Preview text:

The Vietnam Consumer Survey An accelerating momentum January 2020 Foreword 03 An accelerating momentum 04 The Vietnam Consumer Survey 07 1. Consumer sentiment 09 2. Consumer awareness 13 3. Purchasing preferences 16 4. Purchasing behaviours 22 5. Payment preferences 29 6. Post-purchase loyalty 31 Looking ahead 33 Contact us 35 Foreword

After three decades of economic reform, Vietnam has transformed into one of the most dynamic emerging

markets in the Southeast Asia region. This momentum looks set to accelerate in the near-term, as its economy

continues to show fundamental strength on the back of strong export demand, and a concerted nationwide push for digital transformation.

In this first edition of the Vietnam Consumer Survey, we explore some of the latest consumer behaviour patterns

emerging from the results of our survey conducted in the second half of 2019 across 1,000 respondents through

face-to-face interviews in four cities: Hanoi, Ho Chi Minh City, Can Tho, and Da Nang.

We have structured this report in a sequential manner to trace the consumers’ journey from pre-consumption

to consumption, and finally post-consumption. While it is worthwhile noting that the consumer’s journey may

not always follow this linear pattern, what we endeavour to do in this report is to provide you with a more holistic

understanding of some of the drivers and motivations behind the Vietnamese consumer’s behaviours.

We will begin this journey in the pre-consumption phase, where we take stock of the overall consumer sentiment,

and their outlook of the future, before examining their preferred communication channels, and purchasing

preferences. What we observed was that the Vietnamese consumer’s media consumption diet spans across a

fairly diverse set of offline and online channels, and that quality is a key consideration underpinning many of the

purchasing decisions that they make.

In the consumption phase, we take a look at some of the consumer’s purchasing and payment behaviours. Here,

we found that competition in Modern Trade channels is beginning to heat up, even as Traditional Trade channels

continue to dominate the retail landscape. We also examine the nascent e-commerce and digital payment

markets, and take a look at some of the key highlights of their evolution.

Finally, in the post-consumption phase, we delve into loyalty programs, and elaborate on the rise of digital

aggregator platforms that have emerged as an alternative to conventional, store-specific programs.

We hope that this report will provide you with some insights into the Vietnamese consumer’s journey, and the

considerations that you will need to make to leverage the market’s accelerating momentum. Pua Wee Meng Consumer Industry Leader Deloitte Southeast Asia 03

The Vietnam Consumer Survey | An accelerating momentum An accelerating momentum

An open economy with vibrant trade activity, Vietnam

is expected to emerge as the second fastest-growing economy in Southeast Asia. Economic overview

Since the implementation of its open-door policy, known as the Doi Moi reform, in 1986, Vietnam’s economic

growth has been nothing short of remarkable. Today, it is one of the most dynamic emerging economies in the Southeast Asia region.

In 2018, the size of Vietnam’s Gross Domestic Product (GDP) reached USD 241 billion, representing a 1.3 times

increase from 2015, as its economy expanded at a rate of 7.0%, far exceeding the target of 6.7% set by its

government (see Figure 1). With an average income per capita of approximately USD 2,600 per person per year1,

Vietnam has also managed to successfully propel itself to middle-income status.

