Preview text:

Bài tập ngoài

On 1 January 2020, Lessee Ltd entered into a two-years lease with Lessor Ltd for a equipment. The contract contains an option to extend the lease

term for a further a year. Lessee Ltd ascertained that it is reasonably certain to exercise this option. The equipment has a useful economic life of 10 years.

Lease payments are $25,000 per year for the initial term and $45,000 per year for the period when the option is exercised. All payments are due at the

end of the year (i.e. 31 December). To obtain the lease, Lessee Ltd incurs initial direct costs of $12,500 on 1 January 2020. The interest rate within the

lease is not readily determinable. Lessee Ltd s incremental rate of borrowing is 5%. Assume the initial direct cost was paid by Lessee Ltd to third party rather than to Lessor Ltd. Required:

a. Calculate the initial carrying amount of the lease liability and the right-of-use asset

and prepare the relevant double entries on 1 January 2020. (8 marks)

b. Prepare extracts from the financial statements of Lessee Ltd in respect of the lease agreement for the year ended 31 December 2020. (10 marks)

Note: amortization table is required to show

c. Comment the accounting treatment of lease payment in lessee’s book if the lease term is less than 12 months (2 marks)

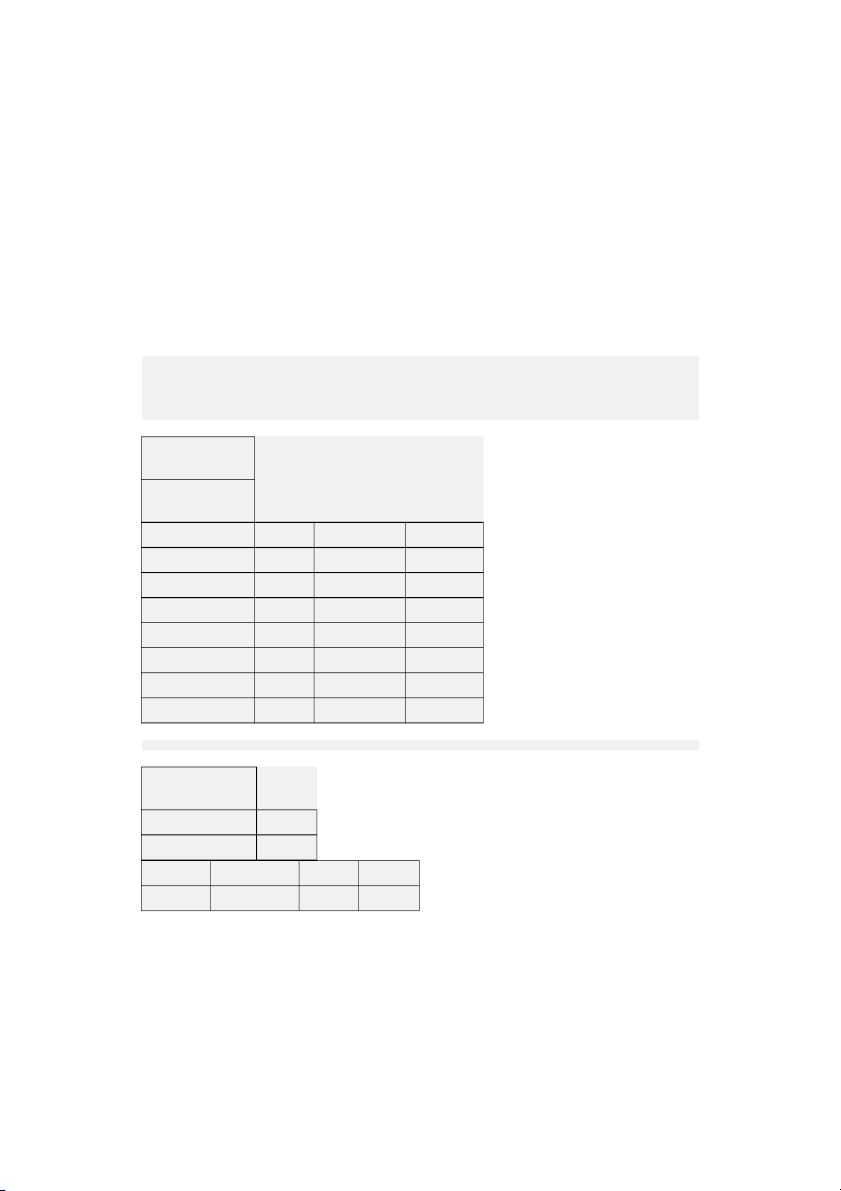

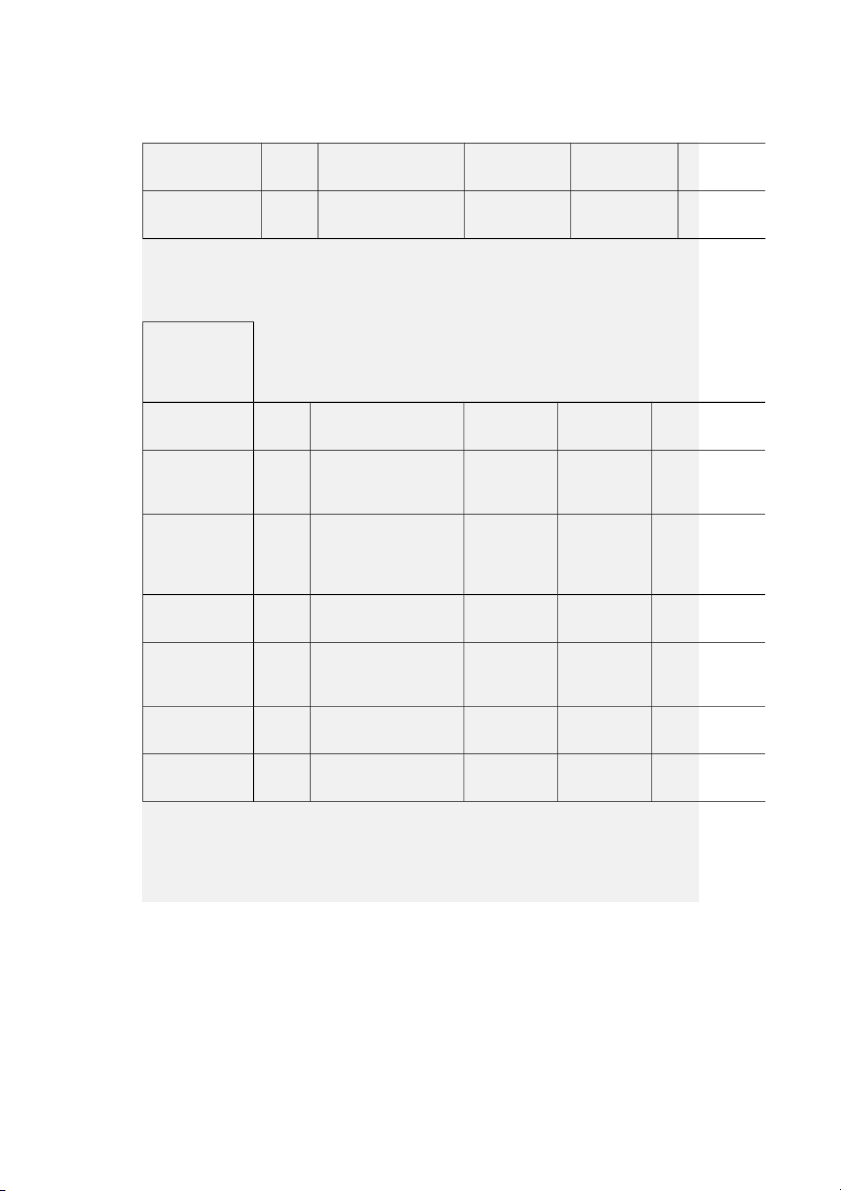

As none of the condition for finance lease is met the given lease is an operating lease for lessee. a. Working - lease liability calculation PV of lease payments $ PVF @ 5% Present value Year 1 $ 25,000 0.9524 $ 23,810 Year 2 $ 25,000 0.9070 $ 22,676 Total $ 46,485 Right of use asset PV lease payment $ 46,485 Initial direct cost $ 12,500 Right of use asset $ 58,985 Answer: - Initial carrying amount of Lease liability $ 46,485 Right of use asset $ 58,985 Date Particulars Debit $ Credit $ 1st Jan 2020 Right of use asset $ 58,985 Lease liability $ 46,485 Cash $ 12,500 b. working - Lease expense Interest @ 5%

Amortization of ROU lease asset asset portion Balance $ 46,485 $ 25,000 $ 2,324 $ 22,676 $ 23,809 $ 25,000 $ 1,190 $ 23,810 $ - Amortization of ROU asset

Initial direct cost amortization over lease term ($12,500/2) Amortization $ 22,676 $ 6,250 $ 28,926 $ 23,810 $ 6,250 $ 30,060 In the Books of lessee

Financial statement as on 31st Dec, 2020 Assets $ Liabilities $ Non current assets Non current liability Right of use asset $ 58,985 Lease liability $ 46,485 Less Amortization $ 28,926 Add Interest $ 2,324 Carrying value $ 30,060 Less lease payment $ (25,000) Carrying value $ 23,809 c.

For lease with term less than 12 months,

Lessee may elect not to apply the recognition requirement for operating lease and hence lesse will recognize the lease payments on income

statement on a straight line basis over the lease term. EXERCISE 7

The value of New Equipment is $ 5000

As per AS 16 - To classify the lease as finance lease or operating lease, the present value of minimum lease payments covers atleast 85% of total value of equipment

