Preview text:

VIETNAM NATIONAL UNIVERSITY OF AGRICULTURE

FACULTY OF ACCOUTING AND BUSINESS MANAGEMENT

INTERNSHIP REPORT

Group of Student: 1.

Pham Thi Hien – 642290 – K64QTKDT 2.

Nguyen The Long – 645125 – K64QTKDT 3.

Vu Thu Ha – 641599 – K64QTKDT

Lecture: Ph.D Tran Minh Hue

HA NOI, 2021

VIETNAM NATIONAL UNIVERSITY OF AGRICULTURE

FACULTY OF ACCOUTING AND BUSINESS MANAGEMENT

INTERNSHIP REPORT

Group of Student: 1.

Pham Thi Hien – 642290 – K64QTKDT 2.

Nguyen The Long – 645125 – K64QTKDT 3.

Vu Thu Ha – 641599 – K64QTKDT

Lecture: Ph.D Tran Minh Hue

HA NOI, 2021 ACKNOWLEDGEMENT

Dear Teachers, this is the first internship, so it means a lot to us, 3rd

year students who are still sitting in the university lecture hall. Because in

addition to cultivating specialized knowledge and skills, internships at

enterprises and preparing necessary skills to complete the graduation thesis

are also very important. It is an opportunity for us to have access to the real

working environment at companies and businesses, and to apply the theory

taught in school to real work. Especially thanks to that, we have gained the

experience and skills as the basis for the final thesis internship.

After 5 weeks of internship, receiving guidance and help from teachers

and the company, our group of students including Pham Thi Hien, Nguyen

The Long, Vu Thu Ha came from K64 Advanced Agribusiness Administration

(K64QTKDT) successfully completed the first practical training session at

GPV Vietnam CO., LTD with the topic of general understanding of the

Company's business operations. During the internship period, we had many

opportunities and conditions to learn, research and collect comprehensively

information from the history of formation and development, organizational

structure, business fields. to the market, processes, production activities and

business results of the company. Thereby helping us to better understand the

company in all aspects and complete the Internship Report on the company.

We sincerely thank Instructor Ph.D Tran Minh Hue, Lecturer in

Accounting and Business Administration Faculty, Vietnam National Academy

of Agriculture, Mr. Vu Tien Thinh and the Board of Directors of GPV

VIETNAM CO., LTD. The staff in the company enthusiastically guided and

helped us during the internship period and wrote the report.

Due to many limitations in knowledge as well as practice time, the

report cannot avoid errors, our team would like to receive comments and

guidance from teachers to report the internship program 1 of our group is more complete. We sincerely thank you! ii

TABLE OF CONTENTS

CHAPTER 1. INTRODUCTION..............................................................................1 1.

Introduction ...................................................................................................1 1.1.

The rationale of the internship report .......................................................1 1.2.

Report objectives .........................................................................................2

1.2.1. General objective .........................................................................................2

1.2.2. Specific objective .........................................................................................2 1.3.

Scope of report ............................................................................................2

1.3.1. Scope of space ............................................................................................2 1.4.

Report methodology ....................................................................................3

1.4.1. Data collection ..............................................................................................3

1.4.2. Statistical method ........................................................................................3

1.4.3. Analytical method ........................................................................................3

1.4.4. Synthesis .......................................................................................................3

CHAPTER 2: FINDING ............................................................................................4 2.

Finding ...........................................................................................................4 2.1.

Introduction of a company..........................................................................4 2.2.

Operating characteristics and consumption market ..............................5 2.3.

Resources and Facilities ............................................................................5

2.3.1. Organization stucture ..................................................................................5

2.3.2. The main product.........................................................................................7

2.3.3. Equipment .....................................................................................................9 2.4.

Business results of the company in 3 years ........................................ 10 2.5.

Performance Analysis .............................................................................. 13

CHAPTER 3: CONCLUSIONS AND RECOMMENDATIONS........................ 15 3.

Conclusions and Recommendations ..................................................... 15 3.1.

Conclusions ............................................................................................... 15 3.2.

