Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com CHAPTER 6

Note: The letter A indicated for a question, exercise, or problem means that the question, exercise,

or problem relates to the chapter appendix. ANSWERS TO QUESTIONS

1. No. If all of the merchandise sold by one affiliate to another has subsequently been sold to outsiders,

the only effect that the elimination of intercompany sales of merchandise will have on the

consolidated financial statements is to reduce consolidated sales and consolidated cost of sales by an

equal amount. Consolidated net income will be unaffected.

2. The effect of eliminating profit on intercompany sales after deducting selling and administrative

expenses rather than gross profit is to include selling and administrative expenses associated with the

intercompany sale in consolidated inventories. Support for the gross profit approach is based on the

proposition that consolidated inventory balances should include manufacturing costs only and that

generally accepted accounting standards normally preclude the capitalization of selling and administrative costs.

3. $10,000 in intercompany profit should be eliminated on the consolidated statements workpaper

($60,000 – $100 ,000 = $10,000). After this elimination the merchandise will be included in the 2

consolidated statements at its cost to the affiliated group of $50,000 ( $100 ,000 ). 2

4. Yes. Although 100 percent elimination of intercompany profit has long been required in the

preparation of consolidated financial statements, the adjustments to the noncontrolling interest

described in this text were discretionary prior to the current standard. The FASB requires that these

adjustments be allocated between the noncontrolling and controlling interests.

5. When the subsidiary is the intercompany seller, the unrealized profit is shown in the accounts of the

sub (S Company). These accounts provide the starting point for the calculation of the noncontrolling

share of current year earnings. Failure to eliminate unrealized profit would result in the overstatement

of the noncontrolling share in profits. However, when the parent is the intercompany seller, the

unrealized profit is shown in the accounts of the parent (P Company). Since the noncontrolling

interest does not share in the earnings of P Company, the noncontrolling interest is not affected by the unrealized profit therein.

6. Noncontrolling interest in consolidated net assets at the beginning of the year is adjusted by debiting or

crediting the subsidiary’s beginning retained earnings in the consolidated statements workpaper.

7. The only procedural difference in the workpaper entries relating to the elimination of intercompany

profits when the selling affiliate is a less than wholly owned subsidiary is that the noncontrolling

interest in the amount of intercompany profit in beginning inventory must be recognized by debiting

or crediting the noncontrolling shareholders’ percentage interest in such adjustments to the

beginning retained earnings of the subsidiary.

8. Controlling interest in consolidated net income is equal to the parent company’s income from its

independent operations that has been realized in transactions with third parties plus its share of

reported subsidiary income that has been realized in transactions with third parties and adjusted for its

share of the amortization of the difference between implied and book value for the period. 6 - 1 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

9. It is important to distinguish between upstream and downstream sales because the calculation of

noncontrolling interest in the consolidated financial statements differs depending on whether the

intercompany sale giving rise to unrealized intercompany profit is upstream or downstream.

10. Profit relating to the intercompany sale of merchandise is recognized in the consolidated financial

statements in the period in which the merchandise is sold to outsiders. It is recognized in the

consolidated financial statements by reducing cost of goods sold (thus increasing gross profit and net income). 6 - 2 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

ANSWERS TO BUSINESS ETHICS CASE 1.

Independence of the auditor is essential in maintaining effective audits. When auditors

are involved in non-audit services, their independence may be impaired (in essence they

may be viewed as auditing their own work).

Many times auditors have to rely on management representation when no supporting evidence

is available. Auditors’ involvement in non-audit services can help them gain sufficient

familiarity with their client’s business and operational activities to reduce such

dependencies and perhaps to lower audit risk. 2.

The growing importance of non-audit service fees to the audit firms over time may have

increased the potential for the auditors to lose independence, even to the extent of financial fraud involvement.

The increasing effort to reduce costs (in a competitive marketplace for audit services)

imposes limitations on the scope of the audit work involved-- to avoid operating at a loss.

Subsidizing any shortfall between audit revenues and audit costs with non-audit fees can

help in overcoming such limitations. 3.

Audit fees would have to increase if auditors are held liable to a greater degree. The

increased fees would cover both increased auditor effort to detect errors and to cover

the increased litigation settlements/insurance premiums. The additional benefits would be weighed against the costs.

