Preview text:

lOMoAR cPSD| 47270246

SUPPLY, DEMAND AND GOVERNEMNT POLICIES MICROECONOMICS WEEK 5 CONTROLS ON PRICES -

Market ice cream in chapter 4: at the euilibrium price -

Conflict between American association of ice cream eaters ( AAIE & of ice cream Maker ( AAIM )

+ AAIE : $3/cone too high for everyone to enjoy 1 conr/day

+ AAIM: $3/cone too low, it depneds incomes of the members

Buyers always want lower price , seller want lower price -

Each of group lobbies the government to pass law that alter market

outcome by directly controlling the price of an ice cream cone -

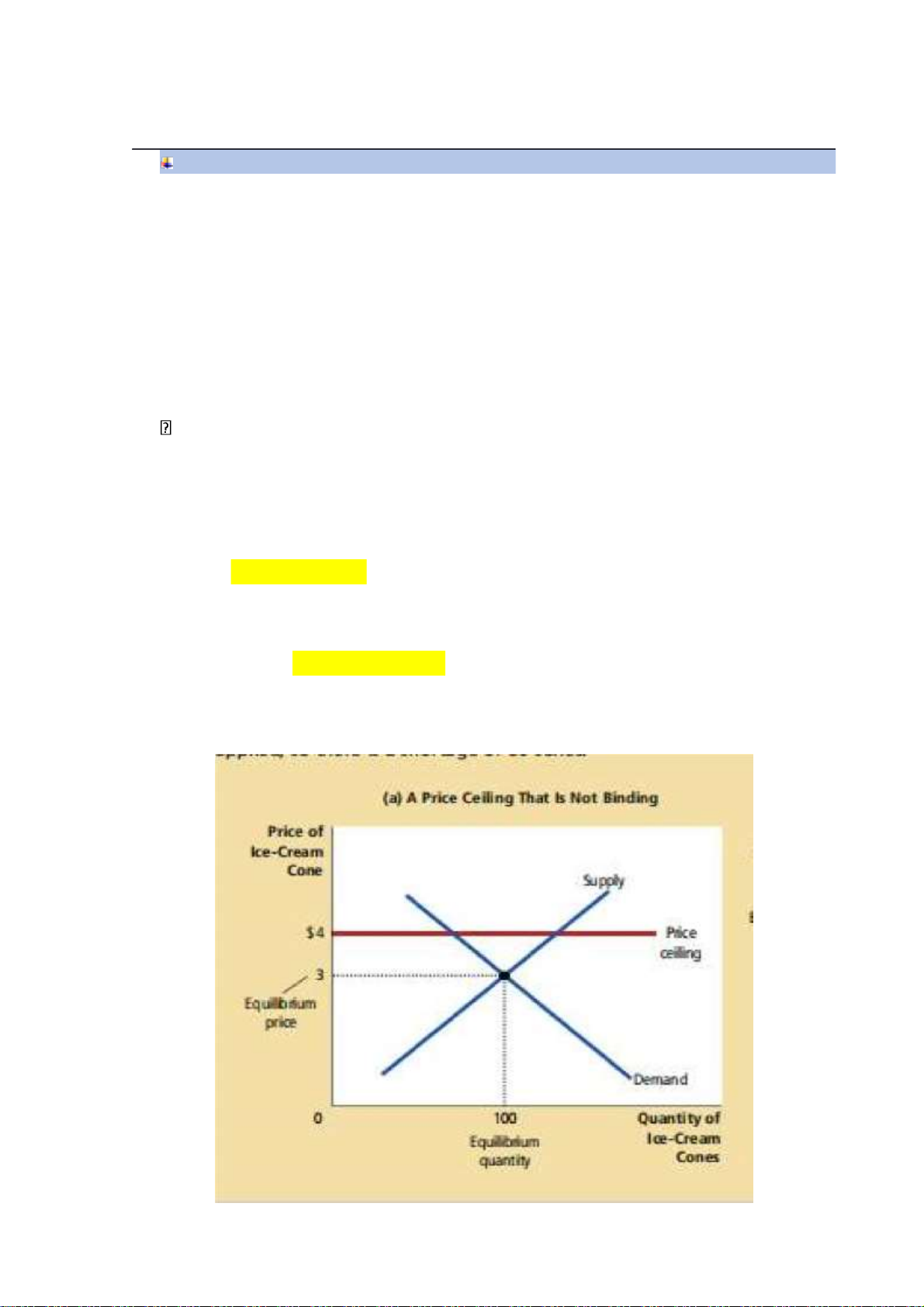

If the ice cream eaters are successful in lobby, the government

imposes a legal maximum on the price ice cream cone can be sold -> it is price ceiling -

