lOMoARcPSD|44862240

lOMoARcPSD|44862240

VIETNAM GENERAL CONFEDERATION OF LABOUR TON DUC THANG

UNIVERSITY FACULTY OF BUSINESS ADMINITRATION

GROUP REPORT SUBJECT: NEGOTIATON THE FAST-CHANGING

ANALYSIS BUSINESS ENVIRONMENT IN RETAIL AND MANUFACTURING

INDUSTRY THE CASE STUDY APPLIES BETWEEN MASAN AND

VINGROUP IN VIETNAM MARKET Advised by MBA. Tran Khanh

Group 3:

1. Truong Minh Thi 719D0173

2. Ho Thi Thuy Duong 719D0270

3. Bui Le Hong Nghia 719D0099

4. Tran Ha My Hien 719D0049

5. Phan Tran Thien Nhi 719D0123

6. Le Tran Thao Vy 719D0255

28

th

, May 2022

ACKNOWLEDGEMENTS

First and foremost, our team would like to express our heartfelt gratitude and respect to

Mr. Tran Khanh for accompanying us during the second semester.

lOMoARcPSD|44862240

Your valuable contributions will motivate our team to finish this report. It is

unavoidable that there will be flaws in the process of implementing the article's content

due to a lack of knowledge. Our team is eager to hear your thoughts and suggestions so

that we can learn from our mistakes and complete this report as efficiently as possible.

Thank you from the bottom of our hearts!

lOMoARcPSD|44862240

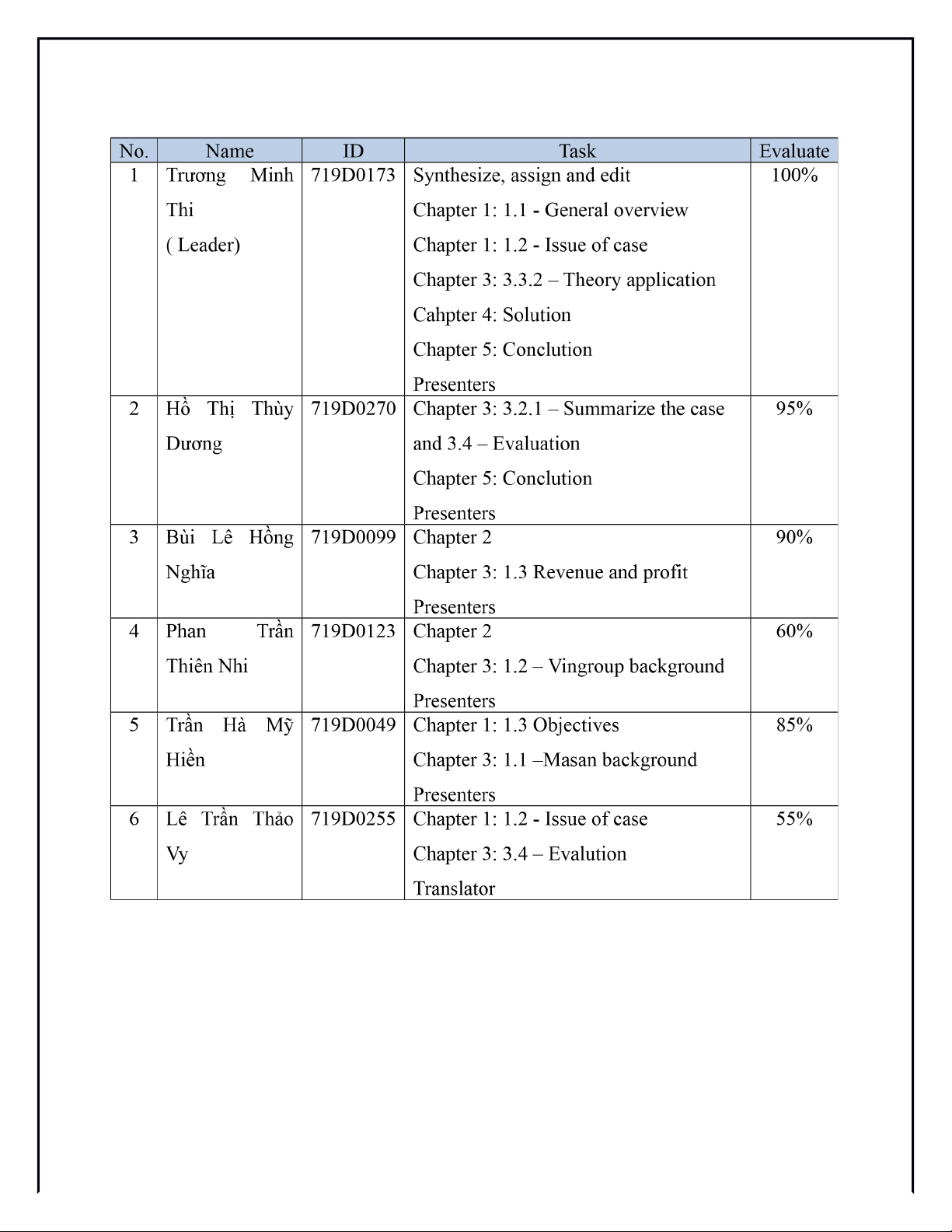

MEMBERSHIP AND ASSESSMENT TABLE

TABLE OF CONTENTS

REASON FOR WRITING.......................................................................................5

I. INTRODUCTION.................................................................................................6

1.1 General overview.........................................................................................6

1.2 Issue...........................................................................................................13

lOMoARcPSD|44862240

1.3 Objectives..................................................................................................14

II. LITERATURE REVIEW....................................................................................15

2.1 BATNA (Best Alternative to Negotiated Agreement)..................................15

2.2 ZOPA.........................................................................................................16

2.3 Integrative negotiation................................................................................17

III. NEGOTIATION ANALYSIS:............................................................................19

3.1 Company background................................................................................19

3.2 Revenue and profit after purchasing VinComerce - VinEco......................24

3.3 Past corporation.........................................................................................26

3.4 Evaluation of the status after M&A (Mergers and acquisitions)..................28

3.5 Challenge:..................................................................................................31

3.6 Theory of application..................................................................................31

IV. SOLUTION:....................................................................................................33

4.1 Past solution review:..................................................................................33

4.2 Future Suggestions....................................................................................37

V. CONCLUSION.................................................................................................40

REFERENCES:....................................................................................................40

LIST OF FIGURES

Figure 1: M&a activities southeast asia countries 2017-2019 (Billion USD).....................8

Figure 2: Top 10 markets by score growth 2020-2021.......................................................9

Figure 3: M&A activities by country 2019-2020..............................................................10

Figure 4: Proportion of mergers and acquisitions in Vietnam..........................................11

Figure 5: M&A value of home and foreign investors from 2018 to 2020 (%)..................11

Figure 6: VietNam - M&A and IOP transactions..............................................................12

Figure 7: M&A market in Vietnam from 2019 to 2021...................................................13

Figure 8: Forecast of M&A value in VietNam in 2021.....................................................14

Figure 9: ZOPA Method...................................................................................................18

Figure 10: Structure of Masan Group...............................................................................21

Figure 11: Masan's Revenue from 2018 to 2021 ( Billion VND).....................................22

Figure 12: Brands of Vingroup.........................................................................................23

lOMoARcPSD|44862240

Figure 13: Vingroup’s shareholder structure....................................................................24

Figure 14: Business results of Vingoup 2015-2019 ( Billions).........................................25

Figure 15: Number of Vinmart and Vinmart + stores.......................................................26

Figure 16: Masan's business results 2020.........................................................................27

Figure 17: Revenue of Masan’s business segments after 6 months in 2020-2021............28

Figure 18: Ownership structure diagram..........................................................................30

Figure 19: Some huge retail chains in 2019.....................................................................31

Figure 20 : Expected sales of Meat Deli...........................................................................32

Figure 21: The grow rate of MEATDeli monthly since June 2019...................................33

Figure 22 : Financial indicators of Masan and MWG in 2019.........................................37

Figure 23: Negative factores affecting M&A activities in VietNam.................................38

Figure 24: Positive factores affecting M&A activities in VietNam..................................39

Figure 25 : Vincommerce profit 2015-2021.....................................................................40

Figure 26: Retail sales of Vietnam - April 2020...............................................................41

REASON FOR WRITING

In recent years, the M&A sector in Vietnam has been in a period of the renaissance

as local companies step up efforts to expand their business operations with M&A as one

of their main strategies. Vingroup, Masan Group, Hoa Phat Group, Vietnam Dairy

Products Joint Stock Company, and Novaland Group are the 5 units with the largest

M&A activities in the market, both in terms of value and number of transactions in the

past two years.

