Preview text:

BỘ GIÁO DỤC VÀ ĐÀO TẠO

TRƯỜNG ĐẠI HỌC HOA SEN FINAL REPORT Topic:

FINANCIAL STATEMENT ANALYSIS OF BINH THANH

IMPORT EXPORT PRODUCTION & TRADE JSC Class : TC302DE01-0100 Students : Võ Yến Nhi (2182763) Nguyễn Thị Hồng Như (2190921) Nguyễn Ngọc Nam (2183408)

Professor’s introduction: Đặng Thị Thu Hằng Dec, 2021 MỤC LỤC I.

INTRODUCTION..................................................................................................3

1. Peer Comparison....................................................................................................3

2. Structure of Subsidiaries, Joint Ventures (Organizational Structure).....................5

3. Shareholder Struture (In Detail).............................................................................5

4. Product...................................................................................................................6

5. Swot.......................................................................................................................7

II. FINANCIAL ANALYSIS.........................................................................................8

1.Common Size Analysis...........................................................................................8

III. RATIO ANALYSIS................................................................................................13

1.Liquidity Ratio......................................................................................................13

2.Solvency Ratio......................................................................................................14

3.Activity Ratio........................................................................................................15

4.Profitability Ratio.................................................................................................17

5.Cash Flow Statement............................................................................................18

6.Dupont Analysis....................................................................................................19

VI. INVESTMENT RISKS.........................................................................................21 I. INTRODUCTION Industry group: Textile

Formerly, Binh Thanh District Export Supply Company was established in 1982.

Then equitization converted from state-owned enterprises to joint-stock companies.

The total number of employees is 2,000 people

The company started listing with code GIL on 02/01/2002

Development prospects of the company and industry:

Gilimex owns an extensive product portfolio in the multi-purpose textile industry from

storage items, household products, laundry baskets, bags, backpacks, outdoor

furniture, children's goods, lampshade to a variety of clothing

Strong growth potential from the world's leading strategic partner Amazon. GIL's

business results grew positively before the Covid pandemic occurred and affected

companies in the same industry.

At the Extraordinary General Meeting of Shareholders on November 5, leaders said

that the company had returned to normal operations with 100% capacity. If there is no

more social distancing, the profit in the fourth quarter will be like normal quarters. 1. Peer Comparison

a. Revenue, Gross Profit, ....

Revenue for the first quarter are around VND 864 trillion and gross profit is around

VND 168 trillion, increase about 20% over the same period

Revenue in second quarter is about 1 thousand 200 billion VND and gross profit is

about 236 trillion VND, increase 37% over the same period Source: https://s.cafef.vn

Due to the impact of the epidemic, it announced that third-quarter revenue fell 31% to

VND 629 billion, profit after tax of parent company shareholders decreased by 79% to

VND 18.2 billion - recording the lowest level in the past 4 years but in general GIL

has better profits than current businesses in the same industry. b. Price Movements

The price movement chart in the last six months shows that in the first 3 months of

continuous change, the lowest in mid-June due to the dividend payment then increased

steadily until mid-July, then dropped sharply to 46,000 per share in the middle of June

epidemic months and peaked in mid-November when up to 73,000 a share because the

economy is starting a new normal.