Recommendations .................................................................................... 15

LIST OF TABLES

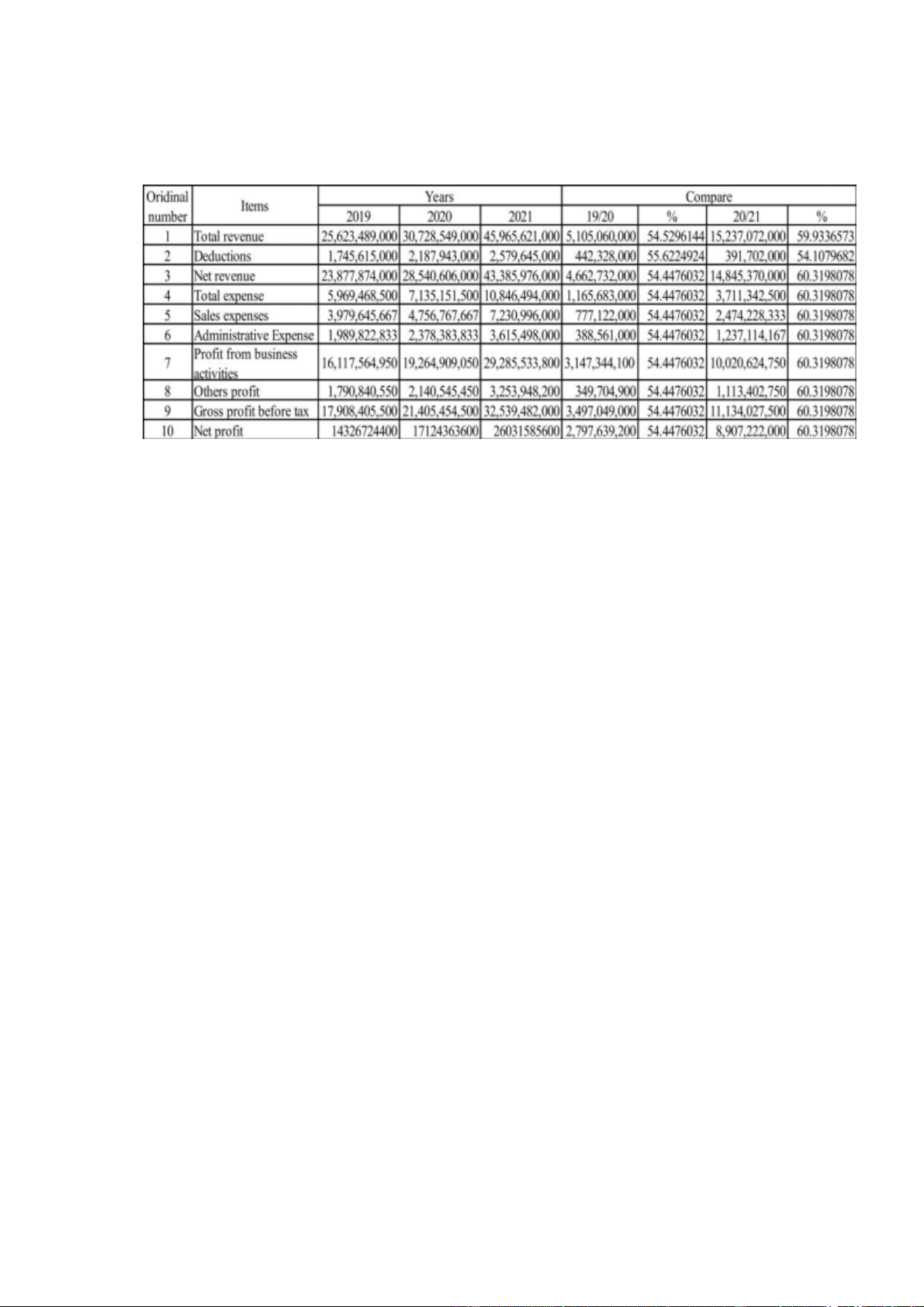

Table 2.1: Income Statement from 2019-2021 (Unit: VND). . .10 iv

CHAPTER 1. INTRODUCTION 1. Introduction 1.1.

The rationale of the internship report

To complete practical course 1st

Help students with practical approach and apply the knowledge they

have learned in practical production and business at production facilities.

