Preview text:

lOMoAR cPSD| 58504431 Chapter 8: Cost management (chapter 11 – ebook)

Key Questions for the Supply Decision Maker lOMoAR cPSD| 58504431 lOMoAR cPSD| 58504431 STRATEGIC COST MANAGEMENT

• Strategic cost management is an externally focused

process of analyzing costs in terms of the overall value chain.

• Cost analysis can be used to measure and improve

cost performance by focusing attention on specific cost elements.

• Cost management systems can be designed that

depend on strategic partnering to achieve competitive advantage.

• Cost management is a major opportunity area for strong

supply leadership and management. lOMoAR cPSD| 58504431

• Cost management is a continuous improvement process Sources of Competitive Advantage

Sources of sustainable competitive advantage are: (1) product differentiation (2) low cost

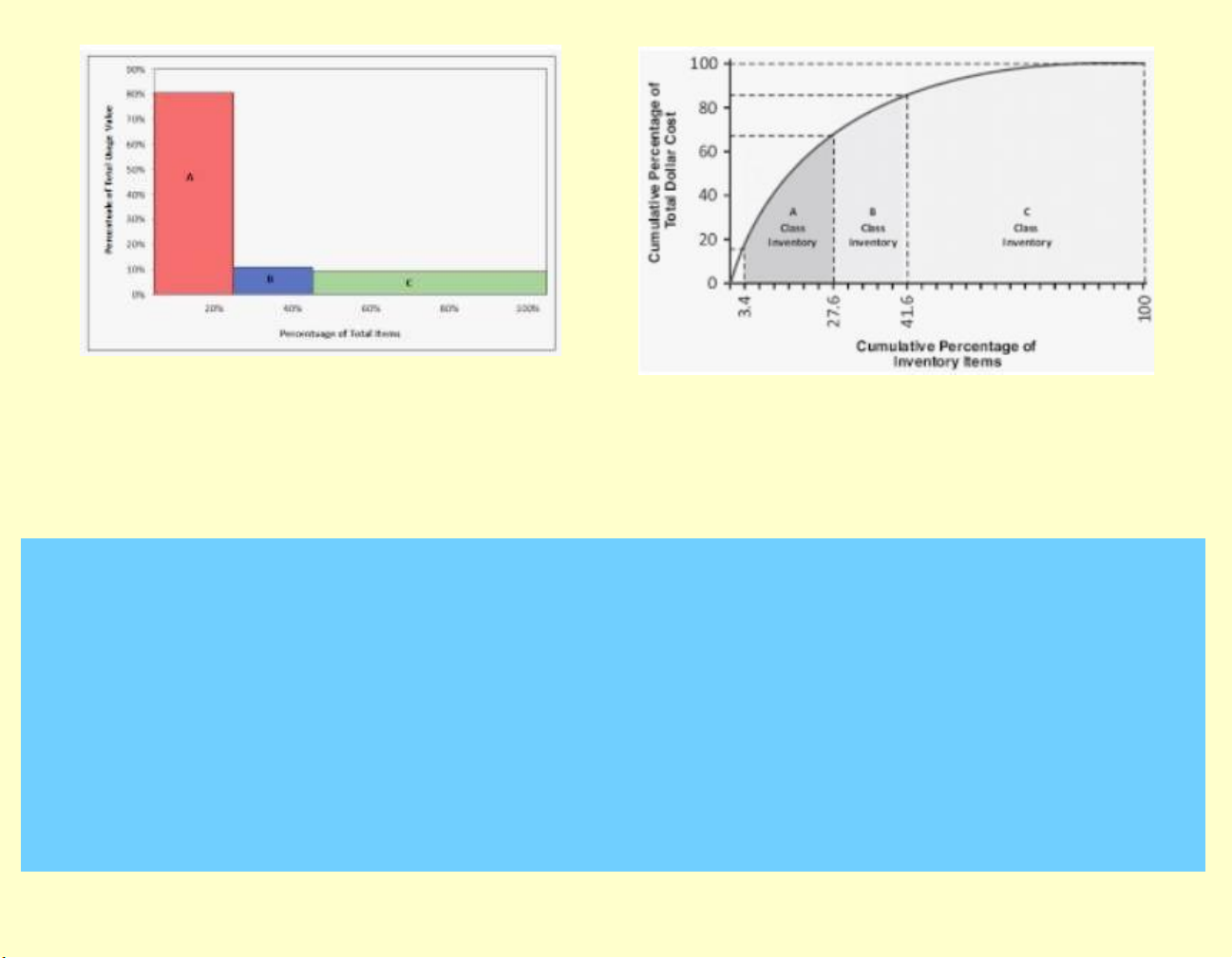

(3) a combination of product differentiation and cost leadership. lOMoAR cPSD| 58504431 Frameworks for Cost Management

Cost analysis and cost management approaches can then

be adapted and applied appropriately.

