Preview text:

EXCHANGE RATE Assignment 1

On 21/08/2019 Techcombank quotes the exchange rates as following: USD/ VND : 22,840 – 22,860 EUR/ VND : 25,460 – 25,650 GBP/VND: 32,470- 32,500 CAD/VND : 20,910 – 20,940 JPY/VND : 270.15 – 290.75 Questions

1/ Company A needs to buy 20,000 USD to pay for importing commodities? What is the amout of VND the

company has to pay to Techcombank?

20,000 x 22,860 = 457,200,000 VND

2/ Mr B receives 2,000 EURs form his son in Germany. Mr B sell the amount of EUR to Techcombank.

What is the amount of VND Mr B get?

2,000 x 25,460 = 50,920,000 VND

3/ Techcombank buy 30,000 GBPs from company D.What is the amount of VND the bank has to pay to company D?

30,000 x 32,500 = 975,000,000 VND

4/ Mr Đạt needs to buy 3,000 CAD to transfer to his son in Canada. What is the amount of VND Mr Đạt has to pay?

3,000 x 20,940 = 62,820,000 VND

5/ Excon company sells 10,000,000 JPYs to get VND to pay for its domestic customer? What is the amount of VND Excon will receive?

10,000,000 x 270.15 = 2,701,500,000 VND

6/ Willing company has to pay 25,000 EURs for its customer.What is the amount of VND Willing company has to pay to Techcombank?

25,000 x 25,650 = 641,250,000 VND 1 Assignment 2

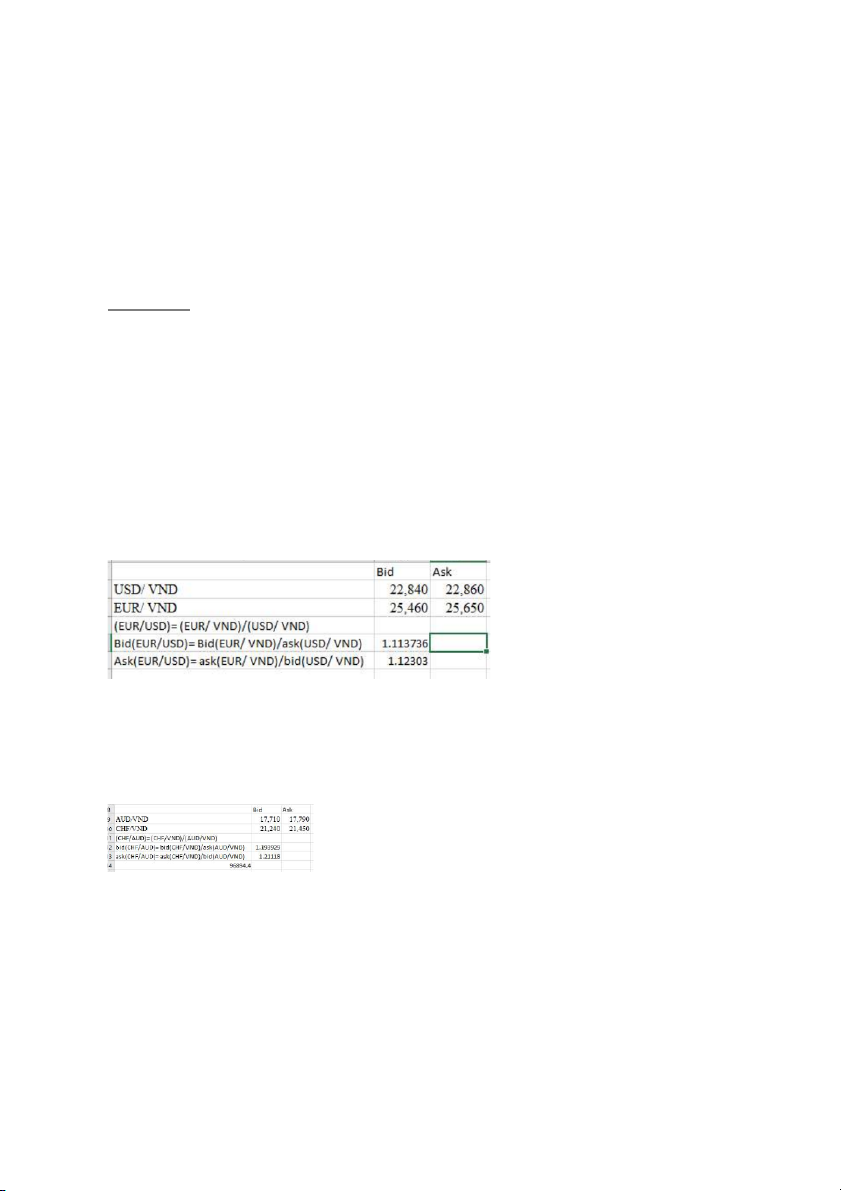

On 22nd July 2020, Shinhan Bank VN announced the following exchange rates USD/ VND : 22,840 – 22,860 EUR/ VND : 25,460 – 25,650 AUD/VND: 17,710- 17,790 CHF/VND : 21,240 – 21,450 JPY/VND : 285.55 – 295.75

1/ Company Anpha wanted to convert 50,000 USD into EUR to pay for their importing commodities.

