Preview text:

lOMoAR cPSD| 58511332

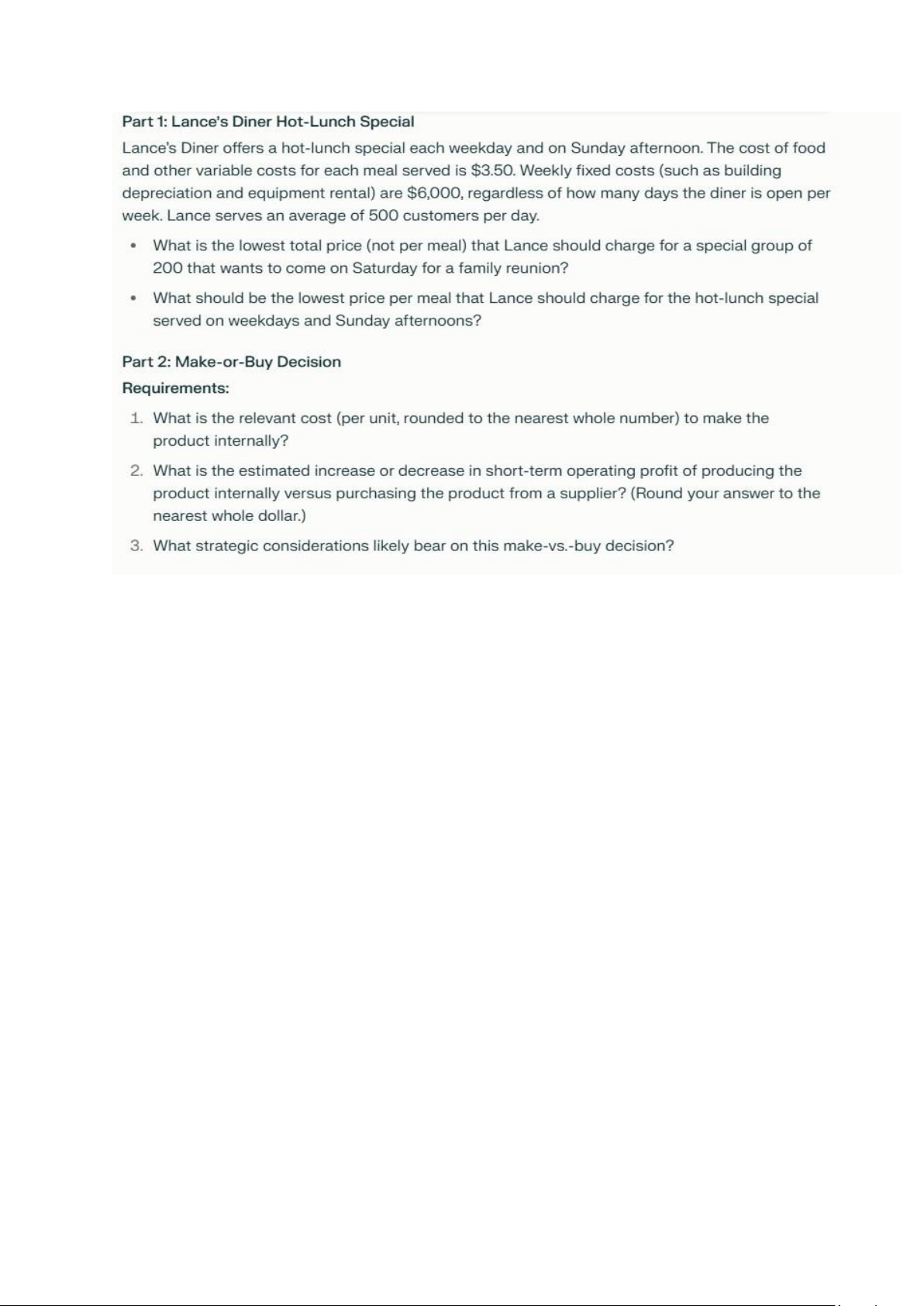

Eggers Company needs 20,000 units of a part to use in producing one of

its products each year. If Eggers buys the part from McMillan Company

for $90 per unit instead of making it, Eggers will not use the released

facilities in another manufacturing activity. Forty percent of the fixed

overhead will continue irrespective of CEO Donald Mickey’s decision.