Timeliness and accuracy present constant tradeoffs in any audit. Time and budget

constraints may potentially result in an audit staff not performing sufficient work to meet

deadlines. Further, excessive cost-cutting may cause audit work to be inappropriately

reduced, which leads to increased reliance by auditors on client presentations to

document areas where the data are not easily available. Such reliance can cause audit

judgments to be inappropriately influenced. When factors outside their control cause

auditors to rely on the representations of others, they should not be solely responsible for

resulting errors. Legislation aimed at protecting auditors to some extent also serves to

keep audits from becoming prohibitively expensive. 6 - 3 lOMoARcPSD|46958826

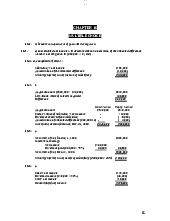

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com ANSWERS TO EXERCISES Exercise 6-1 Part A (1) Sales 2,700,000 Purchases (Cost of Goods Sold) 2,700,000

To eliminate intercompany sales of 2011

(2) 12/31 Inventory-Income Statement (Cost of Goods Sold) 487,500

12/31 Inventory (Balance Sheet) 487,500

To eliminate unrealized intercompany profit in inventory Exercise 6-2 Reported Net Income- S Company $ 525,000

Noncontrolling Interest Percentage 0.20

Noncontrolling Interest in Net Income $ 105,000 Exercise 6-3 2011 Reported net income $ 30,000

Unrealized intercompany profit included therein $20,800 = $5,200; $5,200 0.25 = (1,300) 4

Profit included in consolidated income 28,700 Percentage interest 0.10

Noncontrolling interest in consolidated income $ 2,870

2012 (Rounded to nearest dollar) Reported net income $ 35,000

Intercompany profit included in beginning inventory, now realized 1,300

Unrealized intercompany profit included therein $25,000 = $6,250; $6,250 0.25 = (1,563) 4

Profit included in consolidated income 34,737 Percentage interest 0.10

Noncontrolling interest in consolidated income $ 3,474 6 - 4 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Exercise 6-4

The $600,000 that could not be assigned to specific assets and liabilities is assumed to represent

goodwill (the unidentifiable intangible asset), which is not amortized under current GAAP but is

reviewed periodically for impairment. In contrast, identifiable intangible assets would be amortized if

they have a definite life but not if the life is indefinite in duration. Thus, only if the $600,000 pertained to

an identifiable intangible asset with a finite life would amortization be required. We assume that is not the case here. 2011

Pearce Company's net income from its independent operations $1,500,000

Amount of income not realized in transactions with third parties ($90,000 – $90,000 ) (18,000) 1.25

Pearce Company's income from its independent operations that has been realized

in transactions with third parties 1,482,000

Pearce's share of Searl Company adjusted income that has been realized in transactions

with third parties ($412,500* 0.80) 330,000*

Controlling interest in consolidated net income for 2011 $1,812,000

*[$600,000 – ($75,000 + $112,500)] x 0.80 = 330,000, where $75,000 = $375,000/5 Alternatively,

Control ing Interest in Consolidated Income

Net income internal y generated by Pearce Company $1,500,000

Unrealized profit on DOWNSTREAM

Realized profit (DOWNSTREAM sales) from begin. inventory sales to Searl Company (ending

Inventory) ($90,000 – $90,000/1.25) 18,000 Pearce Company's percentage of Searl Company's income

realized from third parties, .80($412,500) 330,000

Control ing interest in Consolidated Income $1,812,000 2012

Pearce Company's net income from its independent operations $1,800,000

Less profit included therein that has not been realized in transactions with third parties

($105,000 – ($105,000/1.25)) (21,000)

Plus profit realized in 2012 ($90,000 – ($90,000/1.25)) 18,000

Pearce Company's income from its independent operations that has been realized

in transactions with third parties 1,797,000

Pearce's share of Searl Company adjusted income that has been realized in transactions

with third parties ($675,0000 .80) 540,000

Controlling interest in consolidated net income for 2012 $2,337,000

*[$750,000 – $75,000] x 0.80 = $540,000, where $75,000 = $375,000/5 6 - 5 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Exercise 6-4 (continued) Alternatively,

