Preview text:

English for Banking & Finance

BỘ LAO ĐỘNG THƯƠNG BINH XÃ HỘI

TRƯỜNG ĐẠI HỌC LAO DỘNG – XÃ HỘI

-------------***-------------

ENGLISH FOR BANKING AND FINANCE

TIẾNG ANH CHUYÊN NGÀNH TÀI CHÍNH NGÂN HÀNG

Hà Nội, tháng 11 năm 2021

University of Labour and Social Affairs / Foreign Language Faculty Page 1

English for Banking & Finance BỘ LAO ĐỘNG T

HƯƠNG BINH VÀ XÃ HỘI

TRƯỜNG ĐẠI HỌC LAO ĐỘNG - XÃ HỘI -----*****-----

ENGLISH FOR BANKING AND FINANCE

TIẾNG ANH CHUYÊN NGÀNH TÀI CHÍNH NGÂN HÀNG Ban biên soạn:

TS. Phan Thị Mai Hương (Chủ biên)

ThS. Trần Thị Thu Hằng (Thư ký) ThS. Nguyễn Thị Lan Anh ThS. Trương Thị Thúy

ThS. Trương Thị Tuyết Hạnh

University of Labour and Social Affairs / Foreign Language Faculty Page 2

English for Banking & Finance

Lời nói đầu

Giáo trình “Tiếng Anh chuyên ngành tài chính ngân hàng” (English for

Banking and Finance) được tổ chức biên soạn nhằm đáp ứng nhu cầu mở rộng ngành

đào tạo mới và đổi mới chương trình giảng dạy của trường Đại học Lao động – Xã hội

đáp ứng yêu cầu của xã hội và người sử dụng lao động. Giáo trình này được hoàn

thành nhằm đáp ứng nhu cầu cấp bách về tài liệu nghiên cứu và giảng dạy cho giảng

viên và sinh viên chuyên ngành tài chính ngân hàng của trường Đại học Lao động –

Xã hội nói riêng, và chuyên ngành kinh tế nói chung. Trong giáo trình, sinh viên được

cung cấp những ngữ liệu ngôn ngữ (tiếng Anh) thiết thực liên quan đến lĩnh vực tài

chính ngân hàng nói riêng và lĩnh vực kinh tế nói chung với những chủ đề hết sức sát

thực với thực tế chuyên môn. Đồng thời, giáo trình còn được thiết kế với nhiều loại

hình bài tập đa dạng, phong phú nhằm tạo điều kiện giúp cho sinh viên có cơ hội rèn

luyện kỹ năng đọc hiểu tài liệu chuyên ngành, làm quen với kỹ thuật dịch thuật. Đặc

biệt giáo trình có nhiều dạng bài tập, bài kiểm tra, bài thi mẫu giúp cho sinh viên có

nguồn tài liệu hữu ích để ôn tập và chuẩn bị tốt cho kỳ thi kết thúc học phần. Giáo

trình không chỉ là nguồn tài liệu thiết thực cho giảng viên và sinh viên trường Đại học

Lao động – Xã hội, mà còn là nguồn tài liệu tham khảo bổ ích cho giảng viên và sinh

viên khối ngành kinh tế nói chung.

Giáo trình do các giảng viên tiếng Anh thuộc khoa Ngoại ngữ, trường đại học

Lao động – Xã hội biên soạn, gồm: TS. Phan Thị Mai Hương, trưởng khoa Ngoại ngữ

(chủ biên), ThS. Trần Thị Thu Hằng, ThS. Nguyễn Thị Lan Anh, ThS. Trương Thị

Thúy, ThS. Trương Thị Tuyết Hạnh.

Giáo trình này là kết quả của quá trình lao động khoa học nghiêm túc của

nhóm tác giả, đồng thời được sự tư vấn quý báu của các nhà chuyên môn chuyên

ngành tài chính ngân hàng. Nhóm tác giả đã cố gắng hoàn thành giáo trình với nội

dung, kết cấu hợp lý, phù hợp với quy trình đào tạo chuyên ngành tài chính ngân hàng

tại trường Đại học Lao động – Xã hội. Tuy nhiên, trong quá trình biên soạn khó có thể

tránh khỏi những thiếu sót, tập thể tác giả rất mong nhận được nhiều ý kiến đóng góp

chân thành của các nhà khoa học và bạn đọc để giáo trình được hoàn thiện hơn.