Calculate the amount of EUR Anpha got in this transaction. EUR/USD=1.113736-1.12303

50,000 / 1.12303 = 44,522.40813 EUR

2/ Company Beta wanted to buy 80,000 CHF to pay to its foreign customer but its bank account has AUD.

Calculate the amount of AUD Beta had to pay to Shinhan Bank to get 80,000 CHF. CHF/AUD=1.193929-1.21118 2

80,000 x 1.21118 = 96,894.4 AUD

3/ Company Cell received Payment from their Japanese customer 2,000,000 JPY. Cell company sold entire

amount of JPY to Shihan Bank to get VND. After that, Cell ordered Shinhan Bank to deduct their VND

account to buy 15,000 USD. How did VND account of Cell increase/decrease after those transactions? JPY/VND : 285.55 – 295.75

2,000,000 x 285.55= 571,100,000 VND

VND account increase 571,100,000 VND USD/ VND : 22,840 – 22,860

15,000 x 22,860 = 342,900,000 VND

VND account decrease 342,900,000 VND, remaining 228,200,000 VND

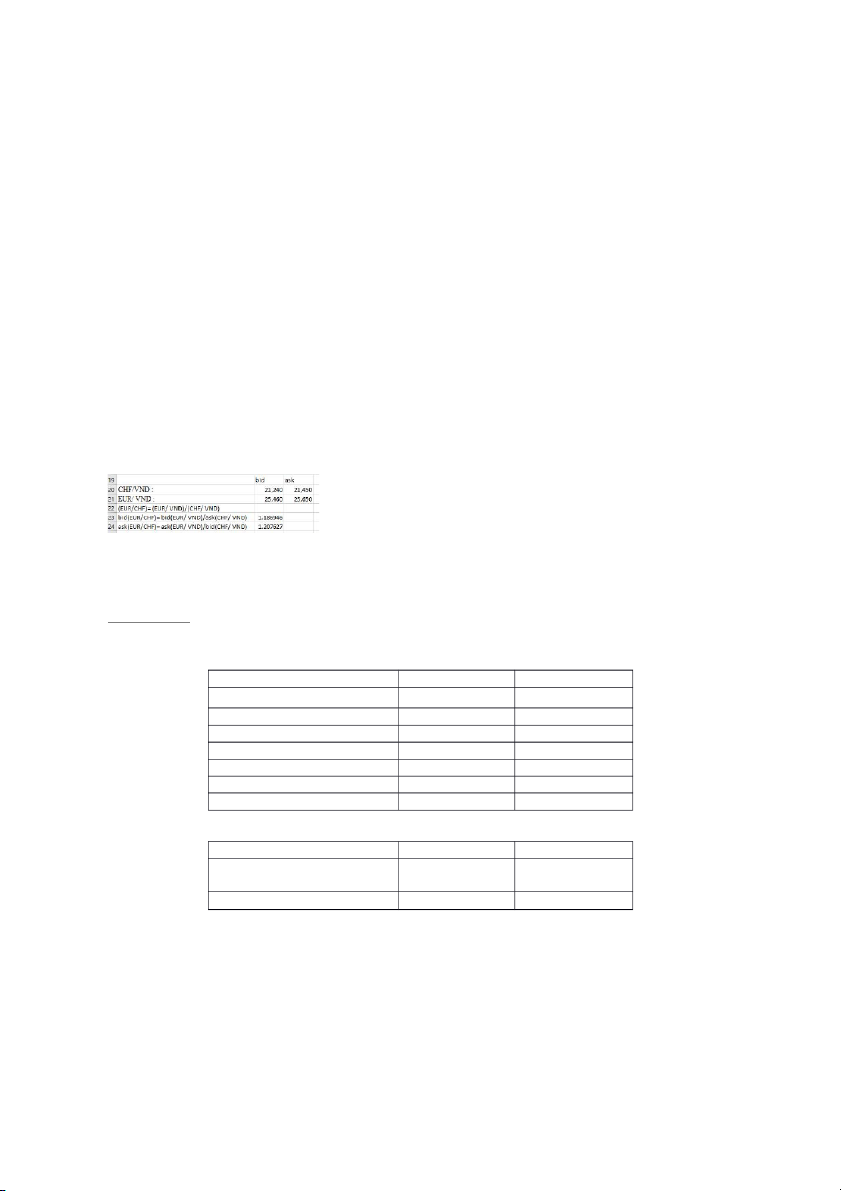

4/ Dallat company sold 50,000 EUR to Shinhan Bank to get CHF. Indentify the amount of CHF that Shinhan Bank had to pay to Dallat? EUR/CHF=1.186946-1.207627

