Preview text:

Exercise 2 A) Acquisition Cost of equipment:

Purchase price including Import duty : 60,000

Installation and assembly costs 1,300

Testing Expense excluding sale proceed of sample(2000-500) 1,500

Total Cost of Equipment 62,800 (60,000+1,300+1,500) Asset/Equipment A/C Dr 62,800 To Bank 62,800 B)

Expenditure incurred in accordance with environmental protection legislation will be capitalized Asset/Equipment A/C Dr 20,000 To Bank 20,000 Exercise 4

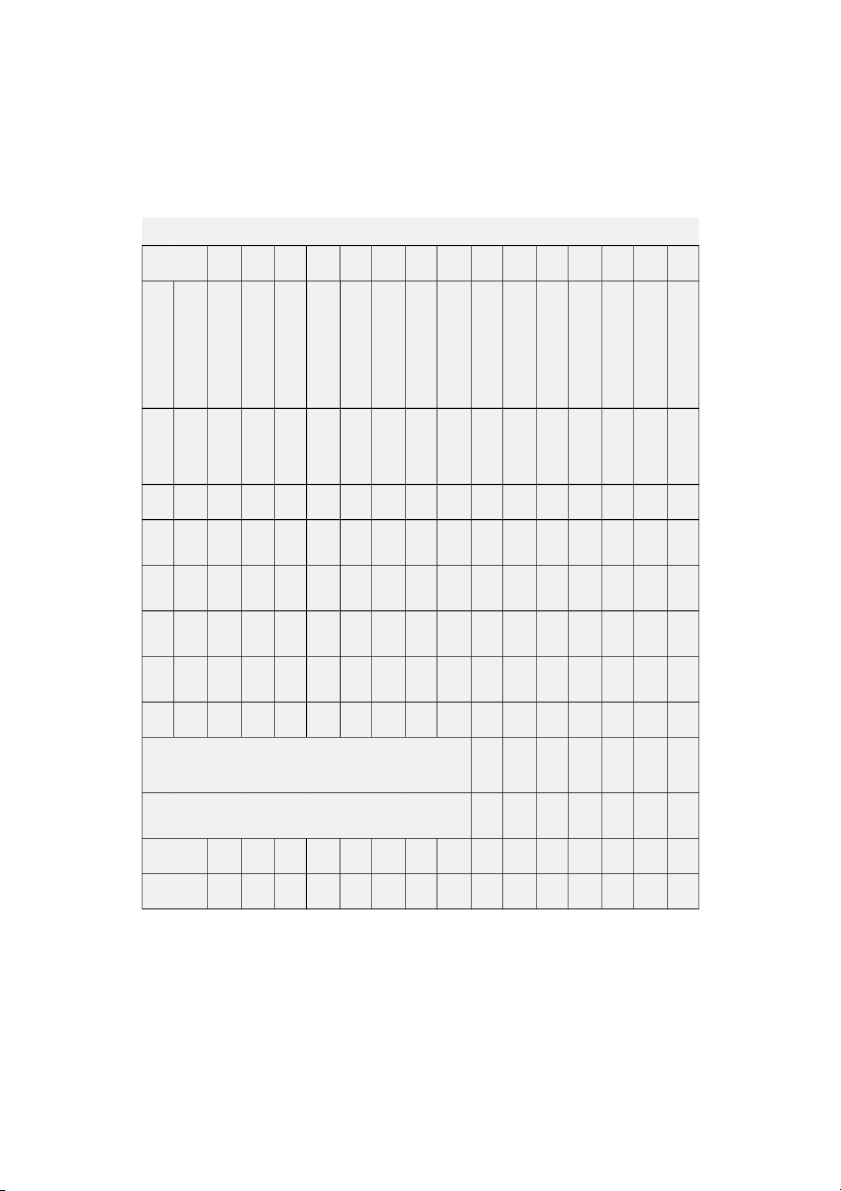

In 1990, Herman Moore Company completed the construction of a building at a cost of $2,000,000 and

first occupied it in January 1991. It was estimated that the building will have a useful life of 40 years and a

salvage value of $60,000 at the end of that time.

