Preview text:

Situation Analysis for Trung Nguyen Coffee by Nguyen Viet Su International Strategy RMIT University Vietnam CONTENTS

ABOUT TRUNG NGUYEN .......................................................................................... 1

PEST ANALYSIS ........................................................................................................ 2

ECONOMIC ............................................................................................................. 2

POLITICAL .............................................................................................................. 7

SOCIAL ................................................................................................................... 8

TECHNOLOGY ........................................................................................................ 8

SWOT ...................................................................................................................... 9

STRENGTHS ............................................................................................................ 9

WEAKNESSES ....................................................................................................... 10

OPPORTUNITIES ................................................................................................... 12

THREATS .............................................................................................................. 12

REFERENCES .......................................................................................................... 14 ABOUT TRUNG NGUYEN

Trung Nguyen Corp is a privately owned company established in 1996 that specializes in

both fresh and instant coffee. Its products are distributed to about 60 countries worldwide and

this Vietnamese brand also operates cafés in Vietnam, Japan and Singapore, amongst other countries.

“Ready to leave no stone unturned to create the finest gourmet coffee

products, specializing in providing the creative energy for glorious

success” Dang Le Nguyen Vu – Chairman, Trung Nguyen Group

According to Euromonitor International 2016c, Trung Nguyen JSC offers four product

categories, which are hot drinks (7.5% value share and 4th ranking), coffee (17.8% value share

and 3rd ranking), tea and other hot drinks. It has six subsidiaries, being Trung Nguyen

Corporation, Trung Nguyen Instant Coffee Company, Trung Nguyen Coffee, G7 Commercial

Services Company, Ðang Le Tourism Company, Trung Nguyen Franchising Company and G7

Ministop Joint Venture Company. 1 PEST ANALYSIS ECONOMIC

According to Fairtrade (2012), coffee provides a livelihood for 125mil people globally,

generates cash returns in subsistence economies, and provides much-needed rural employment in

the labour-intensive production and harvesting processes.

