Preview text:

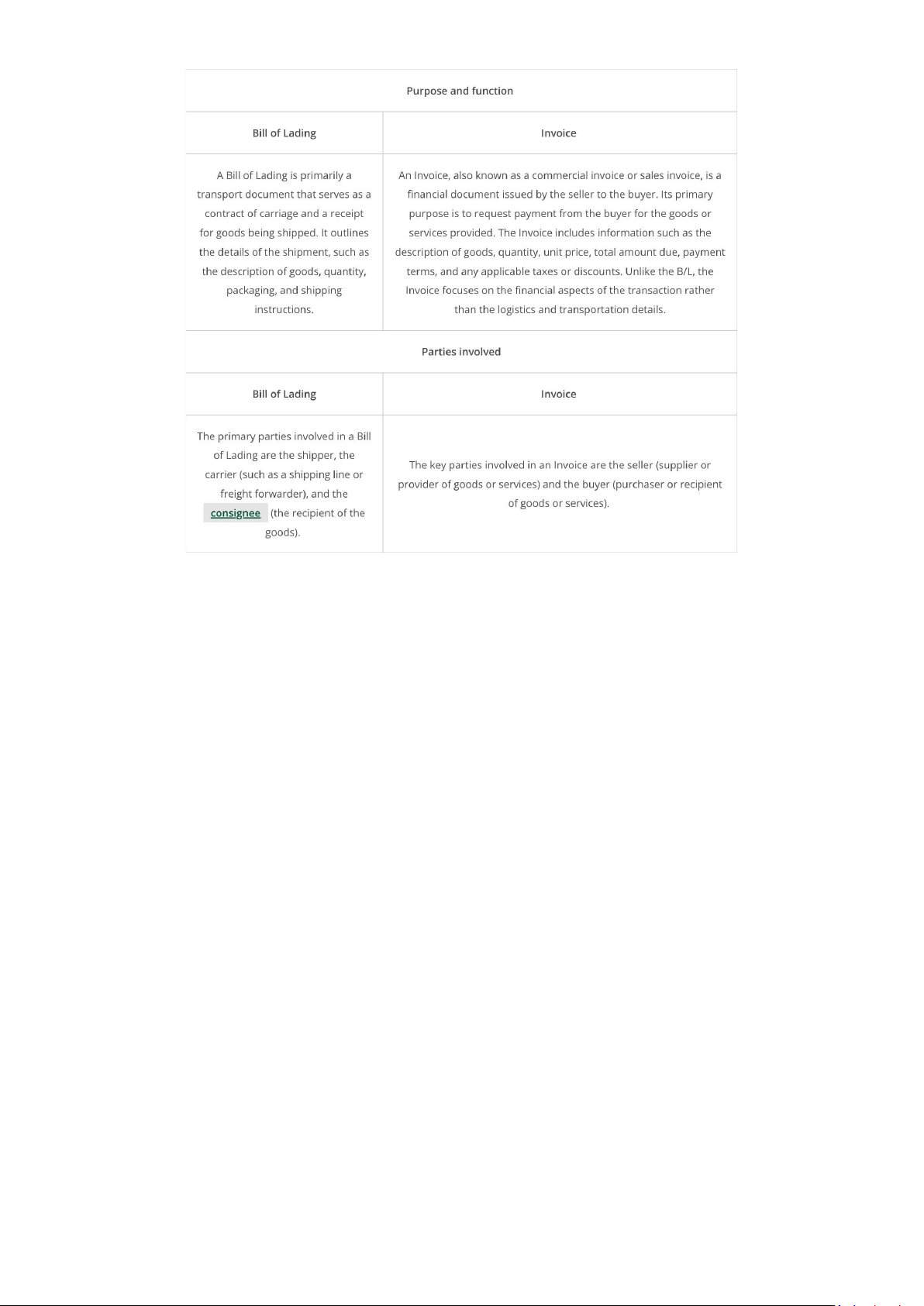

lOMoAR cPSD| 61430673 INVOICE 1. Definition

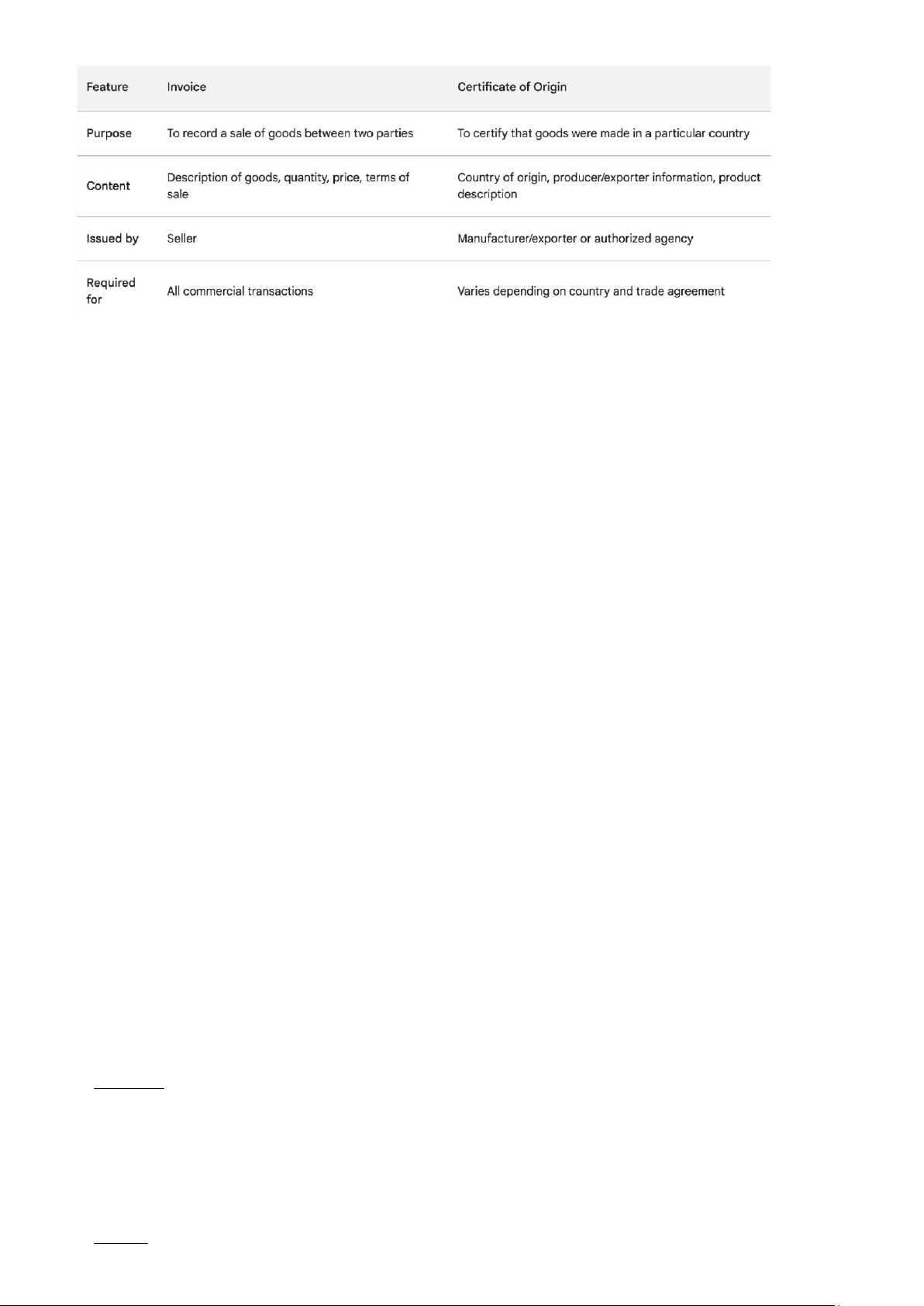

Invoice is a commercial document issued by the seller to insist on the payment for the sale of goods/services,

ensuring that the buyer will get paid after product shipment

2. Types of invoice: - Proforma invoice

A proforma invoice is sent before shipment of goods. This invoice does not contain a means of payment but it

requires precise details of goods, laying the foundation for the buyers’ decisions - Commercial invoice

A commercial invoice serves as proof of sale and facilitates customs clearance. Verification procedures of these

commercial invoices happen in other countries, so any incomplete or incorrect items can result in penalties and

damaged cross-border relationships Commercial invoice Proforma invoice

Terms of payment includes all types of transaction to Terms of payment includes the method that takes the pay for goods highest proportion.

Quantity and total price in commercial invoice has to Quantity and total price in proforma invoice normally

be precise. Final price must be written in words for has an acceptance range of +/- 5-10%. No obligation clearance to say price in words.

Commercial invoice does contain a means of payment, Proforma invoice does not contain a means of utmost important for customs. payment

What is the difference between a commercial invoice and packing list?

Although the information in the packing list and the commercial invoice may seem similar, the two documents

have completely different functions.

Packing List is a document that describes in detail information about the shipment such as size, weight,

unit, ... In addition, it also includes information on how to pack the shipment, brand.

