Preview text:

lOMoAR cPSD| 58562220

Problem 8.4 Botany Bay Corporation

Botany Bay Corporation of Australia seeks to borrow US$30,000,000 in the Eurodollar market. Funding is needed for two years. Investigation leads to

three possibilities. Compare the alternatives and make a recommendation.

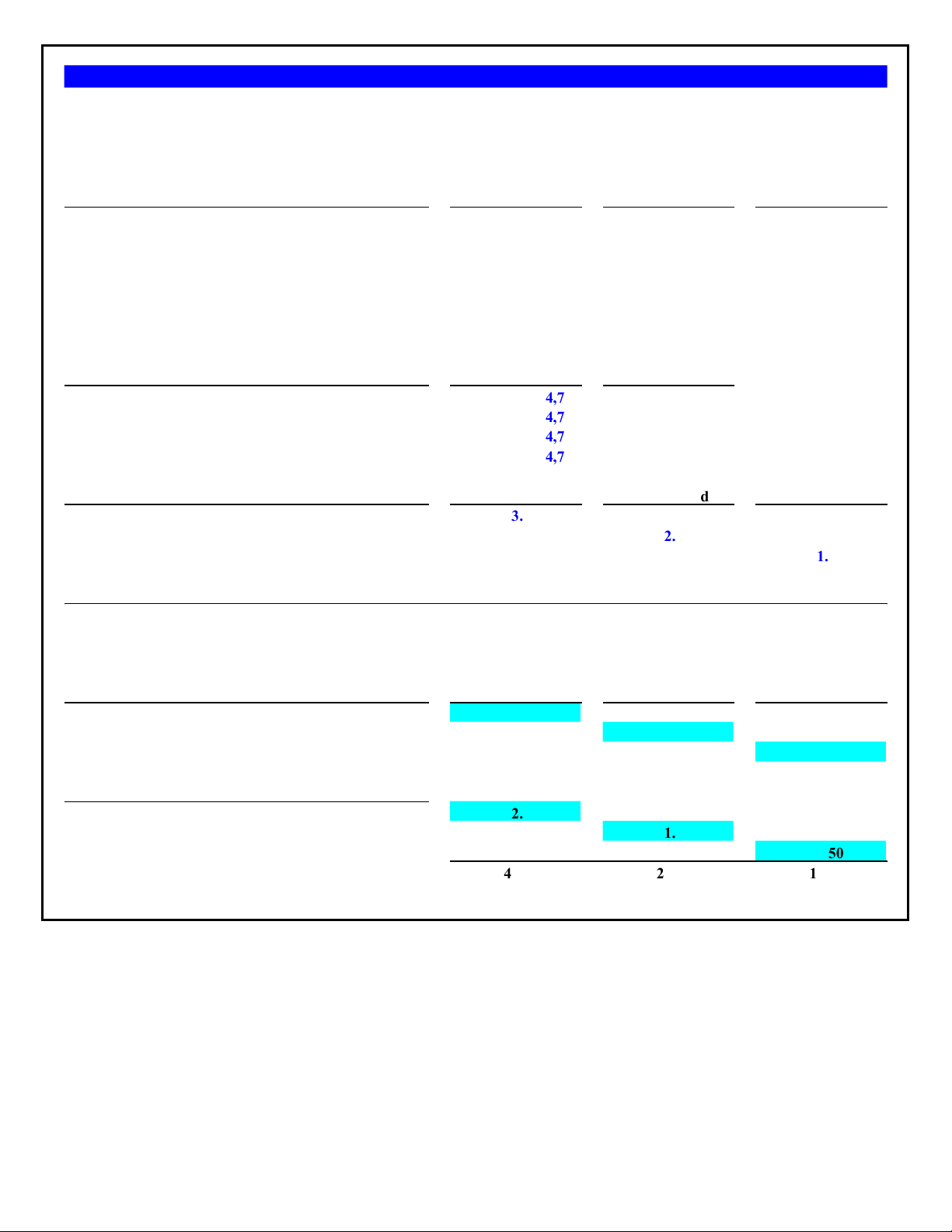

#1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 5% rate of interest

#2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.5%. LIBOR is currently 3.5%, and the rate would be reset every six months #3.

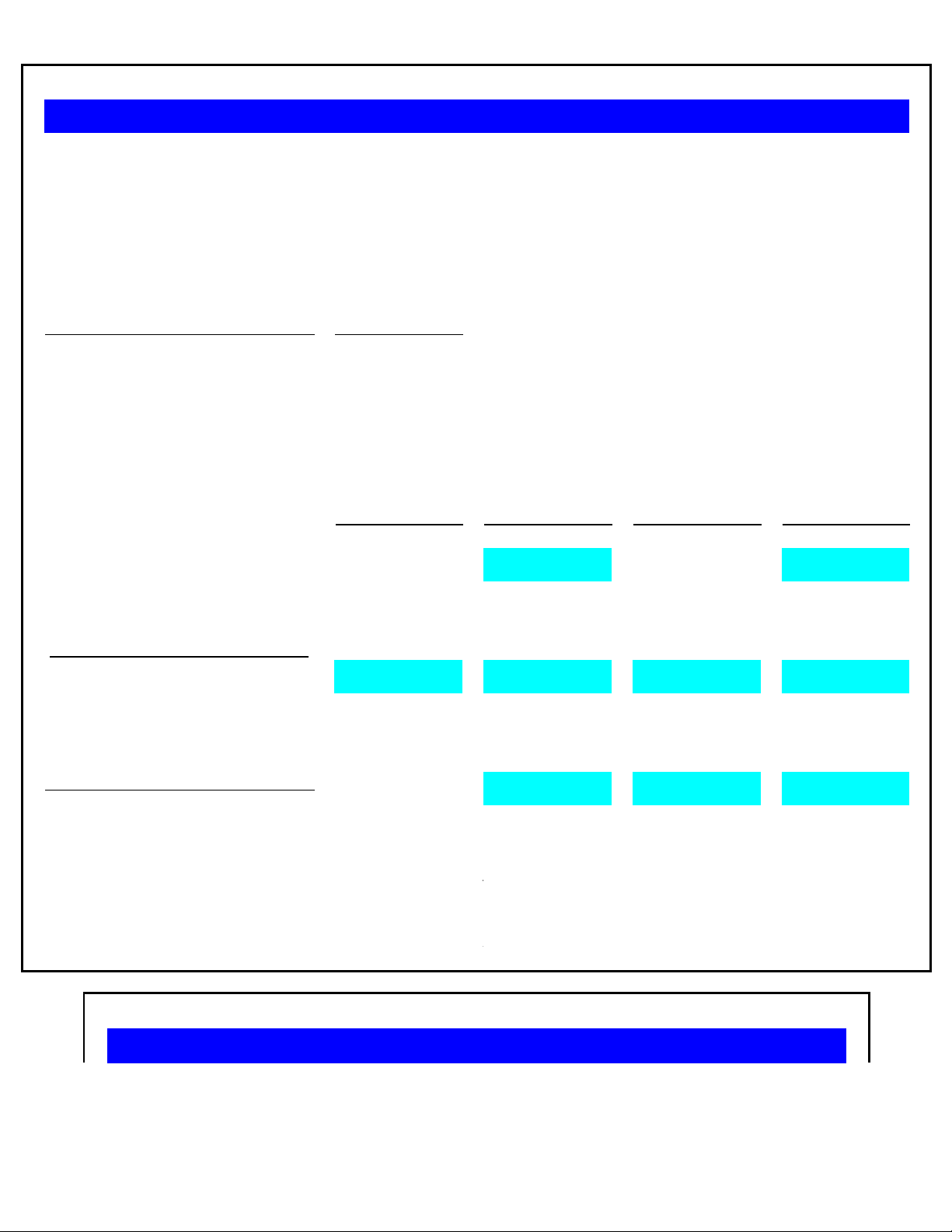

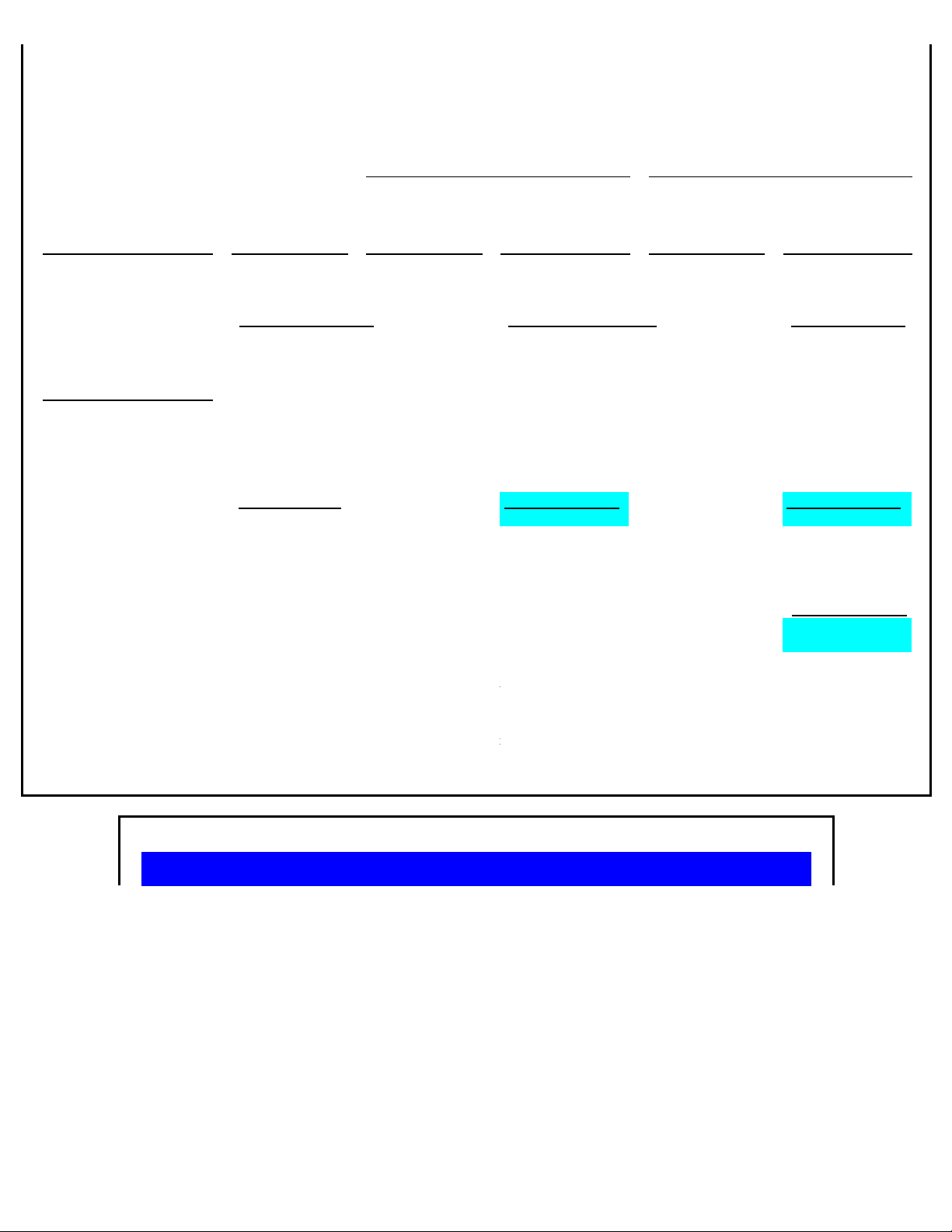

Botany Bay could borrow the US$30,000,000 for one year only at 4.5%. At the end of the first year Botany Bay would have to negotiate for a new one-year loan. Assumptions Values Principal borrowing need ($ 30.000.000) Maturity needed, in years ( 2,00) Fixed rate, 2 years 5,000%