Various tools already discussed in this text provide a

framework for cost management.

These include ABC (Pareto) analysis and portfolio analysis. lOMoAR cPSD| 58504431

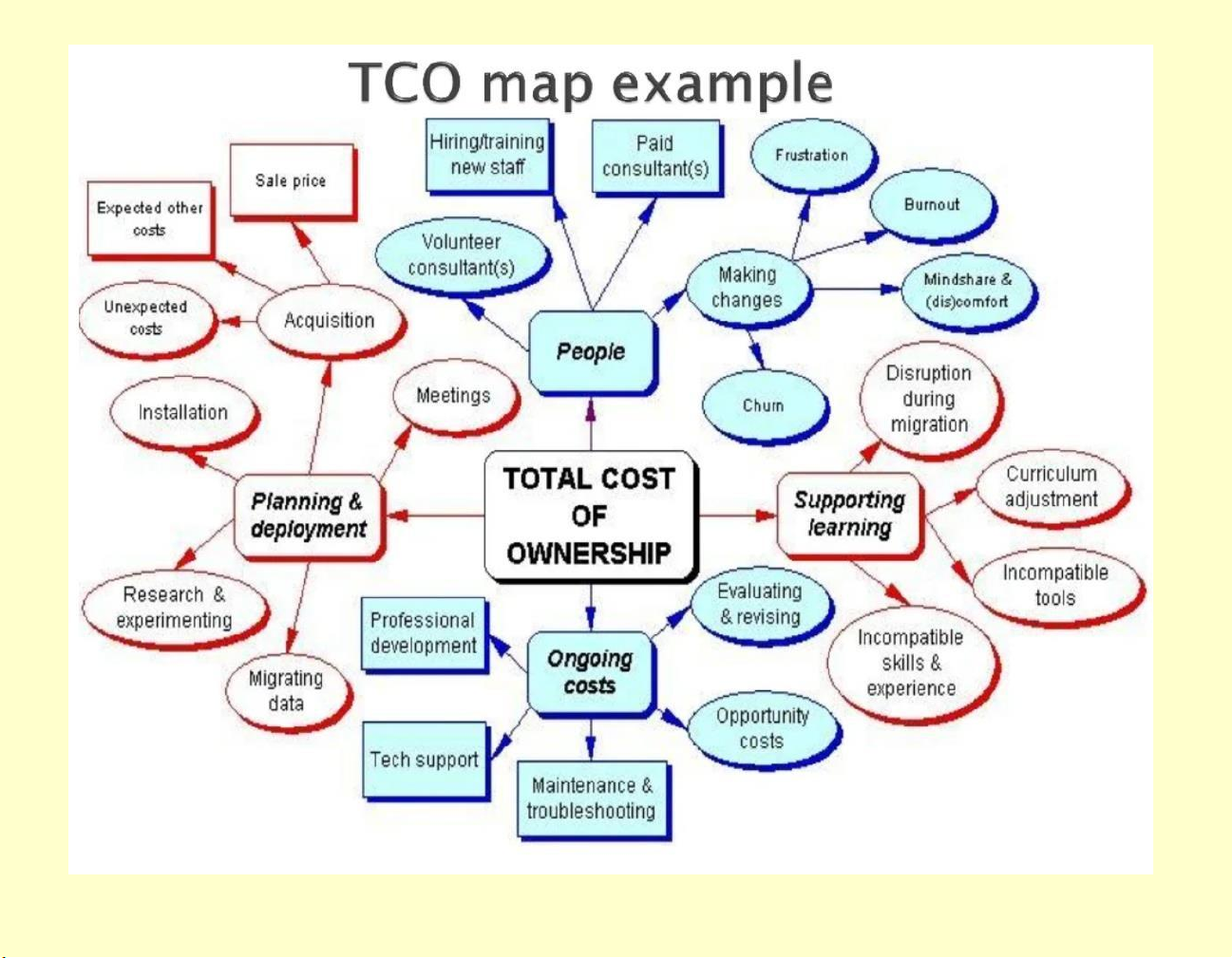

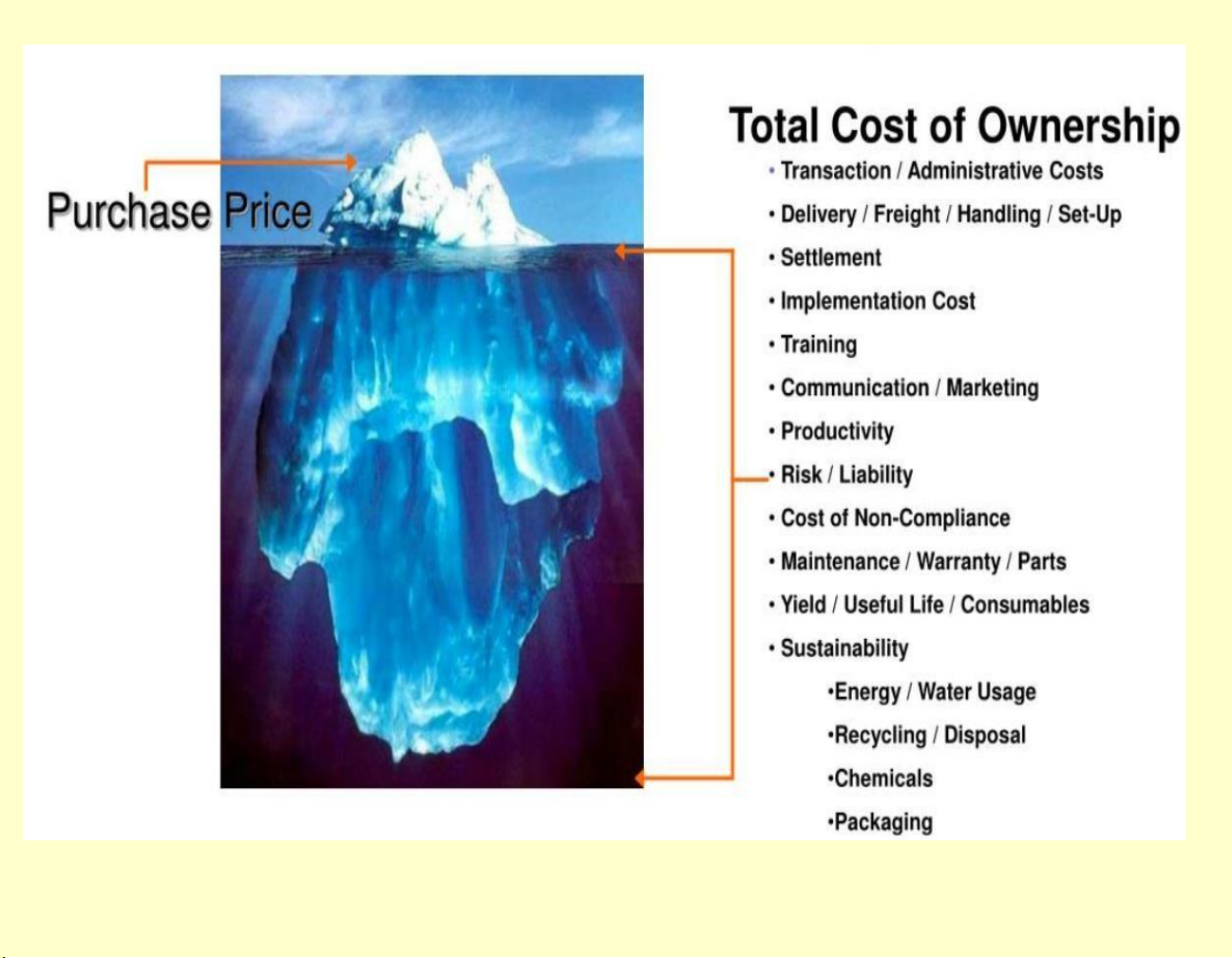

Total Cost of Ownership

The purchaser should estimate the total cost of ownership

(TCO) before selecting a supplier.

