Preview text:

lOMoAR cPSD| 61431571

THE IMPACT OF BALANCE OF PAYMENTS ON

ECONOMIC GROWTH IN VIETNAM Abstract

The study aims to evaluate the role of exports in increasing resources for Vietnam's economic

growth. We used …. (sử dụng chỉ số gì). Our research also used the Balance of Payments

Constrained Growth Model to assess the influence of Balance of Payment on the Vietnam economy

with independent and dependent variables. …. independent variables are representing for …..

The results show that export growth has had a positive impact on the formation and attraction

of resources for economic growth in Vietnam in recent years. Export growth not only helps increase

productivity by promoting economies of scale, but also contributes to creating more jobs and

stimulating investment, increasing capital accumulation, thereby promoting economic growth. 1. Introduction

After 37 years of economic reform since 1986, Vietnam has developed steadily, from a poor

country to become the world's leading exporter of agricultural and aquatic products, entering the

middle-income threshold and increasingly deep integration with the world economy. Vietnam

joined ASEAN in 1995; participated in the ASEAN free trade area (AFTA) in 1996; signed the

Vietnam - United States bilateral trade agreement in 2000, and many other agreements to promote

bilateral and multilateral trade and investment relations. Especially in 2007, Vietnam officially

became the 150th member of the World Trade Organization (WTO), Vietnam's macroeconomy

continued to improve and is relatively stable, the major balances of the economy continued to

improve. According to data from the World Bank (WB), in 2019, Vietnam's GDP per capita was

3,425.09 USD, then increased to 3,526.27 USD in 2020 and reached 3,694.02 USD in 2021.

General economy is basically stabilized and actively improved, typically, Vietnam's Export of

goods to the world has grown strongly in both value and rate. These achievements, especially in

export, are reflected in the Balance of Payment.

The Balance of Payment (BoP) is an important macroeconomic indicator that reflects the

overall international economic picture of a country. According to Article 3, Decree 16/2014/NDCP

dated 3/3/2014 of the Government on the management of the BoP of Vietnam, the BoP of Vietnam

is a statistical report summarizing transactions between residents and non-residents for a certain

period of time. The Balance of Payment shows the "health" of each country, helping to raise that

country's position in the world. Through in-depth analysis of one component in the BoP (Exports),

we can see the country's export status, which also reflects whether the country's macroeconomic

stability or unstable, from that helps policymakers make more flexible and appropriate policy decisions for the country.

Vietnam’s balance of payments from 2013 to present has been in almost continuous surplus,

especially in 2018 the balance of payments had a double surplus in both the current balance and

the capital and financial balance. These results are due to the Government's efforts in stabilizing

the macroeconomy, maintaining growth at a reasonable management, associated with innovating

the growth model and restructuring the economy, improving the efficiency and competitiveness lOMoAR cPSD| 61431571

of the economy... Besides, the balance has improved thanks to the positive progress of the

balance. Trade goes hand in hand with maintaining a surplus in the capital and financial balance,

Vietnam's balance of payments has been restored and strengthened significantly, with an

increasingly large surplus, helping Vietnam's foreign currency reserves continuously increased

sharply, reaching more than 35 billion USD in 2014 and by October 2019, it had reached 73

billion USD (equivalent to 14 weeks of imports).

In terms of export, Vietnam's export of goods to the world has grown strongly in both value

and rate. In the period 2013-2022, Vietnam's export turnover continuously increased. In 2022,

Vietnam's total export turnover will reach 371.85 billion USD, an increase of 10.6% compared to

2021. In terms of growth rate, export growth in the period 2013-2022 will average 12.3%/year. In

the period 2013-2017, export growth decreased compared to the previous period. According to the

General Statistics Office, export growth increased during this period of decline because industrial

production encountered difficulties due to the impact of the financial crisis and public debt crisis

in Europe. In 2019 and 2021, due to the great impact of the Covid-19 pandemic, Vietnam's export

growth decreased compared to previous years. However, by 2021, Vietnam's export growth began

to recover, reaching 19.5%. According to the General Statistics Office, Vietnam's exports in 2022

show signs of recovery thanks to the fact that Vietnamese businesses have well implemented the

goal of both fighting the epidemic and conducting production and business activities. Along with

that, consumer demand increased again in export markets, helping to increase Vietnam's export

turnover compared to the previous year.

Although the association between the growth of the economy and export has always been a

point of attention for many studies over the past decades, the literature on factors that determine

the role of exports in increasing resources for Vietnam's economic growth in Vietnam is still

limited. Moreover, there have been many studies related to a country's Balance of Payments, but

very few in-depth studies on export. Therefore, in this study we focus on analyzing and clearly

showing the effects of the balance of payments in general and of exports in particular on the

economy. This study is, therefore, an endeavor to address these caveats and gaps in the mentioned existing body of knowledge.

Our study is motivated by the reason that arises from the emerging nature, the need for deeper

understanding and the lack of updated research on Vietnam's export situation. In fact, Vietnam

Export has been developing with a stable socio-political environment, favorable geographical

location... but also contains many challenges from exchange rate risks, trade agreements and the

world's political and economic situation. Besides, our motivation comes from the urgency and

potential positive impact of research on export and macroeconomic stakeholders. Researching the

roles and impacts of imports and exports on the economy will help policymakers understand and

appropriately adjust policies, avoiding difficulties brought to the economy.

This study focuses on the Vietnam export sector in recent years. The paper includes five

sections. The first section is the introduction part. Other parts are the background of literature,

methodology, selected data, research variables, research hypotheses, research models, empirical results, and conclusions.

Through our study, it can be seen that exports are considered a positive factor in forming and

attracting resources for the economy, improving people's living standards and bringing Vietnam to

join the ranks of other countries that have average income. lOMoAR cPSD| 61431571 2. Literature Review

Export is one of the important sectors of global trade. It contributes to many economic

achievements and creates different values. Export has become an important element for enhancing

the competitiveness of a country and the economy. Many researchers have shown the linkages

between the issues of logistics and the economy by qualitative and quantitative results. 2.1.

Economic Growth Concept

Economic growth is a core issue of economic science. According to Samuelson and Nordhaus

(1985), economic growth is the expansion of a country's gross domestic product (GDP) or potential

output. In other words, economic growth occurs when a country's production possibilities frontier

(PPF) shifts outward. Thus, economic growth is considered an increase in the quantity of GDP or

gross national product (GNP) over a certain period of time. Economic growth can be expressed in

absolute numbers (growth scale) or relative numbers (growth rate). The growth scale reflects the

increase more or less, while the growth rate is used with a relative comparison meaning and reflects

the rapid or slow increase between periods. According to Samuelson and Nordhaus (1985),

economic growth is the expansion of a country's gross domestic product (GDP) or potential output.

In other words, economic growth occurs when a country's production possibilities frontier (PPF)

shifts outward. Thus, economic growth is considered an increase in the quantity of GDP or gross

national product (GNP) over a certain period of time. Thus, the nature of economic growth is to

reflect quantitative changes in the economy. But this change contains two quantitative and

qualitative attributes. The quantitative aspect of economic growth is the external manifestation of

growth, expressed right in the concept of growth and reflected through indicators assessing the

scale and rate of income growth. The quality aspect of economic growth is an internal attribute of

the economic growth process, expressed through indicators that reflect the effectiveness of

achieving the quantitative aspect of growth and the ability to maintain it in the long term. 2.2.

Sources of Economic Growth in Vietnam

The essence of approaching the origin of economic growth is to determine which factor is the

driving force and limit of growth, is this limit due to supply or demand? Originating from the fact

that resources for economic growth are becoming increasingly scarce, supply still cannot meet

demand, especially for developing countries, research on sources of economic growth often

focuses on analyzing from the supply side. According to the current perspective, economic growth

is formed from three factors: capital, labor and total factor productivity (TFP). Capital and labor

are considered material factors whose impact on economic growth can be quantified and are

considered broad growth factors. TFP is considered a non-material factor, reflecting the increase

in output not due to increased capital or labor, due to technological progress, human capital,

efficient use of resources, etc. is considered a factor. quality of growth or growth in depth.

Increasing TFP is associated with applying technical advances, technological innovation,

improving management methods and improving skills and qualifications of workers... Increasing

capital and labor can lead to growth. Short-term economic growth, suitable for the first stage of

industrialization and modernization, while increasing total factor productivity (TFP) is the source of long-term growth. lOMoAR cPSD| 61431571 2.3.

