Preview text:

Quarterly Knowledge Report Vietnam Real Estate Quarter 1 | 2021 Accelerating success. Table of Contents

VIETNAM ECONOMIC OVERVIEW ............................................................................................. 3 OFFICE

Supply .................................................................................................................................... 4

Performance ......................................................................................................................... 5

Outlook .................................................................................................................................. 8 RETAIL

Supply .................................................................................................................................... 9

Performance ....................................................................................................................... 11

Outlook ................................................................................................................................ 12 CONDOMINIUM

Supply .................................................................................................................................. 15

Performance ....................................................................................................................... 16

Outlook ................................................................................................................................ 17 LANDED PROPERTIES

Supply .................................................................................................................................. 18

Performance ....................................................................................................................... 19

Outlook ................................................................................................................................ 19 SERVICED APARTMENTS

Supply .................................................................................................................................. 20

Performance ....................................................................................................................... 21

Outlook ................................................................................................................................ 22 INDUSTRIAL

Supply .................................................................................................................................. 23

Performance ....................................................................................................................... 24

Outlook ................................................................................................................................ 25

GLOSSARY ................................................................................................................................. 26 2

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam Economic Overview Foreign Direct

Gross Domestic Product (GDP) International Arivals Investment (FDI) 4.48% y-o-y WB estimate 6.6% 18.5% y-o-y 98.7% y-o-y 77.3% in March for 2021 From February

Consumer Price Index (CPI) Retail Sales Trade Balance

0.29% y-o-y; smallest increase 5.1% y-o-y Exports up Imports up in 20 years 22% y-o-y 26.3% y-o-y GDP

The World Bank’s latest update highlighted that Vietnam is expected to enjoy strong growth of 6.6 percent in 2021. The rapid

suppression of the Covid-19 outbreak in late January 2021 helped maintain Vietnam’s positive outlook for economic recovery

in 2021. Emphasis should be given to how the Covid-19 vaccinations are rolled out domestically and globally and the support

of the Vietnamese government in providing fiscal and monetary support. CPI

The CPI increase can be attributed to the increase in price of rice by 8.55 percent year-on-year from January to March due

to rising global price and high demand for premium rice during the Tet holidays. The increase in prices of several main

groups of goods and services pushed up the costs of catering services by 2.08 percent year-on-year. On the other hand,

the Vietnam Electricity (EVN)’s power bill cut in the second and fourth quarters of last year caused the electricity price to

decline 7.18 percent in January, which contributed to a CPI decrease of 0.24 percentage points. The average petrol and oil

prices in Q1 fell by 9.54 percent year-on-year, making the three-month CPI to drop 0.34 percentage points. FDI

Foreign investors pumped capital in 17 sectors, of which the highest is in processing and manufacturing with over 5 billion

USD (49.6 percent), followed by power production and distribution with 3.9 billion USD, real estate with 600 million USD, and

science-technology with 167 million USD. Long An lured a significant amount of FDI contributed by a 3.1 billion USD Singapore-

invested project to build gas-fuelled power plants Long An I and II. Retail Sales

Domestic trade and freight transportation showed positive signs, showing that consumer demand increased again. Freight

transport reached 472.6 million tons of transported goods, up 10.2% compared with the same period last year. The

transportation of international passengers and foreign travelers to Vietnam continues to face difficulties. International Arrivals

While domestic tourism has bounced back well from the third wave of Covid-19 pandemic in February, international arrivals

and tourism spending is crucial for Vietnam’s economy. A representative from the Ho Chi Minh City Tourism Association

said the implementation of a “COVID-19 vaccine passport” would aid in tourism recovery. National flag carrier Vietnam

Airlines is working with partners from the International Air Transport Association (IATA) on a digital health passport project

and pilot the IATA Travel Pass app, that allows travelers to store and manage certifications for COVID-19 tests or vaccines,

which will be an important basis for international aviation activities to restart. Trade Balance

For exports, phones and components earned the largest export value, reaching 14.1 billion USD, accounting for 18.2%

of total export turnover, up 9.3% over the same period last year, followed by electronics, computers and components

reached 12 billion USD, up 31.3%; machinery, equipment, tools and spare parts reached 9.1 billion USD, up 77.2%. The