Total cost of ownership for noncapital goods acquisition

includes all relevant costs, such as administration, follow-

up, expediting, inbound transportation, inspection and lOMoAR cPSD| 58504431

testing, rework, storage, scrap, warranty, service,

downtime, customer returns, and lost sales. TCO Components: Purchase cost Operating costs

Preventive maintenance costs Repair costs Cost of disposal Capital costs

Other costs, e.g. insurance lOMoAR cPSD| 58504431

Other considerations, e.g.: speed/capacity lOMoAR cPSD| 58504431 lOMoAR cPSD| 58504431

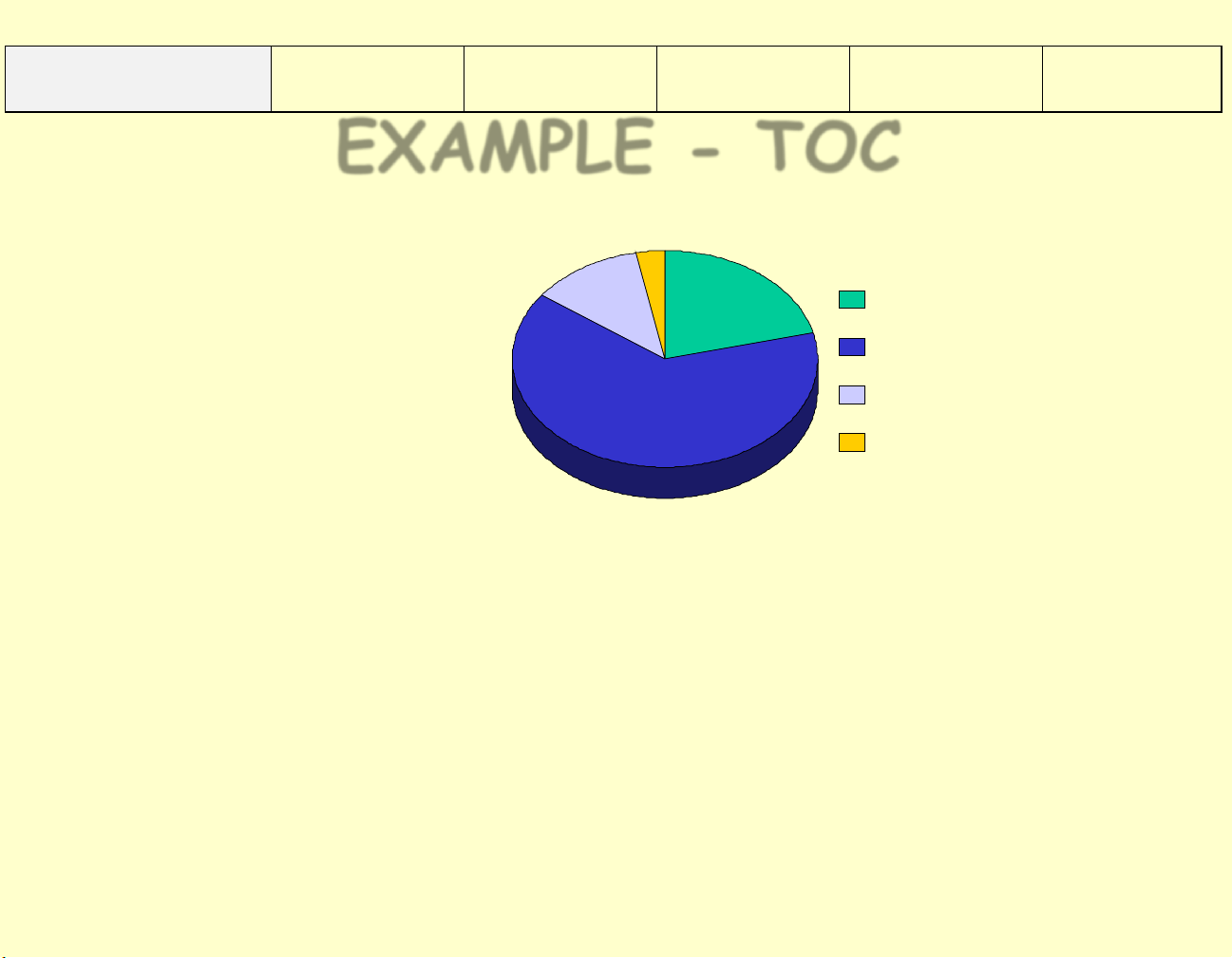

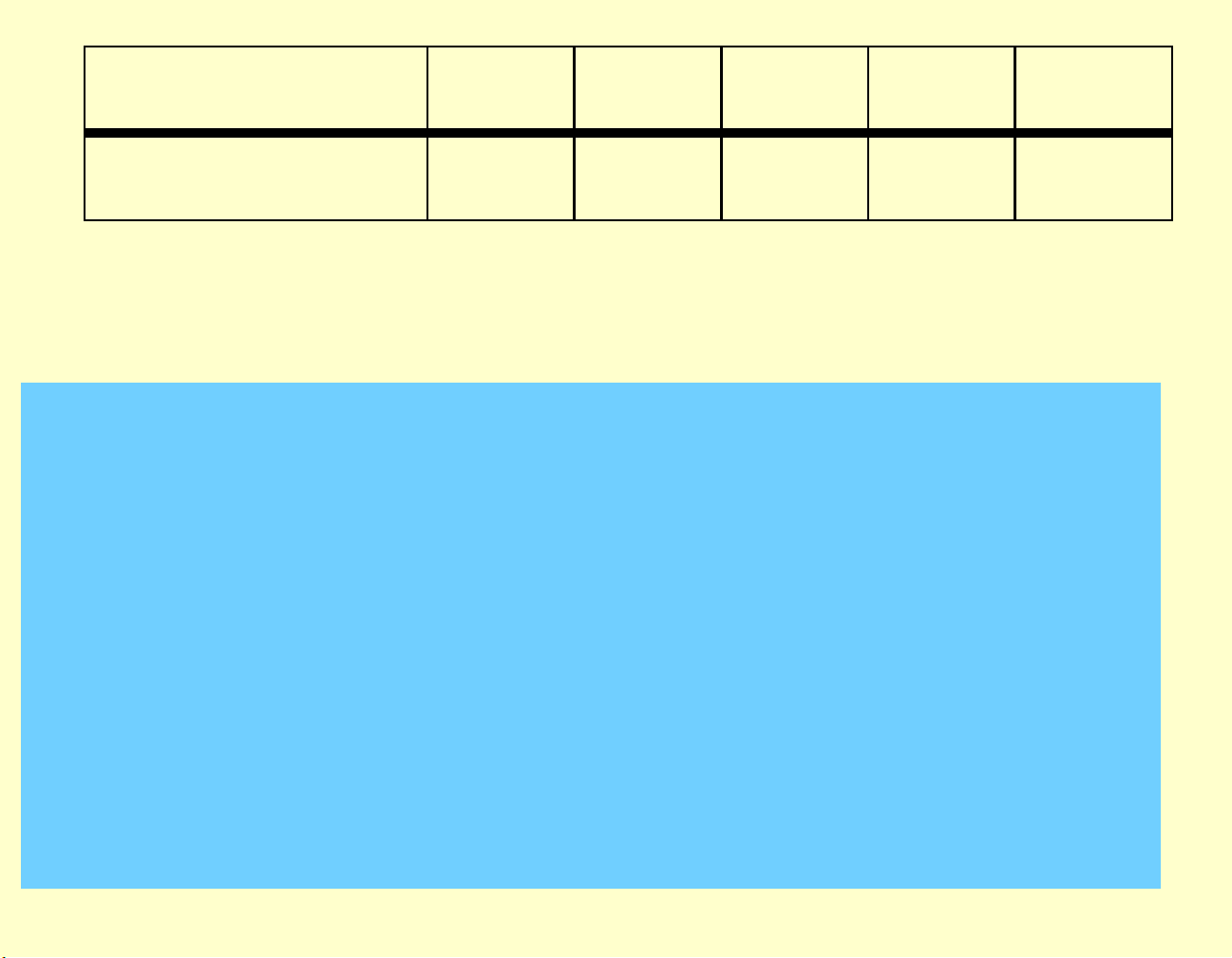

Breakdown of total cost of ownership a HV electric motor Element of cost Year 1 Year 2 Year 3 Year 4 Year 5 Purchase price $50,000 Electricity $30,000 $30,000 $30,000 $30,000 $30,000 Maintenance $5,000 $5,000 $5,000 $5,000 $5,000 lOMoAR cPSD| 58504431 Disposal $7,000 EXAMPLE - TOC Example: main TCO