Floating rate, six-month LIBOR + spread Current six-month LIBOR 3,500% Spread 1,500%

Fixed rate, 1 year, then re-fund 4,500% First 6-months Second 6-months Third 6-months Fourth 6-months

#1: Fixed rate, 2 years Interest cost per year ($ 1.500.000) ($ 1.500.000)

Certainty over access to capital Certain Certain Certain Certain

Certainty over cost of capital Certain Certain Certain Certain

#2: Floating rate, six-month LIBOR + spread Interest cost per year ($ 750.000) ($ 750.000) ($ 750.000) ($ 750.000)

Certainty over access to capital Certain Certain Certain Certain

Certainty over cost of capital Certain Uncertain Uncertain Uncertain

#3: Fixed rate, 1 year, then re-fund ($ 1.350.000) ??? ??? Interest cost per year

Certainty over access to capital Certain Certain Uncertain Uncertain

Certainty over cost of capital Certain Certain Uncertain Uncertain

Only alternative #1 has a certain access and cost of capital for the full 2 yea r period.

Alternative #2 has certain access to capital for both years, but the interest co sts in the final 3 of 4 periods is uncertain.

Alternatvie #3, possessing a lower interest cost in year 1, has no guaranteed access to capital in the second year.

Depending on the company's business needs and tolerance for interest rate r isk, it could choose between #1 and #2.

Problem 8.5 Chrysler LLC lOMoAR cPSD| 58562220

Chrysler LLC, the now privately held company sold-off by DaimlerChrysler, must pay floating rate interest three

months from now. It wants to lock in these interest payments by buying an interest rate futures contract. Interest rate

futures for three months from now settled at 93.07, for a yield of 6.93% per annum.

a. If the floating interest rate three months from now is 6.00%, what did Chrysler gain or lose?

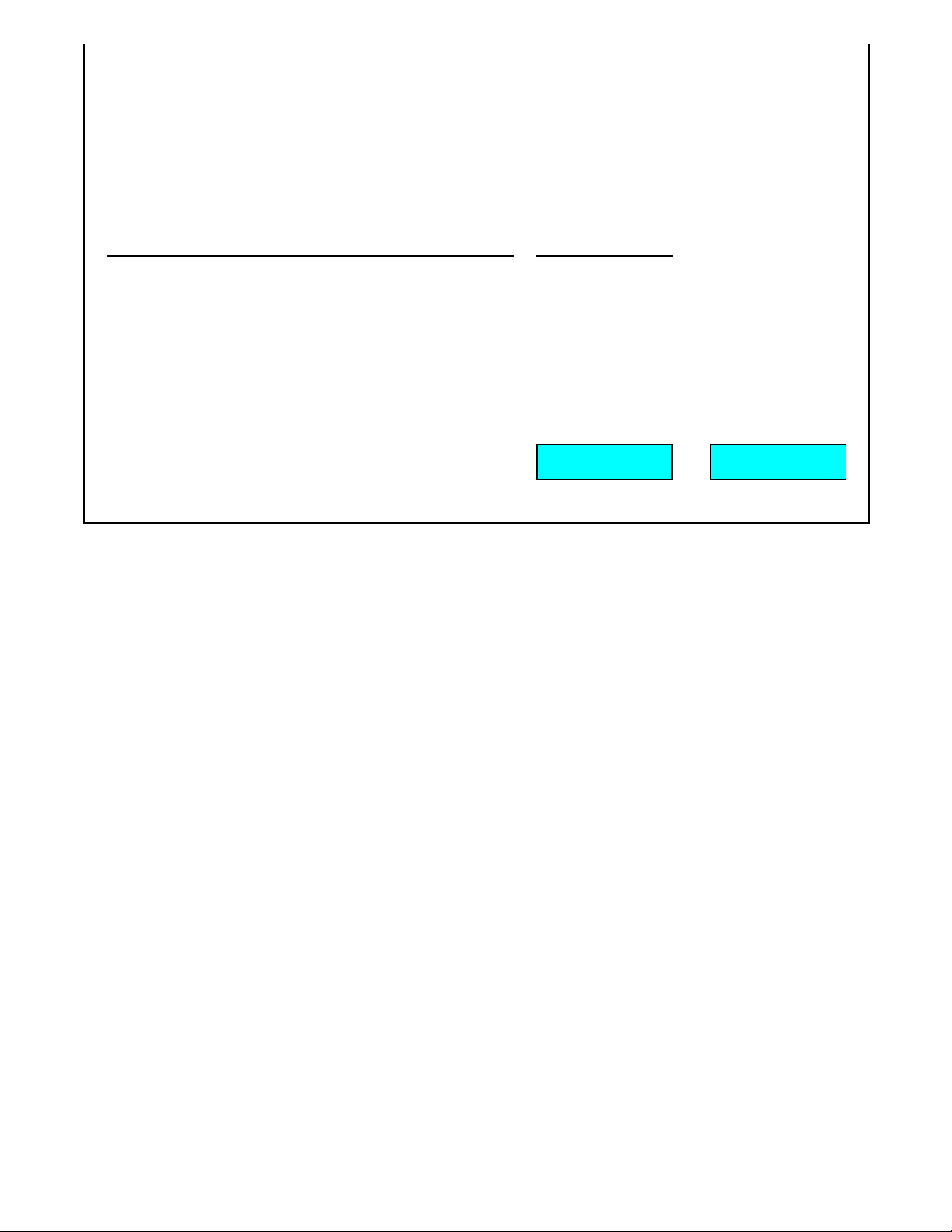

b. If the floating interest rate is 8.00% three months from now, what did Chrysler gain or lose? Assumptions Values

Interest rate futures, closing price ( 93,07)

Effective yield on interest rate futures 6,930% Three Months From Now Floating Rate is Floating Rate is

Chrysler's interest rate payments with futures 6,000% 8,000%

Interest payment due in three months 6,000% 8,000%

Sell a future (take a short position) -6,930% -6,930% Gain or loss on position -0,930% 1,070% Loss Gain lOMoAR cPSD| 58562220

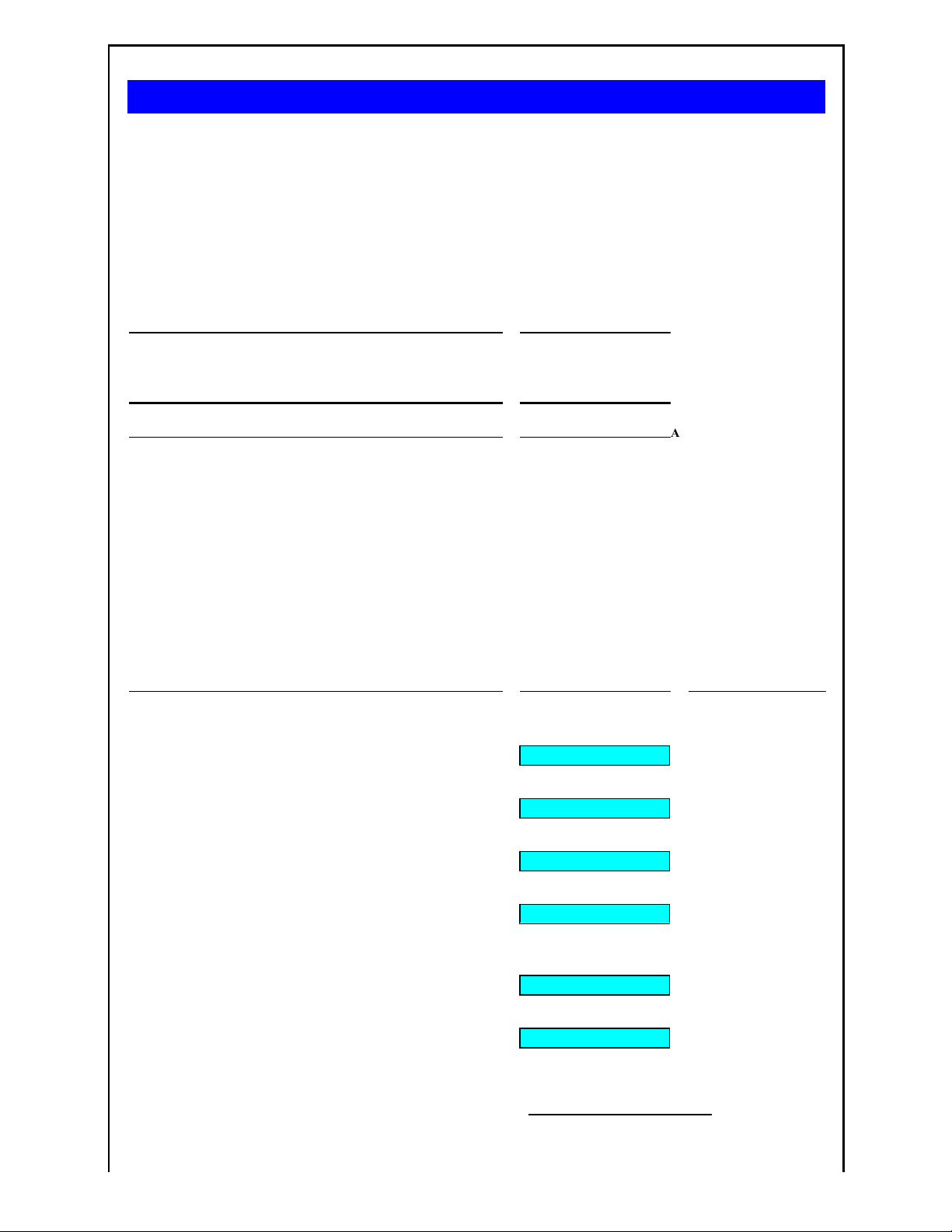

Problem 8.11 Raid Gauloises

Raid Gauloises is a rapidly growing French sporting goods and adventure racing outfitter. The company has decided to borrow €20,000,000 via a euro-euro floating

rate loan for four years. Raid must decide between two competing loan offerings from two of its banks.

