Preview text:

Executive Summary

USASuperCars recently signed a contract to sell 27 luxury super cars in a year’s time

in five countries, including the United States of America (USA). Revenues from the

other four countries will be paid in their local currencies at the exchange rate

prevailing at the time of delivery. However, HSBC offered the company a sure sum of

money $2,150,000 to purchase the contract. The objective of the report is therefore to

conduct an analysis of profitability and risks to the company as well as the bank,

based on which a recommendation will be made to the company on whether to accept

or reject the HSBC’s offer. The analysis was carried out using exchange rate data from Bank of America.

To achieve this objective, we computed various statistics. The expected (uncertain)

revenue from the sale of the cars is computed as $2,192,868 including revenue from

the sale of one car in the USA) and the risk is (standard deviation) $38,241.97. The

probabilities of the revenue exceeding $2,200,000 and 2,225,000 are 42.47 and 20.05

per cent, respectively, while the probabilities of revenue being less than $2,150,000

and 2,120,000 are 13.14 and 2.87 per cent, respectively. This indicates that the

probability of exceeding the expected revenue is higher. In addition, the study

computed the bank’s value at risk defined at the 5th percentile of the uncertain

revenue to be $62,908.04, while its expected profit is $42,868.

In conclusion, the report recommends that the bank’s offer be rejected by the

company, due to the possibility of earning higher than the amount offered by HSBC. Introduction

USASuperCars is a company based in the USA, and specializes in marketing luxury

sports cars, usually referred to SuperCars. These are custom built, expensive and fast

sports cars, specifically made for celebrities around the world. Recently, the company

signed a contract to sell 27 cars across four continents; to be paid in local currencies at

the prevailing exchange rate at the time of delivery. This definitely involves

uncertainties about the final revenue to be generated by the company at the end of the

contract period. In order to make a proper analysis, Bank of America provided

exchange rate estimates for these countries, and their standard deviation for the next twelve months.

To manage the exchange rate risk, HSBC offered the sum of $2,150,000 to the

Company in return for all the revenue in local currencies.

The aim of the report is to calculate the probabilities of earning revenue in excess or

below the expected revenue, assesses the offer from HSBS, and appraises other risks

facing the company and the bank. Based on this, a recommendation was made to the

company to reject HSBC’s offer and wait for the contract sum that would be paid in twelve months’ time. Main Body

USASuperCars signed a contract to sell 27 cars in five countries, including the USA.

These include 12 cars in United Kingdom (UK); eight in Japan; four in Canada; two

in South Africa and one in the United States of America (USA). The contract in both

Japan and Canada involve two agents each, making a total of four. Though the

exchange rate means and standard deviations for the countries are the same, the

selling prices are different, thus, presenting different risk levels. With the exception of

the one to be sold in USA, the rest will be paid in local currencies at an exchange rate

prevailing at the time of delivery. Given that exchange rate between these currencies

and the US dollar are flexible, there is additional uncertainty about the expected

revenue at the end of the contract period. To reduce the exchange rate uncertainty,

Bank of America provided estimates for exchange rates and their standard deviation

around their averages (Table 1). While mean indicates the expected average of the

exchange rates, the standard deviation, according to Wikipedia (2013) shows the

expected variation of the revenue from the average uncertain revenue.

