Report tài liệu

Chia sẻ tài liệu

Cost of Equity Calculation | Môn Investment Banking - Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

Cost of Equity Calculation Môn Investment Banking. Tài liệu được sưu tầm gồm 5 trang, giúp bạn ôn tập tốt hơn. Mời các bạn đón xem.

Môn: Investment Banking 7 tài liệu

Trường: Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh 2 K tài liệu

Tác giả:

Tài liệu khác của Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

Preview text:

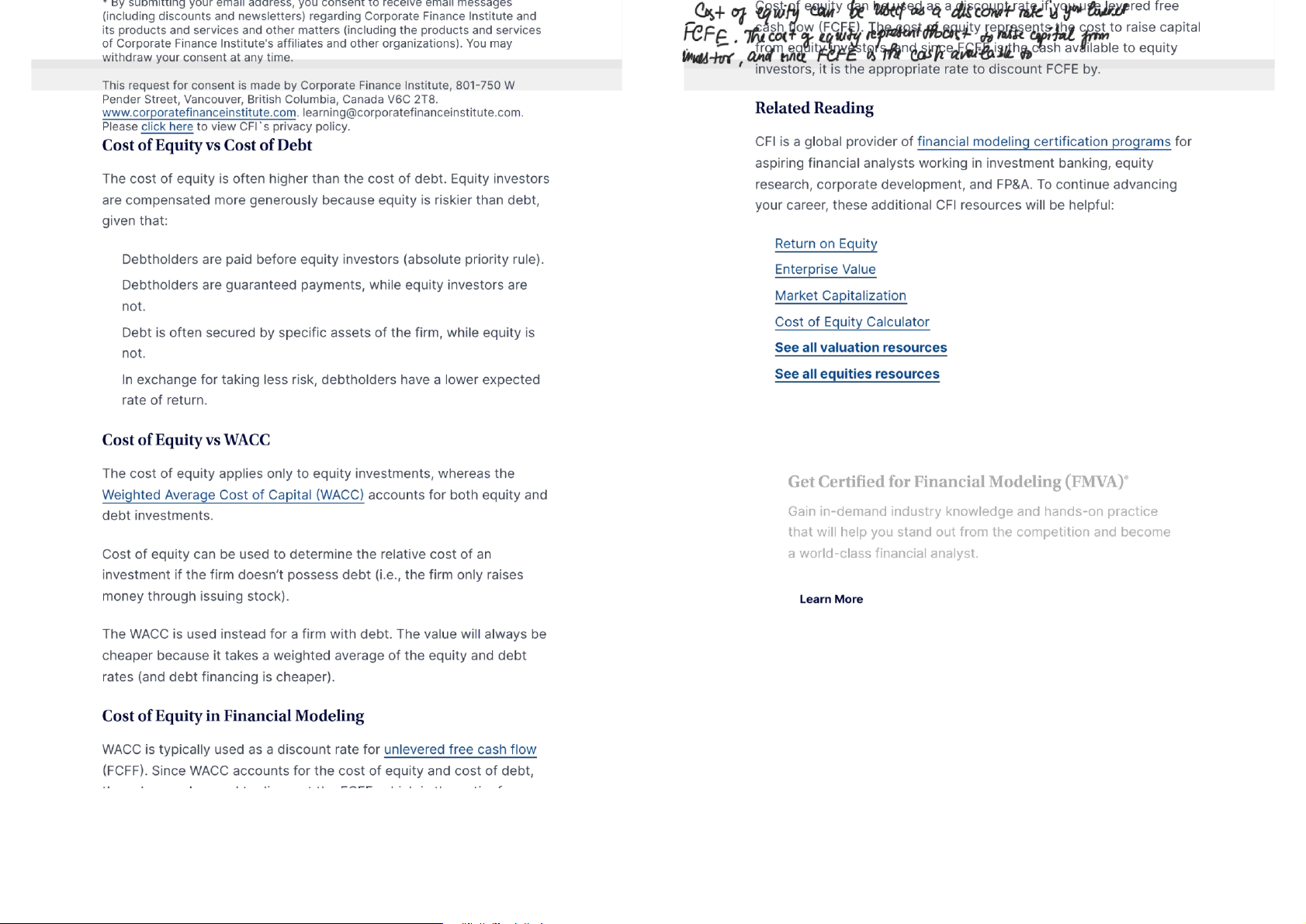

historical information, an analyst estimated the dividend growth rate of XYZ Co. to

be 2%. What is the cost of equity? D1 $0.50 P0 $5 g 2% Re = $0.50/$5 2%

The company with the highest beta sees the highest cost of equity and vice versa. Re 12%

It makes sense because investors must be compensated with a higher return for

the risk of more volatility (a higher beta).

The cost of equity for XYZ Co. is 12%.