50,000 x 1.186946= 59,347.3 CHF Assignment 3

On 20th August 2020, Ngân hàng HSBC Vietnam quoted the exchanger rates: Exchange rate Buying rate Selling rate USD/VND 22,850 22,870 EUR/VND 25,500 25,570 AUD/VND 17,750 17,800 CHF/VND 21,250 21,320 JPY/VND 276.30 297.20 CAD/VND 20,960 20,990 HKD/VND 2,670.5 2,690.3

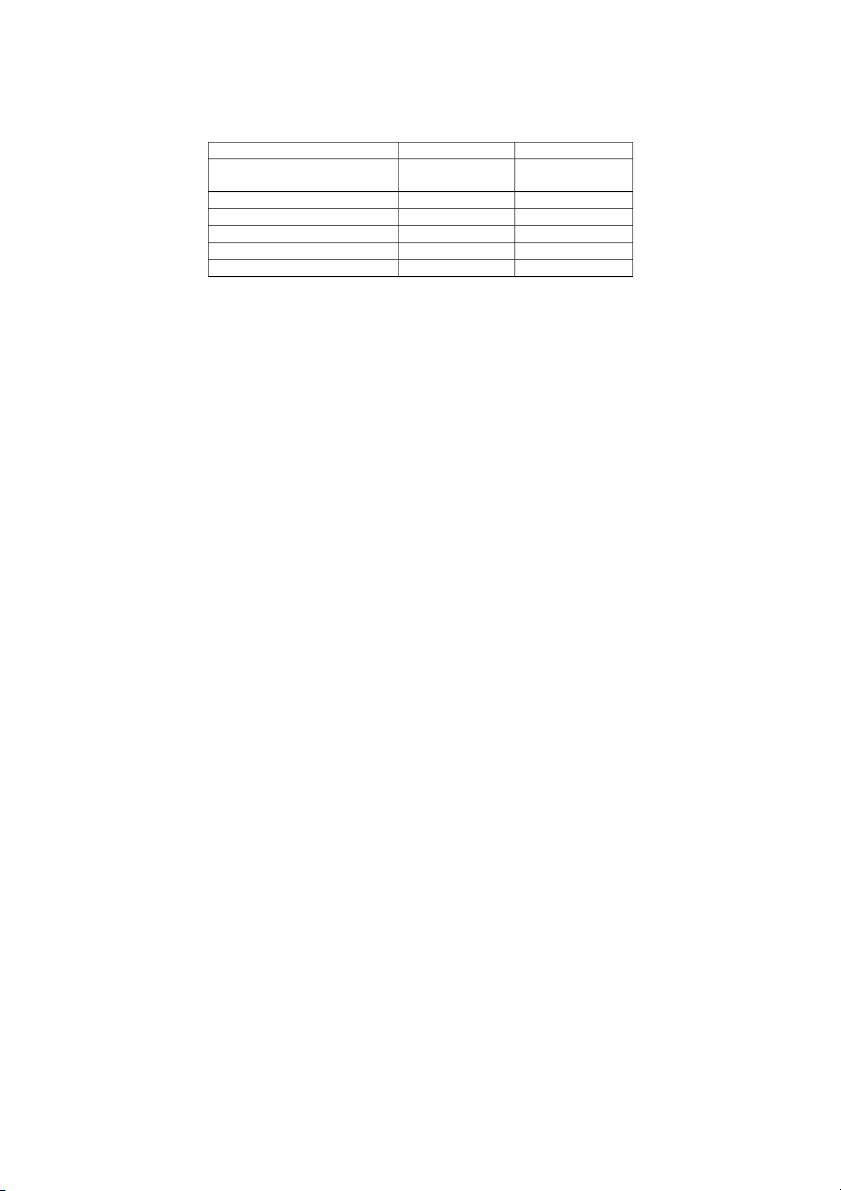

Indentify the cross exchange rates at HSBC Vietnam : Cross exchange rate Buying rate Selling rate EUR/USD 1.11499 1.11903 8 7 AUD/USD 1.28370 1.28845 3 8 1 CAD/EUR 1.21486 1.21994 4 3 JPY/HKD HKD/CAD EUR/JPY HKD/USD CAD/JPY 4 FOREX TRANSACTION Assignment 1

At time G, the international forex markets had the following exchange rates:

NewYork : EUR/USD : 1.2264 – 1.2300

Zurich : EUR/CHF :1.2003 – 1.2030 USD/CHF :0.9818 – 0.9840

London : GBP/USD : 1.5603 – 1.5649 GBP/EUR : 1.2764 – 1.2780

If you had 100 million EURs, how would you ultilize arbitrage between 2 forex markets to get profit?