By contrast, if the Ice-Cream Makers are successful, the government

imposes a legal minimum on the price. Because the price cannot fall

below this level, the legislated minimum is called a price floor. lOMoAR cPSD| 47270246

• How price ceiling affect the market outcome -

In response to this shortage, some mechanism for rationing ice cream will be naturallyy dveloped

+ Buyers queue up ij the long line, some other quit

+ Sellers could reion ice cream according to thir personal biases, selling to onlu friends,.. -

Notice that even though the price ceiling was motivated by a desire to

help buyers of ice cream, not all buyers benefit from the policy.

When the government imposes a binding price ceiling on a competitive

market, a shortage of the good arises, and sellers must ration the scarce

goods among the large number of potential buyers. -

The rationing mechanisms that develop under price ceilings are rarely

desirable. Long lines are inefficient because they waste buyers’ time.

Discrimination according to seller bias is both inefficient (because the

good does not necessarily go to the buyer who values it most highly)

and potentially unfair. By contrast, the rationing mechanism in a free,

competitive market is both efficient and impersonal. When the market lOMoAR cPSD| 47270246

for ice cream reaches its equilibrium, anyone who wants to pay the

market price can get a cone. Free markets ration goods with prices.

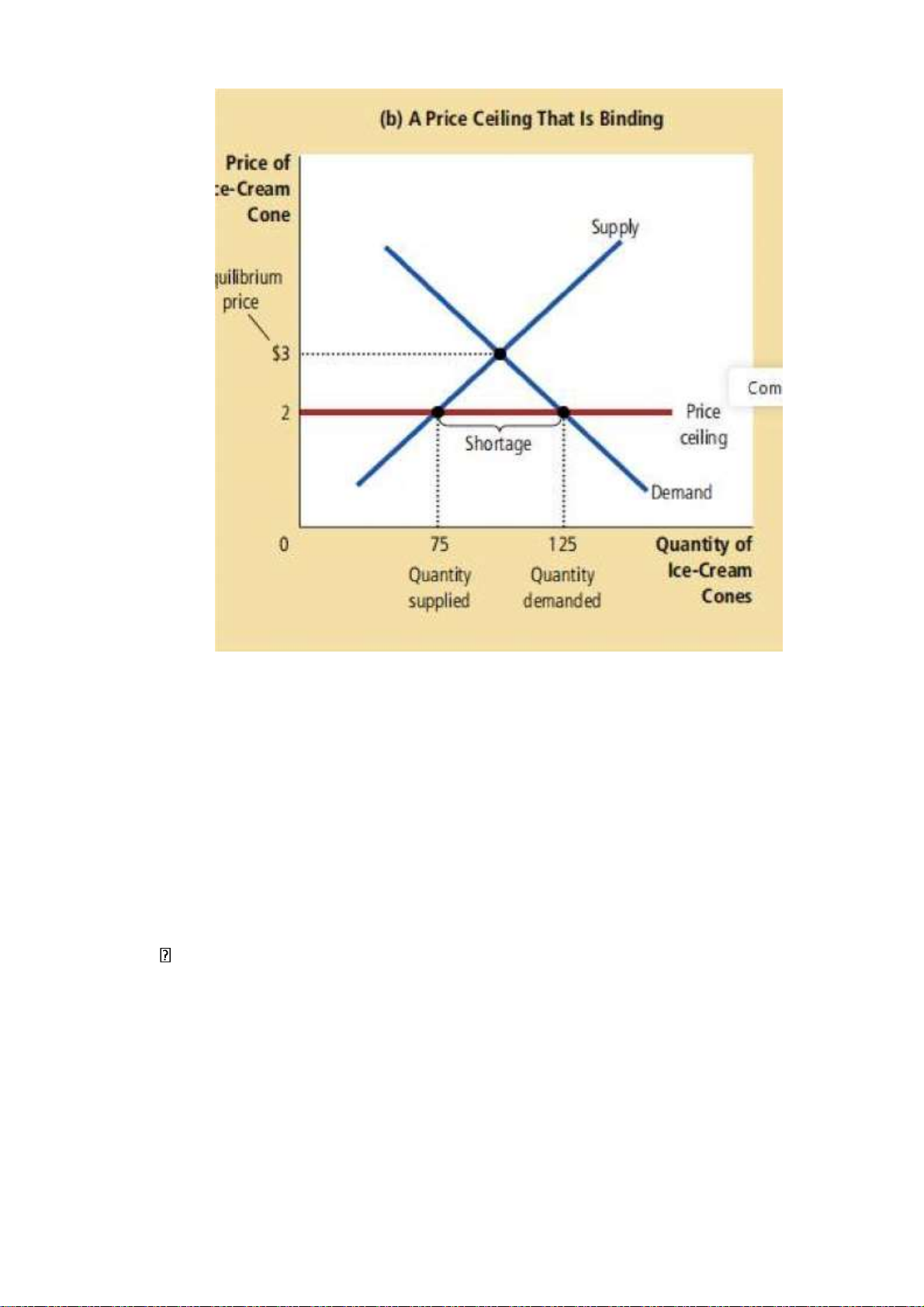

How price floor affect market outcomes

A binding piece floor causes a surplus -

Surplus can lead to undesirable rationing mechanism : The sellers who

appeal to the personal biases of the buyers, perhaps due to racial or

familial ties, are better able to sell their goods than those who do not. -

By contrast, in free market , the price serves as the rationing

mechanism, and sellers can sell all they want at the equilibrium price. -

Principle 6 : Markets are usually a good way to organize the market -

Principle 7 : government can sometimes improve market outcome

+ Price control is aimed to help the poor

+ Policy markers are led to control price bcs they view the market’s outcome as unfair

• Evaluating the Price Control -

Price controlls often hurt those they’re trying toohelp

+ rent control may help rent low, but also discourage landlord from

maintaining their buildings n make the housing hard to find +

minimum-wage laws may raise the incomrs of some workers but also

can cause other waorkers to be unemployed . lOMoAR cPSD| 47270246 -

Helping in-need ppl can be accomplished in ways other can controlling prices -

Although these alternative policies are often better than price control but they are not perfect -

Rent n wage subsidies costs the government money n thus, require high taxes TAXES -

All government use taxes to raise revenue for public projects : roads ,s chools, n national defense •