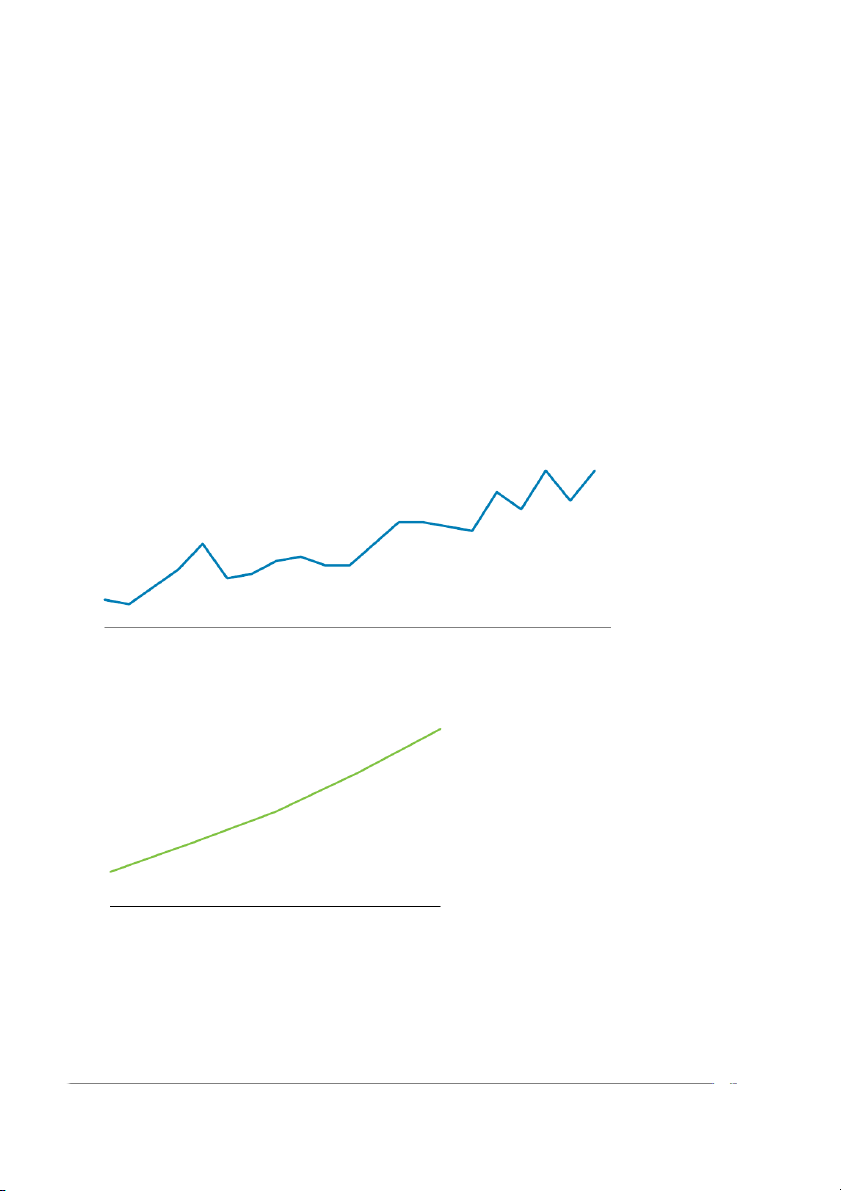

Figure 1: Vietnam’s GDP growth rates and inflation rates (2008-2018)

Looking ahead, Vietnam’s economy is expected to continue to show fundamental strength, on the back of steady

Foreign Direct Investment (FDI) inflows, robust domestic demand, as well as its export-oriented manufacturing and

rising tourism sectors. For 2019, Vietnam is expected to emerge as the second fastest-growing economy in Southeast

Asia, with an estimated economic growth rate of 6.8%2 (see Figure 2). 19.9% 18.6% GDP growth rate Inflation rate 11.8% 6.9% 6.4% 6.8% 6.7% 6.8% 7.1% 5.7% 6.2% 6.1% 6.0% 6.2% 5.4% 5.2% 5.4% 4.8% 4.0% 3.5% 1.8% 0.6% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Source: General Statistics Office

1 “Deputy PM gives positive forecast for economic growth in 2019”. The Voice of Vietnam. 2 May 2019. https://english.vov.vn/economy/deputy-

pm-gives-positive-forecast-for-economic-growth-in-2019-391701.vov

2 “Asian Development Outlook 2019: Strengthening disaster resilience”. Asian Development Bank. April 2019. https://www.adb.org/