The positive transformation in domestic M&A activities will still be maintained for

these businesses because in addition to having enough cash in reserve to find quality

targets, but also being strategic in continuing to invest and continue to look for market

expansion opportunities and improve profit margins.

As Vietnam's economy continues to grow thanks to supportive regulations and

policies of the Government and trade agreements. Domestic companies will continue to

play an important role in future M&A activities, creating many corporations with a scale

comparable to large corporations in the region. Therefore, in order to have a deeper

understanding of M&A transactions between buyers and sellers, the team analyzed the

lOMoARcPSD|44862240

topic: “ The fast-changing analysis business environment in retail and manufacturing

industry - The case study applies between Masan and Vingroup in Vietnam market".

I. INTRODUCTION

1.1 General overview

In the free trade market, merger and acquisition (M&A) is a familiar concept for

domestic and foreign strategic investors.

In the M&A process businesses need to plan, prepare for transactions, access and

exchange information with investors. On the other hand, enterprises need to focus on the

appraisal and contract negotiation carefully. Besides, the reason for enterprises to

consider an M&A transaction cognize be business expansion, market development,

market share, finding partners, receive attractive offers from buyers; financial difficulties,

risk of default.

Statistics over the past 20 years demonstrate that Vietnam has more than 4,000

M&A deals with a value of nearly 50 billion USD, ranking third in Southeast Asia in

terms of M&A value. Vietnam is considered a dynamic country in M&A activities when

it attracts foreign capital flows and foreign investors to participate in the market.

However, in the new context, the goal of the enterprise when determining a successful

M&A deal changes according to the requirements and vision of the enterprise is a

problem that needs to be solved (Ministry of industry and trade - VN).

Market trends:

M&A activities in Vietnam have increased sharply during the 10 years from 2007 to

2017 and peaked in 2017 with a scale of 10 billion USD, of which contributed 50% of the

value of the Sabeco deal. M&A value tends to decrease in 2018 and 2019 (Vietnam M&A

Forum - MAF).