Commercial invoice is proof of commercial transaction between importer and exporter - Custom invoice - Consular invoice - Provisional invoice - Final invoice - Certificated invoice Commercial invoice * Risks

Counterfeit or fraudulent commercial invoices mainly involve two contents: invoice value and description of

goods on the invoice. Fraud occurs when the exporter delivers insufficient goods but still declares the full value

and description of the goods on the invoice in accordance with the L/C to claim money.

Fraudulent tricks or forged commercial invoices are a way that many exporters take advantage of when they

realize that Vietnamese importers want to buy cheap raw materials. When realizing that domestic import

enterprises lack information about the market and prices, some foreign export enterprises offer cheap goods with

very attractive services. To defraud, along with the low offer price, the exporter agrees to let the importer use the

extremely strict documentary credit payment method on export documents, but after payment is completed, both

the exporter and goods all disappear.

There are also cases where exporters and importers collude to fraudulently prepare invoices to present to banks for discounts. * Example

A Chinese company exported a shipment of textiles to a US company using a documentary credit. The commercial

invoice for the shipment was counterfeit. The invoice inflated the value of the goods by 20%. The US company

discovered the counterfeit invoice before making payment. The company reported the fraud to the Chinese lOMoAR cPSD| 61430673

authorities and to the bank that issued the documentary credit. The bank refused to honor the documentary credit,

and the Chinese company did not receive any payment for the shipment.

This case highlights the importance of verifying the authenticity of commercial invoices, especially when using documentary credit.

CERTIFICATE OF ORIGIN (C/O) 1. Definition

A Certificate of Origin (C/O) is a document used in international trade issued by authorities to certify the origin

of goods being exported from them. It specifies the country in which the goods were manufactured, produced, or

processed. The C/O serves as proof that the goods meet the eligibility criteria under trade agreements or

regulations, which can impact customs duties and tariffs

A C/O often include some of the following elements:

+ Consignor, consignee, description of goods

+ A statement of origin of the goods

+ The name, signature or stamp or seal of the certifying authority

Information must be shown on C/O? The goods 2. Types

From aforementioned cautions, C/O is decisive in calculating taxes or tariffs for a specific product, therefore, there are 2 types of C/O:

- Non-preferential COs: also known as "ordinary COs," indicates that the goods do not qualify for reducedtariffs

or tariff-free treatment under trade agreements between countries.

If an exporting country does not have in place a treaty or trade agreement with the importing country, an

ordinary CO will be needed. Or, if a particular product being shipped has been excluded from tariff relief

it must also be declared using an ordinary CO.

- Preferential COs indicate the presence of a free trade agreement or reduced tariffs between countries. 3. Forms

* Non-preferential C/O forms:

+ C/O form B (Certificate of Origin Form B): This is the most common and most used type of certificate of origin

for goods exported from Vietnam to all countries under non-preferential rules of origin. The purpose of C/O form

B is to prove that the goods are manufactured or originated in Vietnam.

C/O form B is granted in the following cases:

● Countries that import goods from Vietnam do not have GSP (Generalized System of Preferences) preferences

● Countries importing goods from Vietnam have GSP incentives but do not allow Vietnam to benefit from these incentives.

● Countries importing Vietnamese goods, having the GSP preferential regime, give Vietnam preferential

treatment. However, the exported goods do not meet the standards of this regime.

+ C/O form Textile (referred to as T form) is granted to textiles and garments exported to the EU under the Vietnam-EU textile agreement.

+ C/O form ICO: granted for products from coffee grown and harvested in Vietnam exported to all countries

according to the regulations of the World Coffee Organization (ICO). C/O form ICO is used for coffee goods of

Vietnamese origin and exported to other countries. There are different types of coffee products: coffee received,

coffee with beans, roasted coffee, instant coffee and many other types of coffee. If a consignment includes many

types of coffee, it must be declared in multiple sets of ICO form C/O for each type of coffee.

+ C/O form Venezuela: issued for exports to Venezuela according to Venezuelan regulations.

* Preferential C/O forms: lOMoAR cPSD| 61430673

+ Form AANZ: issued according to the rules of origin of the ASEAN-Australia-New Zealand Free Trade Area Agreement;

+ Form A: issued for Vietnamese products exported to countries and territories that grant Vietnam the Generalized

System of Preferences (GSP) tariff preference. This is one of the most common forms representing preferential

C/O. Other forms also have the same layout and rules as this form so we will dig into this form.

+ Form AHK: issued according to the rules of origin of the ASEAN-Hong Kong Free Trade Agreement;

+ Form AI: issued according to the rules of origin of the ASEAN-India Free Trade Agreement;

+ Form AJ: issued according to the rules of origin of the ASEAN-Japan Free Trade Agreement;

+ Form AK: issued according to the rules of origin of the ASEAN-Korea Free Trade Agreement;

+ Form CPTPP: issued according to the rules of origin of the Comprehensive and Progressive Agreement for

Trans-Pacific Partnership (CPTPP);

+ Form D: issued according to the rules of origin of the ASEAN Trade in Goods Agreement (ATIGA);

+ Form E: issued according to the rules of origin of the ASEAN-China Free Trade Agreement;

+ Form EAV: issued according to the rules of origin of the Vietnam-Eurasian Economic Union Free Trade Agreement (VN-EAEU FTA);

+ Form S: issued according to the rules of origin of the Vietnam-Laos Free Trade Agreement;

+ Form VC: issued according to the rules of origin of the Vietnam-Chile Free Trade Agreement;

+ Form VJ: issued according to the rules of origin of the Vietnam-Japan Free Trade Agreement;

+ Form VK: issued according to the rules of origin of the Vietnam-Korea Free Trade Agreement;

+ Form X: issued according to the rules of origin of the Agreement on the Promotion of Bilateral Trade between Vietnam and Cambodia. lOMoAR cPSD| 61430673

Certificate of Origin ( C/O ) * Risks

The situation of counterfeit C/O for goods originating from China is becoming increasingly common. Forging

domestic C/O can be done at any time. Before being issued, the C/O can be forged in case the enterprise provides

false evidence (fake documents) or corrects documents: Invoices, Lists, Import/Export Customs Declarations...

While issuing C/O, businesses can fake it when the C/O issuer conducts an inspection and discovers that the goods

do not meet standards, the business replaces or supplements corrected documents or revolves and uses documents

many times... And after the C/O has been issued, businesses can cheat by editing data on the C/O such as changing

the quantity and low value (to reduce tax), product name...

Additionally, The Ministry of Industry and Trade said sanctions for origin fraud are limited and not enough to

deter. For example, falsifying a C/O is only subject to a maximum fine of 40 million VND, while using a fake

C/O is only subject to a maximum fine of 50 million VND, so fraud cannot be prevented.

=> The consequences of fraud and falsification of documents cause businesses to not only lose their reputation

but also lose customers and the market they are focusing on exploiting. More imperatively, fraud and falsification

of documents also seriously affects the image of the country, the reputation of the document-issuing organization

will be affected and the possibility of the enterprise's products removed from the list of preferential tariffs cannot

be ruled out, losing the ability to compete in the international market and acquiring or discounting banks will not be able to recover debts. * Example

In 2022, US Customs and Border Protection (CBP) seized a shipment of counterfeit

C/Os from China. The shipment was destined for a US company that imports textiles. The counterfeit C/Os were

designed to make it appear as if the textiles were made in a country that has a free trade agreement with the United

States, which would have allowed the US company to avoid paying tariffs on the goods.

The counterfeit C/Os were detected by CBP officers during a routine inspection. The officers noticed that the C/Os

were of poor quality and that they contained a number of discrepancies, such as incorrect dates and signatures.

The US company that imported the textiles was not aware that the C/Os were counterfeit. The company was fined

by CBP for importing goods with false documentation.