Banque de Paris has offered the four-year debt at euro-LIBOR + 2.00% with an up-front initiation fee of 1.8%. Banque de Sorbonne, however, has offered

euroLIBOR + 2.5%, a higher spread, but with no loan initiation fees up-front, for the same term and principal. Both banks reset the interest rate at the end of each year.

Euro-LIBOR is currently 4.00%. Raid’s economist forecasts that LIBOR will rise by 0.5 percentage points each year. Banque de Sorbonne, however, officially

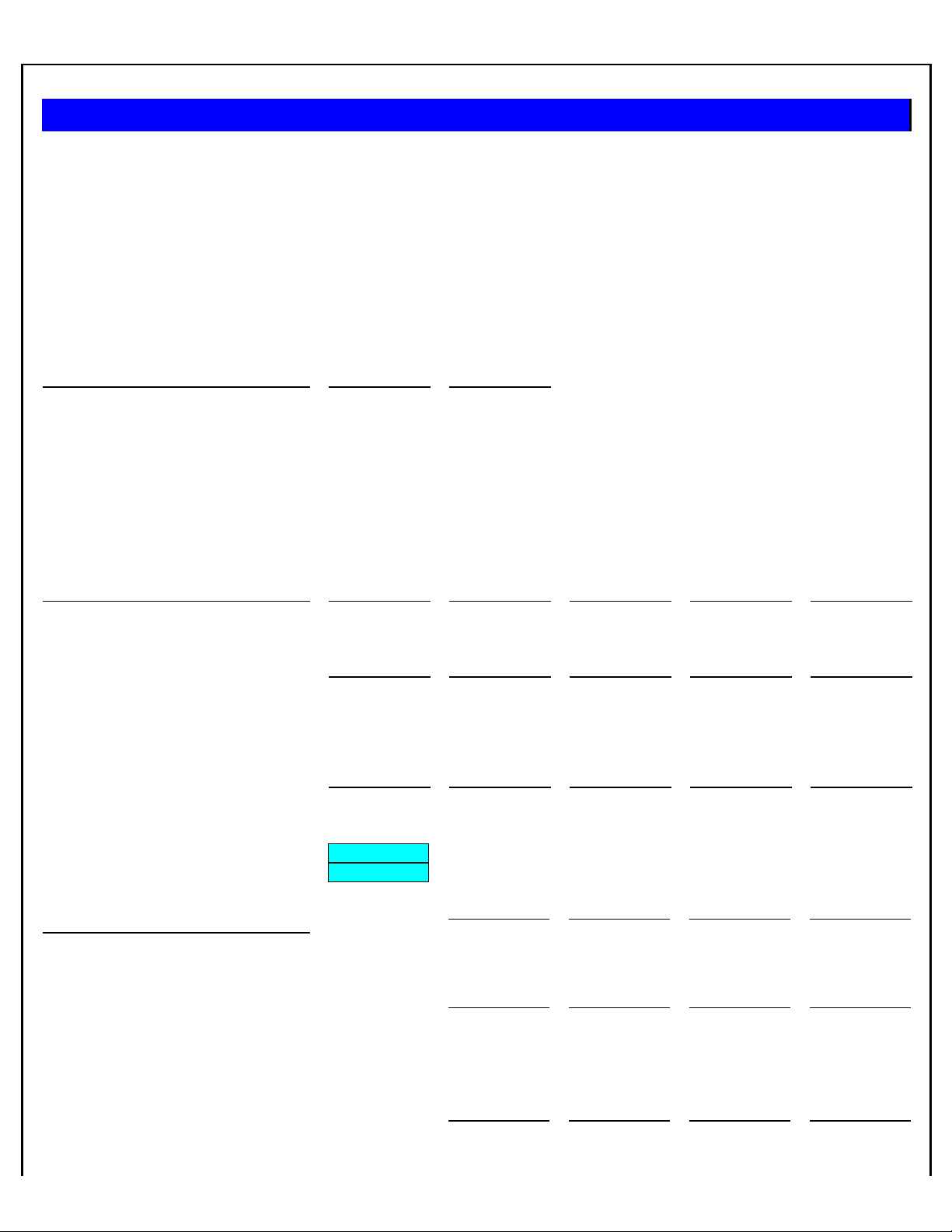

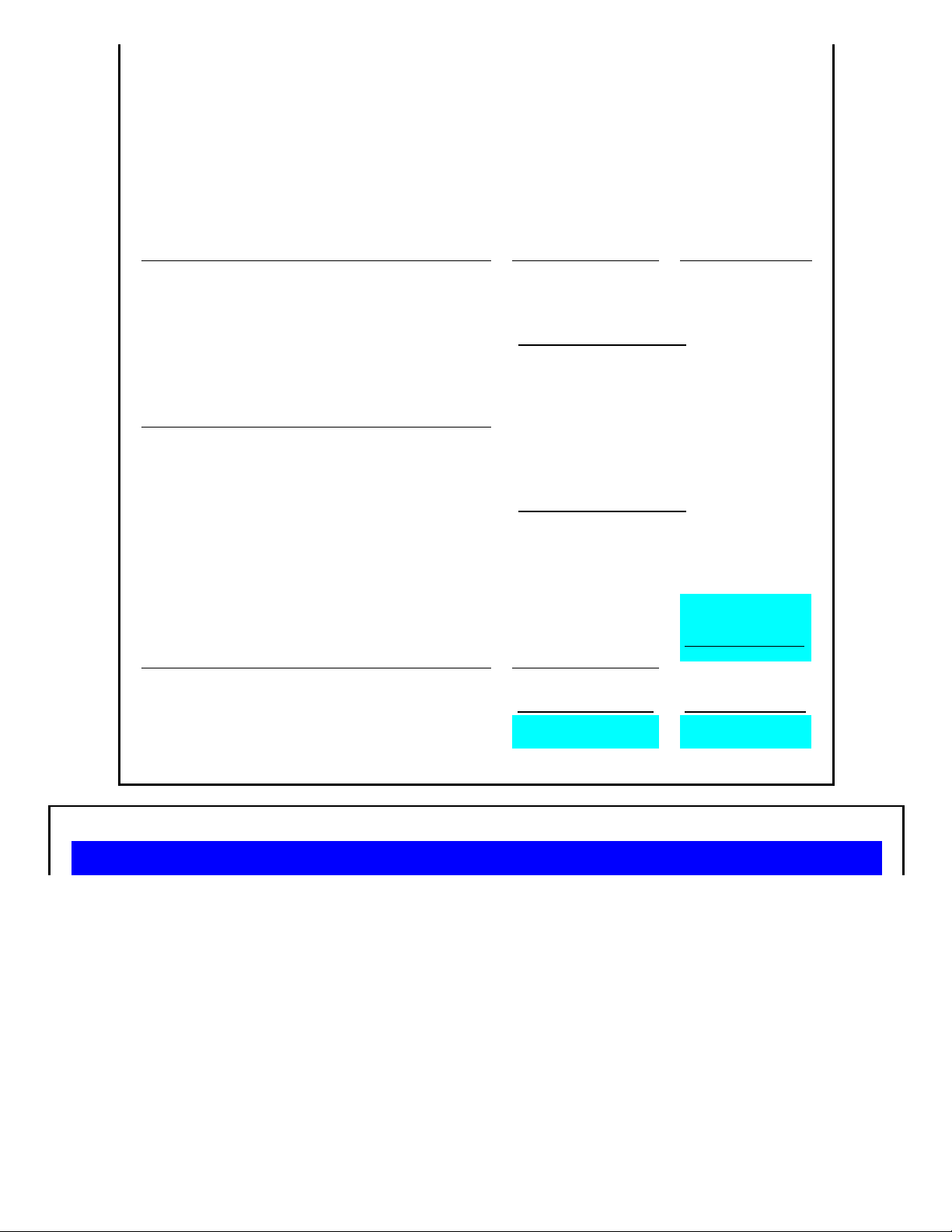

forecasts euro-LIBOR to begin trending upward at the rate of 0.25 percentage points per year. Raid Gauloises’s cost of capital is 11%. Which loan proposal do you recommend for Raid Gauloises? Expected Chg Assumptions Values in LIBOR Principal borrowing need € 20.000.000 Maturity needed, in years ( 4,00) Current euro-LIBOR 4,000%

Banque de Paris' spread & expectation 2,000% 0,500%

Banque de Paris' initiation fee 1,800%

Banque de Sorbonne's spread & expectation

2,500% 0,250% Banque de Sorbonne's initiation fee 0,000%

Raid Gauloises must evaluate both loan proposals under both potential interest rate scenarios.