Hà Nội, tháng 11 năm 2021

TẬP THỂ TÁC GIẢ

University of Labour and Social Affairs / Foreign Language Faculty Page 3

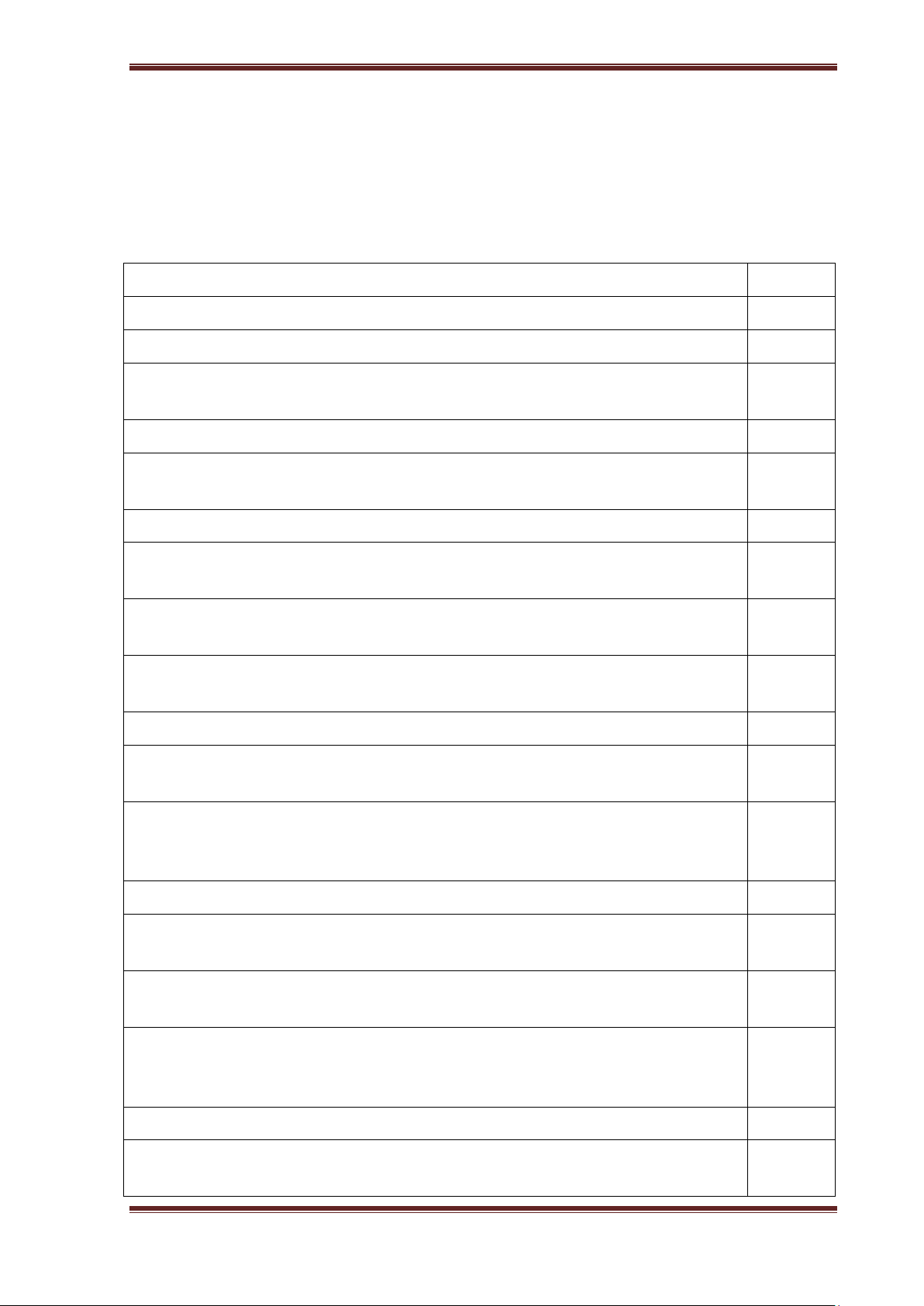

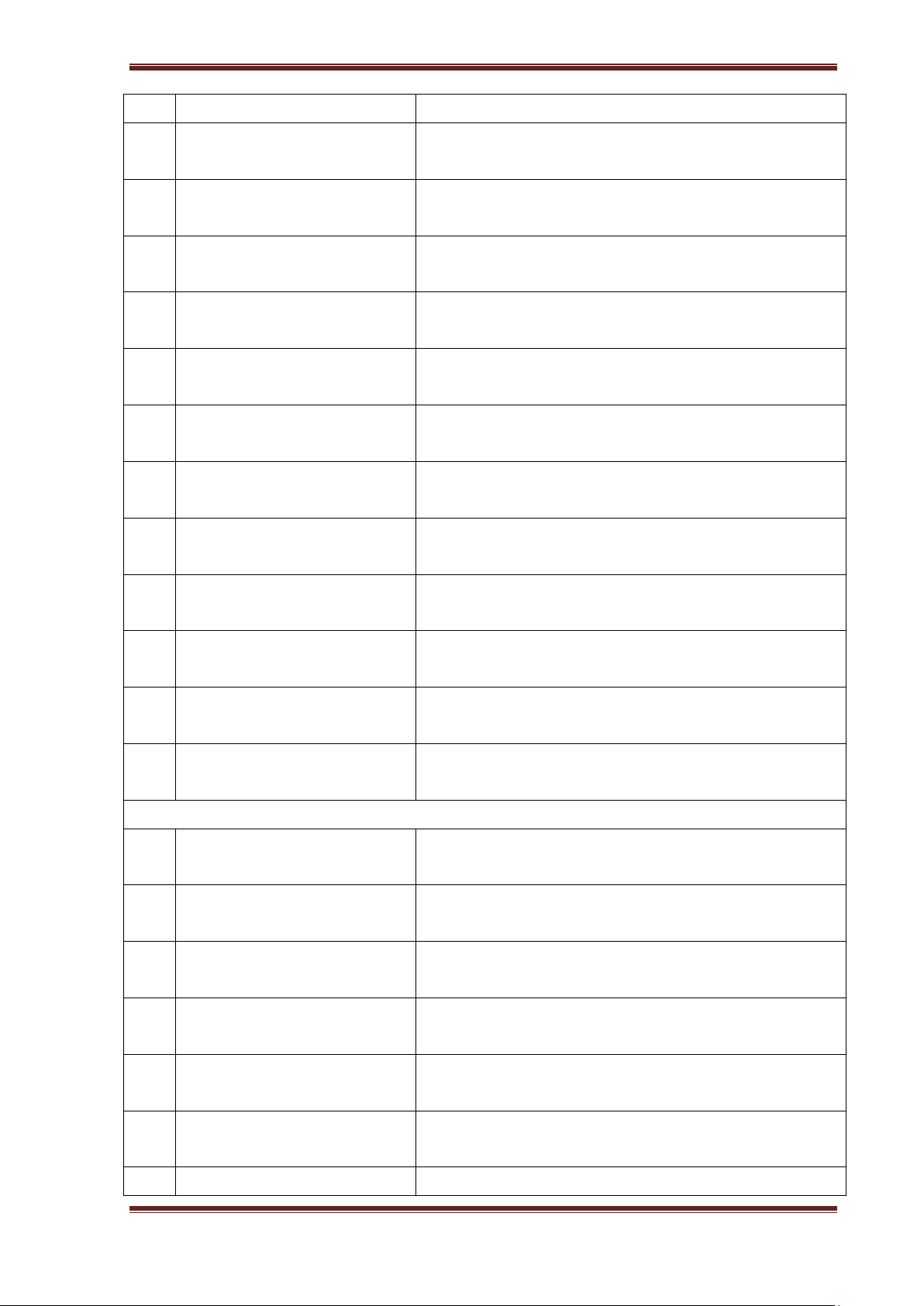

English for Banking & Finance TABLE OF CONTENTS Page

Lời nói đầu ............................................................................................................ 3