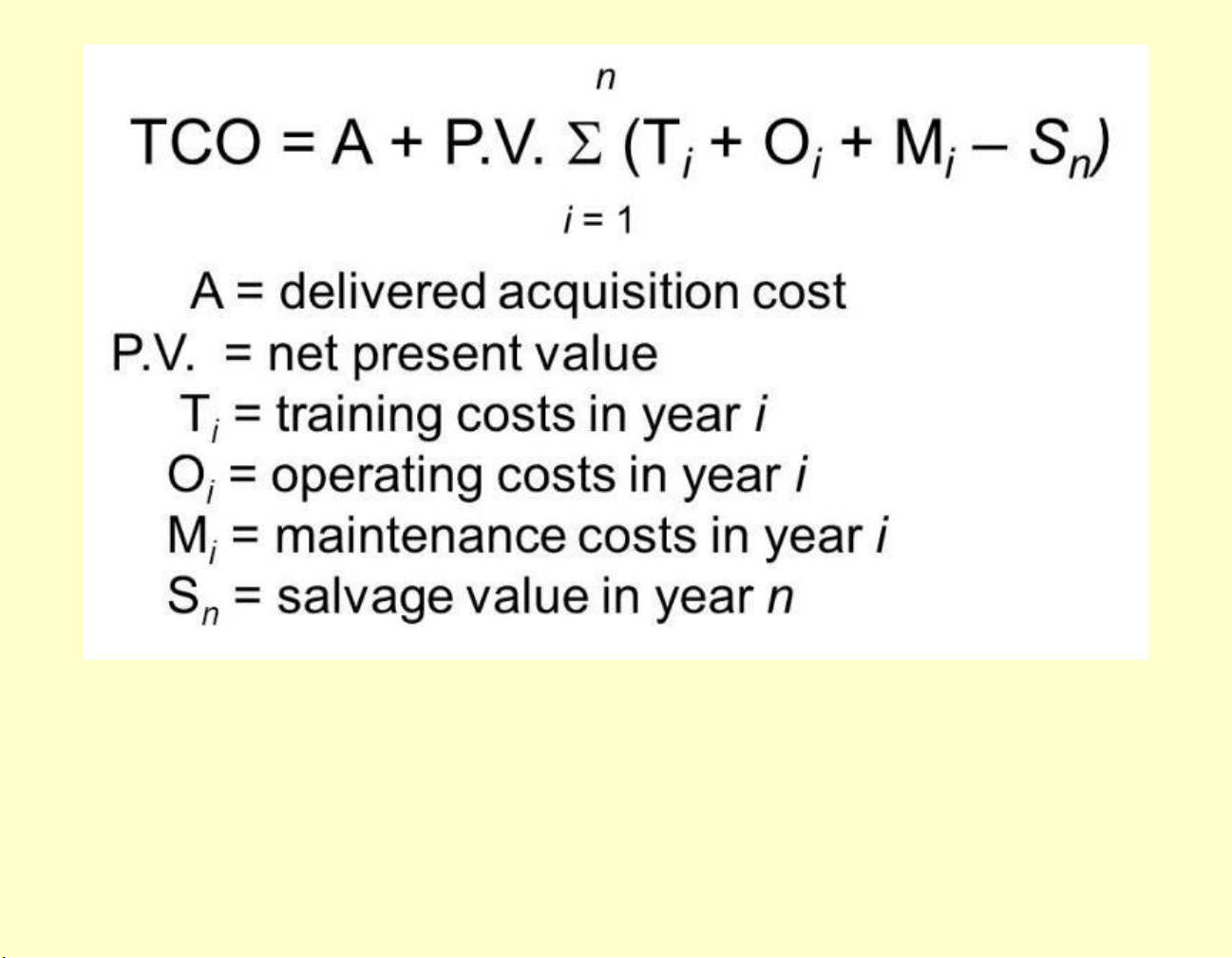

11%%3 21% Purchase price elements for a high Electricity voltage electric motor 65% Maintenance contract Disposal lOMoAR cPSD| 58504431 Time Value of Costs