This case highlights the growing problem of counterfeit C/Os for goods originating from China. Counterfeit C/Os

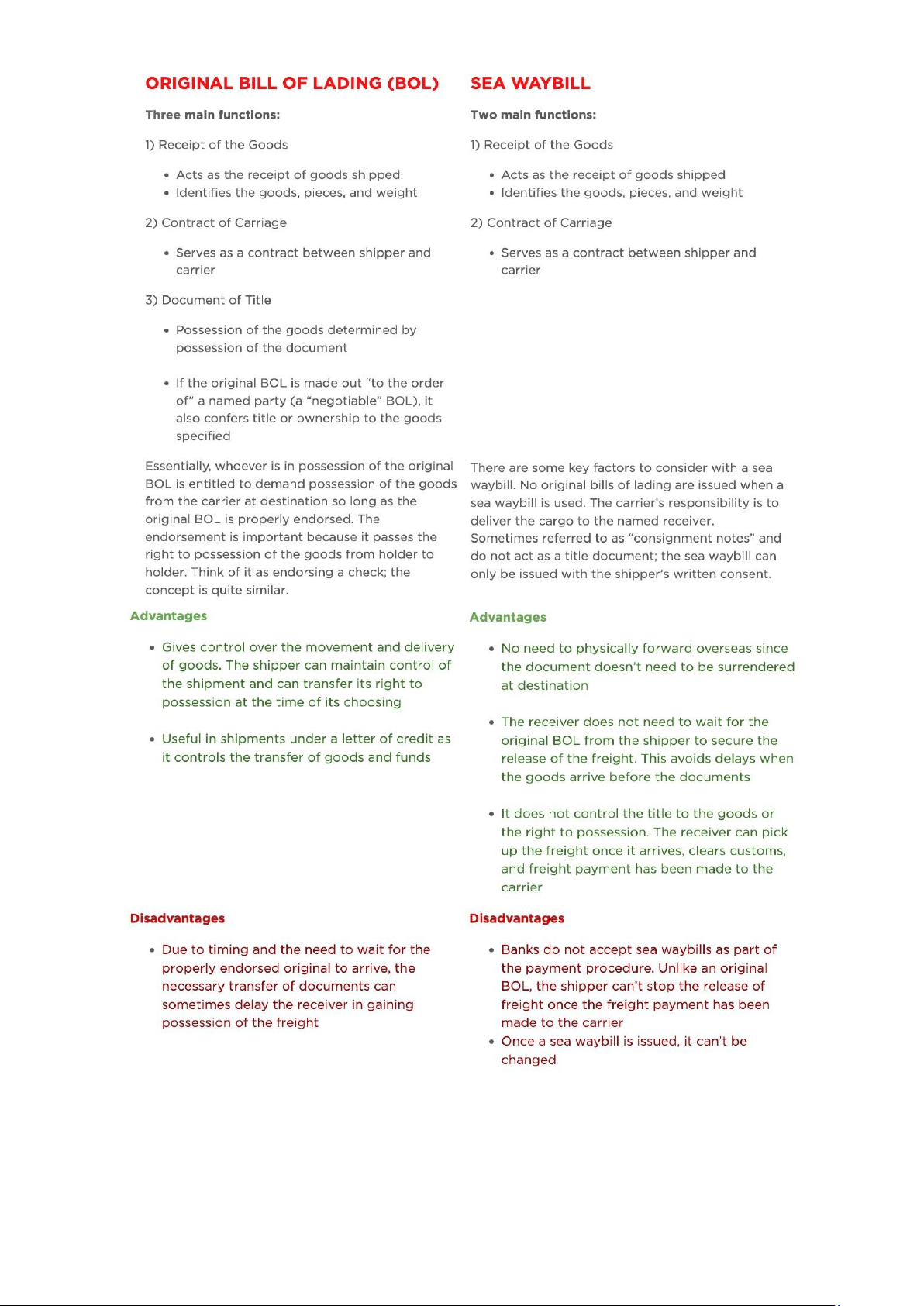

can be used to smuggle goods into the United States without paying tariffs and to avoid customs regulations. BILL OF LADING 1. Definition

Bill Of Lading is one of the essential shipping documents that is a legally recognized record of the goods received

by the shipper on board. It serves as an instrument of agreement between the carrier and the shipper regarding the

freight shipment along with a carrier. It also acts as a receipt for the carrier from the exporter. It is one of the

essential documents used for international shipping, and in this article, we are going to understand its need, types

as well as its use in international trade. 2. Content lOMoAR cPSD| 61430673 - Bill of Lading number

- The complete name and official address of the shipper and the receiver

- Details of the shipping line

- Details of the freight forwarder - The pick-up date

- Name of the vessel used for transport

- Details of the goods (including the number of units, weight, and dimensions)

- Nature of the goods transported

- The packaging material used such as pallets, crates or drums

- If the items transported are hazardous, the BL must be tagged as such and also have the necessary certificationto allow such transport

- Any specific instructions for the carrier 3. Functions

A Bill of Lading has three primary functions:

- It is a contract of carriage between the carrier and the shipper.

This type of BoL essentially serves as evidence of a contract’s existence. It gives the carrier a record of how to

handle the goods. The carrier gets the go-ahead to pick up the goods and deliver them to the final destination once

this BoL is transmitted to the shipper. Without the BoL, you can’t carry out a shipment. It often serves as proof of

ownership over the goods the carrier is carrying.

- It is a receipt for shipped goods.

After the carrier receives the cargo from you to be shipped, it goes through inspection. After which, the carrier

creates a BoL to you which is then handed over to you. All the details for the goods will be stated on the document

and will serve as proof that they’re in good condition. From then on, the responsibility falls into the hands of the

carrier to keep them safe and undamaged, otherwise they can be held liable for those damages. Shippers usually

hold on to the original copy of the BoL until payment is made. This ensures that the consignee has access to their

goods only after the payment, and when the BoL is released.

- It serves as a document of title of the goods

“Title for the goods” signifies that the shipper has transferred the goods to the carrier, and the latter has temporary rights over the goods.

When the goods arrive at the final destination, the receiver (consignee) is given a title for the goods. He should

present this to release the shipment and claim ownership. It acts as evidence of the confirmation of delivery.

The importance of a bill of lading lies in the fact that it’s a legally binding document that provides the carrier and

the shipper with all of the necessary details to accurately process a shipment. This implies that it can be used in

litigation if the need should arise and that all parties involved will take great pains to ensure the accuracy of the document.

Essentially, a bill of lading works as undisputed proof of shipment. Furthermore, a bill of lading allows for the

segregation of duties that is a vital part of a firm’s internal control structure to prevent theft. 4. Types Straight BOL:

In this form, the cargo is consigned to a specified party in either the format of an Ocean BoL or a house bill. The

carrier delivers it only to the party who presented the bill of lading to the carrier. It is not negotiable and cannot

be transferred from one entity to another.

- Bill states that the goods are consigned to a specific person and it is not negotiable.

- Also known as the ‘non-negotiable Bill of Lading’. Order BOL lOMoAR cPSD| 61430673

This bill of lading gives an option to the consignee to sell or transfer ownership rights to a third party. It is also

known as a “to order” bill of lading, and similar to a negotiable instrument, it may be endorsed over to another

party, such as a bank or financing institution.

- BOL uses express words to make the bill negotiable.

- I.e.: delivery to ABC Ltd or assigns.

- Also known as ‘negotiable Bill of Lading Bearer BOL

A bearer Bill of Lading (B/L) is a type of document that serves as a negotiable instrument in international trade.

Unlike other types of B/Ls, which are typically issued to a named consignee or order, a bearer B/L is issued to

“bearer” or “to the bearer.” This means that whoever is in possession of the physical document has the legal right

to claim the goods mentioned in the B/L.

- BOL states that delivery shall be made to whoever holds the bill lOMoAR cPSD| 61430673 Seaway Bill

Seaway Bill only serves two of those three functions. A Seaway Bill acts as a Contract Of Carriage and a

Receipt of the Goods, but not as a Transfer of Title Ownership

A Sea Waybill is used when the shipper decides to release ownership of the cargo immediately. This means

that the goods can be delivered to the person identified in the document, and they will simply have to verify their

identity instead of presenting a document to claim the freight.

When the shipment is loaded, the shipper receives a SWB simply as a reference. In this case, neither the

shipper nor the importer are obligated to submit any additional documents to the carrier, and therefore the cargo

is released as soon as it is available at the port

-> For this reason, Seaway Bills are often used interchangeably with the terms “Express Bill Of Lading” or

“Straight Bill Of Lading”.

Sea Waybill only plays an evidential function and does not give title to the goods (non negotiable).

When is it better to use a Sea Waybill?

- When there is a high degree of trust between the shipper and the consignee.

- When the goods will not be traded or sold during transport.

- When the goods are paid for with an approved line of credit. lOMoAR cPSD| 61430673 Air Waybill (AWB)

- All documents accompanying the goods are shipped through international air couriers.

- It can also be referred to as an air consignment note.

- AWB is a standard form distributed by the International Air Transport Association (IATA).

- Serves as a contract of transportation and is non-negotiable. lOMoAR cPSD| 61430673

Differentiate between a certificate of origin, a commercial invoice, and a bill of lading

- Certificate of Origin: A document that certifies the country of origin of goods being exported,

providinginformation about the place where the goods were manufactured or processed.

- Commercial Invoice: A document issued by the seller to the buyer, itemizing the goods or services

provided,their quantity, value, and other relevant details for customs and payment purposes.

- Bill of Lading: A document issued by a carrier or their agent, acknowledging the receipt of goods forshipment,

specifying the terms of transportation, and serving as a title of ownership for the goods.

- A Certificate of Origin confirms the country of origin of exported goods. A Commercial Invoice

providesdetails of the goods and services involved in a transaction. A Bill of Lading serves as a receipt and

contract for the transportation of goods.

[?] Hầu hết các doanh nghiệp sử dụng vận tải đường biển. Trình bày ý kiến về vấn đề trên 1. Definition 2. Function 3. Comparison

- Cost: B/L is the most economical shipping method, while AWB is the most expensive method. Sea transport

is the lowest cost form of transport among all types of transport. This is because ships have large tonnage, can

transport large volumes of goods, and fuel and labor costs are also lower than other forms of transport.