UNIT 1: BANKING ............................................................................................ 6

I. READING COMPREHENSION ............................................................................. 6

II. GRAMMAR: Word formation .............................................................................. 16

III. WORD STUDY ................................................................................................... 26

IV. TRANSLATION.................................................................................................. 40

V. LESSON REVIEW ............................................................................................... 48

VI. MOCK TEST ....................................................................................................... 53

UNIT 2: FINANCIAL MANAGEMENT ....................................................... 59

I. READING COMPREHENSION ........................................................................... 59

II. GRAMMAR: Passive voice .................................................................................. 69

III. WORD STUDY ................................................................................................... 81

IV. TRANSLATION.................................................................................................. 95

V. LESSON REVIEW ............................................................................................. 105

VI. MOCK TESTS ................................................................................................... 110

UNIT 3: FINANCIAL STATEMENT .......................................................... 118

I. READING COMPREHENSION ......................................................................... 118

II. GRAMMAR: Relative clause ............................................................................. 135

III. WORD STUDY ................................................................................................. 146

IV. TRANSLATION................................................................................................ 161

V. LESSON REVIEW ............................................................................................. 173

VI. MOCK TESTS ................................................................................................... 179

MIDTERM SAMPLE TEST 1 ...................................................................... 191

MIDTERM SAMPLE TEST 2 ...................................................................... 198

MIDTERM SAMPLE TEST 3 ...................................................................... 205

UNIT 4: INVESTMENTS .............................................................................. 212

I. READING COMPREHENSION ......................................................................... 212

II. GRAMMAR: Conditional sentences ................................................................... 221

III. WORD STUDY ................................................................................................. 238

IV. TRANSLATION................................................................................................ 251

V. LESSON REVIEW ............................................................................................. 261

University of Labour and Social Affairs / Foreign Language Faculty Page 4

English for Banking & Finance

VI. MOCK TEST ..................................................................................................... 265

UNIT 5: INTERNATIONAL FINANCE ...................................................... 274

I. READING COMPREHENSION ......................................................................... 274

II. GRAMMAR: Inversion ....................................................................................... 285

III. WORD STUDY ................................................................................................. 297

IV. TRANSLATION................................................................................................ 315

V. LESSON REVIEW ............................................................................................. 322

VI. MOCK TESTS ................................................................................................... 327

ENDED-TERM SAMPLE TEST 1 ............................................................... 335

ENDED-TERM SAMPLE TEST 2 ............................................................... 343

ENDED-TERM SAMPLE TEST 3 ............................................................... 350

ENDED-TERM SAMPLE TEST 4 ............................................................... 357

ENDED-TERM SAMPLE TEST 5 ............................................................... 365

WORD LIST .................................................................................................... 373

REFERENCES ................................................................................................ 383

University of Labour and Social Affairs / Foreign Language Faculty Page 5

English for Banking & Finance UNIT 1: BANKING

I. READING COMPREHENSION READING 1: BEFORE YOU READ

Work in groups of 4 or 5 and discuss the following questions:

1. Name different types of banks you know.

2. What are the roles of banks in modern life?

3. What kinds of banking services do you use? READING TEXT

BANKING, BANKS AND TYPES OF BANKS Banking

Banking is an industry that handles cash, credit, and other financial

transactions. Banking is the business activity of banks and similar institutions (Collins

English Dictionary). In simple words, banking can be defined as the business activity

of accepting and safeguarding money owned by other individuals and entities, and

then lending out this money in order to earn a profit. However, with the passage of

time, the activities covered by banking business have widened and now various other

services are also offered by banks. The banking services these days include issuance of

debit and credit cards, providing safe custody of valuable items, lockers, ATM

services and online transfer of funds across the country/ world.

History in making with striking simplicity, the birth, and evolution of banking

has many untold stories. It is narrative fascinating that banking introduced in the 14th

century in cities of Italy and the bank of England was the first to begin the permanent issue of banknotes in 1695.

In today’s progressive world, the bank sector has become the backbone of every

economy worldwide just like blood is to the veins and unique because of its formation,

staffing and extraordinary services rendered by the industry. Banking sector works in

the best interest of the country and due to their contribution in the financial stability,

banking is highly regulated in most of the country. It is well said that banking plays a

silent, yet crucial part in our day-to-day lives. The banks perform financial

intermediation by pooling savings and channelizing them into investments through

University of Labour and Social Affairs / Foreign Language Faculty Page 6

English for Banking & Finance

maturity and risk transformations, thereby keeping the economy’s growth engine revving.

Banking business has done wonders for the world economy. The simple looking

method of accepting money deposits from savers and then lending the same money to

borrowers, banking activity encourages the flow of money to productive use and

investments. This in turn allows the economy to grow. In the absence of banking

business, savings would sit idle in our homes, the entrepreneurs would not be in a

position to raise the money, ordinary people dreaming for a new car or house would

not be able to purchase cars or houses.

To sum up, banking fundamentals refer to the concepts and principles relating

to the practice of banking. Banking is an industry that deals with credit facilities,

storage for cash, investments, and other financial transactions. The banking industry is

one of the key drivers of most economies because it channels funds to borrowers with productive investments. Banks

A bank is a financial institution licensed to receive deposits and make loans.

Banks may also provide financial services such as wealth management, currency

exchange, and safe deposit boxes.

Banks are closely concerned with the flow of money into and out of the

economy. They often cooperate with governments in efforts to stabilize economies and

prevent inflation. They are specialists in the business of providing capital, and in

allocating funds on credit. Banks originated as places to which people took their

valuables for safe-keeping, but today the great banks of the world have many functions

in addition to acting as guardians of valuable private possessions.

Banks normally receive money from their customers in two distinct forms: on

current account and on deposit account. With a current account, a customer can issue

personal cheques. No interest is paid by the bank on this type of account. With deposit

account, however, the customer undertakes to leave his money in the bank for a

minimum specified period of time. Interest is paid on this money.

The bank in turn lends the deposited money to customers who need capital.

This activity earns interest for the bank, and this interest is almost always at a higher

rate than any interest which the bank pays to its depositors. In this way, the bank makes its main profits.

University of Labour and Social Affairs / Foreign Language Faculty Page 7

English for Banking & Finance

We can say that the primary function of a bank today is to act as an

intermediary between depositors who wish to make interest on their savings, and

borrowers who wish to obtain capital. The bank is a reservoir of loanable money, with

streams of money flowing in and out. For this reason, economists and financiers often

talk of money being liquid, or of the liquidity of money. Many small sums which

might not otherwise be used as capital are rendered useful simply because the bank acts as reservoir.

The system of banking rests upon a basis of trust. Innumerable acts of trust

build up the system of which bankers, depositors and borrowers are part. They all

agree to behave in certain predictable ways in relation to each other and in relation to

the rapid fluctuations of credit and debit. Consequently, business can be done and

cheques can be written without any legal tender visibly changing hands. Types of banks

Retail banks deal specifically with retail consumers, though some global

financial services companies contain both retail and commercial banking divisions.

These banks offer services to the general public and are also called personal or general

banking institutions. Retail banks provide services such as checking and savings

accounts, loan and mortgage services, financing for automobiles, and short-term loans

like overdraft protection. Many larger retail banks also offer credit card services to

their customers, and may also supply their clients with foreign currency exchange.

Larger retail banks also often cater to high-net-worth individuals, giving them

specialty services such as private banking and wealth management. Examples of retail

banks include TD Bank and Citibank.

Commercial or corporate banks provide specialty services to their business

clients from small business owners to large, corporate entities. Along with day-to-day

business banking, these banks also provide their clients with other things such as credit

services, cash management, commercial real estate services, employer services, and

trade finance. JPMorgan Chase and Bank of America are two popular examples of

commercial banks, though both have large retail banking divisions as well.