United States was Vietnam’s largest export market with a turnover of 21.2 billion USD, a year-on-year increase of 32.8%;

followed by China with 12.5 billion USD, up 34.3%. For imports, the electronics, computers and components reached

16.8 billion USD, accounting for 22.3% of total import turnover and up 22% over the same period last year, followed by

machinery, equipment, tools and spare parts reached 10.8 billion USD, up 30.7%. China was still Vietnam’s largest import

market with a turnover of 23.8 billion USD, a year-on-year increase of 47.3%; followed by South Korea with 13 billion USD, up 9.9%.

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam 3 Office - Supply

Two notable new office buildings in Hanoi

Table 2: Hanoi Office, Upcoming Projects (2021) and Da Nang NLA Expected Ho Chi Minh City Name of Project Grade District (sqm) Completion Year

There were no new launches in the first quarter of 2021. In Vinhomes Ocean Park (Techno Tower) B Gia Lam N/A 3Q2021

the next 3-5 years, Thu Duc City is expected to supply the

market with an additional 400,000 sqm of office space, Hoan Oriental Sun Tower A 19,200 4Q2021

especially from the Thu Thiem area. The quality of buildings Kiem

are given special attention to achieve international standards, Thanh HUD Tower B 48,000 2021

such as LEED and Lotus, and developers of existing buildings Xuan

are taking active steps towards enhancing their buildings to Source: Colliers Vietnam

compete with upcoming projects.

Table 1: HCMC Office, Upcoming Projects (2021) Expected Name of Project Grade District NLA Completion (sqm) Year D'. Saint Raffles A 1 30,000 4Q2021 The Spirit of Saigon A 1 35,000 2024 Techcombank TBC 1 TBC 4Q2022 Saigon Tower

Photo 1: Thai Building, Hanoi Empire 88 B 2 10,500 4Q2021 Da Nang Cobi Tower 2 B 7 17,527 2021

Diamond Time Complex was added into the market this

quarter, which provided approximately 1,300 sqm of Grade The Grace B 7 8,295 2021

A office space into the market. Grade B and Grade C

segments did not record any new supply. A number of Grade V Plaza Towers B 7 66,000 1Q2023

A buildings are near completion and are expected to increase

the supply in the coming quarters. Geleximco B Tan Binh 10,000 2Q2021 E.town 6 B Tan Binh 35,000 2023

Table 3: Da Nang Office, Upcoming Projects (2021) Expected Source: Colliers Vietnam Name of Project Grade District NLA (sqm) Completion Year Hanoi SHB Da Nang B Hai Chau 4,257 3Q2021 Building

