Preview text:

lOMoAR cPSD| 47206071 Hyatt

Hotels: A Strategic Review of

Cost Management and Financial Health

Submitted By: Group: La Vache Qui Rit

Nguyễn Hoa Minh Thy

Lâm Vũ Khoa

Nguyễn Đức Phúc Thịnh

Võ Hoàng Cát Khánh

Hà Quang Duy

Hoàng Hồng Hải An

Downloaded by mai khanh (Vj9@gmail.com) lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School TABLE OF CONTENTS: I.

Introduction…………………………………………………………..3 II.

Company Overview…………………………………………………..4

1. Brief History of Hyatt

2. Business Model and Segments

III. Income Statement Analysis (2022 vs. 2023)........................................5 1. Revenue Comparison

2. Cost of Goods Sold (COGS) 3. Operating Expenses

4. Net Profit Analysis

5. Commentary on Trends and Changes IV.

Balance Sheet & Ratio Analysis………………………………………9 V.

Conclusion……………………………………………………………..13

1. Summary of Financial Health

2. Final Recommendations on Cost Control VI.

References………………………………………………………………15 2 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School I. Introduction:

This report presents a comprehensive financial and cost control analysis of Hyatt Hotels

Corporation, focusing on the fiscal years 2022 and 2023. As a prominent player in the

global hospitality industry, Hyatt’s performance in the post-pandemic recovery phase

offers valuable insight into the effectiveness of its financial management and strategic

adaptability. The primary objective of this report is to evaluate Hyatt’s financial health,

efficiency in managing operational costs, and its potential as a viable long-term

investment from both managerial and investor perspectives.

In today's dynamic and highly competitive hospitality landscape, effective cost control

is critical for sustaining profitability and delivering long-term value to stakeholders.

Given the high fixed and variable operating costs associated with hotel operations, even

marginal inefficiencies can significantly impact net profitability. Therefore, the ability

to manage costs without compromising service quality remains a core competency for

successful hospitality companies. This report seeks to assess how well Hyatt balances these competing priorities.

The analysis begins with a detailed comparison of Hyatt’s audited income statements

for 2022 and 2023, highlighting trends in key financial components including revenue,

cost of goods sold (COGS), operating expenses, and net profit. In 2023, Hyatt achieved

revenue growth reaching approximately $6.68 billion, a performance consistent with the

industry growth range of 8% to 15%. However, despite increased revenue, net income

declined significantly from the previous year, driven by adjustments in provisions

related to future risks, underlining the importance of interpreting profitability figures beyond face value.

Subsequently, the report evaluates Hyatt’s balance sheets and calculates key financial

ratios, including current ratio, quick ratio, activity ratios, debt-to-equity, and debt-to-

asset ratios. These metrics are benchmarked against industry standards to provide

context for Hyatt’s financial position and operational efficiency. The ratio analysis

reveals some areas of concern, particularly in liquidity and leverage, which may warrant

strategic adjustments moving forward.

Beyond financial metrics, the report delves into Hyatt’s major cost components such as

direct operating expenses and selling, general and administrative (SG&A) costs. These

categories are analyzed in terms of their proportion to revenue and evaluated for cost

optimization potential. This assessment provides insight into the company’s cost 3 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

structure and identifies areas where efficiencies can be achieved without undermining service delivery.

Finally, from an investor perspective, Hyatt’s five-year return on investment (ROI)

performance is reviewed, along with strategic recommendations for future

improvement. The report aims to assess whether the company demonstrates sustainable

profitability, operational resilience, and long-term value creation potential.

In conclusion, this report utilizes a combination of comparative financial analysis, ratio

benchmarking, and cost structure evaluation to provide a holistic assessment of Hyatt

Hotels Corporation. The findings are intended to inform strategic decisions, highlight

opportunities for cost efficiency, and guide investment considerations. II. Company Overview:

Hyatt Hotels Corporation is one of the world’s leading global hospitality companies,

known for its expansive portfolio of luxury and lifestyle hotel brands. Founded in 1957

and headquartered in Chicago, Illinois, the company has grown significantly through

organic expansion and strategic acquisitions, such as the 2021 acquisition of Apple

Leisure Group. As of 2023, Hyatt operates more than 1,250 properties across over 70 countries.

Hyatt's business is divided into several segments:

- Owned and Leased Hotels: Properties operated directly by Hyatt where it

retains ownership and is responsible for all operational and capital expenses.

