Preview text:

CORPORATION MANAGEMENT Final Assignment Topic: Question 2

Group Name: Phụng Hoàng HCMC, 12/2023

2.1 Reasons for choosing the business:

In the market today, milk tea is one of the popular drinks among young people. A

joint study by Momentum Works and Qlub (Singapore) has shown that Southeast

Asian consumers spend 3.66 billion USD/year to buy bubble milk tea. Of which,

Vietnam ranks third with 362 million USD, equivalent to nearly 8,500 billion VND in

2021. (Lan, 2022). That is the reason why famous milk tea brands from Taiwan and

the world have begun to enter the Vietnamese market, especially Ngo Gia Ice Black Tea- a brand from Taiwan.

Although it has just entered the Vietnamese market, Ngo Gia Ice Black Tea

quickly became one of the most popular milk tea brands. Known as a completely

natural drink, with no preservatives and no artificial flavors, customers can feel secure

when using this type of milk tea. The product price is quite cheap, ranging from

12,000 VND to 45,000 VND for a drink. Up to now, this is one of the major milk tea

brands loved and chosen by many customers. Currently, Ngo Gia Ice Black Tea has

nearly 60 stores across the country. With this wide coverage, Ngo Gia Ice Black Tea

plans to open more branches in the Southeast region, which is Tay Ninh City,

specifically in Phuoc Dong town with an area of about 23.10 km .2

We realize that Ngo Gia Ice Black Tea has great potential for development,

especially when locating a branch in Phuoc Dong town - a place with a strongly

developed economy; People's living standards are increasing; have a need to spend on

drinks every year. The average income per capita in Phuoc Dong by the end of 2023,

about 77 million VND/person/year (TayNinhOnline, 2023). In the area, there is also

Phuoc Dong Industrial Park operating effectively, attracting more than 80,000 people

to work in companies, enterprises, and service businesses, contributing to promoting

socio-economic development significantly compared to before. (BaoTayNinh, 2023).

2.2. Feasibility analysis

2.2.1. Market feasibility

Tay Ninh City - one of the key economic regions in the South, Tay Ninh has a

favorable location for the development of industry, agriculture, tourism and services.

The population of Tay Ninh in 2022 is 1,188,758 people with a population density of

294.1 person/km2. Trang Bang town alone accounts for 15.23% (the highest),

followed by Go Dau district, accounting for 13.06% of the population. In 2022, the

Province will attract 16,500 billion VND of total domestic and foreign investment

capital, an increase of 4.7% compared to last year (VCCINEWS, 2023). Implemented

56 new investment projects, including agricultural, industrial projects, and urban

development consulting services,... including 2 new solar power projects in the Dau

Tieng lake area with a total registered investment capital is more than 7,000 billion VND.

In the first 6 months of 2023, Tay Ninh rose to rank 2nd in economic growth in

the Southeast region with GRDP reaching more than 50,000 billion VND, an increase

of 4.07% over the same period. Currently, Tay Ninh city is becoming bustling with

shopping stores and cafes also appearing more and more. In Tay Ninh, there are more

than 4 Ngo Gia Hong Tra stores, but some towns still do not have them. Especially,

Phuoc Dong commune, a place with an industrial park and many schools from

kindergarten to high school, needs daily drinks. Therefore, this place is considered a

potential and promising market to establish new branches and expand the store chain of Hong Tra Ngo Gia.

2.2.2. Target Market and Trade Area

Table 2.1. Information about locations District Area Population 1 Thanh Phuoc 25,08 km2 18,798 people 2 Phuoc Dong 23,10 km2 19.080 people 3 Bau Don 35,83 km2 17.873 people Target Market: - Gender: Male, Female

- Age: 10 – 19 years old, 20 – 29 years old

- Occupation: student and working person - Income level: Medium - low

Hong Tra Ngo Gia's market segment focuses on customers with medium to low

income. Currently, Hong Tra Ngo Gia's products are quite cheap compared to the

market, typically ranging from 12,000 VND - to 45,000 VND for a product. Hong Tra