- Safety: Sea transport is safer than other forms of transport. This is because ships are designed with many

safety measures; At the same time, sea traffic is extremely open, with few vehicles moving, the sea routes are

strictly controlled, helping the transportation process go smoothly and accidents with means of transport are

very rare. sea. Meanwhile, AWB may have a higher risk depending on weather conditions and other factors

such as type of goods (liquid), equipment,...

➔ With the above advantages, sea transport has become the top choice of businesses in transporting goods.

In the coming time, as the demand for goods transportation of businesses increases again, sea transport

will continue to develop and play an important role in the business activities of businesses. 4. Vietnam

According to statistics, about 80% of global trade volume is transported by sea. Maritime transport plays an

important role in the logistics service chain, especially in Vietnam as a country with a long coastline, near

important maritime routes of the world. Based on the situation of the international transport market and in the

context of the Vietnamese government's participation in signing bilateral and multilateral free trade agreements lOMoAR cPSD| 61430673

and maritime transport agreements with countries around the world, The volume of goods through Vietnam's

seaports has tended to grow high and steadily in recent years

Vietnam currently has a modern overall seaport system, meeting the economy's needs for export and import of

goods. On July 8, 2022, Deputy Prime Minister Le Van Thanh signed and promulgated Decision No. 804/QDTTg

announcing the list of Vietnamese seaports. According to this Decision, the list of Vietnamese seaports includes

34 seaports, including 02 special ports, 11 type I seaports, 07 type II seaports and 14 type III seaports. In particular,

cargo throughput capacity is increasing, receiving more and more large tonnage ships. Vietnamese seaports in Hai

Phong, Ho Chi Minh City, Ba Ria - Vung Tau are on the list of 50 seaports with the largest cargo throughput in the world.

News from the Vietnam Maritime Administration (Ministry of Transport), in the first 10 months of 2023, the total

volume of goods through seaports is showing a positive trend. Accordingly, the volume of goods through the

seaport is estimated to reach 624.559 million tons, an increase of 3% over the same period in 2022.

In Vietnam, although sea freight transport accounts for a small proportion in transportation structure, the rotation

accounts for a quite high proportion. In 2022, shipping goods by sea only accounts for 5.4% of the total volume

of goods transported but accounts for 53.4% of the volume of goods circulated. BILL OF EXCHANGE 1. Definition

Bill of Exchange is a type of negotiable instrument/valuable papers, issued by the drawer, demanding the

unconditional payment of a specified amount either upon request or at a specific future date to the designated

beneficiary (Article 2, Section 4, the Vietnamese Law on Transferable Instruments).

Luật hối phiếu Anh 1882 (Bill of Exchange Act of 1882).

Luật thương mại thống nhất của Mỹ năm 1962 (uniform commercial codes of 1962 UCC)

Luật thống nhất về hối phiếu (Uniform law for bills of exchange – ULB), được ký tại Giơ – ne – vơ (Genève) năm 1930.

Ủy ban thương mại quốc tế của Liên hợp quốc kỳ họp thứ 15 tại New York – thông qua văn kiện A/CN 9/211

ngày 18/2/1982 về hối phiếu và lệnh phiếu quốc tế (International Bills of Exchange and Promissory notes). 2. Characteristics

Bill of Exchange has 3 basic characteristics.

- The abstraction or independence of the debt recorded on the bill of exchange.

+ No need to state the reason for making the B/E,meaning that the value of payment on the B/E is completely

independent and not dependent on the reason for this payment.

+ The B/E is legally independent, meaning that the legal validity of the B/E does not depend on the reason for making the B/E.

+ With the abstract, the B/E can be abused for counterfeit / false issuance. Laws in many countries strictly

prohibit the issuance of counterfeit/ false B/E.

- The compulsory payment obligation of Bill of Exchange.

+ The drawee is obligated to pay according to the contents of the B/E, and cannot give any reasons to refuse

to pay unless the B/E has been made and transferred illegally

+ The drawer is also responsible for paying theB/E to the beneficiary unconditionally if the B/E is not paid by the drawee

- The negotiability of Bill of Exchange 3. Participants -

Drawer (Người ký phát): the person who makes and signs for issuing the B/E, who is the creditor and has theright to order payment. -

Drawee / Payer (Người bị ký phát): the person who receives payment order, who is the debtor and

obligated topay the amount of money specified on the B/E. lOMoAR cPSD| 61430673 -

Beneficiary / Payee (Người thụ hư ở ng): the person who receives the interest and value of the B/E,

meaningthe holder/bearer (người cầm phiếu) of the B/E. The holder of the B/E:can be the drawer, or someone

nominated and specified on the/E by the drawer, or someone who receives the B/E transfer by endorsement or

hand. - In addition, there is also acceptor (người chấp nhận hối phiếu);avaliseur (người bảo lãnh hối phiếu);

endorser / assignor(người chuyển nhượng hối phiếu) 4. Functions

- As a means of payment:

By relying on the B/E, relevant parties can fulfill their payment rights and obligations, specifically:

+ B/E is a means for the creditor to demand payment from the debtor and for the debtor to transfer money to the creditor.

+ B/E fully reflects all the elements serving for payment: payer (drawee), payee (beneficiary),amount to be

paid, payment term, and payment place…

- As a means of guarantee:

+ B/E is secured by a real value.

+ Therefore, B/E is a means of guarantee for relevant parties:

● Guaranteeing the drawer that they have legal basis to demand payment and will be paid.

● Guaranteeing the drawee that making payment means receiving a real value in return.

● Guaranteeing the beneficiary that they feel secure about holding B/E, as if they are holding an asset.

- As an instrument of providing credit):

+ In commercial credit, when issuing and transferringB/E, the seller has transferred the buyer’s debt to a third

party, reducing the risk for the seller. Therefore, B/E is an effective instrument for granting credit.

+ In bank credit, B/E is an instrument for banks to provide credit to customers more easily and quickly through

transactions of mortgaging and discountingB/E

Some cases of fake bills of exchange in Vietnam 2012:

4 people (including 1 Chinese and 3 Vietnamese people, residing in Ho Chi Minh City and Dong Nai) went to

Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietinbank Dong Nai) to send 140 bills of

exchange, each bill worth 1 million euros. While carrying out the procedure to calculate the asset retention fee,

the bank staff became suspicious and quickly reported it to the police. The Security Investigation Agency of Dong

Nai Police discovered that the case showed signs of "storing, transporting and circulating fake valuable papers".

On August 2, Dong Nai Provincial Police said it had requested the State Bank of Vietnam - Dong Nai branch to

recall 140 bills of exchange with a face value of 1 million euros, 18 bills of exchange with a face value of 10,000

USD and 2 bills of exchange with a face value of 1 million euros. 1 million USD because it was counterfeited for fraud purposes. 2018:

Can Tho City Police arrested an Australian overseas Vietnamese for fraudulently appropriating more than 3 billion

VND and seized 2 bills of exchange worth more than 5 billion USD. According to verification results from the

Federal of the United States (FBI), no competent agency of this country has issued the above two bills of exchange. Current situation

a, International payment services provided by commercial banks

In Vietnam, commercial banks hold a large market share of international payments including: VCB, Vietinbank,

BIDV, ACB, Agribank, Techcombank, SCB, VIP, Abbank, Sacombank, Lienvietpostbank, Eximbank. The list of

international payment products of Vietnamese commercial banks includes:

Remittance: transfer money in and out

Collection of payment: export and import collection lOMoAR cPSD| 61430673

Documentary credit: L/C issuance, L/C payment, Authorization to receive goods, Endorsement of bill of lading,

Issuance of goods receipt guarantee under L/C, Notice, L/C amendment, Confirmation L/C, Document receipt

and payment service, Discount with recourse, Discount without recourse, L/C transfer

Bills of exchange are used as a means of serving international payment methods such as collection of payment and documentary credit.

b, Current state of use 2013-2017

In terms of export payments, in 2013, the proportion of remittance accounted for only 45%, collection of payment

and L/C accounted for 55%, which indicates that drafts were still commonly used in international payments.

However, the rate of remittance increased rapidly in the 4-year period and reached 65% in 2017, while L/C and

collection of payment decreased gradually.

In terms of import payments, the proportion of payment methods also changed similarly to that of export. In 2013,

banks mainly paid through collection of payment and L/C (accounting for 63%), remittance payments accounted

for a smaller proportion (only 37%). However, in 2017, remittance payments increased and reached 50%.

Covid-19 and after Covid-19

Due to social distancing, almost all productions and business activities were stagnated. The L/C procedure

revealed more limitations in terms of time (longer time), cost (higher cost) and more complicated procedures.

