Preview text:

FOREX TRANSACTION Assignment 1

At time G, the international forex markets had the following exchange rates:

NewYork : EUR/USD : 1.2264 – 1.2300

Zurich : EUR/CHF :1.2003 – 1.2030 USD/CHF :0.9818 – 0.9840

London : GBP/USD : 1.5603 – 1.5649 GBP/EUR : 1.2764 – 1.2780

If you had 100 million EURs, how would you ultilize arbitrage between 2 forex markets to

get profit? Calculate the profit in this case. 1/

NewYork : EUR/USD : 1.2264 – 1.2300

Zurich: EUR/USD: 1.219817-1.2253

First, using 100,000,000 EUR to buy USD in Newyork with Bid price: 100,000,000 x 1.2264 = 122,640,000 USD

Next, using 122,640,000 USD to buy EUR in Zurich with Ask price: 122,640,000 / 1.2253 = 100,089,773.9 EUR

Profit = 100,089,773.9 - 100,000,000 = 89,773.9 EUR 2/

NewYork : EUR/USD : 1.2264 – 1.2300

London: EUR/USD: 1.220892-1.226026

First, using 100,000,000 EUR to buy USD in Newyork with Bid price: 100,000,000 x 1.2264 = 122,640,000 USD

Next, using 122,640,000 USD to buy EUR in London with Ask price: 122,640,000 / 11.226026 = 100,030,505.1 EUR

Profit = 100,030,505.1- 100,000,000 = 30,505.1 EUR Assignment 2

At time G, we noticed the exchange rates in international forex markets as following:

Paris : EUR/JPY : 97.3525 – 97.4550

London: EUR/CHF : 1.1960 – 1.1990

Singapore: EUR/SGD: 1.5389 – 1.5420

In Tokyo forex market, we had the following exchange rates CHF/JPY: 81.302 – 81.360 SGD/JPY: 63.413 – 63.429

If you had 100 million EURs, how would you use arbitrage between 3 markets to get profit?

Calculate the profit in this trading. 1/

Paris : EUR/JPY : 97.3525 – 97.4550

London: EUR/CHF : 1.1960 – 1.1990 CHF/JPY: 81.302 – 81.360

First, using 100,000,000 EUR to buy CHF in London with Bid price: 100,000,000 x 1.1960 = 119,600,000 CHF

Next, using 119,600,000 CHF to buy JPY in Tokyo with Bid price: 119,600,000 x 81.302 = 1,471,058.523 JPY

Finally, using 1,471,058.523 JPY to buy EUR in Paris with Ask price: 1,471,058.523 / 97.4550 = 143,362,008.3 EUR

Profit = 143,362,008.3 - 100,000,000 = 43,362,008.3 EUR 2/

Paris : EUR/JPY : 97.3525 – 97.4550

Singapore: EUR/SGD: 1.5389 – 1.5420 SGD/JPY: 63.413 – 63.429

First, using 100,000,000 EUR to buy SGD in Singapore with Bid price: 100,000,000 x 1.5389 = 153,890,000 SGD

Next, using 153,890,000 SGD to buy JPY in Tokyo with Bid price: 153,890,000 * 63.413= 9,758,626,570 JPY

Finally, using 9,758,626,570 JPY to buy EUR in Paris with Ask price: 9,758,626,570 / 97.4550 = 100,134,693.7 EUR

Profit = 100,134,693.7 - 100,000,000 = 134,693.7 EUR 3/

London: EUR/CHF : 1.1960 – 1.1990

Singapore: EUR/SGD: 1.5389 – 1.5420

Tokyo: CHF/SGD=1.281779628-1.283017678

First, using 100,000,000 EUR to buy SGD in Singapore with Bid price: 100,000,000 x 1.5389 = 153,890,000 SGD

Next, using 153,890,000 SGD to buy CHF in Tokyo with Ask price: 153,890,000 / 1.283017678 =

Finally, using 119,943,787.7 CHF to buy EUR in London with Ask price: 119,943,787.7 / 1.1990 = 100,036,520.2 EUR

Profit = 100,036,520.2 - 100,000,000 = 36,520.2 EUR Assignment 3

ACB has the exchange rates and interest rates as following. Use the forward exchange rate

formula to calculate the forward exchanre rates to fill in the below sheet Fb b + Sb x n x (r −r ) A / B