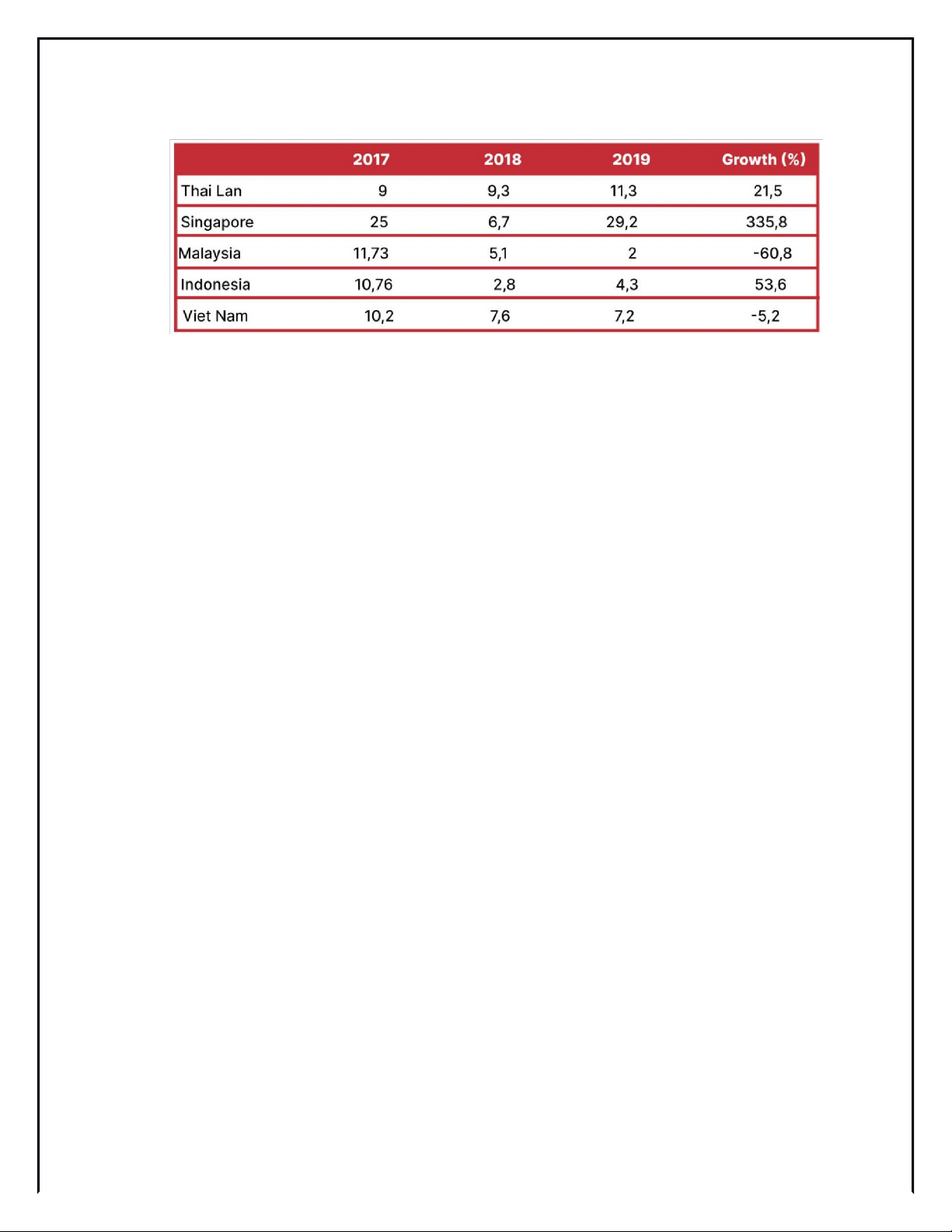

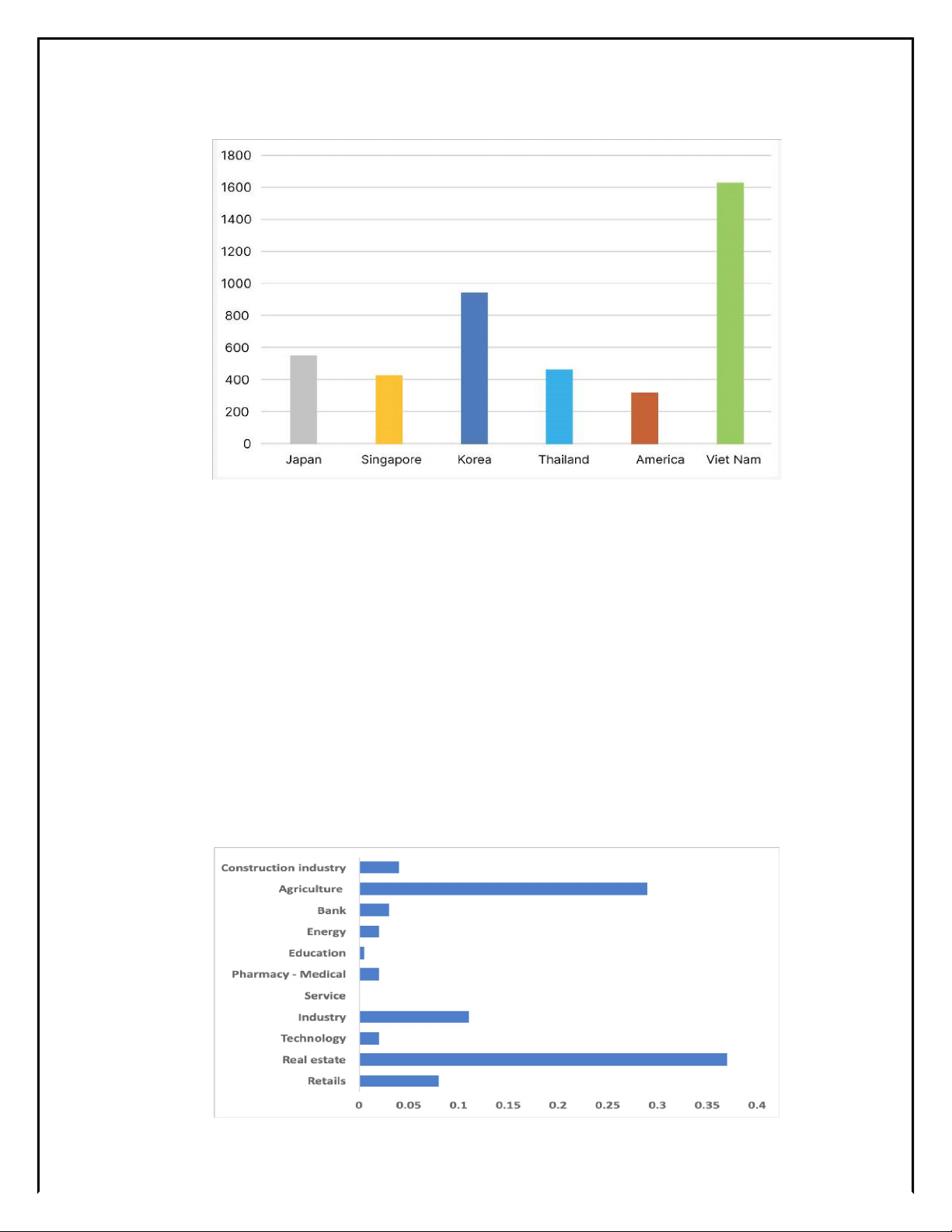

M&A activities of Southeast Asian countries from 2017 to 2019 are different. In

2018, Vietnam ranked 2nd in terms of M&A value in Southeast Asia, but in 2019 it has

dropped to 3rd place, after Singapore and Thailand.

lOMoARcPSD|44862240

Figure 1: M&a activities southeast asia countries 2017-2019 (Billion USD)

Source:MAF,HSF

Over the past 25 years, Vietnam has transformed from a low-income country into

one of the fastest-growing economies in the world, with GDP per capita increasing nearly

tenfold from 1996 to 2021, which is supported by the strong socioeconomic status of a

young population and a rapidly growing middle class. Along with economic growth,

mergers and acquisitions (M&A) activities in Vietnam have also skyrocketed thanks to

the progress of equitization and market liberalization.

What makes Vietnam attractive in the eyes of investors, is its young and dynamic

population, with an increasing average income in society. Out of your 100 million people,

nearly 45 million are now middle class. Young people, well-educated, and enjoying a

good education will be a strong point of Vietnam in the eyes of investors (MAF- VN

2021). These favorable demographic factors will help provide potential human resources

for the development of current and future technology businesses.

The Covid-19 pandemic has had a huge impact on the economy. M&A activities in

Vietnam as well as globally decreased sharply due to cautious reactions from investors.

At the same time, conditions of global isolation hinder understanding, assessment, and

decision-making. This led to many deals having to be halted because buyers and

consultants incapability to carry out detailed appraisals, meetings, negotiations, etc. The

turmoil caused by Covid-19 in global markets has severely affected the M&A market,

according to a report by market research firm Euromonitor. In the first half of 2020, the

number of global M&A deals decreased by 25% year on year due to the Covid-19

pandemic.

lOMoARcPSD|44862240

In Vietnam alone, the total value of M&A in 2019 reached $7.2 billion, equaling

94.7% of the value in 2018. Due to the impact of Covid-19 as well as a number of other

factors, the M&A value in 2020 is expected continue to decline, estimated at 3.5 billion

USD, equal to 48.6% compared to 2019. Besides, Vietnam's M&A value is expected to

start recovering in mid-2021 to about 4.5 - 5 billion USD and reach 7 billion USD before

the pandemic by 2022 (CMAC).

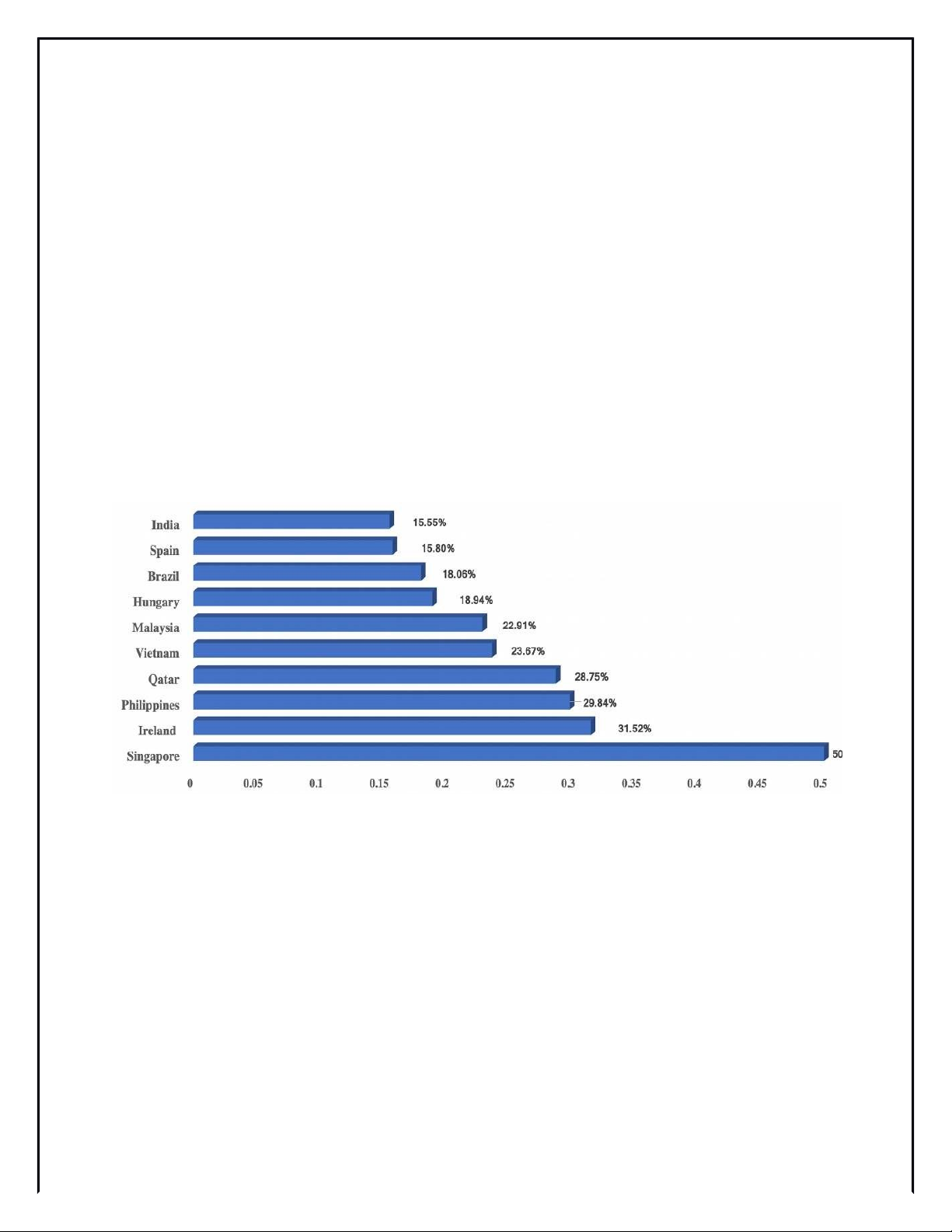

According to Euromonitor, Vietnam is predicted to be fifth in the ranking with an

expansion rate of 23.67% between 2020 and 2021, after countries such as Singapore,

