Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826 CHAPTER 6

INTERCOMPANY DEBT, CONSOLIDATED STATEMENT OF

CASH FLOWS AND OTHER ISSUES Chapter Outline

I. Variable interest entities (VIEs)

A. VIEs typical y take the form of a trust, partnership, joint venture, or corporation. In most

cases a sponsoring firm creates these entities to engage in a limited and wel -defined set

of business activities. For example, a business may create a VIE to finance the acquisition

of a large asset. The VIE purchases the asset using debt and equity financing, and then

leases the asset back to the sponsoring firm. If their activities are strictly limited and the

asset is pledged as col ateral, VIEs are often viewed by lenders as less risky than their

sponsoring firms. As a result, such arrangements can al ow financing at lower interest

rates than would otherwise be available to the sponsor.

B. Control of VIEs, by design, often does not rest with its equity holders. Instead, control is

exercised through contractual arrangements with the sponsoring firm who becomes the

"primary beneficiary" of the entity. These contracts can take the form of leases,

participation rights, guarantees, or other residual interests. Through contracting, the

primary beneficiary bears a majority of the risks and receives a majority of the rewards of

the entity, often without owning any voting shares.

C. An entity whose control rests a primary beneficiary is referred to by FASB Interpretation

46R "Consolidation of Variable Interest Entities," (FIN 46R) as a variable interest entity.

The fol owing characteristics indicate a control ing financial interest in a variable interest entity.

1. The direct or indirect ability to make decisions about the entity's activities

2. The obligation to absorb the expected losses of the entity if they occur, or

3. The right to receive the expected residual returns of the entity if they occur

The primary beneficiary bears the risks and receives the rewards of a variable interest

entity and is considered to have a control ing financial interest.

D. FIN 46R reasons that if a "business enterprise has a control ing financial interest in a

variable interest entity, assets, liabilities, and results of the activities of the variable interest

entity should be included with those of the business enterprise." Therefore, primary

beneficiaries must include their variable interest entities in their consolidated financial

statements consistent with the provisions of SFAS 141R.

II. Intercompany debt transactions

A. No real consolidation problem is created when one member of a business combination

loans money to another. The resulting receivable/payable accounts as wel as the interest

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-1 lOMoARcPSD|46958826

income expense balances are identical and can be directly offset in the consolidation process.

B. The acquisition of an affiliate's debt instrument from an outside party does require special

handling so that consolidated financial statements can be produced.

1. Because the acquisition price wil usual y differ from the book value of the liability, a

gain or loss has been created which is not recorded within the individual records of either company.

2. Because of the amortization of any associated discounts and/or premiums, the interest

income being reported by the buyer will not correspond with the interest expense of the debtor.

C. In the year of acquisition, al intercompany accounts (the liability, the receivable, interest

income, and interest expense) are eliminated within the consolidation process while the

gain or loss (which produced al of the discrepancies because of the initial difference) is recognized.

1. Although several alternatives exist, this textbook assigns al income effects resulting

from the retirement to the parent company, the party ultimately responsible for the

decision to reacquire the debt.

2. Any noncontrol ing interest is, therefore, not affected by the adjustments utilized to consolidate intercompany debt.

D. Even after the year of retirement, al intercompany accounts must be eliminated again in

each subsequent consolidation; however, the beginning retained earnings of the parent

company is adjusted rather than a gain or loss account.

1. The change in retained earnings is needed because a gain or loss was created in a

prior year by the retirement of the debt, but only interest income and interest expense

were recognized by the two parties.

2. The amount of the change made to retained earnings at any point in time is the original

gain or loss adjusted for the subsequent amortization of discounts or premiums.

III. Subsidiary preferred stock

A. Subsidiary preferred shares not owned by the parent are a component of the noncontrol ing interest.

B. In an acquisition, the fair value of any subsidiary preferred shares not acquired by the

parent is added to any consideration transferred along with the fair value of the

noncontrol ing interest in common shares to compute the acquisition-date fair value of the subsidiary.

IV. Consolidated statement of cash flows

A. Statement is produced from consolidated balance sheet and income statement and not

from the separate cash flow statements of the component companies.

B. Intercompany cash transfers are omitted from this statement because they do not occur

with an outside, unrelated party.

