Preview text:

MINISTRY OF EDUCATION AND TRAINING QUY NHON UNIVERSITY

ĐINH THỊ HỒNG NHUNG

A STUDY OF MOVEMENT METAPHORS IN THE

ECONOMIST AND THE FINANCIAL TIMES.

Major: English Linguistics

Subject: General Linguistics Course: 25

Supervisor: Prof. Dr. Truong Van Dinh Binh Dinh, 2023 ABSTRACT

The purpose of this study is to demonstrate how similar categories of movement

metaphors are used in the two papers. Even within the same domain, some

significant variances in the frequency of specific instances can be found by

comparing the hits. Specifically, we have based our analysis on the theories of

earlier researchers who applied cognitive theories to the study of the language of

economics (Charteris-Black 2000, Charteris-Black and Ennis 2001, Henderson

1994). This is because cognitive theories of metaphors (Lakoff and Johnson 1980)

see them as linguistic expressions and mental representations. The results of the

numerous electronic searches conducted on the corpus may provide information on

the discourse techniques used by newspapers and magazines. TABLE OF CONTENT LIST OF TABLES

Table 1…………………………………………………………………………… 5

Table 2…………………………………………………………………………… 5

Table 3…………………………………………………………………………… 5

Table 4…………………………………………………………………………… 8 1. INTRODUCTION

This essay examines metaphors used to describe market movements in a corpus of

web-retrieved articles from the electronic back issues of The Economist and The

Financial Times. It was necessary to build a semi-technical corpus regarding the

language of economics for a more specialized readership, which is why these two

sources were chosen. Between July 2001 and June 2002, or six months before and

six months after the introduction of the single currency, all of the articles were

published. We chose this time period because it is when the historical event of the

currency switchover is of greatest interest, and because it may allow us to evaluate

market fluctuations in writings that deal with a similar topic.

We have based our analysis on cognitive theories of metaphors, which see them as

linguistic expressions and mental representations (Lakoff and Johnson 1980). In

particular, we have based our analysis on the theories of previous researchers who

applied cognitive theories to the study of the language of economics (Charteris-

Black 2000, Charteris-Black and Ennis 2001, Henderson 1994).

The purpose of this study is to demonstrate how similar categories of movement

metaphors are used in the two papers. Even within the same domain, some

significant variances in the frequency of specific instances can be found by

comparing the hits. For instance, preliminary quantitative research of The Financial

Times revealed that the domain MARKET MOVEMENTS ARE NAUTICAL OR

WAYS OF MOVING IN THE WATER received twice as many hits as The Economist.

It was feasible to investigate the nature of the economy and the market by looking at

the players and situations in movement metaphors. In other words, we have made a

distinction between the economy and market as autonomous entities and as

autonomous entities dependent on human involvement.

The results of the numerous electronic searches conducted on the corpus may

provide information on the discourse techniques used by newspapers and magazines.

This study is a component of an ongoing project that involves editing a corpus of

texts regarding the euro currency that provides a comprehensive assessment of how

the British press has covered the newly introduced European currency. The corpus

should be representative of both texts obtained from high-quality papers and texts

written for a more general audience but intended for a more specialized audience in

economics. For this reason, it is a compilation of pieces that have been pulled from

a variety of websites, including The Economist, The Financial Times, The Guardian, and The Times.

The articles were chosen based on two key factors: the date of publication and the

articles' applicability to the subject. Six months before and six months after the

introduction of the single currency, the selected articles were all published between

July 1 2001 and June 30 2002, giving us the chance to examine the various attitudes

of the papers regarding predictions and the immediate aftermath of such a

significant event, a turning point in the history of European nations. Regarding their

applicability to the subject, the chosen articles have either "the euro" or

"single/European currency" in the headline or lead.

