Preview text:

Question 1:

Henry, a manufacturing company, purchases a property of $1,000,000 on 1 January 2011 for its

investment potential. The land element of the cost is believed to be $400,000 and the building element

is expected to have a useful life of 50 years. At 31 December 2011, the local property market suggests

that the fair value of the property has risen to $1,100,000. Show how the property would be presented

in the financial statements as at 31 December 2011 if Henry adopts: a. The cost model b. Fair value model Solution: a. Cost model:

Depreciation on building $600,000 / 50 years = $12,000

Investment property $1,000,000 - $12,000 = $988,000 b. Fair value model

Investment property (at fair value) $1,100,000

Gain on investment property $100,000 (i.e $1,100,000 - $1,000,000)

No depreciation is to be charged Question 2:

An entity purchased an investment property on 1 January 2004, for a cost of $400,000. The property

has a useful life of 50 years, with no residual value, and at 31 December 2006 had a fair value of

$560,000. On 1 January 2007 the property was sold for net disposal proceeds of $540,000

Required: Calculate the profit or loss for the end of the year 2007 concerning the disposal of the property Solution:

The amount that should be recognised as part of the profit or loss for the year ended 31 December

2007 regarding the disposal of the property is shown below: a/The cost model

Carrying amount: 400,000 – (400,000 / 50 x 3) = 376,000 Net proceeds = 540,000 Profit on sale = 164,000 b/ The fair value model Fair value = 560,000 Net proceeds = 540,000 Loss on sale = 20,000 Question 3:

Which of the following should be treated as an investment property according to IAS 40?

(1) An entity has a factory which due to a decline in activity is no longer required and is now being held for sale.

This is a property held for sale in the ordinary course of business and is not an investment property.

(2) Farming land is purchased for its investment potential. Planning permission has not

been obtained for building constructions of any kind.

This is land held for long-term capital appreciation and therefore is an investment property. The

lack of planning permission is not relevant as values can appreciate in the absence of permission to build.

(3) A new office building used by an insurance entity as its head office which was

purchased specifically in the centre of a major city in order to exploit its capital gains potential.

This building generates cash flows as part of a larger organisation. This is therefore an owner-

occupied property dealt with under IAS 16 rather than IAS 40. Question 4:

Carter Property Ltd acquired an investment property on 1 July 20x6 at a cost of $1,400,000

and sold it for $1,860,000 on 31 December 20x8. The fair value of the property was $1,562,000 on 30 Ju

ne 20x7 and $1,633,000 on 30 June 20x8 Show the general journalentry

for this property on 1 July 20x6, 30 June 20x7,30 June 20x8 and 31 December 20x8 if the fair value mod el is used Solution 1/7/20x6 – 30/6/20x7

Gain on revaluation = FV – cost = 1,562,000 – 1,400,000 = 162,000 30/6/20x7 – 30/6/20x8

Gain on revaluation = FV – cost = 1,633,000 – 1,562,000 = 71,000 30/6/20x8 - 31/12/20x8

Gain on sale = 1,860,000 - $1,633,000 = $227,000 Journal entries: 01/7/20x6 Dr Investment Property 1,400,000 Cr Cash 1,400,000 30/6/20x7 Dr Investment Property 162,000 Cr Gain on revaluation 162,000 30/6/20x8 Dr Investment Property 71,000 Cr Gain on revaluation 71,000 31/8/20x8 Dr Cash 1,860,000 Cr Investment Property 1,633,000 Cr Gain on sale 227,000 Question 5:

Kapital Co owns a building which it has been using as a head office. In order to reduce costs, on 30 June

20X9 it moved its head office functions to one of its production centres and is now letting out its head

office. Company policy is to use the fair value model for investment property.

the building had an original cost on 1 Jan 20X0 of $250,000 and was being depreciated over 50 years. At

31 June 20X9 its Fair value was judged to be $350,000. Until to end of 20x9, its fair value was $380,000

How will this appear in the financial statement of Kapital Co at 31 Dec 20X9? Solution: PPE IP Cost = $250,000 1/1/20x0 – 30/6/X9

Depreciation expense = 250,000/50*9.5 = 47,500

Carrying amount = 250,000 – 47,500 = 202,500 31/6/20x9

Revaluation surplus = 350,000 – 202,500 = 147,500 31/12/20x9

Gain on revaluation = 380,000 – 350,000 = 30,000 Question 6:

Valiant Ltd acquired an investment property (buildings) for cash on 1 July 20x6 at a cost of