The Relationship Between Exports and Economic Growth

The impact of exports on economic growth can be approached from a direct or indirect

perspective. Exports have a direct impact on growth when any change in exports has a direct impact

on growth. This direct impact is often seen under the approach that exports are an integral part of

GDP, so any change in exports directly affects the change in scale and growth rate. GDP. In this

case, exports act as a constitutive factor of economic growth. Exports have an indirect impact on

economic growth when the influence of exports is transmitted through intermediary channels both

from the supply and demand side. That is the impact of exports on input factors (capital, labor,

TFP) or other factors of aggregate demand (impact on imports, consumption, investment). In this

case, exports demonstrate more clearly their nature as a factor that "impacts" economic growth. In

addition, the impact of commodity exports on economic growth is also considered in the direction

of positive or negative impacts, according to goals, impacts from the total supply or total demand

of the economy; over time and "lag", short-term and long-term impacts. Impacts from many

different angles, more or less, direct or indirect, have been mentioned in studies, however, analysis

of the impact of commodity exports on economic growth is more focused. on the dynamic, indirect

and long-term effects of exports on growth because of the importance of these effects on economic growth.

The relationship between exports and economic growth has been analyzed in many recent

empirical studies. Exporting is defined by the WTO as the sale of goods or services from one

country to the market of another country. Or according to the Organization for Economic

Cooperation and Development (OECD), export is the sale of foreign goods, services or production

activities from one country to another country during a certain period of time. However, the

evidence suggests that this relationship is quite diverse. While some studies show the existence of

a causal relationship between exports and economic growth, some other studies suggest that there

is no proportional relationship between these two factors. In the case of Vietnam, there are a

number of other empirical studies on the above issue, among which author Phan Minh Ngoc and

colleagues (2003) have researched "Export and Long Run Growth in Vietnam, 1975-2001” uses

various representative econometric models with modern time series techniques to directly measure

the contribution of exports to GDP growth during the above period. The main conclusion of this

study is that exports have not been the driving force for GDP growth in Vietnam during the years

since national reunification, including the post-renovation period - a period that witnessed a boom

in exports. exports thanks to reform policies and international economic integration. Richards

(2001) studied the case of Paraguay, a country that achieved high growth rates in the 1970-1980

period. He said that Paraguay's export growth rate is not as stable as its economic growth rate due

to political and economic reasons. Despite the recent presence of exports and export-related

production in Paraguay in economic development activities, it cannot be affirmed that exports

“play a leading role in promoting long-term economic growth as understood in the assumption of export-led economic growth.

Besides, there are also views supporting the export-based economic growth model. First of all,

it should be said that there is a huge literature of academic research on the role of exports in

economic growth, at least starting with the arguments of economists hundreds of years ago.

predecessors such as Adam Smith and David Ricardo, and was followed most recently by a series

of theoretical works by other famous economists such as Romer, Grossman, Helpman, etc. lOMoAR cPSD| 61431571

These empirical studies tend to confirm that exports have a positive relationship with economic

growth. Gylfason (1999) affirms that exports can be considered the main driving force for

economic development, both directly and indirectly because on the one hand they are part of

production, on the other hand they promote the import of goods, services and capital. Sharing this

view, Sharma and Panagiotidis (2005) believe that exports are one of the determinants of economic

growth. This assertion is even more evident when not taking into account positive external factors

such as non-export factors, the application of more effective forms of management, the

improvement of production techniques, and increased economic efficiency. economies of scale and

the ability to create clear comparative advantages. Or according to Thirlwall (1979), if a country's

balance of payments is in a bad state, aggregate demand will be cut, domestically produced goods

will become less attractive than foreign goods; thus, continuing to worsen the balance of payments.

On the contrary, when the balance of payments improves, it will help expand aggregate demand,

create more jobs, production factors will move from inefficient areas to more efficient areas...,

thereby promoting economic growth. Based on the model of Thirlwall, our study tries to assess the

influence of export on Vietnam’s economic development. 3. Research Methodology 3.1.

Research Method and Model Specification

3.1.1. Balance of Payments Constrained Growth Model

The balance-of-payments-constrained growth model was developed by the Thirlwall Law

(Thirlwall, 1979). According to Thirlwall (1979), the main constraint of aggregate demand in open

economies is the balance of payments. If a country's balance of payments is in a bad state,

aggregate demand will be cut, then supply will not be fully used, investment will not be attracted,

technology will be slow to develop, goods will not be fully utilized. Domestically produced goods

will become less attractive compared to foreign goods; thus, continuing to worsen the balance of

payments. This process repeats itself into a vicious cycle. On the contrary, when the balance of

payments improves, it will help expand aggregate demand, which will stimulate investment,

increase capital and promote technological progress, create more jobs, and production factors will

shift. from inefficient areas to more efficient areas..., thereby promoting economic growth.

From that argument, Thirlwall (1979) points out that no country grows faster than the growth

rate when in balance of payments equilibrium. This implies that economic growth is bound by the

equilibrium of the balance of payments. When exports grow or the income elasticity of imports

decreases, the economy will grow faster in the long run. The economic growth rate in the

equilibrium state of the balance of payments according to the Thirlwall Law is expressed by the

following equation: g = x/π In which: •

g: Economic growth rate in the equilibrium state of the balance of payments • x: Export growth rate •

π: Elasticity coefficient of imports with income

3.1.2. Model Specification

To analyze the impact of exports on Vietnam's economic growth, the article uses the VAR

(Vector Autoregression) model with the variables being the natural logarithm of exports (LNX),

capital (LNK), labor (LNL) and gross domestic product (LNGDP). lOMoAR cPSD| 61431571

The structural VAR model consists of many equations (system of equations model) and has lags of

the variables. VAR is a vector model of autoregressive variables. Each variable depends linearly

on its own lagged values and the lagged values of other variables. For example, let's consider two

time series Y and Y . The general VAR model for Y and Y has the following form: 1 2 1 2 Y = Y +i = 1pγi Y + U 1 ⍺ + i = 1p t i 1t-i 2t-i 1t

Y = δ + i = 1p Y +i = 1p i Y + U 2t მi 1t-i 𝛉 2t-i 2t

In the model above, each equation contains p lags of each variable. With two variables, the

model has 22.p slope coefficients and 2 intercept coefficients. So in the general case, if the model

has k variables, there will be k2.p slope coefficients and k intercept coefficients (can include

constants, linear or polynomial trends), As k becomes larger, the number of coefficients that must be estimated increases.

In this model, first the variables LNX, LNK, LNL and LNGDP will be stationary tested through

the ADF unit root test. Then, the VAR model will be estimated and the response functions of the

variables to the endogenous shocks that will be estimated to test the hypothesis about the role of

exports to Vietnam's economic growth according to the transmission channel of the growth model

bound by the balance of payments. The optimal lag for the model's variables is selected according

to LR, FPE, AIC and HQ standards. 3.2. Data Collection

The macroeconomic data used in this research are the detailed data calculated by quarter of

Vietnam’s Gross Domestic Product (GDP), export turnover value, realized social investment

capital, and labor force in working age. The period covered will be from 2013 to 2022.

The data sources include Asia Development Bank (ADB), The General Statistics Office of

Vietnam (GSO), The Ministry of Finance (MOF), The State Bank of Vietnam (SBV), Trading

Economics, and Vietstock Finance.

3.3. Variables and Hypotheses 3.3.1. Variables

- Gross domestic product (GDP): measured by Vietnam's real GDP.

- Capital (K): is the actual capital stock measured in units of trillion VND at the fixed price

in2010. Because in Vietnam there is no data on this indicator, we use realized social investment

capital to implement the whole society as our data.

- Labor force (L): Labor used in the study is Vietnam's working-age workforce, unit ofmillion people.