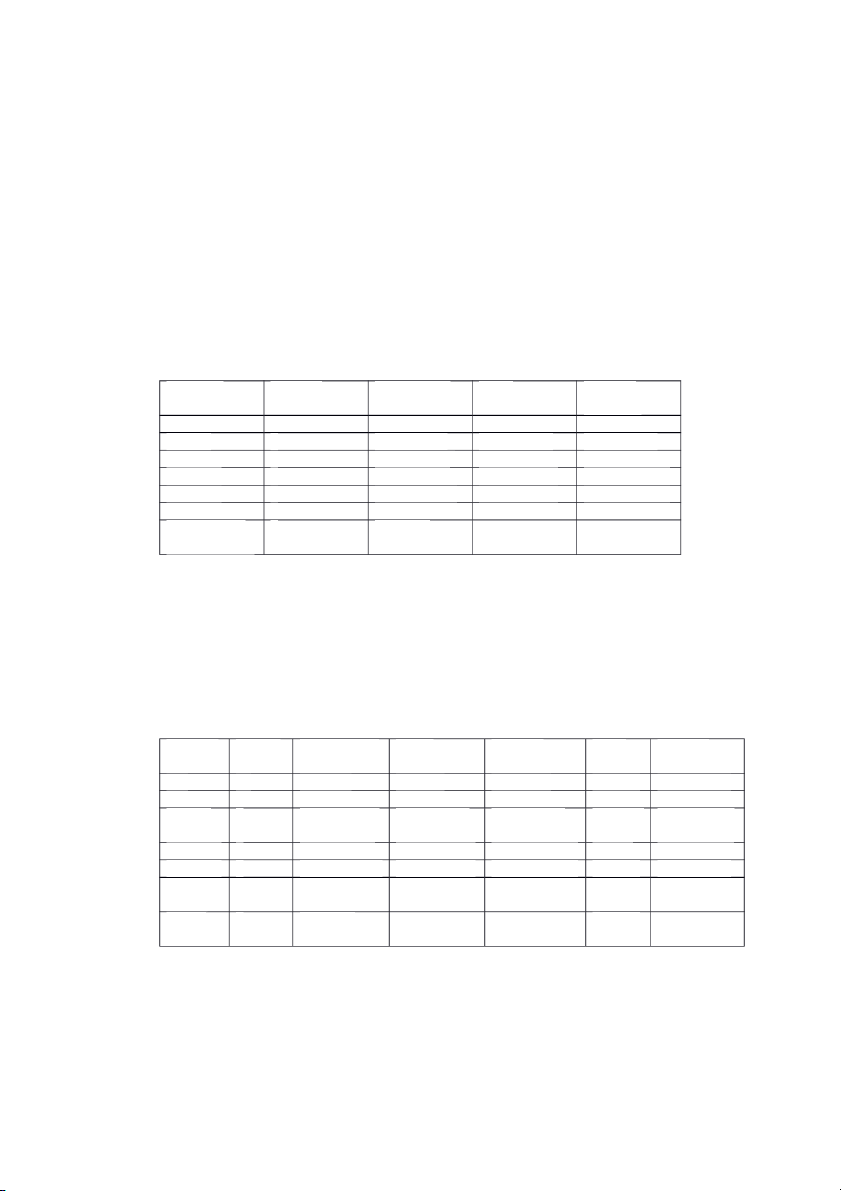

Table 1: Car Sales Details Worldwide Orders Exchange Rate (to $) Customer Quantity Selling Price Mean Standard Deviation UK 12 £ 57,000 $ 1.41/£ $ 0.041/£ Japan 1 5 Y 8,500,000 $ 0.00904/Y $ 0.00045/Y Japan 2 3 Y 90,000,000 $ 0.00904/Y $ 0.00045/Y Canada 1 1 CAD 97,000 $ 0.824/CAD $ 0.0342/CAD Canada 2 3 CAD 100,000 $ 0.824/CAD $ 0.0342/CAD South Africa 2 R 4,100,000 $ 0.0211/R $ 0.00083/R United States 1 $100,000

Using these figures, the mean and the standard deviation of the uncertain revenue was

calculated. The mean was obtained by multiplying the quantity of the cars ordered, the

selling price and the exchange rate mean, while the standard deviation of the expected

revenue was computed by calculating the variances between the mean of the expected

revenue, squaring them to obtain the variance before taking the square root of their

summation to get the standard deviation. The results are shown below in Table 2 below:

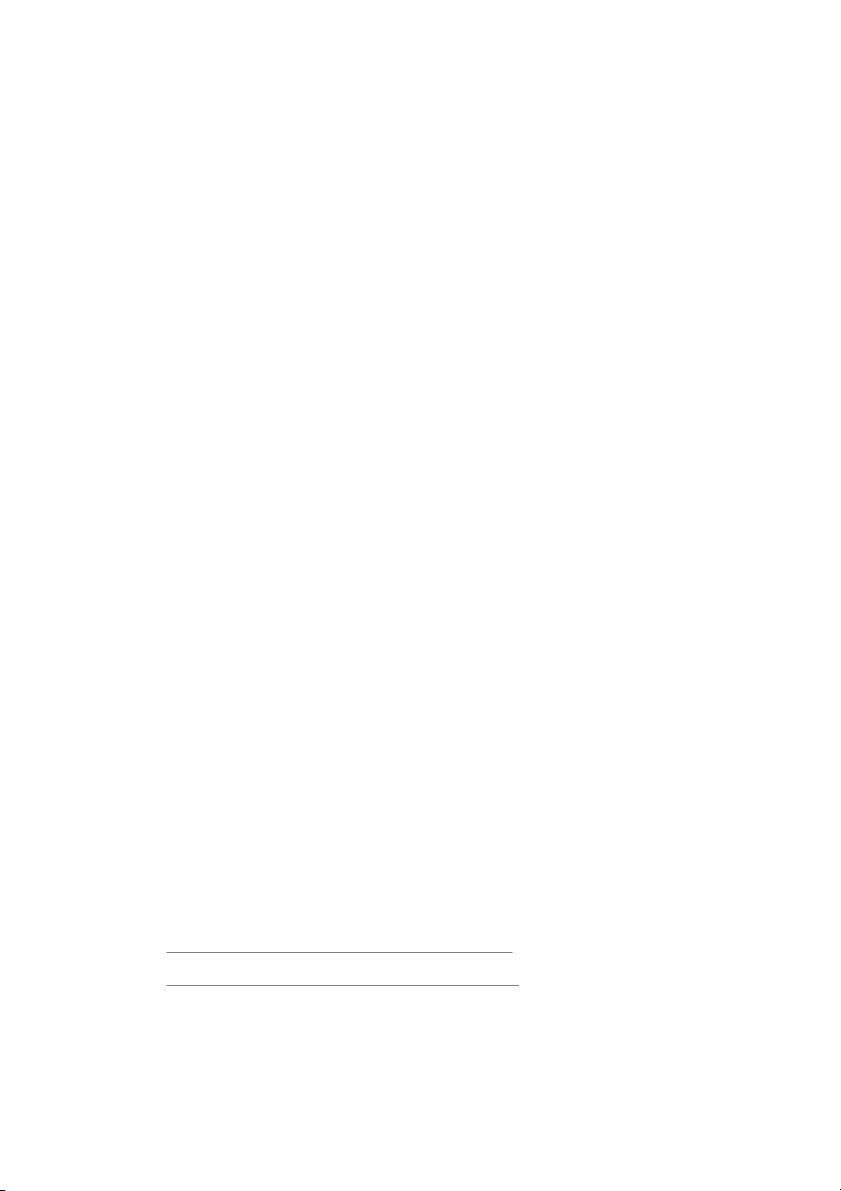

Table 2: Expected Return and Standard Deviation

Worldwide Orders Exchange Rate (to $) Expected Revenue Custome Quantit Selling Price Mean Standard Mean Variance r y Deviation UK 12 £ 57,000 $ 1.41/£ $ 0.041/£ 964,440 786,465,936 Japan 1 5 Y 8,500,000 $ 0.00904/Y $ 0.00045/Y 384,200 365,765,625 Japan 2 3 Y 90,000,000 $ 0.00904/Y $ 0.00045/Y 244,08 147,622,500 0 Canada 1 1 CAD 97,000