Here lets assume that implicit rate of return is 10%

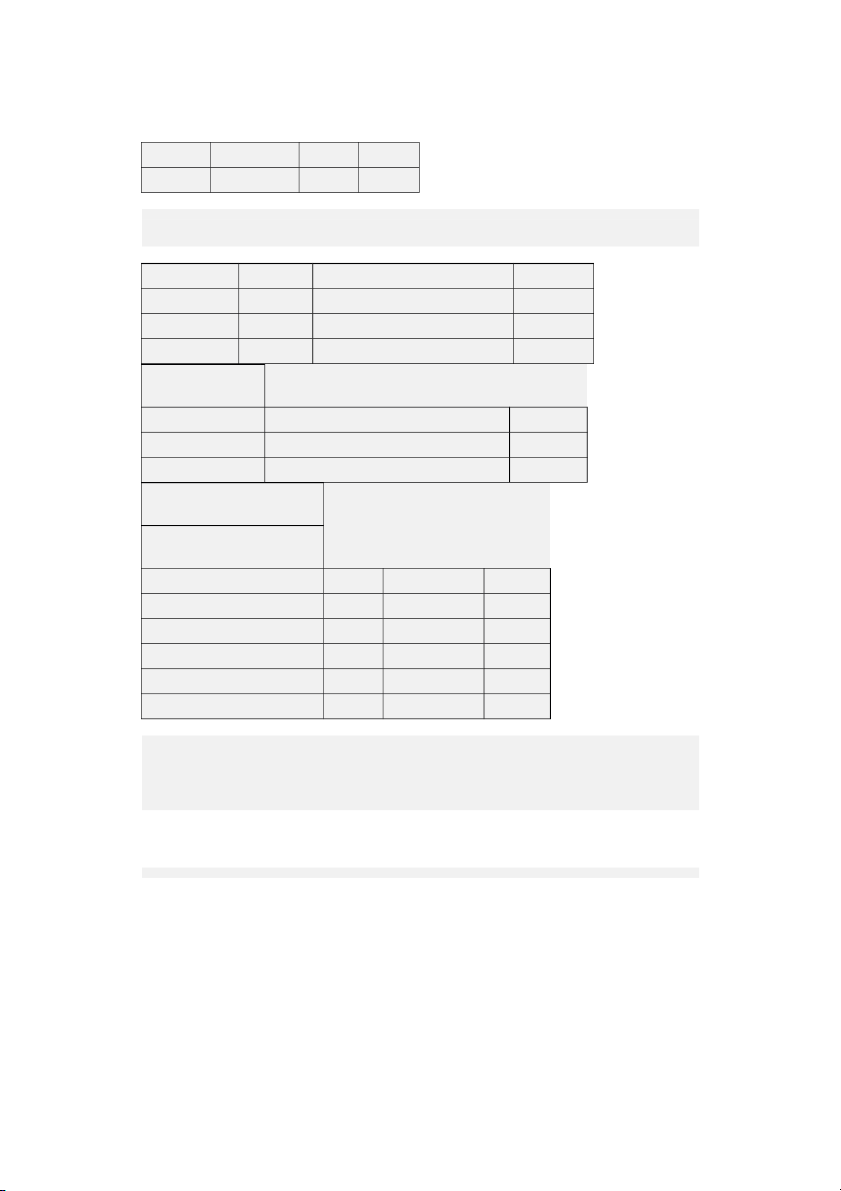

Then Present value of minimum lease payments: Year Pvf Lease payments PV of Minimum lease payments 1 1 1500 1500 2 0.909 1400 1272.60 3 0.826 1400 1156.40 4 0.751 1500 1126.50 5 0.683 1500 1024.50

Total Value of minimum lease payments is 6080

It exceeds the fair value of Equipment. Hence this lease is considered as Finance Lease

b) Journal entries on 30th June 2019

1. Leased Asset A/c...................Dr 6080

....................To Lease Liability/ Lessor A/c 6080

2. Lease Liability A/c..................Dr 1363

Interest expense A/c .............Dr 137

.........................To Cash/ Bank A/c 1380

.........................To Incentive on LeaseA/c 120 (600/5)

(The Interest expense is assumed based on implicit rate of return is 10%) EXERCISE 16 Cheg

As per given details it is financial lease contract due to present value calculated is more than 90%

of current lease contract value.

1. Calculate Interest rate Implicit in lease contrct Ans :-

The formula we use is total amount paid/amount borrowed raised to 1/number of periods = x. Then

x-1 x100 = implicit interest rate.

X = ((Amount paid / amount borrowed )^1/4)

Then x-1 x100 = implicit interest rate.