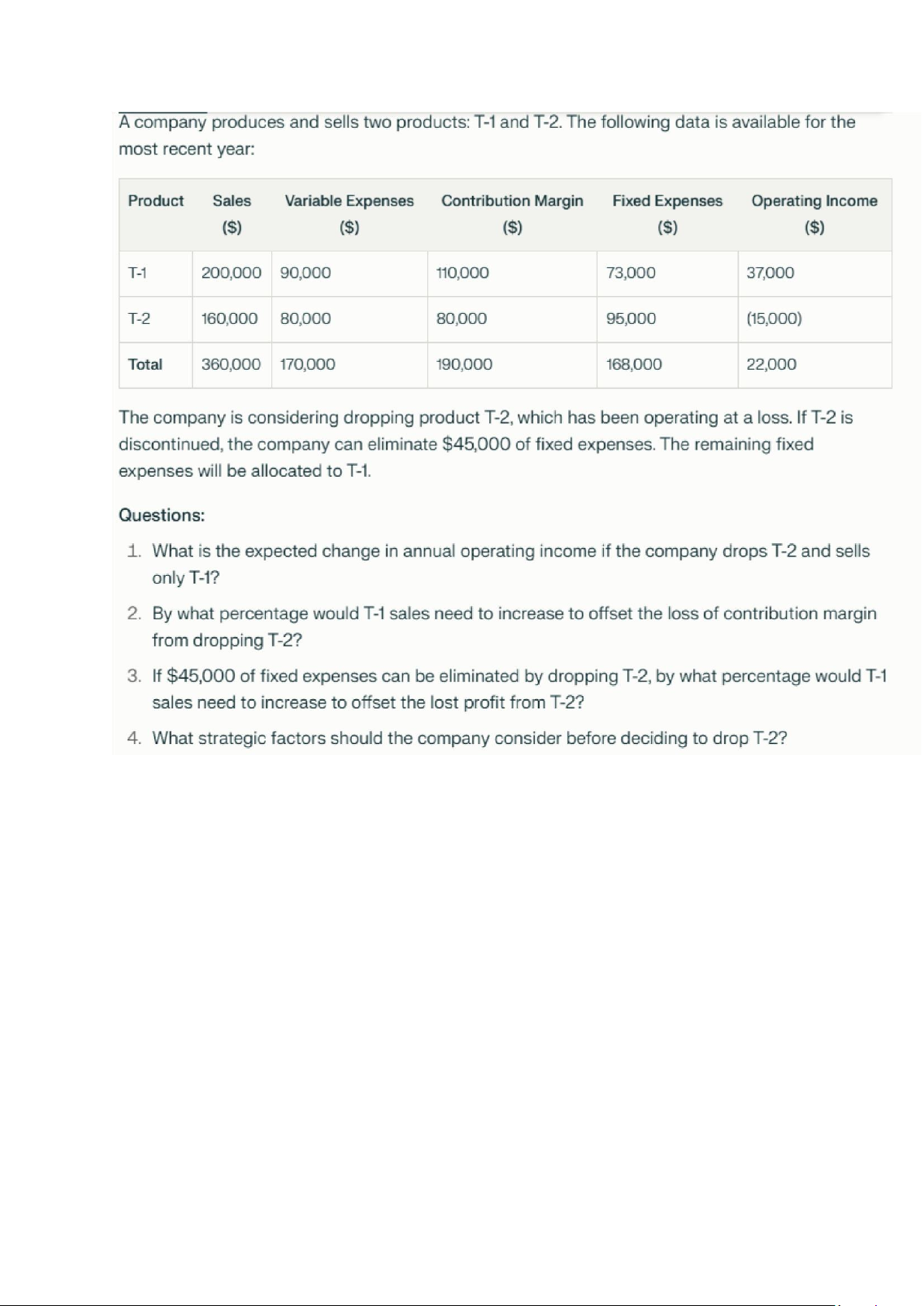

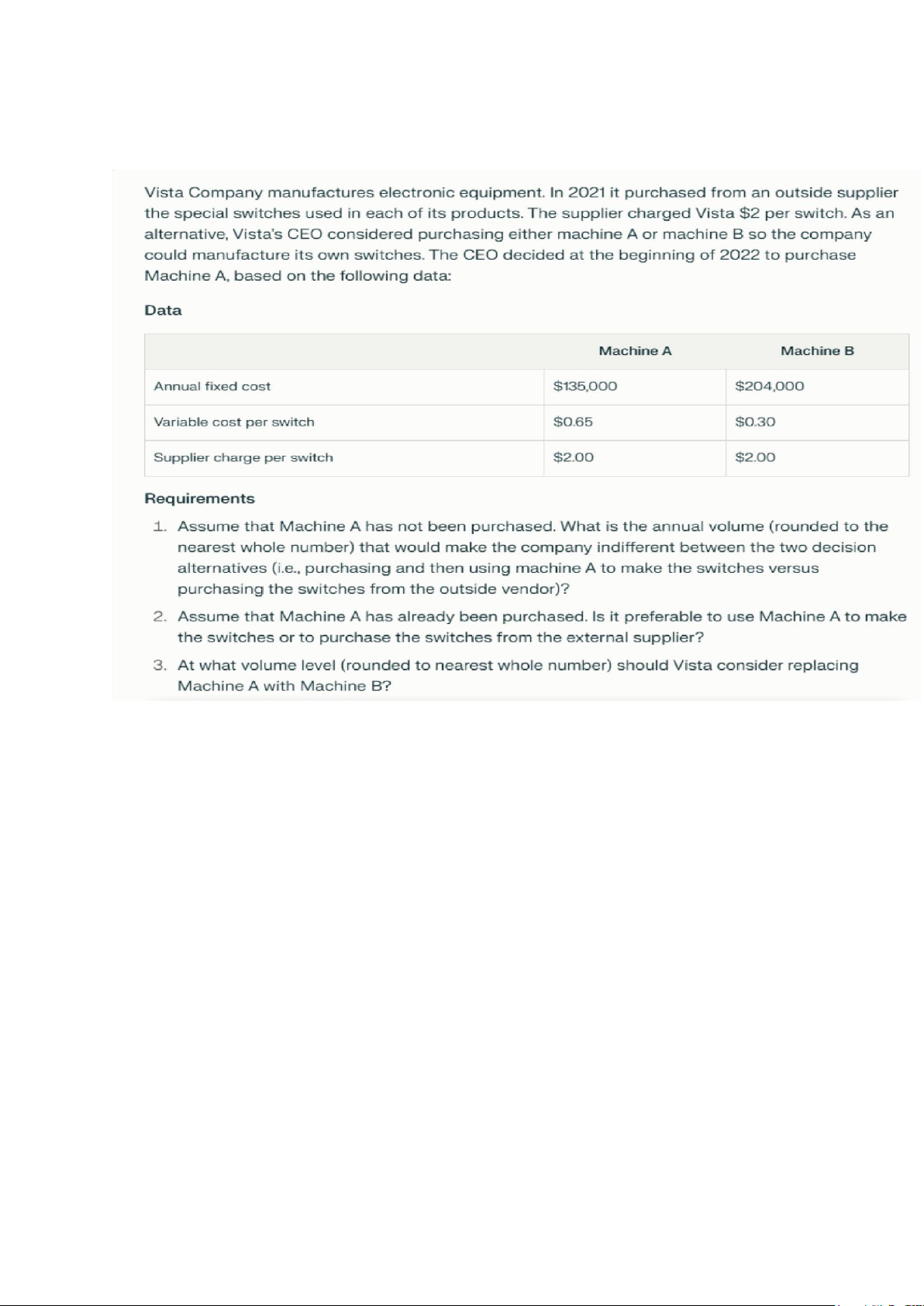

The cost and volume data are given below: Data: -

Volume of parts (units) required: 20,000 per year -

Purchase price per unit from outside supplier: $90.00 -

% of fixed overhead that is unavoidable: 40% Full

Manufacturing Cost per Unit Produced: - Direct materials: $35.00 - Direct labor: $16.00 - Variable overhead: $24.00 - Fixed overhead: $20.00 Total: $95.00 Requirements

1. Determine which alternative is more attractive to Eggers and by what amount.

2. What strategic factors might bear upon the ultimate decision? If Eggers MAKES the part: Relevant costs: Direct materials: $35 Direct labor: $16 Variable overhead: $24

Avoidable fixed overhead: 60% × $20 = $12

Total relevant cost per unit: $35 + $16 + $24 + $12 = $87 If Eggers BUYS the part: Relevant cost per unit: $90

B. Total Relevant Cost for 20,000 Units lOMoAR cPSD| 58511332

Alternative Relevant Cost per Unit Total Relevant Cost (20,000 units) Make$87 $1,740,000 Buy $90 $1,800,000

Difference: $1,800,000 (Buy) – $1,740,000 (Make) = $60,000

Conclusion: Making the part internally saves Eggers $60,000 per year compared to buying.

2. Strategic Factors to Consider

When making the final decision, Eggers should also consider:

- Quality control: Will the supplier meet the same quality standards as internal production?

- Reliability of supply: Is the supplier dependable regarding delivery times and quantities?

- Confidentiality and proprietary knowledge: Will outsourcing risk

disclosing proprietary processes or designs?

- Long-term flexibility: Will Eggers be able to restart production

easily if needed in the future?

- Employee impact: Will stopping internal production negatively

affect employee morale or result in layoffs?

- Supplier relationship: Could dependency on a single supplier create risks?

- No opportunity cost: Since the facilities cannot be used for other

purposes, there is no opportunity cost benefit from buying. Summary

- Eggers should continue to make the part internally, as it is $60,000 cheaper per year than buying.

- Strategic factors such as quality, supply reliability, and long-term

flexibility should also be weighed before making a final decision.