publications/asian-development-outlook-2019-strengthening-disaster-resilience 04

The Vietnam Consumer Survey | An accelerating momentum

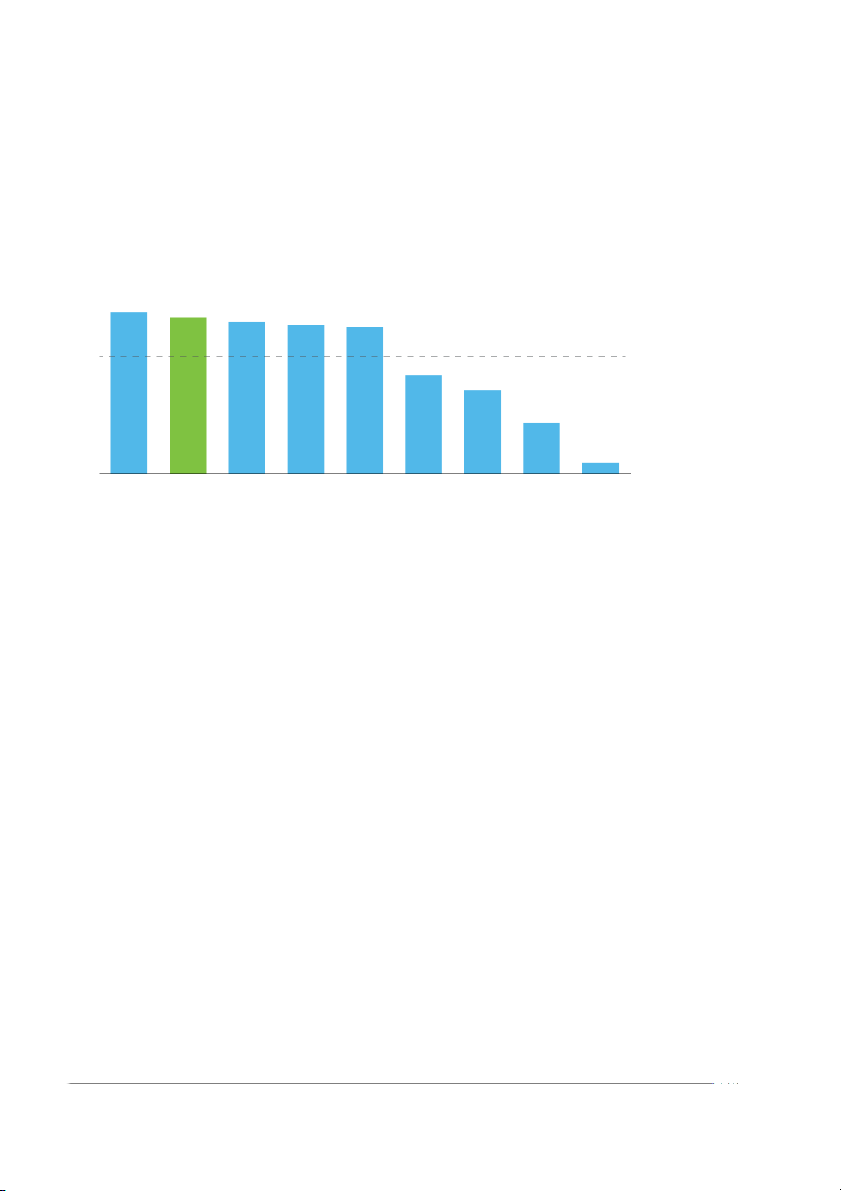

Figure 2: Estimated GDP growth rates for Southeast Asian economies 7.0% 6.8% 6.6% 6.5% 6.4% Regional average: 4.9% 4.5% 3.9% 2.6% 1.0% Cambodia Vietnam Myanmar Lao PDR Philippines Malaysia ThailandSingapore Brunei Source: Asian Development Bank An open economy

Overall, Vietnam is an open economy with vibrant trade activity, with its trade to GDP ratio reaching nearly 200%

in 20183. Indeed, consistently high FDI inflows have been a key pillar of Vietnam’s economic growth: in the first nine

months of 2019, foreign investors collectively invested about USD 26.1 billion in Vietnam’s economy4.

Currently, Vietnam’s strong export demand is supported by rising costs in China, which are forcing manufacturers

to look for alternative destinations in Asia to locate their factories. In line with this, its manufacturing and

processing sectors have attracted the greatest amount of foreign investments at about USD 18 billion in the first nine months of 2019.