Because the student who does an internship receives credit from the

university, graded credit determined by the technical writing faculty, there

needs to be documentation in addition to the site supervisor's evaluation as a

basis for that graded credit. Submitting an internship report not only provides

the faculty with a document which qualifies the student for graded credit, it

also provides the faculty with in-depth information about the profession they

are responsible for preparing students to participate in. Furthermore, and of

considerable importance, the internship report increases the student's

responsibility by requiring the student intern to gather information and plan

the report throughout the work experience. The student then has an

opportunity to demonstrate maturity as a technical writer by presenting,

analyzing, and evaluating his or her own work on the job.

Responding the demand of faculty accounting and business

management also our requirement.

The concept of business analysis

In the most general sense is the process of studying all phenomena and

things directly and indirectly related to human production and business

activities. The analysis process is carried out from the step of actual

investigation to abstract thinking from observing reality, collecting data

information, processing and analyzing data information, finding the cause to

the decision. set out operational orientations and solutions to implement those orientations.

The main content of business analysis is the business results indicators

such as sales revenue, production value, cost, profit,etc. When analyzing, it is

necessary to clearly understand the boundary between quantitative criteria and

quality indicators, absolute, relative, average,etc.

Deeply research the factors affecting the performance of business results on those targets.

1.2. Report objectives

1.2.1. General objective

Clarify the current status of business activities in the company. Observe

the operation, thereby proposing some solutions related to business performance.

1.2.2. Specific objective

Firstly, contribute to systematizing the theoretical and practical basis of

business activities and resreach the history of GPV VIET NAM TECHNOLOGY COMPANY LIMTED.

Secondly, understand the organization, human resource, understand the

process of producing product, and their products and analyze financial status in 3 years ago.

Finally, Proposing some solutions to improve the efficiency of the

company's business operations. 1.3.

Scope of report

1.3.1. Scope of space

Research at GPV VIET NAM TECHNOLOGY COMPANY LIMTED.

Address: Vat Cach Village, Dong Cuong Commune, Yen Lac District,

Vinh Phuc Province, Vietnam.

1.3.2. Scope of time

From 22/11/2021 to 26/12/2021: go to practice GPV VIET NAM

TECHNOLOGY COMPANY LIMTED and get information

From 27/12/2021 to 03/02/2022: Write the report 2

1.4. Report methodology

1.4.1. Data collection

Data collection is the process of gathering and measuring information

on targeted variables in an established system, which then enables one to

answer relevant questions and evaluate outcomes.

Secondary data: From available materials of GPV VIET NAM TECHNOLOGY COMPANY LIMTED.

Primary data: Using observe to survey.

1.4.2. Statistical method

Based on the report which GPV VIET NAM TECHNOLOGY

COMPANY LIMTED give for us: Asset, liability, machines, material,etc.

Statistical methods are mathematical formulas, models, and techniques

that are used in statistical analysis of raw research data. The application of

statistical methods extracts information from research data and provides

different ways to assess the robustness of research outputs.

1.4.3. Analytical method

An analytical technique (analytical method) is a procedure or a method for

the analysis of some problem, status or a fact. Analytical techniques are usually

time-limited and task-limited. They are used once to solve a specific issue.

Using the financial statement to analyze based on the outside factors

and inside factors; using excels software to compute; using diagram, table,etc. 1.4.4. Synthesis

Research synthesis is the overarching term we use to describe

approaches to combining, aggregating, integrating, and synthesizing primary

research findings. Each synthesis methodology draws on different types of

findings depending on the purpose and product of the chosen synthesis

Synthesis the data in financial statement, in the table. For example:

table show the number of employees and equipment of GPV VIET NAM TECHNOLOGY COMPANY LIMTED.

CHAPTER 2: FINDING 2. Finding 2.1.

Introduction of a company General Information

Name: GPV VIET NAM TECHNOLOGY COMPANY LIMTED.

Address: Vat Cach Village, Dong Cuong Commune, Yen Lac District, Vinh Phuc Province, Vietnam Director is Mr. Vu Tien Thinh

GPV VN CO.,LTD operates mainly in the field of food processing

History and Development: Company was founded in September 29, 2019.

GPV Vietnam Technology Co., Ltd, formerly known as VEGAN

PARADISE COMPANY LIMITED (VEGETARIAN PARADISE COMPANY

LIMITED) was established in 2012, co-founded by Mr. Tuong Ngoc Tan and Mr.

Vu Tien Thinh, with address at Address: No. 16, lane 18, Ta Thanh Oai, Ta Thanh

Oai Commune, Thanh Tri District, Hanoi City. The main business of the company

is the production and supply of ready-to-eat foods.