Control ing Interest in Consolidated Income

Net income internal y generated by Pearce Company $1,800,000

Unrealized profit on DOWNSTREAM

Realized profit (DOWNSTREAM sales) from begin. inventory 18,000 sales to Searl Company (ending Inventory)

21,000Pearce Company's percentage of Searl Company's income

realized from third parties, .80($675,000) 540,000

Control ing interest in Consolidated Income $2,337,000 Exercise 6-5 2011

Pearce Company's income from its independent operations $1,500,000

Plus: Pearce Company's interest in the realized net income of Searl Company: Reported Net income $600,000

Less Amortization of difference between implied and book value ($75,000 + $112,500) (187,500)

Less unrealized profit included therein ($90,000 - $90,000 ) (18,000) 1.25

Income realized in transaction with third parties $394,500

Pearce Company's interest therein (0.8 $394,500) $315,600

Controlling interest in consolidated net income $1,815,600 2012

Pearce Company's income from its independent operations $1,800,000

Plus: Pearce Company's interest in the realized net income of Searl Company: Reported Net income $750,000

Less amortization of difference between implied and book value (75,000)

Less profit included therein that has not been realized in transactions

with third parties ($105,000 - $105,000 ) (21,000) 1.25

Plus profit realized in 2012 ($90,000 - $90,000 ) 18,000 1.25

Income realized in transaction with third parties $672,000

Pearce Company's interest therein (0.8 $672,000) 537,600

Controlling interest in consolidated net income $2,337,600 6 - 6 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Exercise 6-6 Part A

Payne Company's net income from its independent operations $280,000

Sierra Company's net income from its independent operations $172,000

Plus: profit realized from beginning inventory 3,800

Less: unrealized profit in ending inventory (4,800)

Sierra Company's net income realized in transactions with third parties $171,000

Payne Company's share thereof (1.00 $171,000) 171,000

Santa Fe Company's net income from its independent operations $120,000

Plus: profit realized from beginning inventory 4,600

Less: unrealized profit in ending inventory (2,300)

Santa Fe Company's net income realized in transactions with third parties $122,300

Payne Company's share thereof (0.80 $122,300) 97,840

Controlling interest in consolidated net income $548,840 Exercise 6-7 Part A 2011 (1) Sales 450,000 Purchases (Cost of Goods Sold) 450,000

To eliminate intercompany sales

(2) Ending Inventory – Income Statement (CoGS) 25,000

12/31 Inventory (Balance Sheet) 25,000

To eliminate intercompany profit in ending inventory ($150,000 - $150,000 ) 1.20 2012 (1) Sales 486,000 Purchases (Cost of Goods Sold) 486,000

To eliminate intercompany sales

(2) Beginning Retained Earnings-Perkins 25,000

Beginning Inventory – Income Statement (CoGS) 25,000

To recognize intercompany profit included in beginning inventory and reduce beginning

consolidated retained earnings for unrealized intercompany profit at the beginning of the year

(3) Ending Inventory – Income Statement (CoGS) 27,000

12/31 Inventory (Balance Sheet) 27,000 $162,000

To eliminate intercompany profit in ending inventory ($162,000 - ) 6 - 7 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Exercise 6-8 2011 (1) Sales 450,000 Purchases (Cost of Goods Sold) 450,000

(2) Ending Inventory – Income Statement (CoGS) 25,000

12/31 Inventory (Balance Sheet) 25,000

To eliminate intercompany profit in ending inventory ($150,000 - $150,000/1.2) 2012 (1) Sales 486,000 Purchases (Cost of Goods Sold) 486,000

To eliminate intercompany sales

(2) 1/1 Retained Earnings-Perkins Company (85%)($25,000) 21,250

1/1 Noncontrolling Interest (15%)($25,000) 3,750

Beginning Inventory – Income Statement (CoGS) 25,000

To recognize intercompany profit in beginning inventory realized during the year and reduce

controlling and noncontrolling interests for their share of unrealized intercompany profit at beginning of year.