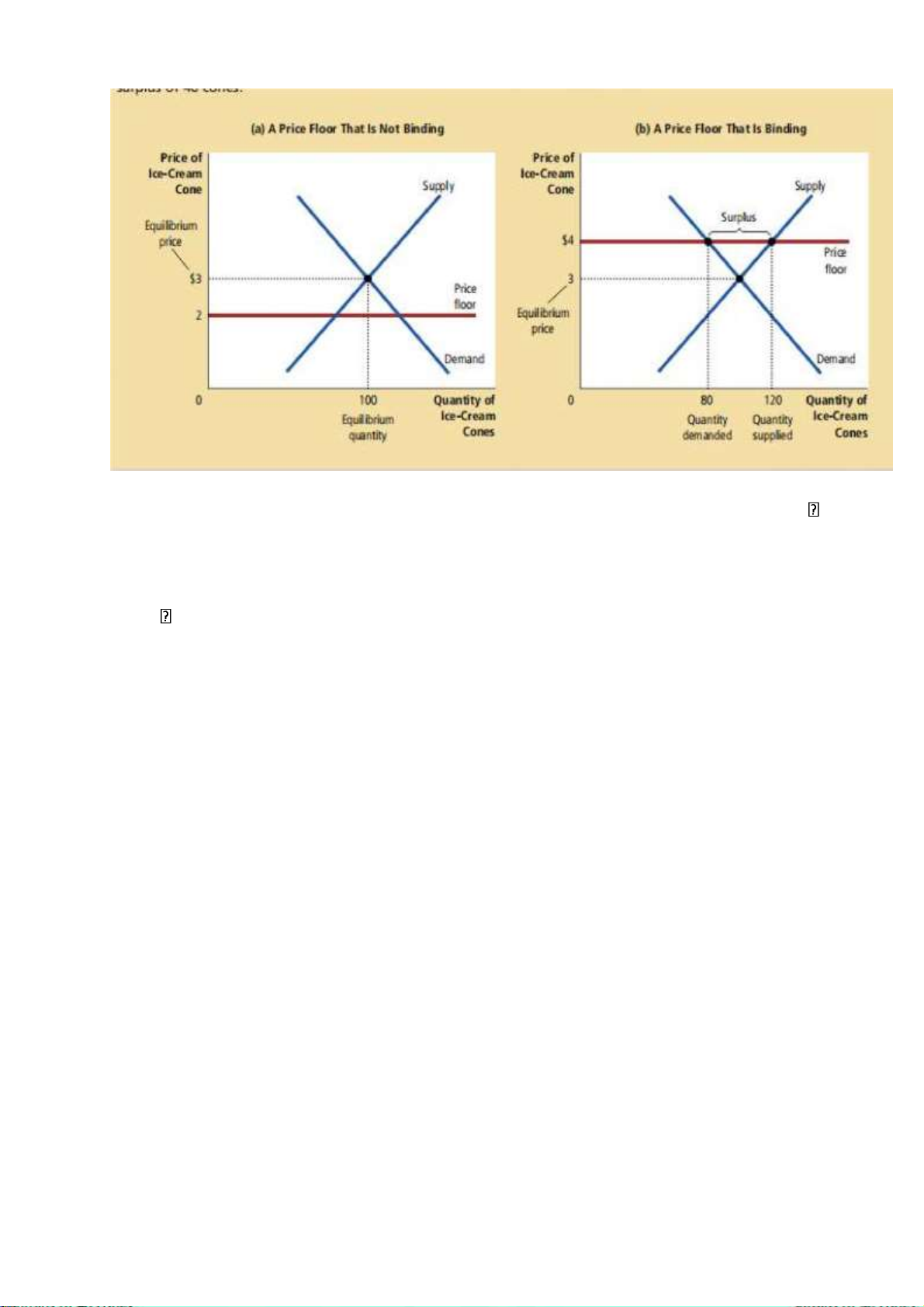

How Tax on sellers affect Market outcome •

- Suppose the local government passes a law requirinh seller of ice

cream cones to send 0,5/ cold coen to the government

- Follow 3 steps in Chap 4 – analysing supplu n demand

+ Step1: decide whether the law affects the supply curve or demanf

curve : the demand curve doesn’t change the tax shift the supply curve lOMoAR cPSD| 47270246

+ Step2: decide ehich way the curve shift: it reduce the quantity

supplied the supply curve shifg to the left must be higher than $0,5 to compensate

+ Step3: examine hjow it affect the euilibrium quantity n price: E

price is rise , E quantity fall taxes reduce the size of the ice cream market Implication : Who pay the tax

- Although sellers send the entire tax to the government, buyers n sellers

share the burden => the tax make buyers n sellers worse off

- Two lessons sum up: taxes discourage market activity / buyers n sellers share the burden •

