Preview text:

Group 3: Vũ Trần Nhã Đoan Nguyễn Phạm Thanh Phương Nguyễn Thành Mỹ Duyên Nguyễn Minh Nguyệt Mai Tấn Quân Nguyễn Tiến Dũng Nguyễn Ngọc Như Ý Nguyễn Lê Ngọc Diễm Lê Thị Kim Quý EXERCISE 2.10

1. With the recognition of increase in land value by $1.5 million and decrease in

building value by 1.7 million dollars, this allocation will increase future income as the

land is non-asset depreciated. Thus, the company's pre-tax profit will increase to $0.5 million.

2. The assistant faces an ethical dilemma because if he does according to the

controller's allocation method, will not meet the principle of recognizing assets as

“Cost must be determined reliably” and does not follow the accounting principle

maths. But if the assistant doesn't follow through, he may be disciplined for

increasing the difficulty problems with the company's profitability. EXERCISE 3.4 (i)

In this case, CGU is a plant in Alandia as a whole, as individual assets do not generate

cash inflows largely independently from others.

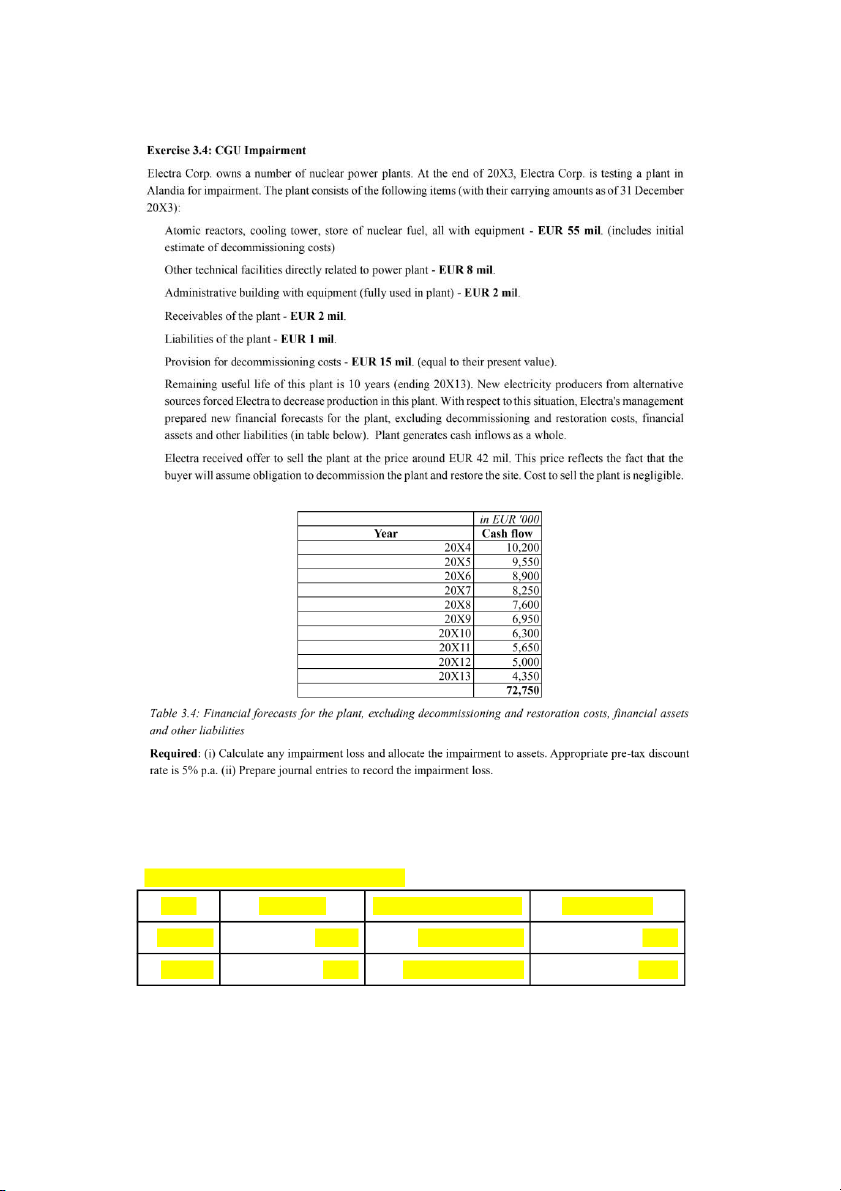

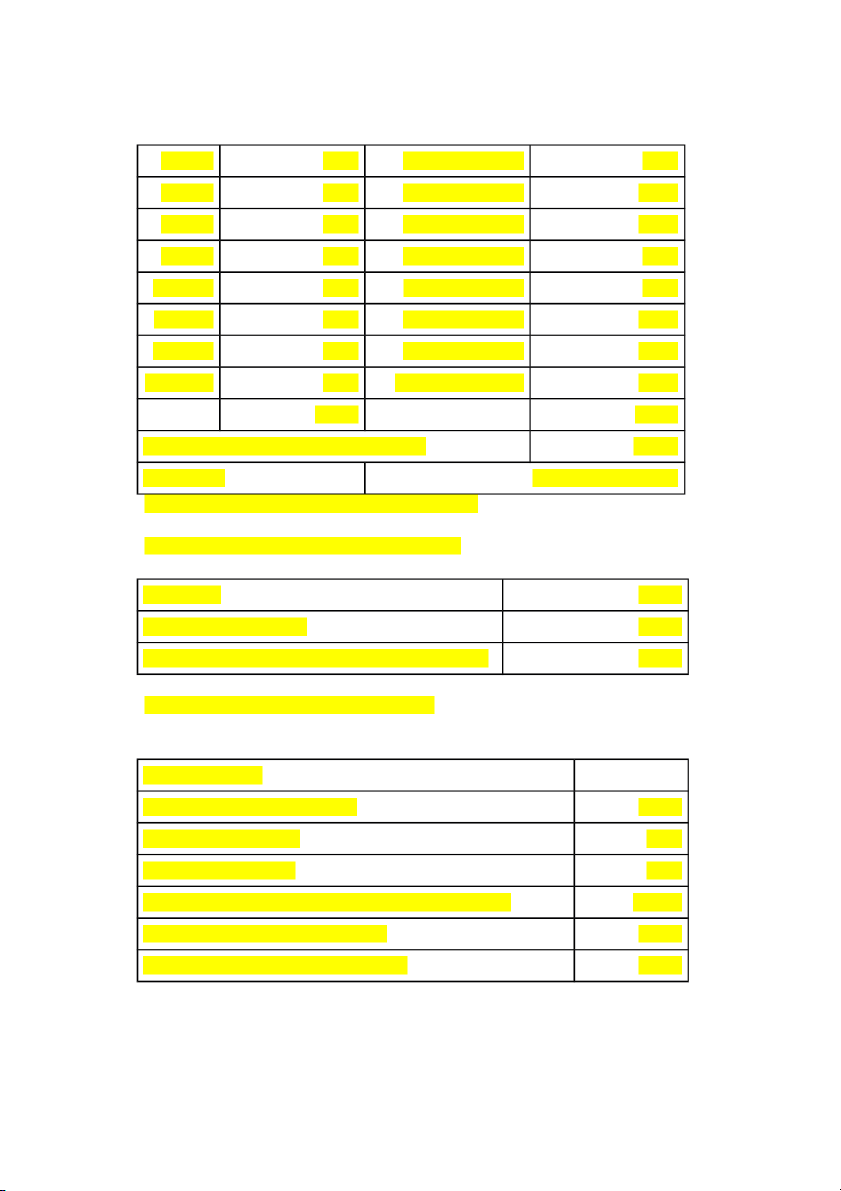

Calculation of value in use (EUR ‘000) Year Cash flow Discount factor at 5% Present value 1- 20X4 10,200 1/(1+5%)=0,952 9,714 2- 20X5 9,550 1/(1+5%)^2=0,907 8,662 3- 20X6 8,900 1/(1+5%)^3=0,864 7,688 4- 20X7 8,250 1/(1+5%)^4=0,823 6,787 5- 20X8 7,600 1/(1+5%)^5=0,784 5,955 6- 20X9 6,950 1/(1+5%)^6=0,746 5,186 7- 20X10 6,300 1/(1+5%)^7=0,711 4,477 8- 20X11 5,650 1/(1+5%)^8=0,677 3,824 9- 20X12 5,000 1/(1+5%)^9=0,645 3,223 10- 20X13 4,350 1/(1+5%)^10=0,614 2,671 72,750 58,188

Present value of decommissioning in 20X13 -15000 Value in use 58,188 -15000=43,188

Discount Factor Formula used: DF= 1/(1+r)^year

Calculation of recoverable amount (EUR ‘000) Value in use 43,188 Fair value less cost to sell 42,000

