Preview text:

Accepted Manuscript

Financing and monitoring in emerging economy: Can investment efficiency be increased?

Muhammad Kaleem Khan, Ying He, Umair Akram, Suleman Sarwar PII: S1043-951X(17)30076-7 DOI:

doi: 10.1016/j.chieco.2017.05.012 Reference: CHIECO 1065 To appear in: China Economic Review Received date: 29 October 2016 Revised date: 27 February 2017 Accepted date: 29 May 2017

Please cite this article as: Muhammad Kaleem Khan, Ying He, Umair Akram, Suleman

Sarwar , Financing and monitoring in emerging economy: Can investment efficiency be

increased?, China Economic Review (2017), doi: 10.1016/j.chieco.2017.05.012

This is a PDF file of an unedited manuscript that has been accepted for publication. As

a service to our customers we are providing this early version of the manuscript. The

manuscript will undergo copyediting, typesetting, and review of the resulting proof before

it is published in its final form. Please note that during the production process errors may

be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain. ACCEPTED MANUSCRIPT

Financing and monitoring in emerging economy: Can investment efficiency be increased? 1) Muhammad Kaleem Khan T

School of Economics and Management, Beijing University of Posts and

Telecommunications, Beijing, China mkaleemkhan@yahoo.com IP R 2) Ying He C S

School of Economics and Management, Beijing University of Posts and

Telecommunications, Beijing, China U heyingcn2001@126.com N A 3) Umair Akram M D E

School of Economics and Management, Beijing University of Posts and T

Telecommunications, Beijing, China P leo_umairinfo@yahoo.com 4) Suleman Sarwar CE C

School of Economics, Shandong University, Jinan, China A suleman.sarwar@yahoo.com 1 ACCEPTED MANUSCRIPT

Financing and monitoring in emerging economy: Can investment efficiency be increased? Abstract

This study investigates the influence of the financial system on firms’ investment

efficiency in China. For this purpose, we employ country level data of capital

markets and financial institutions along with financial data T from 2797 Chinese firms

in the period from 1998-2015. The firms are priori classified into four groups, by high

and low values of financial constraints and agency problems.

firms’ investments positively IP Results show that

financial development influences either directly or by

reducing cash flow sensitivity. The impact remains the R same for all types of firms.

Moreover, the financial structure has an impact on investment efficiency of firms;

this result also remains the same even after market C

controlling levels of financial

development. Study contributes that capital Sbased financial structure

impacts investment decisions by reducing financing constraints and agency issue

due to its strong monitoring ability.

Key words: Financial Development, Financial U

NStructure, Financing Constraints, Agency Cost, Investments A

JEL Classification: G10, G20, G30, G31, G32, O16, O53 1. Introduction M Economic development is D

dependent upon active role of financial institutions and

financial markets. Financial development is identified by the ability of financial

system (financial institutions, activity E

instruments and markets) to provide a mechanism to strengthen economic of

Tin an economy. (Gurley & Shaw, 1955) defined it as an increase in the number economic growth (Liang P

financial institutions. Financial development is related to

& Jian-Zhou, 2006). Financial development not only makes

smooth flow of capital, but also bridges information gap between capital deficit and

capital surplus units. To ease the information and lower transaction costs is the primary CE

purpose of efficient financial system, which results in efficient and effective allocation of tasks C

resources and thereby economic growth (Beck & Levine, 2004). Major

conducted by financial system are to maintain smooth flow of capital within economy A

and to develop efficient monitoring system to monitor the users of acquired funds.

Financial development is among the most vigorous elements of corporate decisions

(Antzoulatos, Koufopoulos, Lambrinoudakis, & Tsiritakis, 2016). Economic theory

illustrates that advancement of financial institutions and financial markets results in

lowering the transaction costs and information asymmetries, thus maximizing the

investment efficiency of economies. Structure of financial system is also important

for corporate performance. Financial structure means whether the system is

dependent upon financial institutions or financial markets. Researchers have

debated a lot about relative importance of both types of structures in particular 2 ACCEPTED MANUSCRIPT

investment decisions of firms (Baum, Schäfer, & Talavera, 2011; Beck & Levine,

2002; F. Castro, A. E. G. Kalatzis, & C. Martins-Filho, 2015b).