Calculate the profit in this case. Assignment 2

At time G, we noticed the exchange rates in international forex markets as following:

Paris : EUR/JPY : 97.3525 – 97.4550

London: EUR/CHF : 1.1960 – 1.1990

Singapore: EUR/SGD: 1.5389 – 1.5420

In Tokyo forex market, we had the following exchange rates CHF/JPY: 81.302 – 81.360 SGD/JPY: 63.413 – 63.429

If you had 100 million EURs, how would you use arbitrage between 3 markets to get profit? Calculate the profit in this trading. Assignment 3

ACB has the exchange rates and interest rates as following. Use the forward exchange rate formula to

calculate the forward exchanre rates to fill in the below sheet 5 Fb

= Sb +Sb xnx(r −r ) A / B A / B A / B depositB borrowA Fs

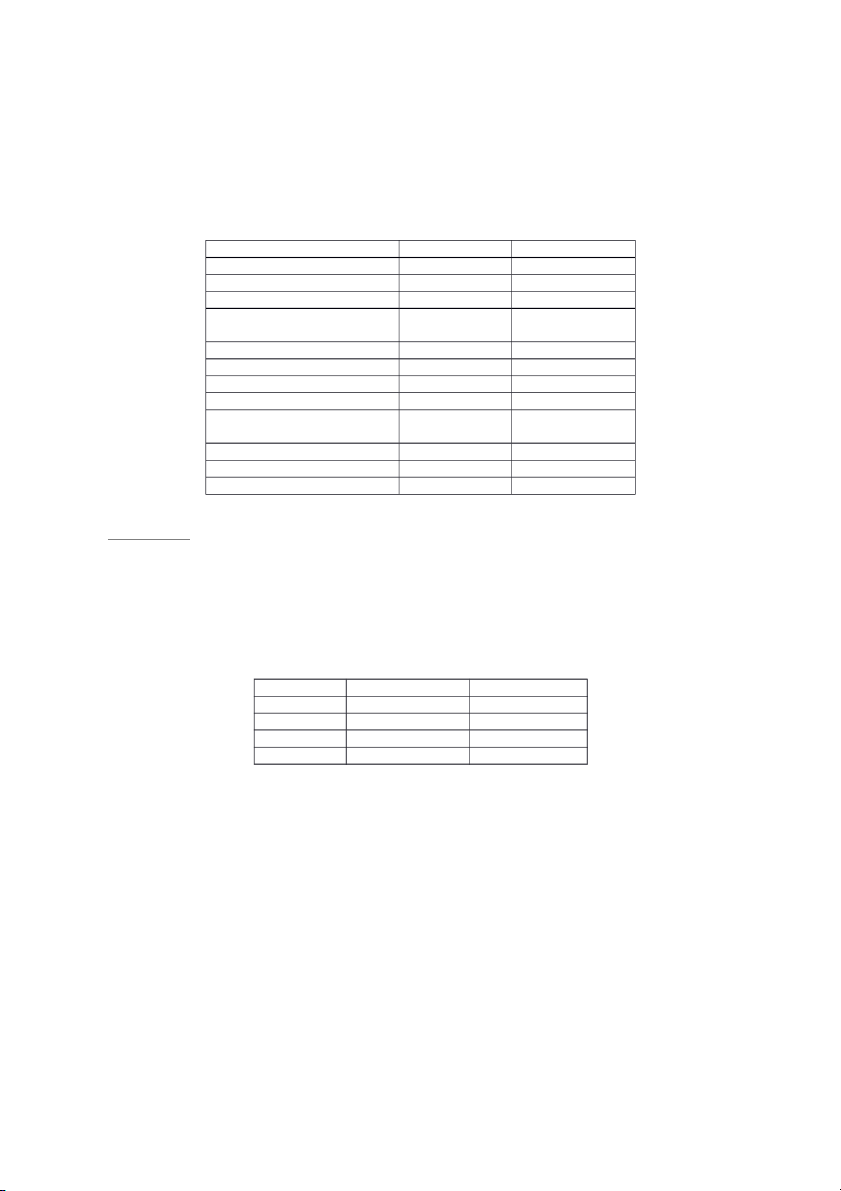

= Ss +Ss xn x ( r −r ¿ A / B A / B A / B borrowB depositA Exchange rate Ask rate Bid rate USD/VND 22,840 22,855 EUR/VND 25,471 25,500 GBP/VND 32,520 32,560 Lãi suất Deposit interest Loan Interest rate rate USD 1.75%/year 6.5%/year EUR 2%/year 7.5%/year GBP 1.5%/year 5.5%/year VND 0.75%/month 1.1%/month Forward Exchange rate Ask rate Bid rate USD/VND for 3 months EUR/VNDfor 6 months GBP/VND for 12 months Assignment 4

On 15th July 2020, at HSBC HCM Branch quoted the exchange rates and interest rates as following: USD/VND: 22,850 – 22,900 EUR/VND : 25,540 – 25,590 GBP/VND : 32,540 – 32,590 Currency Loan Interest Deposit Interest VND 12%/year 9%/year USD 7%/year 2%/year GBP 6.5%/year 1.75%/year EUR 5%/year 1.5%/year

On that date, the bank conducted some forex transactions as following:

Operation 1: Bought at spot rate 150,000 USD from Anpha company and settled the transaction by VND.