$ 0.824/CAD $ 0.0342/CAD 79,928 11,005,142.8 Canada 2 3

CAD 100,000 $ 0.824/CAD $ 0.0342/CAD 247,200 105,267,600 South 2 R 4,100,000 $ 0.0211/R $ 0.00083/R 173,02 46,321,636 Africa 0 United 1 $100,000 100,000 States Expected Revenue = $2,192,868

Standard Deviation = = $38,241.97

From the above, the uncertain revenue to be collected in a year’s time amounts to

$2,192,868. This is on the assumption that all the revenue, including the one sold to

the USA car dealer, who is paying in US$ involves some risk or uncertainty, which is

defined as “the probability of loss inherent in financial methods which may impair the

ability to provide adequate return” (Investopedia, 2013). Though it has no exchange

rate risk, there are other risks that the Company has to bear if it has to wait for twelve

before receiving its payment, which include credit and physical risks.

While risk cannot be quantified, in finance, the standard deviation of values from their

mean is used to represent the risk of investing in an asset or a portfolio. From the

computations in Table 2, the standard deviation from the expected revenue is

$38,241.97, which represents the risk to USASuperCars due to expected fluctuations

in exchange rates. In calculating the standard deviation, sales to Japan and Canada

were treated differently (their variances were squared differently before summing

them), which reduces risk, thus achieving the benefit of diversification.

In order to help Managers make informed decisions, further calculations on the

probability of earning higher or lower revenue than the average were made. Thus, the

probabilities of revenue exceeding the mean by $7,132 or $32,132 (revenue exceeding

$2,200,000 or $2,225,000) as well as the revenue falling below the mean by $42,868

or $72,868 (revenue being less than $2,150,000 or $2,120,000) were calculated.

Results show that the probability that revenue will exceed $2,200,000 is 42.6 per

cent, while that of exceeding $2,225,000 is 20.0 per cent. On the other hand, the

probability that revenue will be less than $2,150,000 is 13.1 per cent and for

earning less than $2,120,000 is 2.8 per cent.

This shows that the possibility of exceeding the expected revenue is higher than

earning less. This is supported by the global economic outlook, as economies

around the world recover from the global financial crisis. The major world

economies have stabilized from the shock of the 2008 global financial crisis, and

are on the path of recovery, while the euro zone has recorded real economic

growth in July, 2013 after 18 months in recession. As a result, demand for luxury

cars is expected to increase. Furthermore, exchange rates are expected to

stabilize as there is less competitive devaluation by countries to spur economic growth.

As an option of managing its risk, the Company received an offer of a sure sum

of $2,150,000 from Hongkong and Shanghai Banking Corporation (HSBC). This

is below the uncertain return of $2,192,868 by $42,868, which is quite logical

since it involves less risk. On the contrary, if the offer of the sure sum provided

by the bank is higher that the uncertain revenue (supposing the $100,000 revenue

from the sale of the car in the USA is excluded from the uncertain revenue), then

the CEO of USASuperCars will surely accept it. Considering that the probability

of USASuperCars getting revenue below this amount is low (13.14 per cent)

compared to the probability of earning more than the offer (86.86 per cent) the

offer is not good for the Company.

After considering the offer from HSBC, the Sales Manager is willing to accept it,

while the Chief Executive Officer (CEO) is not. We can conclude that the Sales

Manager is more risk-averse than the CEO, which according to Wikipedia (2013)

is “the reluctance of a person to accept a bargain with an uncertain pay-off

rather than another bargain with more certain, but possibly lower expected pay- off”.

Considering risk involved in international financial transaction, the bank is

taking other risks, apart from exchange rate risk. These include credit, country

and physical risks. Credit risk is the inability of the car dealers or the final buyer

to pay the expected price as and when due, while physical risk involve the

possibility of the cars being damaged after delivery but before selling them to the

final consumer due to a natural disaster. Though these risks can be managed

through providing insurance cover to the cars, it however involves additional

cost. Another risk to the bank is market stagnation due to a financial or

economic crisis. Others include country risks such as changes in legislations and

regulations, as well as political risks in these countries.