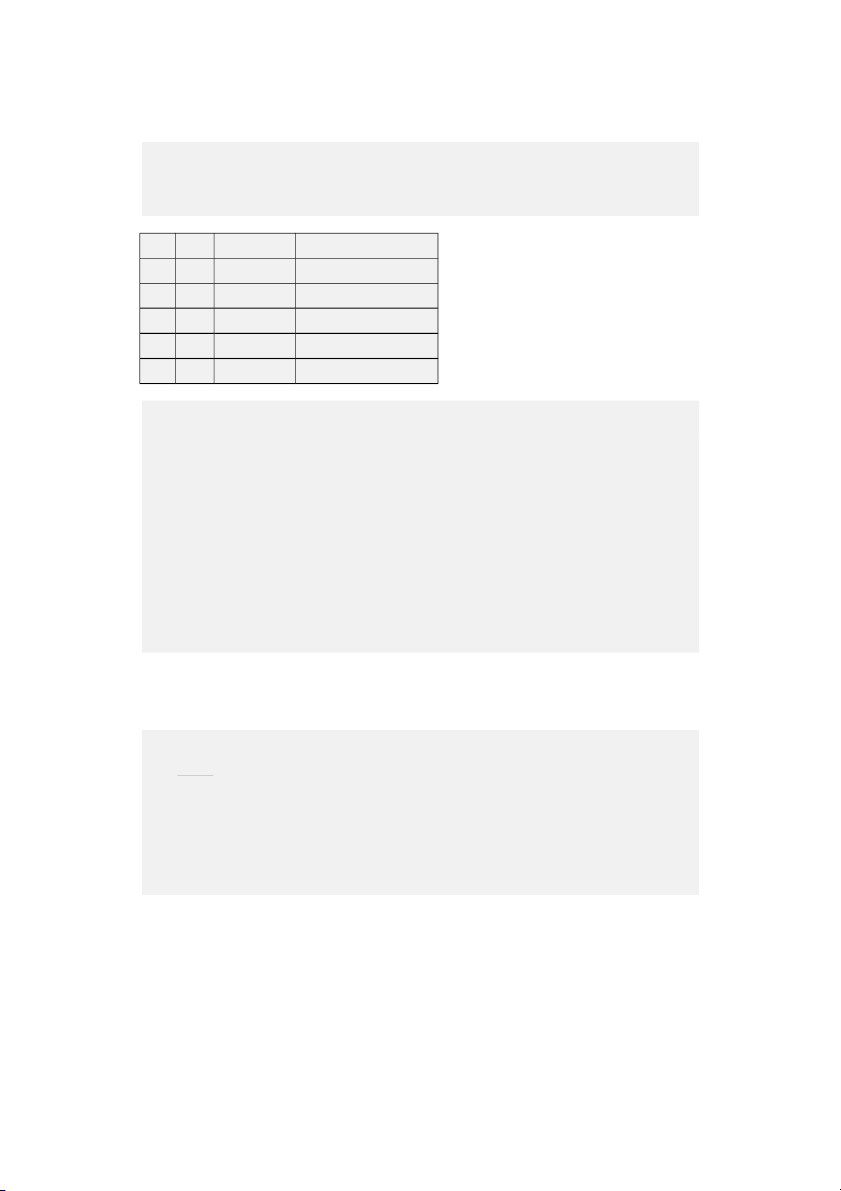

1st we need to know how much amount we paid to Long Vuong Company in 4 years Year Amount 1st year payment $ 400,000.00 2nd year payment $ 424,000.00

6% inflation rate applied on 400000 3rd year paymnet $ 424,000.00 4th year poayment $ 449,440.00

6% inflation rate applied on 424000 Total payment $ 1,697,440.00

Total paymnet / Amount borrowed = 1697440/1300000 = 1.305

Then these answer into 1/number of periods = 1.305 ^(1/4) = 1.068

Now we take these X to calculate implicit rate (X-1)*100 = (1.068-1)*100 = 6.88

Interest rate in Implicit in Lease contract is 6.881% Question 2 -

2. Assuming the lease contract’s interest rate is 9% each year, determine liability and right-touse

and present how to account this lease contract on January 1, 2015. Ans :-

The lease liability is defined as the present value of your future lease payments.