(3) Ending Inventory – Income Statement (CoGS) 27,000

12/31 Inventory (Balance Sheet) 27,000

To eliminate intercompany profit in ending inventory. ($162,000 - $162,000/1.2) 6 - 8 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Exercise 6-9 PEAT COMPANY AND SUBSIDIARY Consolidated Income Statement

For the Year Ended December 31, 2012

Sales ($14,000,000 - $1,400,000) $12,600,000 Cost of Goods Sold (a) $7,900,000 Operating Expense 1,800,000 9,700,000 Consolidated Income 2,900,000

Less Noncontrolling Interest in Consolidated Income (b) 210,000

Controlling Interest in Consolidated Net Income $2,690,000

(a) Reported Cost of Goods Sold $9,200,000

Less intercompany sales in 2012 (1,400,000)

Plus unrealized profit in ending inventory ( 2 ($1,400,000 - $900,000)) 200,000 5

Less realized profit in beginning inventory ( 1 ($1,800,000 - $1,500,000)) (100,000) Corrected cost of goods sold 3 $7,900,000 $200 ,000

(b) Reported net income of subsidiary $2,000,000 0.1

Plus unrealized profit on subsidiary sales in 2011 that is considered realized in 2012 ( 1 ($1,800,000 - $1,500,000)) 100,000 3

Less unrealized profit on subsidiary sales in 2012 (there were no upstream sales in 2012) 0

Income realized in transactions with third parties 2,100,000 0.10

Noncontrolling interest in consolidated income $210,000 6 - 9 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com ANSWERS TO PROBLEMS Problem 6-1 Part A 2011 (1) Sales 436,000 Purchases (Cost of Goods Sold) 436,000

To eliminate intercompany sales

(2) 12/31 Inventory (Income Statement) 18,167 Inventory (Balance Sheet) 18,167

To eliminate unrealized intercompany profit in ending inventory ($109,000 – $109,000 ) 1.2 2012 (1) Sales 532,000 Purchases (Cost of Goods Sold) 532,000

To eliminate intercompany sales

(2) Beginning Retained Earnings-Peel Co. (0.9 $18,167) 16,350 Noncontrolling Interest (0.10 $18,167) 1,817

1/1 Inventory (Income Statement) 18,167

To recognize gross profit in beginning inventory realized in 2012

(3) 12/31 Inventory (Income Statement) 22,167 Inventory (Balance Sheet) 22,167

To eliminate unrealized intercompany profit in ending inventory

($133,000 – ($133,000/1.2))

Part B Reported subsidiary income $130,000

Add: Realized profit in beginning inventory 18,167

Less: Unrealized profit in ending inventory (22,167)

Subsidiary income included in consolidated income 126,000

Noncontrollong interest ownership percentage 0.10

Noncontrolling interest in consolidated income $12,600

Part C Peel Company's net income from independent operations $300,000

Reported income of Seacore Company $130,000

Less: Unrealized profit on intercompany sales of 2012 (22,167)

Add: Profit on 2011 sales to Peel realized in transactions with third parties 18,167

Subsidiary income realized in transactions with third parties $126,000

Peel 's share of subsidiary income (0.90 $126,000) 113,400

Controlling interest in consolidated net income $413,400 6-10 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-2 Part A 2011 (1) Sales 442,500 Purchases (Cost of Goods Sold) 442,500

To eliminate intercompany sales

(2) 12/31 Inventory (Income Statement) 44,250 Inventory (Balance Sheet) 44,250

To eliminate unrealized intercompany profit in ending inventory ($221,250 0.2) 2012 (1) Sales 386,250 Purchases (Cost of Goods Sold) 386,250

To eliminate intercompany sales

(2) 12/31 Inventory (Income Statement) 15,450

12/31 Inventory (Balance Sheet) 15,450

To eliminate intercompany profit in ending inventory ($77,250 0.20)

(3) Beginning Retained Earnings-Plaster Co. (0.85 $44,250) 37,612 Noncontrolling Interest (0.15 $44,250) 6,638

1/1 Inventory (Income Statement) 44,250

To recognize realization of intercompany profit in beginning inventory

Part B Reported subsidiary income $335,400

Add: Intercompany profit in beginning inventory 44,250

Deduct Unrealized intercompany profit in ending inventory (15,450)

Subsidiary income realized in transactions with third parties

and included in consolidated income 364,200

Noncontrolling interest percentage 0.15

Noncontrolling interest in consolidated income $54,630

Part C Plaster's income from independent operations $780,000

Reported income of Shell Company $335,400

Add: Intercompany profit in beginning inventory 44,250

Deduct: Unrealized profit in ending inventory (15,450)