Supposing the Company decides to accept HSBC’s offer, and it is to receive the

sure sum in three months’ and not in a year’s time, would that make any

difference? Yes, it will. While the bank will prepare to pay the money in twelve

months’ time, the company will prepare to receive the payments in three months’

time. This is because of the time value of money, whereby having money at

present is worth more than the same amount in the future due to its potential

earning capacity (Investopedia, 2013). For instance, $100 now is worth more

than $100 in nine months’ time because if invested now, will be more in nine

months. In addition, because of inflation, $100 now can buy more than what $100

could buy in the future. By collecting the money earlier, the company can invest

it and earn interest income, while by delaying the payment till a later date, the

bank can also benefit by lending it and earning interest from it.

Considering the expected revenue computed earlier, suppose USASuperCars

accepts the bank’s offer, the probability of the bank making loss is 13.14 per cent,

which is the probability of revenue falling short of the bank’s offer of $2,150,000.

However, if the bank decides to define its level of risk due to some information at

its disposal, then its expected loss will be computed differently. Suppose the bank

defines it value at risk at the 5th percentile of the uncertain revenue, (5 per cent

left tail of the distribution), what is the bank’s Value-at-risk and its expected

profit? In this situation, the bank’s value at risk is $62,908.04, while its expected

profit is $42,868. This are obtained as follows:

Value at risk = (5% C.I.) * $ =$62,908.04

Bank expected profit = Expected revenue – Bank offer = $2,192,868 - $2,150,000 = $42,868

Assuming that the company accepts HSBC’s offer, at the end of twelve months, the

bank may convert all or some of its revenue from the local currencies to the US dollar.

However, it decides not to do that, there are other options in which it can manage the

revenue. The bank can invest the currencies in these economies or in other economies

using different means such making bank deposits, or invest in other liquid assets in

the money market. The bank can also invest in capital market instruments in safe

emerging market economies. Another option is a foreign currency swap agreement

with another bank or financial institution. This is an agreement between two parties to

exchange two currencies at a certain exchange rate at a certain time in the future,

which will eliminate the risk of exchange rate moving in a way that is

disadvantageous to one party or the other (Farlex Financial Dictionary, 2013). Others

options include purchasing inputs required for the day-to-day running of the company. Conclusion and Recommendation

This report calculated the expected return and risk for a contract recently signed by

USASuperCars to sell 27 cars in five different countries, including the USA. The

expected revenue is $2,192,868, while the standard deviation is $38,241.97. However,

HSBC is offering the Company a sure sum of $2,150,000 for the return in local

currencies. To assist the company in making a decision on the offer, probabilities of

earning revenues that are higher or lower than the uncertain revenue were calculated.

Results showed that the possibility of earning higher returns by the company if it

waits at the end of twelve months are higher. However, there are other risks that the

bank is taking if the company accepts the offer, which the company is also facing if it

reject HSBC’s offer. These include credit, physical and political risks.

Given all the figures and facts presented above, this report recommends that the Board

of USASuperCars should reject the offer based on the following reasons:

· The probability of achieving higher return is more than the probability of getting a lower return.

· Exchange rates are expected to remain stable against the US dollar in the next twelve

months, thus lowering exchange rate risk.

· Global interest rates are low and central banks are not expected to raise them in the

next twelve months because it would affect the fragile economic recovery being

witnessed, and the threat of inflation is very little. So the interest income of investing

the sure sum will not compensate for the lost revenue.

· Three out of the four countries are developed economies, while the other is among

the biggest emerging markets. As a result, they are largely insulated from political risk

and uncertainties arising from political events.

