Preview text:

Hai An Transport & Stevedoring JSC HOSE: HAH ANALYSIS REPORT JULY 23, 2022

Authored by: Adonis Team 1. Thi Truong Vi Tran 2. Huy Hoang Nguyen 3. Van Duc Pham 4. Thi Kim Thuy Vo 5. Nguyen Minh Dat To Business Description

Hai An Transportation and Loading Company Limited (after changing to Hai

An Transportation and Loading Joint Stock Company) was established in

2009 in Hanoi with a charter capital of VND 150 billion. HAH has an

extensive logistic network with 3 main branches: Port Operations,

Transportation and Depot & Logistics. The company has established 9

subsidiaries and associated companies operating in the fields of: port

exploitation, warehouse exploitation, container transport, maritime agents,

logistics services... with annual profits of continuous growth since 2010. The

company currently owns a fleet of quality container ships with a total of 8

container ships with a capacity of 700 to 1,800 TEUs that operate effectively

on inland and inland Asia routes. With constant efforts, the Company's fleet is

currently in the top 100 largest fleets in the world, and is one of the most

prestigious domestic and intra-Asian container carriers, ensuring the weekly

schedule in accordance with the commitment with customers.

To promote the expansion of the market, in March 2022, HAH opened the

intra-Asian container transport route: Hai Phong – Hong Kong – Nansha –

Hai Phong with a schedule of 1 week/trip, operated by Haian Bell with a

capacity of 1,200 TEU. This is the first time Haian Lines' ship has operated

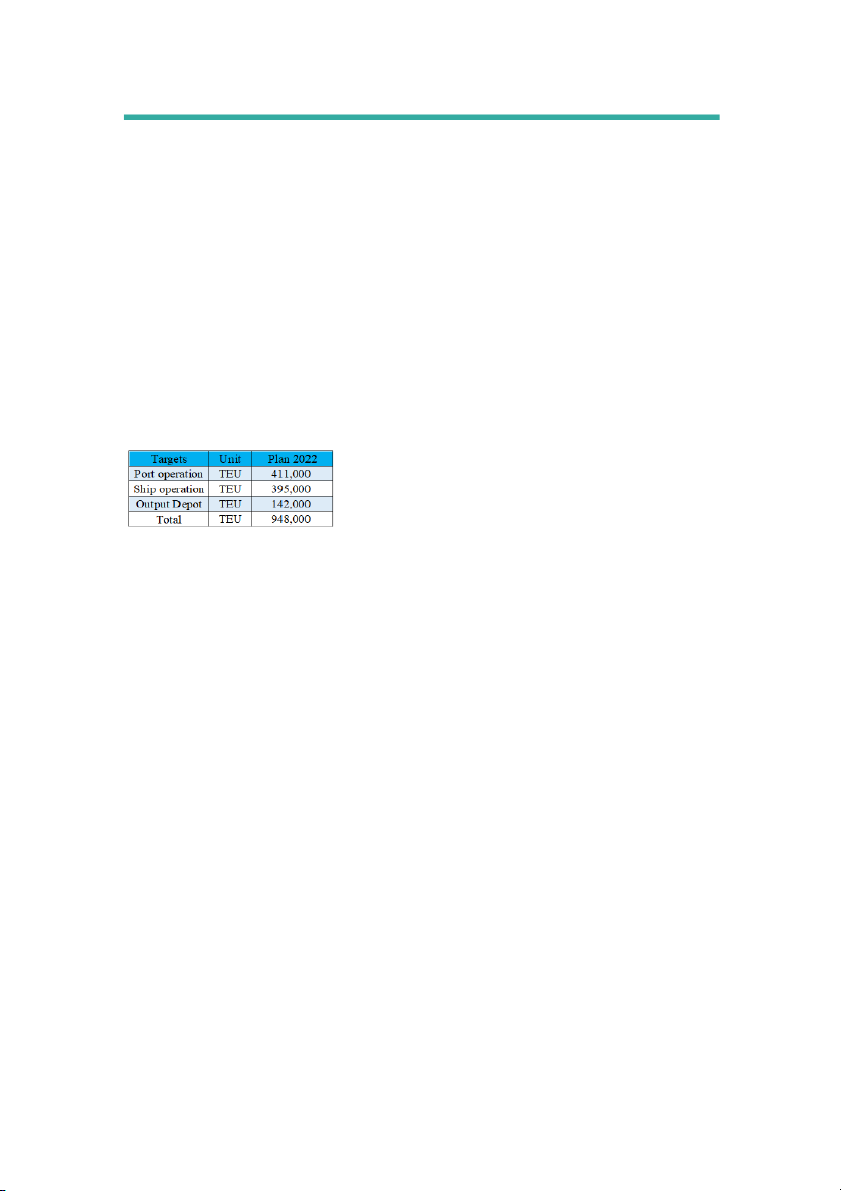

Figure 1: Operational plan in 2022

cargo in a mainland Chinese port. In June 2022, the inland container transport

route of PHONG – QINZHOU (Kham Chau – Guangxi – China) that Hai An

Group has just opened was officially opened. This is the second consecutive

shipping route Hai An Group opened in the last 3 months to transport

containers directly from Hai Phong to China.

After successfully receiving and concluding the charter contract with TS

Lines in late March 2022, in early April 2022 ANBIEN AIRCRAFT was

successfully operated by Hai An Transportation and Loading Joint Stock

Company for the first domestic flight. The container ship Anbien Bay with a

capacity of 25,800 dwt equivalent to a capacity of 1,794 TEU was put into

operation on the North- South route, contributing to less cargo pressure due to

the lack of transport facilities on the North-South route.

Hai An Transportation and Loading Joint Stock Company recorded a net

revenue of goods sales and service provision in Q1 2022 of VND 652 billion,

an impressive 82% growth compared to the same period, a profit after tax of

3 times compared to the same period, reaching VND 263 billion. The growth

of the company's profit after tax is mainly brought about by the fleet. Specifically, 1

the company invested in more HA East and HA West ships in April and May

2021, resulting in more ships in Q1 of this year than in Q1 of the previous year.