Recoverable amount as of 30 Dec 20X3 (higher of): 43,188

Calculation of impairment loss (EUR ‘000) Carrying amount

Reactors, tower, store, equipment 55,000 Other technical facilities 8,000 Administrative building 2,000

Less Provision for decommissioning and restoration costs -15,000

Carrying amount as of 31 Dec 20X3 50,000

Recoverable amount as of 31 Dec 20X3 43,188

Impairment loss as of 31 Dec 20X3 6,812

Allocation of impairment loss (EUR ‘100) Asset Carrying % of total value Allocated Amount (G) impairment loss (G*E) Reactors, tower, store, 55,000 55,000/65,000*100 5,758 equipment %= 84,62% Other technical facilities 8,000 8,000/65,000*100% 838 = 12,31% Administrative building 2,000 2,000/65,000*100% 209 = 3,08% 65,000 100,00% 6.805

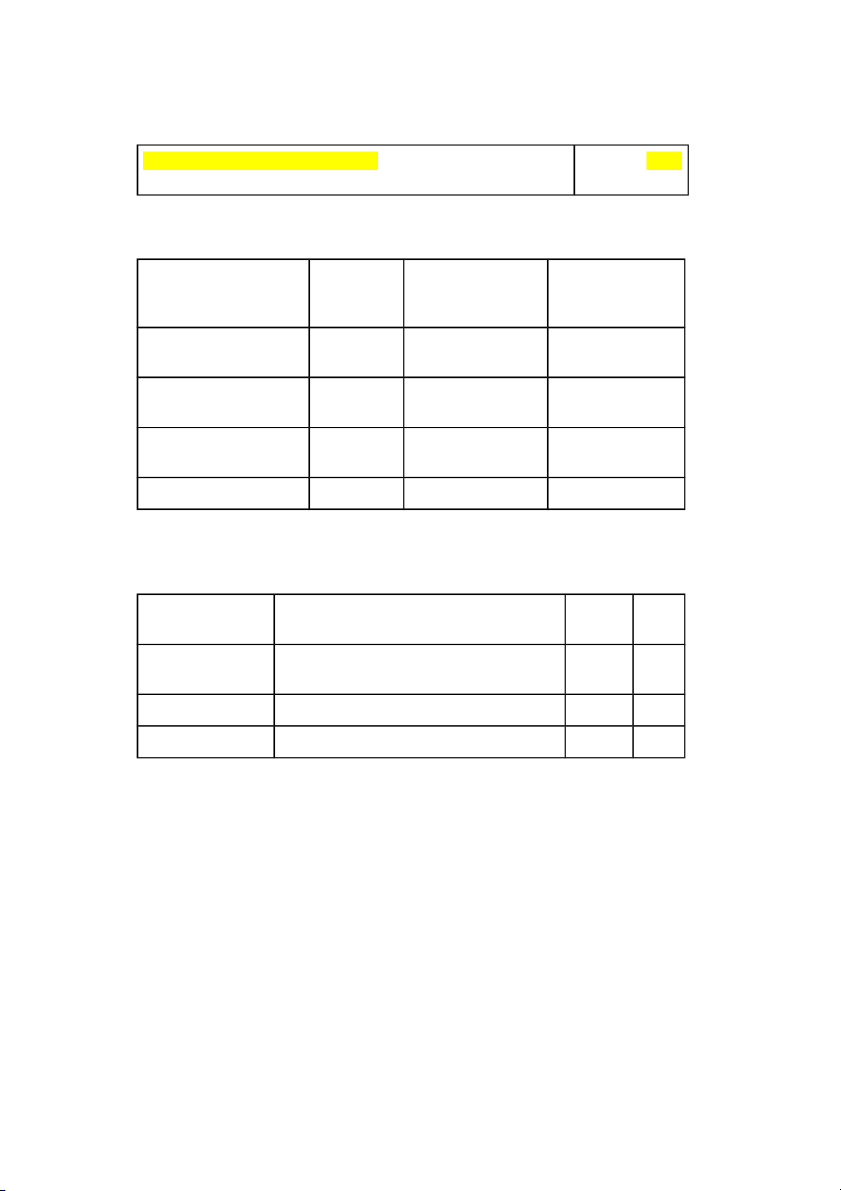

(ii) Prepare journal entries to record the Impairment loss DR Profit or loss - 6,805 Impairment loss

CR PPE (Reactors, tower, store, 5,758 equipment)

CR PPE (Other technical facilities) 838

CR PPE (Administrative building) 209