In conclusion, the company would benefit more if they reject HSBC’s offer and wait

for the maturity period of the contract. References BusinessDictionary (2013)

Financial Risk, (Online) Obtained from:

www.businessdictionary.com/definition/financial-risk.html

Farlex Financial Dictionary (2013) Foreign Exchange Swap (Online) Obtained from:

www.financial-dictionary.thedictionary.com/currency+swap

Investopedia (2013) Time Value of Money (Online) Obtained from:

www.investopedia.com/terms/t/timevalueofmoney.asp

Wikipedia (2012) risk-aversion, Online Obtained from:

www.en.wikipedia.org/wiki/Risk-aversion (assessed on November8, 2013) Appendix 1: Answers

Questions: Q1. Find the distribution and report the mean and the standard deviation of the uncertain revenue in $.

Mean = = [(Quantity) * (Selling Price) * (Mean)] Mean = =2,192,868

Variance = σ² = [(Quantity) * (Selling Price) * (Standard Deviation)] ² σ² (12 x

£57,000 x $0.041/£ )² + ( 5 x Y8,500,000 x $0.00045/Y )² + ( 3 x Y9,000,000 x

$0.00045/Y )² + ( 1 x CAD97,000 x $0.0342/CAD )² + ( 3 x CAD100,000 x

$0.0342/CAD )² + ( 2 x R4,100,000 x $0.00083/R )²

Variance = σ² = 1,462,448,439.76

Standard Deviation = = √ Variance = √σ² = √ 1,462,448,439.76

Standard Deviation = = 38,241.97

Q2. (a) What is the probability that this revenue will exceed $ 2,200,000? Z = x - µ/ s P(X > 2,200,000) Mean 2192868 Stdev 38242 (2,200,000 - µ ) / s

P Z > (2,200,000 – 2,192,868) / 38,241.97 P (Z > 0.1865) P = 0.4260 Probability = 42.6%

(b) What is the probability that this revenue will exceed $ 2,225,000? Z = ( x - µ) / s P(X > 2,225,000) (2,225,000 - µ ) / s Mean 2192868 Stdev 38242

P Z > (2,225,000 – 2,192,868) / 38,241.97 P (Z > 0.840) P = 0.2005 Probability = 20.04%

Q3. (a) What is the probability that this revenue will be less than $ 2,150,000? Z = (x - µ) / s P( X < 2,150,000) Mean 2192868 Stdev 38242 (2,150,000 - µ ) /s

P Z < (2,150,000 – 2,192,868) / 38,241.97 P (Z < -1.21) By symmetry P (Z > 1.21) P = 0.1312 Probability = 13.12%

(b) What is the probability that this revenue will be less than $ 2,120,000? Z x - µ

P(X < 2,120,000), 2,120,000 - µ Mean 2192868 Stdev 38242

P Z < (2,120,000 – 2,192,868) / 38,241.972 P (Z < -1.905) By symmetry P (Z > 1.905) P = 0.0284 Probability = 2.84%

Q4. HSBC offers to pay a sure sum of $2,150,000 in return for the revenue in local

currencies. What do you think, is this a good offer for USASuperCars or not?

Answer: The offer of $2,150,000 by HSBC is below the expected return, which is

logical since it reducing the risk of the Company. However, considering that the

probability of USASuperCars getting revenue below this amount is 13.14 per cent, the

offer is not good for the Company, as there is a higher probability (86.86 per cent) of earning above this amount.

Q5. In USASuperCars, the Sales manager is willing to accept HSBC’s offer, but the

CEO is not. Who is more risk-averse?

Answer: The Sales Manager is more risk-averse than the CEO.

Q6. What other risks the bank is taking apart from the uncertainty in the exchange rates?

Answer: Other risks the bank is facing include credit, physical, market stagnation and

country risks. Credit risk is the inability of the car dealers or the final buyer to pay the

expected price as and when due, while physical risk involve the possibility of the cars

being damaged after delivery but before selling them to the final consumer due to a

natural disaster. Though these risks can be managed through providing insurance

cover to the cars, it however involves additional cost. Another risk to the bank is

facing is market stagnation due to a financial or economic crisis. Others include

country risks such as changes in legislations and regulations, as well as political risks in these countries