In 2019, realizing the increasing market demand, the company

expanded its operations and established GPV Vietnam Technology Co., Ltd.

under the management and administration of Mr. Vu Tien Thinh. The

company operates in the field of food processing and technology transfer for

pastry processing. The company was initially headquartered in Vinh Phuc

with a total area of 2000m2 (of which 600m2 was used as a factory).

In 2020, the Company expanded its factory area to 8000m2, launched the

high-class pastry brand Cindy, and opened a representative office in Hanoi.

Currently, the Company is investing in opening a high-class bakery factory

in Phu Tho with a total area of up to 5000m2, increasing the capacity to 5 tons of

flour per day. New investment in carton and plastic tray production lines, in order

to proactively provide a part of packaging for products. 4 2.2.

Operating characteristics and consumption market

Currently, the company is manufacturing and supplying cakes and instant

cakes every day. In addition, the company also transfers production technology to

facilities and factories in the fields of pastry processing technology and imports

equipment, technology and raw materials for food production.

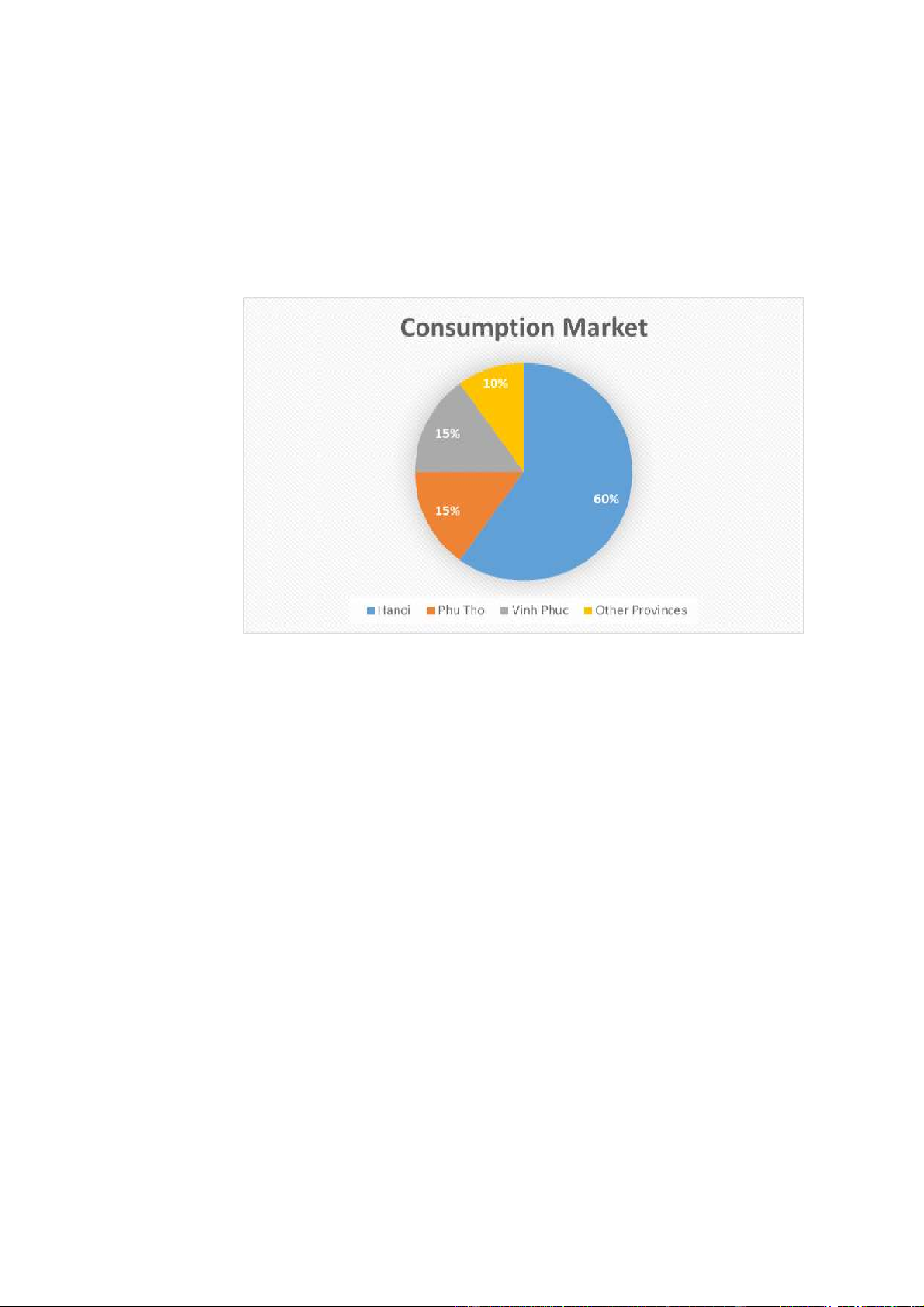

The company's products are a favorite and always selling well at

convenience stores in the Northside of Vietnam, most in Hanoi, Vinh Phuc

and Phu Tho. In which, Hanoi is the highest consumption area, accounting for

60% of the company's total product output. The convenience stores that the

company chooses to cooperate with are small and medium-sized, with evenly

distributed items, so consumers can easily access the products. The company

is gradually moving towards distributing products in large chain of

convenience stores such as Vinmart, Tomita, Dalatfarm to reach out to more

demanding customers in the big urban area.

2.3. Resources and Facilities

2.3.1. Organization stucture

Currently, GPV Vietnam Technology Co., Ltd has about 30 employees

including workers and board of directors. All workers, when recruited into the

factory, are thoroughly trained in food hygiene and safety and all of the

employee working in the department must meet the company's recruitment

requirements in terms of qualifications and experience. CHIEF EXECUTIVE DIRECTOR (CEO) DEPUTY DEPUTY BUSINESS TECHNICAL DIRECTOR DIRECTOR BUSINESS ADMINITRATION ACCOUNTING TECHNICAL DEPARTMENT DEPARTMENT DEPARTMENT DEPARTMENT

Chief Executive Direct (CEO) of the company is Mr. Vu Tien Thinh.