Early in 2001, an addition to the building was constructed at a cost of $500,000. At that time, it was

estimated that the remaining life of the building would be, as originally estimated, an additional 30 years,

and that the addition would have a life of 30 years and a salvage value of $20,000.

In 2019, it is determined that the probable life of the building and addition will extend to the end of 2050,

or 20 years beyond the original estimate.

A) Using the straight-line method, compute the annual depreciation that would have been charged from 1991 through 2000:

B) Compute the annual depreciation that would have been charged from 2001 through 2018.

C) Prepare the entry, if necessary, to adjust the account balances because of the revision of the

estimated life in 2019. (If no entry is required, select "No entry" for the account titles

and enter 0 for the amounts. Credit account titles are automatically indented

when amount is entered. Do not indent manually.)

Account Titles & Explanation Debit Credit

D) Compute the annual depreciation to be charged, beginning with 2019

A) annual depreciationfrom 1991 through 2000 :

Annual Depreciation Using the straight-line method =[Cost - salvage value] / Useful life =[$2,000,000 - $60,000] / 40 = $1940000 / 40 = $48500 per year

B) annual depreciation from 2001 through 2018 :

Depreciation of Addition to the building = [cost of $500,000 - salvage value of $20,000] / 30 years = $480000 / 30 = $16000 per year

Depreciation of Building per year = $48500

Total annual depreciation from 2001 through 2018 = 16000 + 48500 =$64500

C) "No entry" , retrospective effect will be given after 2019

D) annual depreciation to be charged, beginning with 2019 :

Total useful life remaining of Building occupied from 1991 = 40 years - 28 years used life = 12 years

Note:- 28 years = 10 years from 1991 through 2000 + 18 years from 2001 through 2018

In 2019, it is determined that the probable life of the building will extend to the end of 2050, or 20 years beyond the original estimate.

Now, New useful life of Building = 12 years + 20 years = 32 years

annual depreciation of Building = [ 2000000 - [depreciation ($48500*28 years) ] - salvage value 60000 / 32 years

= [2000000 - 1358000] - 60000 / 32 years = 582000 / 32 = $18188 per year

Total useful life remaining of Addition of Building = 30 years - (18 years from 2001 through 2018 used) = 12 years

In 2019, it is determined that the probable life of the addition will extend to the end of 2050, or 20 years beyond the original estimate

Now, New useful life of Addition = 12 years + 20 years = 32 years

annual depreciation of Addition = [ 500000 - [depreciation ($16000*18 years) ] - salvage value 20000 / 32 years

=[ 500000 - 288000] - 20000 / 32 years = 192000 / 32 = $6000 per year

Therefore , annual depreciation to be charged, beginning with 2019 = $18188 + $6000