Investment banks focus on providing corporate clients with complex services

and financial transactions such as underwriting and assisting with merger and

acquisition (M&A) activity. As such, they are known primarily as financial

intermediaries in most of these transactions. Clients commonly range from large

corporations, other financial institutions, pension funds, governments, and hedge

funds. Morgan Stanley and Goldman Sachs are examples of U.S. investment banks.

University of Labour and Social Affairs / Foreign Language Faculty Page 8

English for Banking & Finance

Unlike the banks listed above, central banks are not market-based and don’t

deal directly with the general public. Instead, they are primarily responsible for

currency stability, controlling inflation and monetary policy, and overseeing a

country’s money supply. They also regulate the capital and reserve requirements of

member banks. Some of the world’s major central banks include the U.S. Federal

Reserve Bank, the European Central Bank, the Bank of England, the Bank of Japan,

the Swiss National Bank, and the People’s Bank of China. Bank vs credit union

Credit unions vary in size from small, community-based entities to large ones

with thousands of branches across the country. Just like banks, credit unions provide

routine financial services for their clients who are generally called members. These

services include deposit, withdrawal, and basic credit services.

But there are some inherent differences between the two. While a bank is a

profit-driven entity, a credit union is a nonprofit organization traditionally run by

volunteers. Created, owned, and operated by participants, they are generally tax-

exempt. Members purchase shares in the coop, and that money is pooled together to

provide a credit banks. They also have fewer locations and automated teller machines (ATMs).

(Source: Adapted from https://www.bankerbd.com/what-is-banking;

https://www.investopedia.com/terms/b/bank.asp; Nguyen Phuong Lan. 2007. 145 Tests in Banking &

Finance. Hanoi: National Economic University Publisher)

Comprehension questions:

Read the text above carefully and answer the following questions.

1. When did the bank of England first begin?

.......................................................................................................................

.......................................................................................................................

2. What is banking according to Collins English Dictionary?

.......................................................................................................................

.......................................................................................................................

3. What can banking be defined in simple words?

.......................................................................................................................

.......................................................................................................................

4. What do the banking services include these days?

.......................................................................................................................

.......................................................................................................................

University of Labour and Social Affairs / Foreign Language Faculty Page 9

English for Banking & Finance

5. What would happen if there were the absence of banking business?

.......................................................................................................................

.......................................................................................................................

6. What do banking fundamentals refer to?

.......................................................................................................................

....................................................................................................................... 7. What is a bank?

.......................................................................................................................

.......................................................................................................................

8. What may banks also provide?

.......................................................................................................................

.......................................................................................................................

9. What are banks concerned with?

.......................................................................................................................

.......................................................................................................................

10. What is the primary function of a bank?

.......................................................................................................................

.......................................................................................................................

11. How do banks often get money for themselves?

.......................................................................................................................

.......................................................................................................................

12. What is the difference between current and deposit accounts?

.......................................................................................................................

.......................................................................................................................

13. Which services do retail banks provide?

.......................................................................................................................

.......................................................................................................................

14. Whom do commercial banks provide their specialty services to?

.......................................................................................................................

.......................................................................................................................

15. What do investment banks focus on?

.......................................................................................................................

....................................................................................................................... AFTER YOU READ

Mini-Quiz: Use your understanding from the reading text to do the following mini-quiz.

University of Labour and Social Affairs / Foreign Language Faculty Page 10

English for Banking & Finance

1. The business dealing with money and credit is __________ A. Banking B. Health care C. Education

2. The amount of money a bank charges for the privilege of allowing a person to

borrow money or the amount of money the bank pays a person to deposit his money

for the bank to invest is called? A. Loan B. Mortgage C. Interest

3. The money that a person borrows from a bank or other financial institutions is called a __________ A. Interest B. Commercial C. Loan

4. The money that a person places in a bank account for the bank to use to invest and

that also earns interest is called a __________ A. Loan B. Deposit C. Mortgage

5. A loan to pay for a home, business or other real estates over a period of time is a __________ A. Deposit B. Bankruptcy C. Mortgage

6. Your checking and savings account typically come from a __________ A. retail bank B. commercial bank C. investment bank

7. The banks focus on consumers or the general public as customers A. central banks B. retail banks C. commercial banks

8. Opening a checking account requires completing a signature card. A. True B. False

9. These banks focus on business customers A. retail banks B. commercial banks C. central banks

10. These banks help business work in financial markets A. retail banks b. commercial banks C. investment banks READING 2: BANK ACCOUNTS A bank account

For the safety, convenience and many other benefits, the number of people

opening a bank account is increasing. An account is a record of a customer’s money

transactions (deposits and withdrawals). Its form is like the letter T with Debits on the

left and Credits on the right. An account can have either credit or debit balance. A

credit balance is the statement of an account when more money is deposited than

withdrawn while a debit balance is when less money is deposited than withdrawn.

University of Labour and Social Affairs / Foreign Language Faculty Page 11

English for Banking & Finance

Every month account holders are given an account statement showing the month’s

transactions, consisting of Date, Detail, Debits, Credits and Balance and pay an

account charge, but if they can keep their account in credit, this service will be free of charge.

Banks will make a note of credit or debit entry in customers’ accounts when

they pay money into or out of their accounts. When a customer deposits $50 in his

account, the bank credits this amount to the customer’s account and at the same time

debits $50 to the bank’s account. This is an example of double entry.

Deposits on an account may be demand or time. Normally, a demand – deposit

account pays no or very little interest whereas a time pays interest. The interest rates

paid by banks vary from bank to bank, depending on how long customers leave their

money in the bank: short, medium or long term. The longer the money remains in the

bank, the more interest it earns. With time deposits, account holders usually withdraw

their money at maturity but they can take the money out of the account before the

maturity date if they want. In this case, some interest will be lost.

A withdrawal slip is normally used to withdraw money from an account.

However, current account holders can withdraw money from their account by writing

cheques. In this case, they do not need to write their names as the payee of the cheque,

but write “cash” or “self” in place of the payee’s name.

To open an account, the applicant is required to fill in an account opening

application form and to deposit some money. An account can be opened for

individuals or a company. The former is the personal account while the latter is the

corporate or business account. In general, the procedures of opening a corporate

account are more complicated than a personal one.

To close an account, it is necessary to withdraw all the balance on it.

There are different types of account to meet the various needs of customers:

current (checking), deposit and savings accounts, sole and joint accounts, personal and corporate accounts. Current accounts

A current account, known as a checking account in the USA, is the most

popular bank account. It provides both safety and convenience. Like any other types of

bank account, it is safe because account holders do not need to carry cash, which can be easily lost or stolen.