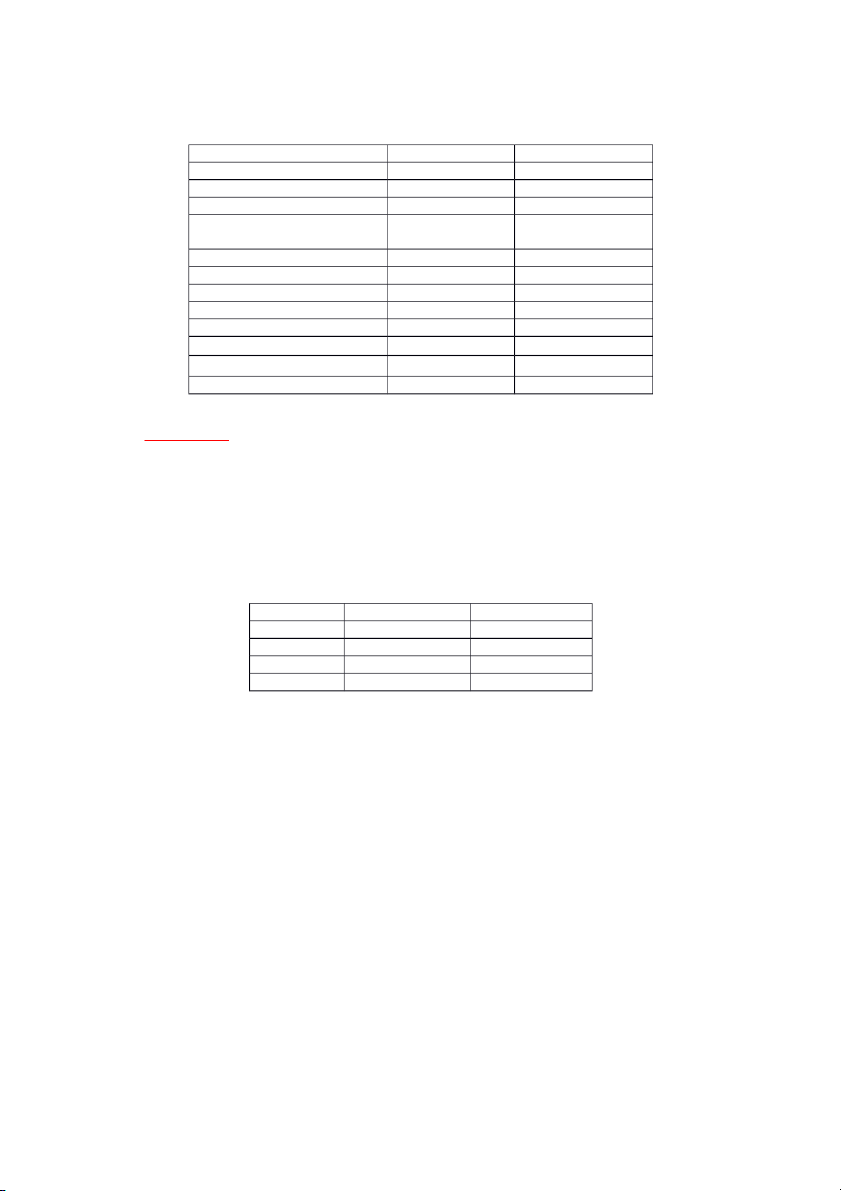

= SA/B A/B depositB borrowA Fs s + s −r ¿ A / B = SA/B S xn A / B x ( rborrowB depositA Exchange rate Ask rate Bid rate USD/VND 22,840 22,855 EUR/VND 25,471 25,500 GBP/VND 32,520 32,560 Lãi suất Deposit interest Loan Interest rate rate USD 1.75%/year 6.5%/year EUR 2%/year 7.5%/year GBP 1.5%/year 5.5%/year VND 0.75%/month 1.1%/month Forward Exchange rate Ask rate Bid rate USD/VND for 3 months 22,982 23,509 EUR/VNDfor 6 months 25,662 26,928 GBP/VND for 12 months 33,658 36,369 Assignment 4

On 15th July 2020, at HSBC HCM Branch quoted the exchange rates and interest rates as following: USD/VND: 22,850 – 22,900 EUR/VND : 25,540 – 25,590 GBP/VND : 32,540 – 32,590 Currency Loan Interest Deposit Interest VND 12%/year 9%/year USD 7%/year 2%/year GBP 6.5%/year 1.75%/year EUR 5%/year 1.5%/year

On that date, the bank conducted some forex transactions as following:

Operation 1: Bought at spot rate 150,000 USD from Anpha company and settled the transaction by VND. USD/VND: 22,850 – 22,900

150,000 * 22,900 = 3,435,000,000 VND

Operation 2: Deducted VND from VND account of Beta company to sell at spot exchange rate 50,000 EURs. EUR/VND : 25,540 – 25,590

50,000 * 25,590 = 1,279,500,000 VND

Operation 3: Mr Brown bought 10,000 GBP to transfer money to his son. Mr Brown settle the transaction by VND. GBP/VND : 32,540 – 32,590

10,000 * 32,590 = 325,900,000 VND

1/ Calculate the amount of VND HSBC HCM city Branch got or paid in each above transactions? Currency Loan Interest Deposit Interest VND 12%/year 9%/year USD 7%/year 2%/year GBP 6.5%/year 1.75%/year EUR 5%/year 1.5%/year

Operation 4: HSCB sold 50,000 USDs to Delta company with 3 month forward exchange rate. USD/VND: 22,850 – 22,900

Bid rate of USD/VND for 3m =22,850 + (22,850 x 3/12 x (9%- 7%)) = 22964.25

Ask rate of USD/VND for 3m =22,900 + (22,900 x 3/12 x (12% - 2%)) = 23472.5

50,000 x 22964.25= 1,148,212,500 VND

Operation 5: the bank bought 30,000 EURs from Ensure company with 4 month forward exchange rate. EUR/VND : 25,540 – 25,590

Bid rate of USD/VND for 4m =25,540 + (25,540 x 4/12 x ( 9% - 5%)) = 25,880.53333

Ask rate of USD/VND for 4m = 25,590+ ( 25,590 x 4/12 x (12% -1.5%)) = 26,485.65

30,000 x 26,485.65= 794,569,500 VND

Operation 6: Fomara Company bought 20,000 GBP with 6 month forward exchange rate. GBP/VND : 32,540 – 32,590

Bid rate of USD/VND for 6m =32,540+ (32,540x 6/12 x ( 9% - 6.5% )) = 32,946.75

Ask rate of USD/VND for 6m =32,590+ (32,590x 6/12 x (12% - 1.75%)) = 34,260.2375

20,000 x 34,260.2375 = 685,204,750 VND

2/ Indentify the amount of VND the bank got or paid in each above transactions. Assignment 5

On 20th July, 2020, there are some forex transaction at Hong Leong Bank VN as following:

1/ Gedo company sold 500,000 USDs to get VND for domestic payments. Indentify the

amount of VND Hong Leong Bank VN paid to Gedo. USD/ VND: 22,980 – 22,995.

500,000 x 22,980 = 11,490,000,000 VND

2/ Marah Company needed to exchange 100,000 USDs to GPBs to pay for the importing

commodities. Calculate the amount of GBP the company received. USD/ VND: 22,980 – 22,995. GBP/VND: 32,515 -32,540. GBP/USD: 1.4140-1.4160

100,000 / 1.4160 = 70,621.46893

3/ On 20th September, 2020, Masan company needed 150,000 USDs to pay to their importing

goods. So Masan company signed a forward contract to buy this amount of USDs from the

bank. Calcuate the amount of VNDs Masan had to pay to the bank in this forward transaction on 20th September, 2020. USD/ VND: 22,980 – 22,995