Ireland, the Philippines and Qatar. The M&A market continues to be led by foreign

investors, with a focus on four countries: Japan, Korea, Thailand and Singapore.

Figure 2: Top 10 markets by score growth 2020-2021

Source: Euromonitor

The M&A market continues to be led by foreign investors, with a focus on four

countries: Japan, Korea, Thailand and Singapore.

lOMoARcPSD|44862240

Figure 3: M&A activities by country 2019-2020

Source: MAF - Vietnam M&A Forum

During the period of 2019 - 2020, the market recorded many more M&A deals such

as Mitsubishi Corporation (Japan) and Nomura Real Estate acquired 80% in phase II of

Vingroup's Grand Park project; Aozora Bank buys 15% shares of Orient Commercial

Joint Stock Bank; Lotte Chemical (Korea) acquired VinaPolytech Company; SCG Group

(Thailand) acquired Bien Hoa Packaging Company; etc. The proportion of M&A in

Vietnam by industry group is highly appreciated, respectively: Real estate, banking, retail

and technology (Vietnam M&A Forum - MAF).

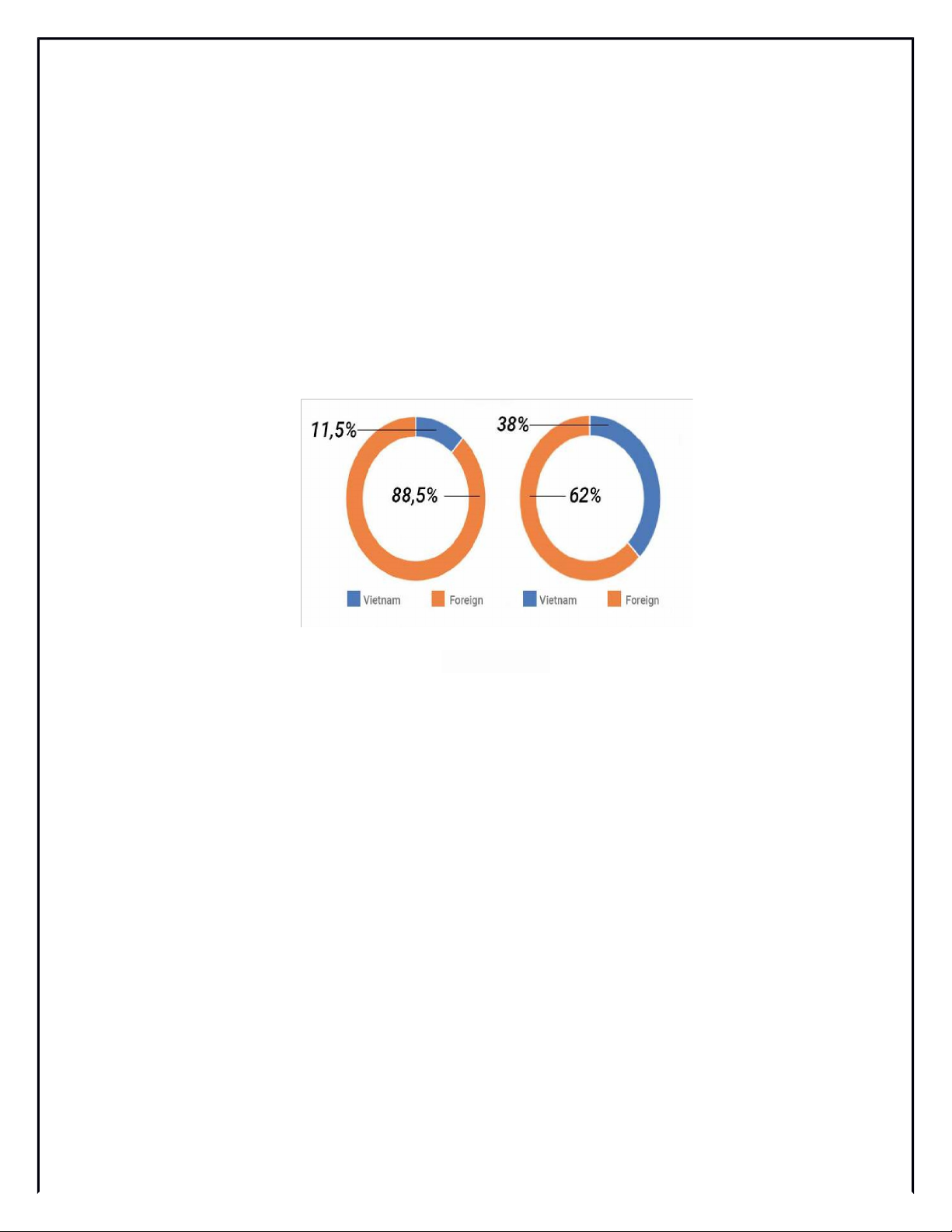

Figure 4: Proportion of mergers and acquisitions in Vietnam from 2019 to 2020 by

industry

lOMoARcPSD|44862240

Source: MAF

According to Vietnam M&A Forum (MAF), the proportion of M&A value of

domestic investors tends to increase, with the initiative of private corporations. In 2018,

the proportion of deals valued by Vietnamese enterprises as buyers stood at 11.5%, but

the value of foreign investors still accounted for 88.5%. In the period of 2019 - 2020, the

value of M&A played by Vietnamese enterprises as the buyer accounts for one-third of

the total value of M&A conducted (Vietnam M&A Forum - MAF).

Figure 5: M&A value of home and foreign investors from 2018 to 2020 (%).

Source: MAF

The situation of M&A activities in Vietnam (Business environment):

Vietnam's M&A market has grown strongly with thousands of successful deals,

reaching a total value of more than 50 billion USD. Singapore, Vietnam, Indonesia, and

Malaysia are the top 4 markets in terms of number of deals and private investment value

in Southeast Asia. Vietnam's economy will enjoy favorable conditions from participating

in many free trade agreements that have been and will come into effect.