University of Labour and Social Affairs / Foreign Language Faculty Page 12

English for Banking & Finance

It is also convenient since holders are given a chequebook – a small booklet full

of cheques – to pay their daily bills easily and to withdraw money from their accounts.

Moreover, current account holders may be provided with a cash card used to withdraw

money from their account by using ATMs (Automated Teller Machines) and a debit

card used to pay for goods or services through auto-payment system without making out a cheque.

However, a current account does not usually pay interest since money on such

an account is usually demand deposit, which can be withdrawn at any time. This does

not allow banks to use this deposit to lend out with interest to those who need capital.

Current account holders may overdraw their account up to a limit, called an

agreed overdraft limit. Sometimes customers write a cheque for more money than they

have in their account. This is called bouncing a cheque. And if a current account

holder bounces a cheque, the bank usually charges a bounced cheque fee. This is

necessary to prevent holders from writing bad cheques.

In practice, however, banks usually require that holders keep a minimum

amount of money in the account. This guarantees that bankers will at least be able to

lend out a certain amount with interest to pay the costs of processing cheque. If

depositors withdraw money and the balance falls below the minimum, the bank will

then charge a service charge – a small fee each month. Savings accounts

Savings accounts are demand deposits (i.e. the customer can withdraw money

at any time without warning of the bank) on which the bank pays interest. The rate of interest is quite low because - savings are demand deposits

- the minimum balance is very low – usually one unit of the relevant currency

Savings accounts are aimed at the small saver – the type of customer who puts

by a small part of his or her income each month to save for the interest. This kind of

account has always been very important for retail commercial banks. Although savings

are demand deposits the bank can be fairly sure that the total balance of savings

accounts will not fall dramatically. The total balance of current accounts tends to be much more volatile.

Most banks provide their savings account customers with a passbook which

records all their transactions. This passbook acts like a statement except that it is

University of Labour and Social Affairs / Foreign Language Faculty Page 13

English for Banking & Finance

always up-to-date. The customer can only deal with the bank – either at the counter or

by letter – there is no chequebook.

Current & deposit accounts

It is acknowledged that the current and deposit accounts are popular bank

accounts. That people decide to open a current or deposit account depends on the

purpose of each type of account.

A current account is used for day-to-day expenses by writing cheques anywhere

at any time. With a chequebook, the payment of everyday bills can be easy. But the

current account usually pays no or very little interest. Thus, a current account is for

safety and convenience, not for investment.

On the other hand, a deposit account is used not for daily handling finances.

With deposit account, the holder is not provided with a chequebook, so the payment of

daily bills can be difficult. But it is really a good form of short-term investment

because it pays interest (3.5% at the moment). A deposit account, therefore, is for safety and benefit.

Sole & joint accounts

A sole account is an account opened in the name of one person who alone can

operate the account. If borrowing is allowed the account holder is solely liable for the debt.

A joint account is an account opened in the names of two or more persons. A

Joint Account Mandate form must be completed and signed by all parties to the

account. Clear instructions must be given by the joint account holders on the mandate

as to whether both or either some or all of them may draw from the account.

The form also states the joint and several liabilities of the account holders. This

means the account holders are fully responsible for any debts recorded in the account.

They are responsible both as a group and as individuals. This means that the bank has

the right of action against all parties, either all together or one by one until the whole debt is recovered.

Mandates can be taken to allow third parties to use the account but the account

holders remain liable for any debts incurred. Such mandates when taken must be treated with great caution.

Remember to ensure all legal formalities are observed prior to opening any

account, e.g. take up references to avoid allegations of negligence.

University of Labour and Social Affairs / Foreign Language Faculty Page 14

English for Banking & Finance

(Source: Adapted from Nguyen Phuong Lan. 2007. 145 Tests in Banking &

Finance. Hanoi: National Economic University Publisher; Cao Thị Sơn, MA. 2003.

English for Finance and Banking. Hanoi: Publisher of Labour and Social Affairs)

