Preview text:

MICROECONOMICS Individual Assignment Full name: Hoang Cong Minh Student ID: 11224180 Class: E-BBA 14.1 CASE STUDY ANALYSIS

1. How can you use the theory of "Supply, Demand- and elasticity " to explain the case (by using graphs)?

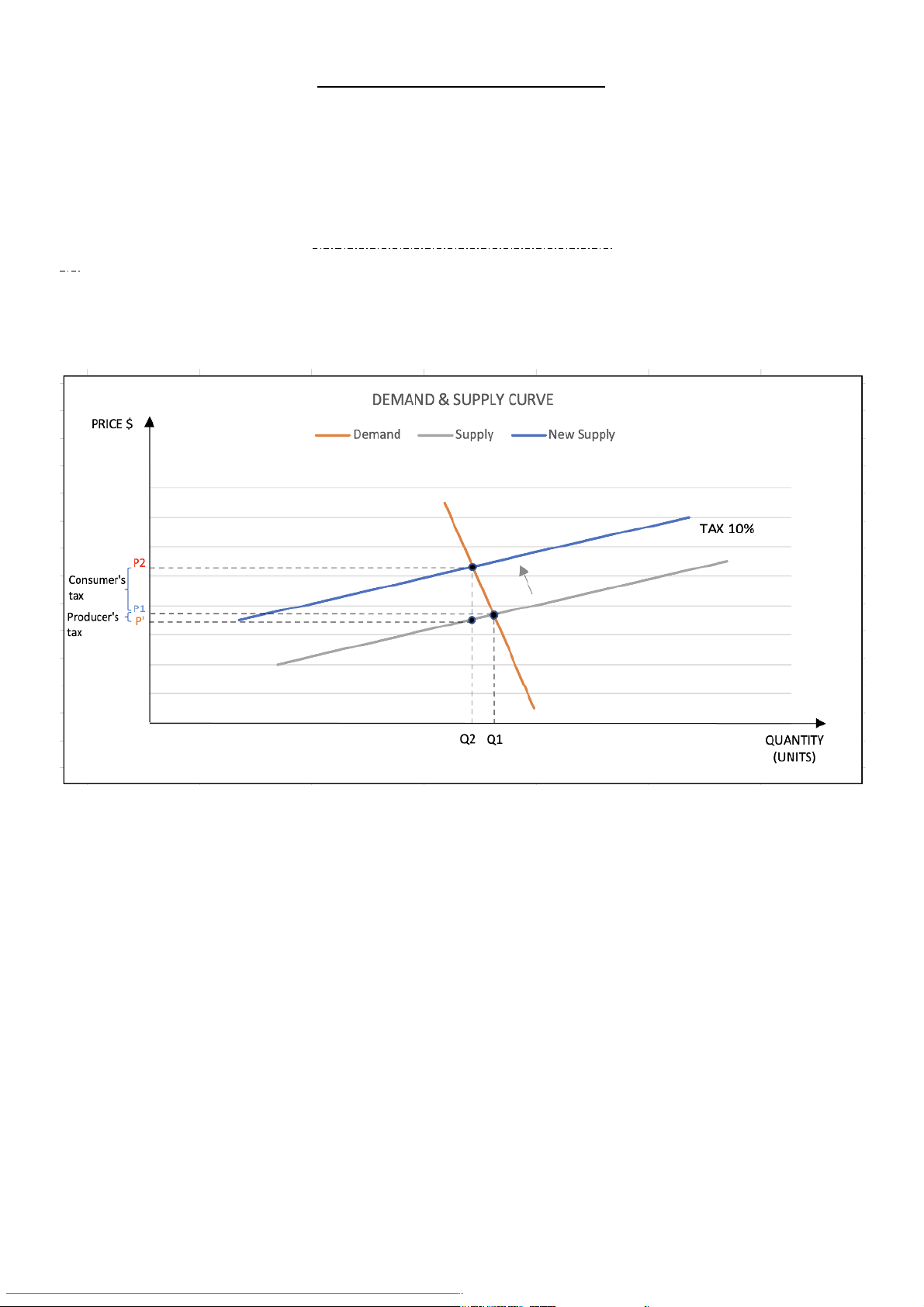

* In this case, the assumption was that the demand for these luxury goods was quite inelastic.