At the same time, however, there are also encouraging signs that Vietnam is beginning to move up the

manufacturing value chain: its electronic exports, for example, are now growing at a faster rate than its textiles

exports5. Its science and technology sector has also witnessed a sharp surge in foreign investments, and is

now the third largest sector in terms of FDI, as an increasing number of global high-technology manufacturing

businesses set up or expand their operations in Vietnam.

Digital transformation across sectors

In its bid to transform Vietnam into a modern and industrialised economy by 2045, the government is currently

working on a series of regulations to encourage all sectors to harness the potential of digital transformation,

with the ultimate objectives of growing Vietnam’s digital economy at a rate of 20% annually, increasing workplace

productivity by 8-10% per year, as well as becoming one of the top 20 most competitive economies in the world

and one of the top three most competitive Southeast Asian economies6.

These are ambitious goals: a 2018 survey by its Ministry of Industry and Trade showed that while up to 82% of

businesses and the majority of its industries are aware of digital transformation, their digital transformation efforts

remain at an infancy stage. Nevertheless, the government’s new vision is recognition that digital transformation is

inevitable, and not only crucial for Vietnam to leapfrog the economic development cycle7, but also critical for the

sustainability of its overall economy.

3 “World Bank forecasts Vietnam’s 2019 growth at 6.6 %”. Viet Nam News. 27 April 2019. http://vietnamnews.vn/economy/519226/world-

bank-forecasts-viet-nams-2019-growth-at-66-per-cent.html#bBdq6W35gFCQjtcr.99

4 “FDI attraction in 9 months of 2019”. Foreign investment information website. 30 September 2019. https://dautunuocngoai.gov.vn/

tinbai/6231/Tinh-hinh-thu-hut-dau-tu-nuoc-ngoai-9-thang-nam-2019

5 “Economic growth in 2019 may exceed the plan?”. VGP News. 14 July 2019. http://baochinhphu.vn/Kinh-te/Tang-truong-kinh-te-2019-co-the- vuot-ke-hoach/370653.vgp

6 “Digital transformation receiving boost”. Vietnam Economic Times. 9 August 2019. https://vneconomictimes.com/article/business/digital- transformation-receiving-boost

7 “Vietnamese businesses are just getting started with digital transformation”. Banking Magazine. 18 July 2019. http://thoibaonganhang.vn/

doanh-nghiep-viet-chi-moi-nhap-cuoc-voi-chuyen-doi-so-90119.html 05

The Vietnam Consumer Survey | An accelerating momentum High consumer confidence

In light of the rapid economic growth, Vietnam’s consumers also appear to be optimistic: its Consumer Confidence

Index, an indicator of the consumer’s sentiment about the economy, has been on the rise since 2014 (see Figure

4)8. This optimism has been reflected in the growth of its retail sector, which experienced a double digit growth

rate of 11% over the past five years, and is expected to maintain this trajectory in 2019 (see Figure 4).

This momentum is largely due to Vietnam’s rapid population growth, and its emerging middle class. Currently,

Vietnam is home to a population of about 96 million – up from about 60 million in 1986 – with 70% under the age

of 35. The middle class, which now accounts for about 13% of its population, is also expected to grow to about 26% by 20269.

Figure 3: Vietnam’s Consumer Confidence Index (2014-2019) 129 129 124 122 120 117 117 116 115 112 112 108 109 107 107 106 105 104 102 99 98 1Q2014 2Q2014 3Q2014 4Q2014 1Q2015 2Q2015 3Q2015 4Q2015 1Q2016 2Q2016 3Q2016 4Q2016 1Q2017 2Q2017 3Q2017 4Q2017 1Q2018 2Q2018 3Q2018 4Q2018 1Q2019

Source: General Statistics Office

Figure 4: Vietnam’s retail growth rate (2014-2018) 4.4% 4.0% 3.5% 3.2% 2.9% 2014 2015 2016 2017 2018

Source: General Statistics Office

8 “Consumer confidence index (CCI)”. Organisation for Economic Co-operation and Development. https://data.oecd.org/leadind/consumer- confidence-index-cci.htm