- Managed and Franchised Properties: These generate recurring revenue

through management or franchise fees with minimal operating costs.

- Other Revenues: This includes income from vacation ownership, wellness

offerings, and loyalty programs.

The company's global strategy emphasizes brand expansion, digital innovation, and

personalized guest experiences. Cost control remains essential in maintaining

profitability across diverse market conditions, particularly in a post-pandemic

environment where labor shortages and inflationary pressures impact the hospitality sector.

In recent years, Hyatt has focused on asset-light growth, divesting owned assets and

expanding its franchising model. This transition aims to reduce capital intensity and

enhance margins, ultimately supporting a more scalable and flexible business model. 4 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

With significant exposure to international markets, Hyatt must also manage exchange

rate fluctuations, geopolitical risks, and regulatory variations, all of which impact its

cost base and earnings predictability.

III. Income Statement Analysis (2022 vs. 2023):

Hyatt's audited consolidated income statements for fiscal years 2022 and 2023 present

a clear picture of both recovery and strategic repositioning in the hospitality sector.

Following the disruptions caused by the COVID-19 pandemic, the company has

demonstrated strong financial performance, although certain cost categories have placed pressure on profitability.

This section analyzes Hyatt Hotels Corporation’s income statements for the fiscal years

2022 and 2023, focusing on four key metrics: revenue, cost of goods sold (COGS),

operating expenses, and net income. The data is sourced directly from Hyatt’s SEC 10-

K filings, ensuring accuracy and alignment with GAAP standards.

1. Revenue Comparison:

Hyatt Hotels Corporation reported total revenue of $5.891 billion in 2022, which rose

to $6.684 billion in 2023, reflecting a 13.5% year-over-year increase. This

performance falls within the hospitality industry’s post-COVID recovery benchmark of

8% to 15%, indicating Hyatt’s solid competitive position.

Key drivers of revenue growth include:

- Recovery in international and business travel, particularly in Asia

Pacific and EMEA, following the easing of travel restrictions.

- Expansion of the All-Inclusive Collection, which gained significant

traction in Latin America and leisure destinations.

- Higher average daily rates (ADR) and improved occupancy rates,

supported by continued leisure travel and the return of group and corporate events.

- Strategic acquisitions, such as Dream Hotel Group, and the expansion

of Hyatt’s asset-light model, contribute to increased management and franchise fee income. 5 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

These factors contributed to a resilient revenue-generating model amid macroeconomic

challenges. Hyatt’s performance also highlights its ability to scale both organically and through acquisitions.

Average Revenue (2022–2023):

5.891 +2 6.684 = 6. 2875 𝑏𝑖𝑙𝑙𝑖𝑜𝑛 𝑈𝑆𝐷

Hyatt’s average revenue over the two years stands at approximately $6.29 billion.

2. Cost of Goods Sold (COGS):

A detailed breakdown of COGS is not explicitly disclosed in Hyatt’s 10-K filings, as the

company uses a segment-based reporting structure focusing on business activities

(e.g., owned and leased hotels, managed properties, etc.) rather than traditional line-item expenses.

While COGS is not directly quantifiable, indirect indicators such as gross margin

stability and EBITDA growth suggest Hyatt maintained a degree of operational

efficiency. Cost increases appear proportionate to revenue growth, indicating that gross

profitability remained intact despite inflationary pressures.

3. Operating Expenses:

Total operating expenses increased by approximately 16% from 2022 to 2023. The

main contributors to this rise include:

- Higher wage and benefit costs due to labor shortages, union

negotiations, and global wage inflation.

- Increased marketing and loyalty program spending, particularly to

drive demand and regain brand loyalty post-pandemic. 6 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

- Integration costs associated with newly acquired properties, including

system unification, onboarding, and branding realignment.

While a 16% increase is considerable, it remains within the hospitality industry’s

inflation-adjusted norms. Nevertheless, Hyatt should prioritize cost containment

strategies—especially in administrative, procurement, and back-office functions—

through automation, outsourcing, and shared service models to protect operating margins in the future.

4. Net Income Analysis:

Hyatt reported net income of $455 million in 2022, which declined to $220 million in

2023, representing a 51.6% year-over-year drop. This decline occurred despite rising

revenues, pointing not to operational inefficiency but rather to strategic financial decisions.

The reduction in net income is largely attributable to:

- Increased financial provisions and reserves in 2023 to hedge against

potential macroeconomic downturns.