The revenue structure of HAH has shifted over the years in the direction of

increasing ship operating revenue, in contrast, port operating revenue has

decreased over the years in the period of 2018 – 2021. Most of HAH's

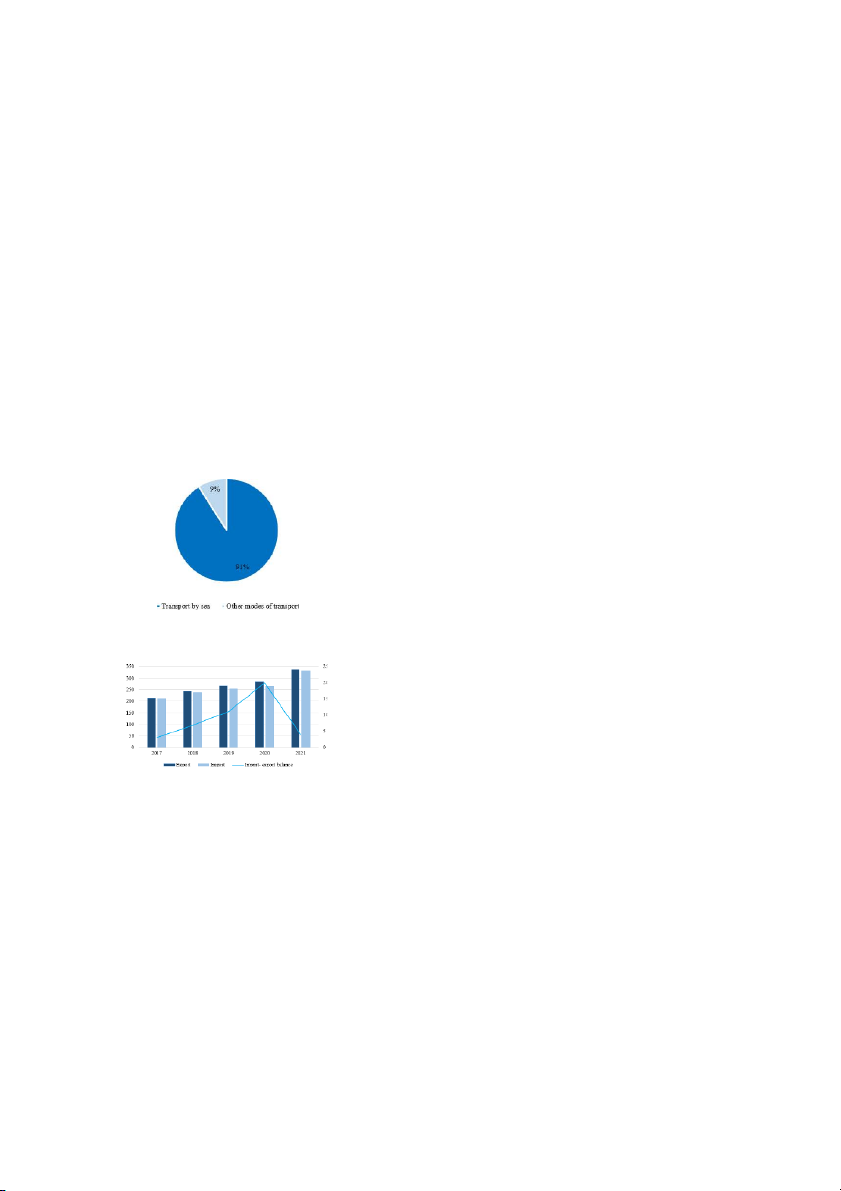

Figure 2: Revenue structure

revenue (more than 80%) comes from ship operation, only a small part comes

from port operation and other activities. Geographical location:

In terms of port exploitation, and depot, HAH has a container yard area of

150,000 m2 along with a CFS bonded warehouse area of 4,000 m2 and a

depot area of 55,000 m2. The geographical location of the logistics is not

favorable for port exploitation but has the potential for ship exploitation.

HAH has stepped up the lease of human mind transport ship haian east -

Singapore - Bangladesh HAIAN WEST – north-south and ship liquidation service named HAIAN SONG. Corporate Governance

Shareholder structure: HAH is a private enterprise with a proportion of

domestic shareholders accounting for 87.96%, the rest are foreign

shareholders. In which, the major shareholders are Hai Ha Investment And

Transport Joint Stock Company with 11.41%, followed by SAOA D.C

Investment Company with 8.27%, CTBC Vietnam Equity Fund is the next

major shareholder with 5.12% shareholding ratio (updated on July 4, 2022),

the rest are other shareholders holding at a very small rate (Appendix 5).

However, this shareholder structure minimizes the risk of large price

fluctuations from the sudden sale of shares from internal shareholders,

causing loss of confidence for investors.

Figure 3: Shareholder structure

Board of Management: The Board of Management has 6 members,

including 1 independent member, ensuring the percentage of independent

members in accordance with the State's regulations (Appendix 2). The

governance structure of HAH has a separate Supervisory Board consisting of

