of a company are priced through

Before an IPO, a company is underwriting due diligence. considered private:.

• a relatively small number of shareholders GO PUBLIC

including early investors like the founders,

family, and friends along with professional

investors such as venture capitalists or angel

the previously owned private share ownership converts to public ownership, investors.

3. Decision to go public initial public offerings IPO Process of Going Public Consider Choose an Prepare the The The pricing The going public underwriter prospectus roadshow meeting consequence Market and Company Investment investment The market has all the banker gains banker are takes over power powers in control