Banque de Paris Loan Proposal Year 0 Year 1 Year 2 Year 3 Year 4

Expected interest rates & payments: Expected euro-LIBOR 4,000% 4,500% 5,000% 5,500% 6,000% Bank spread 2,000% 2,000% 2,000% 2,000% 2,000% Interest rate 6,000% 6,500% 7,000% 7,500% 8,000% Funds raised, net of fees € 19.640.000 Expected interest costs -€ 1.300.000 -€ 1.400.000 -€ 1.500.000 -€ 1.600.000 Repayment of principal -€ 20.000.000 Total cash flows € 19.640.000 -€ 1.300.000 -€ 1.400.000 -€ 1.500.000 -€ 21.600.000 All-in-cost of funds if:

euro-LIBOR rises 0.500% per year euro- 7,7438% LIBOR rises 0.250% per year 7,1365%

Found by plugging in .250% in expectations above. Year 0 Year 1 Year 2 Year 3 Year 4

Banque de Sorbonne Loan Proposal

Expected interest rates & payments: Expected euro-LIBOR 4,000% 4,250% 4,500% 4,750% 5,000% Bank spread 2,500% 2,500% 2,500% 2,500% 2,500% Interest rate 6,500% 6,750% 7,000% 7,250% 7,500% Funds raised, net of fees € 20.000.000 Expected interest costs -€ 1.350.000 -€ 1.400.000 -€ 1.450.000 -€ 1.500.000 Repayment of principal -€ 20.000.000 Total cash flows € 20.000.000 -€ 1.350.000 -€ 1.400.000 -€ 1.450.000 -€ 21.500.000 All-in-cost of funds if: lOMoAR cPSD| 58562220

euro-LIBOR rises 0.500% per year euro- 7,0370%

Found by plugging in .500% in expectations above. LIBOR rises 0.250% per year 7,1036%

The Banque de Sorbonne loan proposal is actually wer all-in-cost under either interest rate scenario. lo

Problem 8.12 Firenza Motors

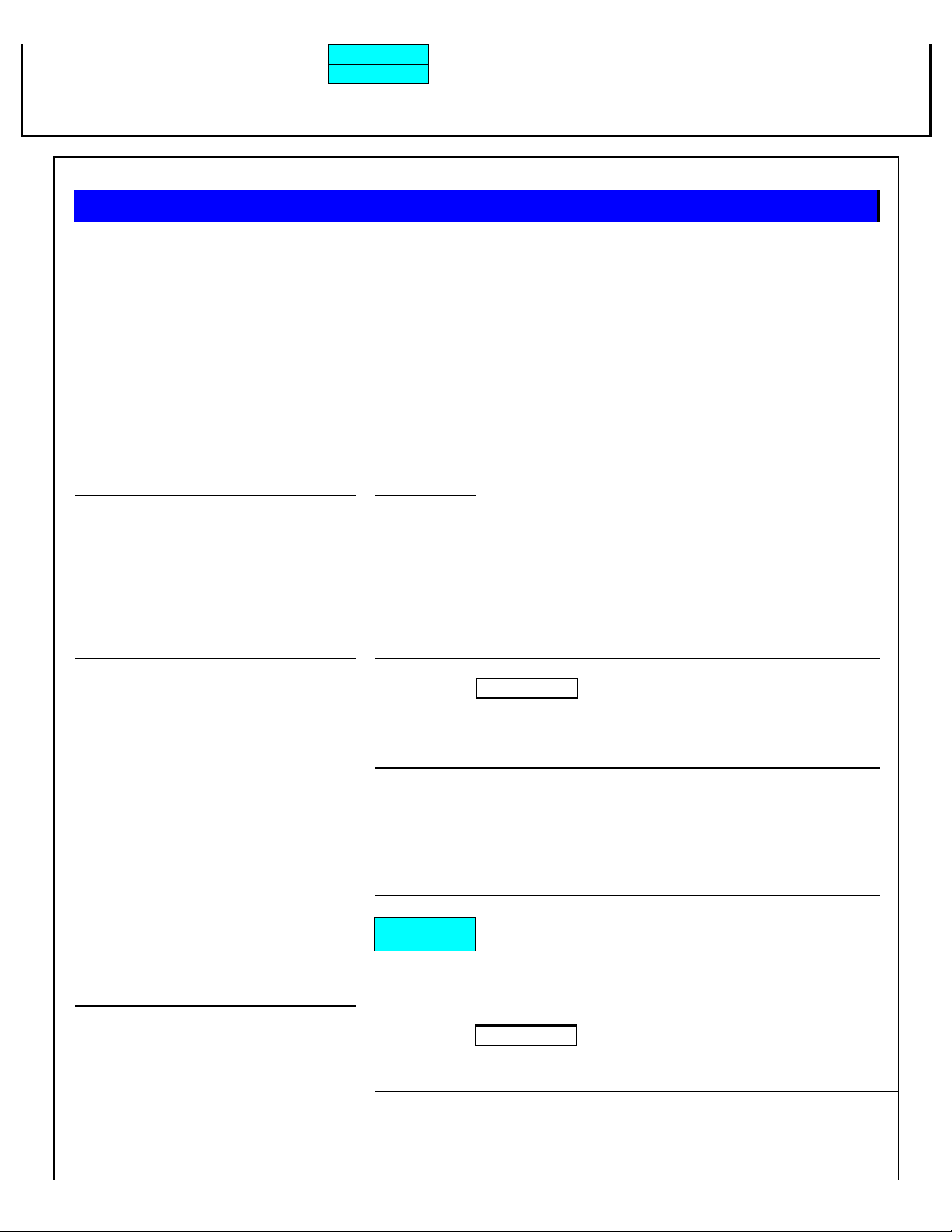

Firenza Motors of Italy recently took out a 4-year €5 million loan on a floating rate basis. It is now worried, however, about rising interest costs.

Although it had initially believed interest rates in the Euro-zone would be trending downward when taking out the loan, recent economic indicators show

growing inflationary pressures. Analysts are predicting that the European Central Bank will slow monetary growth driving interest rates up.

Firenza is now considering whether to seek some protection against a rise in euro-LIBOR, and is considering a Forward Rate Agreement (FRA)

with an insurance company. According to the agreement, Firenza would pay to the insurance company at the end of each year the difference between

its initial interest cost at LIBOR + 2.50% (6.50%) and any fall in interest cost due to a fall in LIBOR. Conversely, the insurance company would pay

to Firenza 70% of the difference between Firenza’s initial interest cost and any increase in interest costs caused by a rise in LIBOR.

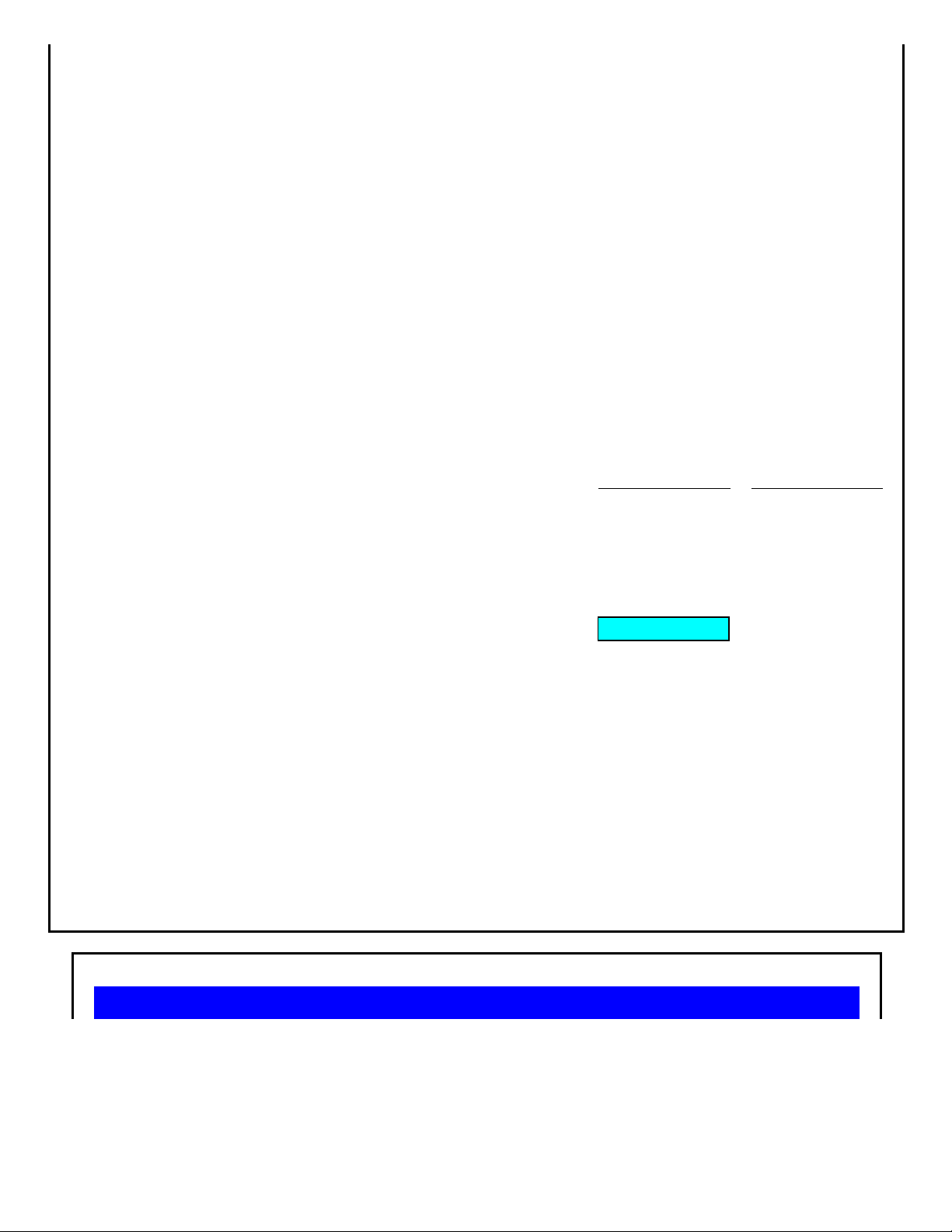

Purchase of the floating Rate Agreement will cost €100,000, paid at the time of the initial loan. What are Firenza’s annual financing costs now if

LIBOR rises and if LIBOR falls.? Firenza uses 12% as its weighted average cost of capital. Do you recommend that Firenza purchase the FRA? Assumptions Values Principal borrowing need € 5.000.000 Maturity needed, in years ( 4,00) Current LIBOR 4,000% Felini's bank spread 2,500%

Proportion of differential paid by FRA 70% Cost of FRA € 100.000

If LIBOR Falls 50 Basis Pts Per Year Year 0 Year 1 Year 2 Year 3 Year 4

Expected annual change in LIBOR -0,500% LIBOR 4,000% 3,500% 3,000% 2,500% 2,000% Bank spread 2,500% 2,500% 2,500% 2,500% 2,500% Interest rate 6,500% 6,000% 5,500% 5,000% 4,500% Funds raised, net of fees € 5.000.000

Expected interest (interest rate x principal) -€ 300.000 -€ 275.000 -€ 250.000 -€ 225.000 Forward Rate Agreement -€ 100.000 -€ 25.000 -€ 50.000 -€ 75.000 -€ 100.000 Repayment of principal -€ 5.000.000 Total cash flows € 4.900.000 -€ 325.000 -€ 325.000 -€ 325.000 -€ 5.325.000 All-in-cost of funds (IRR) 7,092%

If LIBOR Rises 50 Basis Pts Per Year Year 0 Year 1 Year 2 Year 3 Year 4

Expected annual change in LIBOR 0,500% LIBOR 4,000% 4,500% 5,000% 5,500% 6,000% Bank spread 2,500% 2,500% 2,500% 2,500% 2,500% Interest rate 6,500% 7,000% 7,500% 8,000% 8,500% Funds raised, net of fees € 5.000.000

Expected interest (interest rate x principal) -€ 350.000 -€ 375.000 -€ 400.000 -€ 425.000 Forward Rate Agreement -€ 100.000 € 17.500 € 35.000 € 52.500 € 70.000 lOMoAR cPSD| 58562220 Repayment of principal -€ 5.000.000 Total cash flows € 4.900.000 -€ 332.500 -€ 340.000 -€ 347.500 -€ 5.355.000 All-in-cost of funds (IRR) 7,458%

This rather unusual forward rate agreement is somewhat

one-sided in the favor of the insurance company. When Firenza is correct, Firenza pays the full

difference in rates to the insurance company. But when i nterest rates move against Firenza, the insurance company pays Firenza only 70% of the

difference in rates. And all of that is after Firenza paid 100,000 up-front for the agreement regardless of outcome. Not a very good deal. €

A final note of significance is that since Firenza receives only 70% of the difference in rates, its total cost of funds is not effectively "capped"; they could

in fact rise with no limit over the period as interest rates rose.