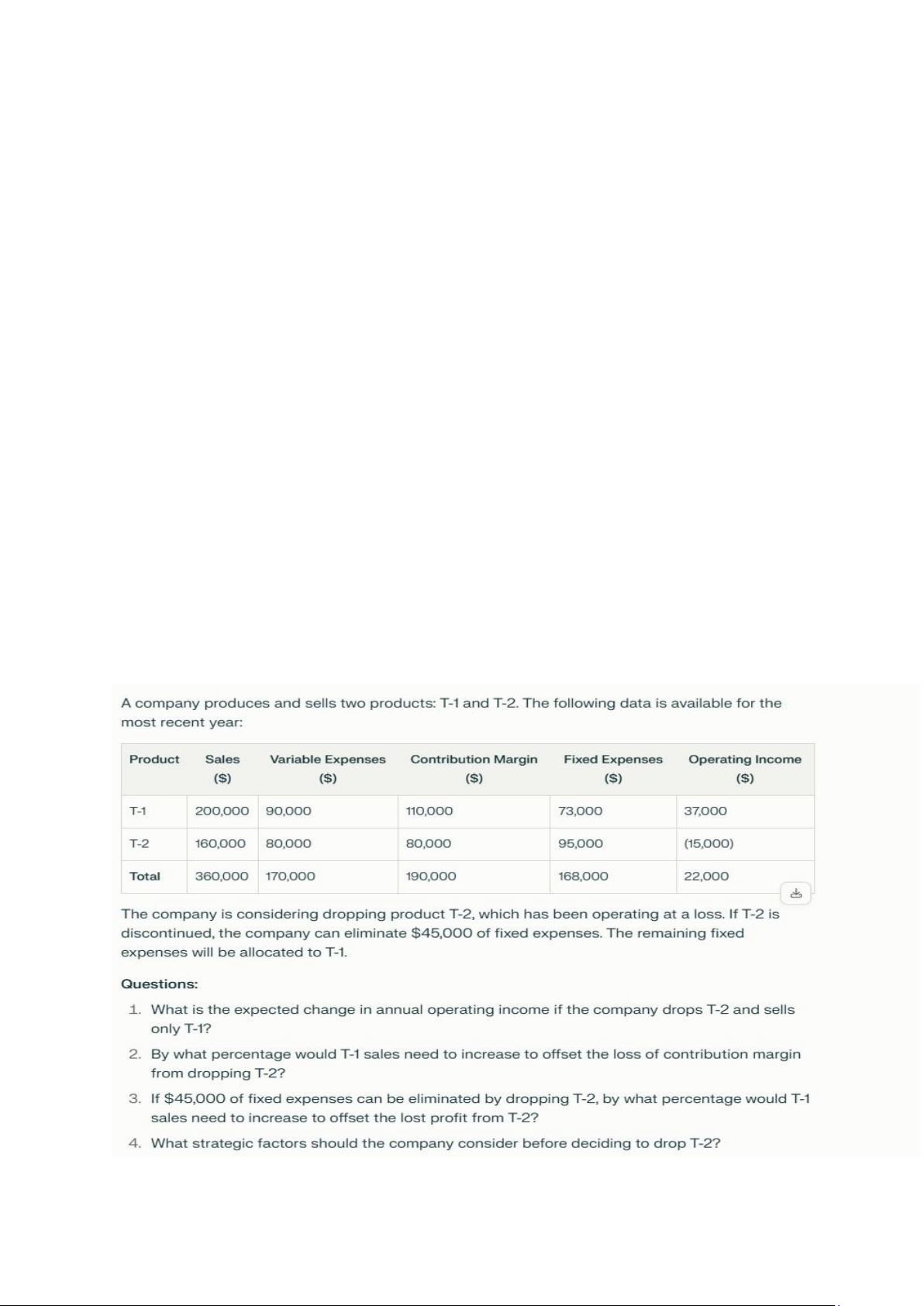

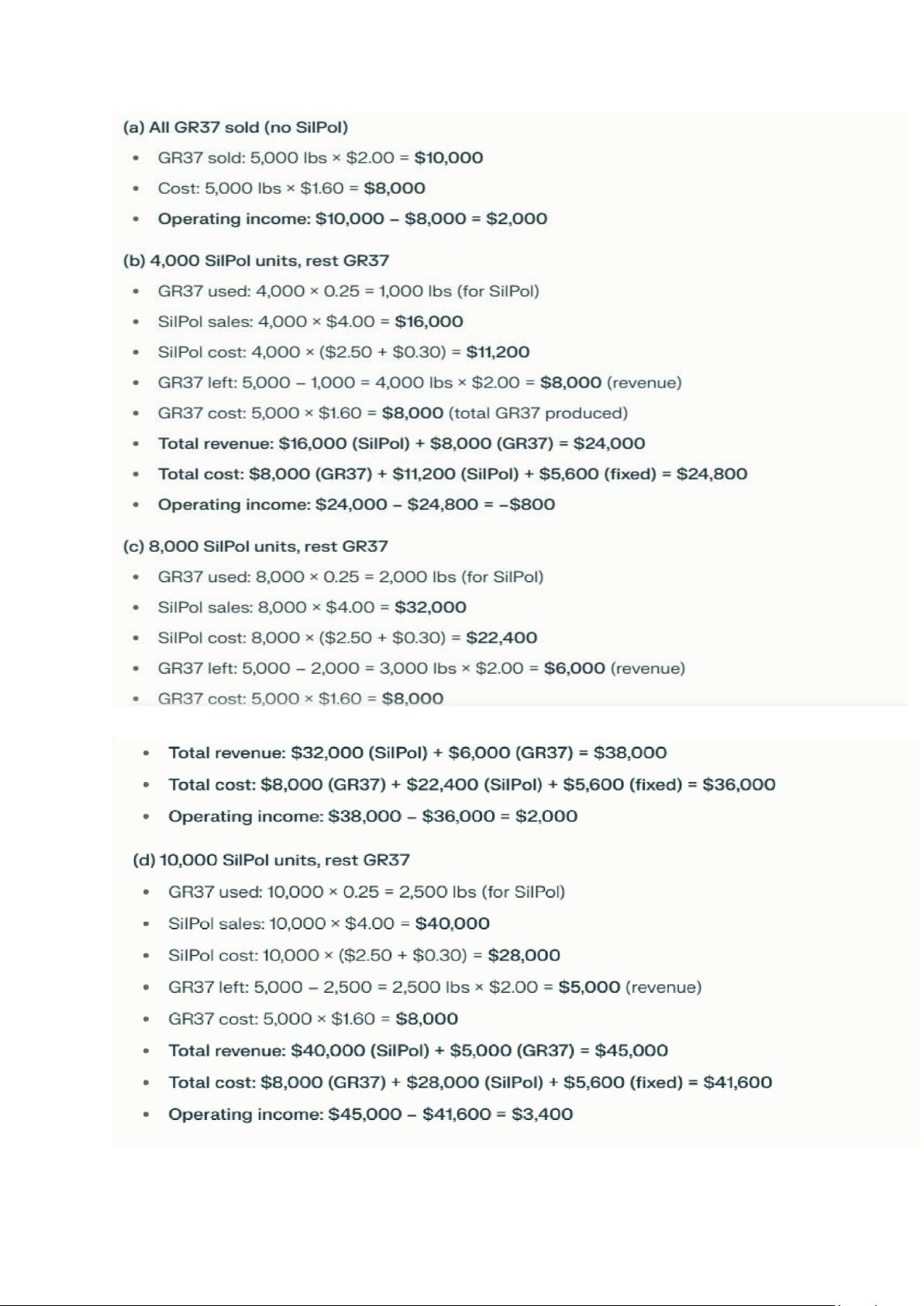

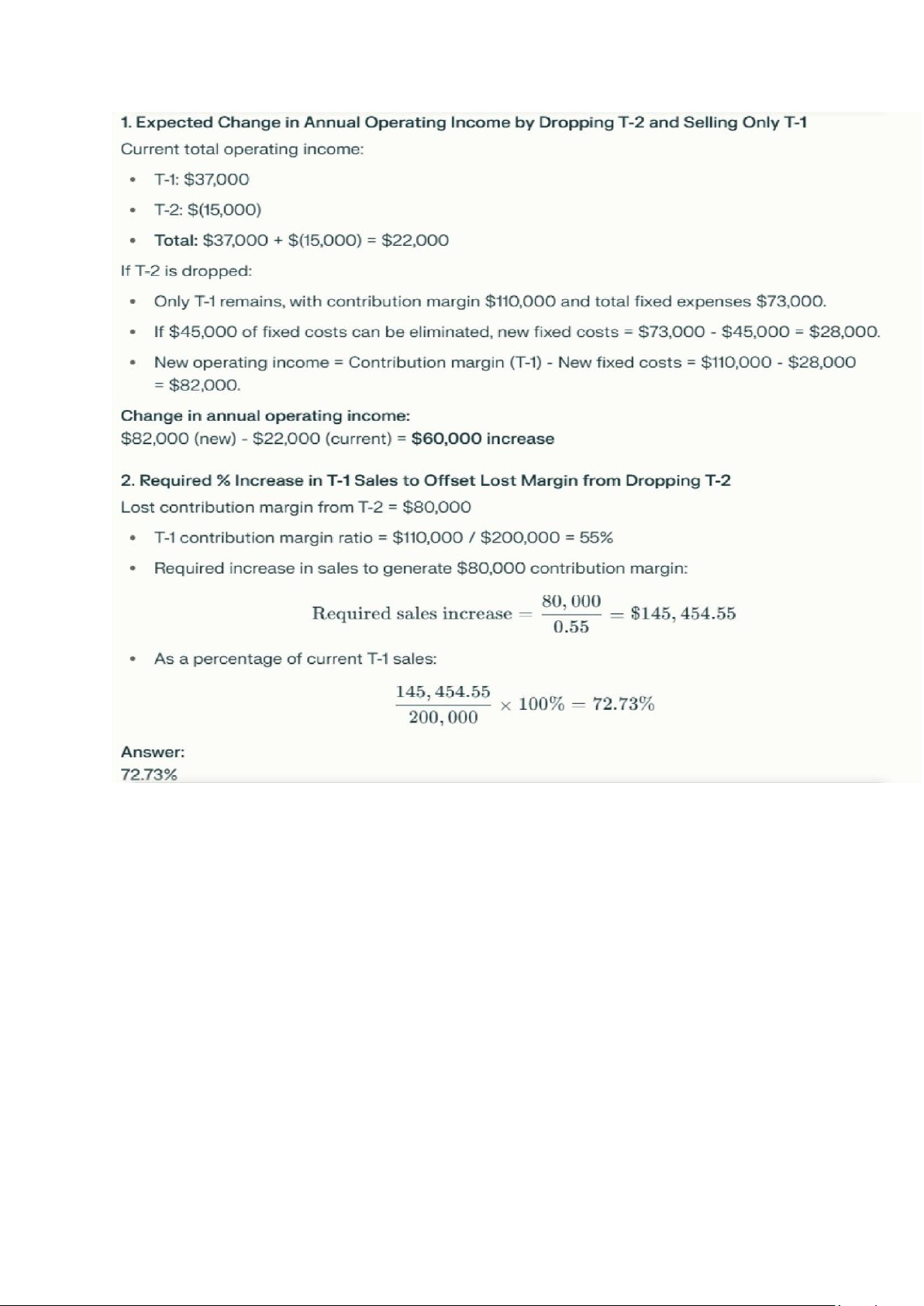

Cantel Company manufactures cleaning compounds for both

commercial and household customers. Some of these products are

produced through a joint manufacturing process. For example, GR37 is

a coarse cleaning powder intended for commercial sale, which costs

$1.60 per pound to produce and sells for $2.00 per pound. Part of the

annual production of GR37 can be further processed in a separate lOMoAR cPSD| 58511332

department, where it is combined with other ingredients to create SilPol,

a silver polish that sells for $4.00 per unit.

Producing SilPol requires ¼ pound of GR37 per unit. Additional

processing costs are $2.50 per unit of SilPol, and variable selling costs

for SilPol average $0.30 per unit. If SilPol production is discontinued,

$5,600 of processing department costs would be avoided. At this time,

Cantel has unlimited demand for both products, but can only produce a limited amount of GR37.