Ngo Gia's target customers are divided into 4 segments: Customers from 10 - 19 years

old are usually middle school students, an age group that loves drinking milk tea and

often invites friends to buy milk tea with them; Customers aged 20 - 29 often change

their taste every day, sometimes craving this dish, sometimes craving that dish, so

Hong Tra Ngo Gia's menu is very suitable for these customers. Ngo Gia Ice Black Tea

is considered a brand with creativity, a diverse and outstanding menu with super

"unique - strange" but very delicious drinks. Trade Area:

Ngo Gia Ice Black Tea provides beverage products to customers living,

studying, and working in Phuoc Dong commune and surrounding areas within a 10km

radius. Commercial area of Phuoc Dong commune 23.10 km2. Competing commercial

areas include Thanh Phuoc commune and Bau Don commune, 7.3 km and 8.6 km

from Phuoc Dong commune, respectively. After researching and evaluating based on

collected data, we found that the competition rate is not too high. People in the area

have limited mobility, and no one wants to travel more than 5 km just to buy a glass of

water. Besides, shoppers will choose the store closest to them for convenience in

transportation. In summary, we expect to earn 70% of our revenue from students of

schools surrounding the store premises, the next 20% will be from low-income earners

and the remaining 10% will be from visitors hybrid.

2.2.3. Market potential:

According to the Tay Ninh Population Statistics Department, by age group, the

10 - 19-year-old group is 164,313 people out of a total of 1,188,758, accounting for

13.82%. Finally, the group aged 20 - 29, accounting for 177,893 people out of a total

of 1,188,758, equivalent to 14.96%. (Cổng Thông Tin Điện Tử Tỉnh Tây Ninh, 2018)

Estimated average income per capita of Tay Ninh city in 2022 is VND

55,404,000 (Cổng Thông Tin Điện Tử Tây Ninh, n.d.). In particular, the total spending

on beverage needs of Tay Ninh city residents will be estimated to be 10% of the

average total income, equivalent to VND 5,540,400.

Ngo Gia Ice Black Tea will be opened in Phuoc Dong - population: 19,080

people. The neighboring areas of Thanh Phuoc and Bau Don have populations of

18,798 people and 17,873 people with areas of 25.08 km2 and 35.83 km2 respectively.

In Phuoc Dong, the number of people aged 10 - 19 years old who are willing to

spend money on drinks at Ngo Gia Ice Black Tea according to the owner's estimate is

65%. Estimated revenue of Ngo Gia Ice Black Tea in Phuoc Dong:

5,540,400 x(28.78 % x 19,080 x 65 % )=VND 19,754,711,730

The estimated revenue for Ngo Gia Ice Black Tea in two neighboring Phuoc

Dong wards, Thanh Phuoc and Bau Don, for the age group from 10 to 19 years old is

35% and 21%, respectively. For the age group 20 - 29 it will be 30% and 25%

respectively. So the estimated revenue of Ngo Gia Ice Black Tea in these two areas:

5,540,400 x[(13.82 % x 35 % x 18,798)+(13.82 % x 21 % x 17,873)+(14.95% x 30 % x 18,798)+ (14.95

Therefore, the potential market share of Ngo Gia Ice Black Tea in Phuoc Dong will be:

potential market share=19,754,711,730+16,283,585,426=VND 36,038,297,156 2.2.4. Market Share

Ngo Gia Ice Black Tea is expected to open a new facility with an area of 25m2.

According to an actual survey, there are 6 milk tea shops in Phuoc Dong area. Based

on the above data, Ngo Gia Ice Black Tea’s market Share will be: 25 Market share = =12.5 % (25 X 7)+25

Revenue is expected to increase by 20% each year. The number sold is 150,159 glasses. Cost per unit = VND 18,000 2.2.5. Projected Income

Based on the data above, revenue figure in 2024 will be:

Revenue=Market potential x Market share=36,038,297,156 x 12.5 %=VND 4,504,787,14

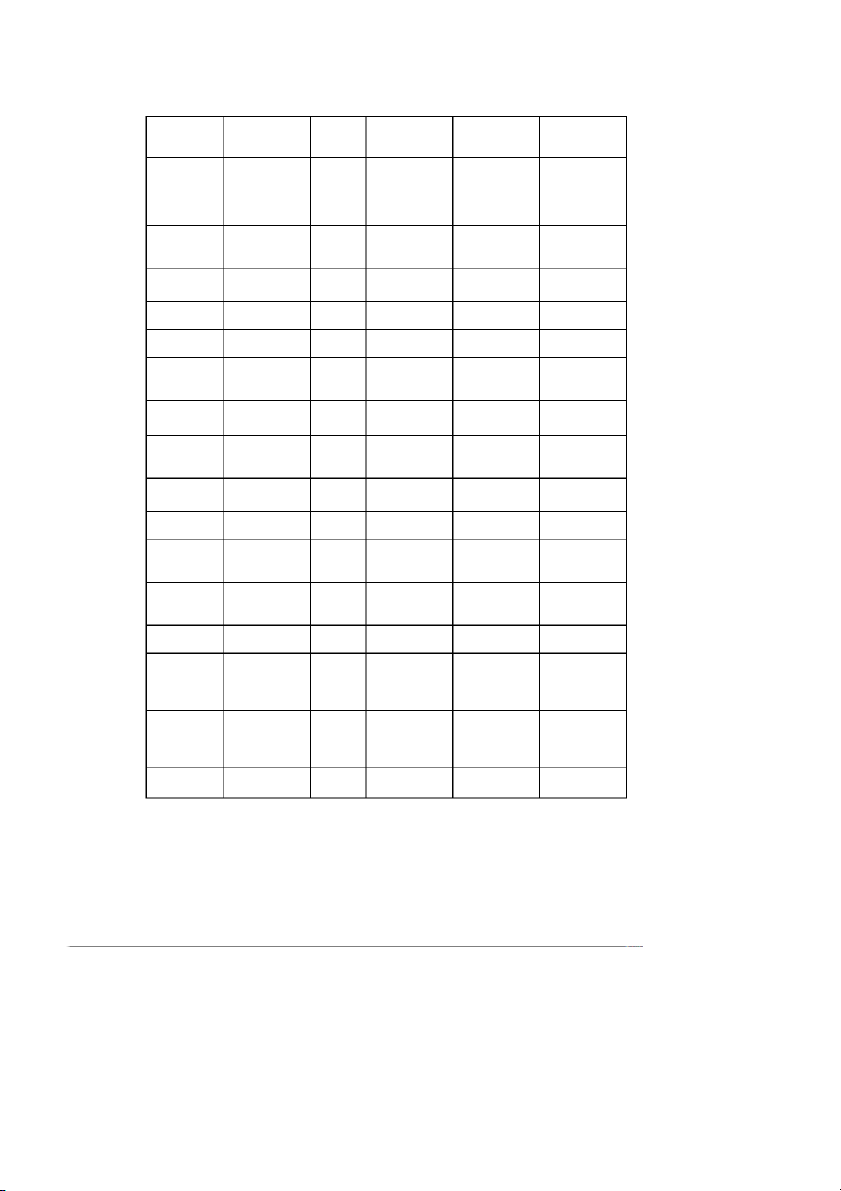

Table 2.2. The Projected Income in three years 2024 2025 2026 Sales

4,504,787,145 5,405,744,574 6,486,893,489 Cost of

2,702,862,000 3,108,291,300 3,792,115,386 goods sold Gross margin

1,801,925,145 2,297,453,274 2,694,778,103 Period cost Staff wages 324,000,000 340,200,000 357,210,000 Staff benefits 50,000,000 68,040,000 89,802,500 Advertising 24,000,000 26,400,000 29,040,000 expenses Rent expenses 60,000,000 60,000,000 60,000,000 Depreciation expenses Material 72,000,000 79,200,000 91,080,000 Other 36,000,000 39,600,000 45,540,000 Utilities 32,100,000 35,310,000 40,606,500 Expenses Miscellaneous 105,840,000 111,132,000 133.358.400 expenses Total 679,940,000 759,882,000 846,637,400 Earning before tax

1,121,985,145 1,537,571,274 1,848,140,703 (EBIT) Tax (4.5%) + tax

800,489,331.5 1,069,190,707 1,083,166,332 income Income 321,495,813.5 468,380,567 764,974,371 (Source by the Author) Lương mỗi năm tăng 5%