Investment efficiency means creating balance between overinvestment and

underinvestment. Investment inefficiency is caused by investment distortions. Two

problems that affect the corporate investments adversely are agency problem and

information asymmetry, these problems have been widely discussed in economic

theories of firm behavior after 1960s. Agency problem arises due to mismatch of

interest of shareholders with managers. It becomes the worst T when firms have

substantial amount of free cash, affecting investment efficiency adversely.

Overinvestment hypothesis illustrates that when there is a IP conflict of interest

between different stakeholders of firm, managers may exploit their discretionary

rights if they have excess free cash flow and invest more in R projects, which may not

be in long-term favor of shareholders and result in overinvestment (Michael C

Jensen, 1986). This problem may become severe if

system for watching agents. On the other hand, the C

there is no efficient monitoring S underinvestment hypothesis is

grounded on asymmetric information, which illustrates that a firm’s insiders and

capital market investors have different level of form U

information about the firm’s future

prospective. By this, transfer of wealth

Nnew to existing shareholders may

occur. This creates credit rationing and a wedge between the internal and external

finance and ultimately financial A

constraints (Michael C Jensen, 1986; Michael C.

Jensen & Meckling, 1976; Myers & Majluf, 1984). Agency problem and financing constraints jointly affect investment M

efficiency of firms adversely by making

investment cash flow sensitivity positive. How financial system D

development and structure are related with a lower degree of financial constraints and E

agency problem comes out to be an essential topic in the literature. This study T

postulates that if there is a developed financial system and an appropriate financial P

structure is adopted, then problem of agency and asymmetric

information can be controlled and then corporate investments will become more

productive. Financial development is associated with active monitoring of

corporate sector and flow of capital that reduces agency problem and financing constraints. CE The number of C

studies, which have explained the role of financial development and financial avenues of A

structure, is scarce and their contradictory results have created more

discussion. Most of these studies have been conducted in developed

economies and have ignored emerging economies. As almost all of these studies are

based upon cross-country comparison, they have dealt with the factor of

heterogeneity between countries, while our work is the pioneer to study the

individual companies within a single country instead of cross-country analysis.

Considering the presence of information asymmetry and agency problem, the role of

financial development and structure in determining corporate investment efficiency

is quite a new topic for financial literature. No other study has discussed all these

elements together, according to our best knowledge. Topic becomes more

interesting because we have selected China as our case study that has unique 3 ACCEPTED MANUSCRIPT

financial and economic system in terms of its characteristics. Technically speaking,

this work is to evaluate the financial development of Chinese economy in terms of

financial system’s main tasks i.e. capital flow and monitoring. This study is also to

find the answer to the question that whether agency issue and information

asymmetric problem are resolved well in financial institution based or financial

market based financial system. Our study is different from existing literature in

many aspects. First, almost all of the studies have studied this relationship in cross-

country comparison and have not bothered the heterogeneity problem between

countries. Second, there is no study, which has incorporated T the problem of

financing constraints and agency problem simultaneously. Third, no study has

addressed this issue for Chinese economy as it has peculiar IP nature compared to

other economies in the world. Moreover, we have analyzed the relationship

between financial system and investment for R different levels of financial

developments. So this study shows a deep understanding of Chinese financial C

system and can diagnose shortcomings and suggest remedies.

The current manuscript is also a prominent S

addition in the existing literature to

build the relationship between financial and real , ght U

sides of the economy. Investment

is core function for economy so if it goes in ri

As (Castro et al., 2015b) suggested, the scruNdirection, economy will progress.

tiny of a corporate investment is a

pertinent way to know the networks A

employed by financial systems to enhance

economic growth. So this topic is to link macro and micro level economic activities. Purpose of this study is to M

determine what happens to corporate investment in

response of financial structure and financial development when firm is having agency conflict as well as D

financial constraint and what lessons can be learnt from

this for theoretical and practical usefulness. This manuscript is on the background, juncture of these streams: E

investments, financial constraints, agency problem, financial development and a T

financial structure. No other research has related them all in single study. Our have focused a single P

study is different from all conventional works because we

economy with all its characteristics rather than studying

cross-county comparison after ignoring individuality between economies. China plays the CE

most prominent role in global economy and is the fastest growing economy, as C

well as the biggest economy of the world. But in spite of all these hallmarks, A

Chinese economy has some obstacles internally like less developed

financial system (Allen, Qian, & Qian, 2005). This makes our study more interesting

and influential. If we compare banking system of China with stock markets, then we

come to know that banking system is more important due to its larger size, but it is

also inefficient because it has higher overhead cost to total assets ratio(Allen et al.,