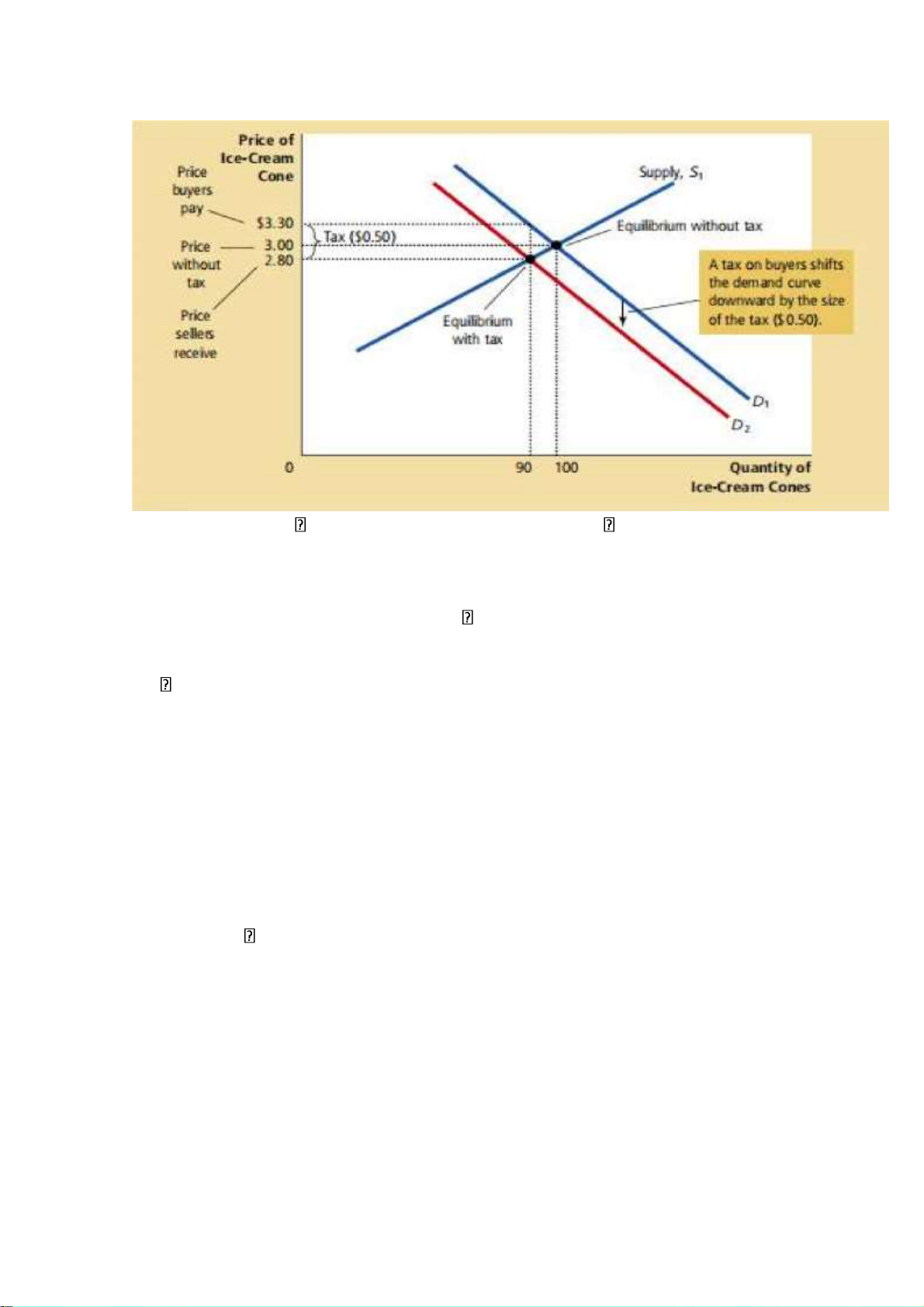

How taxes on Buyers affcet market outcome

Case 2 : Suppose that local govern, passes a law requiring the

buyers of ice cream cone to send 0,5 $ / purchases cone to the

government => What are the effect of this law ?

- Step 1: The initial impact of the tax is on the demand for ice cream.