3 members supervising the activities of the Board of Management and the

Board of Directors. Hai An has a leadership with extremely long experience

in shipping. Specifically, Mr. Vu Ngoc Son, Chairman of the Board of

Directors of HAH has more than 50 years of experience when working in

Vietnamese shipping companies since 1970. We have faith that an

experienced Board of Directors is fully

able to provide the right development strategies for the company.

Specifically, in 2021, Hai An Transportation and Loading Joint Stock

Company also benefited from the high trend of international fares, many

shipping companies took the opportunity to lease ships to foreign markets. At

the same time, domestic fares were gradually adjusted to suit the general

trend, thanks to the attempt to invest more ships, so from Quarter IV, the

Company leased 02 ships of type 1740 – 1800 TEU to foreign countries.

Therefore, the profit of Quarter IV for the whole year 2021 increased 3 times compared to the plan.

Board of manager: The Board of Directors of the company consists of 7

people (Appendix 3), in addition to their managerial capacity, members have

professional ability in the field of economics, engineering, transportation and

finance due to their time as specialists in the departments. We believe that this

multi-disciplinary understanding can help the Board of Directors make sound,

expeditious, and disciplined decisions. Industry Overview

In the 40s and 50s of the nineteenth century, a series of shipping companies

were born. By the beginning of the twentieth century, industrial raw materials

accounted for two-thirds of the volume of goods transported by sea. Today,

sea transport has become an indispensable international mode of transport,

accounting for 91% of the goods transported. The shipping industry plays an

important role in the global supply chain.