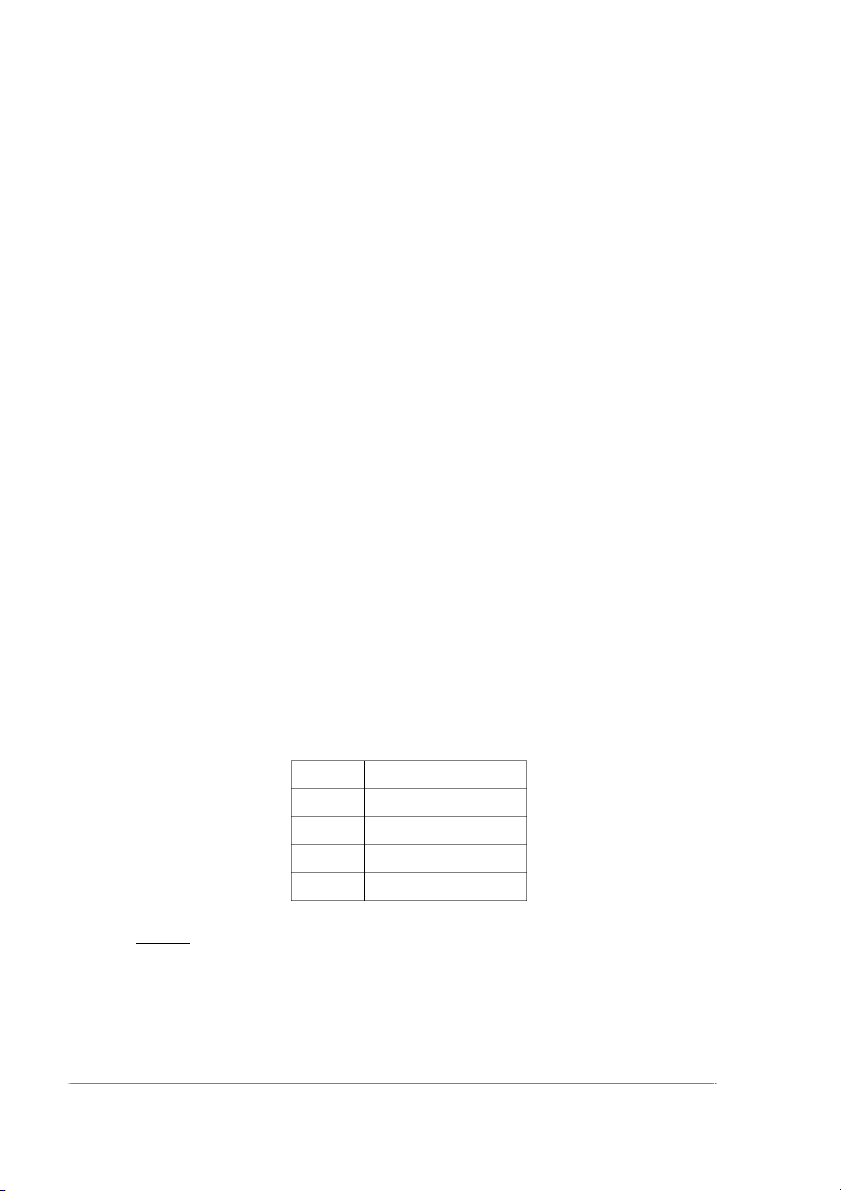

$1.6 million. The property was valued on 30 June of each year that it was held, with the following results: Year Fair value on 30 June 20x7 $1,800,000 20x8 1,700,000 20x9 2,000,000 20x10 2,500,000

The property was sold on 30 June 20x11 for $2.6 million. Required:

1. If the fair value model is chosen, prepares general journal entries from 1 July 20x6 to 30 June 20x11.

If the cost model is chosen, prepares general journal entries from 1 July 20x6 to 30 June 20x11. It is

assumed that recoverable amount and fair value are the same, and depreciation charged in each year is 10% of cost Question 7

1. The building owned by ABC is leased to other entities under an operating contract as an office

2. The building is leased by ABC under a financial contract, and then leased to other units under an

operating contract as an office

3. The resort is owned by ABC, specializing in room rental and providing accompanying resort travel

services. The accompanying activities account for a significant part of the resort's activities

4. The apartment complex is owned by ABC, specializing in renting to households as accommodation (in

the form of an operating contract). Maintenance, cleaning and security services are included. The

attached services account for an insignificant part in the operation of the apartment building

5. The land in the suburban area is owned by ABC. The company's management estimates that about 5

years later, when the city develops and expands, land in the suburbs will increase in price and the

company will sell this land for a profit.

6. The complex building is owned by ABC, an insignificant part is used as a store to distribute ABC's

products, most of the rest is leased to other companies as stores (in the form of operating leases), The

above 2 parts cannot be separated