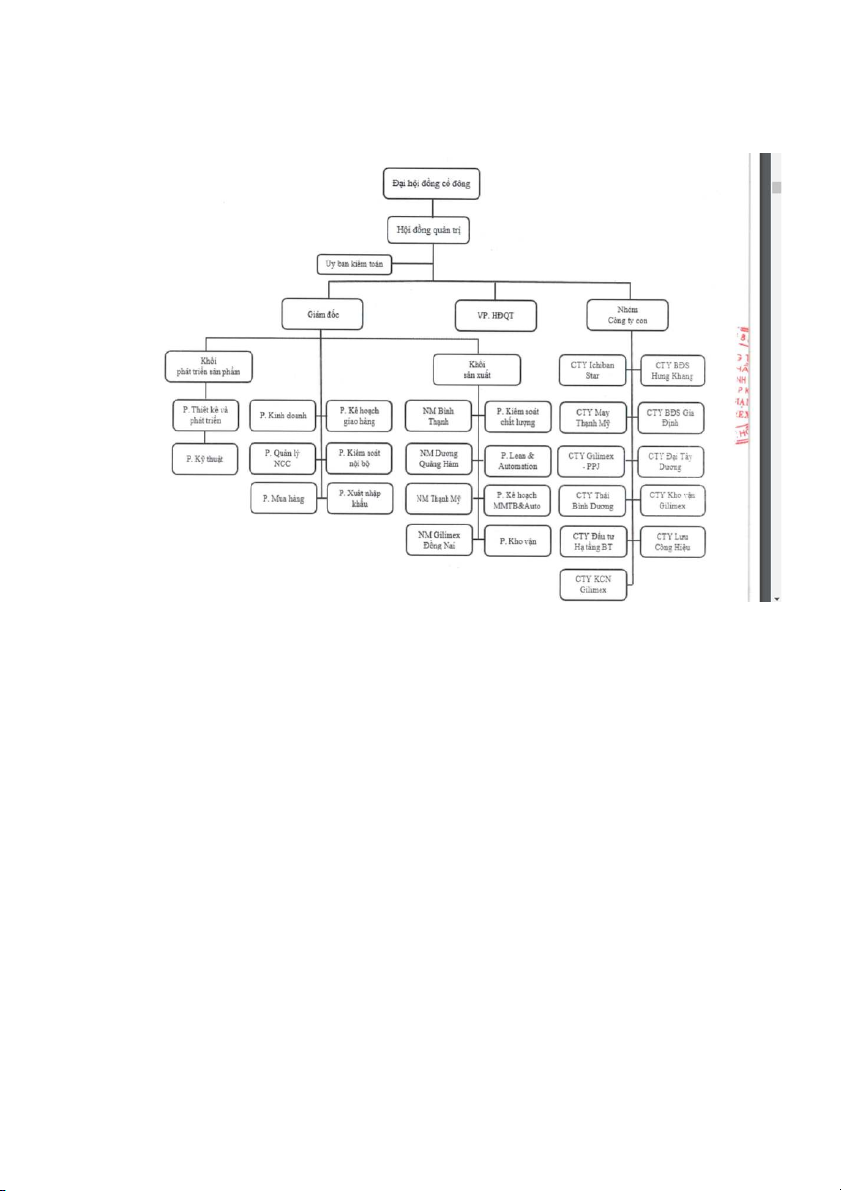

2. Structure of Subsidiaries, Joint Ventures (Organizational Structure)

Source: https://www.gilimex.com

GIL currently has 11 subsidiaries and 2 associates, namely Hoang An Investment and

Development Joint Stock Company and Gia Dinh Textile Investment Joint Stock Company 3.

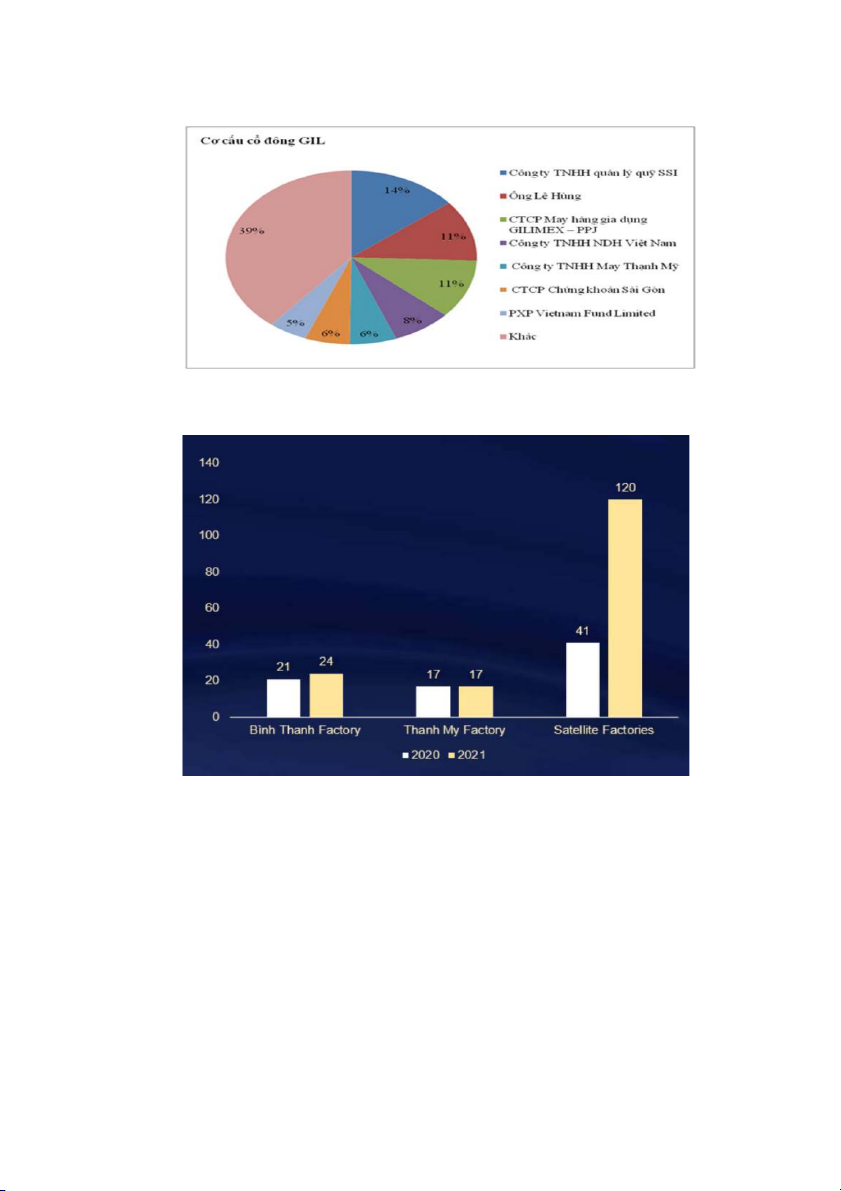

Shareholder Struture (In Detail) 4. Product a. Operating Capacity

With a vision to become a leading company in Vietnam in the field of manufacturing a

variety of textile and garment products. Gilimex has gradually spent 36 years

constantly innovating, developing, and transforming the model into a joint stock company. c. Main Customers