Problem 7.1 Saguaro Funds

Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the following futures quotes on the British pound (£) to speculate on the value of the pound.

British Pound Futures, US$/pound (CME)

Contract = 62,500 pounds Open Maturity Open High Low Settle Change High Interest March ( 1,4246) ( 1,4268) ( 1,4214) ( 1,4228) ( 0,0032) ( 1,4700) ( 25.605) June ( 1,4164) ( 1,4188) ( 1,4146) ( 1,4162) ( 0,0030) ( 1,4550) ( 809)

a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3980/£, what is the value of her position?

b. If Tony sells 12 March pound futures, and the spot rate at maturity is $1.4560/£, what is the value of her position?

c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4560/£, what is the value of her position?

d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3980/£, what is the value of her position? a) b) c) d) Assumptions Values Values Values Values

Pounds (₤) per futures contract £62.500 £62.500 £62.500 £62.500 Maturity month June March March June Number of contracts ( 5) ( 12) ( 3) ( 12)

Did she buy or sell the futures? buys sells buys sells Ending spot rate ($/₤) $1,3980) $1,4560) $1,4560) $1,3980)

Pound futures contract, settle price ($/₤) $1,4162) $1,4228) $1,4228) $1,4162) Spot - Futures ($0,0182) $0,0332) $0,0332) ($0,0182)

Value of position at maturity ($) buys: ($5.687,50) ($24.900,00) $6.225,00) $13.650,00)

Notional x (Spot - Futures) x contr acts

sells: - Notional x (Spot - Futures) x cont racts Interpretation

Buys a futures: Tony buys at the futures price and sells at the ending spot price. She therefore profits when the futures price is less than the ending spot price.

pot price and sells at the futures price. She therefore profits when the futures price is greater than the

Sells a future: Tony buys at the ending s ending spot price.

Problem 7.3 Cece Cao in Jakarta

Cece Cao trades currencies for Sumatra Funds in Jakarta. She focuses nearly all of her time and attention on the U.S. dollar/Singapore dollar

($/S$) cross-rate. The current spot rate is $0.6000/S$. After considerable study, she has concluded that the Singapore dollar will appreciate

versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. She has the following options on the Singapore dollar to choose from: lOMoAR cPSD| 58562220 Option Strike Price Premium Put on Sing $ $0.6500/S$ $0.00003/S$ Call on Sing $ $0.6500/S$ $0.00046/S$

a. Should Cece buy a put on Singapore dollars or a call on Singapore dollars?

b. What is Cece's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Cece's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed $0.7000/S$?

d. Using your answer from part (a), what is Cece's gross profit and net profit (including premium) if the spot rate at the end of 90 days is $0.8000/S$?

Option choices on the Singapore dollar: Call on S$ Put on S$

Strike price (US$/Singapore dollar) $0,6500) $0,6500)

Premium (US$/Singapore dollar) $0,00046) $0,00003) Assumptions Values

Current spot rate (US$/Singapore dollar) $0,6000) Days to maturity ( 90)

Expected spot rate in 90 days (US$/Singapore dollar) $0,7000)

a. Should Cece buy a put on Singapore dollars or a call on Singapore dollars?

Since Cece expects the Singapore dollar to appreciate versus the US dollar, she should buy a call on Singapore dollars. This gives her the

right to BUY Singapore dollars at a future date at $0.65 each, and then immediately resell them in the open market at $0.70 each for a

profit. (If her expectation of the future spot rate proves correct.)

b. What is Cece's breakeven price on the option purchased in part a)? Per S$

Strike price $0,65000) Note this does not

include any interest cost on the premium. Plus premium $0,00046) Breakeven $0,65046)

c. What is Cece's gross profit and net profit (including premium) if the ending spot rate is $0.70/S$? Gross profit Net profit (US$/S$) (US$/S$) $0,70000) Spot rate $0,70000) Less strike price ($0,65000) ($0,65000) Less premium ($0,00046) Profit $0,05000) $0,04954)

d. What is Cece's gross profit and net profit (including premium) if the endi ng spot rate is $0.80/S$?

Gross profit Net profit (US$/S$) (US$/S$) Spot rate $0,80000) $0,80000) Less strike price ($0,65000) ($0,65000) Less premium ($0,00046) Profit $0,15000) $0,14954) lOMoAR cPSD| 58562220

Problem 7.4 Kapinsky Capital (A)

Christoph Hoffeman trades currency for Kapinsky Capital of Geneva. Christoph has $10 million to begin with, and he must state all profits at the

end of any speculation in U.S. dollars. The spot rate on the euro is $1.3358/€, while the 30-day forward rate is $1.3350/€.

a. If Christoph believes the euro will continue to rise in value against the U.S. dollar, so that he expects the spot rate to be $1.3600/€ at the end

of 30 days, what should he do?

b. If Christoph believes the euro will depreciate in value against the U.S. dollar, so that he expects the spot rate to be $1.2800/€ at the end of 30 days, what should he do? a. b. Assumptions Values Values

Initial investment (funds available) $10.000.000) $10.000.000) Current spot rate (US$/€) $1,3358) $1,3358) 30-day forward rate (US$/€) $1,3350) $1,3350)

Expected spot rate in 30 days (US$/€) $1,3600) $1,2800) Strategy for Part a):

One of the more interesting dimensions of speculating in the forward market, is that if the speculator has access to the forward market (bank

lines or relationships when working on behalf of an established firm), many forward speculation strategies require no actual cash flow position

up-front. In this case, Christoph believes the dollar will be trading at $1.36/€ in the open market at the end of 30 days, but he has the ability to

buy or sell dollars at a forward rate of $1.3350/€. He should therefore buy euros forward 30 days (requires no actual cash flow upfront), and at

the end of 30 days take delivery of those euros and sell in the spot market at the higher dollar rate for profit.

Initial investment principle $10.000.000,00)

30 day forward rate (US$/€) $1,3350)

Euros bought forward (Investment / forward rate) € 7.490.636,70)

Spot rate in open market at end of 30 days (US$/€) $1,3600) US$ proceeds (euros

bought forward exchanged to US$ spot) $10.187.265,92) Profit in US$ $187.265,92) Strategy for Part b):

Again, a profitable strategy can be executed without any actual cash flow changing hands at the beginning of t he period. Since Christoph

believes that the dollar will strengthen to $1.28 in 30 days, he should sell euros forward now at the higher doll ar rate, wait 30 days and buy

the euros needed on the open market at $1.28, and immediately then use those euros to fulfill his forward contr act to sell euros for dollars at $1.3350. For a profit.

Investment funds needed in 30 days $10.000.000,00)

Spot rate in open market at end of 30 days $1,2800)

Euros bought in open market in 30 days (Investment / spot rate) € 7.812.500,00)

Stefan had sold these euros forward at the start of the 30 day period.

30 day forward rate (US$/€) $1,3350)

US$ proceeds (euros sold forward into US$) $10.429.687,50) Profit in US$ $429.687,50) lOMoAR cPSD| 58562220

Problem 7.8 Cachita Haynes at Vatic Capital

Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her latest speculative position is to

profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen. The current spot rate is

¥120.00/$. She must choose between the following 90-day options on the Japanese yen: Option Strike Price Premium Put on yen ¥125/$ $0.00003/S$ Call on yen ¥125/$ $0.00046/S$

a. Should Cachita buy a put on yen or a call on yen?

b. What is Cachita's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Cachita's gross profit and net profit (including premium) if the spot rate at

the end of 90 days is ¥140/$? Assumptions Values

Current spot rate (Japanese yen/US$) ( 120,00) in US$/yen $0,00833 Maturity of option (days) ( 90)

Expected ending spot rate in 90 days (yen/$) ( 140,00) in US$/yen $0,00714 Call on yen Put on yen

Strike price (yen/US$) ( 125,00) ( 125,00) in US$/yen $0,00800 $0,00800

Premium (US$/yen) $0,00046

$0,00003 a. Should she buy a call on yen or a put on yen?

Cachita should buy a put on yen to profit from the rise of the dollar (the fall of the yen).

b. What is Cachita's break even price on her option of choice in part a)?

Cachita buys a put on yen. Pays premium today.

In 90 days, exercises the put, receiving US$. in yen/$ Strike price $0,00800 ( 125,00) Less premium -$0,00003 Breakeven $0,00797 ( 125,47)

c. What is Cachita's gross profit and net profit if the end spot rate is 140 yen/$?

Gross profit Net profit (US$/yen) (US$/yen) Strike price $0,00800 $0,00800 Less spot rate -$0,00714 -$0,00714 Less premium -$0,00003 Profit $0,00086 $0,00083 lOMoAR cPSD| 58562220

Problem 7.11 Calandra Panagakos at CIBC

Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a contrarian -- as opposed to most of

the forecasts, she believes the Canadian dollar (C$) will appreciate versus the U.S. dollar over the coming 90 days. The current

spot rate is $0.6750/C$. Calandra may choose between the following options on the Canadian dollar: Option Strike Price Premium Put on C$ $0,7000) $0.00003/S$ Call on C$ $0,7000) $0.00049/S$

a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars?

b. What is Calandra's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed $0.7600?

d. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is $0.8250? Assumptions Values

Current spot rate (US$/Canadian dollar) $0,6750) Days to maturity 90

Option choices on the Canadian dollar: Call option Put option

Strike price (US$/Canadian dollar) $0,7000) $0,7000)

Premium (US$/Canadian dollar) $0,00049) $0,0003) a) Which option should Giri buy?