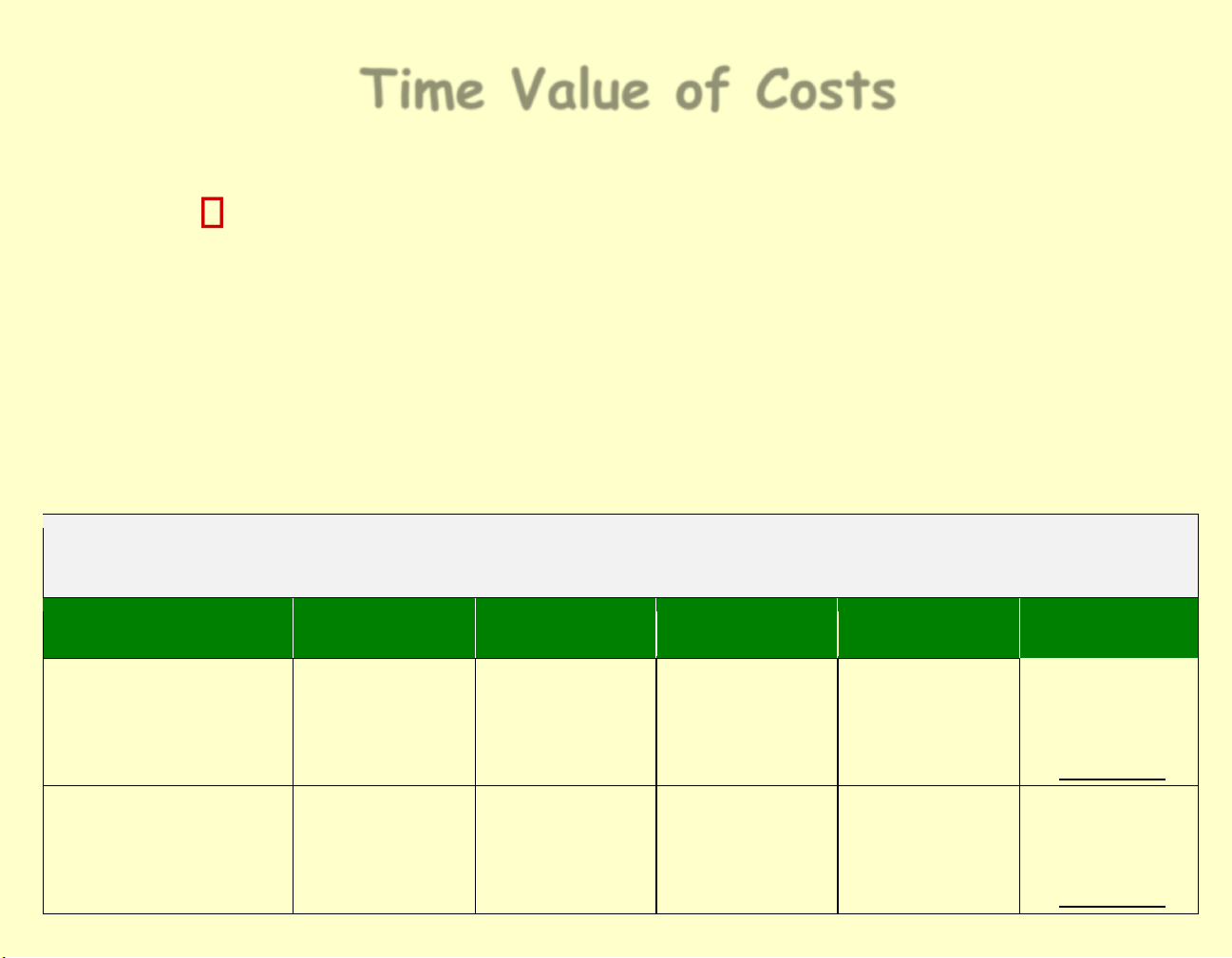

Although the sum of all costs of two

offers are similar, one offer might involve

higher costs in early years while the other

might involve higher costs in later years, e.g.:

Purchase of production machinery: Summary of costs over time Offers Year 1 Year 2 Year 3 Year 4 Total cost Purchase price: Supplier X $60,000 $5,000 $20,000 $5,000 $90,000 Purchase price: Supplier Y $80,000 $3,000 $3,000 $4,000 $90,000 lOMoAR cPSD| 58504431

Cost of using Supplier X taking interest payments into account Year 1 Year 2 Year 3 Year 4 Total Year 1 cost $60,000 $60,000 Interest payments $6,000 associated with Year 1 $6,600 $7,260 $7,986 $27,846 Year 2 cost $5,000 $5,000 Interest payments associated with Year 2 $500 $550 $605 $1,655 Year 3 cost $20,000 $20,000 Interest payments associated with Year 3 $2,000 $2,200 $4,200 Year 4 cost $5,000 $5,000 lOMoAR cPSD| 58504431 Interest payments associated with Year 4 $500 $500 Total $124,201

Quiz: At an interest rate of 15% per year... lOMoAR cPSD| 58504431

Quiz: At an interest rate of 15% per year...