Subsidiary Income realized in transactions with third parties $364,200

Plaster's share of subsidiary income ($364,200 0.85) 309,570

Controlling interest in consolidated net income $1,089,570 6-11 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-3 Part A 2011 (1) Sales 265,000 Purchases (Cost of Goods Sold) 265,000

To eliminate intercompany sales

(2) 12/31 Inventory (Income Statement) 25,000

12/31 Inventory (Balance Sheet) 25,000 $125,000

To eliminate unrealized profit in ending inventory ($125,000 – ) 1.25 2012 (1) Sales 475,000 Purchases (Cost of Goods Sold) 475,000

To eliminate intercompany sales

(2) 12/31 Inventory (Income Statement) 34,000

12/31 Inventory (Balance Sheet) 34,000

To eliminate intercompany profit in ending inventory

($170,000 – ($170,000/1.25))

(3) Beginning Retained Earnings-Peer Co. 25,000

1/1 Inventory (Income Statement) 25,000

To recognize intercompany profit in beginning inventory realized during the year 2011 2012

Part B Reported subsidiary income $225,000 $275,000

Noncontrolling interest ownership percentage 20% 20%

Noncontrolling interest in consolidated income $45,000 $55,000 2012

Part C Peer Company's income from independent operations $480,000

Less: Unrealized profit in ending inventory (34,000)

Add: Realized profit in beginning inventory 25,000

Peer Company's income realized in transactions with third parties 471,000

Peer Company's share of subsidiary income ($275,000 0.8) 220,000

Controlling interest in consolidated net income $691,000 6-12 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-4 Part A (1) Sales 225,000 Purchases (Cost of Goods Sold) 225,000

To eliminate intercompany sales for 2012

(2) Ending Inventory – Income Statement (CoGS) 21,000

12/31 Inventory (Balance Sheet) 21,000

To eliminate unrealized profit in ending inventory

(3) Beginning Retained Earnings-Pace Company

($7,000 + ($8,000 0.85) + $8,000) 21,800

Noncontrolling Interest ($8,000 0.15) 1,200

Beginning Inventory – Income Statement (CoGS) 23,000

To recognize gross profit in beginning inventory realized in current year

Part B Consolidated income (a) $477,000

Noncontrolling interest in consolidated income (b) 21,450

Controlling interest in consolidated net income (c) $455,550

(a) ($475,000* + $23,000 – $21,000)

(b) (0.15 ($150,000 + $8,000 – $15,000)

(c) ($200,000 + ($7,000 – $2,000) + (0.85 ($150,000 + $8,000 – $15,000)) + ($125,000 + $8,000 – $4,000))

* ($200,000 + $150,000 + $125,000) 6-13 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-5