100 articles were chosen at random from each paper's collection of all articles in

order to produce four sub-corpora of roughly 60.000 words each. The Economist

sub-corpus is the lone exception to this criterion; while there were fewer stories in

the magazine overall but they were significantly longer than those in broadsheets,

we only selected 50 of them, totaling about 50.000 words. The amount of articles

published each month was taken into account in the sample procedure for the four

sub-corpora because we wanted to create a corpus that would accurately reflect the

unequal editorial coverage over the course of the twelve months. As it stands, there

were three times as many articles written in December and January than there were

on average each month, the two months closest to the start of the new unified currency. 2. LITERATURE REVIEW

We used a different method to analyze the newspapers The Guardian and The

Times in a prior study based on our corpus (Vaghi and Venuti 2003). We looked

into how the metaphors "EURO IS A CONTAINER" and "EURO IS A

MECHANICAL OBJECT" could be used to compare how two politically opposite

broadsheets approach discourse.

Regardless of the political viewpoint of either newspaper, the similar number of hits

about the potential UK membership into the EMU was indicative of the

inevitableness of such an important topic in both newspapers. However, a more

thorough study also found some significant disparities between the two domains.

Because these figures of speech aid in understanding and interpreting a text, the

language of economics is heavily metaphorical (Mc Closkey 1993; Mason 1990).

This occurs as “Metaphors are supposed to facilitate and enhance understanding

and to add an additional level of meaning by choice of a linguistic expression that

may not be the conventional or ordinary way of expressing an idea” (Charteris- Black and Ennis 2001, p 252).

Since metaphors use the transference of meaning from one form to another to describe

reality, this is their primary characteristic that helps to facilitate and improve understanding

(Beccaria 1989). We have chosen to analyze the examples from our sub-corpora using this

as the predictable starting point because Lakoff and Johnson's 1980 cognitive theory views

metaphors as both verbal expressions and mental representations. Using the connection A

is B, where A is the "target" domain and B is the "source," this theory claims that

metaphors are typically expressed. In this essay, we shall contrast how The Economist and

The Financial Times use the metaphor "market movements are physical movements" in

their respective sub-corpora. Following the above schema, PHYSICAL MOVEMENTS are

the source domain B and MARKET MOVEMENTS are the target domain A.

The main reason, in our opinion, is that by treating the relationship between the target and

the source as constant, this method of metaphor analysis always makes it possible to

compare entities with similar features—indeed, we are comparing the same types of

metaphors in two different sets of texts. On the other hand, this approach encourages

creativity because there are practically endless permutations to the target/source pairings

that go into making a metaphor. According to the founders of the cognitive theory of

metaphors: “The most salient of the dimensions of poetic power ... is the power to

extend the basic metaphors ... This is the power that metaphor has to reveal

comprehensive hidden meaning to us, to allow us to find meaning beyond the

surface, to interpret texts as wholes, and to make sense of patterns of events.”

(Lakoff and Turner 1989, p 159).

We have based our examination of functional theories on the study of the economy

and market moving autonomously or requiring human intervention, conceptualizing

movement metaphors as processes involving actors and circumstances (Halliday 1994, pp. 106-112). 3. METHODOLOGY 3.1. Research methods

We started out by thinking about how metaphorical language is defined as being

used to convey economic ideas in texts: “it is part of the generative aspect of

metaphor to assist in the development of a routine vocabulary for handling

economic ideas” (Henderson 1994, p. 358).

Given Henderson’s words and the frequent perception of markets and the economy

as moving entities, we have chosen to examine all expressions that depict these

abstract concepts as physical movements and categorize them under the

metaphorical domain MARKET MOVEMENTS ARE PHYSICAL MOVEMENTS.

According to the medium in which the movement occurs, we have further divided

the metaphors into three sub-domains, following the lead of Charteris-Black and

Ennis (2001, pp. 256–258): Market movements are ways of moving in the air, in the

water, or on the ground. They are also known as nautical or water movements.

We used WordSmith Tools 3.01 to search our two sub-corpora in order to conduct a

thorough and methodical identification and inspection of the three sub-domains.