Therefore, bills of exchange and documentary credits were used less in international payments. Instead,

commercial banks were actively promoting money transfer procedures by offering many incentives to import,

export businesses when transferring money to foreign countries. Vietinbank

2021: VietinBank launched the program "VietinBank SME Stronger 2021 - One fee only, transfer money freely”

with many attractive incentives. In detail, small and medium-sized business customers wishing to transfer foreign

currency at VietinBank will have the opportunity to opt for the international payment fee program package with

a fee reduction of up to 30%. When participating in the program, customers will benefit from promotions and

incentives such as: Only need to make a lump sum payment for all foreign currency transfers outside VietinBank

system (both domestically and internationally); Unlimited number of foreign currency transfers during the validity period of the fee package. VP Bank

2022: VPBank is implementing a series of incentives to encourage SME customers to use TTR Online services:

100% free online international money transfer fees and electricity fees, foreign currency transaction limit up to 3

million USD/transaction, along with other incentive programs depending on the Bank's regulations from time to time. MB Bank

From June 1, 2023 to August 30, 2023, business customers with a revenue of less than VND1,000 billion using

the online international money transfer service on the BIZ MB Bank digital banking platform will have to pay no

fee of money transfer and telegraph until June 30, 2024. At the same time, all international money transfer

transactions performed on BIZ MBBank also enjoy favorable exchange rates depending on the transaction

currency, up to a maximum of 80 points compared to the quoted exchange rate.

With the program "The more transactions made, the lower the fee" customers will receive up to 90% discount on

international money transfer fees, only from 10 USD - 100 USD/transaction.

With the "Loc Phat International Money Transfer" program, customers will receive a fee of 68 USD/first 5

international money transfer transactions; unlimited transaction value; Up to 50% discount on fees and

telecommunication fees for the next 5 transactions, free incoming money transfer.

The "Super cheap, multi-limit international money transfer” program is for customers who have fixed money

transfer costs according to their business plan. Accordingly, SHB provides packages with money transfer limits

from 100,000 USD to 5,000,000 USD/package, customers pay a lump sum payment and use for 6 or 12 months;

Unlimited number of transfers, unlimited number of packages purchased. lOMoAR cPSD| 61430673 Bill of lading (B/L): * Risks -

The exporter presented a full set of 3/3 original Bills of Lading to the bank to request a discount, but in

realitythe exporter colluded with the shipping line to issue a 4th original bill of lading sent directly to the importer.

As a result, the importer took the entire shipment without paying, leading to the discounting bank not being able to collect the debt. -

The B/L was falsified by copying the entire content of a real B/L, forging the form and forging the shipping

company's signature and using this bill of lading to apply for a discount at the bank. - The exporter prepares many

sets of documents and many B/Ls for the same L/C and requests discounts at different banks. -

The exporter's set of documents are consistent, but the issuing bank informs them that the set of documents

isdifferent and sends it back to the negotiating bank. In the set of documents returned to the negotiating bank, an

original copy of the bill of lading was replaced with a fake bill of lading. The fraudster used the original bill of

lading to pick up the goods without paying.

Usually, in the above type of fraud, the exporter will collude with some shipping company employees to create

fake bills of lading or delivery documents. The purpose of forging this B/L is to fraudulently request a discount

or advance money from banks when in fact there is no goods, or the fraudster swaps the bill of lading to appropriate

the goods without paying. Such cases of fraud are very sophisticated and only the forwarder or shipping company

can detect them through identifying the bill of lading form and checking the signature. Therefore, according to

US Customs regulations, when detecting cases of commercial fraud in transportation, transportation businesses

will be put on the "black" list of illegal transporters. Businesses will therefore have difficulty finding business

markets and cannot sign contracts. * Example

A US company imported a shipment of electronics from a Chinese company using a documentary credit. The

commercial invoice and packing list for the shipment were authentic, but the bill of lading was fake.

The Chinese company was trying to defraud the US company by receiving early payment for the goods without

actually delivering them. The company replaced the original B/L with a fake one in order to obtain payment from the negotiating bank.

The negotiating bank discovered the fake bill of lading before making payment to the Chinese company. The

bank refused to honor the documentary credit, and the Chinese company did not receive any payment for the shipment.

This case highlights the importance of verifying the authenticity of all documents, especially bills of lading, when

using a documentary credit. It also shows how criminals can use fake bills of lading to commit fraud. ACCEPTANCE 1. Definition

Acceptance of a bill of exchange is the act of the drawee committing to pay unconditionally when the bill of exchange matures.

It is the drawee's unconditional commitment to payment when the B/E comes due. *Method of carrying out:

-Write directly on the B/E: Just below the drawee name and address, the drawee writes the phrase“For

Acceptance ' / “ Accepted” or writes nothing, then notes the date and signature. -Acceptance by letter or (wireless) message.

*Acceptance of B/E is unconditional

- Sight B/E does not require acceptance. Time/ Usance B/E is not obligated to make acceptance, but it isrecommended to do so.

-B/E must be presented (either directly or through registered airmail) for acceptance prior to the due date of

payment. The Date of presentation can be agreed and indicated on the B/E.

- In the case of the B/E with a term as "X days after sight of this B/E“, acceptance is required and the date mustbe

clearly stated because the date of acceptance is the date for sight of B/E. For this type of B/E, if the date of lOMoAR cPSD| 61430673

presentation is not agreed, according to the ULB and the Vietnam’s Law on Negotiable Instruments, the term of

presenting B/E for acceptance is one year from the date of B/E issuance

- The drawee can make acceptance for paying a part of B/E. In this case, the drawee only needs to write

theaccepted amount and sign, without further explanation.

- The acceptance date is not mandatory except for the type ofB/E with the term "X days after sight of this B/E”.* In international trade:

- In the collection method, if B/E is accepted by the drawee who is the importer, this B/E will be called

"tradeacceptance” (“chấp phiếu thương mại”).

- In the document credit method, if B/E is accepted by the drawee who is the bank opening L/C (the issuingbank),

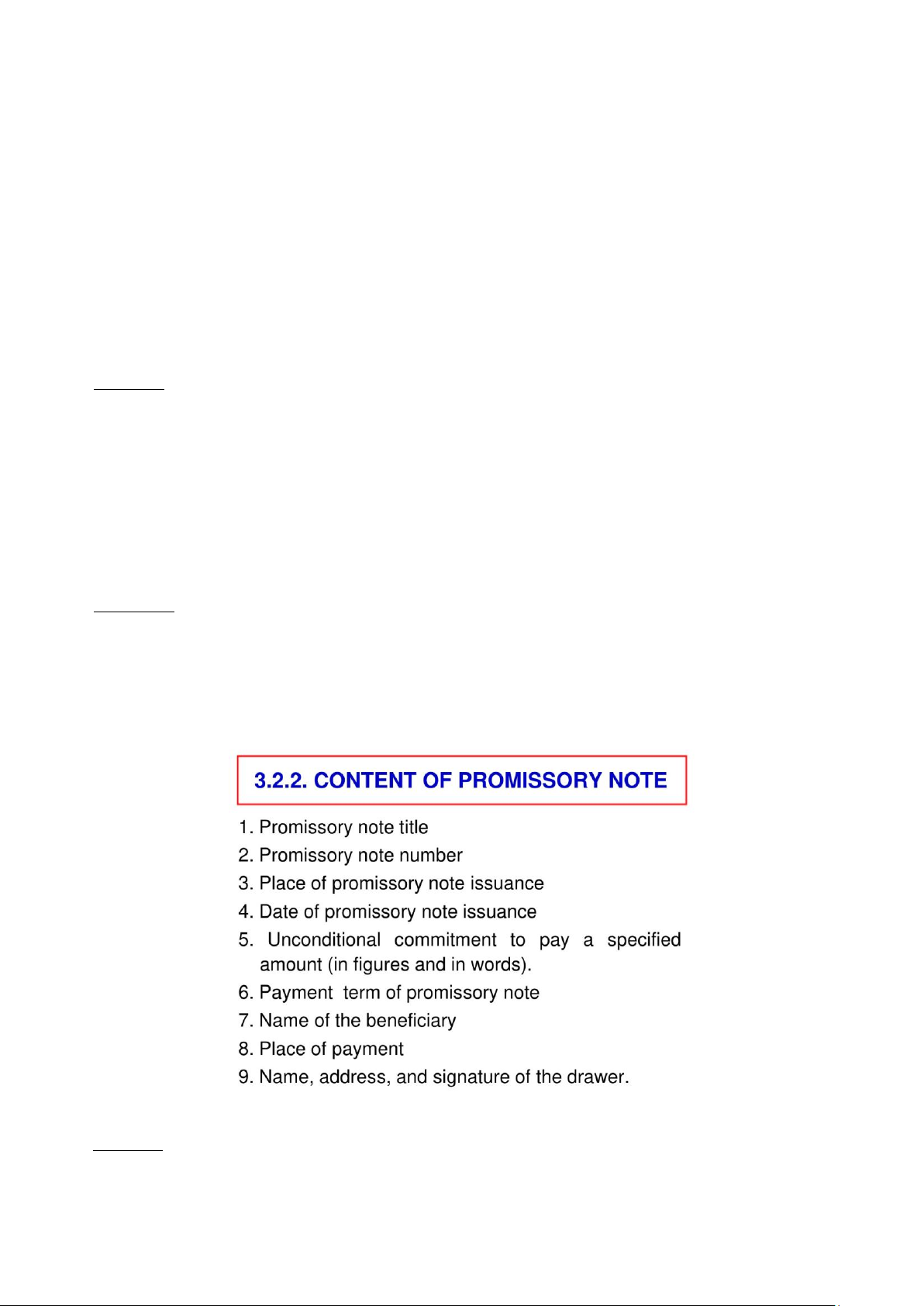

it will be called “banker’s acceptance” (“chấp phiếu ngân hàng”) PROMISSORY NOTE 1. Definition

According to Item 1, Article 83, Part IV of BEA 1882:“A promissory note is an unconditional promise in

writing made by one person to another signed by the maker,engaging to pay, on demand or at a fixed or

determinable future time, a sum certain in money, to, or to the order of a specified person or to bearer.”