Despite the large impact from the COVID-19 pandemic, the total cargo

volume through the port of Vietnam in 2021 still reached more than 703

Figure 4: Output of goods transported by

million tons, an increase of 2% compared to 2020. In particular, the volume modes of transport

of imports and exports of international transport of Vietnam's seagoing fleet

has reached a rare growth rate of 54% (reaching nearly 5 million tons)

compared to 2020. The main items are transported on the routes: China,

Japan, Korea, Southeast Asia and some European routes...

The supply chain is congested the price of transport fish is high. In the global

Figure 5: Import – Export balance (billion USD)

shipping market, container freight rates began to fall sharply in February due

to weakened demand during the Chinese New Year, followed by the closure

of China's cities under the "No Covid" policy. According to Drewry, the

average container freight rate has fallen 21% since February but is still 5

times higher than the level before Covid. Shanghai reopened on June 1 and

the high season will put additional pressure on already congested supply

chains. Therefore, we think that congestion will continue to persist until 2023

until the backlog is released, whereby freight rates remain high.

Shipbuilding orders have continued to rise in recent months as hauliers

rushed to expand their fleets to address supply constraints. Total new

shipbuilding orders have reached 26% of the existing fleet tonnage, with 872

vessels (6.6 million TEUs). However, the majority of new shipbuilding orders

are expected to be delivered in 2023 and 2024, so there is no pressure on ship

supply in the short term. However, the consolidation of the container shipping

industry over the past decade will help carriers better control freight rates by:

increasing ship demolition activities to offset the very low level of demolition

in 2021-2022; and reducing the number of trains and reducing the speed of

trains to reduce supply. As a result, the controlled capacity can offset part of

the new train traffic and help maintain transport fares higher than before Covid. Competitive position

Open more intra-Asian service lines from the second half of 2022. HAH is

establishing Zim – Hai An Container Transport Joint Venture with Zim

Integrated Shipping Services Ltd. (the 10th largest container carrier in the

world) to provide transportation services on Inner Asia routes and gradually

expand into South Asia, the Middle East, Oceania... At the beginning, the

Consortium plans to operate 2 routes in Vietnam - Southeast Asia (from the

second half of 2022) and Vietnam - China (from the first half of 2023). With

charter capital of $2 million, the Consortium will not invest its own fleet and

will charter from Zim – Hai An. This joint venture will bring two sources of

income for HAH: revenue from chartering and profit shared from operating the fleet.

Over the past few years, the container shipping industry has been strongly

consolidated, increasing the level of market concentration with the 10 largest

shipping lines controlling about 85% of the market. By leveraging Zim's

established international network, HAH's fleet can access the Intra-Asian

market as a transshipment vessel for long-distance services operated by Zim

and increase its presence in the international market. We think that the current

shortage of empty ships and containers will create opportunities for Zim –

Hai An Joint Venture to build customer files faster. Financial Analysis

Revenue and NPAT in 2021 grew strongly. In 2020, revenue reached 1,191

billion VND. Although the Covid-19 epidemic is still complicated, the total

stocks of goods through Vietnam's seaports have reached more than 689

million tons. The stocks of container cargo through the port reached more

than 22 million TEUs, an increase of 13% over the same period in 2019. Hai

An port operated 277 ships with a total throughput of more than 346,934

TEUs (reaching more than 110.14% of the plan). Transport stocks in 2020

reached 348,862 TEUs (120.30% of the expectation - domestic transport:

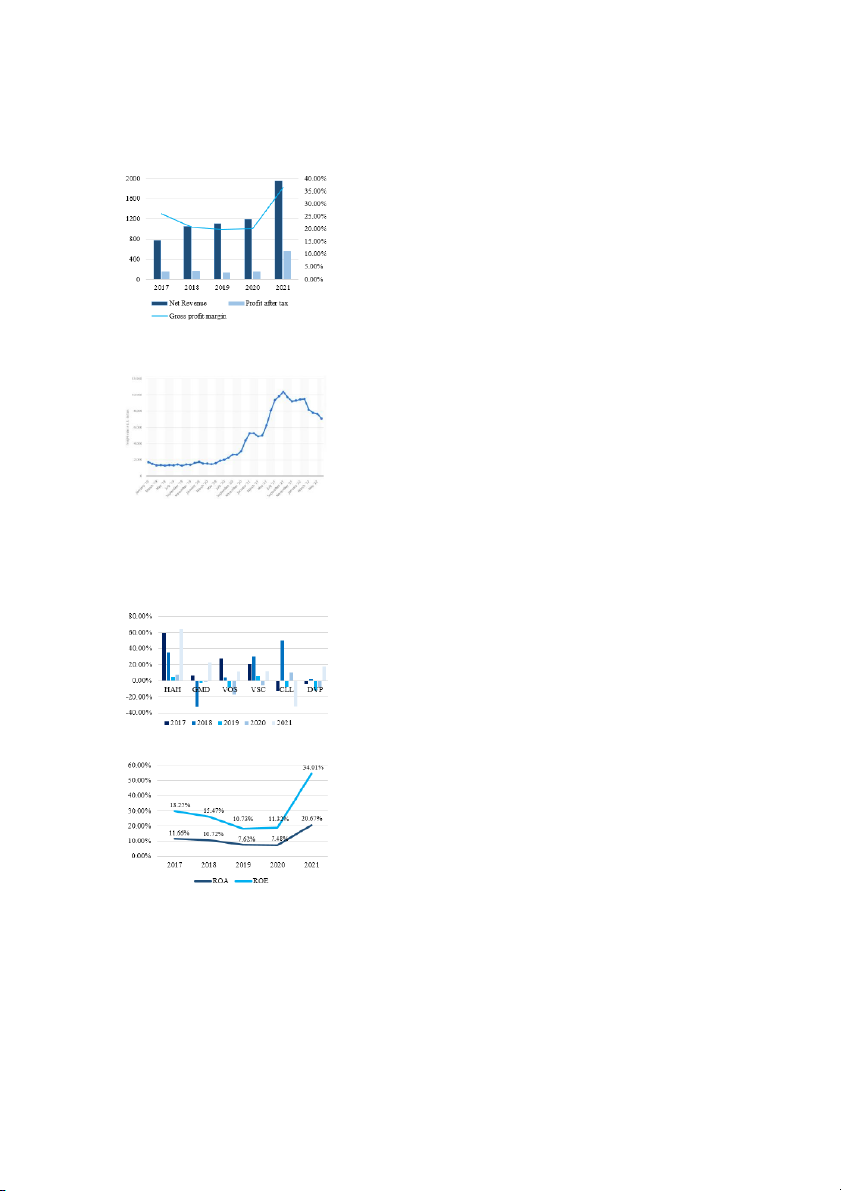

Figure 6: Business results (billion VND)

295,210 TEUs, international transport: 53,652 TEUs.

In 2021, HAH's revenue got VND 1955 billion, up 64.1% over the same

period in 2020, reaching the highest level in 2017 - 2021. The Covid-19

pandemic has disrupted supply chains, causing bottleneck seriously at some

importance ports in the world that cause a decrease in transport capacity and

supply. Accordingly, freight rates along with the demand for chartering

increased to compensate for the affected power. Due to high international

freight rates, many shipping lines have taken advantage of the opportunity to

lease ships to foreign markets while domestic freight rates have also been

Figure 7: Global container freight rate index

from January 2019 to June 2022(in U.S dollars)

gradually adjusted to suit the general trend, so the activities of enterprises Sea – Cre: Statista

transport and Logistics still achieved good results. Operating in the fields of

seaports, shipping and logistics, despite being heavily affected by the Covid-

19 pandemic, the Company still grew in profit during the year thanks to

domestic transportation (market share of nearly 30% and increased year-on-

year). freight rates according to the route) and chartering (4 ships), etc.

Outstanding growth in net revenue: HAH is an enterprise with positive net

revenue growth otherwise many businesses have negative net revenue growth

in 2017-2021. This stems from HAH's strong fleet development, high freight

rates, and foreign cooperation with SM Lines or ZIM, which has helped

Figure 8: Net revenue growth rate

HAH's revenue grow significantly. In 2021, Hai An was successful when it

earned a net revenue of up to 1,955 billion VND, a record revenue since its

inception, especially the ship exploitation segment contributed 82% of total revenue - 78.4 % profit.

Profitability: We evaluate through ROA and ROE.