Phúc lợi năm 2024 là 15%, 20%, 25% ở năm 2024, 2025 Material tăng 10% mỗi năm

Based on the Projected Income table, we can see that the store's revenue is expected to

increase by 20% each year. From VND 4,504,787,145 in 2024 increased to VND

5,405,744,574 and VND 6,486,893,489 in 2025 and 2026. The cost of making each

cup of VND 18,000, with the amount of revenue in 2024, each year must be sold at

150,159 glasses for Selling cost to customers is VND 30,000/cup. Therefore, the cost

of goods sold in 1 year is VND 2,702,862,000. During the year, the store also has to

pay expenses such as salaries, employee benefits, advertising costs and space rent.

Each employee is paid VND 20,000/hour, the shop is open 15 hours a day and the

benefit for each employee per year is 15%. Besides, advertising costs are spent at

VND 2,000,000/month and VND 24,000,000 in 2024 and reduced to VND 22,000,000

in 2025 and 2026. Furthermore, the store is located in Phuoc Dong commune. Go Dau

district with a rental cost of 25m2 and a house rental cost of VND 3,000,000/month, so

VND 36,000,000/year because it is in the countryside so the rental cost is quite cheap.

In addition, the store also has to bear costs including the cost of purchasing raw

materials, other costs, utilities expenses and miscellaneous expenses. Specifically,

each month the store has to spend VND 6,000,000/month on materials, and other costs

including printing costs for cups, signage costs and packaging costs are VND

3,000,000/month. In addition, ultimate expenses include costs for electricity, water and

Internet and miscellaneous expenses include costs for maintenance, repair and

insurance of equipment, respectively VND 2,675,000/month and VND

8,820,000/month. In summary, the total period cost in 2024 is VND 679,940,000/year

and VND 677,940,000 in the next two years.

Taxable revenue and tax rates are specified in Clause 2, Article 2 of Circular

92/2015/TT-BTC as follows: the tax rate for milk tea businesses is 4.5% including

VAT and tax corporate income (Có phải đăng ký kinh doanh và phải đóng thuế khi

kinh doanh trà sữa?, 2015). The store's expected income in the next 3 years is VND

321,495,813.5; VND 1,183,820,158 and VND 2,216,317,372 from 2024 to 2026. References

BaoTayNinh. (2023, 05 23). Tây Ninh Online. Retrieved from baotayninh.vn:

https://baotayninh.vn/xa-phuoc-dong-huyen-go-dau-hoan-thanh-19-19-

tieu-chi-xay-dung-ntm-nang-cao-a158587.html

Có phải đăng ký kinh doanh và phải đóng thuế khi kinh doanh trà sữa? (2015,

September 12). Retrieved from luatminhkhue.vn:

https://luatminhkhue.vn/co-phai-dang-ky-kinh-doanh-va-phai-dong-thue- khi-kinh-doanh-tra-sua-.aspx

Cổng Thông Tin Điện Tử Tây Ninh. (n.d.). Retrieved from tayninh.gov.vn:

https://www.tayninh.gov.vn/vi/page/GIOI-THIEU-CHUNG-53.html

Cổng Thông Tin Điện Tử Tỉnh Tây Ninh. (2018, November 21). Retrieved from

hoidap.tayninh: https://hoidap.tayninh.gov.vn/ChiTietHoiDapTT.aspx? id=5914

Lan. (2022, 09 05). Báo Thanh Niên. Retrieved from thanhnien.vn:

https://thanhnien.vn/nguoi-viet-nam-chi-gan-8500-tinam-cho-tra-sua-thu-

nuoc-co-gi-ma-van-tin-do-me-man-1851490209.htm

TayNinhOnline. (2023, 08 31). Tây Ninh Online. Retrieved from baotayninh.vn:

Doanh Nghiệp có độ phủ sóng thương hiệu cao

VCCINEWS. (2023, 05 31). VCCINEWS. Retrieved from vccinews.vn:

https://vccinews.vn/news/46724/tay-ninh-diem-den-dau-tu-hap-dan-an- toan-hieu-qua.html