9 “Vietnam’s population to reach 96.2 million”. Vietnam Investment Review. 12 July 2019. https://www.vir.com.vn/vietnams-population-to- reach-962-million-69245.html 06

The Vietnam Consumer Survey | An accelerating momentum The Vietnam Consumer Survey

In the first edition of the Vietnam Consumer Survey, we explored a Recreational

number of consumer behaviour patterns uncovered by the recent Basic Necessities Goods

consumer survey conducted by Deloitte in Hanoi, Ho Chi Minh • Beverages (Non- • Beverages

City, Can Tho, and Da Nang in the second half of 2019. We begin by Alcoholic) (Alcoholic)

examining the overall consumer sentiment and spending patterns, • Confectionery • Tobacco

before deep diving into specific buying behaviours and brand • Packaged Foods

preferences. Finally, we will analyse the communication and buying

channels, and the issue of payment in Vietnam’s predominately Lifestyle Goods Consumer cash-based economy. Electronics • Clothing & • Audio & Video Methodology Footwear Electronics

The survey was conducted in the second half of 2019 across 1,000 • Household • Household

households through face-to-face interviews in four major cities: Cleaning Appliances

Hanoi, Ho Chi Minh City, Can Tho, and Da Nang. Hanoi and Ho Chi Products (Major)

Minh City were selected for this survey as they are two of the most • Personal Hygiene • Household

significant contributors to Vietnam’s GDP, as the capital of Vietnam Products Appliances (Small)

and the largest metropolitan in the country respectively. On the • Mobile Phones,

other hand, Can Tho was chosen as it is widely considered to be the Digital Cameras &

capital of the western provinces, with its strong economic growth Other Gadgets

and rapid ascension as one of Vietnam’s leading economic hubs, Others

while Da Nang was chosen as the largest city, as well as commercial

• Housing & Transportation

and educational centre, of central Vietnam.

• Welfare & Leisure

The respondent sample was constructed to be representative

of Vietnam’s overall population in terms of age, gender, monthly

household income level, education level, and decision-making role.

Respondents were surveyed on their spending patterns, buying

behaviours, brand preferences, communication channels, buying

channels, e-commerce activities, and geographic differences across 14 product categories. 07