In order to find all the verbs and nouns that might be connected to the metaphorical

domain MARKET MOVEMENTS ARE PHYSICAL MOVEMENTS, we first

studied the two wordlists that were obtained from the two sub-corpora of The

Economist and The Financial Times. We were able to recognize every inflected

word in WordLists (A) and (F) after a thorough analysis.

All of the concordance lines for the concepts we had so far found were printed out

and carefully verified to remove any instances where the search terms had literal

rather than metaphorical meanings or did not refer to market or economic movements.

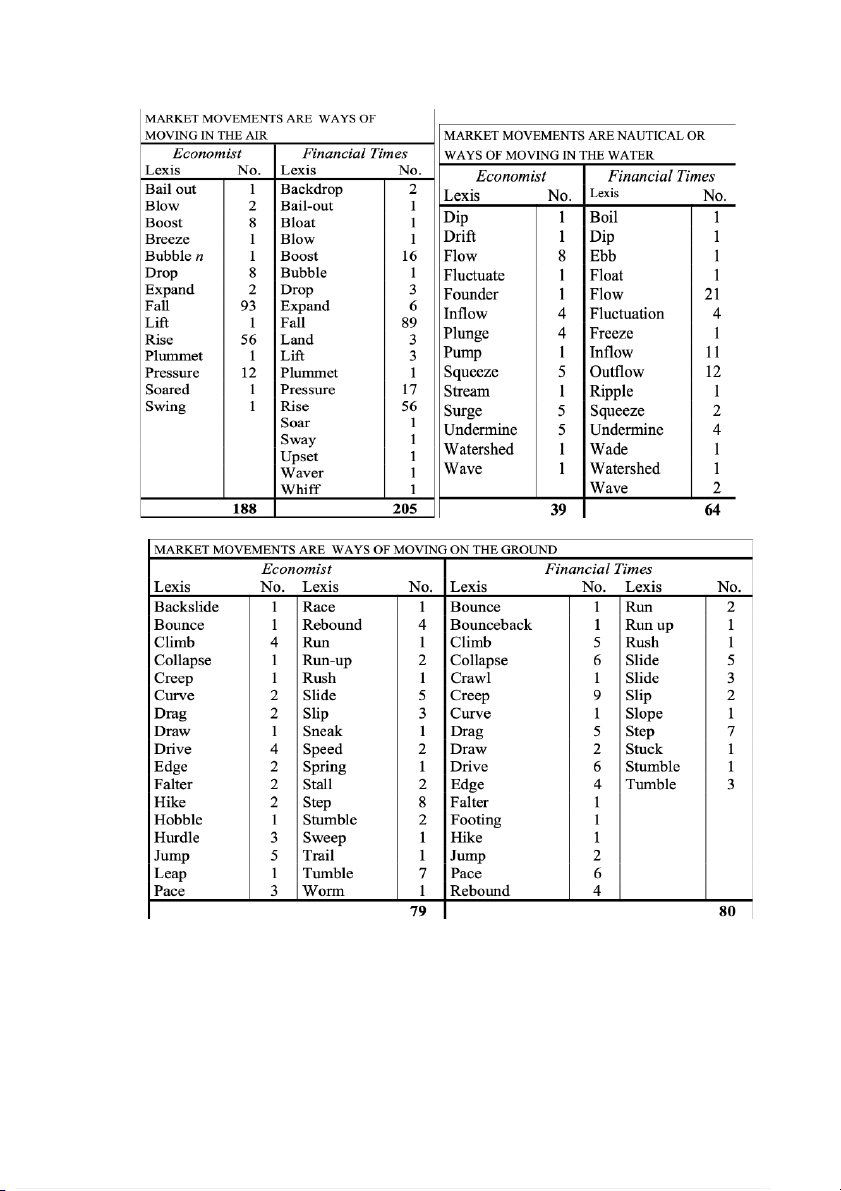

According to the classification of movements we previously said, Tables 1, 2, and 3

were created with the findings of this initial investigation. The occurrences of verbs,

nouns, and their inflected forms are all included for each phrase in the lexis column. Table 1 Table 2 Table 3 3.2. Data analysis