The first quarter of 2021 welcomed a new grade A project

named Thai Building which provides 25,950 sqm to the Source: Colliers Vietnam

market. Located in Cau Giay district, it shows that developers

are gradually moving quality office buildings away from the

CBD, where land fund is abundant yet still provides easy

access to the city center and residential areas. The Techno

Park Tower located in Vinhomes Ocean Park Gia Lam that will

supply more than 115,000 sqm of office space by end 2021

further highlights the trend of new office spaces moving out of the CBD area. 4

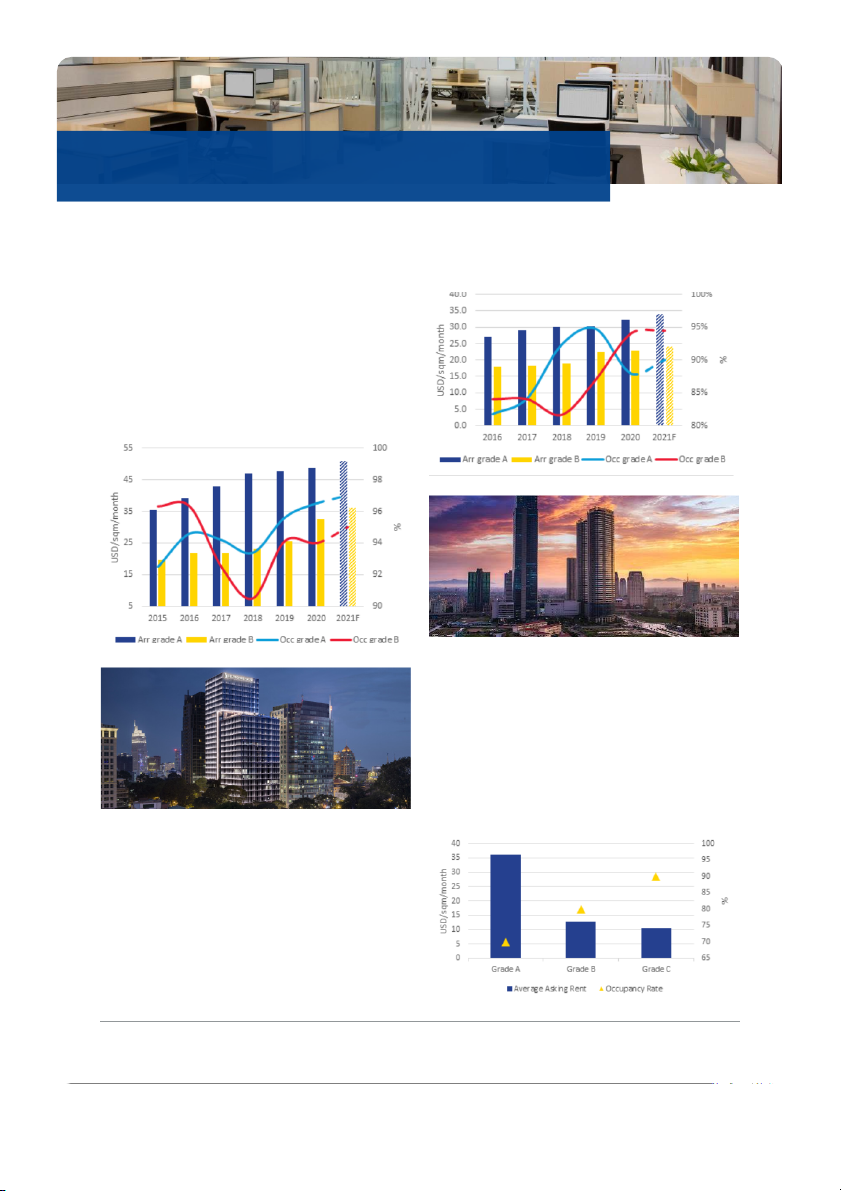

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam Office - Performance

which are having strong breakthroughs due to new

Continued gradual recovery in key cities

infrastructure projects that are attracting several new investors. Ho Chi Minh City

Figure 2: Hanoi Office, Average Asking Rent and Occupancy Rate

After a turbulent 2020, the Ho Chi Minh City office market

recorded an average asking rental rate increase in Grade A

and Grade B segments of 2% year-on-year. This was

supported by the state issuing many policies to support

businesses and to encourage foreign investment. It is a

significant improvement from 2020 when many tenants

returned office spaces, moved to lower segment offices, or

switched to lease cheaper spaces in other districts.

Figure 1: HCMC Office, Average Asking Rent and Occupancy Rate Source: Colliers Vietnam

Photo 3: AON Landmark 72, Hanoi Source: Colliers Vietnam Da Nang

Overall, the average occupancy rate remained high and

increased by more than 6% q-o-q. Demand for office space

in Da Nang is expected to grow strongly in the future as Da

Nang is attracting many high-value FDI projects and recorded

new business registrations. The average rental rates have

also been increasing, whereby the Grade B segment achieved the fastest growth.

Figure 3: Da Nang Office, Average Asking Rent and Occupancy

Photo 2: Deutsches Haus, HCMC Rate Hanoi

While the office market in Hanoi was affected in 2020 due to

the pandemic, it is continuing its gradual recovery, fueled by

high demands from companies in the technology industry,

including from FinTech, e-commerce, software development

and data centers. Overall, there was an increase in asking

rents of 4.6% in Grade A segment and 2.8% in Grade B segment y-o-y.