C. The "Noncontrol ing Interest's Share of the Subsidiary's Income'' is not included as a cash

flow although any dividends paid to these outside owners is reported as a financing activity.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-2 Solutions Manual lOMoARcPSD|46958826

V. Consolidated earnings per share

A. This computation normal y fol ows the pattern described in intermediate accounting

textbooks. For basic EPS, consolidated net income is divided by the weighted-average

number of parent shares outstanding. If convertibles (such as bonds or warrants) exist for

the parent shares, their weight must be included in computing diluted EPS but only if earnings per share is reduced.

1. The subsidiary's diluted earnings per share are computed first to arrive at (1) an

earnings figure and (2) a shares figure.

2. The portion of the shares figure belonging to the parent is computed. That percentage

of the subsidiary's diluted earnings is then added to the parent's income in order to

complete the earnings per share computation.

VI. Subsidiary stock transactions

A. If the subsidiary issues new shares of stock or reacquires its own shares as treasury

stock, a change is created in the book value underlying the parent's investment account.

The increase or decrease should be reflected by the parent as an adjustment to this balance.

B. The book value of the subsidiary that corresponds to the parent's ownership is measured

before and after the transaction with any alteration recorded directly to the investment

account. The parent's additional paid-in capital (or retained earnings) account is normal y

adjusted although the recognition of a gain or loss is an alternate accounting treatment.

C. Treasury stock acquired by the subsidiary may also necessitate a similar adjustment to the

parent's investment account. In addition, any subsidiary treasury stock is eliminated within the consolidation process. Learning Objectives

Having completed Chapter 6, students should have fulfil ed each of the fol owing learning objectives:

1. Describe a variable interest entity and primary beneficiary. Also should know when a variable

interest entity is subject to consolidation.

2. Eliminate al intercompany debt accounts and recognize any associated gain or loss created

whenever one company acquires an affiliate's debt instrument from an outside party.

3. Recognize that intercompany debt transactions require a constantly changing consolidation

entry to be prepared for each subsequent period until the debt is formal y retired.

4. Compute the appropriate amounts and make the worksheet entry needed in each subsequent

consolidation when one company has purchased the debt of an affiliate directly from an outside parry.

5. Discuss the various theories as to the appropriate al ocation of any income effect created by

intercompany debt transactions and identify the assignment employed in this textbook (and the rationale for its use).

6. Understand that subsidiary preferred stocks not owned by the parent are initially valued in

consolidated financial reports as noncontrol ing interest at acquisition-date fair value.

7. Prepare a consolidated statement of cash flows.

8. Compute basic and diluted earnings per share for a business combination in which the

subsidiary has dilutive convertible securities.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-3 lOMoARcPSD|46958826

9. Identify subsidiary stock transactions that can impact the underlying book value figure

recorded within the parent's Investment account.

10. Calculate the effect that a subsidiary stock transaction has on the parent's investment balance

and make the required journal entry to record that impact.

Answer to Discussion Question Who Lost the $300,000?

This case is designed to give life to a theoretical accounting issue discussed within the chapter: If

a subsidiary's debt is retired, should the resulting gain or loss be assigned to the parent or to the

subsidiary? The case attempts to il ustrate that no clear-cut solution to this question can be found.

This lack of an absolute answer makes financial accounting both intriguing and frustrating.

Interesting class discussion can be generated from this issue.

Students should note that the decision as to assignment only becomes necessary because of the

presence of the noncontrol ing interest. Regardless of the level of ownership al intercompany

balances are simply eliminated on the worksheet with the gain or loss being recognized. Not until

the time that the noncontrol ing interest computations are made does the identity of the specific party become important.

Al financial and operating decisions are assumed to be made in the best interest of the business

entity as a whole. This debt would not have been retired unless corporate officials believed that

Penston/Swansan would benefit from the decision. Thus, a strong argument can be made against

any assignment to either separate party.

Students should be required to pick one method and justify its use. Discussion usual y centers on the fol owing issues:

Parent company officials made the actual choice that created the loss. Therefore, assigning

the $300,000 to the subsidiary directs the impact of their reasoned decision to the wrong

party. In effect, the subsidiary had nothing to do with this transaction (as indicated in the case)

so that its financial records should not be affected by the $300,000 loss.