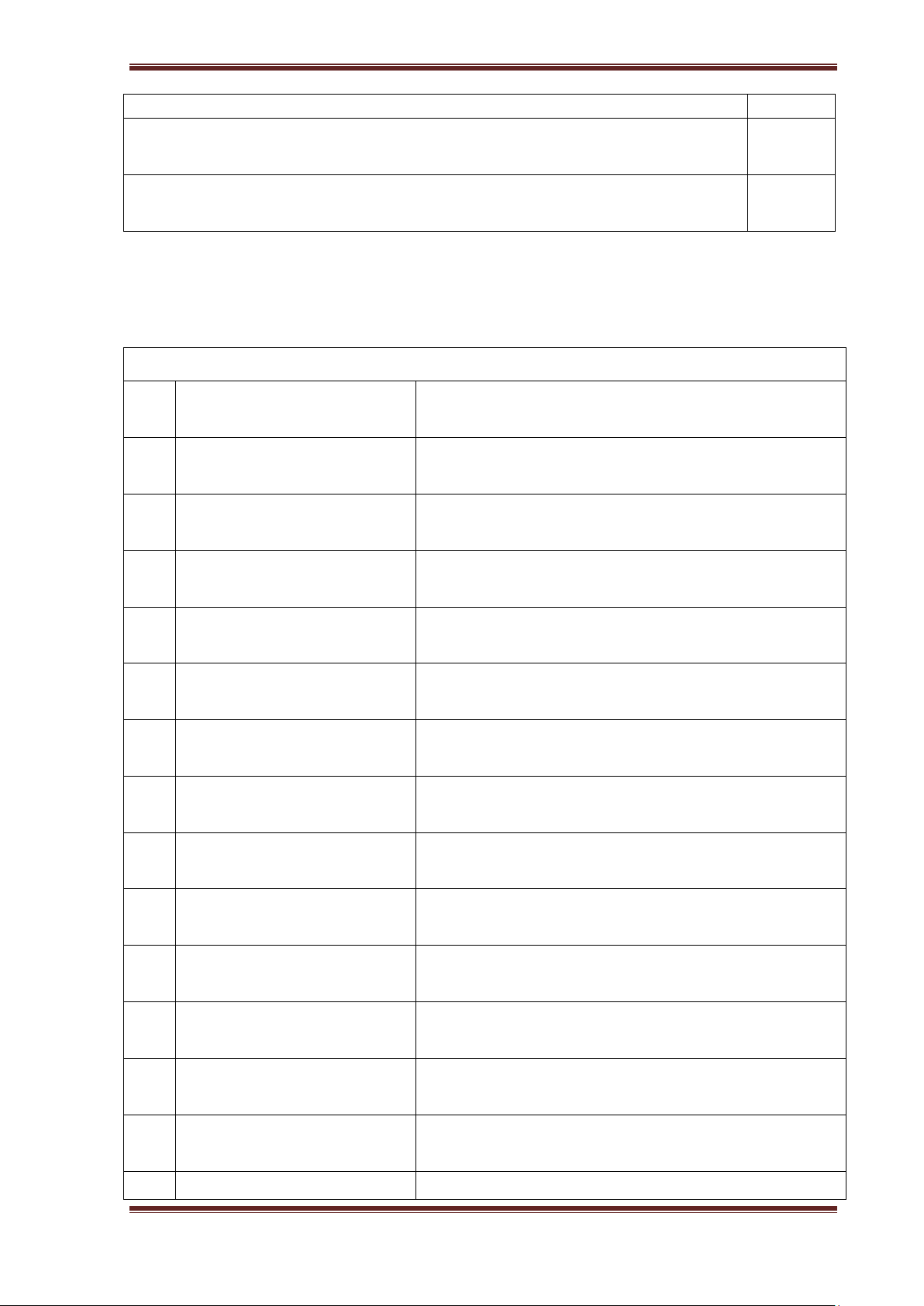

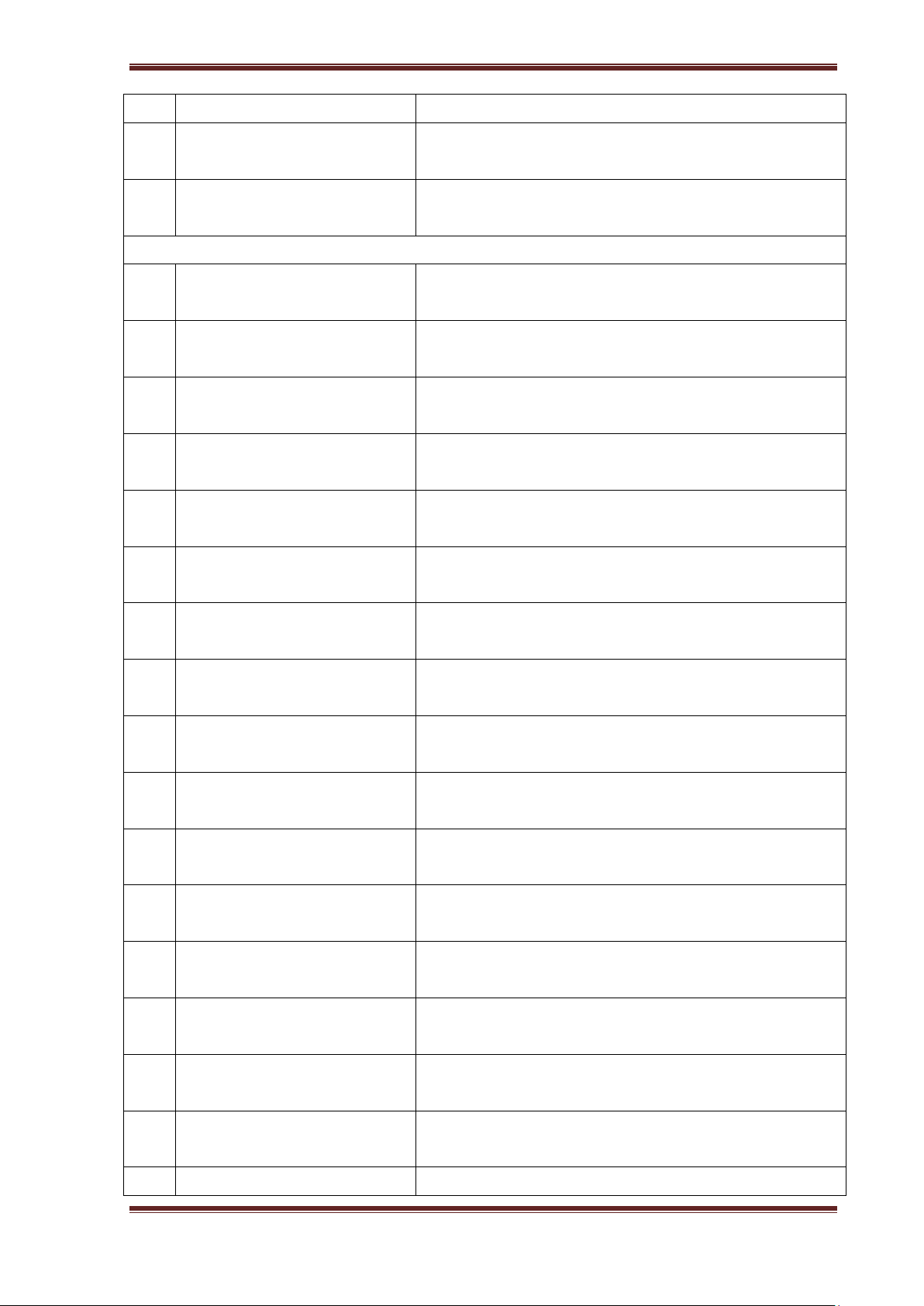

Read the text above carefully and decide if the following statements TRUE

(T), FALSE (F), or NOT GIVEN (NG) Statements T/F/NG

1. An account has two columns.

2. A monthly account statement has five columns.

3. Money transactions of an account can be deposits, withdrawals and loans.

4. An account in debit means that loans are accepted.

5. An account holder may be freed from paying an account charge when he keeps his account in debit.

6. Money on an account is maybe demand or time.

7. The rates of interest on demand deposits are higher than those on time ones.

8. The rates of interest on long-term deposits are higher than those on short-term ones.

9. “Cash” is written on a cheque instead of your name when you withdraw money from your account.

10. To close an account, it is unnecessary to withdraw all the balance on it

11. Banks will send a statement of credit or debit entry to customers when

they pay money into or out of their accounts.

12. The interest rates paid by banks vary from bank to bank, depending on

how long customers leave their money in the bank: short, medium, or long term.

13. A current account is also called a checking account in the USA.

14. Current account holders can use a debit card to withdraw money from

their account by using ATMs (Automated Teller Machines).

15. Current account holders can overdraw their account up to a limit,

called an agreed overdraft limit.

16. If a current account holder bounces a cheque, the bank usually charges

a bounced cheque fee. This is necessary to prevent holders from writing bad cheques.

17. Savings accounts are aimed at the small businesses.

18. Most banks provide their savings account customers with a passbook

which records all their transactions. This passbook acts like a statement

University of Labour and Social Affairs / Foreign Language Faculty Page 15

English for Banking & Finance

except that it is always up-to-date.

19. Mandates can be taken to allow third parties to use the account but the

account holders remain liable for any debts incurred.