HAH's ROE has clearly improved in 2021 to 34.01%, in which the main

Figure 9: ROA & ROE of HAH from 2017-2021

reason is that the business has focused on investing in its fleet, expanding its

chartering, transportation and seaports in 2021. In the beginning of 2021, Hai

An has invested 580 billion VND in the fleet. Although the company is

maintaining a fairly safe leverage ratio when it wants to save some financial

costs, but the company is still in a good ROE level along with a lot of growth

potential, which will be potential to become a good growth indicator in the future of Hai An.

HAH's ROA is regularly maintained at the leading level of the industry,

which is predicted that in the coming years HAH's ROA will only increase

slightly. And HAH will continue to expand its fleet greatly to make total

assets increase in the coming years while revenue and profit will not grow

suddenly because freight rates are quite high and difficult to increase further. Figure 10: ROE

In contrast to HAH is VOS, which has low profits and even reported losses in

2020. The main reason is that the industry situation in this period is so

difficult and VOS has been greatly affected. Although this business will

report a profit in 2021, it is only a banking structure operation of VOS. In

fact, this business still operates at a loss.

HAH has indicated the industry wave so well and used capital

effectively so which created more confidence from investors.

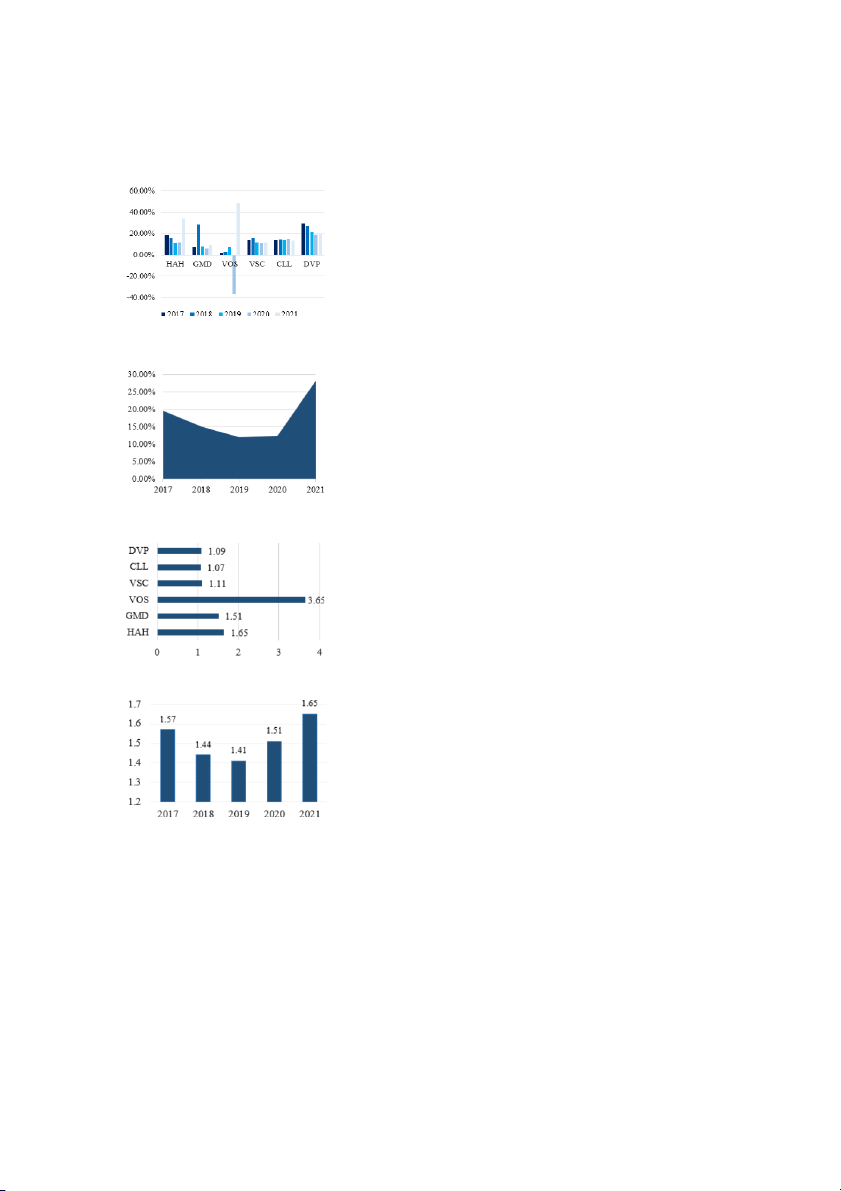

Efficiency ratios: To evaluate the ability to optimize all kinds of costs of the

Figure 11: Net profit margin

enterprise expressed through the net profit margin (figure 11). HAH's net

margin is always high due to the reasonable strategy of the management.