The supply curve is not affected because, for any given price of ice

cream, sellers have the same incentive to provide ice cream to the

market. By contrast, buyers now have to pay a tax to the government

(as well as the price to the sellers) whenever they buy ice cream. Thus,

the tax shifts the demand curve for ice cream. lOMoAR cPSD| 47270246

- Step 2 : Determmine the directio of the shift

- Step 3: Comparing the initia n the new E to see the effect of the tax

- Implication: The only difference between th two is who sends the

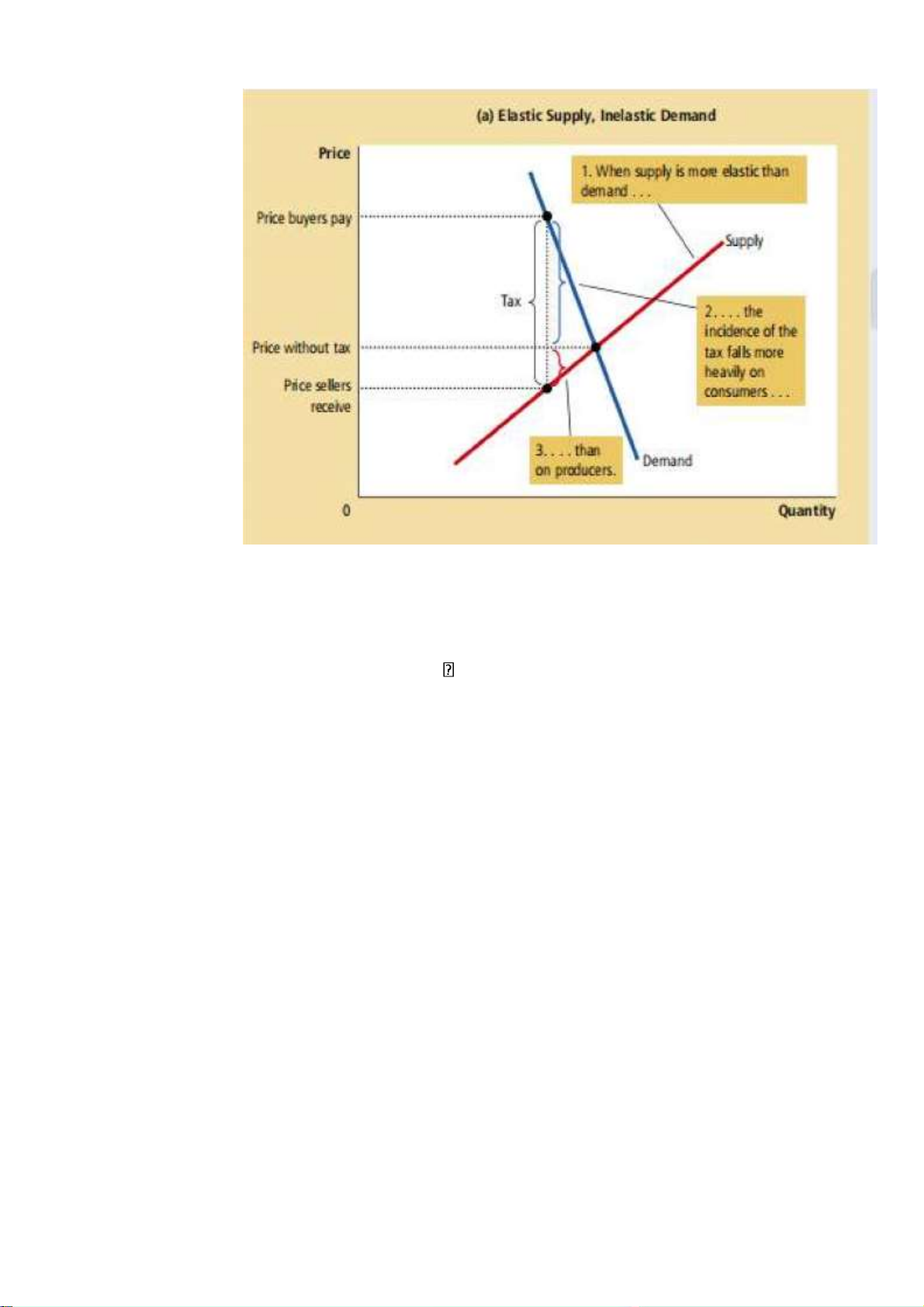

money to the government Elasticity n Tax incidence

- Panel b: inelastic supply n very elastic demand => sller bear most of burden of the tax

- The differnce between 2 panel is the relative elasticity of supply n demand