- Export (X): is the value of Vietnam's actual export turnover of goods, unit of billion

VND.This variable is standardized to 2010 prices by dividing the nominal value of merchandise

exports by the deflation index. 3.3.2. Hypotheses

The table below illustrates a holistic view of macroeconomic factors mentioned above: lOMoAR cPSD| 61431571 Indicators Variable Unit

Hypotheses of impact on GDP s Gross domestic product GDP Billion VND Capital K Trillion VND (+) Million Labor force L (+) people Export value X Billion VND (+)

4. Results and Discussions

4.1. The Role of Exports in Forming and Attracting Resources for Economic Growth 4.1.1. Capital

Capital was regarded as the primary element necessary to ensure growth from the beginning of

the 20th century, under the influence of Keynesian theory and the Harrod-Domar model. The

Keynesian cross model illustrates how changes in investments will affect the number of assets

through the Multiplier effect.

Moreover, despite the limited role that capital plays in long-term economic growth in

succeeding growth models, capital continues to make major contributions to the growth of economies.

One of the largest sources of additional capital for the economy is foreign trade activities. To

increase capital accumulation for the economy, many countries have selected foreign trade

development policies, which means promoting export activities and enhancing the balance of payments.

When the balance of payment is improved, it will help expand aggregate demand, which will

facilitate more investment and increase capital. In addition, exports generate significant foreign

exchange earnings for a country, providing foreign exchange that allows to increase imports of

technology, capital goods and intermediate goods necessary for the development of industries,

increase a country's productive potential. For many developing countries, foreign trade has become

the main source of capital accumulation in the early stages of industrialization.

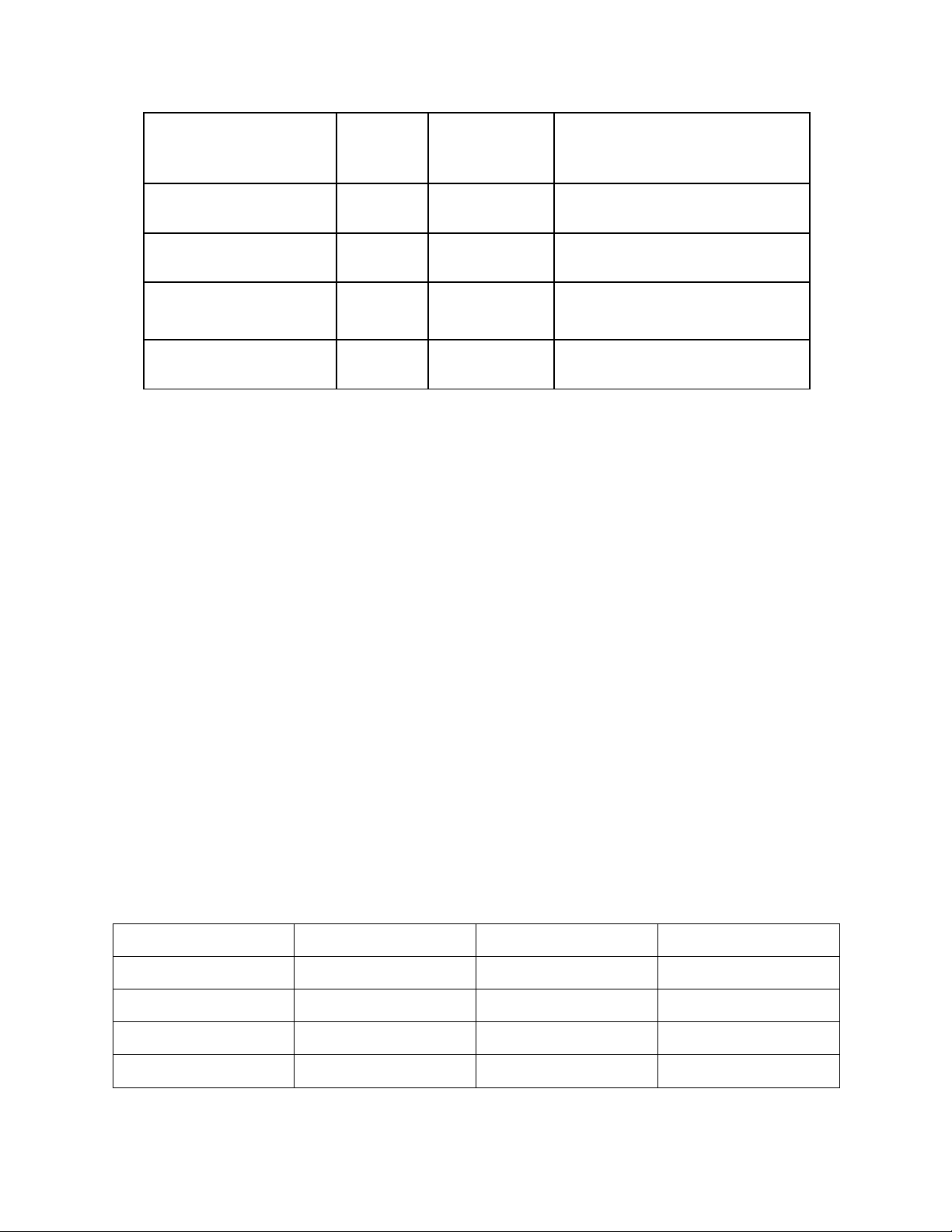

Table 1: Contribution of Resource Factors to Vietnam GDP Growth (%) Year Contribution of K Contribution of L Contribution of TFP 2013 50.9 16.9 32.2 2014 54.2 9.2 36.6 2015 50.2 1.5 48.3 016 47.2 7.9 44.9 lOMoAR cPSD| 61431571 2017 45.1 8.8 46.1 2018 43.6 11.6 44.8 2019 40.5 11.8 47.7 2020 41.8 20.7 37.5 2021 41.7 21.2 37.1 2022 34.7 21.5 43.8

Table 1 shows the contribution of resource factors in Vietnam's GDP growth, showing that

capital has played a huge role in Vietnam's economic growth in recent years. In the period

20132016, the average contribution of capital to GDP was about 50.6%. This accurately reflects

the fact that Vietnam is a developing country and has mobilized a large amount of investment

capital since implementing the open-door policy. However, in the period 2017-2020, the average

contribution of capital to GDP gradually decreased because our country implemented economic

restructuring, changing the growth model from "growth in width" to "growth in depth", which

means that TFP plays a leading role. In 2021-2022, due to the impact of the Covid 19 pandemic,

the contribution of capital to GDP has decreased, specifically in 2022 the contribution of capital is

only 34.7% (a decrease of 10-20% compared to previous periods). This is partly because foreign

trade and export activities are seriously affected when many countries tend to use domestic

products instead of imported products by enacting closed-door policy to prevent epidemics.