While the Hanoi market has mainly focused on developing

strongly in the West, the East of the Red River has started

rising recently, including Long Bien, Gia Lam, Dong Anh, Source: Colliers Vietnam

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam 5

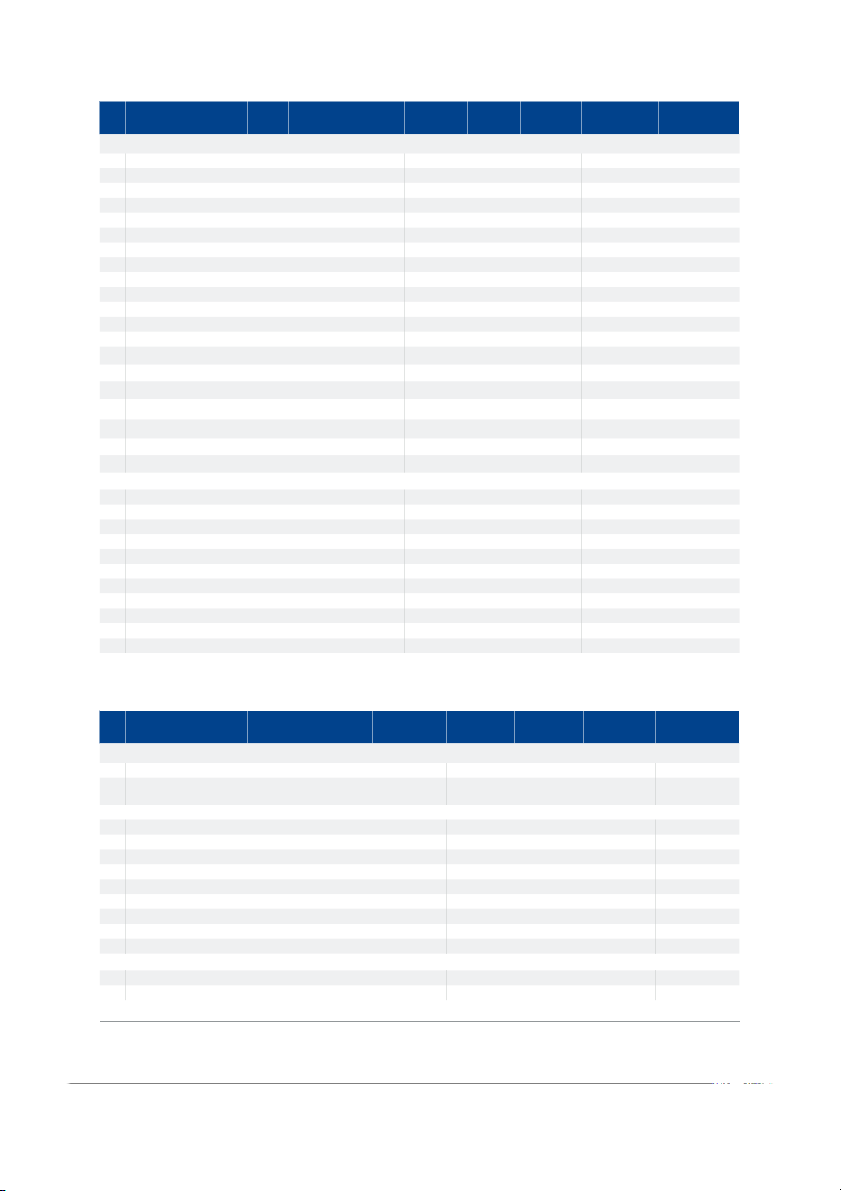

Table 4: HCMC – Office, Notable Projects No Completion Name Grade Address Service Charges Average Asking NLA (sqm) Occupancy Rate Year (USD) rent (USD/sqm) Grade A 1 Saigon Centre Tower 1 A 65 Le Loi 1996 10,600 $6.50 91.91% $46.00 2 Saigon Tower A 29 Le Duan 1997 13,950 Included 99.00% $51.00 3 Sunwah Tower A 115 Nguyen Hue 1997 20,800 $6.50 99.70% $43.00 4 The Metropolitan A 235 Dong Khoi 1997 15,200 $6.00 87.25% $38.00 5 Diamond Plaza A 34 Le Duan 1999 15,936 $8.00 100.00% $37.00 6 mPlaza Saigon A 39 Le Duan 2009 26,000 $7.00 89.00% $45.00 7 Bitexco Financial Tower A 2 Hai Trieu 2010 38,000 $8.00 100.00% $46.00 8 President Place A 93 Nguyen Du 2012 9,200 $7.00 96% $47.00 9 Riverbank Place A 3C Ton Duc Thang 2013 9,125 $7.00 74.26% $44.00 10 Times Square A 22-36 Nguyen Hue 2013 12,704 $7.00 100.00% $65.00 11 Vietcombank Tower A 5 Me Linh Square 2015 55,000 $7.00 99.11% $55.00 12 Deutsches Haus A 33 Le Duan 2017 30,000 $7.00 93.36% $65.00 13 Saigon Centre Tower 2 A 67 Le Loi 2017 44,000 $6.85 99.14% $52.00 14 Lim Tower 3 A 29A Nguyen Dinh Chieu 2019 29,357 $6.00 65.00% $40.00 Grade B 1 The Landmark Tower B 5B Ton Duc Thang 1995 8,000 Included 96.89% $31.00 2 Harbour View Tower B 35 Nguyen Hue 1996 10,000 $5.00 91.86% $26.00 3 Saigon Trade Center B 37 Ton Duc