= $24188 per year Exercise 7

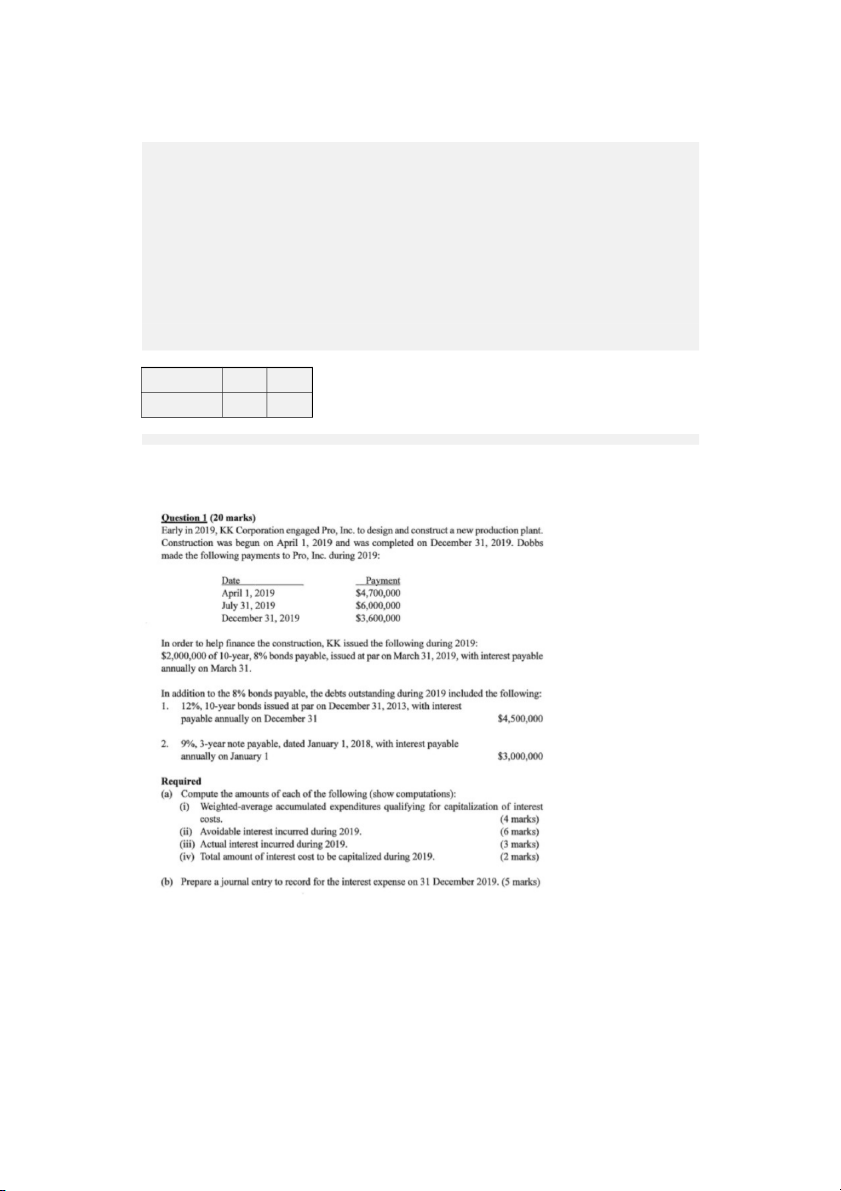

Question 1 Topic: Property, plant and equipment.

Answer both parts independently of each other.

PART A (21 marks) On 1 July 2018, ABC Ltd purchased and recorded equipment at its cost of

acquisition of $320 000. The equipment is expected to have a useful life for seven years and an

estimated residual value of $10 000. ABC Ltd depreciates the asset using the straight-line

method. ABC Ltd uses the revaluation model to equipment and records accumulated

depreciation using the net method. The reporting period end of ABC Ltd is 30 June. ABC Ltd

revalued the equipment on 30 June 2020, when the fair value of the equipment was $250 000.

On 1 July 2020, the useful life of the equipment is reassessed: it is expected to have a

remaining useful life of 6 years. The estimated residual value remains unchanged. ABC Ltd

revalued the equipment on 30 June 2021, when the fair value of the equipment was $180 000.

On 30 June 2022 the equipment was sold for $200 000.

REQUIRED: (1) Prepare journal entries to account for the revaluation of the equipment of 30

June 2020. Show all working steps.

(2) Prepare journal entries to account for the revaluation of the equipment of 30 June 2021. Show all working steps.

(3) Prepare journal entries to account for the sale of the equipment of 30 June 2022. Show all working steps. PART B

ABC Ltd acquired a machine for $750 000 on 1 July 2018. The machine had a useful life of five

years and was depreciated on a straight-line basis with no disposal value. ABC Ltd adopts the

cost model for accounting for assets in this class. ABC Ltd makes the following estimates of the

value of the machine: Date Net selling price Value in use Fair Value 30 June 2019 $550 000 520

000 590 000 30 June 2020 $460 000 420 000 490 000 Indicators of impairment were identified

on 30 June 2019, while indicators of a reversal of impairment were found on 30 June 2020.

REQUIRED: Prepare journal entries relating to this asset from 30 June 2019 to 30 June 2020.

Show the steps of impairment (or reversal of impairment) tests. Show all working (step by step) Cost of equipment =$320,000 Useful life= 7 years Residual value= $10,000

Depreciation p.a.= $320,000-$10,000/ 7 years =$44,286 p.a.