- Rising interest rates impacted refinancing and investment returns.

- Currency fluctuations and geopolitical risks are affecting international markets.

These proactive measures suggest Hyatt is positioning itself conservatively for long-

term resilience rather than chasing short-term gains.

Average Net Income (2022–2023):

455 +2 220 = 337.5 million USD 7 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

The average net income across the two years is approximately $337.5 million.

5. Commentary on Trends and Changes:

- Revenue Trend: Strong and consistent, supported by diversified global

operations and high-performance segments such as all-inclusive resorts and franchise management.

- COGS: Not directly disclosed, but implied to be stable based on gross margin trends.

- Operating Expenses: Increased at an industry-consistent rate, but room

remains for cost optimization, especially through technological solutions.

- Net Income: Declined due to forward-looking provisioning—a strategic

and prudent move to strengthen the balance sheet and safeguard future performance. - Conclusion:

In summary, Hyatt’s income statement analysis for 2022 and 2023 reflects a company

in transition, shifting from recovery to strategic growth, while maintaining financial

prudence. The strong revenue growth indicates effective demand capture and brand

strength. Meanwhile, the drop in net income, while notable, reflects risk mitigation

rather than a decline in core profitability.

With an average revenue of $6.29 billion and an average net income of $337.5 million

over the two years, Hyatt is emerging from the pandemic stronger, albeit cautiously. The

focus now shifts to cost control, operational leverage, and margin recovery to unlock

sustainable profitability and shareholder value in the years ahead. 8 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