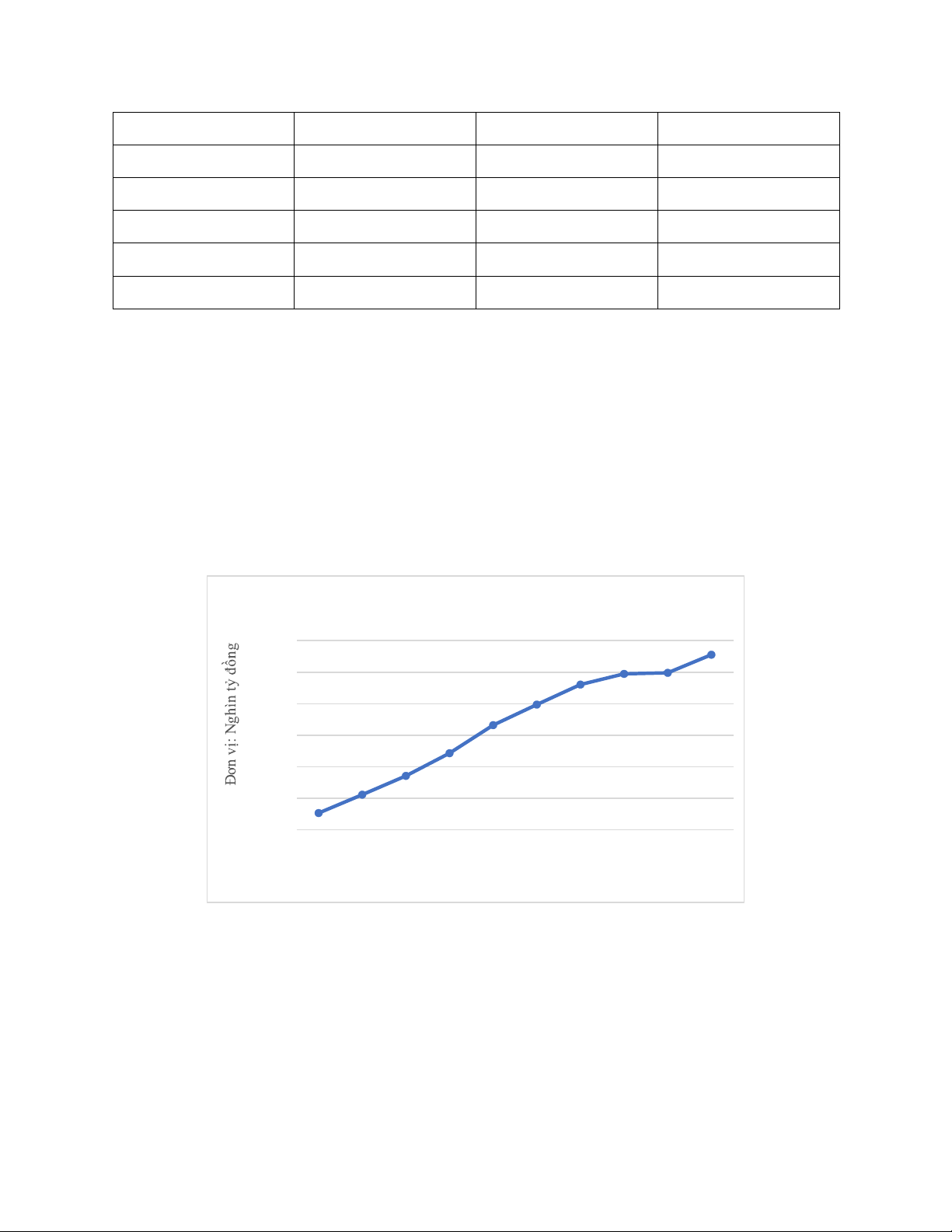

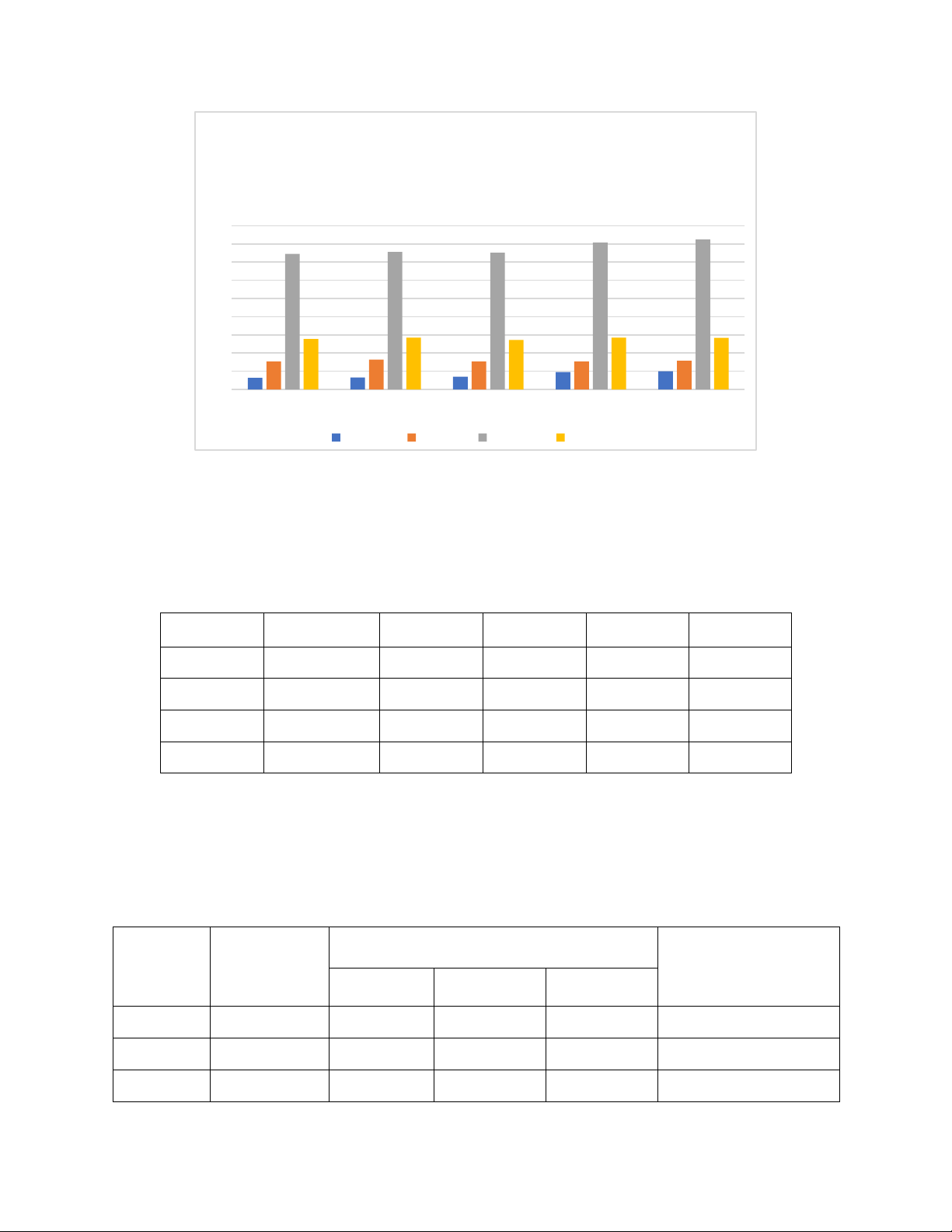

Figure 1. Vietnam's Investment Capital 2200 2000 1800 1600 1400 1200

1000 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Năm

In the years between 2013 and 2020, Total investment capital increased continuously (Figure

1), which led to the steady rise in the ratio of investment capital to GDP. Vietnam is categorized

as having a high ratio of investment capital to GDP when compared to other nations in the region

and developing nations worldwide. The amount of investment capital was stagnant in 2021

(slightly decreased by 6.54 trillion VND) and has recovered and increased sharply in 2022