Depreciation upto 30 June 2020:- =$44,286 *2 years= $88,572

Book value as on June 30,2020:- =$320,000-$88,572 = $231,428

But it was revalued at $250,000

Upward revaluation= $250,000-$231,428 =$18,572

1-Journal entry as on 30 June, 2020:- Date Account Title and Explanation Debit Credit Equipment $18,572 Revaluation Surplus $18,572

2-On July 1,2020, useful life is reassessed to 6 years

Depreciation p.a.=$250,000-$10,000/ 6 years =$40,000 Book value as on 30 June 2021 =$250,000-$40,000 =$210,000

But fair value on revaluation= $180,000

Downward revaluation= $210,000-$180,000 =$30,000 Entry on 30 June 2021 Date Account Title and Explanation Debit Credit 1- Revaluation surplus $18,572 Profit and Loss $11,428 Equipment $30,000 OR 1- Impairment loss $30,000 Equipment $30,000 2- Revaluation surplus $18,572 Profit and Loss $11,428 Impairment loss $30,000 3-Depreciation for 2022:- =$180,000-$10,000 / 5 years =$34,000

Book value as on 30 June 2022 =$180,000-$34,000 =$146,000 Sold for $200,000

Profit on sale= $200,000-$146,000 =$54,000 Journal Entry:- Date Account Title and Explanation Debit ($) Credit ($) Cash $200,000 Equipment $146,000 Profit and Loss $54,000 2- Calcuation of depreciation

(Value of asset- scrap value)/ estimated life of asset ($750000-0)/5 Depreciation for the year 2019 150000

book value of asset as 30 june,2019 Cost of asset- depreciation $750000-$150000 $600,000

Recoverable value will be the higher of fair value less cost to sale and value in use fair value value in use

so recoverable value will be 590000

Impairment loss is the difference between the book value and recoverable value

so the impairment loss= $600000-$590000 = $10000

Journal entry for the year for 30 th june 2019 dr cr Impairment loss 10000 Machinery 10000

Now the book value of the machinery as on 30th june 2019 is 590000

depreciation for the year 2020 will be = Book value as on 30th june2019/ remaining estimated life = $590000/4 =$147500

so the book value of machinery as 30 june 2020 = Book value as on 30th june2019- depreciation = $590000-$147500 = $442500

Recoverable value will be the higher of fair value less cost to sale and value in use Fair value =$490000 Value in use= $42000

So the recoverable value is $ 490000

As the recoverable value is more than book value the impairment loss recorded earlier should be reversed but the value of the asset should

not be more than in the case if no impairment has been recorded

Value of the asset if there is no impairment loss=

cost of assets- dep. for two years = 750000- (2*150000) = $ 450000

so the impairment loss of $ 7500 i.e ($450000-$442500)will be reversed the journal entry will be Machinery $7,500 Impairment loss $7,500