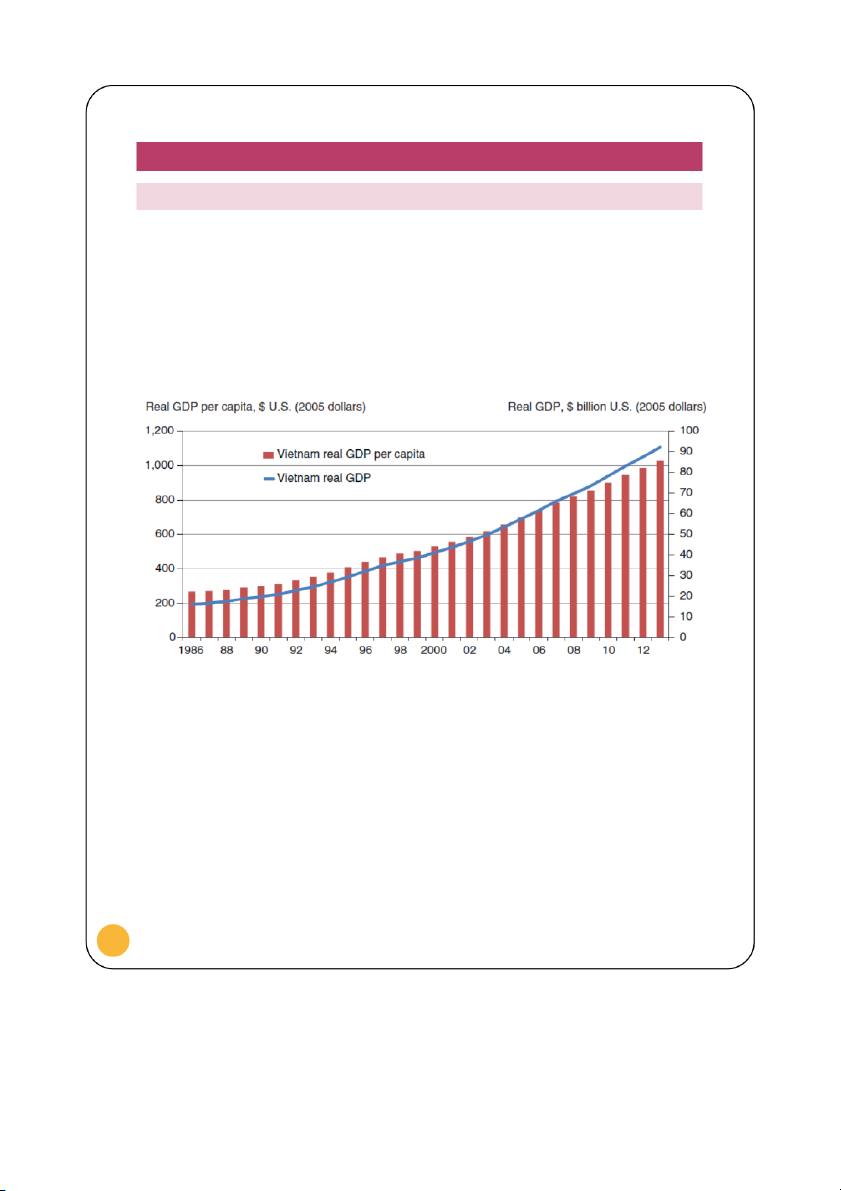

A general outlook of Vietnam reveals it still depends heavily on agriculture exports to

grow its economy while the agricultural value-added as a share of GDP has been declining since

1985. Nonetheless, its economic development has been successful given the strong growth

following 2008 financial crisis as indicated in Figure 1.