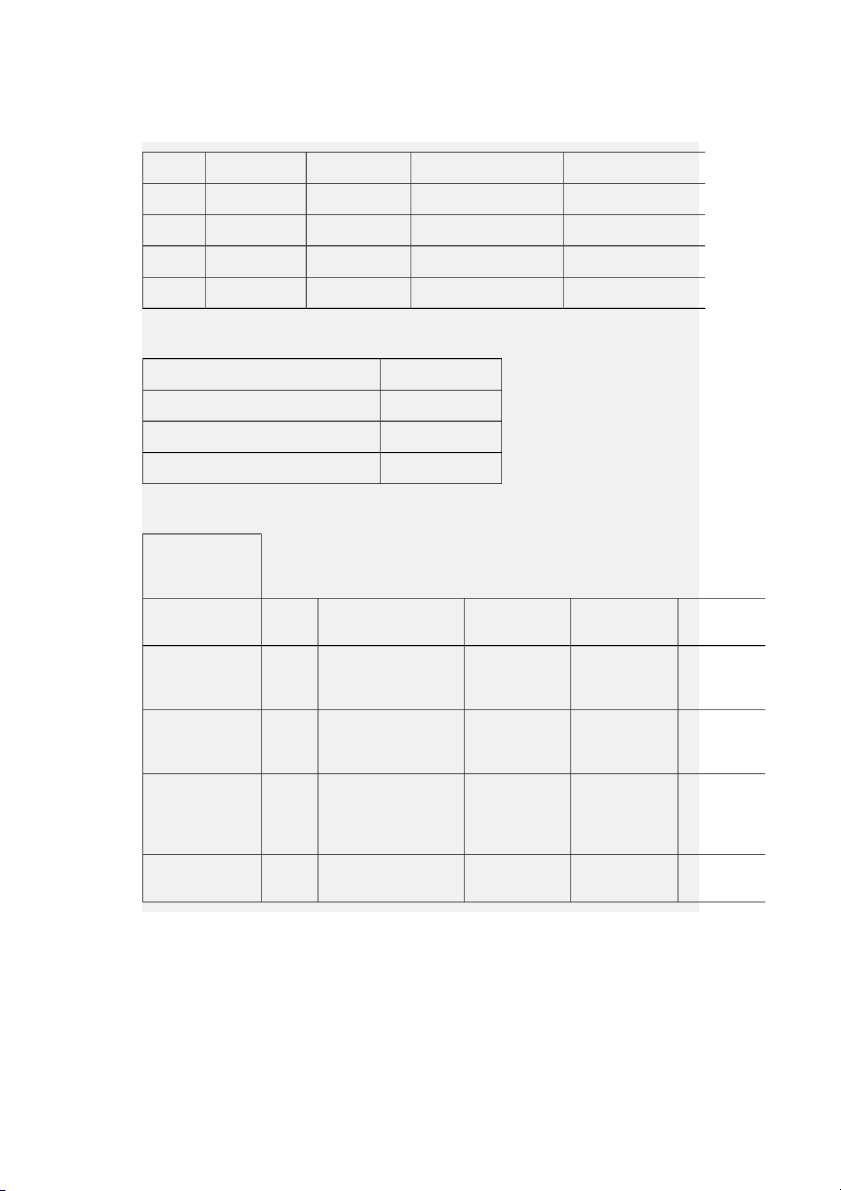

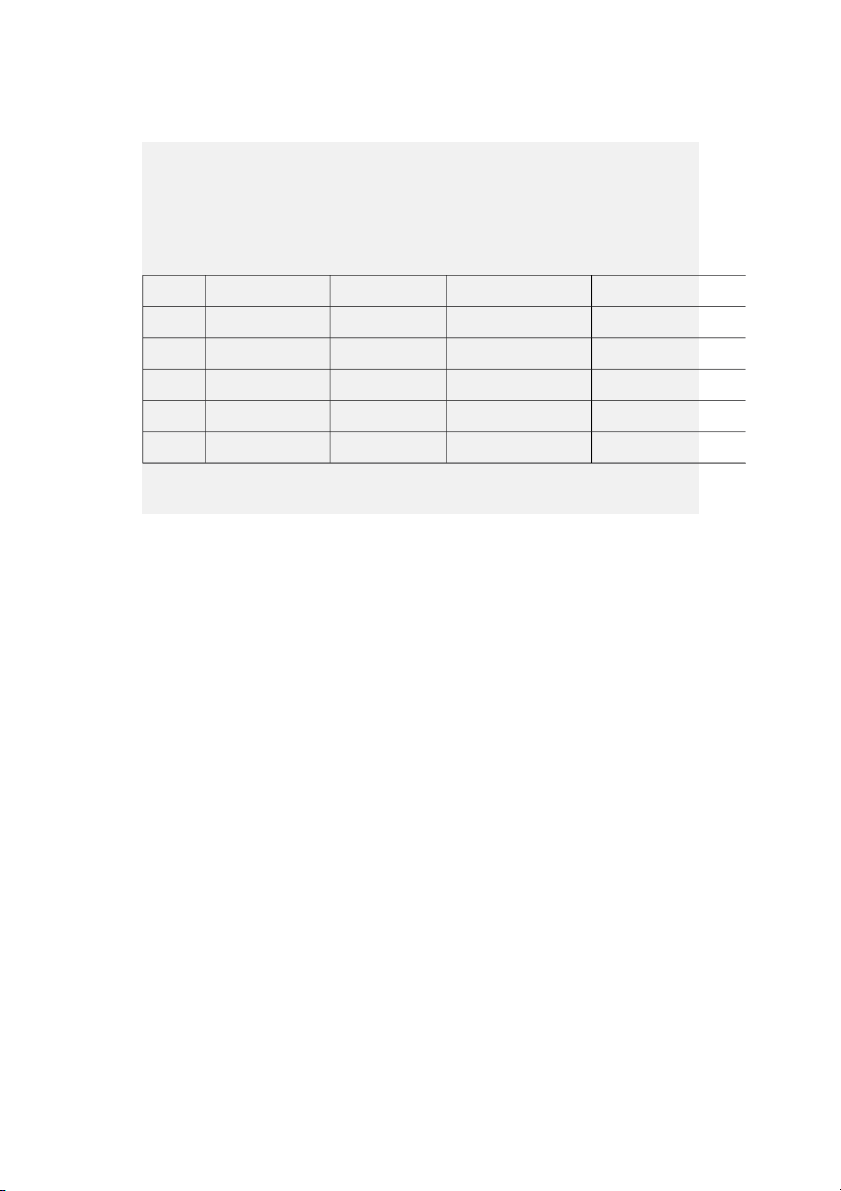

Lease Liability at the rate of 9% is $1,369,645.22. Period Cash Expenses Liability Reduction Liability Balance $ 1,369,645.22 1 $ 400,000.00 $ 123,268.07 $ 276,731.93 $ 1,092,913.29 2 $ 424,000.00 $ 98,362.20 $ 325,637.80 $ 767,275.48 3 $ 424,000.00 $ 69,054.79 $ 354,945.21 $ 412,330.28 4 $ 449,440.00 $ 37,109.72 $ 412,330.28 $ -

Right to Use of Asset Calcualted $1,469,645.22. Please refer below details. Particualrs Amount

Initial Amount of lease Liability $ 1,369,645.22 Add Consultancy Fee $ 100,000.00

Total Cost of Right to Use of Asset $ 1,469,645.22

Broker fee is paid by other company hence not part of our calculations. Journal Entries of Tusanmi Company Debit Credit Sr No Date Particulars Reference Amount Amount Wind-generating 1-Jan- 1 device Account 2015 1,369,645.22 Debit To long Vuong company Payble 1,369,645.22 account Credit Being Lease agrremnt done with Long Vuoung Company 1-Jan- Consulancy Fee 2 2015 Account Debit 100,000.00 To Cash Account 100,000.00 Being Consultaion Fee has been paid.