20. A sole account is an account opened in the name of one person who

alone can operate the account.

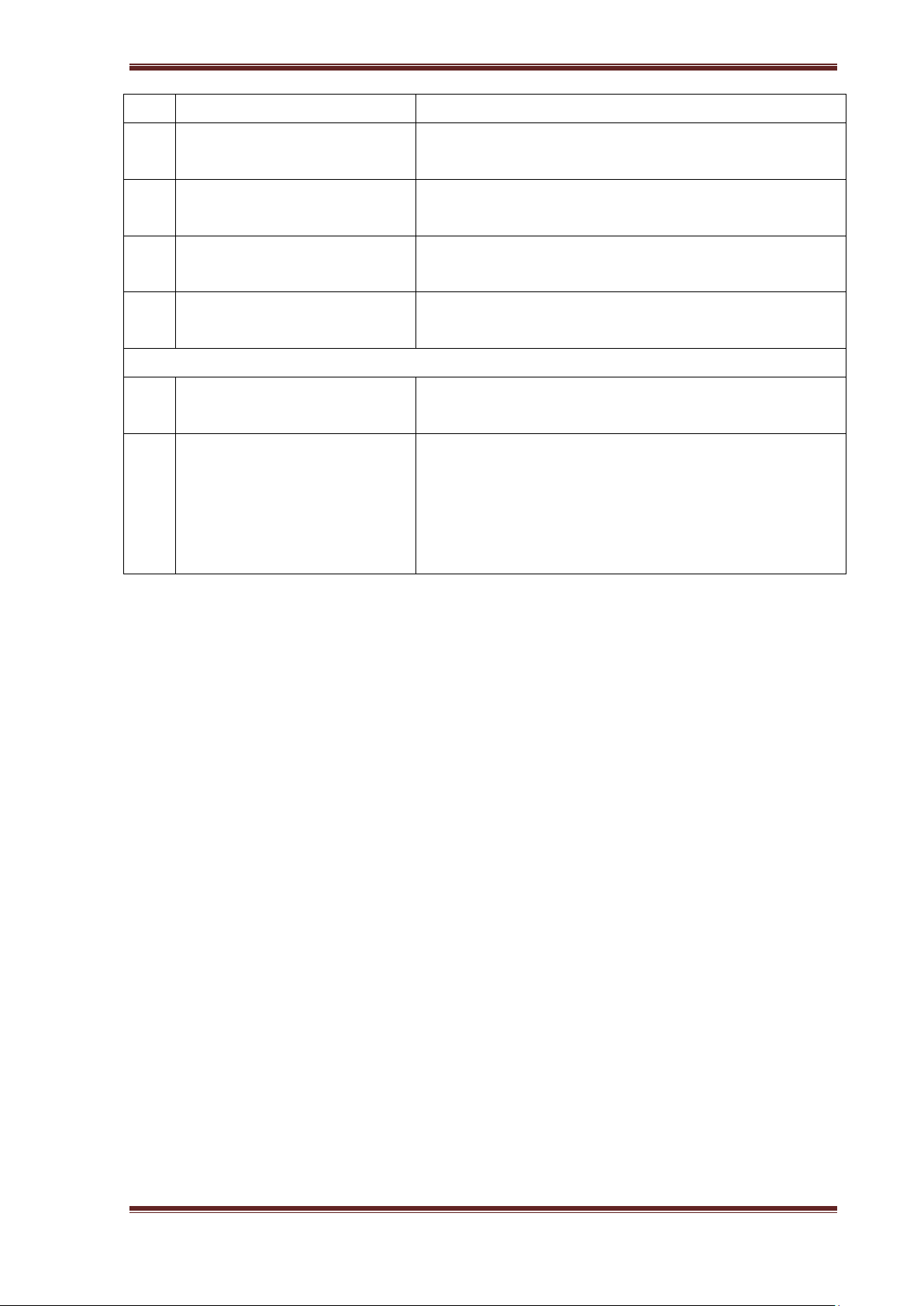

II. GRAMMAR: Word formation A. THEORY THE FORMATION OF NOUNS 1 V + ment -> N

develop (v) + ment = development (n)

entertain (v) + ment = entertainment (n) 2 V + ance -> N

attend (v) + ance = attendance (n)

perform (v) + ance = performance (n) 3 V + ion/ation -> N

invent (v) + ion = invention (n)

inform (v) + ation = information (n) 4 V + age -> N

marry (v) + age = marriage (n)

carry (v) + age = carriage (n) 5 V + al -> N

survive (v) + al = survival (n) arrive (v) + al = arrival (n) 6 V + ing -> N

teach (v) + ing = teaching (n)

train (v) + ing = training (n) 7 V + er -> N work (v) + er = worker (n)

employ (v) + er = employer (n) 8 V + or -> N act (v) -> actor (n) edit (v) -> editor (n) 9 V + ress -> N act (v) -> actress (n) wait (v) -> waitress (n) 10 V + ant -> N

assist (v) + ant = assistant (n)

depend (v) + ant = dependant (n) 11 V + ee -> N emply (v) + ee = employee (n)

interview (v) + ee = interviewee (n) 12 V + ist -> N type (v) + ist = typist (n) cycle (v) + ist = cyclist (n) 13 V + ar -> N lie (v) + ar = liar (n) beg (v) + ar = beggar (n) 14 V + ence -> N

depend (v) + ence = dependence

exist (v) + ence = existence (n) 15 Adj + ness -> N

rich (adj) + ness = richness (n)

University of Labour and Social Affairs / Foreign Language Faculty Page 16

English for Banking & Finance

polite (adj) + ness = politeness (n) 16 Adj + ity -> N

able (adj) + ity = ability (n)

responsible (adj) + ity = responsibility (n) 17 Adj + y -> N

honest (adj) + y = honesty (n)

dishonest (adj) + y = dishonesty (n) 18 Adj + ty -> N

certain (adj) + ty = certainty (n)

uncertain (adj) + ty = uncertainty (n) 19 Adj + ism -> N

social (adj) + ism = socialism (n)

racial (adj) + ism = racialism (n) 20 Adj + th -> N warm (adj) + th = warmth (n) wide (adj) + th = width (n) 21 N1 + hood -> N2

child (n) + hood = childhood (n)

neighbor (n) + hood = neighborhood (n) 22 N1 + ship -> N2

friend (n) + ship = friendship (n)

member (n) + ship = membership (n) 23 N1 + ism -> N2

capital (n) + ism = capitalism (n) hero (n) + ism = heroism 24 Super + N1 -> N2 super + man = superman super + market = supermarket 25 Under + N1 -> N2

under + current = undercurrent under + growth = undergrowth 26 Sur + N1 -> N2 sur + face = surface sur + name = surname 27 Sub + N1 -> N2 sub + way = subway sub + marine = submarine THE FORMATION OF VERBS 1 Adj + en -> V Wide (adj) + en = widen (v)