2005). China's bank-dominated financial sector is famous for its inefficiency and

misallocation of capital (H. Chen, 2006). In contrast to (Hasan, Wachtel, & Zhou,

2009) who found that development in financial sectors affects economy negatively,

(Hao, 2006) advocated that development in financial sectors of China has

contributed to its economic growth. According to (Allen et al., 2005), China’s

underdeveloped financial system does not match with blooming economic growth. 4 ACCEPTED MANUSCRIPT

State-owned banks are dominant over system but still they have a higher proportion

of non-performing loans. Unfortunately, these institutions also have to finance state-

owned enterprises which are sometimes in losses (Allen et al., 2005). Moreover,

Chinese stock market is not as old and developed as compared to most of the

economically developed countries. As stated by (Allen et al., 2005), share market is

also not well-organized and fundamental values cannot be depicted by stock prices.

But still China is the fastest growing economy and world’s biggest economy by

volume. So China provides a best case study for this title, as its financial system is in

growth phase and corporations are exhibiting both agency and T financial constraints

problems. Moreover, Chinese economy is experiencing transition form centrally

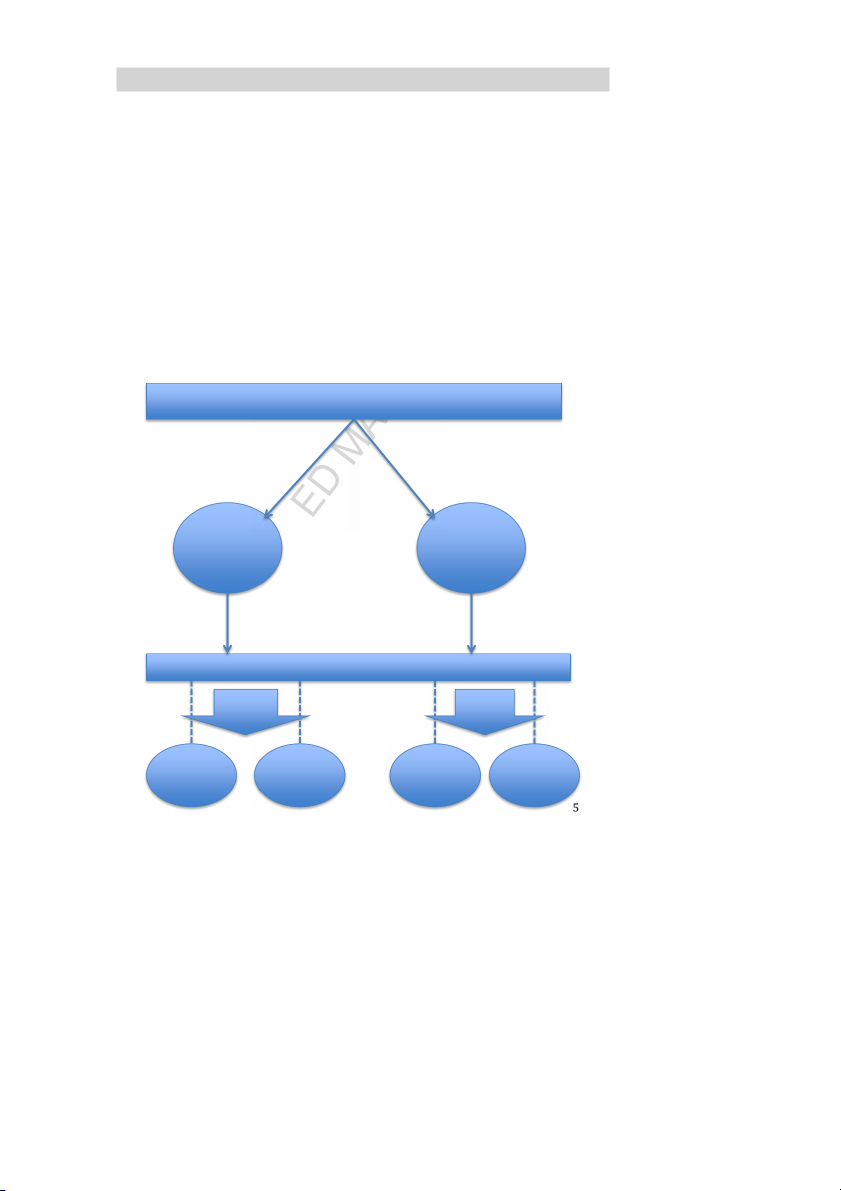

planned to market economy from last 30 years (Bhattacharjee IP & Han, 2014). Fig. 1

illustrates the main theme of our paper. This theme p R resents the theory that

investment efficiency is affected by agency cost and financing constraints, that can

be overcome by efficient monitoring and flow of C

funds, which is expected to be

delivered by financial system. S U N

Financial Development & Financial Structure T Financing Monitoring P CE C A

Investment Efficiency of Firms Firms Firms With Without Agency Fin. Agency Fin. Cost Constr. Cost Constr.