The Vietnam Consumer Survey | An accelerating momentum

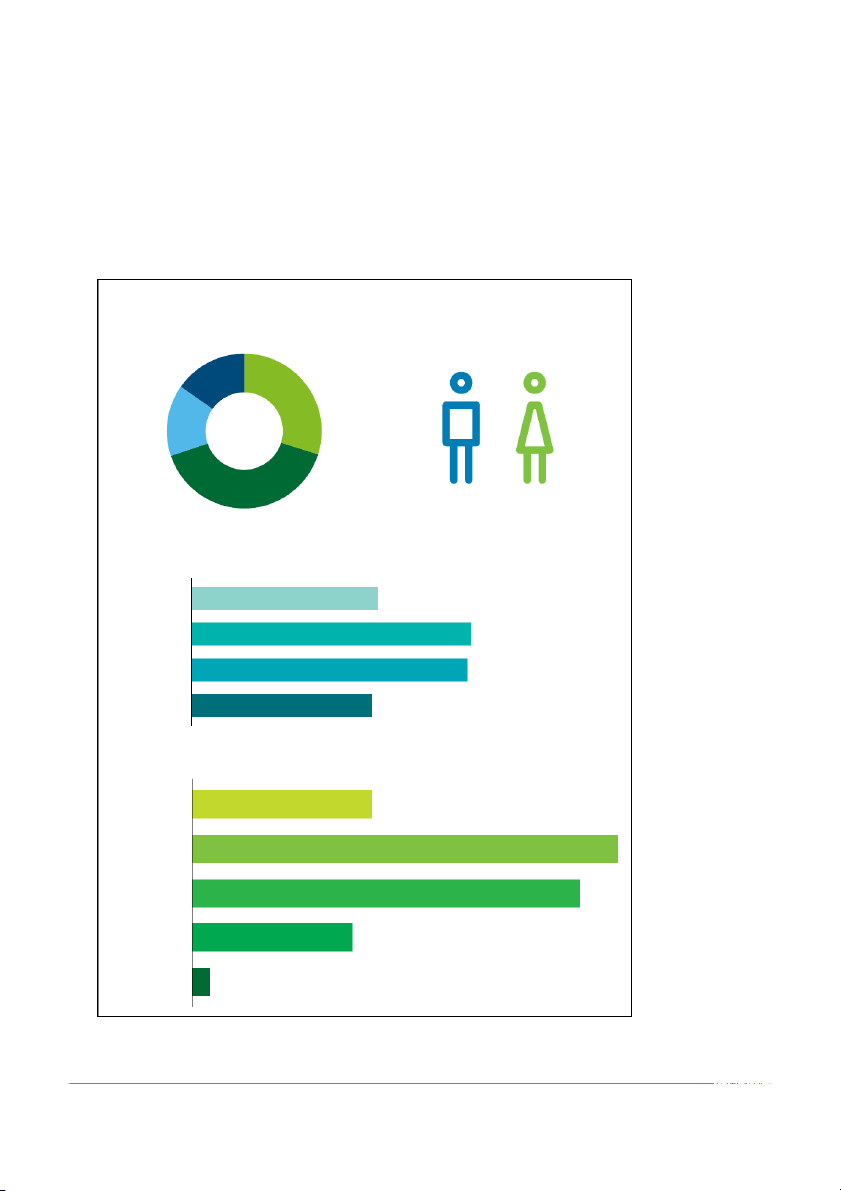

Demographics of survey respondents

Geographical distribution Gender distribution Da Nang 15% Hanoi 30% Can Tho 15% 40% 50% 50% Ho Chi Minh City Age distribution Age group, years 20-29 20% 30-39 30% 40-49 30% 50-60 20%

Monthly household income distribution

Monthly household income level, VND million 5-9 15% 10-14 36% 15-19 33% 20-39 14% More than 40 1% 08

The Vietnam Consumer Survey | An accelerating momentum Pre-consumption 1. Consumer sentiment

Overall, the Vietnamese consumer is optimistic

about the future economic outlook, and the majority

plan to increase their expenditure in the year ahead. A bright outlook

The Vietnamese consumer is optimistic about their economic prospects in the near future. On average, survey

respondents rated their confidence levels in Vietnam’s overall economy 7.5 out of 10 (where 0 represents the

lowest confidence level, and 10 represents the highest confidence level).