Download the Free Template

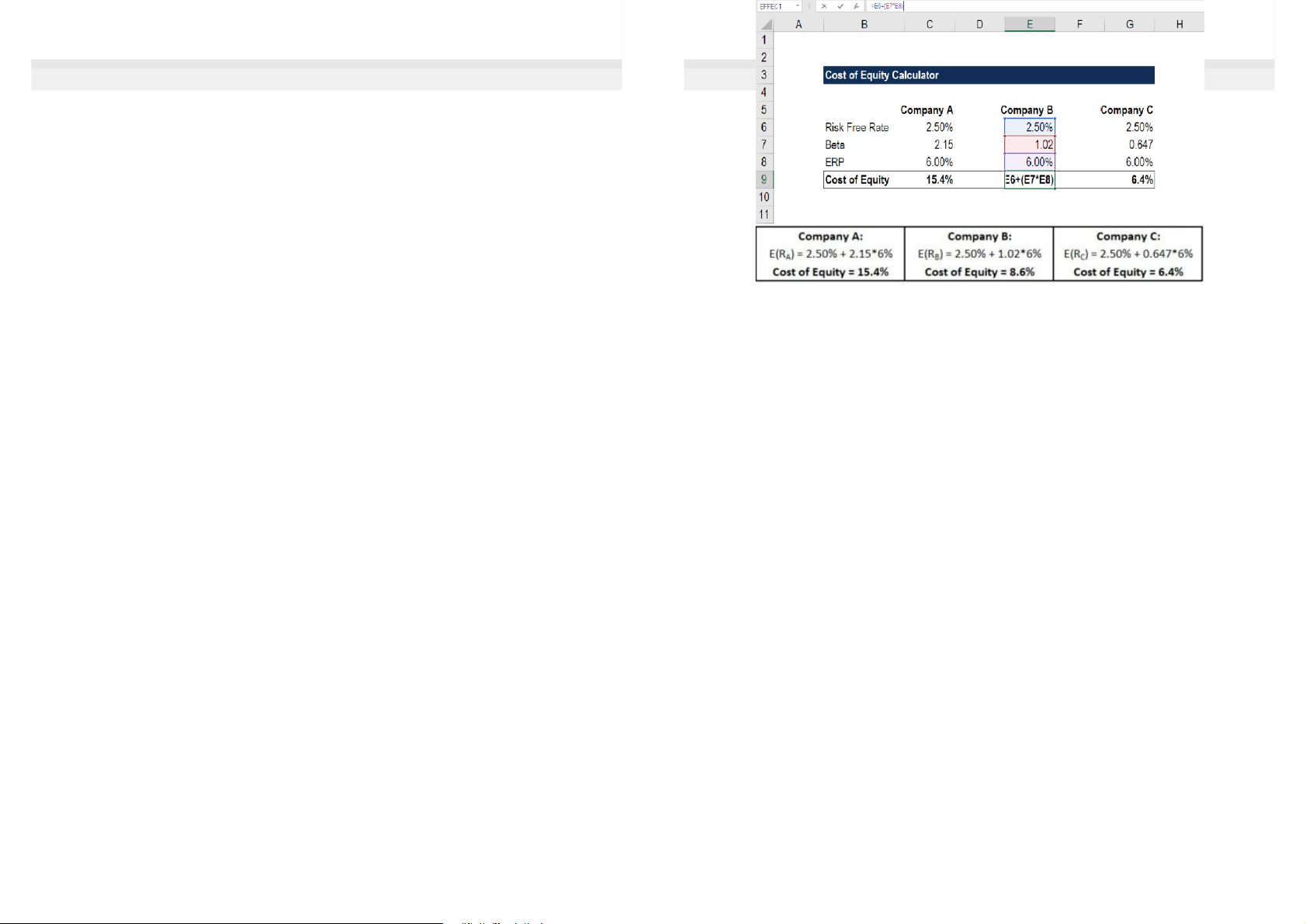

Cost of Equity Example in Excel (CAPM Approach)

Step 1 Find the RFR (risk-free rate) of the market

Step 2 Compute or locate the beta of each company

Step 3 Calculate the ERP Equity Risk Premium) ERP E Rm) Rf lOMoAR cPSD| 58562220

Enter your name and email in the form below and download the free template now!

Tài liệu liên quan:

-

Discussion Questions Lecture 3 | Môn Investment Banking - Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

95 48 -

Focus Notes: Key Concepts & Analysis Techniques | Môn Investment Banking - Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

93 47 -

Law on Credit instituion | Môn Investment Banking - Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

81 41 -

Portfolio Risk and Return Part II - Exam Questions and Answers | Môn Investment Banking - Trường Đại học Quốc tế, Đại học Quốc gia Thành phố Hồ Chí Minh

88 44