(increased by 114.83 trillion VND). lOMoAR cPSD| 61431571

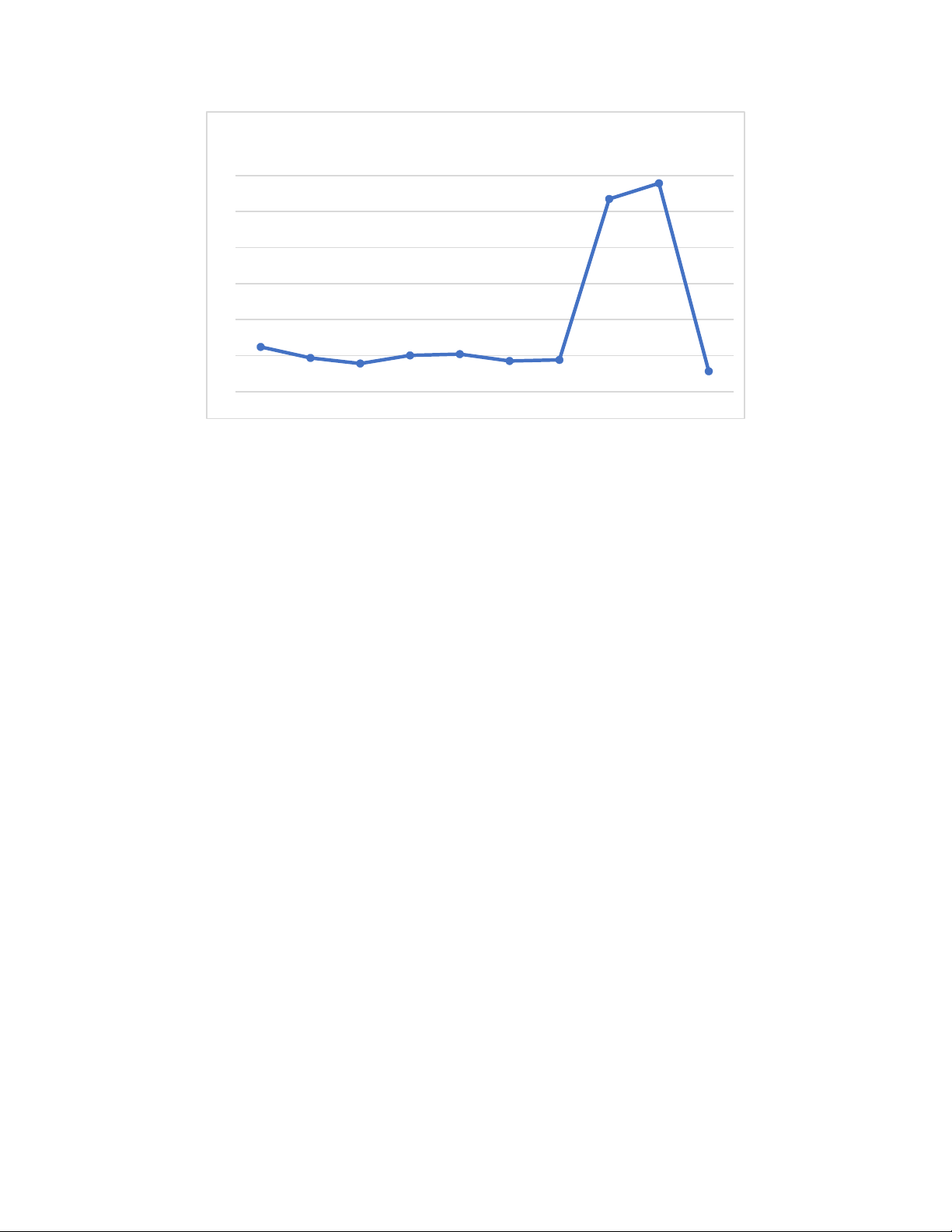

Figure 2. Vietnam's ICOR Coefficient 16 14 12 10 8 6

4 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

However, our country's economic growth method also reveals disadvantages that make growth

fluctuating and unstable. Although Vietnam has raised a large amount of investment capital since

implementing the open-door policy, the total investment capital has increased but the investment

efficiency is still low, reflected in the quite high ICOR index during the developmental periods

from 2013 to 2019 average amount of investment capital is 5.9; The main reason is that Vietnam's

technical equipment and technology are still limited compared to the world; High costs of renting

and purchasing production and business premises; Social costs are still large; Management level

and skills are still low; There is a significant amount of capital buried in gold, land or running

around in markets without direct investment for production, business and economic growth.

In 2020, due to the negative impact of the COVID-19 epidemic, production and business

activities of the economy stagnated, completed construction projects and put into use have not yet

been able to develop their capacity, so ICOR in 2020 reached 14.7; in 2021 amount of investment

capital increases slightly to 15.57.

In 2022, although the ratio of development investment capital/GDP is lower than in previous

years, because the ICOR coefficient is low and decreasing (dropped sharply to 5.13), investment

efficiency is high and contributes to GDP growth. higher. Investment efficiency increases due to

many reasons. Part of the reason is that the pandemic prevention strategy has shifted towards

openness for socio-economic recovery..., contributing to GDP growth 2-3 times higher than the

growth rate of 2 last year. When GDP increases, it means that the absolute increase in GDP also increases. 4.1.2. Labor

Export growth also helps create more jobs for workers, especially for countries with an

abundant labor force like Vietnam. From the supply side, increasing employment creates an

important resource for long-term growth. At the same time, employment also affects the economy

from the demand side when the income of workers in the manufacturing sector increases,

increasing consumer demand for goods and services, stimulating domestic production development. lOMoAR cPSD| 61431571

Table 2: Proportion of Workers Aged 15 and Over Working in the Economy Who Have Received Traning (%) Year Country City Countryside 2013 18.2 34.1 11.5 2014 18.7 34.8 11.5 2015 20.4 36.9 13.0 2016 20.9 37.3 13.4 2017 21.6 37.7 14.1 2018 22.0 37.3 14.7 2019 22.8 39.0 14.9 2020 24.1 39.7 16.3 2021 26.1 41.1 17.5 2022 26.4 41.2 17.7

Table 2 shows that labor also has a significant contribution to promoting Vietnam's economic

growth in the period 2013 - 2022. The young population structure with the working-age population

increasing over the years is clearly an abundant additional source for the Vietnamese labor force

(Data from the General Statistics Office in 2022, Vietnam has about 46.2 million people of working

age). Population age structure is one of the important factors for economic growth and

development. A young workforce with advantages in health and the ability to absorb expertise,

techniques and science and technology will help Vietnam gain a more important position in the

global production chain. Increasing the number of employed people will increase savings and

increase contributions to the social security fund, thereby positively affecting economic growth and social stability.

However, the rate of trained workers in Vietnam is still low and there is a large gap between

urban and rural areas (Table 2). Trained workers are also poor in quality, most of them are unable

to work after graduating and must take time to retrain. Vietnam's young and abundant labor force

also faces major challenges of unemployment and underemployment while the labor market is increasingly competitive.

4.1.3. Total Factor Productivity (TFP)

In addition to increasing capital and employment, exports also have the effect of promoting

total factor productivity (TFP) thanks to optimal resource allocation through promoting

comparative advantages and economies of scale that increase productivity.

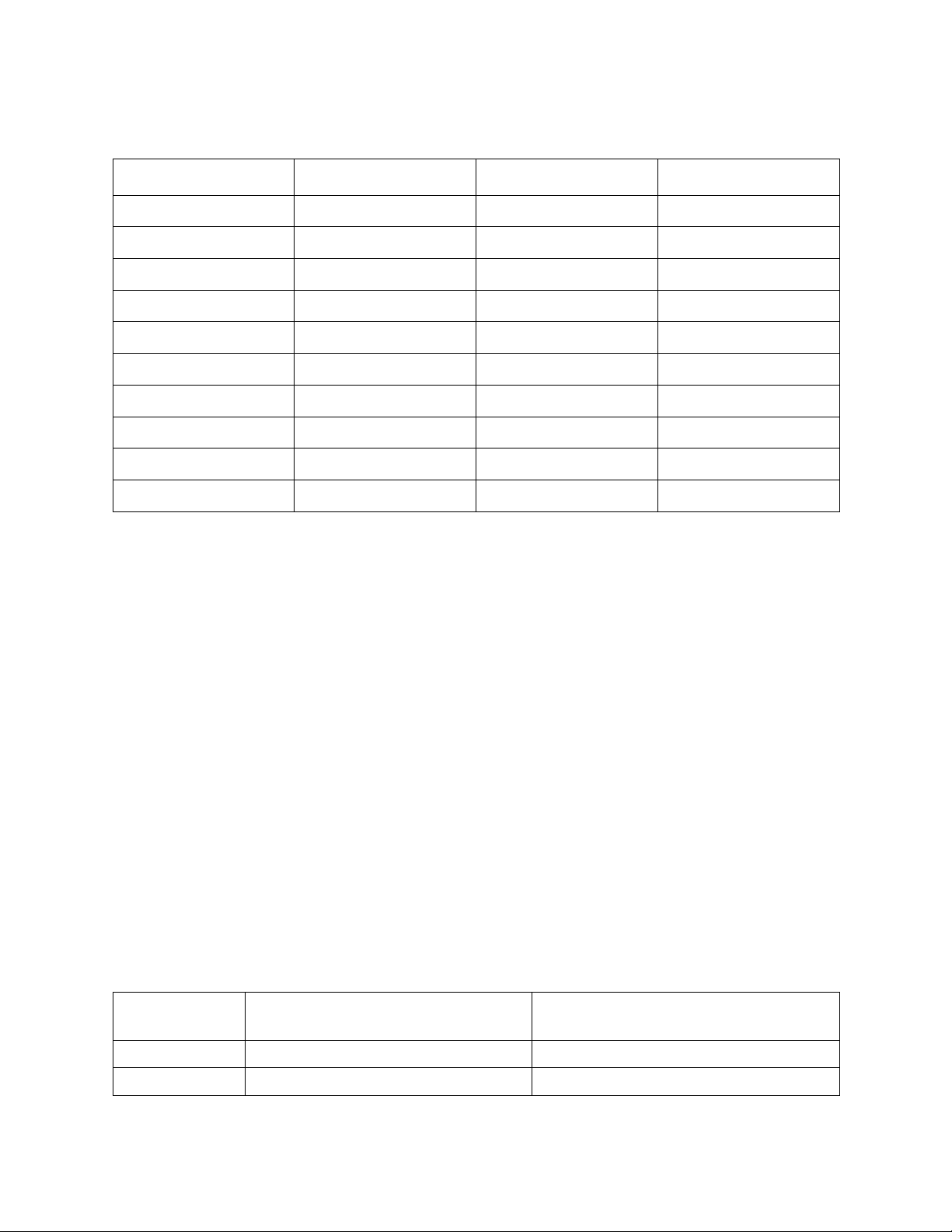

Table 3: Social Labor Productivity of Vietnam

Average labor productivity

Labor productivity growth rate Year

(million VND/person/year) (%/year) 2013 85.2 8.11 2014 93.1 9.27 lOMoAR cPSD| 61431571 2015 97.75 4.99 2016 105.71 8.14 2017 117.19 10.86 2018 129.12 10.18 2019 141.00 9.20 2020 150.06 6.43 2021 172.80 15.15 2022 187.99 8.79