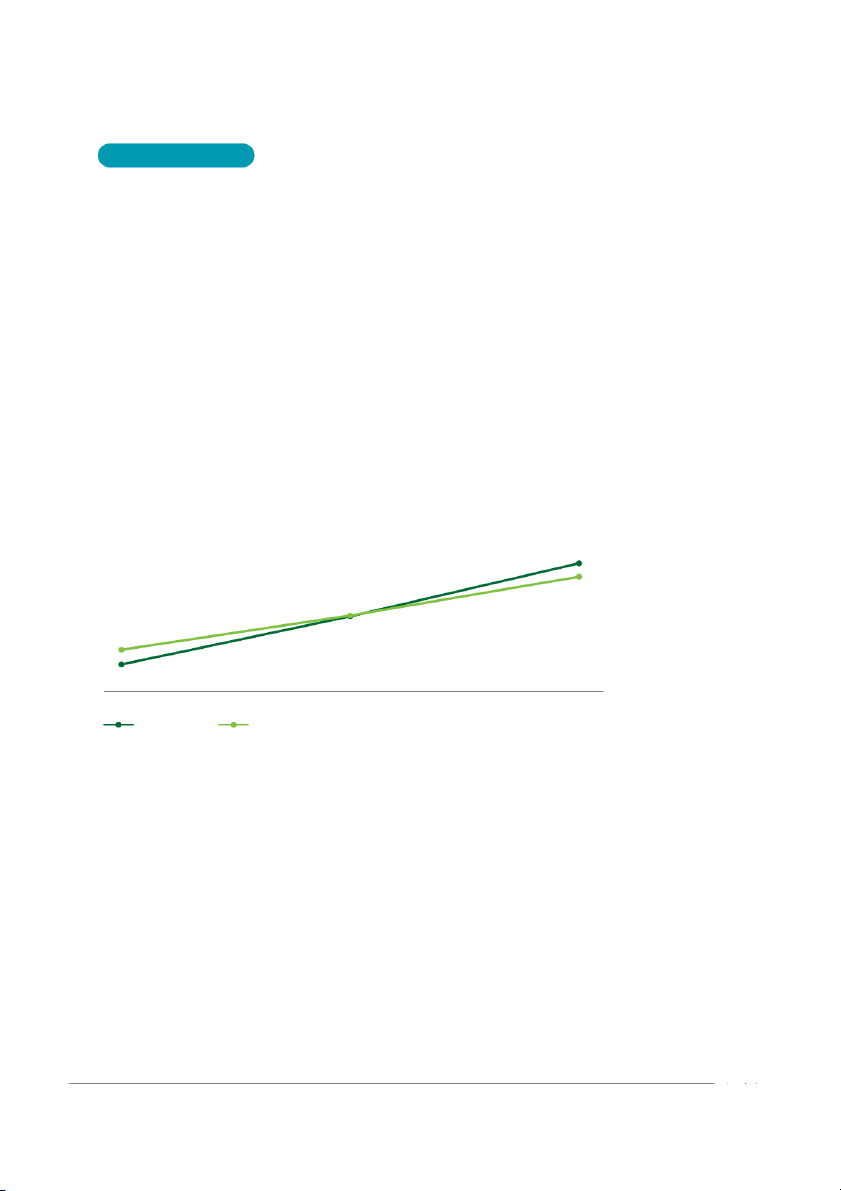

Furthermore, these scores increased with the timeframe in question: survey respondents assigned higher

confidence level scores for the next year, and even higher scores for the next three to five years. A similar trend

can also be observed for the confidence level in household income level improvements (see Figure 5).

Figure 5: Confidence levels in improvements to overall economy and household income level 8.1 8.0 7.8 7.6 7.5 This year Next year Next 3-5 years Overall economy Household income level

Source: Deloitte’s Vietnam Consumer Survey (2019) 09

The Vietnam Consumer Survey | An accelerating momentum

Different expenditure patterns across cities

Generally, Basic Necessities accounted for a significant proportion of expenditure, with survey respondents across

the four cities spending about 40-50% of their monthly household expenditure on Basic Necessities, such as