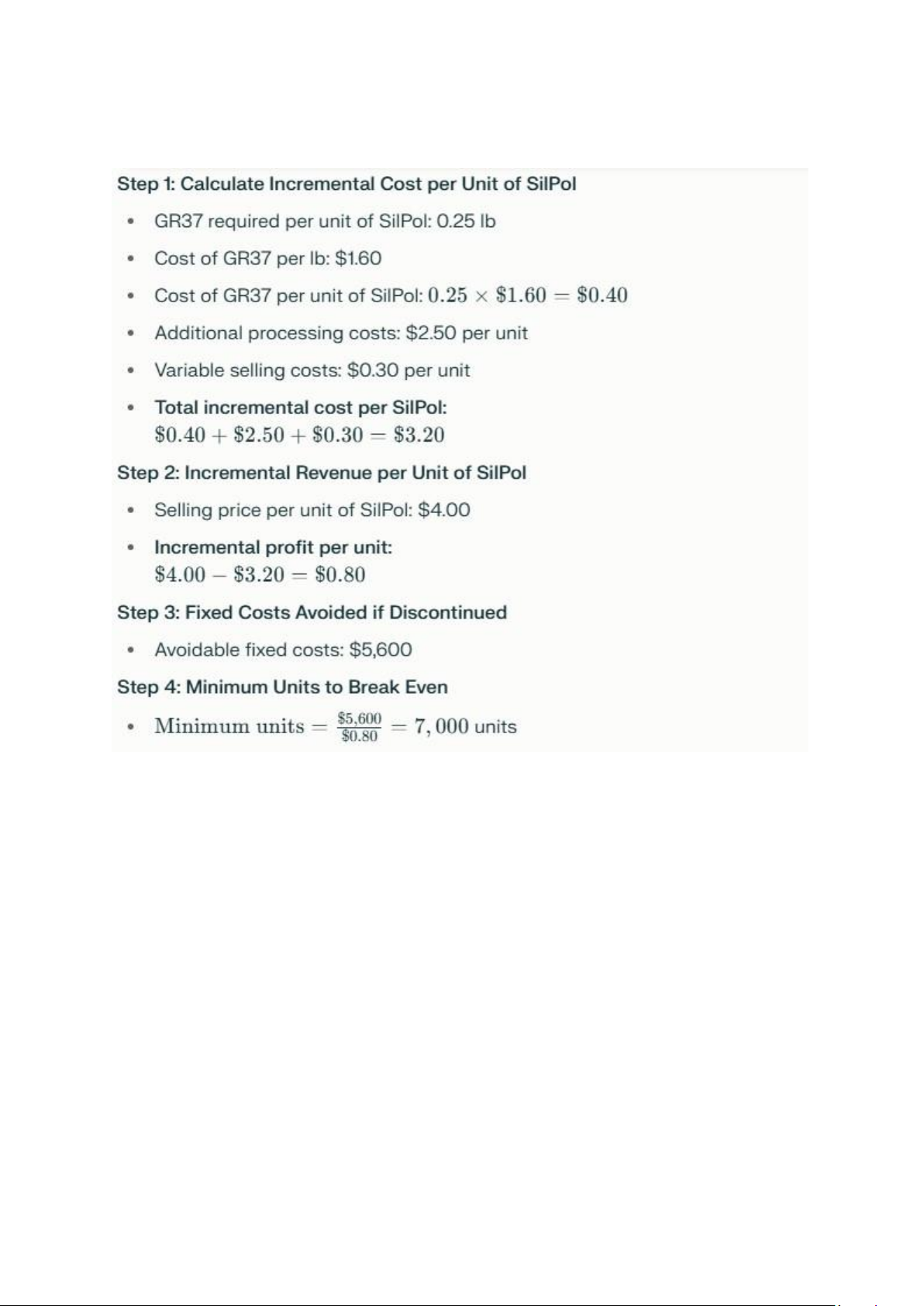

Assume the cost data for GR37 is based on a maximum output of 5,000

pounds, which is the company's current production limit. What is the

expected operating income (rounded to the nearest dollar) under each of the following scenarios:

(a) All available capacity is used to produce GR37 only (no SilPol). (b)

4,000 units of SilPol are produced, with the remaining capacity used for GR37. (c)

8,000 units of SilPol are produced, with the remaining capacity used for GR37. lOMoAR cPSD| 58511332

(d) 10,000 units of SilPol are produced, with the remaining capacity usedfor GR37. Answer:

7,000 units of SilPol must be sold to justify further processing of GR37

2. Expected Operating Income Under Different Scenarios Assumptions: lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332