He is also the founder of GPV. His responsibilities are manages and directs

the company toward its primary goals and objectives. Oversees employment

decisions at the executive level of the company. Leads a team of executives to

consider major decisions including acquisitions, mergers, joint ventures, or large-scale expansion.

Deputy Business Director is Mr. Vu Tien Thinh has responsible for

overseeing the development of an organization's business goals and

objectives. They typically work to increase business revenue, identify and

develop business opportunities, and expand the company's presence and its brands.

Deputy Technical Director is Mr. Vu The Vuong has responsible for

recording the technical specifications of the products they use to maintain

consistency throughout the production process. He also makes purchases of

tech systems, oversee their installation and train their staff to use the new technology during production. 6 Business Department include marketing, finance, operations

management, human resource, and IT. These five divisions represent the

major departments within a publicly traded company, though there are often

smaller departments within autonomous firms.

Adminitration Departmant is important to any company because it

works across all departments and with all kinds of work. The functions of the

Admin Department include General Office Management; Asset Management;

Transport Management and Security and Safety Management.

Accounting Department records accounts payable and receivable,

inventory, payroll, fixed assets and all other financial elements. The

department's accountants review the records of each department to determine

the company's financial position and any changes required to run the company cost-effectively.

Technical Department has fuctions that manage, implement and inspect

technical work, ensure work progress, saftey, quality and economic efficiency

in company; management of using, reparing, purchasing equipments,

machines for business operations in company.

2.3.2. The main product

Salted shredded meat hamburger

(Net weight: 55g, Price 8,000-10,000/piece)

This is the company's first salty cake product. It is a best-selling

product, loved and trusted by consumers. Buttermilk hamburger

(Net weight: 55g, Price: 6,000-8,000/piece).Buttermilk hamburger

providesdelicious, convenient and nutrition.

Grape coconut milk bread (Net weight: 250g, Price 25,000- 30,000/piece).

This is a sold-out product as soon as it hits the shelves of GPV's high- end cake line. 8

Chrysanthemum bread (Net weight: 250g, Price 25,000-30,000/piece).