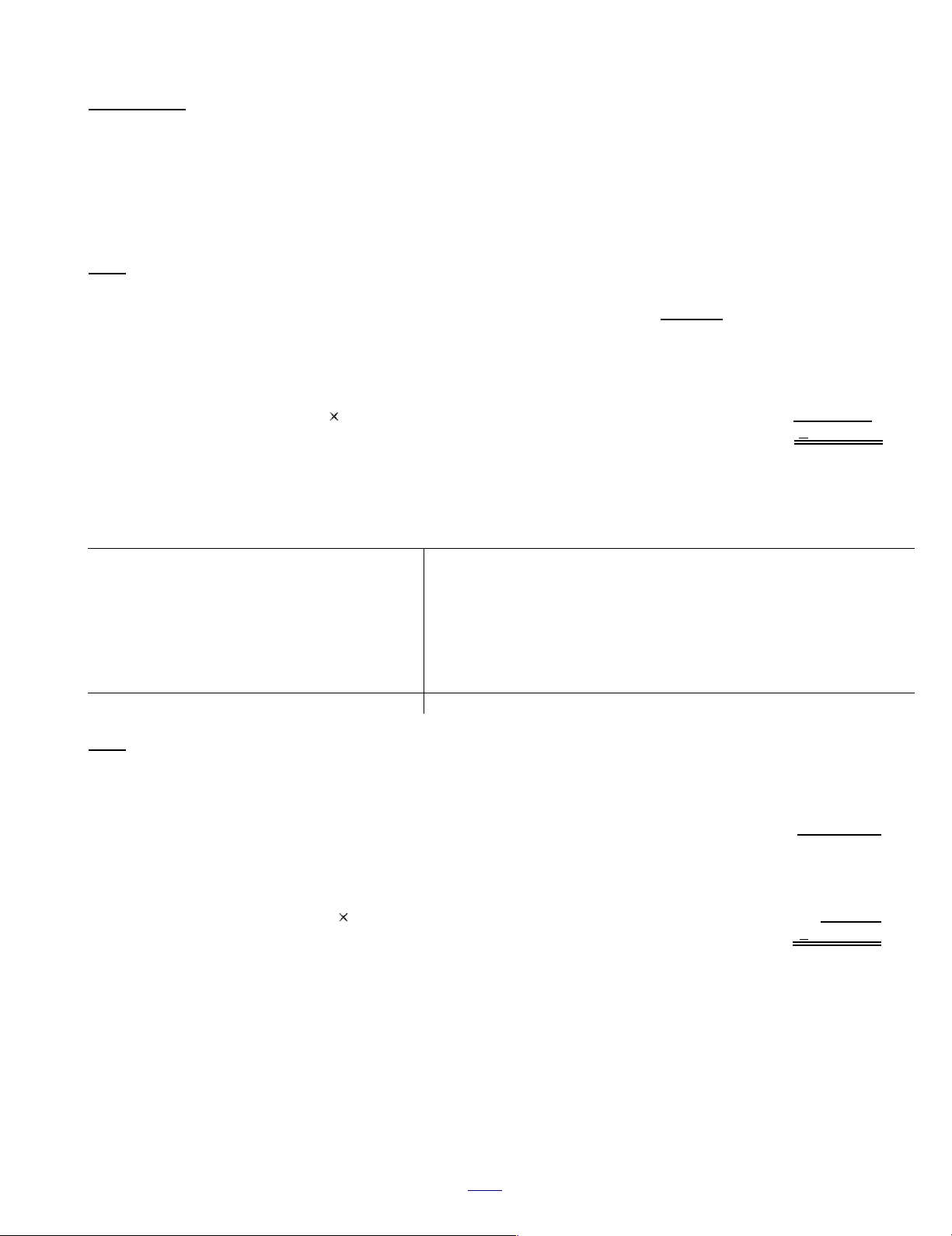

PRUITT CORPORATION AND SUBSIDIARY Part A

For the Year Ended December 31, 2013 Pruitt Sedbrook Eliminations Noncontrolling Consolidated Corporation Company Debit Credit Interest Balances Income Statement Sales

$1,210,000 $636,000 (2) $250,000 $0 $0 $1,596,000 Dividend Income 31,500 (5) 31,500 Total Revenue 1,241,500 636,000 1,596,000 Cost of Goods Sold: Inventory, 1/1 165,000 132,000 (4) 25,000 272,000 Purchases 935,000 420,000 (2) 250,000 1,105,000 Cost of Available for Sale 1,100,000 552,000 1,377,000 Inventory, 12/31 220,000 144,000 (3) 10,000 354,000 Cost of Goods Sold 880,000 408,000 1,023,000 Other Expense 198,000 165,000 363,000 Total Cost and Expense 1,078,000 573,000 1,386,000 Net/Consolidated Income 163,500 63,000 210,000

Noncontrolling Interest In Consolidated Income 6,300 (6,300)

Net Income to Retained Earnings $163,500 $63,000 $291,500 $275,000 $6,300 $203,700 Retained Earnings Statement 1/1 Retained Earnings: Pruitt Corporation $598,400 (4) 25,000 (1) 44,100 $617,500 Sedbrook Company 144,000 (6) 144,000 Net Income from above 163,500 63,000 291,500 275,000 6,300 203,700 Dividends Declared Pruitt Corporation (110,000) (110,000) Sedbrook Company (35,000) (5) 31,500 (3,500)