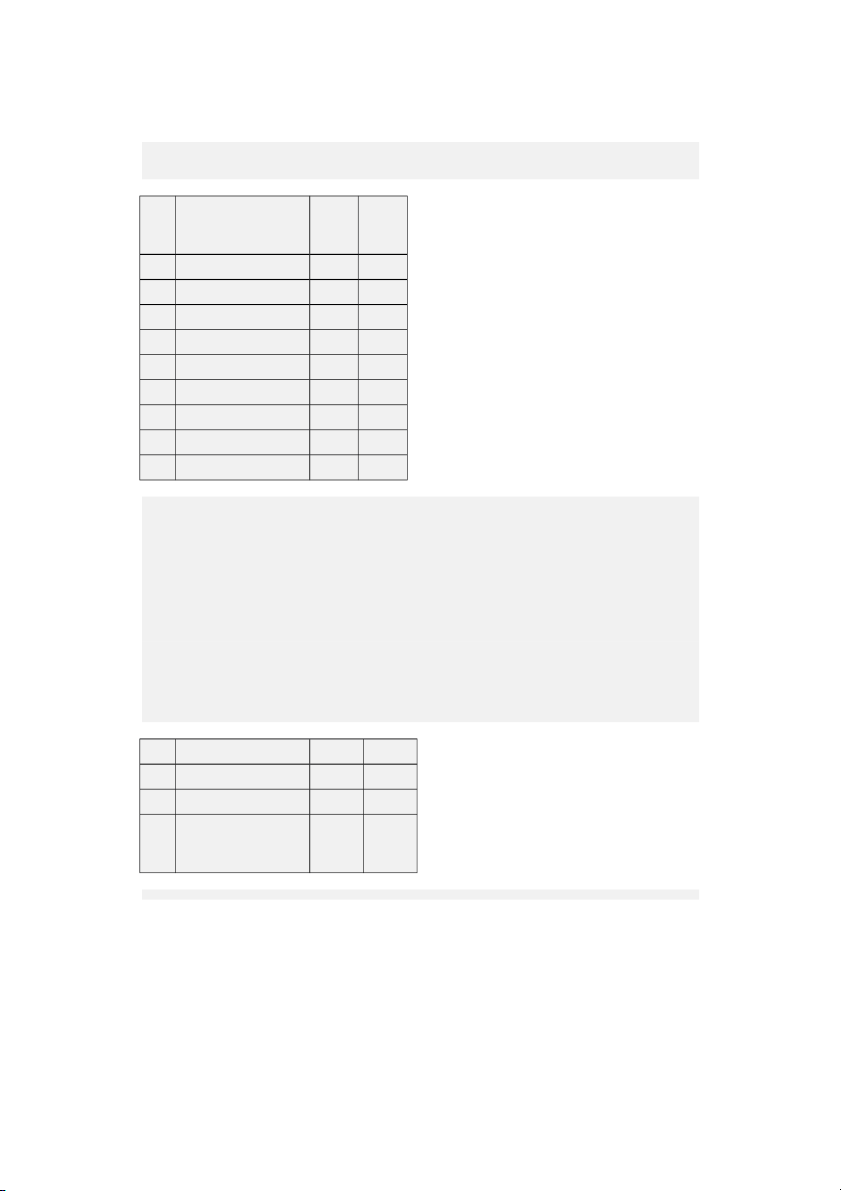

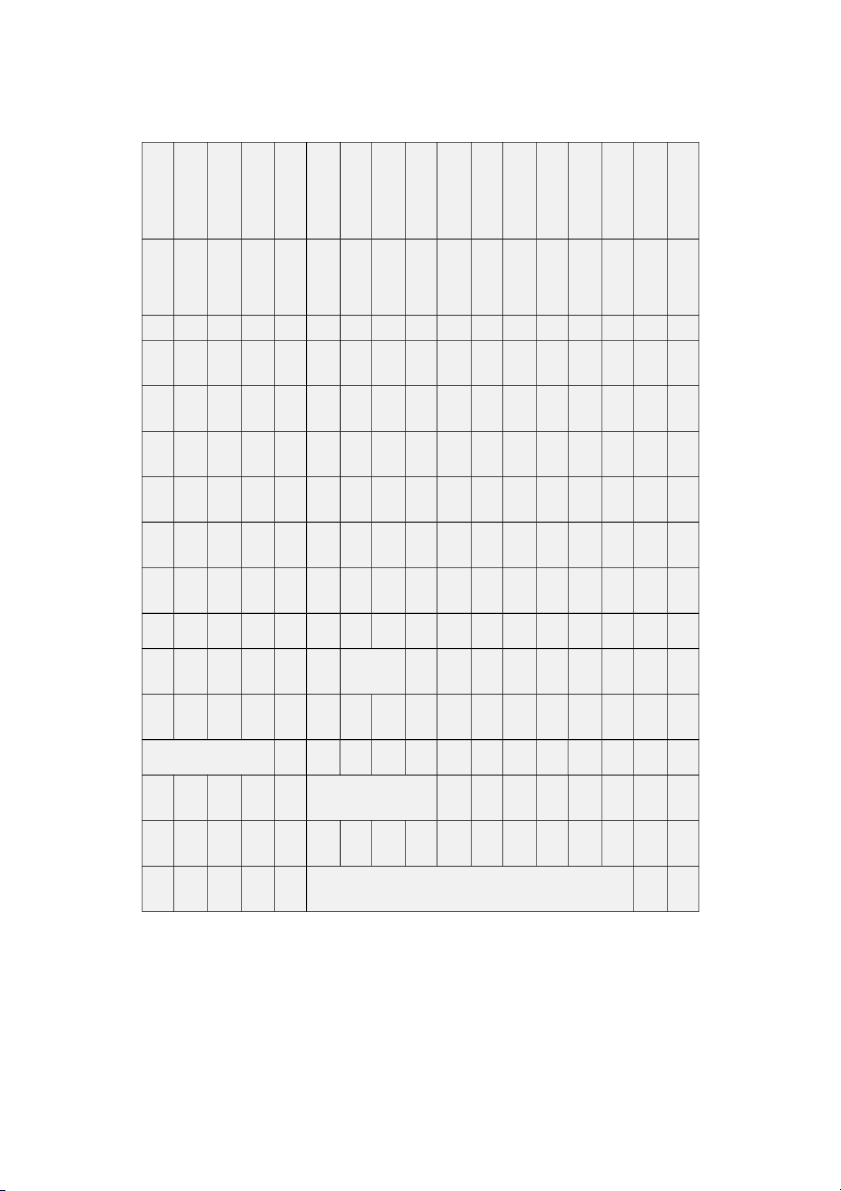

Hence the value of machinery as on 30 th june 2020 will be $450000 Exercise 9 Exercise 16 Answer- Part a Accu mula Bal Bal Bal ted Dep Depr anc Depr anc Depr anc Dat depr reci eciat e as eciat e as eciat e as e of eciat atio ion on ion on ion on Pur Cost ion n for 31. for 31. for 31. cha as Per 201 12. 201 12. 201 12. se on Year 2 201 3 201 4 201 01.0 2 3 4 1.20 15 =Co st / Life of Ass ets I=C+ A B C D E F G H E+G 01- 180 360 360 144 360 108 360 720 1080 01- 00 0 0 00 0 00 0 0 0 12 01- 220 440 220 198 440 154 440 110 1100 07- 00 0 0 00 0 00 0 00 0 12 01- 300 600 600 240 01- 0 0 0 6000 00 0 00 14 0 01- 240 480 240 216 07- 0 0 0 2400 00 0 0 00 14 Tota 940 188 580 342 800 262 164 638 3020 l 00 00 0 00 0 00 00 00 0

Since No Entry has been passed in the yer 2012, 2013 & 2014 for the

depreciation expenses, there is increased income is being appearing in the

income statement for $ 5800, $ 8000 and $ 16400 for the year 2012, 2013 & 2014 respectively.