With low-cost ship investment, depreciation and interest expenses are always

low, which help to keep net profit margin on the top.

Financial Potential: The use of reasonable leverage is a problem for

businesses in general and shipping businesses in particular. HAH's financial

Figure 12: Financial leverage of sea transport companies in 2021

leverage is used reasonably. During the gloomy market period, they used low

leverage. When the market went up and freight rates increased, they

borrowed debt to invest in a new fleet, so they can amplify profits and

increase profits and the ROE index (in 2021 it reached 1.65). However, when

compared to the common ground, HAH's leverage is also low, so that

enterprises do not have to bear too much pressure from interest expenses

compared to other enterprises in the same industry, thereby helping

enterprises to Sustained through bad market times.

Figure 13: Financial Leverage Investment summary

We believe that HAH is in the process of accumulating in the shipping

industry and if VNIDEX exceeds the threshold of more than 1,200 points, growth is

very likely. In the short term, we think that HAH will maintain high profit

growth rate thanks to capacity expansion.

The current seaport sector still benefits greatly from the rupture of the supply

chain, as a result of the Russian-Ukrainian war. In addition, in the world

shipping market, container freight rates have fallen sharply since March, but

as of now July, freight rates are still higher than the same period last year.

HAH is a major operating enterprise and profits from shipping activities.

Current fares remain anchored at high prices. Current fares remain anchored

at high prices. So this is a very high advantage for HAH, especially in 2022,

HAH has improved capacity and number of fleets, this will be a huge

advantage for sudden revenue and profit growth in 2022. Valuation

The method we use is DCF and Market-based valuation

Regarding revenue forecast, based on the growth rate of fleet capacity, the

plan to buy and build new ships, along with the forecast of sea freight rates

will increase or decrease in the coming time.

In terms of cost structure, it is worth noting that fuel costs (accounting for 30%)

- this cost depends on world oil prices, depreciation costs - depend on the

growth of fixed assets such as fleet and port. In addition, there are interest

expenses, selling and administrative expenses.

Indices in the balance sheet, the forecast group is based on the plan to buy

new ships, the capital used to buy the ship, and the past turnover indexes to give future projections.

In 2022, the group's forecast scenario is as follows:

- The company continues to invest in a port and depot project in Vung Tau,

Ho Chi Minh City to create a long-term logistics base for the company in the

southern region. Established and supported a joint venture with Zim Lines to

enter the regional Feeder market.

- In the period of 2022-2024, the company has ordered more ships serving

both domestic and international.

Expand production, increase revenue.

- Freight rates will level off or decrease in the coming quarters, oil prices are

also on a downward trend, which will have a small impact on HAH's revenue,

but according to the team's assessment, when looking at the broader picture, this is still acceptable.

- The plan to expand market share to intra-Asia and gradually to larger

regions is a wise move that brings significant revenue and profit to HAH.