Operation 2: Deducted VND from VND account of Beta company to sell at spot exchange rate 50,000 EURs. 6

Operation 3: Mr Brown bought 10,000 GBP to transfer money to his son. Mr Brown settle the transaction by VND.

Calculate the amount of VND HSBC HCM city Branch got or paid in each above transactions?

Operation 4: HSCB sold 50,000 USDs to Delta company with 3 month forward exchange rate.

Operation 5: the bank bought 30,000 EURs from Ensure company with 4 month forward exchange rate.

Operation 6: Fomara Company bought 20,000 GBP with 6 month forward exchange rate.

2/ Indentify the amount of VND the bank got or paid in each above transactions. Assignment 5

On 20th July, 2020, there are some forex transaction at Hong Leong Bank VN as following:

1/ Gedo company sold 500,000 USDs to get VND for domestic payments. Indentify the amount of VND

Hong Leong Bank VN paid to Gedo.

2/ Marah Company needed to exchange 100,000 USDs to GPB to pay for the importing commodities.

Calculate the amount of GBP the company received.

3/ On 20th September, 2020, Masan company needed 150,000 USDs to pay to their importing goods. So

Masan company signed a forward contract to buy this amount of USDs from the bank. Calcuate the amount

of VNDs Masan had to pay to the bank in this forward transaction on 20th September, 2020.

We have the following information

The spot exchange ratea and interest ratea on 20 July, 2020 of Hong Leong Bank as following: USD/ VND: 22,980 – 22,995. EUR/VND : 25,480 – 25,510 GBP/VND: 32,515 -32,540.

Interest rate of USD : 2.5%/năm – 7%/năm.

Interest rate of EUR : 1.5%/year – 6%/ year

VND : 0.7%/month – 1.2%/month. Assignment 6

In order to give 400,000 GPB loan to Bewlen Company with loan interest of 6.5%/year, ACB exchange

USDs to GPBs with VCB on the interbank market. 7

In order to hedge against the exchange rate variation, ACB also signs a 3 month forward contract to sell the

amount of GPB got from the loan to VCB for USD. Indentify the the amount of USD ACB will get after those transactions.

The spot exchange rates and interest rates of VCB are quoting as following: USD/VND : 22,820 – 22,850 GBP/VND: 32,650 – 32,710 USD: 1.8%/year – 4%/year GBP: 1.2%/year – 3.5%/year Assignment 7

On 15th, August 2020, Citibank NewYork received some forex transaction orders as follow:

1/ Amazon requested to buy 120,000 CHF and settle the transaction by USD. Calculate the amount of USD

Amazon had to pay to Citibank New York.

2/ Belle company sold 90,000 EURs to get USD. Indentify the amount of USD Belle received.

3/ Coca Cola resquested to exchange 100,000 EURs to GPB. Indentify the amount of Coca Cola got in this transaction.

Citibank NewYork quoted the spot exchange rates as following: USD/CHF : 1.0184 – 1.0195 USD/EUR: 0.8050 – 0.8095 USD/GBP: 0.6488 – 0.6495 Assignment 8

On 30th August, 2018, Pizzo company received 350,000 USDs from an exporting contract. At that

time, the company wanted to make a payment of 50,000 GBPs to an English customer and 100,000 CHFs to

a Swiss client. Pizo asked HSBC to exchange USD to GBP and CHF for those payments.

Indentify the remaining amount of USDs after those transactions.

HSBC quoted the spot exchange rate as following: USD/EUR : 0.8071 – 0.8090 CHF/EUR : 0.8331 – 0.8350 8 EUR/GBP : 0.7835 – 0.7840 Assignment 9

In order to provide a loan to a customer, Bank of Tokyo used domestic currency to buy 150,000 CHF

with spot exchange rate and sold the entire amount of CHFs collecting from this loan to HSBC with 3 month forward exchange rate.

Calculate the profit of Bank of Tokyo after those transactions.