Also, One combined entry has been passed in the year 2015 relating to

depreciation of previous years due to which decreased income is appearing in

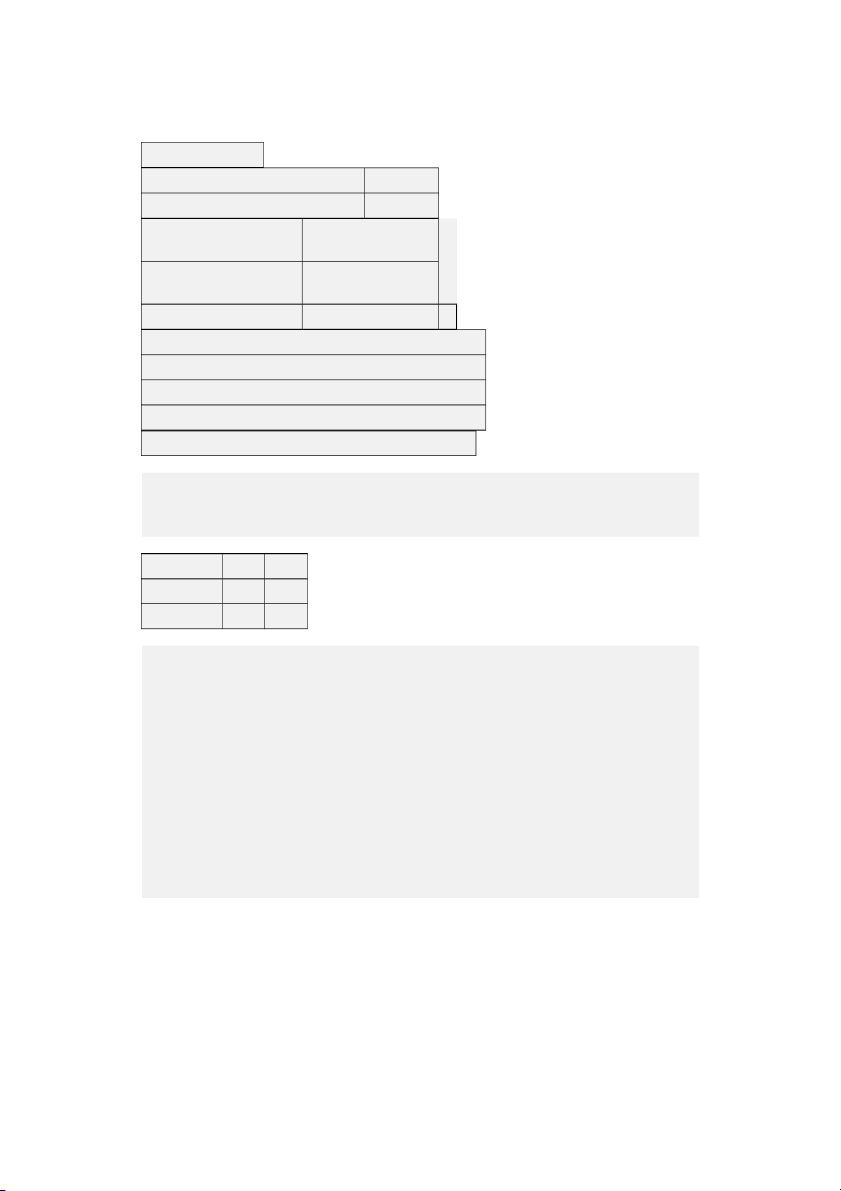

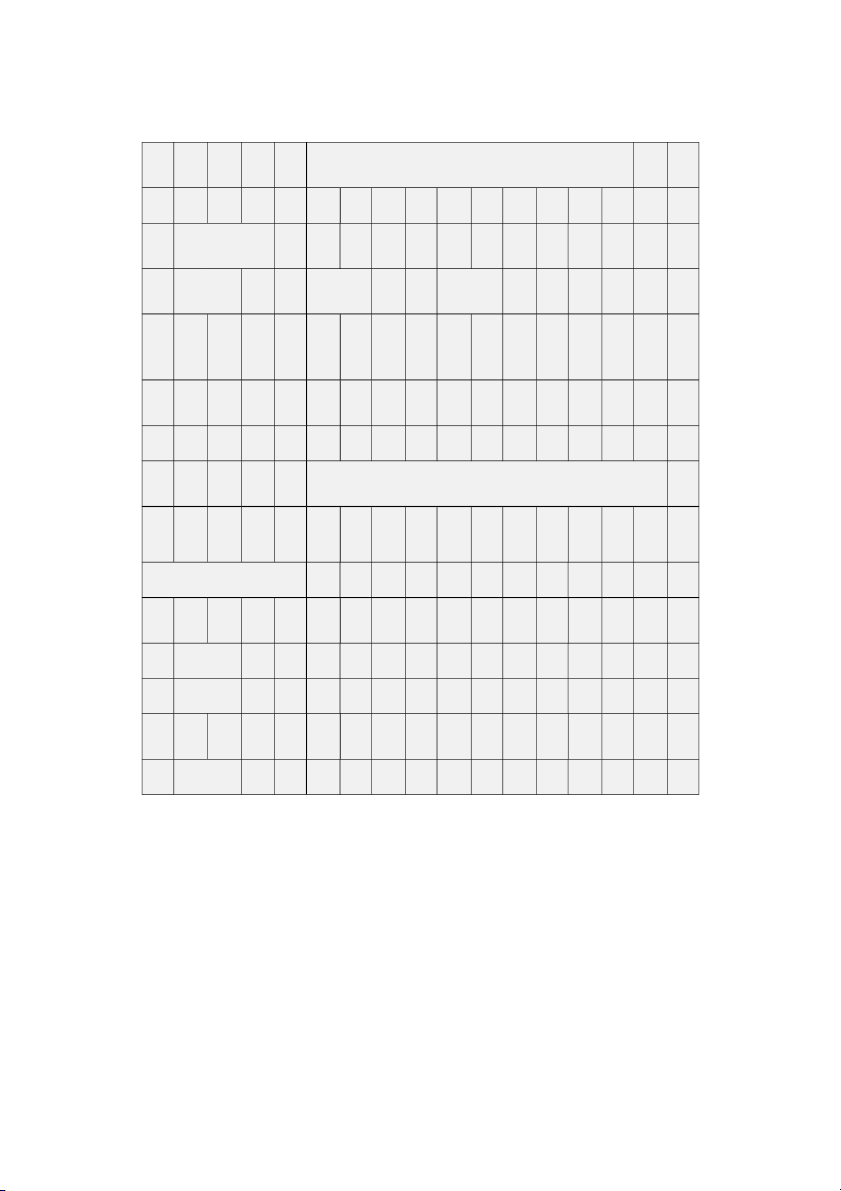

the income statement because of recrding of previous year expenses. Answer- Part b Corrected Schedule Bal Bal Bal Bal Bal Bal Bal Dep Depr anc Depr anc Depr anc anc Depr anc Depr anc Depr anc Dat Depr reci eciat e as eciat e as eciat e as e as eciat e as eciat e as eciat e as e of eciat atio ion on ion on ion on on ion on ion on ion on Pur Cost ion n for 31. for 31. for 31. 31. for 31. for 31. for 31. cha for Per 201 12. 201 12. 201 12. 12. 201 12. 201 12. 201 12. se 2015 Year 2 201 3 201 4 201 201 6 201 7 201 8 201 2 3 4 5 6 7 8 =Co st / Life of Ass ets A B C D E F G H I J K L M N O P 01- 180 360 360 144 360 108 360 720 360 01- 3600 0 0 0 0 0 0 00 0 0 00 0 00 0 0 0 12 01- 220 440 220 198 440 154 440 110 660 440 220 220 07- 4400 0 0 0 00 0 0 00 0 00 0 00 0 0 0 0 12 01- 300 600 600 240 180 600 120 600 600 600 01- 0 0 0 0 6000 0 00 0 00 0 00 0 0 0 14 0 00 01- 240 480 240 216 168 480 120 480 720 480 240 07- 0 0 0 0 4800 00 0 0 00 00 0 00 0 0 0 0 14 01- 400 800 360 800 280 800 200 800 120 07- 0 0 0 0 0 0 4000 00 0 00 0 00 0 00 0 00 