It is possible to do a preliminary comparison by merely looking at table results. The

results demonstrate that The Financial Times uses a significantly richer

metaphorical vocabulary than The Economist when it comes to movement

metaphors. The Financial Times has over 10% more metaphors in Table 1:

MARKET MOVEMENTS ARE WAYS OF MOVING IN THE AIR than The

Economist. Table 2: MARKET MOVEMENTS ARE NAUTICAL OR WAYS OF

MOVING IN THE WATER shows an even greater disparity, with the daily paper

receiving almost 36% more hits than the magazine. Table 3 does not reiterate the

distinction between the two papers: MARKET MOVEMENTS ARE WAYS OF MOVING ON THE GROUND.

While editing the tables, we made sure to include all terms referring to the economy

and market movements; however, after looking through the concordances, we

decided to exclude terms like fall and rise because of our concerns that their

primary meanings were more physical than abstract. According to Smith (1995), “A

number of what were originally metaphors have become conventionalised in the

language of economics, and can now better be considered as technical terms than

“living metaphors”. Such terms are equilibrium, float, inflation, leakage, boom;

liquidity and slump are now so familiar in the jargon of the subject that their

metaphorical etymology is not immediately obvious. (Smith 1995, p 45)

As a result, we did not include the terms "fall," "rise," "float," "flow," "inflow,"

"outflow," "drop," and "pressure" in our analysis.

The context of each term was then examined by looking at all concordances. Each

concordance has been expanded to occasionally contain the entire paragraph or even

the entire article in order to assess the role of the metaphors.

During the investigation, we looked to see if movement metaphors referred to the

market and economy as dependent animate agents or as independent, autonomous

entities. Our strategy is based on a well-established trend in the study of economic

language that associates animate agents with the potential to control economic

events, while inanimate ones express the impossibility of accurate forecasting and

lasting theories on market fluctuations (Charteris-Black 2000, pp. 160–162).

On Halliday's concept of process, we evaluate movement metaphors.2 "consist[ing],

in principle, of three components: (i) the process itself; (ii) participants in the

process; and (iii) circumstances associated with the process" (Hallyday 1994, p.

107). Actor, "the one that does the deed" (Hallyday 1994, p. 109), and Goal, "the

one to which the process is extended" (Hallyday 1994, p. 110), are therefore two

ways to categorize the players. 4. FINDINGS AND DISCUSSION

The Financial Times and the Economist both provide enhanced concordances that

include examples3 of living and inanimate Actors of the processes of movement.

MARKET MOVEMENTS ARE WAYS OF MOVING IN THE AIR is the subject of the next two examples.

1. E1 The dollar will fall if they merely reduce the pace at which they add to

their holdings. It will fall even more if American investors continue or

expand this year's buying of foreign assets, notably European equities. Until

recently, net capital inflows more than covered America's current-account deficit.

2. E2 Hours worked also fell by 0.4%, after dropping by 0.3% in July. The

downturn seems to be spreading to the services sector. The NAPM index of

non-manufacturing activity plummeted to 45.5 in August from 48.9 in July.

A number below 50 is a sign that activity is contracting.

A human being working on the Goal "buying foreign assets" is the Actor "American

investors" of the Process "expand" in E1. The entire process might change another

process, which would lead to a further decline in the value of the dollar. In contrast,

E2 is a process that consists of a non-human Actor called the NAPM index and a

process that has "plummeted" without a goal. An independent economic or market

movement is exemplified by the lack of a Goal and the existence of a personified

inanimate Actor. In actuality, the index's decline is portrayed as a self-contained

movement that adheres to a distinct pattern.

The examination of the following two enlarged concordances from the domain

MARKET MOVEMENTS ARE NAUTICAL OR WAYS OF MOVING IN THE

WATER serves as an example of how the same methodology was used for the

concordances acquired from The Economist.

1. FT1 "You have to look back to 1995 for the last time the US intervened to

push the dollar higher and, since then, it has twice waded into the market to

bring the dollar lower," he added. In spite of the rhetorical support for a

strong dollar it is thought unlikely that the US would stand in the way of a

gradual depreciation of the dollar.