Since Giri expects the Canadian dollar to appreciate versus the US dollar, he should buy a call on Canadian dollars.

b) What is Giri's breakeven price on the option purchased in part a)? Strike price $0,7000) Plus premium ( 0,00049) Breakeven $0,7005)

c) What is Giri's gross profit and net profit (including premium) if he ending spot rate is $0.7600/C$? Gross profit Net profit (US$/C$) (US$/C$) Spot rate $0,7600) $0,7600) Less strike price ( (0,7000) ( (0,7000) Less premium ( (0,00049) Profit $0,0600) $0,05951)

the ending spot rate is $0.8250/C$?

d) What is Giri's gross profit and net profit (including premium) if Gross profit Net profit (US$/C$) (US$/C$) lOMoAR cPSD| 58562220 Spot rate $0,8250) $0,8250) Less strike price ( (0,7000) ( (0,7000) Less premium ( (0,00049) Profit $0,1250) $0,12451)

Problems 9.11-9.14 Forecasting the Pan-Pacific Pyramid: Australia, Japan & The United States Industrial Forecast Forecast Production Rate Latest Qtr Qtr* 2007 e 2008 e Recent Qtr Latest Gross Domestic Product Unemployment Country Australia 4,3% 3,8% 4,1% 3,5% 4,6% 4,2% Japan 1,6% -1,2% 2,0% 1,9% 4,3% 3,8% United States 1,9% 3,8% 2,0% 2,2% 1,9% 4,7% Consumer Prices Interest Rates Forecast 3- month 1- yr Govt Bond Year Ago Latest 2007 e Latest Latest Country Australia 4,0% 2,1% 2,4% 6,90% 6,23% Japan 0,9% -0,2% 0,0% 0,73% 1,65% United States 2,1% 2,8% 2,8% 4,72% 4,54%

Trade Balance Current Account

Current Units (per US$) Last 12 mos Last 12 mos Forecast 07 Country (billion $) (billion $) (% of GDP) Oct 17th Year Ago Australia -13,0 -$47,0 -5,7% ( 1,12) ( 1,33) Japan 98,1 $197,5 4,6% ( 117) ( 119) United States -810,7 -$793,2 -5,6% ( 1,00) ( 1,00)

Source: Data abstracted from The Economist, October 20, 2007, print edition. Unless otherwise noted, percentages are percentage changes over one-year.

Rec Qtr = recent quarter. Values for 2007e are estimates or forecasts.

11. Current spot rates. What are the current spot exchange rates for the following cross rates?

a. Japanese yen/US dollar exchange rate = '¥/$ ( 117,00)

b. Japanese yen/Australian dollar exchange rate = ¥/$ / A$/$ ( 104,46)

c. Australian dollar/US dollar exchange rate = A$/$ = ( 1,1200) = ange in 12.

Purchasing power parity forecasts. Assuming ng power parity, and assuming that the forecasted ch =

purchasi consumer prices is a good proxy of predict ed

forecast the fol owing cross rates: inflation,

Spot (¥/$) x (1 + ¥-inflation) / (1 + $-inflation)

a. Japanese yen/US dollar in 1 year ( 113,81)

Spot (¥/A$) x (1 + ¥-inflation) / (1 + A$-inflation)

b. Japanese yen/Australian dollar in 1 year ( 102,02)

= Spot (A$/$) x (1 + A$-inflation) / (1 + $ inflation)

c. Australian dollar/US dollar in 1 year ( 1,1156) = wing future =

onal Fisher applies to the coming year, forecast the follo lOMoAR cPSD| 58562220 13.

International Fischer forecasts. Asssumi ng

for the respective country currencies: ( 113,77)

Internati spot exchange rates using the government bond ( 99,96) rates

Spot (¥/$) x (1 + i-¥) / (1 + i-$) ( 1,1381)

Spot (¥/A$) x (1 + i-¥) / (1 + i-A$)

a. Japanese yen/US dollar in 1 year n consumer

Spot (A$/$) x (1 + i-A$) / (1 + i-$)

b. Japanese yen/Australian dollar in 1 year

c. Australian dollar/US dollar in 1 year

te is the government bond rate, and the current change i 14.

Implied real interest rates. If the nominal interest 3,74% 1,65%

ra prices is used as expected inflation, calculate the

(1 + nominal) / (1 + A$ consumer price change) - 1 1,69%

implied "real" rates of interest by currency. a. Australian ¥ consumer price change) - 1 dollar "real" rate =

(1 + nominal) / (1 + $ consumer price change) - 1 b. Japanese yen "real" rate = (1 + nominal) / (1 + c. US dollar "real" rate =

Problems 9.15-9.16 Forecasting the Pan-Pacific Pyramid: Australia, Japan & The United States Industrial Forecast Forecast Production Rate Latest Qtr Qtr* 2007 e 2008 e Recent Qtr Latest Gross Domestic Product Unemployment Country Australia 4,3% 3,8% 4,1% 3,5% 4,6% 4,2% Japan 1,6% -1,2% 2,0% 1,9% 4,3% 3,8% United States 1,9% 3,8% 2,0% 2,2% 1,9% 4,7% Consumer Prices Interest Rates Forecast 3- month 1- yr Govt Bond Year Ago Latest 2007 e Latest Latest Country Australia 4,0% 2,1% 2,4% 6,90% 6,23% Japan 0,9% -0,2% 0,0% 0,73% 1,65% United States 2,1% 2,8% 2,8% 4,72% 4,54%

Trade Balance Current Account

Current Units (per US$) Last 12 mos Last 12 mos Forecast 07 Country (billion $) (billion $) (% of GDP) Oct 17th Year Ago Australia -13,0 -$47,0 -5,7% ( 1,12) ( 1,33) Japan 98,1 $197,5 4,6% ( 117) ( 119) United States -810,7 -$793,2 -5,6% ( 1,00) ( 1,00)

Source: Data abstracted from The Economist, October 20, 2007, print edition. Unless otherwise noted, percentages are percentage changes over one-year.

Rec Qtr = recent quarter. Values for 2007e are estimates or forecasts.

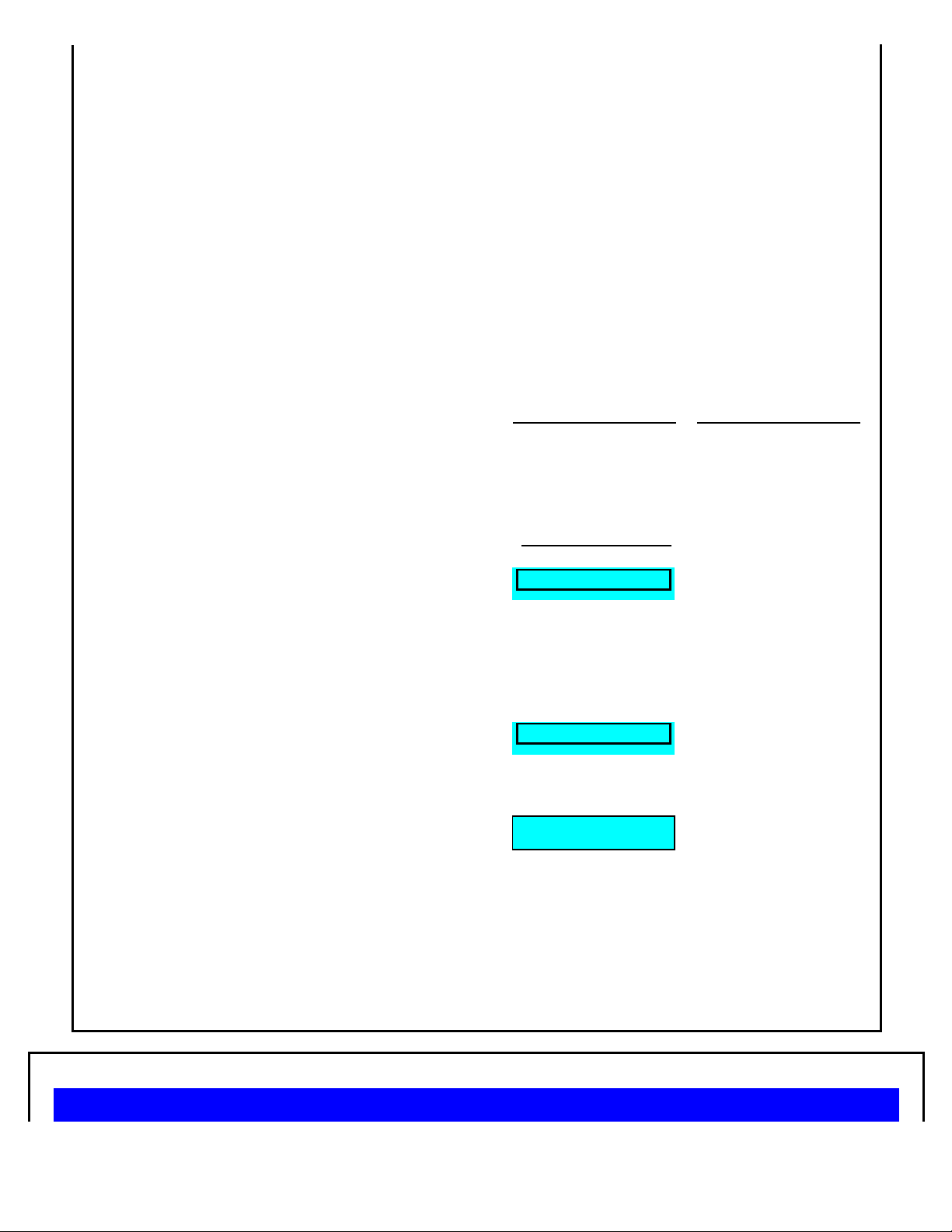

15. Forward rates. Using the spot rates and three-month interest rates above, calculate the 90-day forward rates for:

a. Japanese yen/US dollar exchange rate

= Spot (¥/$) x (1 + i¥ 3 month) / (1 + i$ 3 month) ( 115,85)

b. Japanese yen/Australian dollar exchange rate = Spot (¥/A$) x (1 + i¥ 3 month) / (1 + iA$ 3 month) ( 102,88) ( 1,1260) lOMoAR cPSD| 58562220

c. Australian dollar/US dollar exchange rate

= Spot (A$/$) x (1 + A$ 3 month) / (1 + i$ 3 month)

Note: All interest rates need to be adjusted for a 90 day period of a 360 day year for the calculation.