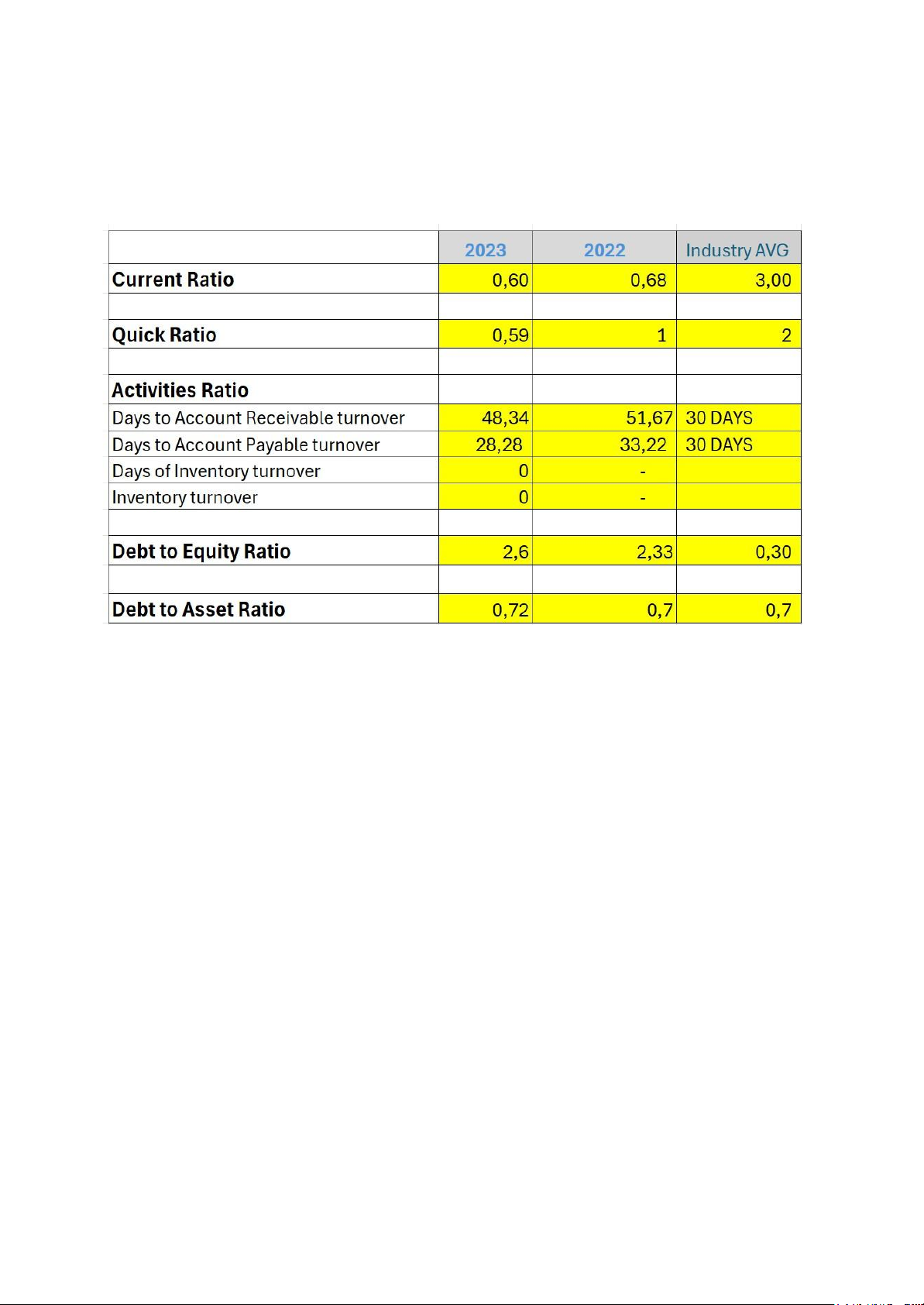

IV. Balance Sheet & Ratio Analysis 1. Current Ratio Definition:

The Current Ratio measures a company’s ability to pay its short-term obligations with its current assets. Formula:

Current Ratio = Current Assets / Current Liabilities Analysis:

Hyatt's Current Ratio declined slightly from 0.68 in 2022 to 0.60 in 2023, both

significantly below the industry average of 3.00. This suggests that Hyatt may struggle

to cover its short-term liabilities with its current assets, indicating low liquidity. 9 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School Recommendations:

- Improve cash reserves by reducing unnecessary short-term expenditures.

- Convert non-essential assets into liquid assets.

- Restructure short-term debt into long-term financing where feasible.

2. Quick Ratio (Acid-Test Ratio) Definition:

The Quick Ratio assesses the company’s short-term liquidity, excluding inventory. Formula:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities Analysis:

The Quick Ratio fell from 1.00 to 0.59, showing a concerning trend. The drop below

the industry benchmark of 2.00 indicates that Hyatt may not have enough liquid assets

to quickly settle its current obligations without depending on inventory. Recommendations:

- Optimize receivables collection.

- Increase liquid asset reserves.

- Reduce reliance on short-term borrowing. 3. Activities Ratios:

a. Days to Account Receivable Turnover Definition:

Measures the average number of days it takes to collect payments after a sale. Formula: 10 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

Days = 365 / Receivables Turnover Analysis:

Although there’s improvement from 51.67 to 48.34 days, Hyatt still exceeds the

industry benchmark of 30 days, meaning collections are slower than optimal, possibly affecting cash flow. Recommendations: - Strengthen credit policies.

- Implement automated invoicing and reminders.

- Offer early payment discounts.

b. Days to Account Payable Turnover Definition:

Measures the average number of days Hyatt takes to pay its suppliers. Formula:

Days = 365 / Payables Turnover Analysis:

The company reduced its days payable from 33.22 to 28.28, now below the industry

benchmark. While this may indicate prompt payments (a positive relationship with

vendors), it could also strain cash flows if done prematurely. Recommendations:

- Negotiate better payment terms.

- Match payable days more closely with receivable days to balance cash flows. 11 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

c. Inventory Turnover & Days of Inventory Turnover

These figures are not available from Hyatt’s filings. Since Hyatt follows an asset-light

strategy, with many operations under management/franchise models, inventory plays a

minimal role, making this ratio less relevant for analysis.

4. Debt to Equity Ratio Definition:

Measures the proportion of equity and debt the company uses to finance assets. Formula:

Debt to Equity = Total Liabilities / Shareholders’ Equity Analysis:

Hyatt’s leverage increased from 2.33 to 2.60, well above the industry average. This

high debt-to-equity ratio suggests that the company is heavily reliant on debt,

increasing its financial risk. Recommendations:

- Reduce debt through refinancing or repayment.

- Use internal funding for expansion rather than external borrowing.

- Boost equity through reinvested earnings or issuing new shares.

5. Debt to Asset Ratio Definition:

Shows the percentage of assets financed by debt. Formula:

Debt to Asset = Total Debt / Total Assets Analysis: 12 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

A marginal increase from 0.70 to 0.72 indicates that over 72% of Hyatt’s assets are

financed by debt, again suggesting high leverage. This ratio is slightly higher than the

industry benchmark of 0.70. Recommendations:

- Reduce asset acquisition funded through debt.