Table 3 shows that Vietnam's social labor productivity has generally increased over the years,

about 8%/year, except for the 2 years 2020-2021 due to COVID-19 pandemic. The average labor

productivity in the period 2013-2015 stayed below the level of 100 million VNĐ/person/year, and

finally broke through that level in 2016 (at 105.71 million VNĐ/person/year). Since then, it

witnessed a sharp rise in the following 7-year period, and nearly hit the level of 190 million VNĐ/person/year in 2022.

However, despite high productivity increases, TFP's contribution to economic growth showed

a tendency of decreasing in recent years, from 46% in the period 2015-2019 down to 37% in the

period 2020-2021 (Table 1). The decline in TFP's contribution to GDP growth has affected the

sustainability of economic growth in Vietnam, making the economy vulnerable to external factors.

This is reflected in the fact that Vietnam's economic growth rate has continuously remained at an average level during periods.

Besides, although Vietnam's labor productivity has grown quite well, it is still very low

compared to other countries in the world. Even in Southeast Asia, we are only in the group of

countries with average labor productivity. In 2022, Vietnam's labor rate at real prices is 20.1

thousand dollars/person (based on purchasing power price - ADB data), which is 2.5 times lower

than Thailand, 4 times lower than Singapore, and 11 times below Singapore. Low technology, poor

management, production (especially in the agricultural sector) still depending heavily on nature

are some of the main reasons that explain these limited numbers. lOMoAR cPSD| 61431571

Figure 3. Labor Productivity of Vietnam and Some Asian Countries (thousands of USD) 180 160 140 120 100 80 60 40 20 0 2018 2019 2020 2021 2022 Việt Nam Thái Lan Singapore Malaysia

4.2. Experimental Estimation Results

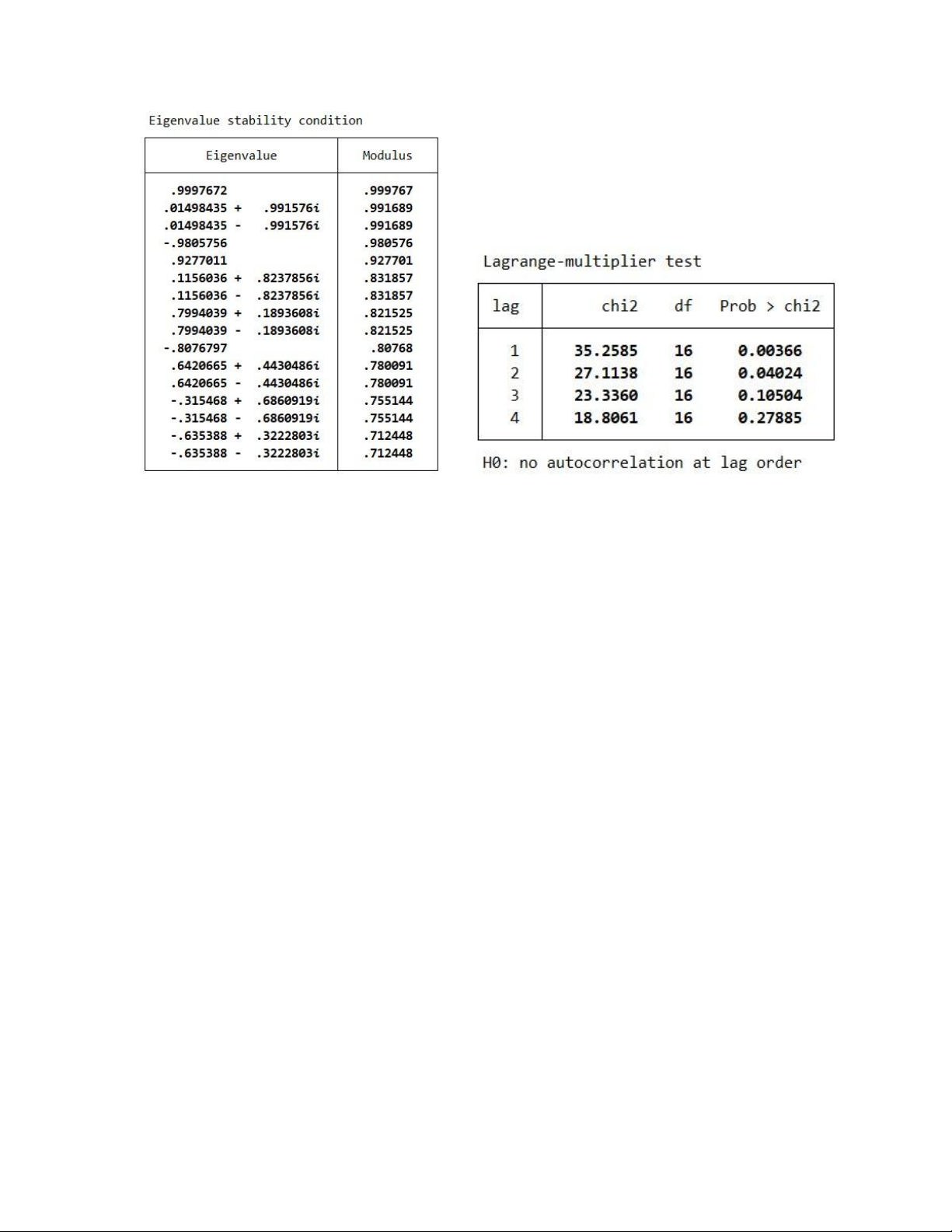

This section presents the results of empirical estimation of the VAR model with the variables

LNX, LNK, LNL and LNGDP, with quarterly frequency for the period 2009-2022 including 56

observations. Summary statistical descriptions of the variables LNGDP, LNX, LNK and LNL are shown in Table 4.