GPV's chrysanthemum bread product lines also possess extremely rich

nutritional content, suitable to be used by all ages. 2.3.3. Equipment

Although GPV is a young company, they invests in very modern

equipment and machinery to create high quality bakery products with

beautiful shapes, saving time and expenses for customers, workers and most

importantly, ensure food safety for products. A full set of cake production

lines with full equipment, high productivity, cost-effective support for bread-

making technology transfer include: Machine 1: Dough Mixer Machine 2: Cake Depositor Machine 3: Rotary Oven

Machine 4: Cake Filling Machine Machine 5: Cooling Conveyor Machine 6: Sterilization

Machine 7: Nitrogen Generator Set

Machine 8: Cake Packing Machine Machine 9: Date Printer 2.4.

Business results of the company in 3 years

Table 2.1: Income Statement from 2019-2021 (Unit: VND) Source: Business department Revenue

In 2019, the company's revenue reached more than 25 billion VND, by

2020 it will reach more than 30 billion VND, an increase of about 5 billion

VND. In 2021, the revenue suddenly increased by nearly one and a half times

higher, about 46 billion VND, an increase of nearly 15 billion VND compared

to 2020. It can be said that the company's revenue has a relatively fast growth.

It proves that the company has constantly made efforts to negotiate, seek to

expand economic relationships in order to increase revenue, and also show

that the quality of products of the enterprise is increasingly improved, created

reputable in the market. In 2019, the company's revenue was 25,623,489,000

VND. This is the year that GPV Technology Co., Ltd. has brought high-class

bakery products to the market. Thanks to this step forward, GPV's revenue in

2020 has increased by nearly 1.2 times. Another reason why revenue is

constantly growing is that the company is very diligent in researching and

understanding customers' tastes to launch new products on special holidays.

Not only that, GPV's products are also constantly innovating in terms of

design to meet the maximum needs of customers. The period 2020-2021 is a

difficult period because the COVID-19 epidemic creates many challenges for

most industries and business fields, but for food industry enterprises, 10

especially leading ones then there are many opportunities. Even, many food

businesses have outstanding business results thanks to flexibility and taking

advantage of available advantages. Adapting to the epidemic, in the context of

a complicated pandemic, many provinces and cities implement the distance,

businesses face difficulties, but there are still food businesses that rise to

dominate market share, large revenue growth and profit. This business has a

great advantage thanks to a closed ecosystem from production to distribution.

Thanks to that, even during the epidemic, the company was still flexibly

adapting, seizing opportunities to gain market share, and achieved impressive

business results. In 2021, the company's revenue is 45,965,621,000 VND, an

increase of more than 15 billion VND. Explaining this, besides the reasons

mentioned above, it must be mentioned that GPV officially started

construction of the factory in Phu Tho. Factory project in Phu Tho on an area

of 5,000m2, including building a factory and investing in a coconut grape cake

production line. The investment in phase 1 of a factory in Phu Tho is expected

to increase Bibica's average annual revenue by more than 40 billion

VND/year and the fact that revenue in 2021 has increased by more than 30

billion VND compared to the previous year 2020. Expense

Through the above analysis, we can see that the company's total

business expenses increased relatively quickly, in 2019 it was nearly 6 billion

VND, but in 2020 it is more than 7 billion VND. In 2021, the company's total

business expenses are nearly 11 billion VND. The fluctuation in selling

expenses from 2019 to 2020 is VND 1,165,683,000. The fluctuation of selling

expenses in 2020 - 2021 is VND 3,711,342,500. Specifically, fluctuations in

selling and administrative expenses are as follows. Selling expenses in the

period of 2019 - 2021, the proportion of selling expenses in total revenue

increased continuously. In 2019, selling expenses were nearly 4 billion VND,

in 2020 it was 4.8 billion VND. In 2021, selling expenses are more than 7

billion VND. The fluctuation in selling expenses for 2019–2020 is VND

777,122,000. The fluctuation of selling expenses in 2020-2021 is VND

2,474,228,333. Although selling expenses increased, the expense ratio

decreased. Administration expenses in 2019 reached nearly 2 billion VND.

The volatility of 2019 - 2020 is 388,561,000 VND. The 2020-2021 volatility

is 1,237,114,167 VND. Similar to selling expenses, although administrative

expenses have increased over the years. However, although selling expenses,

general and administrative expenses, and total operating expenses increased,

the expense ratio still decreased. That's because the company has applied the

advancement of science and technology, using software to help plan

enterprise resources. The company has fully applied the features of the

software suite, including: Accounting and Finance Management, Sales

Management, Purchasing Management, Warehouse Management, Production

Management. This helps GPV manage business activities more scientifically.