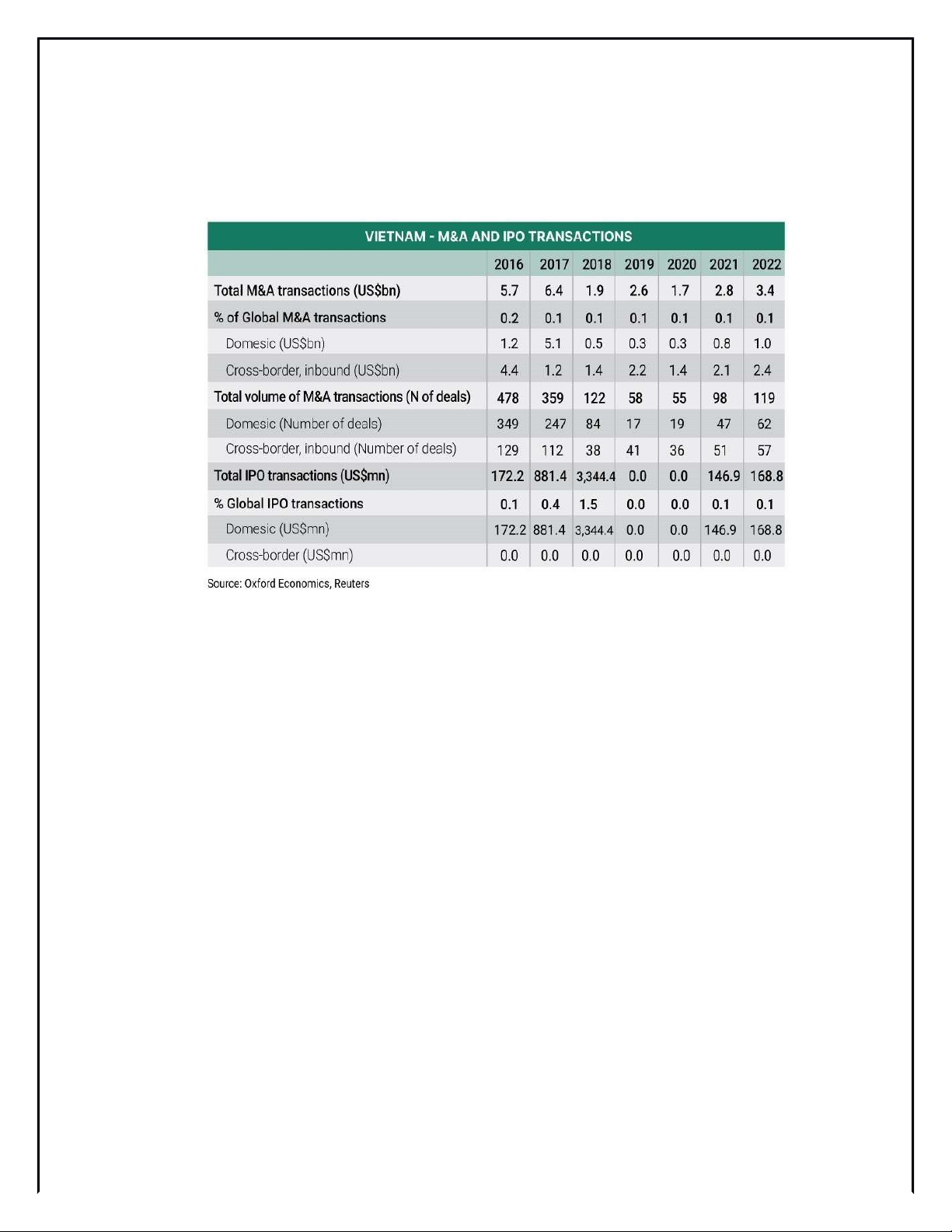

Vietnam recorded 58 M&A deals in 2019 worth $2.6 billion, of which 17 were

domestic and 41 were foreign investors. In 2020, it is expected to reach 55 with a total

transaction of 1.7 billion USD, and the number of cross-border deals continues to

dominate the M&A market in Vietnam with 36 or 65% of total deals. By 2021, mergers

and acquisitions transactions may increase to $2.8 billion and $3.4 billion in 2022, of

lOMoARcPSD|44862240

which the number of deals will increase to 98 and 119 in the period 2021-2022 (Oxford

Economics).

Figure 6: VietNam - M&A and IOP transactions.

Source: Oxford Economics, Reuters

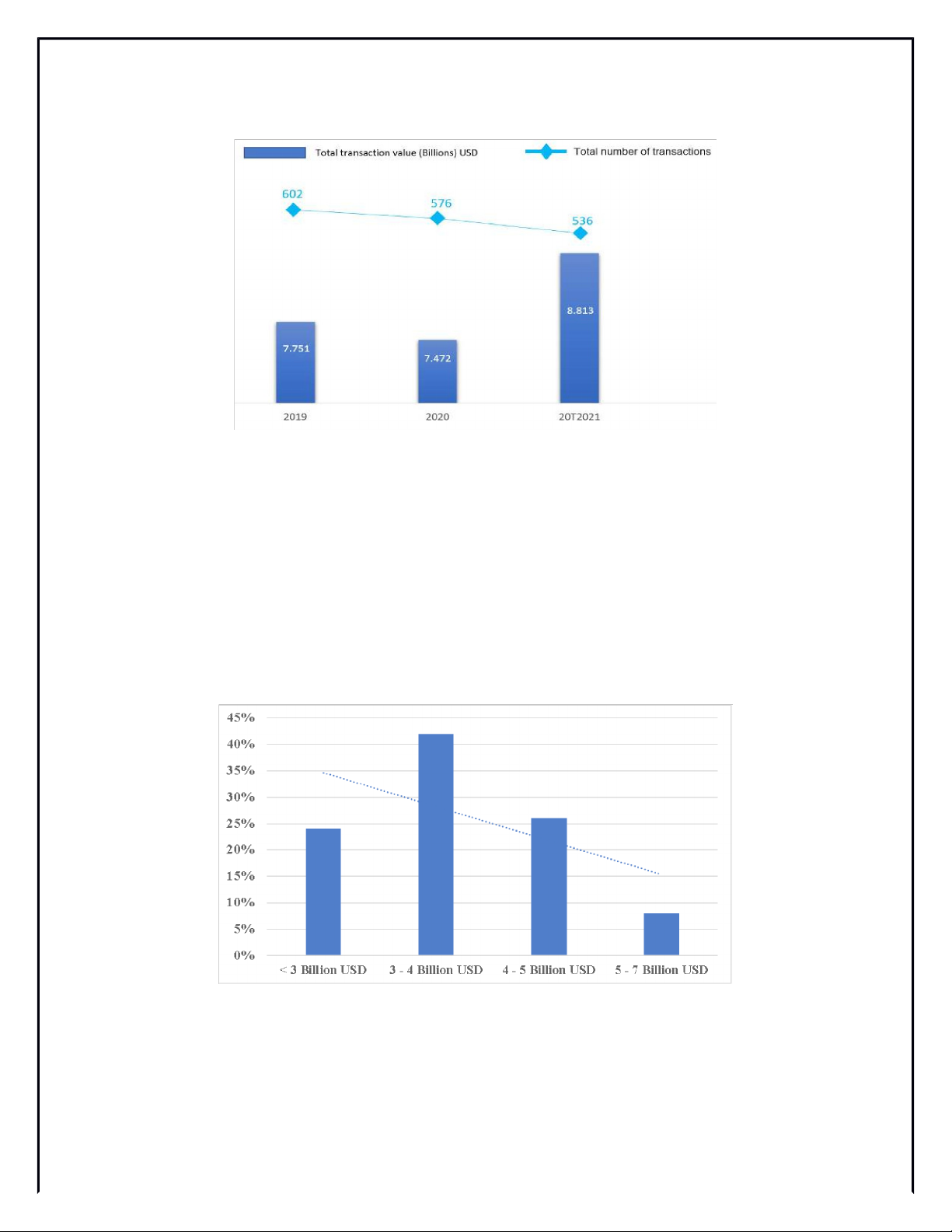

In 2021, despite the negative impact of the COVID-19 pandemic, foreign investment

in Vietnam, including investment flows through M&A, still has growth. According to

data from KPMG Vietnam (a professional service provider in Vietnam), in the first 10

months of 2021, the M&A market has attracted more than $8.8 billion, up 17.9%

compared to 2020 and 13.7% compared to the year before the epidemic, 2019. As of the

end of November 2021, the total newly registered, adjusted investment capital, capital

contribution and share purchase by foreign investors reached 26.46 billion USD, up 0.1%

over the same period in 2020; in which, investment through capital contribution and share

purchase reached nearly 4.4 billion USD.

lOMoARcPSD|44862240

Figure 7: M&A market in Vietnam from 2019 to 2021

Source: KPMG

Along with the development of the economy, the M&A market in Vietnam shows

high stability, even strong growth in 2021. Mergers and Acquisitions Research Institute

CMAC Institute forecasts that the price of M&A value in 2021 in Vietnam will be at 4.5

5 billion USD, the market size will recover equivalent to the average level in the period

2014 - 2017.