According to Item 3, Article 4 of Vietnam’s Law on NegotiableInstruments 2005:“A promissory note is

a valuable paper written by the issuer,committing to unconditional payment of a specified amount on demand or

at a fixed future time to the beneficiary”

-> In summary, a promissory note is a debt document written by a debtor,committing to unconditionally

pay the creditor a certain amount within a specified period 2. Participants

- Drawer (Ngườ i ký phát): the person who makes and signs the promissory note, is the debtor, and commits to

pay the beneficiary indicated on the promissory note

-Beneficiary / Payee (Người thụ hư ở ng): the person who owns promissory note, receives the benefit and value

of promissory note. The beneficiary can be nominated namely, or nominated with “to the order”, or the bearer of a promissory note.

- In addition, there are also related parties such as guarantors, endorsers, discounters… of promissory note CHECK 1. Definition

A check is an unconditional written order of an account holder requesting the bank to deduct from the account

specified amount for paying to the person named on the check, or to the order of this person, or to the bearer of check. lOMoAR cPSD| 61430673 2. Participants

-Drawer (Người ký phát): the person who is obligated to pay the check value to the beneficiary named on check.

-Beneficiary (Người thụ hưởng): the person who receives the amount of the check. The beneficiary can be

nominated namely, or nominated with “to the order”, or the bearer

-Paying bank (Ngân hàng thanh toán): is the bank of the drawer, which holds the deposit account of the drawer

and makes payment to the beneficiary.

-Collecting bank (Ngân hàng thu hộ ): is the bank of the beneficiary, responsible for forwarding the check to the

paying bank to collect the check value for the beneficiary MODES OF PAYMENT

There are 3 popular international payment methods today:

- Money Transfer (T/T): Is the simplest, fastest and lowest cost payment method among current

internationalpayment methods. This method is often used when the parties have a long-term purchase and sale

relationship and a good payment history.

- Collection method (D/P and D/A): A payment method in which banks process documents in accordance withcollection instructions.

- Documentary credit (L/C): is the most complicated and expensive method among international paymentmethods.

Usually used when the parties are new to the transaction and do not yet trust each other.

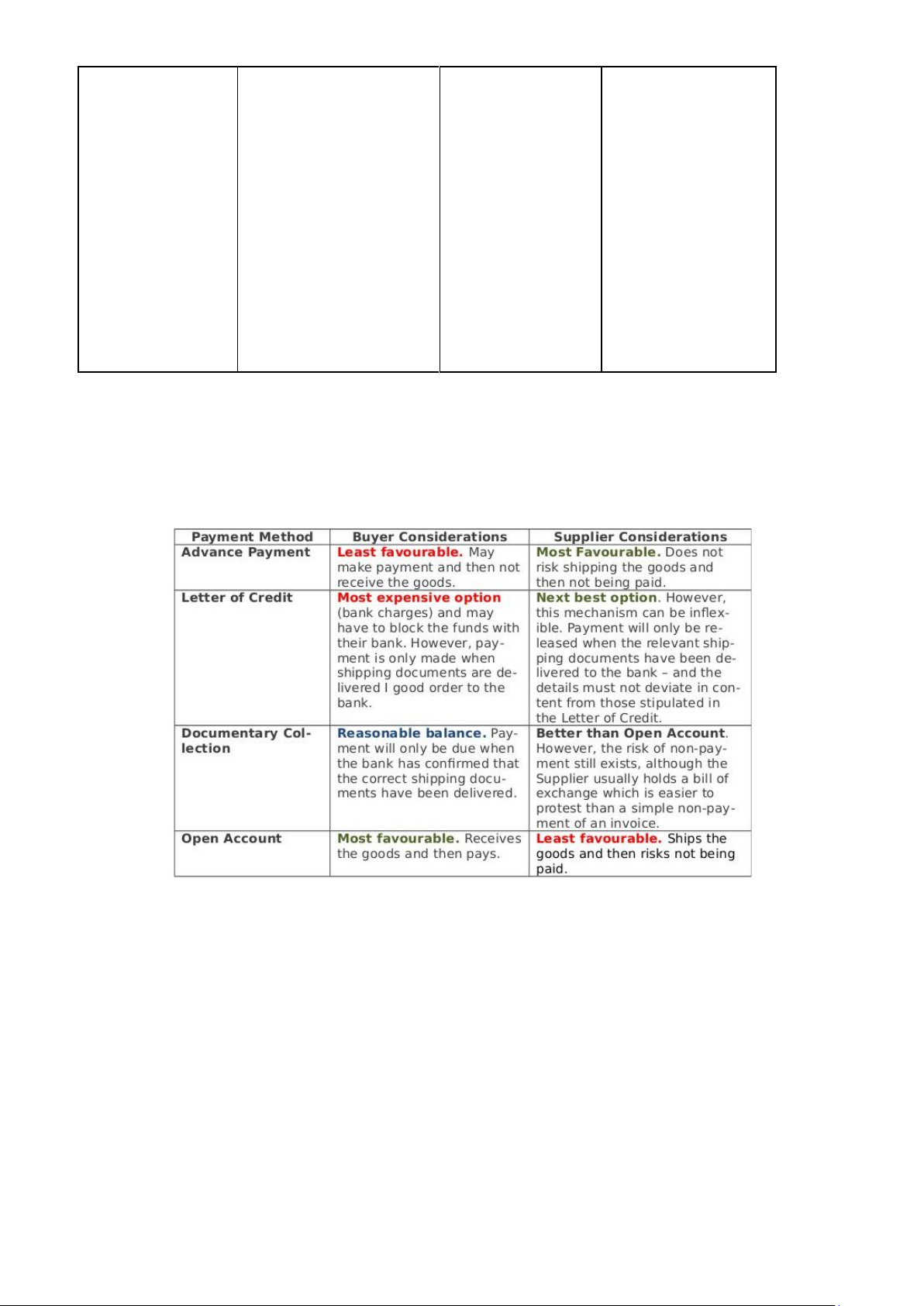

When it comes to international trade, there are several modes of payment that can be used. Some of the most

common modes of payment include:

- Cash in Advance: is a payment method which requires importers to pay fully and before the shipment is received *

Situations using Cash in advance :

- The importer is a new customer and/or has a less-established operating history.

- The importer’s creditworthiness is doubtful, unsatisfactory, or unverifiable.

- The political and commercial risks of the importer’s home country are very high.

- The exporter’s product is unique, not available elsewhere, or in heavy demand.

- The exporter operates an Internet-based business where the acceptance of credit card payments is amust to remain competitive. Pros Cons

The ability to receive goods even when Immediate effect on cash flow

the exporter no longer wants to deliver management them for some reason

Risk of not receiving shipment, Little Buyer

Due to prepayment, the importer can recourse if shipment doesn't arrive.

negotiate with the exporter for a discount

Becomes insurance-heavy otherwise.

Gets paid before goods are received

No way to compete in the market, all

competitors have this opportunity.