Vietnam real GDP per capita and real GDP, 1986-2013

Figure 1. Reproduced from: Arita & Dyck 2014

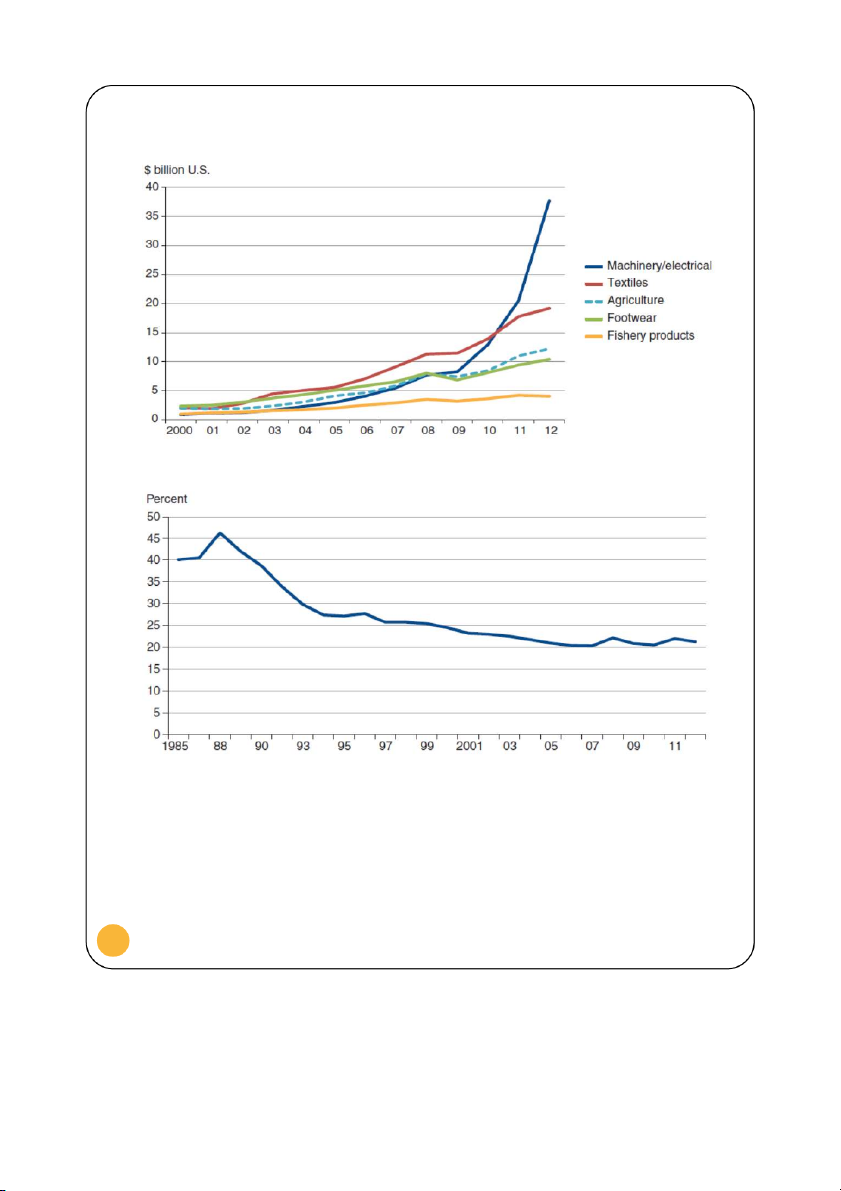

Figure 2 shows Vietnam mainly relies on machinery/electrical, textiles, agriculture,

footwear, and fishery products in its Agri-Food export sector. 2

Vietnamese exports to the world, selected sectors, 2000-12

Figure 2. Reproduced from: Arita & Dyck 2014

Vietnamese agricultural value-added as a share of GDP, 1985-2012

Figure 3. Reproduced from: Arita & Dyck 2014 3

Agricultural value-added as a share of GDP for selected countries, 2011

Figure 4. Reproduced from: Arita & Dyck 2014

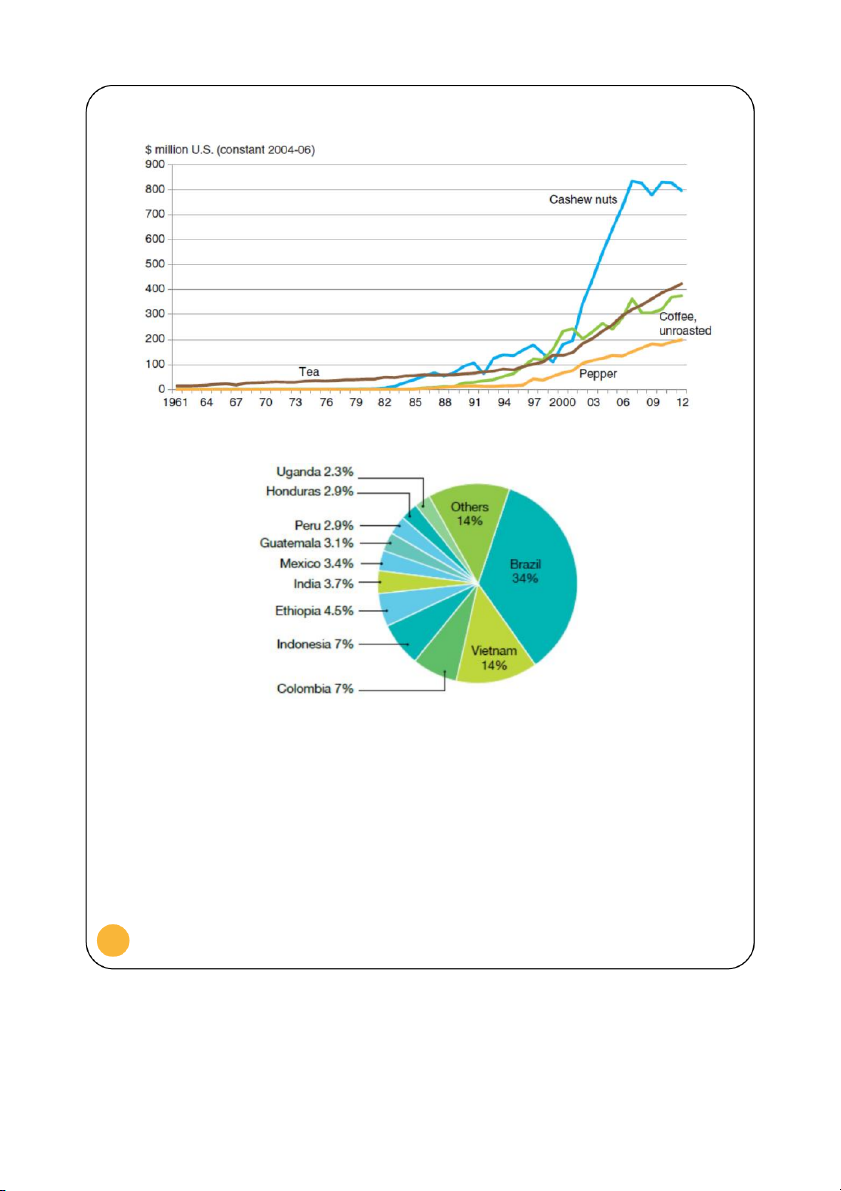

Figure 3 and Figure 4 indicate Vietnam’s agricultural value-added as a share of GDP

(1985-2012) has been falling to around 22% in 2011. Nonetheless, the production and export of

unroasted coffee are on the rise annually in Figure .