Interest rate of USD : 2.5%/year – 7%/year VND : 8.4%/year – 14.4%/year

Bid of USD/ VND for 2m: 22,980 + (22,980 x 2/12 x (8.4% - 7%)) = 23033.62

Ask of USD/ VND for 2m: 22,995 + (22,995 x 2/12 x (14.4% - 2.5%)) = 23451.0675

150,000 x 23451.0675= 3,517,660,125 VND

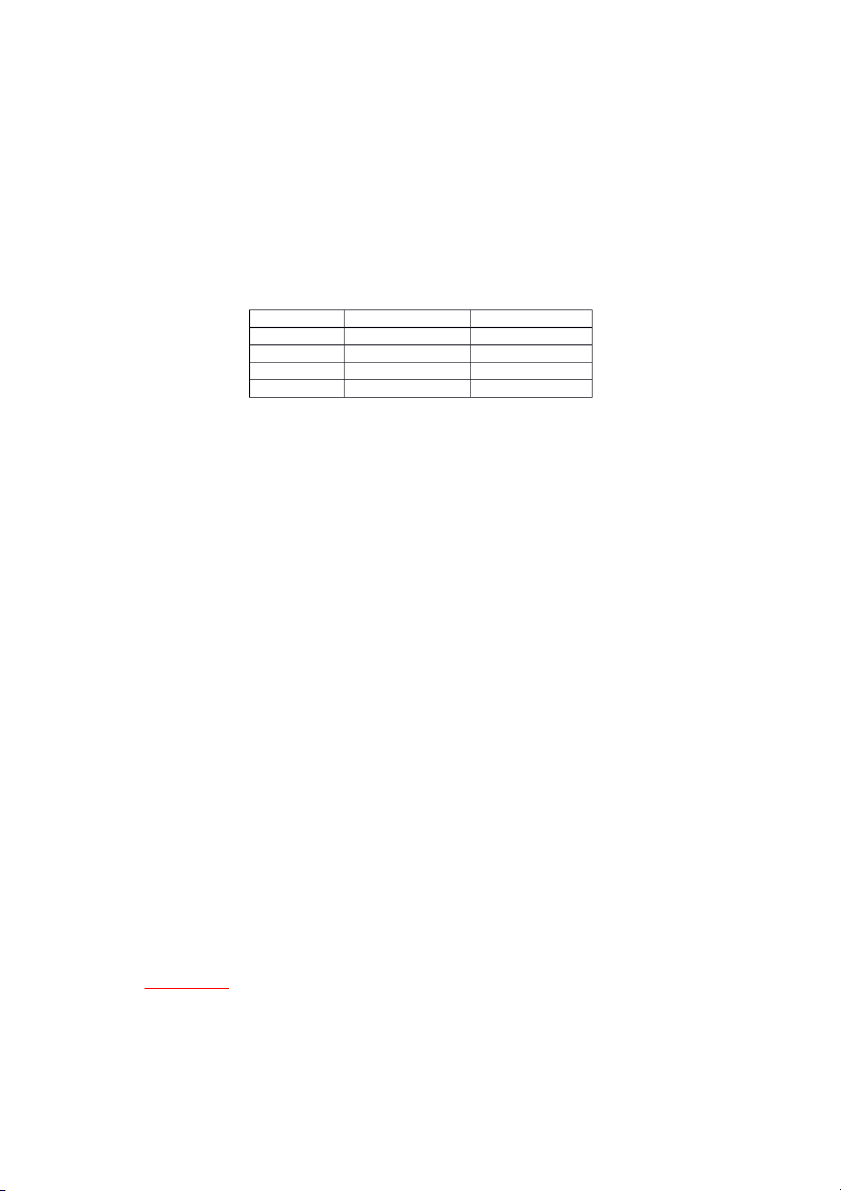

We have the following information

The spot exchange ratea and interest ratea on 20 July, 2020 of Hong Leong Bank as following: USD/ VND: 22,980 – 22,995. EUR/VND : 25,480 – 25,510 GBP/VND: 32,515 -32,540.

Interest rate of USD : 2.5%/năm – 7%/năm.

Interest rate of EUR : 1.5%/year – 6%/ year

VND : 0.7%/month – 1.2%/month. Assignment 6

In order to give 400,000 GPB loan to Bewlen Company with loan interest of 6.5%/year, ACB

exchange USDs to GPBs with VCB on the interbank market.

In order to hedge against the exchange rate variation, ACB also signs a 3 month forward

contract to sell the amount of GPB got from the loan to VCB for USD. Indentify the the

amount of USD ACB will get after those transactions.

The spot exchange rates and interest rates of VCB are quoting as following: USD/VND : 22,820 – 22,850 GBP/VND: 32,650 – 32,710 USD: 1.8%/year – 4%/year GBP: 1.2%/year – 3.5%/year GPB/USD: 1.4289-1.4334

ACB buy 150,000 CHF from VCB at spot exchange rate, they have to pay 150,000 x 1.4334= 215,010 VND

ACB make a loan of 150,000 CHF Bewlen Company with loan interest of 6.5%/. After 3 month they will get

150,000 +150,000 x 6.5% x 3/12 = 152,437.5 CHF

ACB sell the amount and interest of the loan to VCB at 3-month forward exchange

rate, the amount of VND they will receive: USD: 1.8%/year – 4%/year GBP: 1.2%/year – 3.5%/year GPB/USD: 1.4289-1.4334

GPB/USD for 3m: 1.4228-1.4434

152,437.5 x 1.4228 = 216,888.075 USD