2. FT2 Germany has no inflation problem. Annual inflation is estimated to

have fallen to 1.2 per cent this month from 1.6 per cent in April. In June it

may dip to 1 per cent or less, giving Germany the lowest inflation in the 12- nation eurozone.

In FT1, "the US" is the animated actor entering the market and trying to influence

the dollar's exchange rate. As in E1, there are two participants, and one of them is

an actor who is extending the process to achieve a goal and express a direct

intervention to alter an economic trend. The absence of a goal in the second

example from The Financial Times once again demonstrates the independence of

market movements. Although there is no Goal, the Process "may dip" and has an

Actor "annual inflation" in Germany. The inability to include a second participant in

the process and the Actor's personification as an inanimate object have been used to

emphasize that no humans have participated in what is supposed to be an autonomous progression.

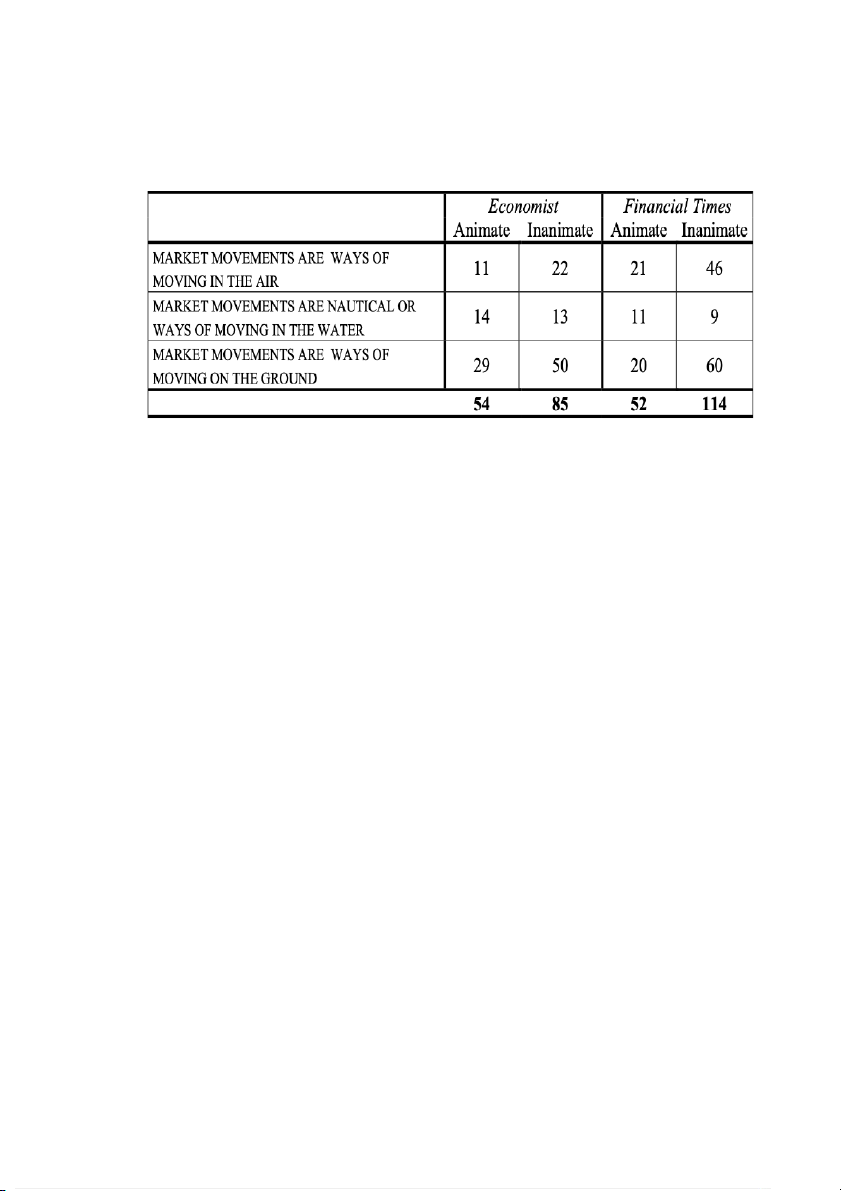

Table 4 displays the findings of the analysis of both animated and inanimate actors.