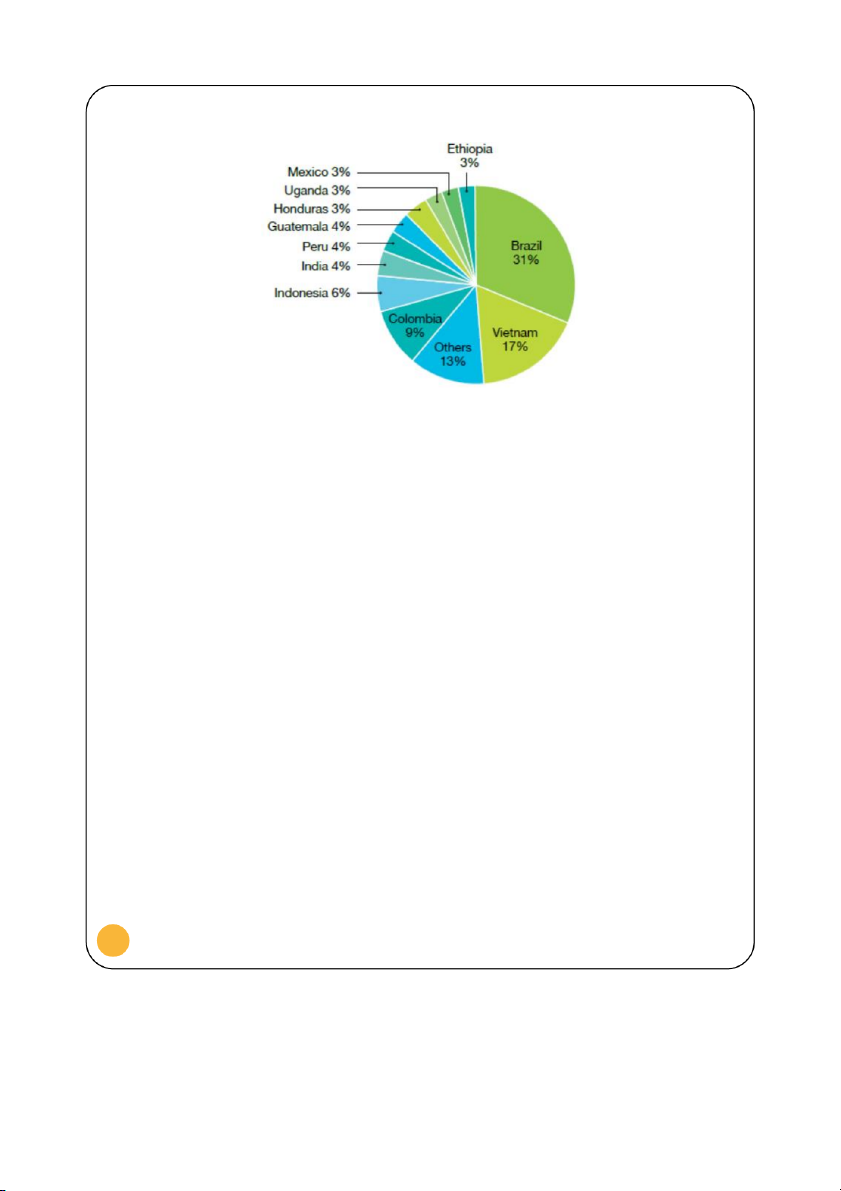

5 In fact, Vietnam is the second largest

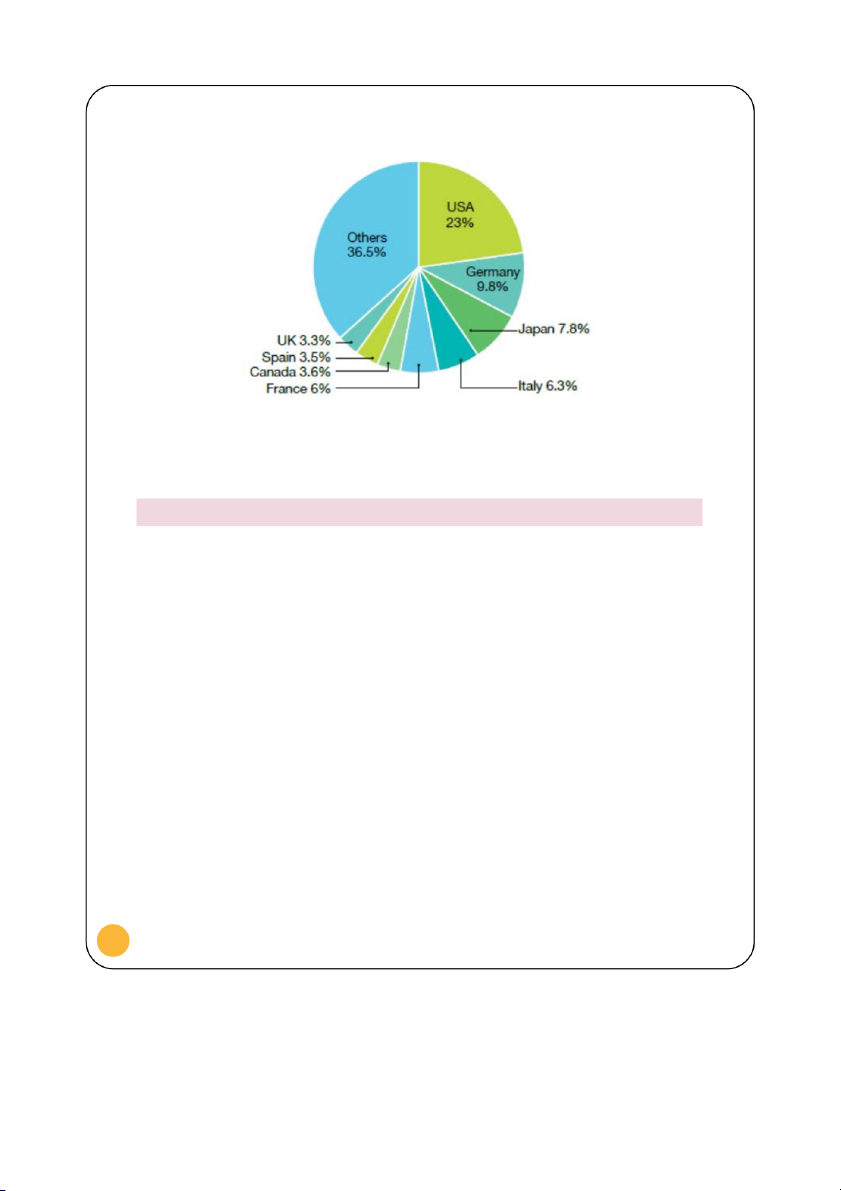

producer (14%) and exporter (17%) of coffee in the world mainly to USA (Figure 6, Figure 7, and Figure 8)

. The US economy grew 2.4% in 2015 (World Bank 2016), indicating a good sign

to export commodities to the US, but US importers have economic power with strong financial

power to bargain for coffee prices, meaning coffee producers trade unroasted coffee in a fickle priced global market.

Vietnam’s production of selected export crops, 1961-2012 4

Figure 5. Reproduced from: Arita & Dyck 2014

Largest producers of coffee as % of world production, 2007-11

Figure 6. Reproduced from: Fairtrade 2012

Largest exporters of coffee as % of world exports, 2007-11 5

Figure 7. Reproduced from: Fairtrade 2012 6

Largest importers of coffee as % of world total 2006-10

Figure 8. Reproduced from: Fairtrade 2012

Furthermore, cafés/bars are projected to grow with a constant 2015 price value CAGR of

4%, but the projected sales per outlet growth is higher (Euromonitor International 2016a). This

declined percentage from previous year means slower growth thanks to rising competition. POLITICAL

The government has been assisting coffee farmers by interfering to decrease interest

costs on loans from the Vietnamese banks to coffee farmers, and offered value-added 5% tax

exemptions on coffee and other agricultural products with regards to exporting (Arita & Dyck

2014). They also benefit from marketing coordination from Vicofe, a state-own enterprise.