About the past 5 years, Gilimex's business results have continuously increased with a

budget of hundreds of billions of dongs per year thanks to the cooperation with major

retailers in the world such as Amazon and IKEA.

Accordingly, the company has cooperated with Amazon since 2016 with fabric

products, since then, business results of Gilimex have continuously increased rapidly

year by year with the average annual revenue growth of over 20%.

In addition, the company is also researching and developing new products for big

brands such as Medline (bags and home appliances); Bugaboo (children's products); IKEA; Teijin; and Puma… 5. Swot a. Trengths

Good product quality, diversified export products; has a loyal customer base, has

a good reputation for doing business, has a place stand on the market. Strong financial

resources, young and dynamic resources; good training policy. b. Weaknesses

The company does not have a division marketing, not focusing on promotion

product. Young human resources but not yet experience and skills are still low. Product

design is still poor, yet diversity. Research and development department work

inefficiently. The recruitment policy is not effective fruit, and mass. There are not

many business strategies suitable business. c. Opportunities

Vietnam's politics are getting better and better stability, the stability of the

economy helps businesses feel secure in doing business own and attract foreign

investors outside. The Vietnam - US relationship is increasingly strengthened and

become better. The United States is a large, multi-ethnic country, so consumers tend to

prefer shopping; consumers are easier than the market EU, Japan. Distributors tend to

switch from China to Vietnamese goods. d. Threats

In the context of the Covid 19 pandemic, the demand for products has

decreased. The process of transporting goods takes a long time and is difficult. The

rising cost of transportation and raw materials is one of the big challenges of today's businesses.

There are many competitors, especially companies from China. The United States

is a country with many regulations about origin, quality, many technical trade barriers,

strict laws. Our country has not received preferential treatment when exporting to the

United States. Ancillary industry yet development, the main raw material imported from abroad, dependent. II. FINANCIAL ANALYSIS 1. Common Size Analysis a. Balance Sheet

Current Assets: In total proportion of Gilimex assets, Current assets take about

80% in total from 2018 – 2020 and other is Long – term assets. In total proportion

from 2018 – 2020, these had some changes, we record net value short term

investments take 13% in 2020 when last 2 years was just 2%. The reason was that

Gilimex opened buy 875,211 stocks of Garmex JSC (GMC) and increased the

ownership rate to 7.08%. (Le Hung and Nguyen Viet Cuong are GIL BoD members and GMC too).

GIL permitted the customer to be held back payment and the result is the 3%

account receivables increased in total. In 2020, we evaluated that GIL managed

inventory efficiency and make these accounts decrease very sharply.

In horizontal analysis, we will see how these increased. Net value short-term

investment increase strongly 1947% from 2018 and account receivables increased

104%. Account receivables increased maybe a flag caution in current assets structure,

but in the next part, we will analyze GIL’s health and ability to make accurate judgments.

Strong decrease accounts are cash and inventory, decrease in cash is the result of

allowing deferred GIL’s customers’ payments. With inventory, we saw in reduced trend from 2018 – 2020. Object 3 Chart 1 Object 5 Chart 2

Long–term assets: In proportion of long–term assets, we saw no big changes

in its. Fixed assets maintain a stable proportion through 2018 – 2019. In both long–

term investments and other long–term assets have some changes. The reason is that the

unfinished transfer process of Gia Dinh Textile & Garment become JSC company, it

led to GIL must transfer this into invest in associated and provision, make decrease 5%

in total and down 21% in value from 2018. Because of this, goodwill value increases

6% in total and 585% value from 2018.

The long–term trade receivables, although recorded at the 1458% value increase

but compared to the total proportion, this is not serious. Object 7 Chart 3 Object 9 Chart 4

Resources: The liabilities of GIL mainly focus on current liabilities with almost

100% in liabilities, and this structure does not focus on short-term borrowing, but it

allocated mainly in short–term borrowing (38% - 23%) and short–term trade payable

(17%) in total from 2018 – 2020.

From 2018 – 2020, the structure of liabilities and owner’s equity returned to the

balance range thanks to GIL’s effort to raise capital very significantly. Owner Equity

increase up to 48% in total from 38% and in value, it increased 82% from 2018.

Mainly come from strongly raising capital from shareholders and the significant

increase in undistributed earnings 97% from 2018. Object 11 Chart 5 Object 14 Chart 6