Thang 1996 34,120 $6.70 75.20% $29.00 4 Saigon Riverside Office B 2A-4A Ton Duc Thang 1997 10,000 Included 95.00% $35.00 5 Central Plaza B 17 Le Duan 1998 7,405 $7.00 85.10% $36.17 6 Me Linh Point Tower B 2 Ngo Duc Ke 1999 17,500 $7.20 93.07% $42.00 7 Zen Plaza B 54-56 Nguyen Trai 2001 11,442 $6.25 92.02% $29.00 8 Opera View B 161-167 Dong Khoi 2006 3,100 $9.00 73.04% $39.00 9 Royal Tower B 235 Nguyen Van Cu 2008 14,320 $6.00 99.42% $24.50 10 Ruby Tower B 81-85 Ham Nghi 2008 12,000 $6.50 95.33% $25.00 11 CJ Building B 5 Le Thanh Ton 2008 14,000 $6.50 94.00% $28.00 12 Vincom Center B 68-70-72 Le Thanh Ton 2010 56,600 $5.00 91.87% $33.00 13 Petro Vietnam Tower B 1-5 Le Duan 2010 20,000 $7.10 96.86% $32.00 14 Maritime Bank Tower B 192 Nguyen Cong Tru 2010 24,250 $5.00 85.74% $31.00 15 AB Tower B 76 Le Lai 2010 25,000 $6.30 92.34% $39.83 16 Empress Tower B 138-142 Hai Ba Trung 2012 18,955 $6.60 98.08% $33.00 17 Lim Tower B 9-11 Ton Duc Thang 2013 33,300 $6.00 95.13% $39.00 18 MB Sunny Tower B 259 Tran Hung Dao 2014 13,200 $5.50 98.52% $24.00 19 Mapletree Business Center B 1060 Nguyen Van Linh 2015 23,010 $6.00 99.12% $27.00 20 Etown Central B 11 Doan Van Bo 2017 33,258 $6.00 100.00% $25.00 21 Viettel Complex Building B 285 Cach Mang Thang Tam 2017 47,000 $5.50 87.42% $26.00 22 Sofic Tower B 8-10 Mai Chi Tho 2019 21,400 $6.00 88.00% $32.00 23 Sonatus Tower B 15 Le Thanh Ton 2019 33,691 $6.00 93.00% $42.00 24 Friendship Tower B 31 Le Duan 2020 18,900 $7.00 76.00% $47.00 25 Phu My Hung Tower B 101 Ton Dat Tien 2020 31,200 $7.00 40.00% $29.00 Source: Colliers Vietnam