Short (adj) + en = shorten (v) 2 En + adj -> V En + rich = enrich (v) En + large = enlarge (v) 3 En + N -> V En + danger = endanger (v) En + case = encase (v) 4 En + V1 -> V2 En + force = enforce (v) En + courage = encourage (v) 5 N + en -> V

length (n) + en = lengthen (v)

strength (n) + en = strengthen (v) 6 Adj + ise/ize -> V

social (adj) + ise/ize = socialize (v)

industrial (adj) + ise/ize = industrialize (v) 7 Over + V1 -> V2 Over + take = overtake

University of Labour and Social Affairs / Foreign Language Faculty Page 17

English for Banking & Finance Over + throw = overthrow 8 Under + V1 -> V2 Under + line = underline Under + go = undergo 9. Super + V1 -> V2 Super + impose = superimpose Super + charge = supercharge

THE FORMATION OF ADJECTIVES 1 N + ly -> adj

friend (n) + ly = friendly (adj) love (n) + ly = lovely (adj) 2 N + ful -> adj

care (n) + ful = careful (adj)

success (n) + ful = successful (adj) 3 N + less -> adj

home (n) + less = homeless (adj)

hope (n) + less = hopeless (adj) 4 N + ic -> adj

economy (n) + ic = economic (adj)

history (n) + ic = historic (adj) 5 N + able -> adj

reason (n) + able = reasonable (adj)

comfort (n) + able = comfortable (adj) 6 N + ous -> adj

danger (n) + ous = dangerous (adj)

industry (n) + ous = industrious (adj) 7 N + some -> adj

trouble (n) + some = troublesome (adj)

hand (n) + some = handsome (adj) 8 N + al -> adj

nation (n) + al = national (adj)

nature (n) + al = natural (adj) 9 N + ern -> adj

west (n) + ern = western (adj)

south (n) + ern = southern (adj) 10 N + y -> adj rain (n) + y = rainy (adj) sun (n) + y = sunny (adj) 11 N + like -> adj

child (n) + like = childlike (adj) life (n) + like = lifelike 12 N + ish -> adj

child (n) + ish = childish (adj)

fool (n) + ish = foolish (adj) 13 V + ing/ed -> adj

interest (v) + ing/ ed = interesting / interested (adj)

worry (v) + ing / ed = worrying / worried (adj) 14 V + ive -> adj act (v) + ive = active (adj)

progress (v) + ive = progressive (adj) 15 V + able/ ible -> adj

accept (v) + able = acceptable (adj)

count (v) + able = countable (adj) 16 Super + adj1 -> adj2

super + natural (adj) = supernatural (adj)

super + sonic (adj) = supersonic (adj) 17 Under + adj1 -> adj2

under + nourished (adj) = undernourished (adj)

University of Labour and Social Affairs / Foreign Language Faculty Page 18

English for Banking & Finance

under + developed (adj) = underdeveloped (adj) 18 Over + adj1 -> adj2

over + anxious (adj) = overanxious (adj)

over + crowed (adj) = overcrowded (adj) 19 Sub + adj1 -> adj2

sub + conscious (adj) = subconscious (adj)

sub + atomic (adj) = subatomic (adj) 20 N + PII -> adj

man (n) + made (PII) = manmade (adj)

hand (n) + made (PII) = handmade (adj) 21 Well/ ill + PII -> adj well + done = well-done (adj)

ill + prepared = ill-prepared (adj)

THE FORMATION OF ADVERBS 1 Adj + ly -> adv

slow (adj) + ly = slowly (adv)

careful (adj) + ly = carefully (adv) 2 Note: good (adj) -> well (adv)

late (adj) -> late/ lately (adv)

hard (adj) -> hard/ hardly (adv) ill (adj) -> ill (adv) fast (adj) -> fast (adv) B. PRACTICE EXERCISES

Exercise 1: Choose the best option (A, B, C or D) to complete the following sentences

1. Faraday made many _________ in the field of physics and chemistry. A. discovery B. discoveries C. discovered D. discovering

2. Faraday was an _________ in Davy’s laboratory. A. assistance B. assist C. assistant D. assisted

3. The generator is one of Faraday’s most important _________. A. achievements B. achievement C. achieve D. achieving

4. His _________ of the generator is very famous. A. invent B. inventive C. invention D. inventor

5. We will _________ our English vocabulary if we read English books every day. A. rich B. richness C. richly D. enrich

6. You study every well. It’s _________ that you will fail the exam. A. possible B. impossible C. possibility D. impossibility

7. Lan always shares her _________ with me. A. sadness B. sad C. sadly D. unsad

8. These children have the _________ to imitate animals’ voice.

University of Labour and Social Affairs / Foreign Language Faculty Page 19

English for Banking & Finance A. able C. disable B. ability D. disability

9. Money doesn’t bring _________ to man. A. happy B. happiness C. happily D. unhappy

10. Good students aren’t _________ intelligent students. A. necessary B. necessity C. necessarily D. unnecessary

11. I don’t believe what he has just said. It is _________. A. unreasonable B. reason C. reasonably D. reasoning

12. The teacher does everything in order to _________ her students. A. courage B. encouragement C. ecouraged D. encourage

13. What is his _________? Is he American or English? A. national B. nationality C. nationalize D. international

14. You should spend your free time _________. A. useful B. useless C. usefully D. uselessly

15. Please decide what you want to do. You must make a _________. A. decision B. decide C. decisive D. decisively

16. He is interested in the _________ of old buildings. A. preserve B. preservation C. preservative D. preserved

17. He has very high _________ of his only son. A. expect B. expected C. expectedly D. expectation

18. All of us need the _________ of fresh air. A. provide B. provided C. provision D. provisions

19. Farmers need to _________ crops A. rotation B. rotate C. rotational D. rotationally

20. We are discussing about a problem of great _________. A. importance B. important C. importantly D. import

21. He doesn’t have a job. He is _________. A. employed B. unemployed C. employer D. employee

22. The cost of _________ must be paid by the buyer. A. carry B. carried C. carrying D. carriage

23. We have to _________ the natural resources of our country. A. conservation C. conserved C. conserve D. conservational

24. The industrial _________ will lead to the country’s prosperity. A. develop B. development C. developing D. developed

25. Forest must be managed _________. A. careless B. careful C. carefully D. care

26. Her _________ from school without any excuse made the teacher angry. A. absent B. absence C. absently D. absences

University of Labour and Social Affairs / Foreign Language Faculty Page 20