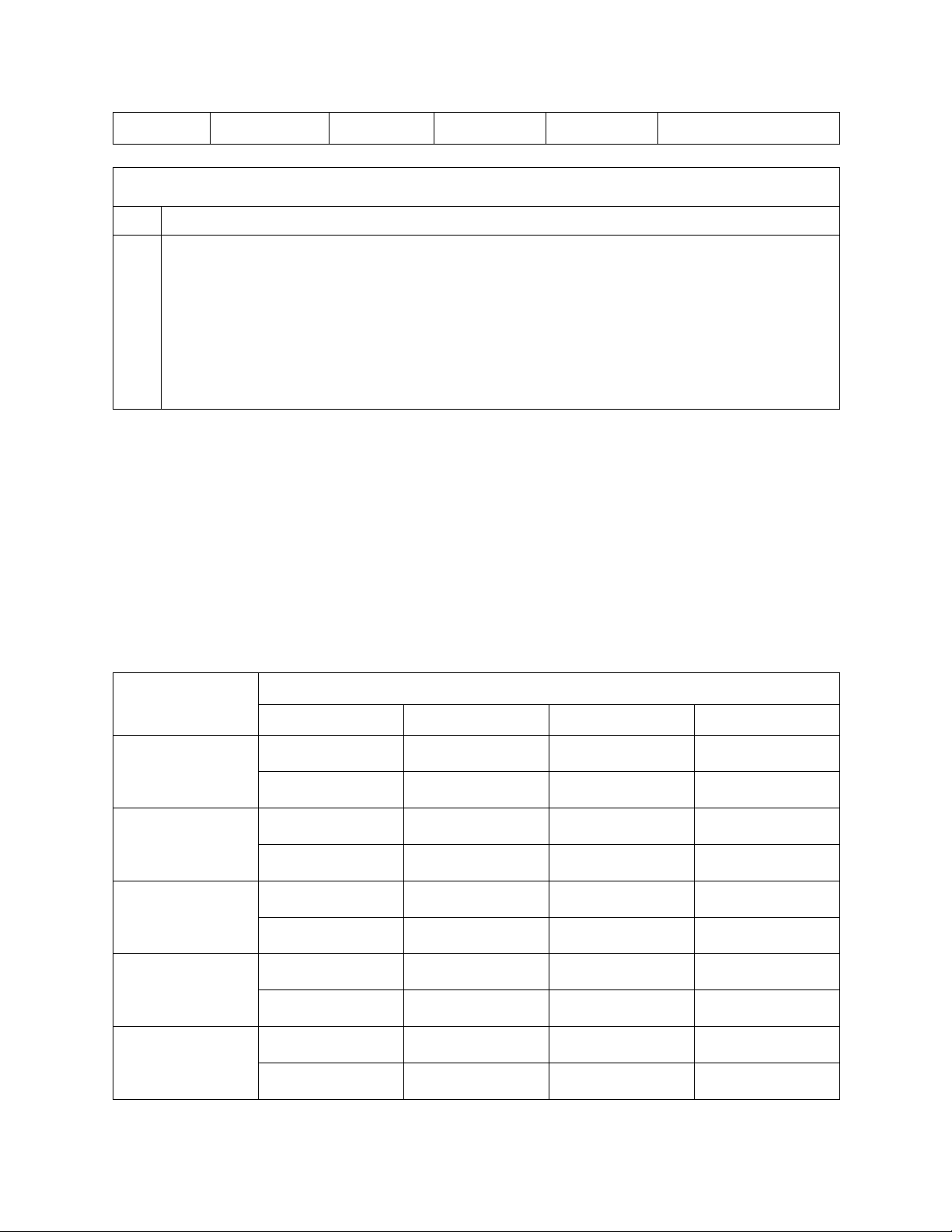

Table 4: Desciptive Statistics in the Period from 2009 to 2022 Variable Observation Mean Std. Dev. Minimum Maximum LNGDP 56 13.53564 0.3716548 12.64799 14.25658 LNK 56 12.77472 0.5006964 11.66393 13.90086 LNL 56 -3.051638 0.0310569 -3.141915 -3.007805 LNX 56 8.751054 0.4638819 7.887667 9.500119

To test stationarity for data series, the Augmented Dickey Fuller (ADF) test was performed.

The ADF test results are summarized in Table 5 showing that all the series LNX, LNL, LNK and

LNGDP are stationary series. The next step is to test the optimal lag for the model's variables. The

results in Table 6 show that according to FPE, AIC, HQIC, and SBIC standards, the optimal lag

selected for the variables for the VAR model is 4.

Table 5: Result of ADF unit root test Critical value

Variable ADF Results Conclusion 1% 5% 10% LNGDP 1.951 -2.62 -1.95 -1.61 Stationary series LNK 1.731 -2.62 -1.95 -1.61 Stationary series LNL -2.197 -2.41 -1.68 -1.30 Stationary series lOMoAR cPSD| 61431571 LNX -2.393 -2.41 -1.68 -1.30 Stationary series

Table 6: Optimal Lag Test Results for Variables

VAR Lag – order Selection Criteria Lag LogL LR df p FPE AIC HQIC SBIC 0 140.087 6.3e-08 -5.2341 -5.17655 -5.084 1 266.828 253.48 16 0.0000 8.9e-10 -9.4934 -9.20569 -8.74292 2 289.323 44.989 16 0.0000 7.0e-10 -9.74318 -9.2253 -8.39232 3 327.481 76.315 16 0.0000 3.1e-10 -10.5954 -9.84734 -8.64416 123.04 4 388.998 16 0.0000

5.6e-11* -12.3461* -11.3678* -9.79446* * * Optimal lag

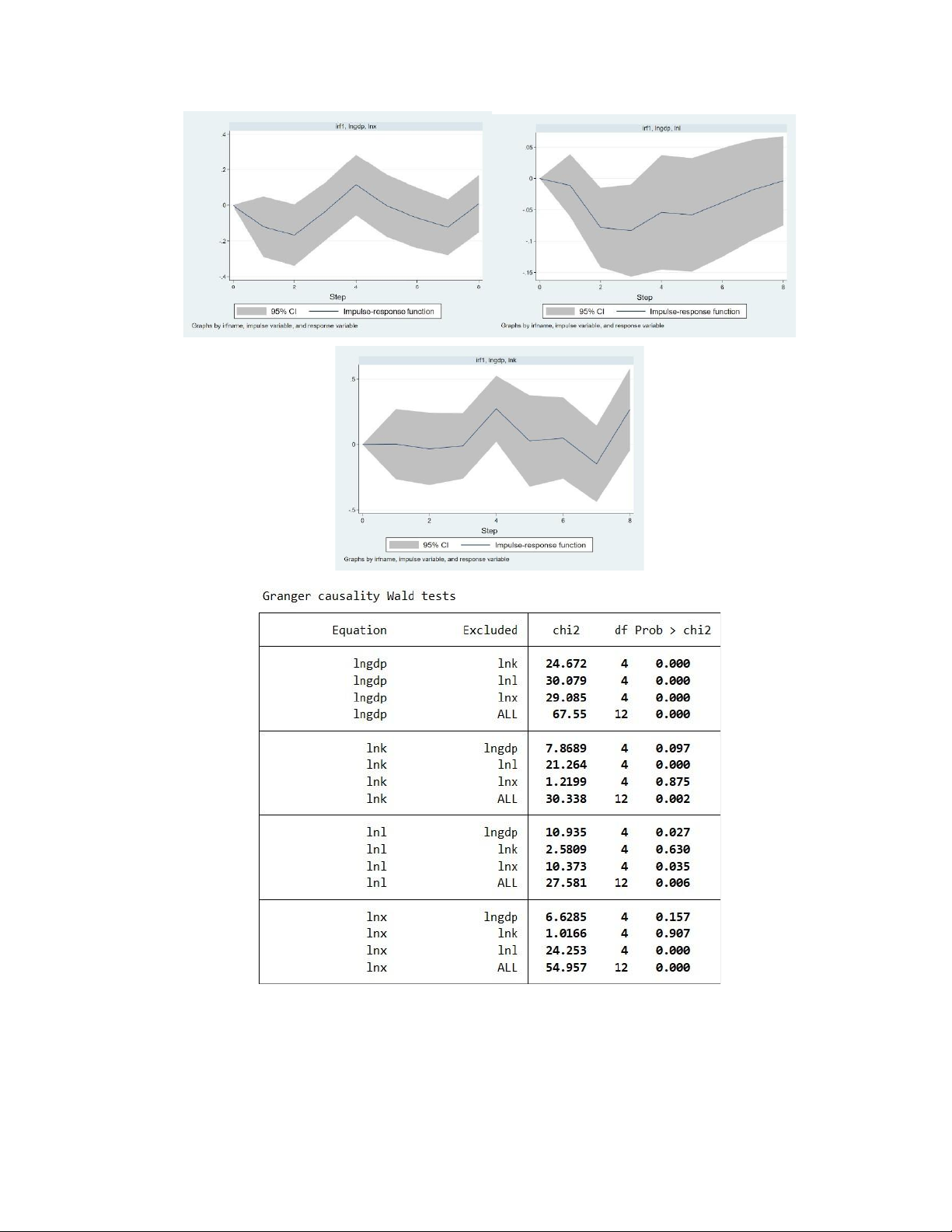

The summary estimation results shown in Table 7 show that exports, capital and labor all have

a positive impact on Vietnam's economic growth. At the same time, exports also have a positive

impact on capital and labor. This clearly shows that besides TFP, capital and labor are also

important transmission channels for the impact of exports on economic growth in Vietnam. Figure

4 shows the response functions over the study period of 8 periods (quarters). Accordingly, GDP

does not react immediately to shocks of X, K and L. In particular, GDP begins to react to shocks

of In the fourth quarter, for the shocks of K and L, the strongest and most complete response was

in the fourth and third quarters, respectively. This shows that the growth of the export sector has

had a fairly rapid and positive impact on the labor force in Vietnam in recent years.