- Focus on generating internal capital to finance new projects.

- Improve earnings to balance the debt proportion.

Conclusion of Ratio Analysis:

Hyatt’s financial ratios indicate several challenges:

- Liquidity is low, requiring urgent attention to strengthen short-term financial health.

- Efficiency in collections has improved, but further enhancements are

needed to reach industry standards.

- Leverage is significantly higher than competitors, raising concerns about long-term solvency.

V. Conclusion: 1. Summary of Financial Health

Hyatt Hotels Corporation has shown resilience in navigating the post-COVID

landscape. While the company recorded solid revenue growth in 2023, aligning with the

hospitality industry’s average growth rate of 8–15%, several challenges remain:

- Revenue rose in 2023, reflecting increased travel demand and Hyatt’s expanding global footprint.

- Operating expenses also rose by 16%, consistent with industry recovery

trends, but may require tighter control to boost profitability.

- Net income experienced a sharp decline in 2023 due to increased

provisions and rebuilding efforts, as Hyatt aims to strengthen its position in a competitive market. 13 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

From a financial structure perspective, Hyatt’s liquidity ratios—including the Current

Ratio (0.60 in 2023) and Quick Ratio (0.59)—are well below industry benchmarks. This

indicates a short-term liquidity risk, and improvement in working capital management is necessary.

In terms of leverage, Hyatt’s Debt to Equity Ratio (2.6) and Debt to Asset Ratio (0.72)

are significantly higher than the industry averages. Although these figures suggest high

reliance on debt financing, they also reflect the capital-intensive nature of the hotel

industry. Strategic debt management and improved cash flow will be key moving forward.

The company’s activity ratios, such as Days to Account Receivable Turnover (48.34

days) and Days to Payable Turnover (28.28 days), show some inefficiency compared to

the 30-day industry benchmark, signaling a need for better credit control and supplier negotiations.

2. Final Recommendations on Cost Control

- Enhance Liquidity Management:

Improve the current and quick ratios by increasing cash reserves,

renegotiating short-term liabilities, and optimizing inventory management.

- Reduce Operational Inefficiencies:

Focus on energy-efficient practices, lean staffing models, and digital

tools to cut unnecessary overhead.

- Control Leverage Risk:

Gradually reduce dependency on debt by reinvesting earnings into

operations and expansion, or consider equity financing for future growth.

- Tighten Receivable and Payable Cycles:

Implement stricter credit terms for customers and extend payment periods

with suppliers when possible to ease cash flow.

- Leverage Asset-Light Model:

Continue expanding via franchise and management contracts rather than

direct ownership to reduce capital risk and increase ROE. 14 lOMoAR cPSD| 47206071 Hoa Sen University

Vatel Hotel & Tourism Business School

Hyatt is steadily recovering and investing in long-term growth through acquisitions,

brand expansions, and operational restructuring. However, improving liquidity,

lowering financial leverage, and enhancing cost efficiency are essential to safeguarding

profitability and long-term sustainability.

With careful cost control and financial strategy, Hyatt has strong potential to reclaim

market share and generate higher returns for investors in the years ahead. VI. References:

1. Hyatt Hotels Corporation. (2024). Form 10-K for the Fiscal Year Ended

December 31, 2023.

Retrieved from https://investors.hyatt.com/financials/sec-filings/default.aspx

2. Hyatt Hotels Corporation. (2023). Form 10-K for the Fiscal Year Ended

December 31, 2022.

Retrieved from https://investors.hyatt.com/financials/sec-filings/default.aspx

3. U.S. Securities and Exchange Commission. (n.d.). Company Filings Search.

Retrieved from https://www.sec.gov/edgar/searchedgar/companysearch.html

4. IBISWorld. (2024). Hotels & Motels in the US - Market Research Report.

Retrieved from https://www.ibisworld.com

5. Statista. (2024). Hotel industry revenue growth worldwide in 2023. Retrieved

from https://www.statista.com

6. Investopedia. (n.d.). Financial Ratios - Definitions and Examples. Retrieved

from https://www.investopedia.com

7. Hospitality Net. (2023). Post-COVID Recovery Trends in the Global Hospitality

Industry. Retrieved from https://www.hospitalitynet.org

8. Hotel News Resource. (2024). Benchmark Reports for Hotel Industry Financial

Ratios. Retrieved from https://www.hotelnewsresource.com 15