=> The number of outstanding shares of HAH is 68.295.817 shares. Through

the analysis of the data and forecast scenarios of the group, we recommend

BUYING for HAH shares and raising the target price of 1 year to 111.002

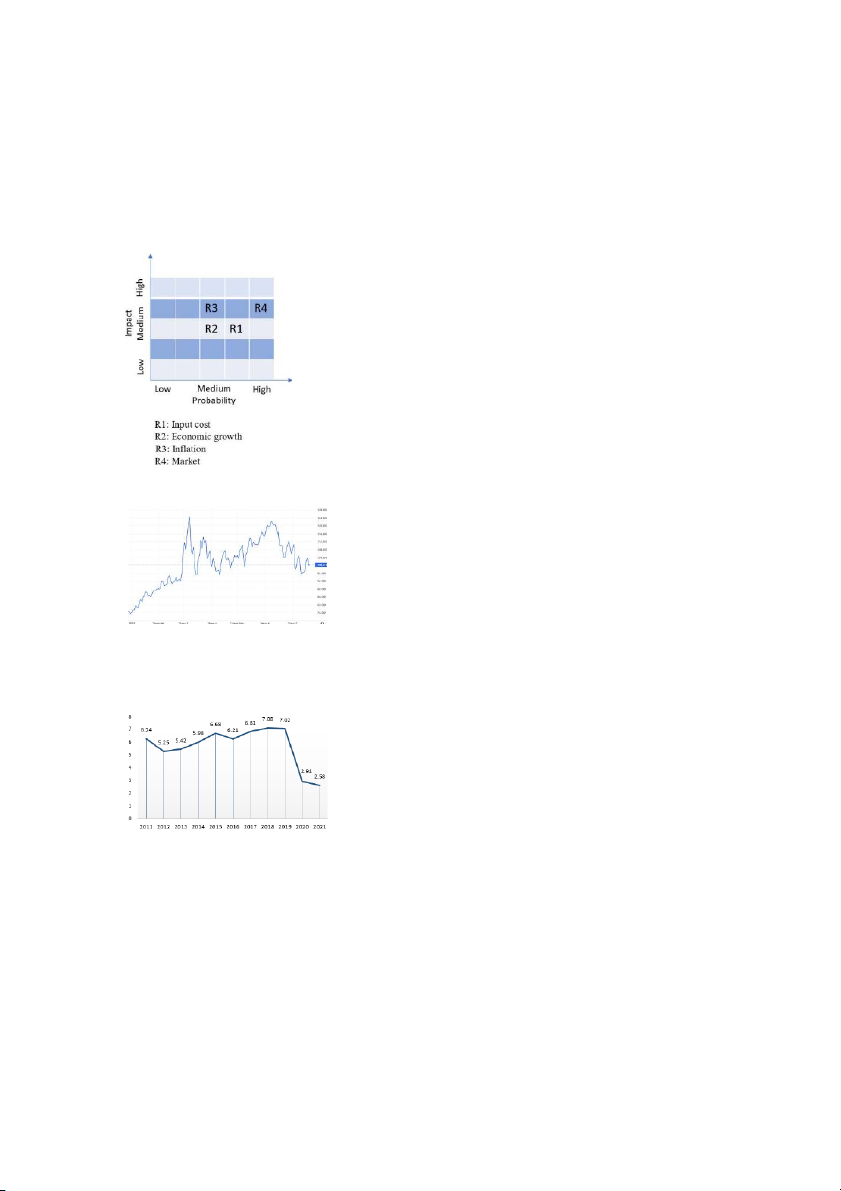

VND/share, corresponding to a potential price increase of 66,9%. Investment risk Input cost:

Due to transportation and freight forwarding activities, Company's activities

are affected by the fluctuation in fuel prices, which is a big risk for

transporting enterprises in general and HAH particularly. With the intense

geopolitical situation at this time, maintaining high oil prices may stand a

great threat against businesses. However, because of petroleum’s international Figure 14: Risk Matrix

dependence, the Company can only adjust service prices accordingly and in line with the market. Economic growth:

For a company specializing in seaport services, transporting and logistics, the

on-going events of industrial production, domestic and international trade

actually has a great impact on the main production and business results.

Economic growth is still low due to the lack of domestic human resources,

then FDI capital will also decline, affecting the entire economy. However, the

Figure 15: The price of crude oil from the

high rate of vaccination against COVID-19 vaccine and the non-hazardous

beginning of 2022 (USD/barrel)

Omicron strain like Delta will be psychological drugs to help the group of

workers quickly return to work, which may be a sign for the future. the

recovery of the economy and the stronger development of the transportation industry.

Inflation (CPI and Basic Inflation)

As a port and shipping service company, the inflation index affects the

Company's production and business activities through input costs, especially

petroleum and labor prices. The pressure to control inflation in 2022 is

Figure 16: VietNam’s economic growth 2011-

considered to be significant, especially when the energy crisis may put a 2021(%)

heavy burden, the tendency of speculation and hoarding of strategic products

of some big countries would make a comprehensive impact on worldwide and

domestic economy. In addition, the

inflation situation also affects import- export