Table 7: VAR model estimation results between LNGDP, LNX, LNK and LNL Independent Dependent variables variable D(LNGDP) D(LNX) LNK LNL D(LNGDP(-1)) D(LNGDP(-2)) D(LNGDP(-3)) D(LNGDP(-4)) D(LNX(-1)) lOMoAR cPSD| 61431571 D(LNX(-2)) D(LNX(-3)) D(LNX(-4)) LNK(-1) LNK(-2) LNK(-3) LNK(-4) LNL(-1) LNL(-2) LNL(-3) LNL(-4)

5. Conclusions and Recommendations 5.1. Conclusions

Research results show that there exists a two-way relationship between exports and economic

growth in Vietnam through both short-term and long-term channels.

Export growth is the driving force for economic growth, and resource factors play an important

role in transmitting the impact of exports on Vietnam's economic growth. Export growth has had

a positive impact on the formation and attraction of resources for economic growth in Vietnam in lOMoAR cPSD| 61431571

recent years. Export growth not only helps increase productivity thanks to promoting economies

of scale and technological advances, but also contributes to creating more jobs and stimulating

investment, increasing capital accumulation, thereby promoting economic growth. economic chief.

In Vietnam, however, the efficiency of using input factors is still low. The level of technology

currently used in Vietnam is relatively low compared to other countries in the region, leading to

low social labor productivity, the production capacity of capital is limited and tends to decrease,

and the labor force is low. Although the labor force is large in number, the rate of trained workers

is still low. Besides, although it is considered a driving force of economic growth, reality shows

that exports are only developing in breadth rather than depth. Exports of raw and semi-processed

goods, resource-intensive goods, and minerals also account for a high proportion in the export

basket. Processed goods are mainly labor-intensive and focus heavily on processing, bringing low added value.

Economic growth also contributes to export growth through increased productivity that

increases international trade competitiveness. Accordingly, economic growth leads to increased

productivity by exploiting economies of scale and technological advances. Increased productivity

will help reduce production costs, thereby contributing to the reduction of domestic goods. This

will have the effect of increasing the real exchange rate, improving international trade

competitiveness and thus promoting exports. lOMoAR cPSD| 61431571 lOMoAR cPSD| 61431571 5.2. Recommendations

5.2.1. Continuing to promote exports to maintain its role as a driving force for sustainable economic growth.

In the coming years, exports need to achieve fundamental changes in quality, both expanding

the export scale and focusing on increasing the added value of exported goods, creating a suitable

position in the global value chain. In the long term, it is necessary to escape the outsourcing and

assembly model, penetrate deeper and rise to higher levels in the value chain along with the process

of deep integration into the world economy. To achieve these changes, Vietnam needs to implement

well the following contents: Restructuring export goods in the direction of reducing the export of

raw products (especially mineral resources), investing in technology to increase the export of

processed products, and reducing dependence on imported raw materials and accessories;

Strengthen export market development, exploit market opening opportunities from international

economic integration commitments, better penetrate and exploit key and large-scale markets such

as the US, EU, Japan, China, Korea...In addition to developing and expanding export markets,

Vietnam needs to ensure it meets the technical barrier requirements of trading partners and

proactively deal with risks from trade lawsuits. The core factor determining success in commercial

transactions is product quality. The quality of exported products must ensure that they meet

international standards for each specific industry. Increasingly stricter regulations on quality

standards for exported goods are the general trend of the international market, and that is the barrier

that exported goods must overcome. In addition to ensuring standard conditions for export

products, businesses must strengthen their legal capacity, negotiation ability and access to global

information to overcome trade defense and discriminatory measures. treatment of partners,

avoiding losses in the international market. At the same time, developing new products and

innovating existing products are also important measures to effectively win, keep and expand the

market. Strengthen control over import of input factors, avoid being too dependent on one or a few lOMoAR cPSD| 61431571

markets. Along with negotiating, signing, and implementing FTA (Free Trade Agreement) with

partners, the Government and businesses of Vietnam must really consider good implementation of

FTA as the best way to diversify markets and export-import partners.

5.2.2. Improving the quality of resource factors of growth

Empirical research results have shown that resource factors play an important role in

transmitting the impact of exports on Vietnam's economic growth. Therefore, further improving

the quality and efficiency of resource use, especially labor productivity, will ensure optimal

transmission of the impact of exports on economic growth in Vietnam. Specific measures are:

Improving the quality of human resources, promoting productivity growth, making total factor

productivity the resource with the biggest role for economic growth in Vietnam. To do this, it is

necessary to invest effectively in science and technology development, education and training to

improve productivity and develop human capital; besides, it is also essential to unlock capital

sources through restructuring the financial system, enhancing the role of the stock market in

mobilizing long-term capital, promoting the strong development of the bond market, especially

corporate bonds, mobilize maximum savings from the population. Additionally, effective public

investment should be promoted, as well as resolutely combating corruption that causes capital loss,

reducing projects that are behind schedule and slow in disbursement. State-owned enterprises can

proactively use their own capital and borrow capital to implement investment projects to develop

production and business, especially in-depth investment and technological innovation to improve

competitiveness and at the same time, they must take full responsibility for investment efficiency,

ensure capital recovery and loan repayment, end the situation of waiting for the state to freeze and write off debt. References

Gylfason, D. (1999). Exports, Inflation and Growth. World Development, 1031-1057.

Phan, N. M. (2003). Export and Long Run Growth in Vietnam, 1975-2001. ASEAN Economic Bulletin, 1-8.

Sharma, A., & Panagiotidis, T. (2005). An Analysis of Exports and Growth in India: Cointegration

and Causality Evidence (1971-2001). Review of Development Economics, 232248.

Richard, DG. (2001). Exports as a Determinant of Long-run Growth in Paraguay, 1966-96. The

Journal of Development Studies, 28-146.

Thế, C. P. (2011). Mô hình tăng trưởng kinh tế dựa vào xuất khẩu của Việt Nam. Tạp chí Khoa học

ĐHQGHN, Kinh tế và Kinh doanh 27, 265-275.

Nguyễn, C. Q. (2021). Bẫy thu nhập trung bình - những vấn đề đặt ra đối với Việt Nam hiện nay. Trường Chính Trị Tỉnh Bình Thuận.

https://truongchinhtri.binhthuan.dcs.vn/Trang-chu/post/207822/bay-thu-nhap-trung-

binhnhung-van-de-dat-ra-doi-voi-viet-nam-hien-nay#

Awokuse Titus O. (2003), “Is the Export-led Growth Hypothesis Valid for Canada?”, Canadian

Journal of Economics, 36 (1), pp. 126-137. lOMoAR cPSD| 61431571

Chu Quang Khởi (2003), Sources of Economic Growth in Vietnam, 1986- 2002, MDEs thesis, NEU.

Emilio, Medina-Smith (2001), Is the Export-Led Growth Hypothesis Valid of Developing

Countries? A case study of Costa Rica, UNCTAD.

Feder G. (1983) “On Exports and Economic Growth”, Journal of Development Economics, 12, pp. 59-73.

Giles, J.A. and Williams, C.L. (2000), Export Led Growth: A Survey of The Empirical Literature

and Some Noncausality Results Part 1, Econometrics Working paper EWP0001, ISSN 1485- 6441, University of Victoria.

Helpman, E. and Krugman, P. (1985), Market Structure and Foreign Trade, MIT Press, Cambridge.

Herzer, Dierk et al. (2005), Export-Led Growth in Chile: Assessing the Role of Export

Composition in Productivity Growth, Verein für Socialpolitik, Research Committee Development Economics.

Nguyễn Quang Hiệp (2013), “Vai trò của các yếu tố nguồn lực đối với tăng trưởng kinh tế của

VN”, Kỷ yếu Hội thảo khoa học quốc tế: Nhìn lại nửa chặng đường phát triển kinh tế xã hội

5 năm 2011 - 2015 và những điều chỉnh chiến lược, NXB Đại học Kinh tế Quốc dân, tr. 209- 220.

Thirlwall, A.P. (1979), “The Balance of Payments Constraint as an Explanation of International

Growth Rate Differences”, Banca Nazionale Del lavoro Quarterly Review, 32 (128), pp. 44- 53.