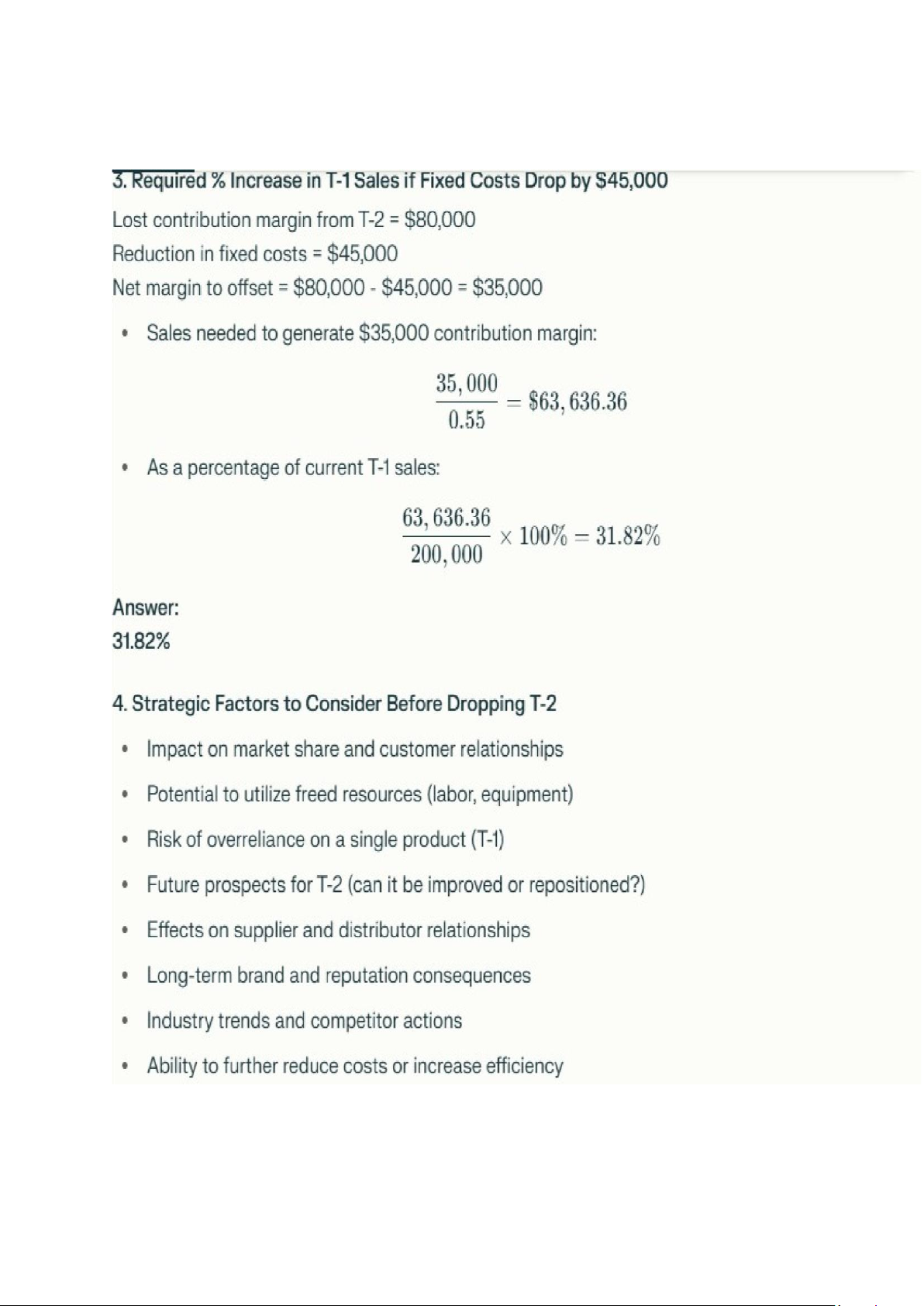

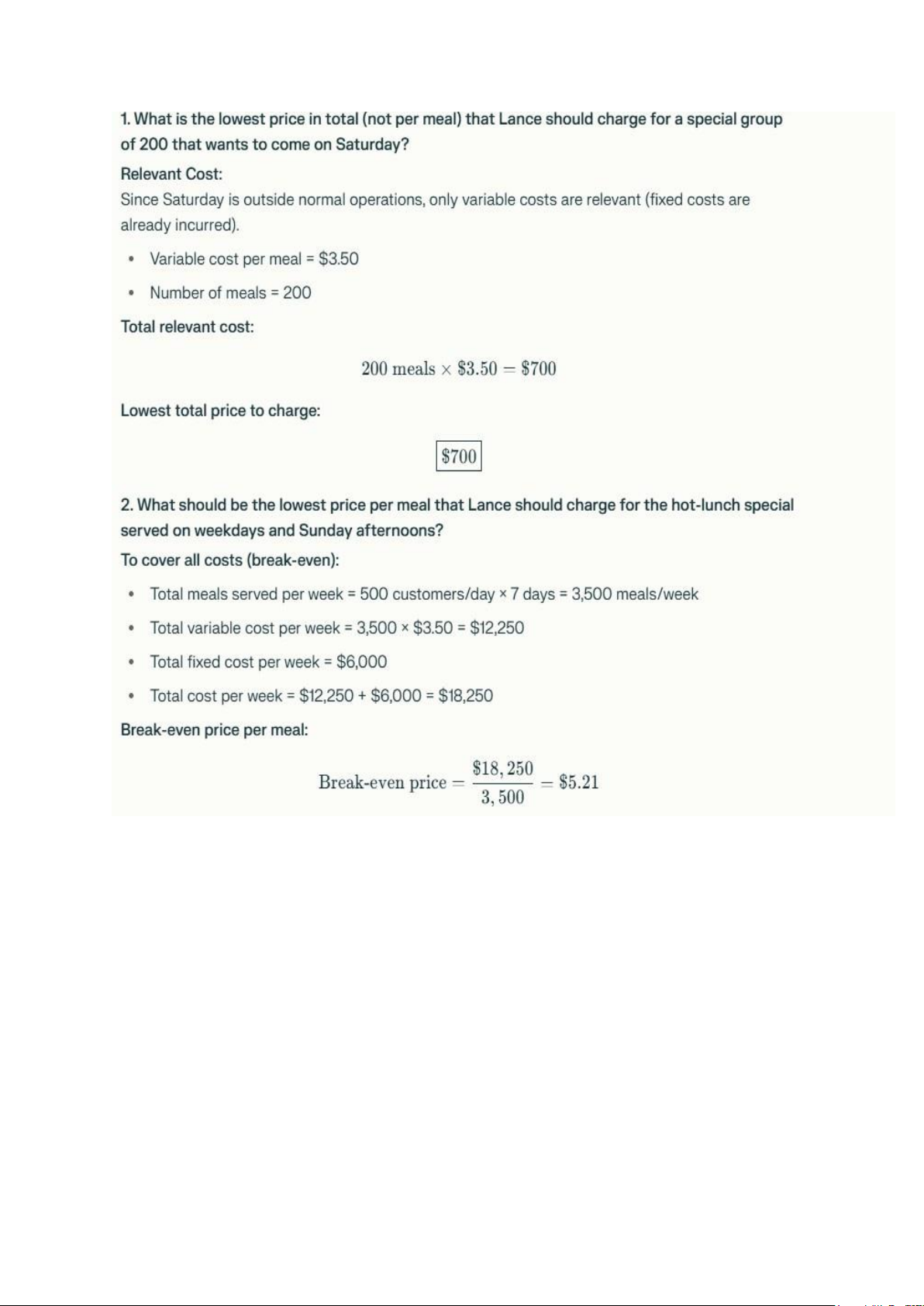

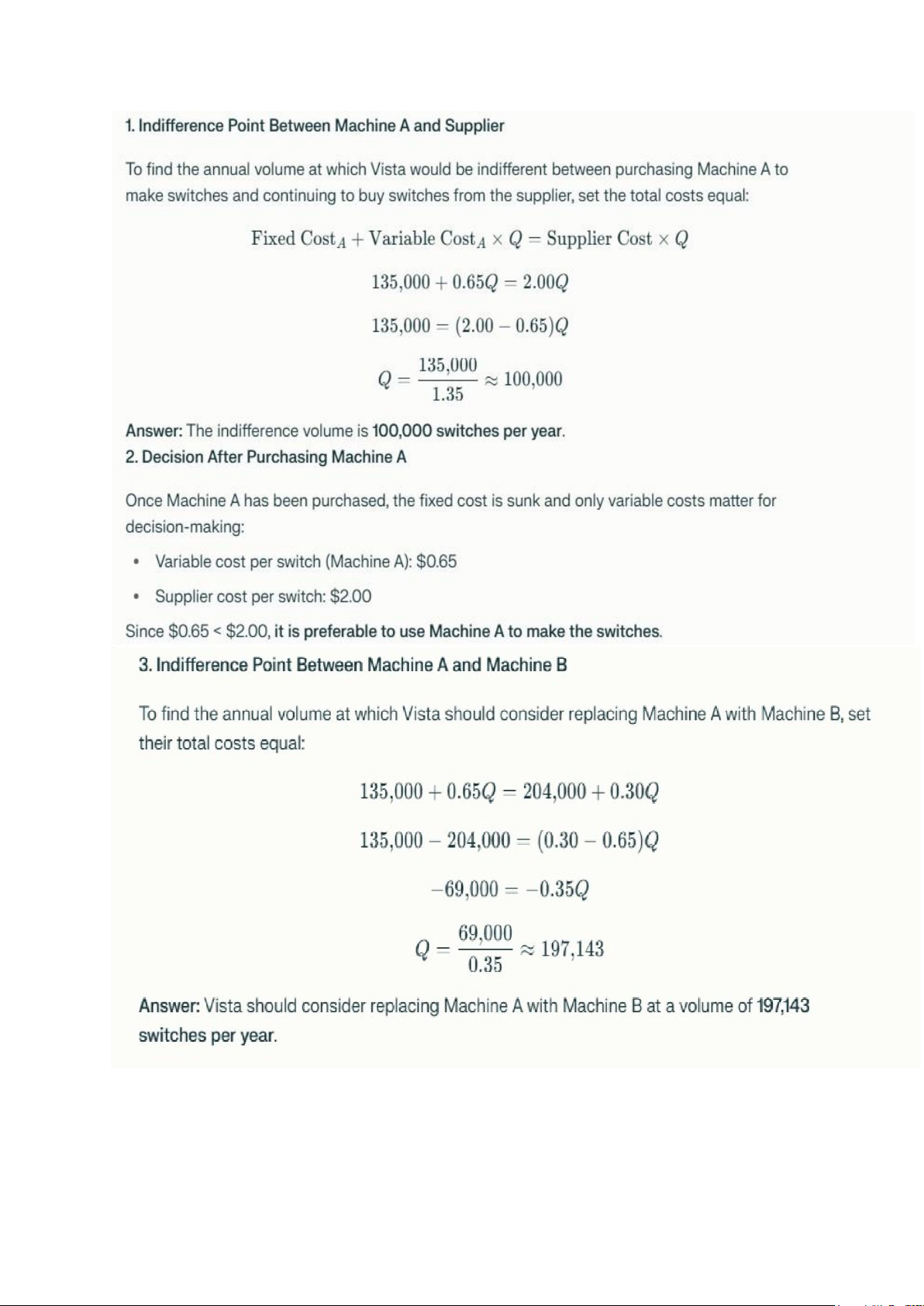

Strategic Considerations in Make-vs.-Buy Decisions

When deciding whether to produce a product internally or purchase it

from an external supplier, companies must weigh a range of strategic

factors beyond just cost. Key considerations include:

- Core Competencies: Assess whether manufacturing the product

internally leverages the company’s core strengths. If the activity is

not a core competency, outsourcing may allow the company to

focus resources on areas that provide greater competitive advantage.

- Total Cost Analysis: Look beyond direct costs to include indirect

and hidden costs such as logistics, supplier management, quality lOMoAR cPSD| 58511332

control, and potential disruptions. A thorough total cost of

ownership (TCO) analysis is essential.

- Quality and Control: In-house production offers greater control

over product quality, intellectual property, and compliance with

regulations. Outsourcing may risk quality issues or loss of

proprietary knowledge, but can also provide access to specialized

expertise and advanced technology.

- Flexibility and Scalability: Consider the ability to scale

production up or down efficiently. External suppliers may offer

greater flexibility and faster response to market changes, while

inhouse production may be less agile but more consistent.

- Supply Chain Risk and Resilience: Evaluate risks such as

supply chain disruptions, geopolitical factors, and reliability of

suppliers. In-house production can reduce dependence on

external parties, while outsourcing may expose the company to more external risks.

- Capacity and Resource Utilization: Assess whether the

company has the available capacity and resources to produce

internally without disrupting other operations. Outsourcing can free

up internal resources for other strategic initiatives.

- Strategic Alignment: Ensure the decision aligns with the

company’s long-term strategic goals, including vertical integration,

market positioning, and innovation objectives.

- Regulatory and Compliance Issues: Ensure compliance with

industry standards and regulations, which may be easier to

manage internally in some cases. lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332 lOMoAR cPSD| 58511332