12/31/ Retained Earnings to Balance Sheet $651,900 $172,000 $460,500 $350,600 $2,800 $711,200 6-14 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-5 (continued) Pruitt Sedbrook Eliminations Noncontrolling Consolidated Balance Sheet Corporation Company Debit Credit Interest Balances Cash 90,800 96,000 186,800 Accounts Receivable 243,300 135,000 378,300 Inventory 220,000 144,000 (3) 10,000 354,000 Investment in Sedbrook Comp. 625,500 (1) 44,100 (6) 669,600 Other Assets 550,000 480,000 1,030,000 Total $1,729,600 $855,000 $1,949,100 Accounts Payable 77,000 36,000 113,000 Other Liabilities 120,700 47,000 167,700 Common stock: Pruitt Corporation 880,000 880,000 Sedbrook Company 600,000 (6) 600,000 Retained Earnings from above 651,900 172,000 460,500 350,600 2,800 711,200

1/1 Noncontrolling Interest in Net Assets (6) 74,400 74,400 12/31 Noncontrolling Interest 77,200 77,200 Total $1,729,600 $855,000 1,104,600 1,104,600 $1,949,100 6-15 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-5 (continued)

Explanations of workpaper entries

(1) Investment in Sedbrook Company (0.90 ($144,000 – $95,000)) 44,100

Beginning Retained Earnings - Pruitt Co. 44,100

To establish reciprocity/convert to equity as of 1/1/13 (2) Sales 250,000 Purchases (Cost of Goods Sold) 250,000

To eliminate intercompany sales

(3) Ending Inventory - Income Statement (CoGS) 10,000

Ending Inventory (Balance Sheet) 10,000

To eliminate unrealized intercompany profit in ending

inventory ($60,000 – ($60,000/1.2)

(4) Beginning Retained Earnings - Pruitt Co. 25,000

Beginning Inventory (Income Statement) 25,000

To recognize intercompany profit in beginning inventory realized during the year

(5) Dividend Income ($35,000 .90) 31,500 Dividends Declared 31,500

To eliminate intercompany dividends

(6) Beginning Retained Earnings - Sedbrook Co. 144,000 Common Stock - Sedbrook Co. 600,000

Investment in Sedbrook Co.($625,500 + $44,100) 669,600

Noncontrolling Interest ($744,000 x .10) 74,400

To eliminate investment account and create noncontrolling interest account 6-16 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-5 (continued)

Part B Pruitt Corporation's Retained Earnings on 12/31/13 $651,900

Amount of Pruitt Corporation Retained Earnings that have not been

realized in transactions with third parties 10,000

Pruitt Corporation's Retained Earnings that have been realized in

transactions with third parties 641,900

Increase in retained earnings of Sedbrook Company that have been

realized in transactions with third parties

from 1/1/09 to 12/31/13 ($172,000 – $95,000) $ 77,000 Pruitt Corporation's share x .90 69,300

Consolidated Retained Earnings as of 12/31/13 $711,200 Consolidated Retained Earnings

Pruitt Corporation's Retained Earnings on 12/31/13 $651,900

Pruitt Corporation's share of the increase in

Sedbrook Company's Retained Earnings

since acquisition ($172,000 - $95,000).90 69,300

Unrealized profit on downstream

sales to Sedbrook Company (in Sedbrook's ending Inventory 10,000 Consolidated Retained Earnings $711,200 6-17 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-6

PRUITT CORPORATION AND SUBSIDIARY

Consolidated Statements Workpaper

For the Year Ended December 31, 2013 Consolidated Consolidated Pruitt Sedbrook Eliminations Income

Retained Noncontrolling Consolidated Corporation Company Dr. Cr. Statement Earnings Interest Balances Debits Cash $ 90,800 $ 96,000 $186,800 Accounts Receivable (net) 243,300 135,000 378,300 Inventory 1/1 165,000 132,000 (4) 25,000 272,000 Investment in Sedbrook Company 625,500 (1) 44,100 (6) 669,600 Other Assets 550,000 480,000 1,030,000 Dividends Declared Pruitt Corporation 110,000 (110,000) Sedbrook Company 35,000 (5) 31,500 (3,500) Purchases 935,000 420,000 (2) 250,000 1,105,000 Other Expenses 198,000 165,000 363,000 Total 2,917,600 1,463,000 Inventory 12/31 $ 220,000 $ 144,000 (3) 10,000 354,000 Total Assets $1,949,100 Credits Accounts Payable 77,000 36,000 113,000 Other Liabilities 120,700 47,000 167,700 Common Stock: Pruitt Corporation 880,000 880,000 Sedbrook Company 600,000 (6)600,000 Retained Earnings Pruitt Corporation 598,400 (4) 25,000 (1) 44,100 617,500 Sedbrook Company 144,000 (6)144,000 Sales 1,210,000 636,000 (2)250,000 (1,596,000) Dividend Income 31,500 (5) 31,500 Totals $2,917,600 $1,463,000 Inventory 12/31 $ 220,000 $ 144,000 (3) 10,000 (354,000) Net/Consolidated Income 210,000