The spot exchange rate and interest rate of HSBC as following USD/CHF = 1.3180 – 1.3185

Interest rate of CHF : 3%/year – 3.55%/year USD/JPY = 111.86 – 111.90

Interest rate of JPY: 4%/year - 4.25%/year 9

INTERNATIONAL PAYMENT INSTRUMENT Assignment 1

On 27th August, 2020, Gidofood locating in HCM city finished shipping exporting commodities to its

client. The value of goods was 45,600 USDs. The importer was Sami Export & Import Ltd, locating in 25

Grand Field street, London. The purchase contract no was 21/2020 date 15th August, 2020. The payment

method was D/P at sight. Collecting bank was Eximbank Ben Thanh branch. Make out a Bill of exchange to

request for the payment from the importer. Assignment 2

On 15th July 2020, Fico Joint stock company locating in Binh Duong finished shipping exporting

commodities. The total value of goods was 120,000 USDs. The importer was Infor Skill corp, locating at 126

Light street, New York, US. The payment method was usance L/C no 236/2020. This L/C was issued by

Citibank, New York, locating 156 Wall street, New York, US. The L/C was issued on 15th April 2020.

Payment peried was 60 days after sight of Bill of exchange. Make out a Bill of exchange to request for the

payment for this commodities. The exporter’ bank was ACB Saigon branch. Assignment 3

Some information of an irrevocable LC no VH1362012 issued on 10th August, 2020. The expired date was 20th December, 2020 -

Buyer: Seafood Import – Export company. Address: 02 Patanakarn Rd., Tokyo, Japan. -

Issuing bank: Mizuho Bank, Tokyo, Japan. -

Seller: Hải Minh ltd company. Address: 14 Nguyễn Tất Thành street, district 4, HCM city -

Advising bank: Vietcombank, Ho Chi Minh Branch, Vietnam -

The total value of commodities: 150,000 EURs. -

Payment period: 30 days after sight of Bill of exchange. The B/L date was 23rd September, 2020.

Base on the above information, make out a Bill of Exchange to request for payment from the issuing bank. 10 Assignment 4

On 15th July 2020, Hoang Anh Trading company signed an exporting contract with Matsu Trading Corp

– Philipines with the following terms and conditions: -

Quantity: 1,000 MTS, Unit price : 300 USD/MT -

Term of payment: 60 days after Bill of exchange’ date. -

Payment method: Irrevocalble L/C No A3523 issued by Citibank – Philipines on 20th August, 2020. -

On 12th September, 2020, Hoang Anh company finished the shipment and present the documents to

Vietinbank (Exporter’s Bank) – Ho Chi Minh branch – VietNam to sent to the Issuing bank.

You are the exporter’s foreign trade officer. Make out a Bill of Exchange to request for payment from the issuing bank. Assignment 5

Van Thanh Ltd want to import hot rolled steel coins from China Steel Corporation. Both sides signed

a purchase contract No HDKT/15-2020 date 16th July, 2020. Van Thanh Ltd applied L/C application form to

ACB Ben Thanh branch, HCM City. The terms and conditions of purchase contract No HDKT/15-2020 as following:

Contract No HDKT/15-2020 Date 16th, July, 2020. Buyer : Van Thanh, Ltd

Address: 125 Huynh Tan Phat, District 7, HCM, VN

Represented by : Mr Do Minh Phu. Director

Account number:012.6901 at ACB - Ben Thanh Branch, HCM City, VietNam Seller: China Steel Corp

Address: 115 Industrial Zone, Wu Cheng Province, China.

Represented by : Mr Dongzho Wei. Director.

Account number : A25.13098 at Rural Development Bank of China, Wu Cheng Branch, China

Both parties agreed to singed this contract which below conditions and articles.

Article 1: COMMODITIES – QUANTITY - PRICE

Hot rolled steel in Coil 4mm Grade A

Price : 650 USD/tons. CIF HCM city port. 11 Quantity: 300 Ton +/-5%.

Total value of contract : 195,000 USD +/- 5%. Article 2: PAYMENT

Payment is made by L/C at sight issued by ACB - Ben Thanh Branch, HCM city, VietNam. Article 3: DELIVERY

Port of Loading : Any China Ports.

Port of Discharge: Tan Cang Port, HCM City.

Shipment date: not later than September 15th, 2020.

Article 4: DOCUMENTS REQUIRED

3/3 Full sets of Original Bill of Lading.

3/3 Signed Commercial Invoice. 3/3 Packing list.

Certificate of Origin in One Original and Two Copies issued by CHAMBER OF COMMERCE AND INDUSTRY OF CHINA.

Article 5: SETTLEMENT OF DISPUTES

The PARTIES agree to work together to resolve any disputes arising out of or related to this AGREEMENT

in a timely, professional and non-adversarial manner.

If mediation does not resolve the dispute, all disputes arising out of or in relation to this contract shall be

finally settled by the Vietnam International Arbitration Centre at the Vietnam Chamber of Commerce and Industry. BUYER SELLER

The L/C application form of Van Thanh Ltd was accepted by ACB Ben Thanh branch. The L/C No was

031LC01120002. The issuing date was 20th July, 2020. The total value of commodities was 190,000 USDs.