Cost of using Supplier Y taking interest payments into account Year 1 Year 2 Year 3 Year 4 Total Year 1 cost $80,000 $80,000 Interest payments associated with Year 1 $8,000 $8,800 $9,680 $10,648 $37,128 Year 2 cost $3,000 $3,000 Interest payments associated with Year 2 $300 $330 $363 $993 Year 3 cost $3,000 $3,000 Interest payments associated with Year 3 $300 $330 $630 Year 4 cost $4,000 $4,000 lOMoAR cPSD| 58504431 Interest payments associated with Year 4 $400 $400 Total $129,151

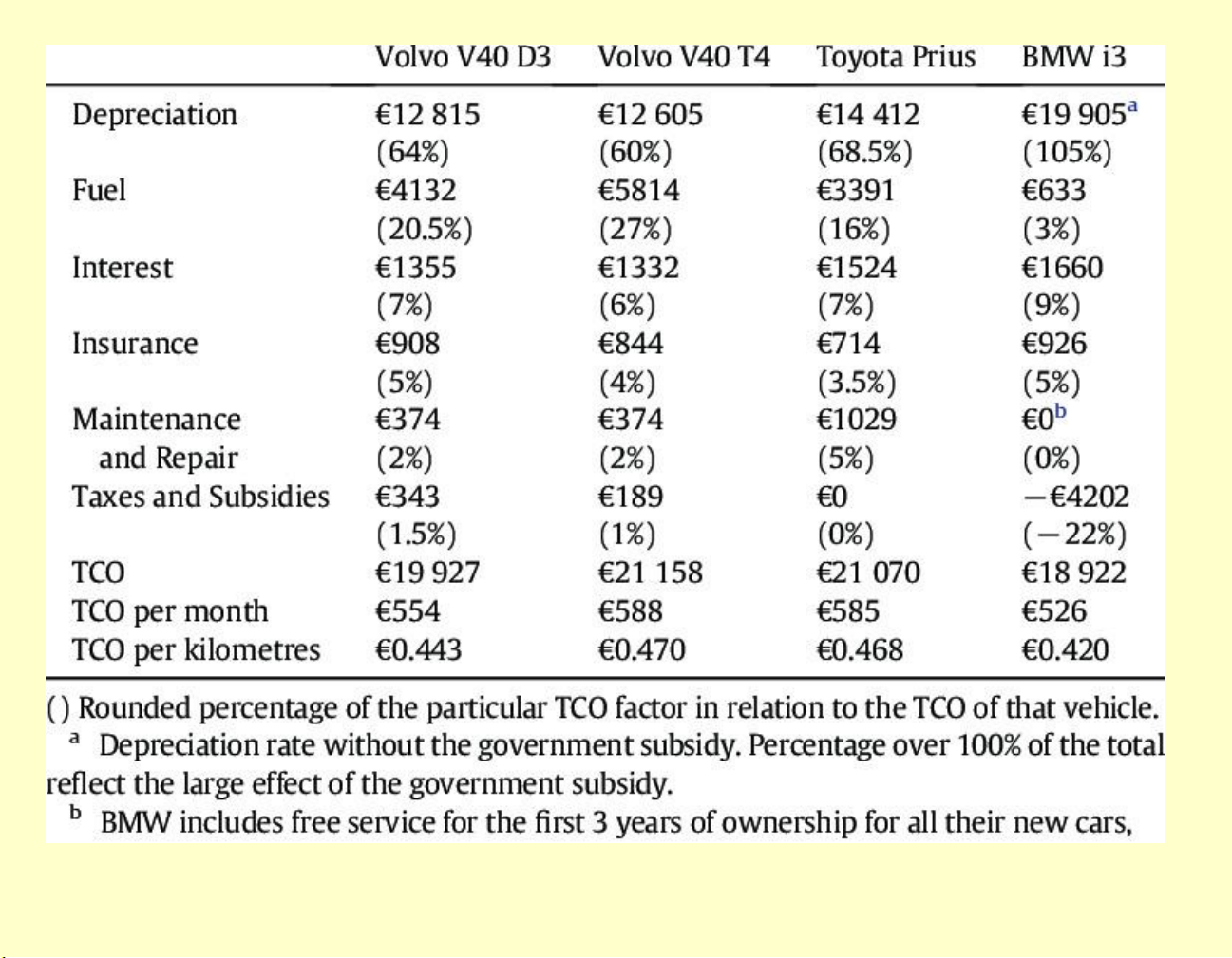

Total Cost of Ownership TCO also can be used to

1. Highlight cost reduction opportunities.

2. Aid supplier evaluation and selection.

3. Provide data for negotiations.

4. Focus suppliers on cost reduction opportunities.

5. Highlight the advantage of expensive, high-quality items.

6. Clarify and define supplier performance expectations. lOMoAR cPSD| 58504431

7. Create a long-term supply perspective.

8. Forecast future performance. lOMoAR cPSD| 58504431 lOMoAR cPSD| 58504431 lOMoAR cPSD| 58504431