Noncontrolling Interest in Consolidated Net Income (6,300) 6,300

Controlling Interest in Consolidated Net Income $203,700 203,700 Consolidated Retained Earnings $711,200 711,200

1/1 Noncontrolling Interest in Net Assets (6) 74,400 74,400

12/31 Noncontrolling Interest in Net Assets _______ __ $77,200 77,200 $1,104,600 $1,104,600 Total Liabilities and Equity $1,949,100

*Noncontrolling Interest in Consolidated Income = 0.10 $63,000 = $6,300

See solution to Problem 6-5 for explanation of Workpaper entries 6-18 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-7

PAQUE CORPORATION AND SUBSIDIARY Part A

Consolidated Statement Workpaper

For the Year Ended December 31, 2013 Paque Segal Eliminations Noncontrolling Consolidated Corporation Company Dr. Cr. Interest Balances Income Statement Sales 1,650,000 795,000(2) 300,000 2,145,000 Dividend Income 54,000 (5) 54,000 Total revenue 1,704,000 795,000 2,145,000 Cost of Goods Aold: Beginning Inventory 225,000 165,000 (4) 45,000 345,000 Purchases 1,275,000 525,000 (2) 300,000 1,500,000 Cost of Goods Available 1,500,000 690,000 1,845,000 Less Ending Inventory 210,000 172,500 (3) 15,000 367,500 Cost of Goods Sold 1,290,000 517,500 1,477,500 Other Expenses 310,500 206,250 516,750 Total Cost & Expense 1,600,500 723,750 1,994,250 Net/Consolidated Income 103,500 71,250 150,750

Noncontrolling Interest in Income 10,125* (10,125)

Net Income to Retained Earnings 103,500 71,250 369,000 345,000 10,125 140,625

Statement of Retained Earnings 1/1 Retained Earnings Paque Corporation 811,500 (4) 40,500(1) 27,000 798,000 Segal Company 180,000 (6) 180,000 Net Income from above 103,500 71,250 369,000 345,000 10,125 140,625 Dividends Declared Paque Corporation (150,000) (150,000) Segal Company (60,000) (5) 54,000 (6,000)

12/31 Retained Earnings to Balance Sheet 765,000 191,250 589,500 426,000 4,125 788,625

*Noncontrolling Interest in Consolidated Income = 0.10 ($71,250 + $45,000 – $15,000) = $10,125 6-19 lOMoARcPSD|46958826

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com Problem 6-7(continued) Paque Segal Eliminations Noncontrolling Consolidated Corporation Company Dr. Cr. Interest Balances Balance Sheet Cash 93,000 75,000 168,000 Accounts Receivable 319,500 168,750 488,250 Inventory 210,000 172,500 (3) 15,000 367,500 Investment in Segal Company 810,000 (1) 27,000 (6) 837,000 Other Assets 750,000 630,000 1,380,000 Total assets 2,182,500 1,046,250 2,403,750 Accounts Payable 105,000 45,000 150,000 Other Current Liabilities 112,500 60,000 172,500 Capital Stock: Paque Corporation 1,200,000 1,200,000 Segal Company 750,000 (6) 750,000 Retained Earnings from above 765,000 191,250 589,500 426,000 4,125 788,625 1/1 Noncontrolling Interest (4) 4,500 (6) 93,000 88,500 12/31 Noncontrolling Interest 92,625 92,625 Total liabilities & equity 2,182,500 1,046,250 1,371,000 1,371,000 2,403,750

Explanations of workpaper entries are on next page 6-20