You are the exporting officer of China Steel Corp. Make out a Bill of Exchange to request for the payment. Assignment 6

On 12th June 2018, Doci Corporation was inform about an exporting L/C with the following contents:

Sender : HSBC HongKong Brach, HongKong.

Receiver : ACB - Phu Lam Branch, HCM city, Viet Nam. 12

40A: Form of documentary credit Irrevocable.

20: Documentary credit number 44/MUK/2018

31C: Date of issue 20180608

31D: Date and place of Expiry 20180925, VietNam 50: Applicant FRESH FOOD CORP 150 Holy Street, HongKong

59: Beneficiary – Name and address DOCI CORP

540 TUNG THIEN VUONG STREET, DISTRICT 8, HCM CITY, VN.

32B: Currency code –Amount CURRENCY CODE : USD AMOUNT : 150,000.00

41A: Available With ...By

ACB PHU LAM BRANCH, HCM CITY, VIET NAM

42C: Drafts at ... AT 90 DAYS AFTER B/L’S DATE. 42A: Drawee HSBC HONGKONG BRACH, HONGKONG.

230 JAMES STREET, KWOLOO, HONGKONG. 43P: Partial Shipments ALLOWED

43T: Transhipment ALLOWED

44E: Port of Loading/Airport of Dep. ANY VIETNAMESE PORT

44F: Port of Discharge/Airport of Dest 13 ANY HONGKONG PORT

44C: Latest Date of Shipment 20180815

45A: Description of Goods &/or Services

500 METRIC TONS , +/- 5PCT TOLERANCE OF VIETNAMESE WHITE RICE.

46A: Documents Required

SIGNED COMMERCIAL INVOICE IN ONE ORIGINAL AND FIVE COPIES.

FULL SET OF OCEAN BILL OF LADING SHIPPED ON BOARD IN THREE.

CERTIFICATE OF ORIGIN IN ONE ORIGINAL AND THREE COPIES.

48: Period for Presentation

DOCUMENTS PRESENTED NOT LATER THAN 21DAYS FROM THE DATE OF SHIPMENT IS

ACCEPTABLE BUT WITHIN THE VALIDITY PERIOD OF THE LC.

Doci Corporation finished the shipment on 15th July, 2018. The total value of commodities was 145,000

USDs. You are the foreign trade officer of Doci Corporation. Make out a Bill of Exchange to request for the payment. Assignment 7

Some terms and conditions of a L/C as following:

From : Mizaho Corporate bank, Singapore branch

To : Asia Commercial bank, HCM branch, VietNam

Form of documentary credit Irrevocable

Documentary credit number LD006526 Date of issue April 06th 2020

Date and place of expiry : July 20th 2020 in Vietnam

Applicant : Kung Hoan, Singapore

Beneficiary : Komatsu Vietnam,HCM branch

Currency code, Amount JPY 2,090 000.00

Draft at : For 100PCT of invoice value ( 60 days after Bill of exchange date )

Latest date of shipment Jun 11th 2020

Drawee :Mizaho Corporate bank, Singapore branch.

Partial shipping : not allowed. 14

The seller finished the shipment on 20th May, 2020. Base on these information make out a Bill of Exchange to request for the payment. Assignment 8.

Some terms and conditions of a L/C as following :

From : BHF, Frankfurtn Germany

To : Vietcombank HoChiMinh City

Form of Documentary credit: Irrevocable

Documentary credit number : LC 152A900 Date of issue : 20 Mar 2019

Date and place of expiry : 30 June 2019 in VietNam

Currency code, amount : USD 240,000.00

Beneficiary : Food Import and Export Company, Ho Chi Minh City Applicant : Serdis LTD

Lastest shipment date : 15 June 2019

Available by negotition of beneficiary's draft at sight drawn on us for 100 percents of invoice value. Drawee : Opening bank Partial shipping: not allowed

The exporter finished the shipment on 13th June, 2019. Make out a Bill of exchange to request for the payment. Assignment 9

On 12 February, 2018 HP Production and Trading Corporation was informed L/C with the following terms and conditions:

Sender: Ashi bank LTD, Tokyo, Japan.

Receiver : Bank for Investment and Development of Vietnam (Transaction center No 2 HoChiMinh CITY Vietnam) .