Savings on management and credit Seller control costs

Because of receiving prepayment, the

financial capability of the exporter is strength

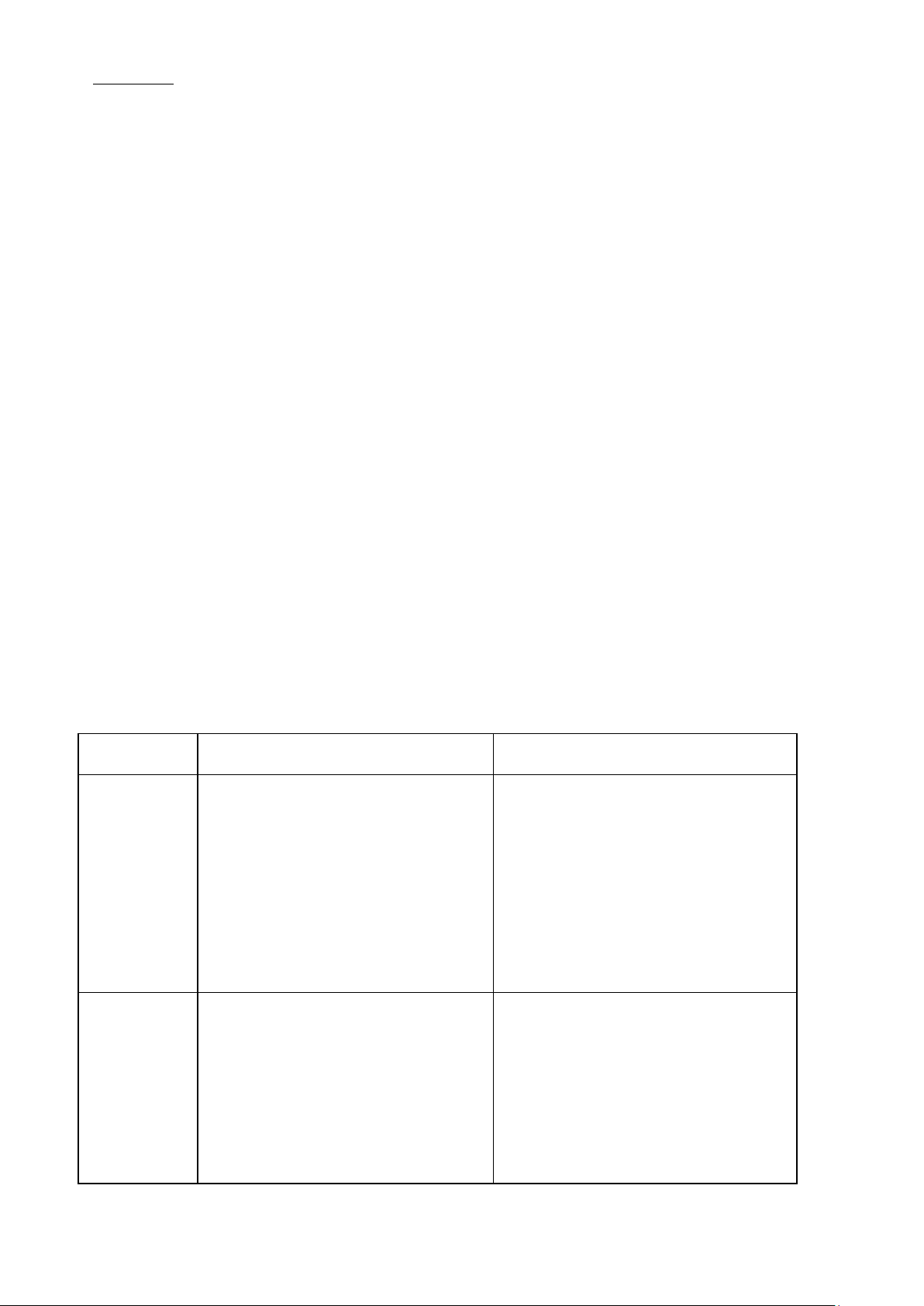

- Open account: This is where the buyer agrees to pay the seller at a later date, typically 30 to 90 days after the

goods have been shipped or the services have been provided. *

Situations using Open Account Method : lOMoAR cPSD| 61430673

- There is an established relationship between the parties

- The exporter wants to establish a long-term partnership with the importer

- There is a binding sales agreement

- The exporter has obtained a credit insurance to cover the potential losses

- The importer is a reputable and trustworthy company with a high credit score- The goods are of small value

- Collection of payment: This is where the seller uses a bank to collect payment from the buyer. The bank acts

as an intermediary, ensuring that the goods are shipped before payment is released. *

Situations using Collection of Payment : Open account trading does not always provide

sufficientsecurity, for instance, if the exporter does not know the importer well enough to hand over the

goods before payment is made. In such cases, the use of international collections can reduce risks.

International collections ensure that the documents are not handed over until the importer has paid for the

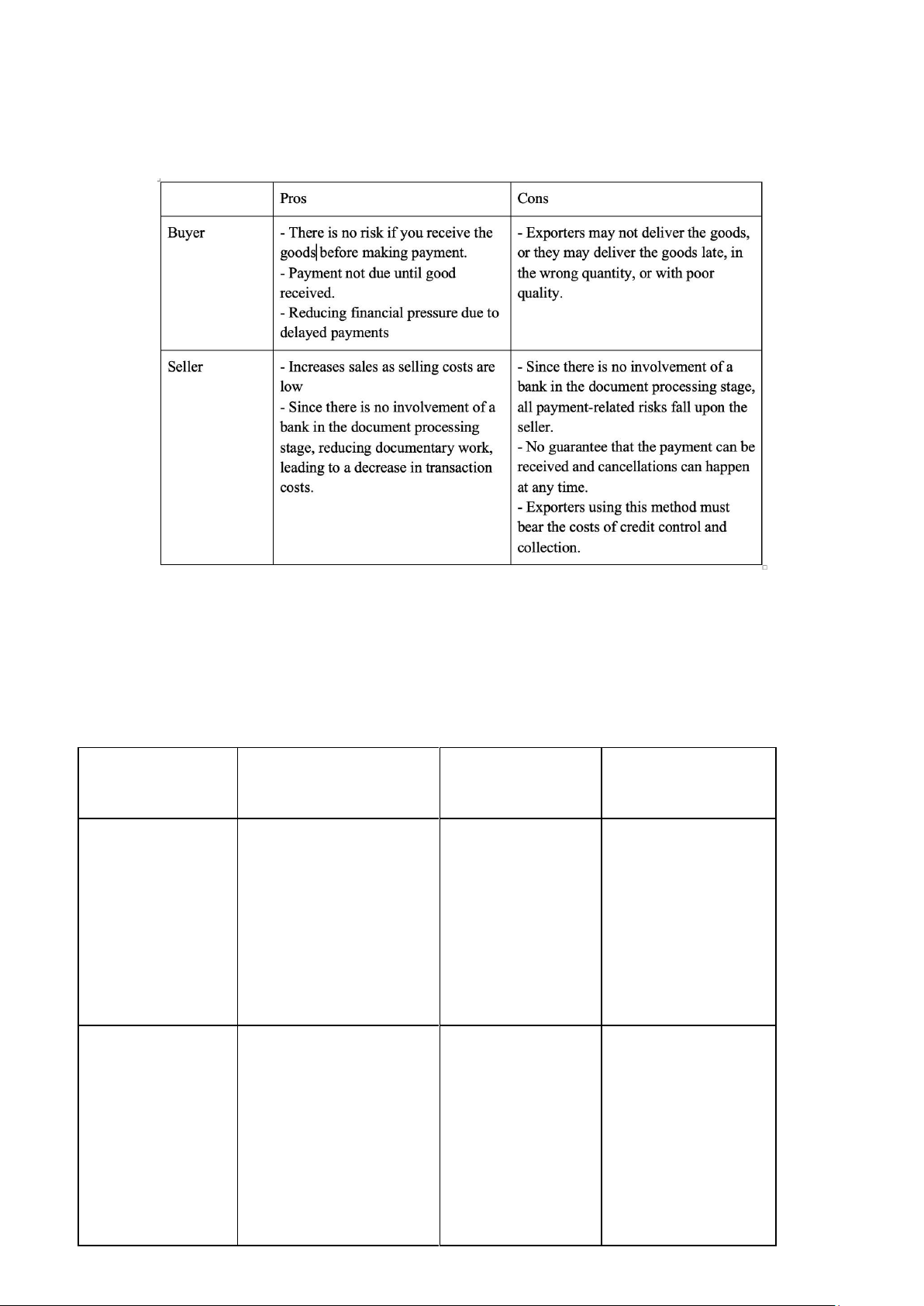

goods or accepted a bill of exchange, that is, a guarantee for payment on a fixed future date Modes of payment Main characteristic Pros Cons Cash in advance

- Buyer must pay in full -Make sure the seller -Buyers must pay in

before receiving goods or receives the money advance, which can

services. -The seller does before the transaction. cause difficulties for

not have to bear the risk of -Safe for sellers. buyers, especially in payment. large transactions. -Can lead to reducing the ability to attract customers. Open account - The buyer receives -Create long- - Risk of not

thegoods or services in term relationships and receivingmoney if the

advance and commits to pay trust between parties. buyer does not pay on

after a specified period of - Allows buyers to time. time. receive goods first - Requires credit - Based on the and pay later. checksand relationshipand trust good between the buyer and risk seller. management. lOMoAR cPSD| 61430673 Collection of - The process of - Allows - May require more payment

collectingmoney after the buyers

toreceive work to collect money

transaction has been made, goods first and pay after the transaction.<-

usually after sending an later without prior Need to carefully invoice to the customer. commitment. monitor and manage - Does not require the - Creates customer finances.

buyerto commit to payment flexibility inthe

before receiving the goods. - payment process. This process focuses on collecting money after transactions.

- Letter of credit: This is where the buyer's bank issues a letter of credit guaranteeing payment to the seller. The

seller can then use this letter of credit to obtain payment from their own bank.

L/C stands for Letter of Credit. This is a payment method that is commonly used in international trade. In this

method, the buyer's bank issues a letter of credit to the seller, guaranteeing payment for the goods or services

being sold. The seller can then use this letter of credit to obtain payment from their own bank. The letter of credit

serves as a form of security for both the buyer and the seller, ensuring that the transaction is completed smoothly and without any issues

[?1]. You are an exporter, which methods in international payment are beneficial to use and what are the benefits?