Question 3 - Prepare all journal entries related to this lease contract on December 31, 2015. Ans :- Journal Entries of Tusanmi Company Debit Credit Sr No Date Particulars Reference Amount Amount 31- Depreciation on Refer $ 1 Dec- Wind-generating Depreciation 325,000.00 2015 device Account Debit Working To Accumulated Depreciation on $ Wind-generating 325,000.00 device Account Debit Being Depreciation is charged on Asset. 31- Long Vuong company $ Refer Present 2 Dec- Payble account Debit 372,480.00 Value Working 2015 Interest Account $ Debit 27,520.00 $ To Cash Account 400,000.00 Depreciation Working

Total Cost of devise = $1,300,000

Life of Device = 4 years (As per given it will 6 year but we use only for 4 years hence taken as 4 years.)

Depreciation for the year = $325,000

Interest Amount Working- Here calculation done basis the interest rate calculated on answer 1 which is 6.88% Period Cash Expenses Liability Reduction Liability Balance $ 1,580,656.13 1 $ 400,000.00 $ 27,520.00 $ 372,480.00 $ 1,208,176.13 2 $ 424,000.00 $ 29,171.20 $ 394,828.80 $ 813,347.33 3 $ 424,000.00 $ 29,171.20 $ 394,828.80 $ 418,518.53 4 $ 449,440.00 $ 30,921.47 $ 418,518.53 $

I hope above answers will resolve your query. Please rate my answer.