16. Real economic activity and misery. Calculate the country's Misery Index (unemployment + inflation) and

then interest differentials to forecast the future spot exchange rate, one year into the future. use it like Australia's Misery Index 6,60%

Forecast spot = Spot x ( 1 + Misery-1) / ( 1 + Misery-2) Japan's Misery Index 3,80% United States's Misery Index 7,50% Starting Forecast

a. Japanese yen/US dollar exchange rate in 1 year Spot Rate Spot Rate

b. Japanese yen/Australian dollar exchange rate in 1 year ( 115,85) ( 111,86)

c. Australian dollar/US dollar exchange rate in 1 year ( 102,88) ( 100,18) ( 1,1260) ( 1,1166) lOMoAR cPSD| 58562220

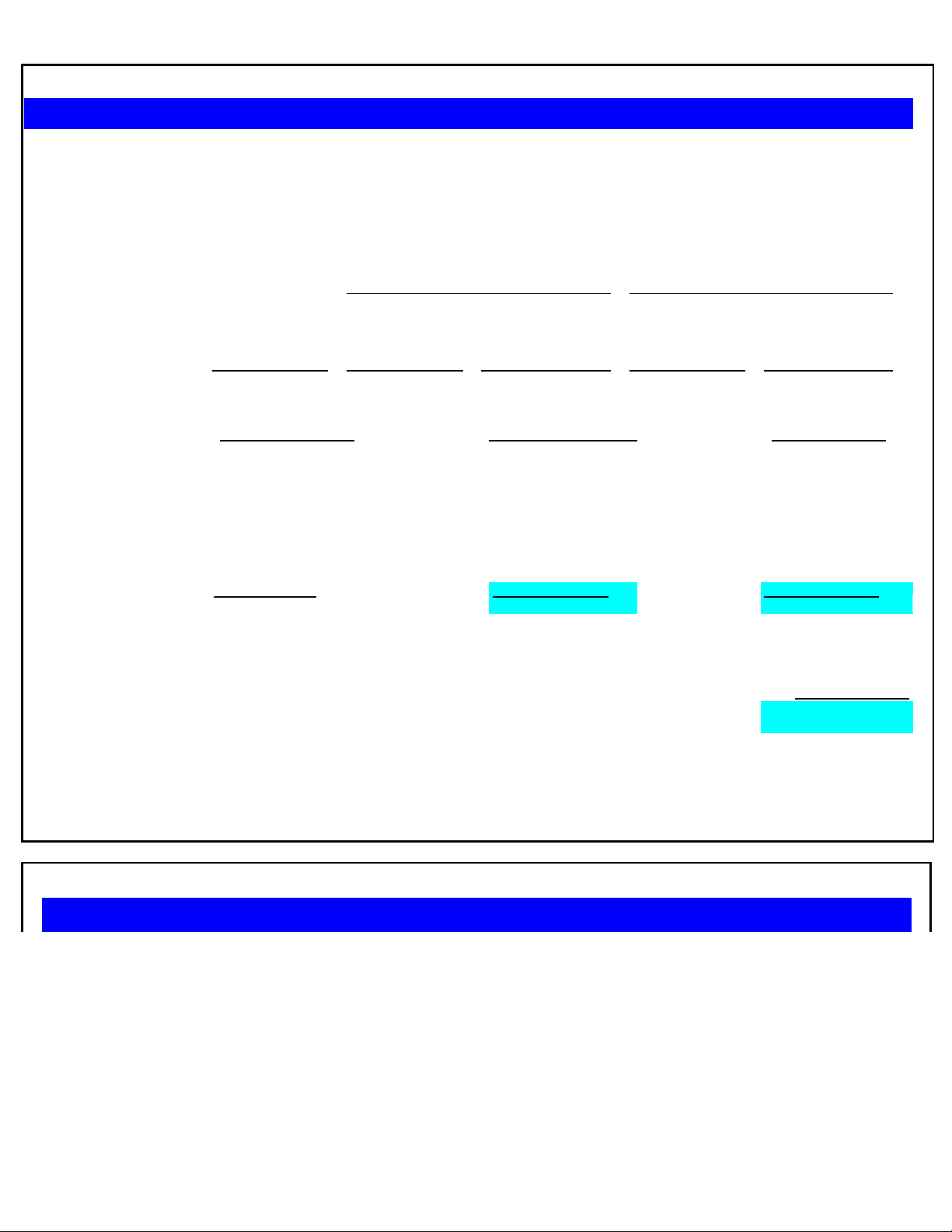

Problem 10.8 Caribou River

Caribou River, Ltd., a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of

the transaction is known with certainty, all foreign currency-denominated cash flows must utilize the following mandatory forward contract cover formula:

Caribou River's Manadatory Forward Cover 0-90 days 91-180 days > 180 days

Paying the points forward 75 % 60 % 50 %

Receiving the points forward 100 % 90 % 50 %

Caribou expects to receive multiple payments in Danish kroner over the next year. DKr 3,000,000 is due in 90 days; DKr 2,000,000 is

due in 180 days; and DKr 1,000,000 is due in one year. Using the following spot and forward exchange rates, what would be the

amount of forward cover required by company policy by period? Forward Assumptions Values Discount Spot rate, DKr/C$ ( 4

, 70 ) 3- month forward rate, DKr/C$ ( 4

, 71 ) -0 ,85% 6- month forward rate, DKr/C$ ( 4 72 , ) -0 ,85%

12- month forward rate, DKr/C$ ( 4

, 74 ) -0 ,84% South Face's Exposures 0- 90 da ys 91-18 0 da ys > 180 days A/R due in 3 months, DKr ( 3

.000.000 ) A/R due in 6 months, DKr ( 2

.000.000 ) A/R due in 12-months, DKr ( 1

.000.000 )

Analysis & Exposure Management

The Danish krone is selling forward at a discount versus the Canadian dollar: it takes more DKr/C$ forward.

Caribou River is receiving foreign currency, DKr, at future dates ("long DKr").

Caribou River is therefore expecting to PAY THE POINTS FORWARD.

Required Forward Cover for Compass Rose: 0- 90 da ys 91-180 days > 180 days A/R due in 3 months, DKr 75 % A/R due in 6 months, DKr 60 % A/R due in 12-months, DKr 50 % DKr Forward Cover A/R due in 3 months, DKr ( 2

.250.000 ) A/R due in 6 months, DKr ( 1

.200.000 ) A/R due in 12-months, DKr ( 5

00.000 )

Expected Canadian dollar value of DKr sold forward ( 4

77.707,01 ) ( 2

54.237,29 ) ( 1

05.485,23 ) lOMoAR cPSD| 58562220

Problem 10.10 Mattel Toys

Mattel is a U.S.-based company whose sales are roughly two-thirds in dollars (Asia and the Americas) and one-third in euros

(Europe). In September Mattel delivers a large shipment of toys (primarily Barbies and Hot Wheels) to a major distributor in Antwerp.

The receivable, €30 million, is due in 90 days, standard terms for the toy industry in Europe. Mattel’s treasury team has collected the

following currency and market quotes. The company’s foreign exchange advisors believe the euro will be at about $1.4200/€ in 90 days.

Mattel’s management does not use currency options in currency risk management activities. Advise Mattel on which hedging alternative is probably preferable. Current spot rate ($/€) $1,4158

Credit Suisse 90-day forward rate ($/€) $1,4172

Barclays 90-day forward rate ($/€) $1,4195 Mattel Toys WACC ($) 9,600%

90-day eurodollar interest rate 4,000% 90-day euro interest rate 3,885%

90-day eurodollar borrowing rate 5,000% 90-day euro borrowing rate 5,000%

Values Assumptions 90-day A/R (€) € 30.000.000,00 Current spot rate ($/€) $1,4158

Credit Suisse 90-day forward rate ($/€) $1,4172

Barclays 90-day forward rate ($/€) $1,4195

Expected spot rate in 90 days ($/€) $1,4200

90-day eurodollar interest rate 4,000% 90-day euro interest rate 3,885%

Implied 90-day forward rate (calculated, $/€) $1,4162

90-day eurodollar borrowing rate 5,000% 90-day euro borrowing rate 5,000%

Mattel Toys weighted average cost of capital ($) 9,600% Risk Hedging Alternatives Values Assessment

1. Remain Uncovered, settling A/R in 90 days at market rate

(20 million euros / future spot rate)

If spot rate in 90 days is same as current $42.474.000,00) Risky

If spot rate in 90 days is same as Credit Suisse forward rate $42.516.000,00) Risky

If spot rate in 90 days is same as Barclays forward rate

If spot rate in 90 days is expected spot rate 2. $42.585.000,00) Risky

Sell euros forward 90 days

Settlement amount at Credit Suisse forward rate $42.600.000,00) Risky

Settlement amount at Barclays forward rate 3. Money Market Hedge $42.516.000,00) Certain Principal A/R in euros $42.585.000,00) Certain € 30.000.000,00

discount factor for euro borrowing rate for 90 days ( 0,9877) 1/(1 + (.05 x 90/360))

Borrow euros against 90-day A/R € 29.629.629,63 Current spot rate, $/euro $1,4158 lOMoAR cPSD| 58562220 US dollar current value $41.949.629,63)

Mattel's WACC carry-forward factor for 90 days ( 1,0240) 1 + (.0960 x 90/360)

Future value of money market hedge $42.956.420,74) Certain

Evaluation of Alternatives

A/R when using the cost of capital as the reinvestment

The money market hedge guarantees Mattel the greatest dollar value for the rate (carry-forward rate). lOMoAR cPSD| 58562220

Problem 11.3 Ganado Europe ( C )

Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2006, in Exhibit 11.4 appreciated from $1.2000/€ to $1.500/€.

Calculate Ganado Europe's translated balance sheet for January 2, 2006 with the new exchange rate using the current rate method.

Translation Using the Current Rate Method: euro appreciates from $1.2000/euro to $1.5000/euro.