Therefore, although selling and administrative expenses still increased, but

the company managed well, so the expense ratio over the years still decreased. Profit

In 2019, GPV's total pre-tax profit reached nearly VND 18 billion. In

2020, this number has reached over 21 billion VND and increased by more

than 3 billion VND compared to 2019. From 2020 to 2021, the total profit

before tax of enterprises has increased faster than the period of 2019-2020,

reaching a high level. nearly 33 billion VND. In general, the profit structure

of the enterprise does not have many significant changes. In the period of

2019 - 2020, profit from production and business activities increased by more

than 3 billion VND. Besides, other profit increased by more than 300 million

dong. However, because it accounts for a small proportion of the total profit,

this figure, although large, does not affect the growth of the total profit. From

2020 to 2021, the profit from production and business activities increased 12

sharply, more than 10 billion VND. At the same time, other profits increased

by more than 1 billion dong. High-class cakes or steamed cakes are consumed

strongly in the midst of the pandemic. With high profit margins, modern sales

channels will create new growth drivers. The COVID-19 pandemic has

changed consumption trends, creating opportunities for modern distribution

channels to develop rapidly as people choose to shop online at home and

supermarkets with quality products. and origin. 2.5.

Performance Analysis Strength

In general, the company's revenue increased rapidly from VND 25.6

billion to nearly VND 46 billion mainly because the company expanded the

market and improved product quality.

GPV is a brand on the rise in the Vietnamese confectionery market

today. The company focuses on improving product quality and building a

brand name in the market. Part of that is because the company has constantly

researched and understood the tastes of customers to launch new products on

special holidays and care about the needs of all customers of all ages.

GPV is a company with quite good asset utilization efficiency,

especially current asset utilization efficiency. The number of days of a

working capital turnover is relatively fast compared to other companies in the

same industry, Bibica's solvency is relatively good, it can avoid the pressure

of debt repayment as well as the ability to raise capital easily. The company

currently has 35 distributors, of which 12 distributors of the Company's

products have been consumed in Hanoi city, 9 distributors in Vinh Phuc

province factory, 8 distributors in Phu Tho province and the remaining 6

distributors in other provinces. Weakness

The increase in the cost of input materials of the product due to the

Covid epidemic affects the company's revenue and is also a difficult problem

for the company to increase or keep the product price unchanged.

Currently, students and workers are mainly working remotely due to the

Covid epidemic, so the purchasing power of the company's products is less than

before. Over the past three years, the company's total expenses increased quite

rapidly in 2019 from nearly 6 billion VND to 11 billion VND in 2021. Because

the company spent too much on selling expenses. Although revenue increased, the

company's profit did not increase as expected, which is reflected in the company's

low profit-to-revenue ratio. Therefore, to meet the needs of development, the

company needs to take measures to improve profits in the future. Opportunities

Bread and instant products are essential necessities, so the demand for the

company's products is increasing, especially during the Covid-19 pandemic. The

company is currently expanding its production plant in Vinh Phuc and opening a

new factory in Phu Tho will increase the company's production capacity, fully

meeting the needs of the market in Hanoi and the northern provinces. At the

same time, this is also a good opportunity to expand the market of the product to

the central provinces and especially the southern market. The Covid-19 epidemic

also created opportunities for the Company to promote its brand and increase

revenue from isolation areas and hospitals. Thearts

Currently, many companies and units are also entering the market of

instant cake production, so there will be many competitors, requiring the

company to improve and diversify products and innovate to meet the needs of

customers. increasing consumer demand. Imported bakery products are also

increasing due to Vietnam's accession to AFTA, the import tax rate of

confectionery products will be reduced, so the selling price of these products

can be more competitive, which consumers Vietnam is also very fond of

imported goods, which will be a challenge for the company's products. 14

PTER 3: CONCLUSIONS AND RECOMMENDATIONS 3.