Figure 1: Flow of research theme ACCEPTED MANUSCRIPT 2. Hypothesis Formulation

As one of the tasks of financial development is to lessen information asymmetry and

financial constraints resultantly, it is directly related with finance availability. It

looks logical to believe that financial constraints faced by the firms may vary with

the given level of financial development. According to MM theory, if a perfect capital market persists,

firms’ investment decisions are never affected

choices. So choice of internal cost to external cost would lead to the T by its financial same amount of

cost (Modigliani & Miller, 1958). With this notion, the

remained to be abandoned with regard to corporate I variable of P finance availability investment until (Myers &

Majluf, 1984) challenged this proposition. Reality is that R there is always asymmetric

information between market participants. This notion let the researchers break

down the divination of MM theory of perfect capital finance C

market. After that, a vigorous

stream of researches studies the relationship of FHP Savailability and investment.

The most significant among them is

(Fazzari, Hubbard, Petersen, Blinder, &

Poterba, 1988). Their research incorporated the by U

financing hierarchy according to

cost, which illustrates that cash generated

compared to finances gathered from outside Ninside sources is less costly as

sources. Firms facing problem to get

required capital to cater investment opp A

ortunity, show more investment cash flow

sensitivity. By using different methodological approach on the same data set,

(Kaplan & Zingales, 1997) proved that M

it was in fact less financial constraint firms

that showed higher sensitivity of cash flow with investment. The most important

question in today’s financial D

research is to study how firms make investment

decisions in financing constraint environment. Moreover, asset tangibility affects investment cash flow E

sensitivity positively in financially constrained firms, while T

results are reverse for unconstrained firms (Almeida & Campello, 2007). Strong relationship P

between external financial constraints and investment decisions

has been revealed by a large number of theoretical and empirical researches (see,

e.g., (Almeida & Campello, 2007; Brown & Petersen, 2009; Chang, Tan, Wong, & Zhang, 2007; CE

Gayane Hovakimian, 2009).(Gayané Hovakimian, 2011) gave different contexts of C

financial constraints by illustrating that if there are external financial

frictions, firms rely more on their internal capital markets and increase investments in A

high Q opportunities. This indication supports that although financial constraints

improve the quality of project selection by reducing free cash flow and pressuring

managers to fund the more valuable investment opportunities.

(Guariglia, 2008) found that the sensitivity between investment and cash flow is U-

shaped with respect to internal financial constraints. Moreover, external financial

constraints increase this sensitivity. (M. Chen & Guariglia, 2013) proved statistically

that internal finances (or cash flow) significantly and positively affect firm’s

productivity.(Jangili & Kumar, 2010) found that a capital market development is

positively related to investment. (Ameer, 2014) studied investment behavior in six

Asian countries and found investment cash flow sensitivity varies with countries 6 ACCEPTED MANUSCRIPT

due to differences in capital market liberalization and banking sector reforms.

(Demirgüç-Kunt & Maksimovic, 2002) suggested that access to external finance becomes

easy with development of legal system, stock markets and banking system. Moreover,

firms’ access to external finance cannot be related with financial system development.

Growth of those firms, which cannot be self financed, is directly related to the

development of financial system.

(Baum et al., 2011) suggested that financing constraint problem may be tackled more

effectively by bank based financial structure, but by this firms may also become more

leveraged. This study is the first one that has addressed financial T development and

financial structure simultaneously. Research argues that financial development and

financial structure work together to take firms out of the financi not c IP ng constraint problem.

However, this study also raises some concerns, as it does Ronsider heterogeneity

between countries under analysis. Each country has its own level of development of

financial institutions, industry patterns, governance patter C

n and financial structure. All

these types of differences may react differently in case of firms’ financial constraints.