Figure 8: Forecast of M&A value in VietNam in 2021

Source: CMAC Investment and Business Research Institute

In the future, M&A will create many Vietnamese corporations with a scale

comparable to large corporations in the region. M&A has become an important part of

lOMoARcPSD|44862240

Vietnam's economic picture. As was shown, M&A transactions also serve to alter the

seller's financial capabilities, and moreover offer up new prospects for the parties

involved. There are deals that generate immediate profits, but there are also deals that

help set the stage for the future. At that time, M&A was seen as an important tool to help

businesses “complete” the missing pieces. In Masan's case, that is the goal of becoming

an “online-offline integrated retail consumer” corporation.

1.2 Issue

The cooperation between Vingroup and Masan is a large-scale M&A transaction and

it is ranked among the highlights of our country in the period from 2019 to now. The

attraction of this deal comes from the novelty of Vingroup's business - Vingroup has

decided to swap all shares in VCM Company - which owns retail chains VinMart,

VinMart+ and VinEco into stock options.

Vingroup at that time was under pressure of cash flow and wanted to free up

economic resources to focus all economic resources on two fields: industry and

technology. Although it is the retailer with the largest number of points of sale in the

Vietnamese market, The break-even point for Vingroup's business operation has yet to be

reached. According to Vingroup's 2019 financial report, the retail segment is the

secondhighest revenue-generating business segment of the group with VND 23,571

billion, just behind real estate transfer. However, this is the second largest loss-making

business in this group with a 9-month loss of 3,461 billion VND, after the manufacturing

segment. Vincommerce is considered by Masan as an important piece to realize its

ambition to become an empire in the field of consumer goods - retail. Owning a large

system like Vinmart will help Masan optimize distribution channels, reduce the ratio of

intermediary costs, and bring great benefits in the long term.

However, entering the retail market will be a big challenge for Masan in the short

term. It is rare for any consumer goods producer to "consider" the retail sector as well.

Manufacturing and retail trade have always been two completely different fields of

activity. According to the annual statistics of the two companies, the pre-tax profit of

lOMoARcPSD|44862240

Masan Consumer reached more than 3,800 billion VND, but the VinCommerce system

lost 5,100 billion VND. Masan's revenue from consumer goods and food is similar to that

from the retail sector, which has recently gotten a boost. The reception of the system of

2,600 supermarkets and stores immediately increased Masan's labor size to over 20,000

people. That is, the size of Masan has almost doubled, and the number of employees has

almost tripled after this merger. In other words, this adoption remains a challenge.

From the above analysis, the author has come up with common problems of the

parties involved. The buyer (Masan) will bear the risk of integration and synergy from the

merger. The buyer will have to work out how to produce future cash flow to cover the

surplus (premium) that might also have to pay to gain control of the seller (Vingroup).

Sell-side shareholders benefit from the (high) valuation of the deal.

1.3 Objectives

Within the research scope of the report, the authors want to give an overview of the

deal between Masan and VinGroup through the successful merger of VinCommerce and

VinEco. Aim to better understand the steps of conducting a complete negotiation and

create more opportunities to hone skills and negotiation techniques not only for large

enterprises but also applicable to situations in everyday life. In addition, new negotiation

methods will transform Vingroup into a world-class corporation in the future. As a third

party, the authors will make reasonable assessments for the deal and at the same time

propose new negotiation methods to overcome difficulties at the time of the old deal. In

order to optimize operational strengths and win-win, to comprehensively focus on core

strengths, including:

Having an overall understanding of the retail sector in the Vietnamese market.

Analysis of Consumer Goods - Retail industry, reasons for negotiation Vingroup

and Masan.

Deeper analysis of the key points in the deal between the two sides.

Provide comments and feedback on the development of two businesses.

Evaluate the level of satisfaction as well as the effectiveness of this deal.

lOMoARcPSD|44862240

II. LITERATURE REVIEW

2.1 BATNA (Best Alternative to Negotiated Agreement)

Fisher, Ury (1991) built deal fails to produce results. In negotiation, BATNA is

considered not only as a backup plan but also as a lever to increase bargaining power

(DTAlamanda; POSaraswati; FSA Prabowo, Muhammad Azhari, 2017). Strong BATNA

in the negotiation improves the

outcome of the negotiators

better than the original bargaining area (Kim & Fragale 2005).

BATNA is a key factor determining the strength of each party in the negotiation

(Bazerman & Neale, 1992). Negotiators with better BATNA will have more bargaining

power and get better negotiating results than the other side (Gerard Beenena & John E.

Barbuto Jr.a, 2014). Although a negotiator's alternatives should in theory be easy to

evaluate, the effort to understand which alternatives represent one's BATNA often goes

uninvested.

To be valuable, options must be realistic and actionable. However, without the

investment of time, options are regularly included in options that will never meet one of

these criteria. When hard negotiators meet soft negotiators, hardline negotiators often

take their place, but at the expense of possibly damaging the long-term relationship

between the parties.

For example: The negotiation between LG Company and Vingroup. LG Electronics

plans to sell its smartphone factories in Brazil and Vietnam to focus on other business

areas and recoup the deficits of these factories in recent years. Vingroup is said to be the

right contractor for this transfer because Vingroup is currently developing and expanding

its technology segment.However, the result of the negotiation was a failure because the

price offered by Vingroup was quite low. LG Company decided to stop negotiating and

not cooperate with Vingroup but choose other potential buyers.

The BATNA concept can be seen in this situation, LG Electronics wants to resell its

smartphone factories at a price that can make up for the deficit that the factory has

the BATN

A

concept,

which

is the bes

t

alternative if the

lOMoARcPSD|44862240

offered, but Vingroup Group proposes a lower price than expected. LG Company, so LG

has offered a better alternative than choosing to find a buyer with a higher price offer, in

line with the price set by LG Company.