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam 6

Table 5: Hanoi – Office, Notable Projects Service No Completion Name Grade Address Average Asking NLA (sqm) Charges Occupancy Rate Year rent (USD/sqm) (USD) Grade A 1 Central Building A 31 Hai Ba Trung 1995 3,653 $9.00 100% $32.00 2 International Centre A 17 Ngo Quyen 1995 6,500 $7.00 95% $47.00 3 Ha Noi Tower A 49 Hai Ba Trung 1997 9,000 Included 99% $30.00 4 63 Ly Thai To Building A 63 Ly Thai To 1998 6,753 Included 100% $47.00 5 Sun Red River Building A 23 Phan Chu Trinh 1999 13,459 $7.00 96% $30.00 6 Vietcombank Tower A 198 Tran Quang Khai 2000 19,563 Included 100% $30.00 7 Opera Business Centre A 60 Ly Thai To 2007 3,787 Included 97% $24.00 8 Pacific Palace A 83B Ly Thuong Kiet 2007 16,600 $7.00 86% $31.00 9 Asia Tower A 2 Nha Tho 2007 3,100 $7.70 82% $35.00 10 Sun City Building A 13 Hai Ba Trung 2007 6,400 - 100% $45.00 11 BIDV Tower A 194 Tran Quang Khai 2010 10,120 $7.00 100% $30.00 12 Leadvisors Place A 63 Pham Van Dong 2010 8,000 $7.00 98% $35.00 13 AON Landmark 72 A Pham Hung-Me Tri 2011 95,000 $6.00 90% $24.00 14 Corner Stone A 16 Phan Chu Trinh 2013 26,500 $7.00 100% $35.00 15 Hong Ha Center A 25 Ly Thuong Kiet 2013 11,000 $5.00 89% $25.00 16 Lotte Center A 54 Lieu Giai 2014 48,880 $4.50 98% $34.00 17 TNR Nguyen Chi Thanh A 54A Nguyen Chi Thanh 2015 37,411 $6.00 93% $24.00 18 Thaiholdings Tower A 210 Tran Quang Khai 2018 34,458 $7.00 45% $33.00 19 Capital Place A 29 Lieu Giai 2020 93,000 $7.00 20% $33.00 20 Thai Building A 22 Duong Dinh Nghe 2021 25,950 $4.00 20% $25.00 Grade B 1 Tungshing Square B 2 Ngo Quyen 1996 8,306 $5.70 89% $23.00 2 Melia Hotel B 44B Ly Thuong Kiet 1997 8,500 - 99% $35.00 3 Prime Centre B 53 Quang Trung 1998 7,600 - 100% $27.00 4 VIB Hai Ba Trung B 59 Quang Trung 2006 3,000 - 100% $16.00 5 Capital Tower B 109 Tran Hung Dao 2010 21,089 $7.00 70% $22.00 6 Hanoi Tourist Building B 18 Ly Thuong Kiet 2010 7,600 - 99% $24.00 7 Capital Building B 72 Tran Hung Dao 2013 5,800 - 98% $20.00 8 Coalimex Building B 33 Trang Thi 2013 5,071 $5.00 95% $26.00 9 VID Building B 115 Tran Hung Dao 2013 4,930 $5.50 89% $18.00 10 Artex Port B 31-33 Ngo Quyen 2014 4,725 $5.00 100% $18.00 11 IDMC B 15 Pham Hung 2020 12,000 Included 40% $19.00 Source: Colliers Vietnam

Table 6: Da Nang – Office, Notable Projects No Service Occupancy Rate Average Asking Name Address Completion Year NLA (sqm) Charges (USD) (%) Rent (USD/sqm) Grade A 1

Indochina Riverside Towers 74 Bach Dang 2008 7,389 Included 83% $23.50 Heritage Treasure Tower 2 50 Bach Dang (Hilton Bach Dang) 2019 4,900 Included 80% $40.00 Grade B 1 Vinh Trung Plaza 253-255-257 Hung Vuong 2006 5,800 Included 95% $12.00 2 Green Plaza 238 Bach Dang 2008 4,400 Included 80% $16.00 3 Softech Tower 02 Quang Trung 2009 20,000 Included 98% $14.00 4 PVFC Building Lot A2.1, 30/4 Street 2010 11,162 Included 100% $10.75 5 Thanh Loi Building 249 Nguyen Van Linh 2011 3,020 Included 81% $12.04 6 One Opera 115 Nguyen Van Linh 2013 4,234 Included 98% $12.00 7 Petrolimex Tower 122, 2/9 Street 2013 6,000 Included 100% $10.00 8 Post Office 155 Nguyen Van Linh 2014 14,449 Included 98.6% $12.90 9 Crystal Tower 65 Hai Phong 2020 9,223 Included 44% $19.00 Grade C 1 DanaBook 78 Bach Dang 2008 3,500 Included 93% $6.75 2 SPT 179 Tran Hung Dao 2009 15,863 Included 98% $6.00 Source: Colliers Vietnam