Letter of Credit (L/C): A Letter of Credit is a widely used method of international payment that offers a high level of security for exporters.

- Payment Security: With an L/C, the buyer's bank guarantees payment to the exporter, provided the exportermeets

the specified terms and conditions. This reduces the risk of non-payment or payment delays.

- Risk Mitigation: The L/C can include conditions that protect the exporter, such as requiring the buyer toprovide

certain documents or fulfill specific obligations before payment is made. This helps mitigate risks associated

with non-compliance or non-performance by the buyer.

- International Acceptance: L/Cs are widely accepted in international trade, making it easier to engage withbuyers from different countries.

Documentary Collection: Documentary Collection is another method of international payment that offers certain benefits to exporters:

- Flexibility: Documentary Collection can be tailored to suit the needs and relationship between the exporter

andthe buyer. It offers different options, such as documents against payment (D/P) or documents against lOMoAR cPSD| 61430673

acceptance (D/A), allowing you to choose the level of risk and payment terms that align with your business

requirements. - Lower Costs: Documentary Collection generally incurs lower costs compared to other payment

methods like Letters of Credit.

- Relationship Building: Documentary Collection allows for direct communication between the exporter and

thebuyer, fostering a closer relationship and potentially leading to future business opportunities.

Cash in Advance: In some situations, an exporter may request an advance payment from the buyer before shipping

the goods. This method offers the following benefits:

- Cash Flow: Advance payment provides immediate cash flow, allowing you to cover production costs,

purchaseraw materials, or invest in your business.

- Reduced Risk: With advance payment, you eliminate the risk of non-payment or payment delays since youreceive the funds upfront.

- Competitive Advantage: Offering advance payment as an option may make your products more attractive

tobuyers who prefer to pay upfront or have limited access to other payment methods

2. You are an importer, which methods in international payment are beneficial to use and what are the benefits?

Letter of Credit (L/C): A Letter of Credit is a widely used method of international payment that offers benefits for

importers. Here are some advantages of using L/C: -

Payment Security: With an L/C, the exporter is guaranteed payment as long as they meet the specified

termsand conditions. This provides assurance to the importer that payment will only be made once the agreed-

upon conditions are fulfilled. -

Risk Mitigation: The L/C can include conditions that protect the importer, such as requiring the exporter

toprovide certain documents or fulfill specific obligations before payment is made. This helps mitigate risks

associated with non-compliance or non-performance by the exporter. -

Trust Building: Using an L/C demonstrates a commitment to fulfilling payment obligations, which can

helpestablish trust and credibility with the exporter. This can be particularly beneficial when dealing with new or unfamiliar trading partners.

Documentary Collection: Documentary Collection is another method of international payment that offers benefits to importers: -

Flexibility: Documentary Collection can be tailored to suit the needs and relationship between the

importer andthe exporter. It offers options such as documents against payment (D/P) or documents against

acceptance (D/A), allowing you to choose the level of risk and payment terms that align with your business requirements. -

Cost Savings: Documentary Collection generally incurs lower costs compared to other payment methods

likeLetters of Credit, which can be advantageous for importers seeking to minimize transaction expenses. -

Direct Communication: Documentary Collection allows for direct communication between the importer

andthe exporter, leading to a closer relationship and potentially facilitating smoother business interactions.

Open Account: In an open account arrangement, the importer makes payment to the exporter after the goods have

been received or within a specified period.While it may involve a higher level of risk for importers, there are potential benefits: -

Cash Flow Management: By deferring payment until after the goods are received or within an agreed-

upontimeframe, importers can manage their cash flow more effectively. -

Simplified Process: Open account terms can streamline the payment process, reducing administrative

burdenand paperwork associated with more complex payment methods. -

Competitive Advantage: Importers may be able to negotiate better pricing or terms with suppliers by

offeringto pay on an open account basis, potentially gaining a competitive advantage in the market. L/C

- L/C is a conditional commitment lOMoAR cPSD| 61430673

- Documentary credit is a conditional payment method

- Conditions for opening LC: Application for opening → Reputation → Financial capacity For exporter:

- Irrevocable Letter of Credit

Irrevocable LC is more commonly used as compared to a revocable LC. Irrevocable LC cannot be revoked or

modified without the consent of the issuing bank, the beneficiary, and the confirming bank. It is a safer option for

the seller or exporter as it assures that the amount mentioned in the LC will be paid if the submitted papers fulfill

the terms and conditions of the agreement. Irrevocable LC further has 2 types - Confirmed and Unconfirmed LC.

Characteristics of L/C transactions:

- L/C is an economic contract between two parties, the issuing bank and the exporter

- L/C is independent of the underlying contract and the goods

=> The nature of L/C is a completely independent transaction from the foreign trade contract or other contract

that is the basis for forming the L/C transaction. In all cases, the bank is not involved in or bound to such contract,

even if the L/C contains any reference to this contract.

● L/C has an important nature, it is formed on the basis of a foreign trade contract, but after being

established, it is completely independent of this contract

- L/C is only transacted by documents and payment is only based on documents

Whether or not the exporter receives payment depends solely on the presentation of appropriate documents; At

the same time, the bank only pays when the documents presented are consistent, meaning the bank is not

responsible for the truth of the goods that any document represents. When the documents presented are in

compliance, the issuing bank must unconditionally make payment to the exporter, even though in reality the goods

may not have been delivered or not delivered entirely as stated on the documents.

- L/C requires strict compliance of documents

Because transactions are only by documents and payments are only based on documents, the requirement of strict

compliance with documents is the basic principle of L/C transactions. To receive payment, the exporter must

prepare a suitable set of documents, strictly comply with the terms and conditions of the L/C, including the number

of types, quantity of each type and the content of the documents must meet the function. required documentation capabilities

- L/C is a payment tool, limiting risks and sometimes also a tool for refusing payment and fraud.

In terms of being a payment and risk prevention tool for exporters and importers, LC has outstanding advantages

compared to other payment methods. That is why this method has existed and developed like this. Nowadays.

However, in international trade practice, due to market developments, prices, etc., LCs can be abused to become

a tool to refuse to accept goods, refuse to pay, and a tool to commit fraud. fraud scam

- There are governing legal documents (UCP, ISBP)

Payment method in Viet Nam

Overall, the proportion of payment methods in commercial banks changed over the given period. As it can be seen

in the line graph, the proportion of payments made via L/C has been gradually decreasing each year. Transitioning

to remittance can help businesses save costs compared to payment through banks. Although this approach allows

for faster payments, businesses still have to contend with certain risks.

In the payment of imported goods, the dominance of payment through L/C, which used to account for the majority

of the total payment volume for imports, is now showing a decreasing trend. This change underscores the

credibility of Vietnamese businesses in the international market.

The reasons for the decreasing trend in the use of L/C as a payment method lOMoAR cPSD| 61430673

- From a commercial bank's perspective, alongside the use of these financing products, risk in the paymentprocess

for exporters has decreased. Therefore, they tend to opt for simpler payment methods such as remittance or

collection services to save costs.

- From export and import business’s perspective,

+ In terms of exports, the proportion of remittance payment methods is often high because Vietnamese goods tend

to be exported to developed markets such as the EU and North America. These are markets with stringent quality

requirements, so importers often receive the goods before making payments

+ In terms of imports, the remittance payment methods is outweigh because Vietnamese importing businesses

have built credibility in payment, and using money transfer methods offers several benefits, including simplicity,

cost savings, and reduced documentation requirements Solutions

- Businesses need to thoroughly research their partners before engaging in transactions, considering factors suchas

transaction history, reputation, products, services, scale, and payment capabilities. Seeking advice from banks

regarding the partner's business operations is also crucial for risk mitigation.

- Information about partners can be obtained through public sources or by services from reputable institutionssuch

as the Credit Information Center of the State Bank of Vietnam (SBV) or agencies affiliated with trade

associations in importing countries, diplomatic missions, trade bureaus, and trade branch offices in the exporting

and importing countries. Many businesses are often focused on sales efforts, clearing inventory, and may have

a tendency to trust their partners, sometimes overlooking risk prevention measures.

- In sales contracts, businesses need to define strict terms that protect them (paying close attention to

disputeresolution and complaint mechanisms) and avoid situations that are disadvantageous to them when disputes arise.

- To safeguard their interests, businesses should proactively enhance their understanding of

internationalcommercial law and research the legal regulations relevant to import and export in major markets

to formulate appropriate strategies. In international payments, import-export businesses should choose reputable

domestic banks to avail their services. D/A vs D/P

D/A or D/P stands for Documents against Acceptance/Payment. This is a type of payment arrangement that is

commonly used in international trade. In this arrangement, the exporter ships the goods to the importer and sends

the shipping documents to their bank. The importer can then obtain these documents from their own bank once

they have accepted or paid for the goods. The main difference between DA and DP is that with DA, the importer

accepts the shipping documents and pays at a later date, while with DP, the importer pays upfront for the shipping documents

Both DA and DP are the terms of payment related to acceptance of shipping documents pertaining to each

consignment from buyer’s bank