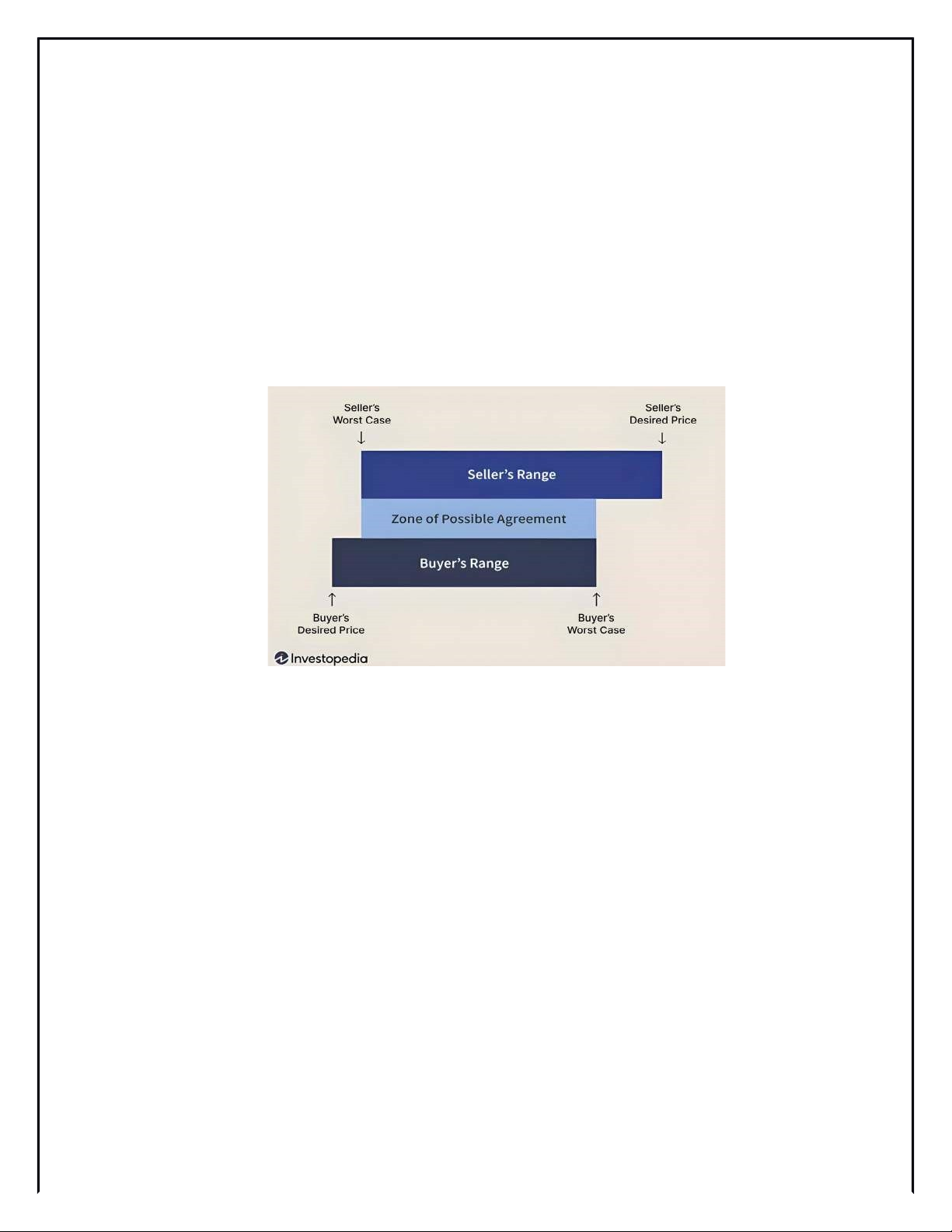

2.2 ZOPA

ZOPA is an area that is built from pre-set cut-off points between the parties,

including an area of agreement that can satisfy both parties (Fisher R, Ury WL, 1991).

Figure 9: ZOPA Method

Source: Financebiz

In a negotiation, whether it includes many possible transactions or just one option,

ZOPA - the area in which both parties can reach a mutually beneficial agreement is a

necessary condition to achieve agreement. Without ZOPA, any agreement would be

unacceptable to at least one party. (Rochelle-Leigh (Shelley) Rosenberg, 2011).

In order to have a workable area of agreement, the negotiating parties need to

understand the needs, values and interests of each other, then the parties need to work

towards a common goal and find an area. a combination containing the ideas of two

parties will then come up with a compromise and the parties reach an agreement in

negotiation. In some negotiations, negotiators may find themselves in a situation where

there is no clear ZOPA due to the overlapping of cut-off points of the two negotiating

parties (Raiffa, 1982; Thompson, Wang, & Gunia, 2010).

lOMoARcPSD|44862240

This leads to several potential outcomes for negotiations such as either party

accepting no-deal negotiation (O'Connor & Arnold, 2001; Thompson, 1998). Or another

outcome is that one of the two negotiators abandons their point of resistance and accepts

a deal worse than their point of resistance. Cohen, Leonardelli, & Thompson, 2014;

Tuncel, Mislin, Kesebir, & Pinkley, 2016)

For example: Company A is intending to sell 52% of its shares at the lowest average

price of VND 46,000/share with the intention of calling for investment in the company's

upcoming project, Company B. willing to buy at the price of 50,000 VND/share with the

aim of expanding the business area of his company.

In this situation, the ZOPA seen here is in the 2,000 dong range. During the

negotiation, any agreed price within this 2000 dong area can satisfy the needs of company

A and company B

2.3 Integrative negotiation

Some types of negotiation have never been used in all negotiation procedures,

although depending on the development and strategy in the negotiation process, many

types of negotiation are needed in one negotiation, so integrated negotiation emerges

(Llamazares and Nieto et al. , 2017).

The integrated negotiation approach produces better results and a more sustainable

winwin (Pruitt et al., 1983; Sebenius, 1992; Lewicki and Saunders, 1999). An integrated

negotiation process is made up of thoughts and opinions as a contributor rather than as a

competitor.(Pruitt et al., 1983). Achieving the best outcome is the goal of integrative

negotiation. To be able to solve the problem and come up with a solution to the

negotiation that both parties can accept, it is necessary to identify the interests and

strategies of the two sides to find common values. (Koning and van Dijk, 2013).

Negotiators never place a high value on how much they will receive as an individual

party. Instead, they focus their efforts on improving overall outcomes through

collaboration between parties. Integrated negotiation tactics are only effective when fair

lOMoARcPSD|44862240

procedures are followed and fair outcomes are achieved. This often means that

individuals approach the negotiating table with a mindset of partners and collaborators

rather than competitors (Getsmarter, Blog, 2020).

For example: Company A and company B are both in the negotiation phase to

acquire two projects C and D that are attractive and influential in the business market.

After the negotiation, company B will hold 70% of the shares, company A holds 30%.

However, company A will have more time and effort to develop the rest of the company.

As for company B, it continues to dominate the business market with projects C and D.

Besides, company A earns a large profit after the transfer, while company B reaps profits

from the transfer continue to do business with projects C and D.

lOMoARcPSD|44862240

III. NEGOTIATION ANALYSIS:

3.1 Company background

3.1.1 Masan group

Established in 2013, Masan Consumer Holdings is a member company of Masan

Group established in 2013, operating in the field of consumer goods including foods and

beverages with many famous and prestigious brands. on the market such as Chinsu, Nam

Ngu, Vinacafe, Cholimex, etc.

Masan currently has more than 20 years of experience in the field of business and

specializes in manufacturing consumer goods in the Vietnamese market. With the goal of

leading in the consumer goods business, Masan has continuously developed and

expanded its business model over the years.