Similarly, countries may utilize different approache s t S

o make smooth flow of finances

and resolve information asymmetry. All these thi U

ngs make the investment behavior of

firms of each country different. A recent study conducted by (Castro et al., 2015b)

highlighted how financial structure and N

financial development matter in an

emerging economy like Brazil. The study a A

holds the view that financial development is

significant determinant of firm investments. But financial development affects

differently for financial constrained and unconstrained firms. Higher finance to M

development generates opportunities for finance availability for firms, thus enabling

the financial constrained firms

Dincrease their investments. Study narrates, “I f

growth opportunities are available, firms will increase investment due to the better E

financing environment created by the development of capital markets”. Monitoring costs are depe T

ndent upon financial development. As (Levine, 1996) argues that development of fina P

ncial system results in lowering the cost of monitoring as

financial intermediaries apply enhanced techniques for gathering and processing

information on potential borrowers and develop improved mechanisms for monitoring firm and manager CE

performance. Financial development strengthens financial institutions

and rating agencies are emerged. Rating agencies also lower monitoring costs for the borrowers beca s. C

use rating firms can certify borrowers at a lower cost than financial

intermediarieAWe link the proposition of Levine with Agency theory presented by

Jensen (1976) which illustrates that when mangers have excessive funds at their

discretion, they invest it irrationally, thus creating overinvestment problem.

H1: Financial development increases investment efficiency by reducing the extent of agency problem.

Moreover, a well-developed financial system can resolve the agency problem efficiently;

by this firms can borrow at cheaper rates and invest more. Financial development

increases market efficiency and allows investors to choose the firms more wisely for

investing their funds (Xie & Mo, 2015). Therefore we expect that there would be a huge

difference between the outputs of two financial structures. 7 ACCEPTED MANUSCRIPT

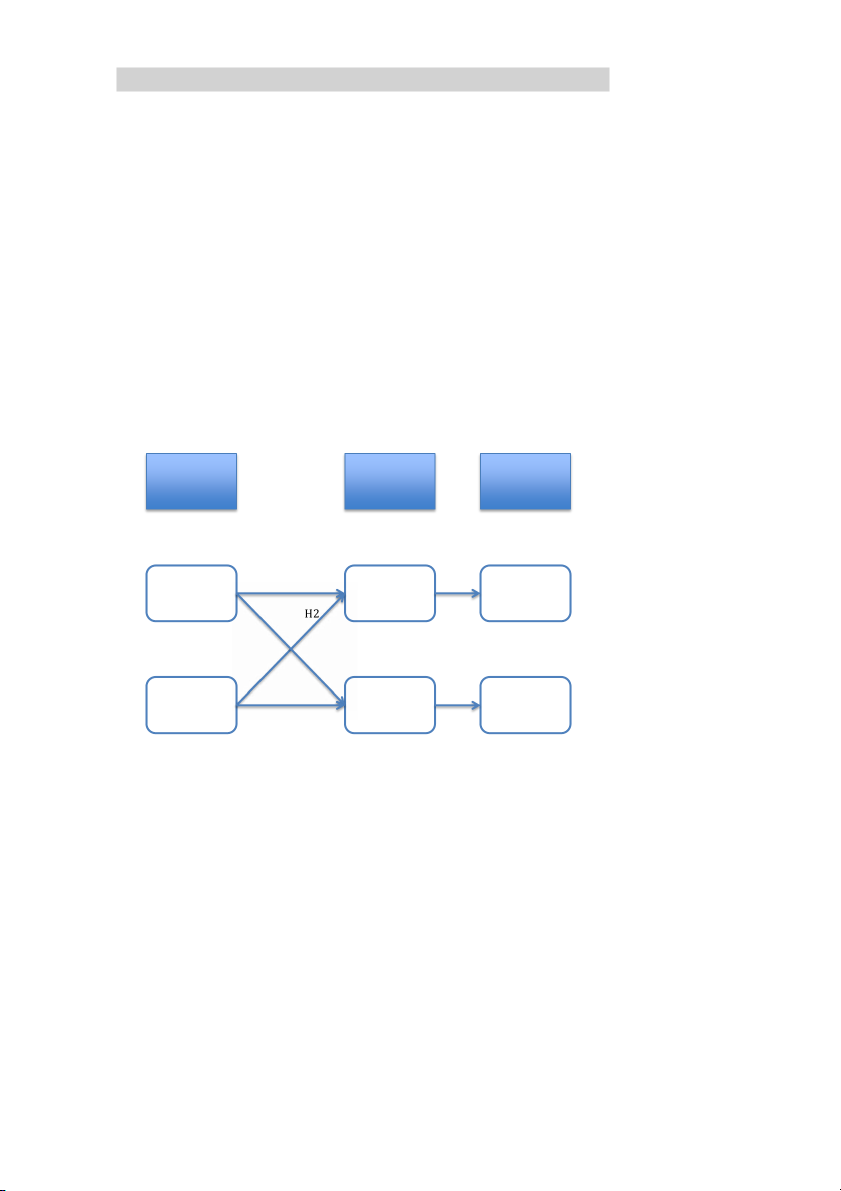

H2: Capital market based financial structure monitors agency problem, which results in

increased investment efficiency.