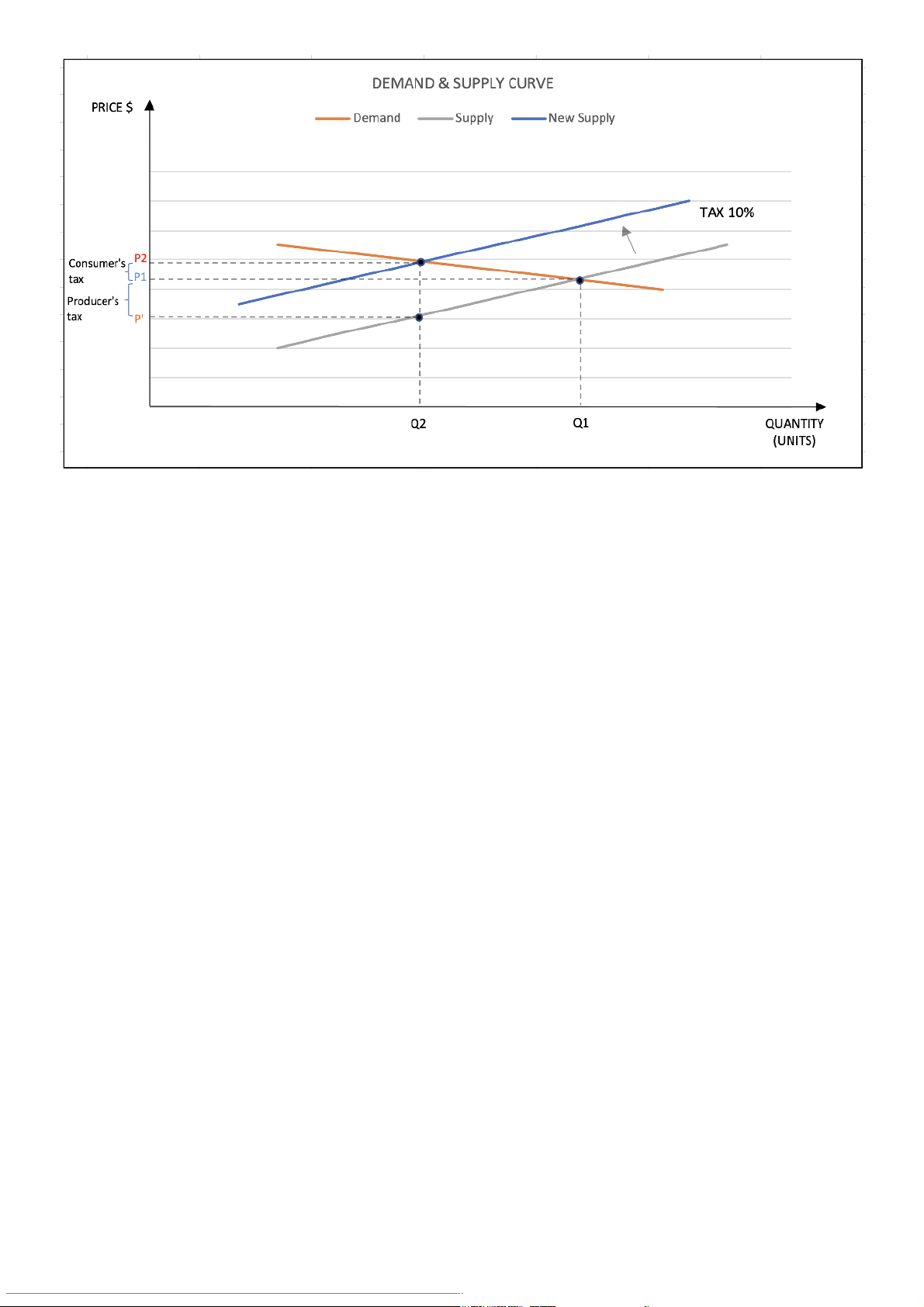

So the demand curve is steep. We can see it in the graph that:

+ Tax caused the shift of the supply curve.

+ The supply curve shift up, the equilibrium quantity would change little while the

equilibrium price would rise much, as the rich simply paid the extra cost.

+ The demand curve was inelastic % Q < % P When the supply curve move up, the

equilibrium point moved along on the demand curve, so the equilibrium quantity would

change little and the equilibrium price would rise much.

+ The demand was inelastic, when the tax was applied.

consumer’s tax incidence > producer’s tax incidence.

* However, when the demand for these luxury goods is reasonable elastic. The demand curve is flat. We can see:

+ The demand curve was elastic % Q > % P

+ The flatness of the demand curve and the upward shift of the supply curve leads to a

much smaller rise in equilibrium price and a lager falling in equilibrium quantity.

+ The demand was elastic, when the tax was applied.

consumer’s tax incidence < producer’s tax incidence.

2. What is the implication for the Government in the tax policy?

“Luxury tax” is a good way to raise money from rich people.But, the fact points out that

the assumption of the elasticity of demand for these luxury goods is not correct. To some

extent, it also shows that the government’s tax policy is not appropriate.

If the demand was elastic, consumer’s tax incidence < producer’s tax incidence. So

the burden of the new luxury tax actually ended up falling on the workers and retailers

who manufacture and sell these luxury items, many of whom are middle class at best.

If the demand was inelastic, consumer’s tax incidence > producer’s tax incidence. But

the rich people who do not response dramatically when there is a change in price would pay most of the tax.

The burden of this tax ended up falling on the workers and retailers who manufacture

and sell these luxury goods, which means the purpose of the tax has failed.