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam 7 Office - Outlook

Physical office unlikely to be threatened

by alternative working models in the near future

Compared to neighboring countries, Vietnam had a relatively

short lockdown period and most companies continued face-

to-face interaction throughout the majority of 2020.

Occupancy rates and rental rates in Ho Chi Minh City, Hanoi

and Da Nang have been recovering well after the initial

setback in the first half of 2020 owing to the Covid-19

pandemic. The abundance of investment and business Photo 5: The Executive Center

opportunities in Vietnam has continued increasing interest

from foreign investors and is likely to spur office demand in key cities.

Co-working spaces in Vietnam are likely to continue its

upward trajectory alongside the traditional office spaces.

Given its flexible lease terms and low costs, it can cater to a

wide range of clients from individuals to corporates, and are

especially appealing to millennials and the burgeoning

number of startups in Vietnam. Photo 4: Dreamplex

On the other hand, the pandemic has presented the

possibility of a traditionally niche office segment, and that is

the virtual office. Virtual office providers help tenants register

an official address in their building and provide services like

receiving physical mail. The Covid-19 pandemic showed

everyone the possibility of working from home or working

remotely. Furthermore, in this current business climate,

many millennials are very entrepreneurial and are starting

their own businesses. These new businesses only need to

register an official address in an office building and work

anywhere they want, be it at home or at cafes. This provides

an opportunity for office buildings which are not doing so

well to improve their performance. With the marginal cost of

providing the service to another virtual office tenant being

negligible, this creates even more upside potential for the office buildings.