Firms’ investments, affected by financial constraints, are more likely to vary with

financial development. Firms, within the economy of less developed credit and capital

markets, have fewer opportunities to expand due to unavailability of required finances

(Xie & Mo, 2015). Such firms are mainly dependent upon internally generated funds.

Financial development and financial constraints are inversely proportional (Love, 2003).

As reductions in information asymmetry can be achieved by a higher level of financial

development, by this firms can cater their investment opportunities more efficiently.

(Khurana, Martin, & Pereira, 2006) and (Islam & Mozumdar, 2007) re T port that cash flow

sensitivity of cash reduces if financial market develops. Information asymmetry theory

(Myers & Majluf, 1984) illustrates that information asymmetry b hi I etP ween managers and

capital markets forces the managers to underinvest. The Rgher the information

asymmetry between insiders and outsiders, the higher the financing constraints and the

cost of external financing will be. Similarly, information as C ymmetry between equity and

credit markets results in discrepancy between internal and external finances. (Ameer, 2014). S

H3: Financial Development increases investment U

efficiency by reducing financing constraints.

H4: Capital market based Financial Structure inc N

Areases investment efficiency by making

information symmetric (reducing financial constraints). M Financial Investment Firms with System D Efficiency E T P Financial H1 Agency Cost Increased Dev. CE C A H3 Market Financing Increased based Fin. Constraints Structure H4

Figure 2: Summary of Hypotheses 8 ACCEPTED MANUSCRIPT

Fig. 2 illustrates the flow hypotheses of study. Figure conveys that, financial system

development and market based financial structure are characterized by efficient

monitoring and smooth flow of funds that can reduce agency cost and financial

constraints, resulting in increased investment efficiency. H1, H2, H3 and H4 represent the

flow of hypotheses 1,2,3 and 4 respectively.

3. Empirical Implementation

3.1. Empirical Model and Estimation T

To study the impact of financial development and structure on i IP nvestment decisions of

firms, we employ a version of investment accelerator model R augmented with financial

system variables (F. Castro, A. E. Kalatzis, & C. Martins- C Filho, 2015a). This modified

version is expected to test our hypotheses in best way a S

s the accelerator effect measures

how much the growth of the market economy alters t U

he amount of fixed investment. This

model begins with the notion that a certain amo ou N

unt of capital is necessary to support a

given level of economic activity. It does it thr Agh analyzing economic factors like GDP

and entrepreneurial activity related factors like sales, profits, cash flows etc. Briefly, this

model is based upon accelerator the or M

y- in which major influence of demand on

investment is admitted (Chenery,

our study), the neoclassical view als D

1952). In a broader sense (and in accordance to aim of

he Eo implies a complete dichotimization of the real and financial decisions faced by t

encT firm (Samuel, 1996). We consider this model fit for

analyzing investment efficiPy as an effect of financial system in Chinese economy for

two reasons. First: literature guides that many of the existing empirical studies for firm investment in transCE

ition economies are based on the accelerator investment model.

Second this model can incorporate the effect of financial system variables to determine investment deci C

sions as it deals with market imperfections (Lensink & Sterken, 2000). (Bo & Zha A

ng, 2002) utilized this model to determine the impact of uncertainty on

investment behavior of Chinese firms due to market imperfections existing in Chinese financial system.

𝐼𝑖𝑡=𝜕𝑖+𝛿1𝐼𝑖𝑡−1 + 𝛿2𝐼2 + 𝛿3𝐶𝐹𝑖𝑡 + 𝛿4𝑆𝐺𝑖𝑡 + 𝛿5𝑆𝑖𝑧𝑒𝑖𝑡 + 𝛿6𝐷𝑖𝑡 + 𝛿7𝐺𝐷𝑃𝑔𝑡 + 𝛿8𝐹𝐷𝑡 + 𝜀𝑖𝑡 (1) 9