15 01- 420 840 420 378 840 294 07- 0 0 0 0 0 0 0 0 0 0 00 0 00 0 00 17 0 Tota 176 352 580 342 800 262 164 638 2280 810 232 542 252 710 272 438 l 000 00 0 00 0 00 00 00 0 00 00 00 00 00 00 00 Entries 2100 225 250 304 Passed for 0 00 50 00 Dep Diff - ere 1800 700 150 320 nce 0 Rectified Entries for the wrong entries passed Jul1 Truc 180 (Being Entry Passed for the ,201 Dr k A/c 00 balane Amount 5 Ven 180 dor Cr 00 A/c 01- Loss Dr 100

(Value of Truck no 1 on 01.01.2016 is $ 3600 and it sold in $ 3500, hence the Jan- on

loss of Rs. 100/- to be book in the books) 16 Sale of Truc k Truc Cr 100 k 01- No Rectified Entry 07- needs to be passed 17 01- Rectified Wrong Entry Correct 07- Entry Passed Entry 17 Loss Loss on Cas on 640 320 640 Sale Dr h Dr Sale Dr 0 0 0 of A/c of truck truck Mis. Mis. Cas 320 Inco Dr 700 Inco Cr 700 Dr 0 me me h A/c Truc 710 Truc 250 Truc 960 Cr Cr Cr k A/c 0 k A/c 0 k A/c 0 31.1 Truc

(Total Depreciation booked for the period 2015 to 2018 is $ 98950/- instetad of 98400/- 2.20 Dr 550

and hence reversal of $ 550/- has been made) 18 k A/c Depr eciat Cr 550 ion A/c

Composite entry for all of the above rectified entry 31.1 Truc 1135 2.20 k A/c 0 18 Loss on Sale 650 of Truck A/c 0 Mis. Income 700 A/c Ven 180 dor 00 A/c Depreciation 550 A/c