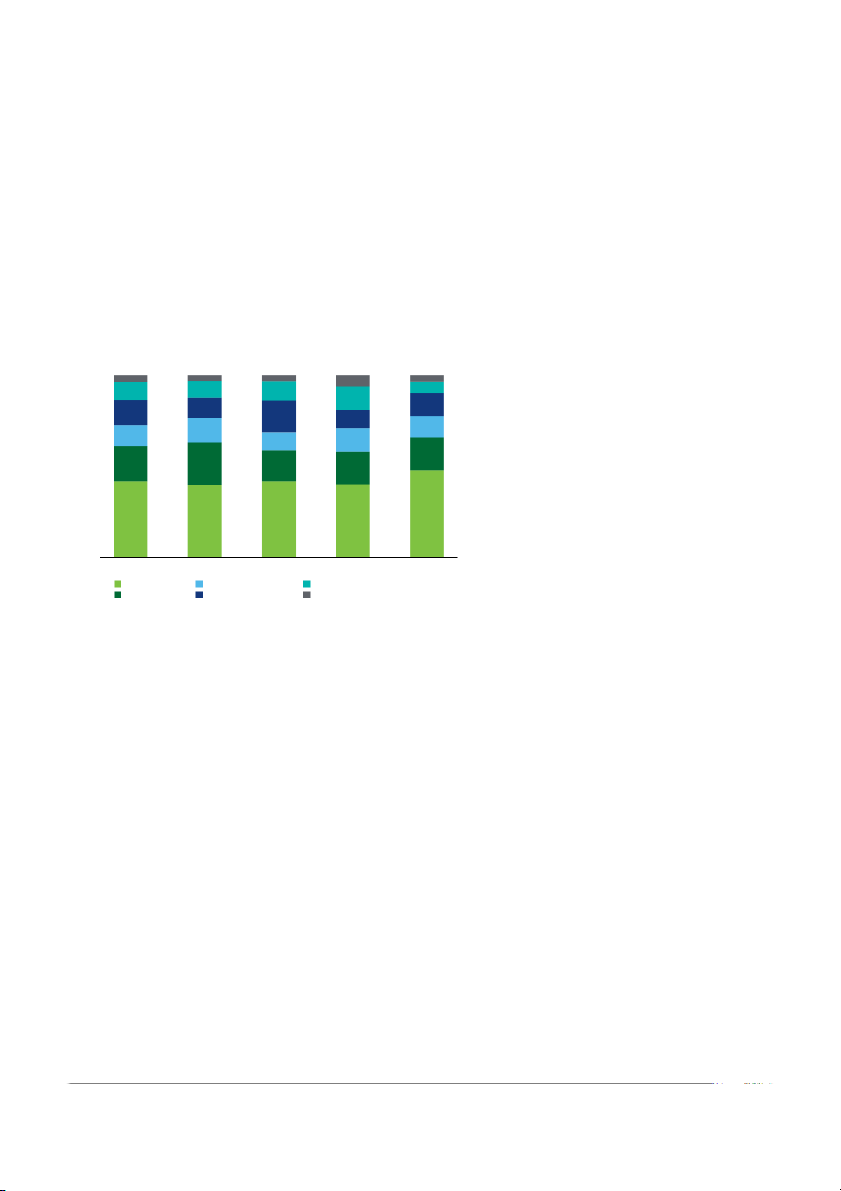

Packaged Foods and Non-Alcoholic Beverages (see Figure 6).

Figure 6: Breakdown of monthly household expenditure by category 4% 3% 3% 6% 4% 10% 9% 10% 6% 13% 13% 14% 11% 17% 10% 13% 12% 12% 10% 13% 17% 19% 24% 18% 18% 41% 48% 40% 42% 40% Overall Hanoi Ho Chi Minh City Can Tho Da Nang Basic Necessities Welfare & Leisure Consumer Electronics Lifestyle Goods Housing & Transportation Recreational Goods

Source: Deloitte’s Vietnam Consumer Survey (2019)

Beyond Basic Necessities, however, several differences have been observed in the expenditure patterns across the four cities:

• Higher expenditure on Housing & Transportation in Ho Chi Minh City: Housing & Transportation accounts

for a larger proportion of household expenditure for survey respondents in Ho Chi Minh City as compared to

survey respondents in the other three cities. One main reason for this could be the rising housing prices in Ho

Chi Minh City, which have been escalating in recent years. For example, the average price per square metre of

an apartment in Ho Chi Minh City costs about VND 58.5 million, whereas a similar apartment in Hanoi would be

priced at about VND 33.4 million per square metre10.

• Higher expenditure on Lifestyle Goods in Hanoi: Amongst all survey respondents, those from Hanoi spent

the highest proportion, or 23%, of their household expenditure on Lifestyle Goods. This reflects the widely

held opinion that Hanoi consumers tend to be more conscious about their public image, including looks and appearances.

• Higher expenditure on Consumer Electronics in Can Tho: Survey respondents in Can Tho have been

observed to be dedicating the highest proportion of their household expenditure to Consumer Electronics.

One reason for this could be the recent uptake of digitisation in the city and its regional areas, which are now

catching up with other parts of the country in terms of digitisation, and access to satellite and wireless services.

This phenomenon is also evident in the mushrooming of electronics retailers and e-commerce activities across

the city, as consumers increase their demand for mid-tier smartphones, and modern consumer electronics products.

10 “Real estate market report Q2/2019”. CafeLand. 15 July 2019. https://cafeland.vn/phan-tich/bao-cao-thi-truong-bat-dong-san- quy-22019-81059.html 10