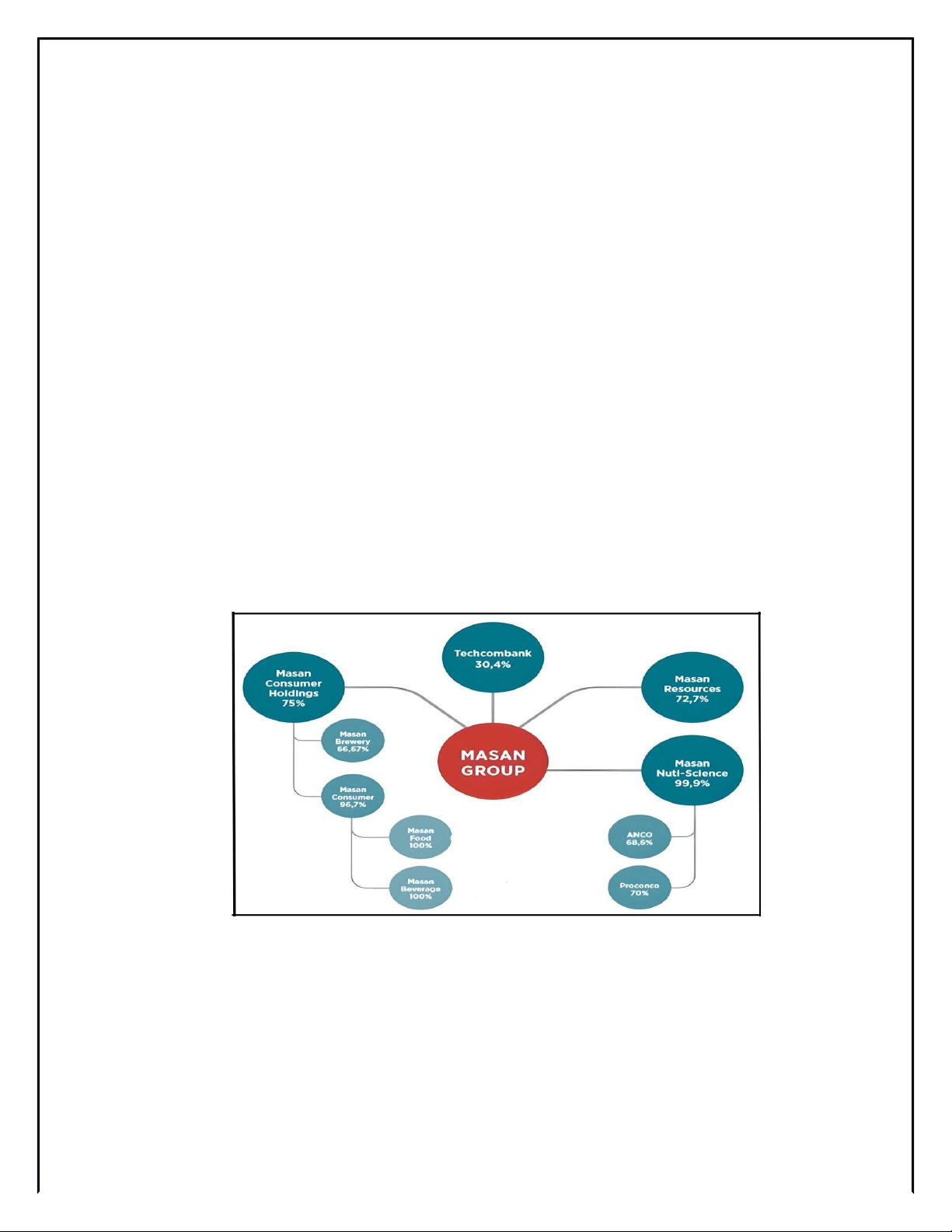

Structure of Masan Corporation:

Figure 10: Structure of Masan Group

Source: Masan group

Field of activity: Currently, Masan operates in the following fields:

Retail segment: The CrownX (WinCommerce, WinEco) and Meatdeli

Food and Beverage: Masan Consumer Holdings

lOMoARcPSD|44862240

Consumer foods: Saigon Nutri food, 3 Viet Food, Cholimex, and more

Financial activities: EVO card with eKYC (electronic customer identification),

Techcombank

High-Tech Materials: Masan High-Tech Material

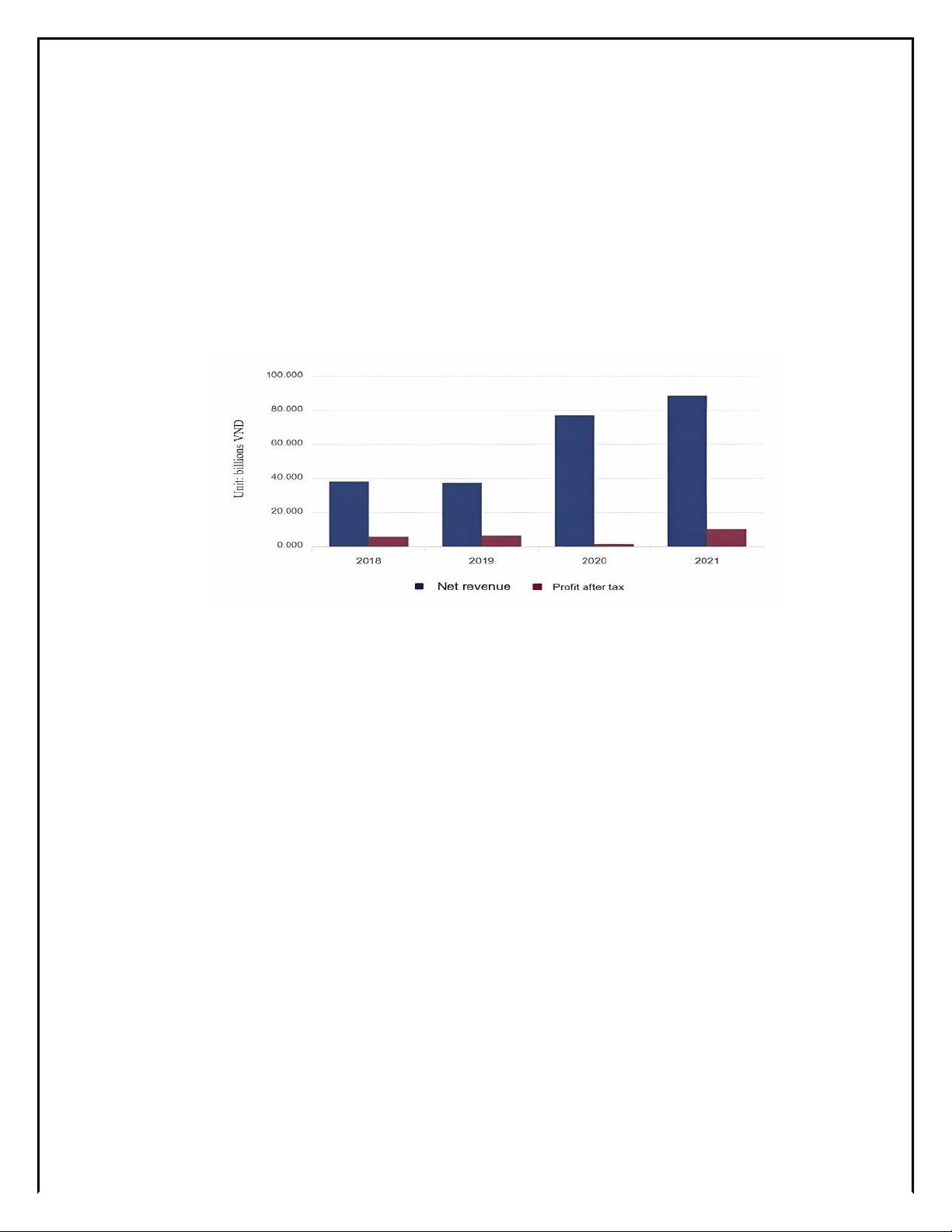

Revenue in recent years:

Figure 11: Masan's Revenue from 2018 to 2021 ( Billion VND)

Source: Masan report 2022

- Therefore, Masan invests not only in the best operating systems but also in the

development of new products. Besides, Masan is also constantly building a brand

by developing or acquiring strong brands that are trusted by consumers, boosting

productivity to meet consumers' needs with factories with high-quality products.

world-class scale. In particular, Masan pays great attention to training and high

quality human resources to meet the needs of businesses as well as customers.

- According to Masan's 2022 report, the company's annual profit has increased

significantly. It can be seen that, from 2018, Masan's consolidated net revenue is

about VND 38,200 billion, with profit after tax of about VND 5,690 billion. In

2020, the company fulfilled its financial target, more than doubling or expanding

107.0% compared to 37,365 billion VND in 2019.

Bấm Tải xuống để xem toàn bộ.