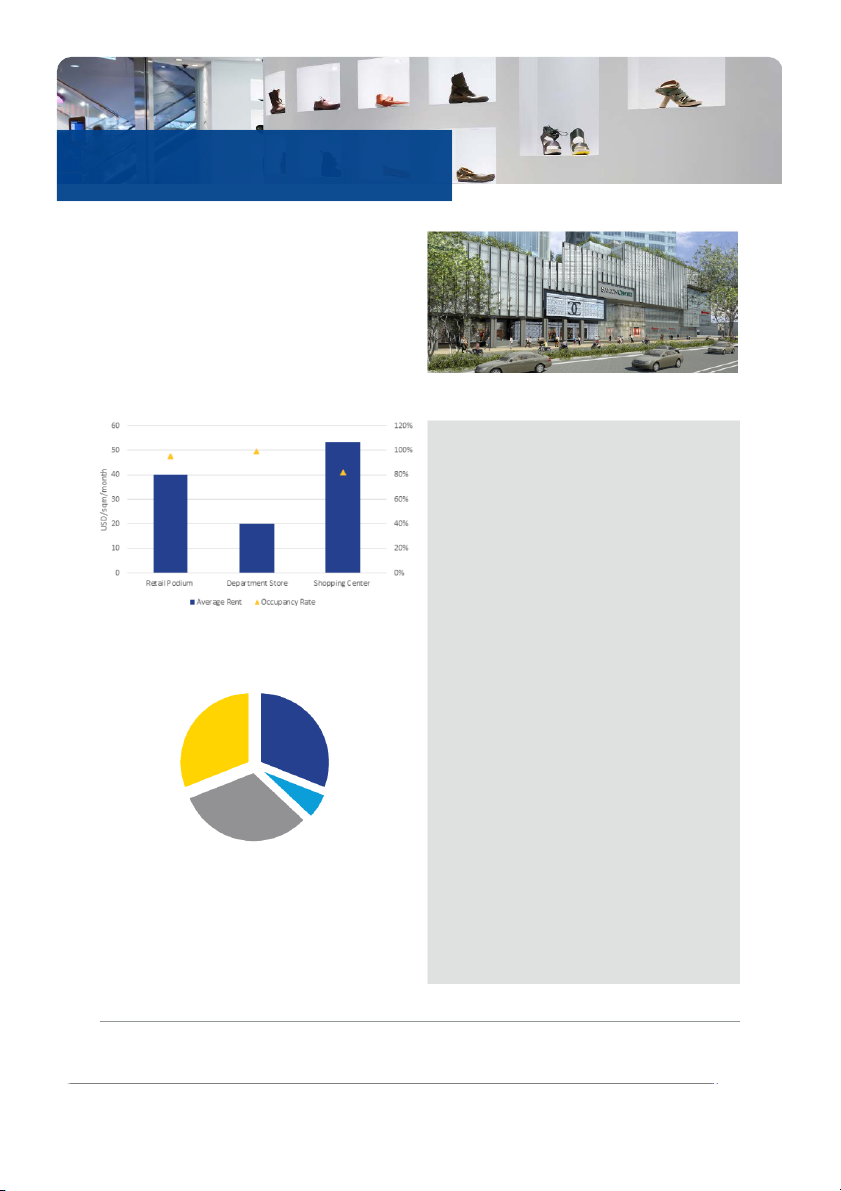

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam 8 Retail - Supply

Limited new supply in Q1 but steady pipeline for 2021 Ho Chi Minh City

In Ho Chi Minh City, there was no new supply recorded in the

market in this quarter. It is expected that there will be more

than 200,000 sqm of retail space in 2021 when the projects

are completed. New supply will concentrate in the East and

where metro line 1 (Ben Thanh - Suoi Tien) passes. In the

North of Ho Chi Minh City, the completion of construction of

Photo 6: Saigon Centre, HCMC

the World Trade Center Binh Duong New City Expo in

February 2021 that is now awaiting an official opening will Hanoi

certainly bring more attention to Binh Duong, and it has

already caught the eye of Central Retail Group (Thailand),

In the next quarter, Vincom Retail will open Vincom Mega

which recently proposed to the leaders of the People’s

Mall Smart City, the first shopping mall offering a unique

Committee of Binh Duong province about the implementation

indoor lighting demonstration LED waterfall experience. The

of the largest commercial center project in Vietnam.

shopping center will provide 68,000 sqm of retail space.

Figure 4: HCMC Retail, Supply by Year

Table 8: Hanoi Retail, Upcoming Projects Expected Name of Project District NLA (sqm) Completed year Name of Project Vincom Megamall Nam Tu Liem 68,000 2Q2021 Smart City Lotte Ciputra Mall Tay Ho 200,000 1Q2022 Source: Colliers Vietnam Source: Colliers Vietnam

Table 7: HCMC Retail, Upcoming Projects Expected Name of District NLA (sqm) Completed Project year

Photo 7: Lotte Ciputra Mall, Hanoi Socar Mall Thu Duc City 40,000 3Q2021 Central Mall East Thu Duc City 39,000 3Q2021 Saigon Sense City East Thu Duc City 50,000 3Q2021 Saigon Vincom Megamall Thu Duc City 45,000 4Q2021 Grand Park Satra Mall (Centre mall) District 6 29,161 2Q2021 Elite Mall District 8 42,000 4Q2021 Source: Colliers Vietnam 9

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam Retail - Supply Da Nang

Parkson Vinh Trung Plaza is recorded to have paid off all

retail space and has no plans to reopen. However, in this

quarter, Da Nang welcomed the VV Mall international trade

center with a total area of 35,000 sqm. VV Mall is connected

to the Crowne Plaza resort complex, the Crowne Games

Club and the JW Marriot Hotel. This is a shopping center that

focuses on famous fashion brands, international duty-free

shops and restaurants with a variety of cuisines. Expected Completion

Photo 8: VV Mall, Da Nang Year

Figure 5: Da Nang Retail, Market Performance Source: Colliers Vietnam

Figure 6: Da Nang Retail, District Distribution Ngu Hanh Son Hai Chau 31% 31% Thanh Khe 6% Son Tra 32% Source: Colliers Vietnam 10

Quarterly Knowledge Report | Quarter 1 2021 | Vietnam