The overall results show how both periodicals have a propensity to represent

economic and market developments through actions taken by inanimate rather than

living actors. However, MARKET MOVEMENTS ARE NAUTICAL OR WAYS

OF MOVING IN THE WATER, so this is true of all metaphorical domains. The

Financial Times specifically makes heavy use of semi-technical jargon, which has

lost its original metaphorical aspect, to describe movement, which is why the

phrases flow, inflow, and outflow are used so frequently in this context. Table 4

It is confirmed by the preponderance of inanimate actors and the absence of an

explicit goal that Charteris-Black (2000) made regarding the co-occurrence of

animate subjects and transitive verbs and that of inanimate subjects and intransitive

verbs “We should also note that the verbs found with animate subjects are generally

transitive while those found with inanimate subjects are generally intransitive. What

we find here is further evidence of the concealment of human agency in the case of

representations of the market.” (Charteris-Black 2000, p 162). 5. CONCLUSION

Another observation may be made if we look at the combined actor scores for

animate and inanimate actors for The Economist and The Financial Times. The

latter more frequently than the former expresses economic movements as

independent and autonomous. This observation would suggest that The Financial

Times favors a more technical language given the prevalence of semi-technical

terminology used to depict movement. The two magazines' differing styles may help to explain this.

A weekly newspaper The Economist frequently focuses more on the analysis of

market and economic movements while paying more attention to the factors that led

to these changes, like the direct involvement of governmental and banking

organizations. The Financial Times, on the other hand, is required to monitor and

report on the daily changes and movements in the market and the economy. This

could be the reason why it utilizes the term "flow" more frequently and why it

emphasizes the movements themselves, which are portrayed as autonomous

happenings rather than looking at the reasons of those movements. REFERENCES

1. Anderson P J, Weymouth A 1999 Insulting the Public? The British Press and the

European Union. London, Longman.

2. Beccaria G L (ed.) 1989 Dizionario di linguistica. Torino, Einaudi.

3. Biber D 1993 Representativeness in Corpus Design. Literary and Linguistic

Computing 8: 243-257. Charteris-Black J 2000 Metaphor and vocabulary teaching

in ESP economics. English for Specific Purposes 19(2): 149-165.

4. Charteris-Black J, Ennis T 2001 A Comparative Study of Metaphor in Spanish

and English Financial Reporting. English for Specific Purposes 20(3): 249-266.

5. Halliday M A K 1994 An Introduction to Functional Grammar. London, Arnold.

Henderson W 1994 Metaphor and Economics. In Backhouse R E (ed), New

Directions in Economic Methodology. London, Routledge, pp 343-367.

6. Henderson W, Dudley-Evans T, Backhouse R (eds) 1993 Economics and Language. London, Routledge.

7. Lakoff G, Johnson M 1980 Metaphors We Live By. Chicago, University of Chicago Press.

8. Lakoff G, Turner M 1989 More than Cool Reason. A Field Guide to Poetic

Metaphor. London, University of Chicago Press.

9. Mason O 1990 Dancing on air: Analysis of a passages from an economics

textbook. In Dudley-Evans T, Henderson W (eds) The Language of Economics: The

Analysis of Economics Discourse. Hong Kong, ELT Document 134, Modern

English Publications and the British Council, pp 16-28.

10. McCloskey D 1983 The rhetoric of economics. Journal of Economic Literature 21: 481-517.

11. Musolff A 1997 International metaphors: bridges or walls in international

communication? In Debatin B, Jackson T R and Steuer D (eds) Metaphor and

Rational Discourse. TPbingen, Niemeyer, pp 229- 237.