40A : Form of Documentary Credits : IRREVOCABLE 15

20 : Documentary Credits Number : OD13003020033

31 C : Date of Issue : 10 FEB 2018

31D : Date and Place of Expiry : 26 April 2018 AT THE NEGOTIATING BANK

50 : Applicant : EIZEN INCORPORARION 4 TH FLOOR, OHOSA BLDG 8-6-4-CHOME, TOKYO ,

59 : Beneficiary : HP PRODUCTION AND TRADING CO

57 NGUYEN CONG TRU STR, DIST 1, HCM

32 B: Currency code amount : USD 97, 600.00

41D :Available with …..by … : BY ANY BANK BY NEGOTIATING

42C : Draft at : 180 DAYS AFTER SIGHT FOR 100 PCT OF INVOICE

42D :Drawee : BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM ( TRANSATION CENTER

N0 2) HOCHIMINH CITY VN

44C : Latest date of shipment : 14 MAR 2018

78 :+ DRAFT(S) AND ALL DOCS TO BE FOWARDTO BANK FOR INVESTMENT AND

DEVELOPMENT OF VIETNAM ( TRANSACTION CENTER N0 2) , HO CHI MINH CITY, VN IN 01

LOT BY COUNTRIER SERVICE.

Base on the above information, make out a Bill of exchange to request for the payment. The Bill of

Lading date was 3rd March 2018. 16

BÀI TẬP BỘ CHỨNG TỪ THANH TOÁN QUỐC TẾ Bài tập 1

Công ty TNHH Xuất Khẩu Ánh Dương vừa nhận được L/C xuất khẩu gạch xây dựng từ đối tác nước

ngoài là Công ty JeaDong, Hàn Quốc với một số nội dung như sau:

Sender bank: Korea Exchange Bank

Sent to: Bank for Foreign Trade of VietNam Form of Documentary credit Irrevocable Documentary credit number 00781282 Date and place of Expiry 20171115 VietNam Applicant

JeaDong Construction and Materials Trading Joint stock company Huyndai Motor Building,

216 Yangjea – Dong, Seocho – Gu, Seoul, Korea. Benificiary

Sunshine Export Limited company

125 Ho Tung Mau Street, district 1, HCM City, VietNam. Currency code and Amount USD 48,500.00

Percentage and credit amount tolerance 10/10 Available with Any Bank in VietNam By Negotiation Draft at 17

Sight fo 100PCT of Invoice value Partial shipments Prohibited Transshipment Prohibited Port of Loading Ho Chi Minh city port Port of Discharge Incheon, Korean Latest date of shipment 20170913 Description of goods +Commodity: Cement title No Specification Size (mm) Weight (Kgs) Quantity(Pcs) 1 Blue 1201 200 x 200 x 10 1 2,000 2 Yellow 2134 200 x 200 x 10 1 3,000 3 Black 1221 250 x 250 x 10 1.5 4,000 4 Green 3461 250 x 250 x 10 1.5 5,000

+Quality: 100PCT Band – new +Origin: VietNam

+Packing: Mill’s Export Standard in paper box.

+Shipping mark: Contract no:CNT10-09 Documents required:

1/Signed commercial invoice in 03 Originals

2/Full set (3/3) of Original clean shipped on Board Ocean bill of Lading Showing L/C Number, Consigned to

the order of Korea Exchange Bank, Marked Freight Prepaid and notify the Applicant. B/L have to mention

L/C number, total number of pieces and boxes, Net and gross weight.

3/Packing list showing number of pieces and boxes, net, gross weight and CBM in 3 Originals. ….. Yêu cầu

1/ Lập hóa đơn thương mại vào ngày 15/08/2017 theo mẫu bên dưới.

2/Lập Packing list cho lô hàng xuất trên theo mẫu gợi ý bên dưới. Biết rằng loại gạch 200 x 200 x 10 được

đóng gói 10 viên/thùng, kích thước thùng 2050 x 2050 x 110 mm, trọng lượng thùng là 0.5 kg/thùng. Loại

gạch 250 x 250 x 10 được đóng gói 10 viên/ thùng, kích thước thùng 2550 x 2550 x 110 mm, trọng lượng

thùng 1 kg/thùng. Đơn giá loại gạch 200 x 200 x 10 là 2.5 USD/viên, đơn giá loại gạch 250 x 250 x 10 là 4 USD/viên. 18

.........................................................................

............................................................................................ COMMERCIAL INVOICE

Buyer:.............................. No & Date of Invoice

Add:.................................

……………………………….

Tel:................................... Port of Loading Port of destination No & Date of L/C

……………………………

…..……………………….. ……………………..

…………………………..

..………………………….. ……………………. GOODS DESCRIPTION No Name of goods Q’ty Unit price Amount (USD) (USD) 1 2 3 4 Total

*Total:……………………………………… USD 19

Say:…………………………………………………………………………………………………………………………

.........................................................................

............................................................................................ PACKING LIST Buyer: Date Add: Port of loading Port of destination GOODS DESCRIPTION No Name of goods Unit Q’ty N.W G.W Volume (KGS) (KGS) (CBM) 1 2 3 4 Total

Total N.W:……………………………. 20