Conclusions and Recommendations 3.1. Conclusions

Despite facing pressure from partners and difficulties of the economy,

GPV has continuously expanded its investment for 3 years now. From the

construction of a steam cake production line at the factory in Vinh Phuc to the

construction of a new factory in Phu Tho. All In 2021, GPV invests in 2 new

production lines. It is expected that in 2022, these two lines will bring the

Company an additional VND 40 billion and the Company's market share will

increase to 5%. If 100% capacity is fully exploited, GPV's market share will

increase to 10% market share. The Company's vision to 2025 will be to

become a leader in the confectionery industry in Vietnam are aimed at making

GPV the leading confectionery brand in the market. To get there, we had to

scale up, increase our selling point, and increase our reach. And before that,

new factories were invested and built. When the factory in Phu Tho comes

into operation, GPV's output can double provide quality products at

reasonable prices. Upgrading the value chain through collaborative

participation, responsibility of the owner and proper training Develop an

effective distribution network Expand the activities of affiliated units through partners above Global. 3.2. Recommendations Increase revenue.

Abou the product quality, enhance the role of the quality system

management function and inspect and monitor the processes at the company's

quality management department to ensure the quality of the product. Establish

a self-inspection, supervision mechanism in all departments, to ensure that

each department and workshop must have sufficient data and records to be

statistically analyzed for operational management and improvement.

continuous progress. Make the most of the available resources into the main

activities of the company, avoiding waste or improper use. Promote marketing

and sales, the company should have a strategy to develop a suitable sales

system. In the immediate future, it is necessary to focus on expanding the

market share of old customers through measures to stabilize prices, diversify

products in the market and strengthen customer care. Gradually develop and

expand market share for potential and new customers. Establishing a team

specializing in competitor research to advise the leadership, the business

department to change - improve management - technology in a timely manner

to maintain competitive advantage. Enterprises should have a reasonable view

and assessment of the risk of debt collection occurring to reduce receivables.

Striving to complete the facilities, sell good quality products to increase

prestige and enhance competitiveness. Reduce the cost

It is necessary to diversify suppliers to have competition in price and

quality of input materials. Continue to review and improve the cost control

system in each department and workshop with the goal of maximizing

existing resources and minimizing costs. Having a policy to manage and

control expenses that are reasonable with the revenue and profit derived from

that increase in costs. Like expenses, typically marketing costs and sales

department salaries increase too quickly, this can increase revenue but also

reduce profits. Therefore, the company needs to make the most of the

resources to avoid the case where the costs are too much compared to the

profits achieved. The company needs to control the growth of financial costs,

by reducing inventory and investments to reduce bank loans, reduce interest

expenses, calculate capital needs each period to have plan to use loan capital

effectively in the period of high inflation economy. Control and use the

unused portion of fixed assets to save maximum costs. Manage inventory

rationally and effectively, minimizing storage costs. There is a department 16

that regularly reviews and strictly manages the transportation process as well

as the preservation of goods to minimize possible damage and loss. There is a

reasonable mechanism of punishment as well as reward to encourage

individuals and departments to well implement the cost control plan at their

units. The company should have a policy to urge as well as quickly complete

the factory project in Phu Tho and put it into stable operation in order to

minimize fixed costs (such as land rent). Manage Accounts Receivable

The company should limit the amount of outstanding capital in

payment. To do that, the company must implement a number of solutions as

follows: Apply policies to encourage customers to pay quickly: payment

discount. It is necessary to evaluate and classify customers based on the

history of trading relationships between the company and customers, or

evaluate the business and financial activities of the customer. If good

customers sell in large volume, average customers sell in limited volume,

weak customers should not sell on credit. Strictly control debt monitoring and

debt collection. Evaluate and make reasonable provision for receivables for

bad debts. Legally handle the case of overdue debt intentionally entangled,

appropriating capital of the company. Manage Accounts Payable

The company should adjust short-term assets reasonably so that it can both

ensure the payment of debts and use capital more efficiently, and at the same

time, avoid long-standing inventory stagnation to reduce quality and

reputation. with customers while at the same time ensuring solvency in the

short term. If the economy is stable, the company should consider taking

advantage of financial leverage by increasing the debt ratio to a safe level of

debt in order to make the most of debt instead of self-financing. equity and

tax savings from the use of debt, increasing net income. In the context of the

current high inflation economy, the company should consider reducing the

debt ratio below the debt safety level. Defining the functions and duties of

specific departments. Create conditions for management staff to learn and

improve their professional qualifications. In order to promote the ability and

complete the assigned tasks effectively, the company needs to encourage and

timely reward individuals and groups with outstanding achievements in

management as well as in production. 18