Just before revaluation

Just after revaluation Translated Translated Euros Exchange Rate Accounts Exchange Rate Accounts Assets Statement (US$/euro) US dollars (US$/euro) US dollars Cash ( 1.600.000) ( 1,2000) ($ 1.920.000) ( 1,5000) ($ 2.400.000) Accounts receivable ( 3.200.000) ( 1,2000) ( 3.840.000) ( 1,5000) ( 4.800.000) Inventory ( 2.400.000) ( 1,2000) ( 2.880.000) ( 1,5000) ( 3.600.000) Net plant & equipment ( 4.800.000) ( 1,2000) ( 5.760.000) ( 1,5000) ( 7.200.000) Total ( 12.000.000) ($ 14.400.000) ($ 18.000.000)

Liabilities & Net Worth Accounts payable ( 800.000) ( 1,2000) ($ 960.000) ( 1,5000) ($ 1.200.000) Short-term bank debt ( 1.600.000) ( 1,2000) ( 1.920.000) ( 1,5000) ( 2.400.000) Long-term debt ( 1.600.000) ( 1,2000) ( 1.920.000) ( 1,5000) ( 2.400.000) Common stock ( 1.800.000) ( 1,2760) ( 2.296.800) ( 1,2760) ( 2.296.800) Retained earnings ( 6.200.000) ( 1,2000) ( 7.440.000) ( 1,2000) ( 7.440.000) CTA account (loss) ( - ) ($ (136.800) ($ 2.263.200) Total ( 12.000.000) ($ 14.400.000) ($ 18.000.000) ($ 2.263.200)

a. The translation gain (loss) is: -------------------------------------------------------------------------------- ( 136.800)

-------------------------------> ($ 2.400.000)

b. The translation gain for the year is added to the balance in the Cumulative Translation

adjustment account, which is carried as a separa te balance sheet

account within the equity section of the consolidated balance sheet. The gain does not pass through the income statement under the curren t rate method in which

the currency of the foreign subsidiary is a local currency functional.

Problem 11.4 Ganado Europe (D) lOMoAR cPSD| 58562220

Using facts in the chapter for Ganado Europe, assume as in Ganado Europe (C) that the exchange rate on January 2, 2006, in Exhibit 11.4 appreciated from $1.2000/€

to $1.5000/€. Calculate Ganado Europe’s translated balance sheet for January 2, 2006 with the new exchange rate using the temporal method.

Translation Using the Temporal Method: euro appreciates from $1.2000/euro to $1.5000/euro.

Just before revaluation

Just after revaluation Translated Translated Euros Exchange Rate Accounts Exchange Rate Accounts Assets Statement (US$/euro) (US dollars) (US$/euro) (US dollars) Cash ( 1.600.000) ( 1,2000) ($ 1.920.000) ( 1,5000) ($ 2.400.000) Accounts receivable ( 3.200.000) ( 1,2000) ( 3.840.000) ( 1,5000) ( 4.800.000) Inventory ( 2.400.000) ( 1,2180) ( 2.923.200) ( 1,2180) ( 2.923.200) Net plant & equipment ( 4.800.000) ( 1,2760) ( 6.124.800) ( 1,2760) ( 6.124.800) Total ( 12.000.000) ($ 14.808.000) ($ 16.248.000)

Liabilities & Net Worth Accounts payable ( 800.000) ( 1,2000) ($ 960.000) ( 1,5000) ($ 1.200.000) Short-term bank debt ( 1.600.000) ( 1,2000) ( 1.920.000) ( 1,5000) ( 2.400.000) Long-term debt ( 1.600.000) ( 1,2000) ( 1.920.000) ( 1,5000) ( 2.400.000) Common stock ( 1.800.000) ( 1,2760) ( 2.296.800) ( 1,2760) ( 2.296.800) Retained earnings ( 6.200.000) ( 1,2437) ( 7.711.200) ( 1,2437) ( 7.711.200) CTA account (loss) ( - ) ($ (0) ($ 240.000) Total ( 12.000.000) ($ 14.808.000) ($ 16.248.000) ($ 240.000) a.

The translation gain (loss) is: ( 0) ($ 240.000) b.

Under the Temporal Method, the translation gain of $240,000 would be closed into retained earnings through the income

statement, rather than as a separate line item. It is shown as a separate line item above for pedagogical purposes only. Actual year-end

retained earnings would be $7,711,200 + $240,000 = $7,951,200. c.

The translation gain (loss) differs from the Current Rate Method because "exposed assets" under the Current Rate Method are

larger th under the temporal method by the amount of inventory and net plant & equipment. an

Problem 11.5 Tristan Narvaja, S.A. (A) lOMoAR cPSD| 58562220

Tristan Narvaja, S.A., is the Uruguayan subsidiary of a U.S. manufacturing company. Its balance sheet for

January 1 follows. The January 1st exchange rate between the U.S. dollar and the peso Uruguayo ($U) is $U20/$.

Determine Tristan Narvaja’s contribution to the translation exposure of its parent on January 1, using the current rate method.

Balance Sheet (thousands of pesos Uruguayo, $U) Exchange Rate Assets January 1st ($U/US$) Cash ( 60.000) ( 20,00) Accounts receivable ( 120.000) ( 20,00) Inventory ( 120.000) ( 20,00) Net plant & equipment ( 240.000) ( 20,00) ( 540.000)

Liabilities & Net Worth Current liabilities ( 30.000) ( 20,00) Long-term debt ( 90.000) ( 20,00) Capital stock ( 300.000) ( 15,00) Retained earnings ( 120.000) ( 15,00) ( 540.000) b) Translation January 1st $U/US$

Calculation of Accounting Exposures: $U (000s) ( 20,00) ($ 27.000) Exposed assets (all assets) ( 540.000)

Less exposed liabilities (curr liabs + lt debt) ( (120.000) ( (6.000) a) Net exposure ( 420.000) ($ 21.000)

Problem 12.1 Mauna Loa Macadamia lOMoAR cPSD| 58562220

Mauna Loa, a macadamia nut subsidiary of Hershey's with planations on the slopes of its namesake volcano in Hilo, Hawaii,

exports Macadamia nuts worldwide. The Japanese market is its biggest export market, with average annual sales invoiced in yen

to Japanese customers of ¥1,200,000,000. At the present exchange rate of ¥125/$ this is equivalent to $9,600,000. Sales are

relatively equally distributed during the year. They show up as a ¥250,00,000 account receivable on Mauna Loa’s balance sheet.

Credit terms to each customer allow for 60 days before payment is due. Monthly cash collections are typically ¥100,000,000.

Mauna Loa would like to hedge its yen receipts, but it has too many customers and transactions to make it practical to sell each

receivable forward. It does not want to use options because they are considered to be too expensive for this particular purpose.

Therefore, they have decided to use a “matching” hedge by borrowing yen.

a. How much should Mauna Loa borrow in yen?

b. What should be the terms of payment on the yen loan?

a. How much should Mauna Loa borrow in yen?

Mauna Loa receives cash collections of one hundred million yen per month. This is the source of repayment of

any balance sheet hedge. If Mauna Loa wants to be covered for one year at a time, it would need to borrow one

year's cash flow plus interest, and convert the borrowed yen to US dollar at once. A sample calculation would be: Sample Values Units One month's cash flow ( 100.000.000) Yen Months per year ( 12) One year's cash flow ( 1.200.000.000) Yen Plus interest 4,000% per annum Principal and interest ( 1.248.000.000) Yen Spot exchange rate ( 125,00) Yen/US$ US dollars $9.984.000) US$

Realistically, Mauna Loa would probably want to be covered for the long term. In tha

t case, the 1.2 billion yen loan

could be structured so that it could be renewed annually with interest reset annually. T his would only cover the

foreign exchange and interest rate risk for a year at a time, but would probably be acc eptable to a bank lender.

Also unknown are the expected sales for year 2 and beyond.

b. What should be the terms of payment on the loan?

The loan should be repaid out of the monthly cash flow, with payments on principal o nly. The interest payment one

year hence has already been covered by borrowing both principal and interest up-fron t.

Note: Mauna Loa should not borrow 250 million yen to cover only its balance

xposure. Such a loan would cover

sheet e only the accounting exposure, and not the cash flow exposure (operating exposure).

Problem 12.2 Acuña Leather Goods lOMoAR cPSD| 58562220

DeMagistris Fashion Company, based in New York City, imports leather coats from Acuña Leather Goods, a reliable and

longtime supplier, based in Buenos Aires, Argentina. Payment is in Argentine pesos. When the peso lost its parity with

the U.S. dollar in January 2002 it collapsed in value to Ps 4.0/$ by October 2002. The outlook was for a further decline

in the peso’s value. Since both DeMagistris and Acuña wanted to continue their longtime relationship they agreed on a

risksharing arrangement. As long as the spot rate on the date of an invoice is between Ps3.5/$ and Ps4.5/$ DeMagistris

will pay based on the spot rate. If the exchange rate falls outside this range they will share the difference equally with

Acuña Leather Goods. The risk-sharing agreement will last for six months, at which time the exchange rate limits will be

reevaluated. DeMagistris contracts to import leather coats from Acuña for Ps8,000,000 or $2,000,000 at the current spot

rate of Ps4.0/$ during the next six months.

a. If the exchange rate changes immediately to Ps6.00/$, what will be the dollar cost of 6 months of imports to DeMagistris?

b. At Ps6.00/$, what will be the peso export sales in Acuña Leather Goods to DeMagistris Fashion Company?

a. If the exchange rate changes immediately to Ps6.00/$, what will be the dollar cost of 6 months of imports to Pucini? Bottom Top

The allowable range of exchange rates is (Ps/$) ( 3,50) ( 4,50)

Outside of this range the trading partners will share the extra risk equally. New exchange rate (Ps/$) ( 6,00)

Allowable exchange rate (Ps/$) ( 4,50)

Difference to be shared (Ps/$) ( 1,50) DeMagistris' share ( 0,75) Acuña's share ( 0,75)

Therefore, DeMagistris will use the following effective exchange ra te after risk-sharing: Top of range ( 4,50) DeMagistris' share ( 0,75)

Effective total of risk-sharing ( 5,25)

Assuming that 6 months of imports will still be (Ps) ( 8.000.000)

Effective exchange rate for DeMagistris (Ps/$) ( 5,25)

DeMagistris' cost in US dollars $1.523.809,52)

However, the lower cost of importing might lead to higher DeMagis tris' sales and therefore a higher import total than Ps 8 million.

b. At Ps6.00/$, what will be the peso export sales in Acuña to D eMagistris?

ower dollar cost encourages DeMagistris to import

The export sales of Acuña would remain at Ps 8 million, unless the l more from Acuña.

Problem 14.1 Copper Mountain Group (USA)