Vietnam’s formal institutional framework restricts foreign-invested business in a way

that forces them to adopt franchising when opening a store (Euromonitor International 2016a).

The success of Starbucks has inspired Viet Idea Food and Beverages to embrace the franchise

model and become the fastest franchisee company.

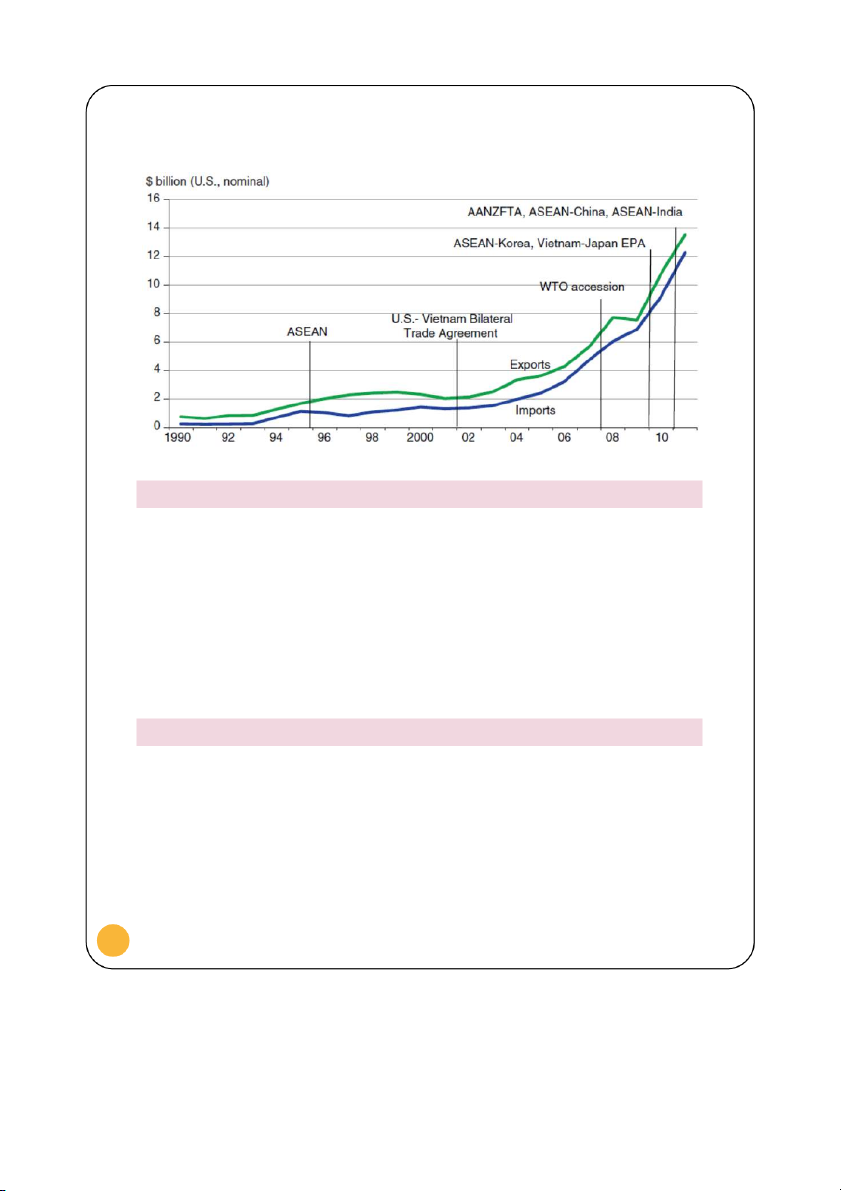

The government has been facilitating open markets in Vietnam through many trade

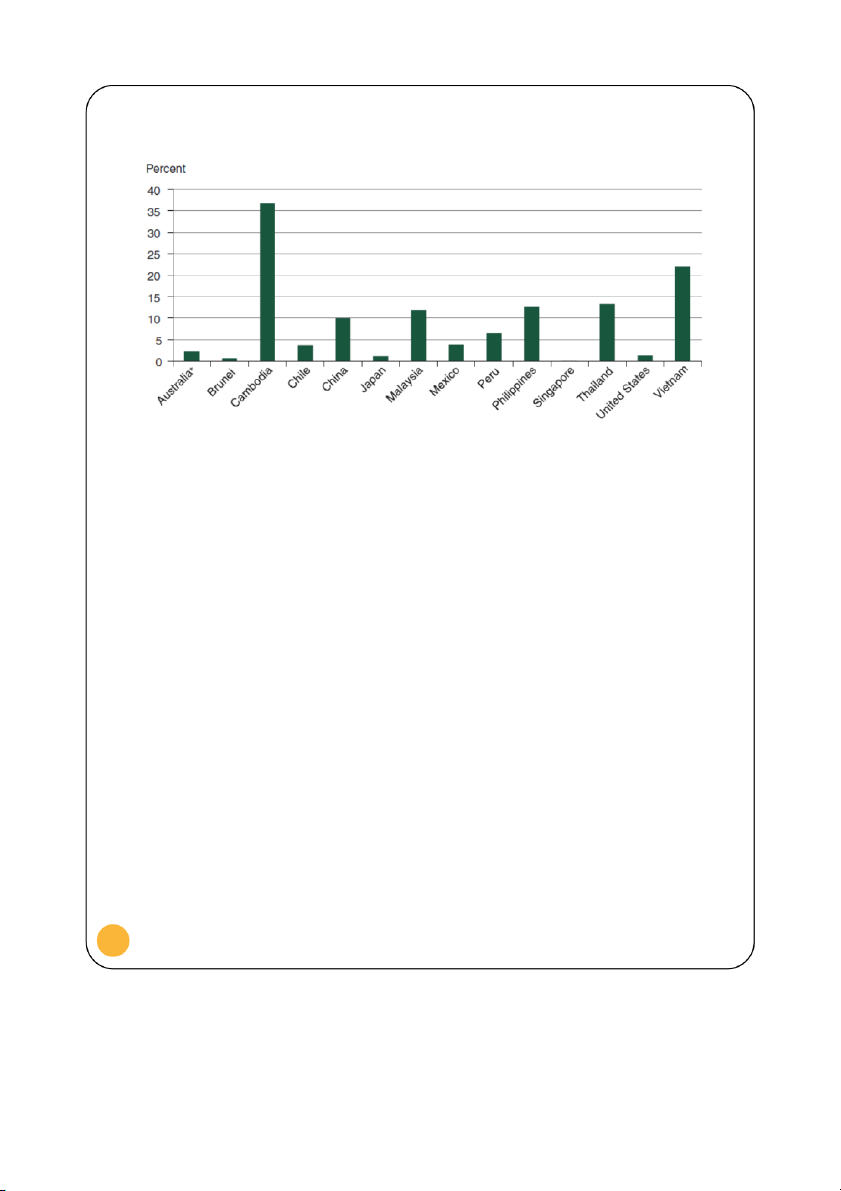

agreements in Figure 9. 7

Vietnam Agricultural Trade and Trade Agreements (1990-2011)

Figure 9. Reproduced from: Arita & Dyck 2014 SOCIAL

Vietnam’s rising middle class are developing more appetite for coffee and café shop as a

culture. Vietnamese consumer expenditure for coffee, tea and cocoa rises from VND13.2mil in

2010 to VND19.9mil in 2015 (Euromonitor International 2016b). Also, wealthy consumers have

the tendency to experience exotic food, and Trung Nguyen offers a unique yet valued tradition in

its Weasel package to meet such a c

onsumer desire (Trung Nguyen 2015).

Catching on to the latest consumer lifestyle inseparable from smartphones, Trung

Nguyen uses the growing media, internet, and social networks on different platforms to advertise

its brands, increase words-of-mouth, and build reciprocal communities with direct feedback

(Euromonitor International 2016a). TECHNOLOGY

Trung Nguyen implements the Microsoft Dynamics NAV

– LS Retail system, which is

an integrated business system to manage the firm’s POS network using its own in-house IT

resources (NaviWorld Vietnam 2011). This technology allows the firm to become a vertically

integrated business to manage its coffee outlets via real-time information to forecast demand,

streamline supplies, take orders and process transactions using handheld devices, and offer

customer loyalty programs across all locations. 8