The debt was that of the subsidiary. Because the subsidiary's debt is being retired, al of the

$300,000 should be attributed to that party. Financial records measure the results of

transactions and the retirement simply culminates an earlier transaction made by the

subsidiary. The parent is doing no more than acting as an agent for the subsidiary (as

indicated in the case). If the subsidiary had acquired its own debt, for example, no question as

to the assignment would have existed. Thus, changing that assignment simply because the

parent was forced to be the acquirer is not justified.

Both parties were involved in the transaction so that some al ocation of the loss is required. If,

at the time of repurchase, a discount existed within the subsidiary's accounts, this figure would

have been amortized to interest expense (if the debt had not been retired). Thus, the

$300,000 loss was accepted now in place of the later amortization. This reasoning then

assigns this portion of the loss to the subsidiary. Because the parent was forced to pay more

than face value, that remaining portion is assigned to the buyer. Answers to Questions

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-4 Solutions Manual lOMoARcPSD|46958826

1. A variable interest entity (VIE) is a business structure that is designed to accomplish a specific

purpose. A VIE can take the form of a trust, partnership, joint venture, or corporation although

typical y it has neither independent management nor employees. The entity is frequently

sponsored by another firm to achieve favorable financing rates.

2. Variable interests are contractual, ownership, or other pecuniary interests in an entity that

change with changes in the entity's net asset value. Variable interests wil absorb portions of a

variable interest entity's expected losses if they occur or receive portions of the entity's

expected residual returns if they occur. Variable interests typical y are accompanied by

contractual arrangements that provide decision making power to the owner of the variable

interests. Examples of variable interests include debt guarantees, lease residual value

guarantees, participation rights, and other financial interests.

3. The fol owing characteristics are indicative of an enterprise qualifying as a primary beneficiary

with a control ing financial interest in a VIE.

The direct or indirect ability to make decisions about the entity's activities

The obligation to absorb the expected losses of the entity if they occur, or

The right to receive the expected residual returns of the entity if they occur

4. Because the bonds were purchased from an outside party, the acquisition price is likely to

differ from the book value of the debt as found on the subsidiary's records. This difference

creates accounting problems in handling the intercompany transaction. From a consolidated

perspective, the debt has been retired; a gain or loss should be reported with no further

interest being recorded. In reality, each company wil continue to maintain these bonds on

their individual financial records. Also, because discounts and/or premiums are likely to be

present, both of these account balances as wel as the interest income/expense wil change

from period to period because of amortization. For reporting purposes, al individual accounts

must be eliminated with the gain or loss being reported so that the events are shown from the

vantage point of the consolidated entity.

5. If the bonds are acquired directly from the affiliate company, al reciprocal accounts wil be

equal in amount. The debt and the receivable will be in agreement so that no gain or loss is

created. Interest income and interest expense should also reflect identical amounts.

Therefore, the consolidation process for this type of intercompany debt requires no more than

the offsetting of the various reciprocal balances.

6. The gain or loss to be reported is the difference between the price paid and the book value of

the debt on the date of acquisition. For consolidation purposes, this gain or loss should be

recognized immediately on the date of acquisition.

7. Because the bonds are stil legal y outstanding, they will continue to be found on both sets of

financial records. Thus, each account (Bonds Payable, Investment in Bonds, Interest

Expense, and Interest Income) must be eliminated within the consolidation process. Any gain

or loss on the retirement as wel as later effects on interest caused by amortization are also

included to arrive at an adjustment to the beginning retained earnings of the parent company.

8. The original gain is never recognized within the financial records of either company. Thus,

within the consolidation process for the year of acquisition, the gain is directly recorded

whereas (for each subsequent year) it is entered as an adjustment to beginning retained

earnings. In addition, because the book value of the debt and the investment are not in

agreement, the interest expense and interest income balances being recorded by the two

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-5 lOMoARcPSD|46958826

companies wil differ each year because of the amortization process. This amortization

effectively reduces the difference between the individual retained earnings balances and the

total that is appropriate for the consolidated entity. Consequently, a smal er change is needed

each period to arrive at the balance to be reported. For this reason, the annual adjustment to

beginning retained earnings gradual y decreases over the life of the bond.

9. No set rule exists for assigning the income effects that result from intercompany debt

transactions although several different theories have been put forth over the years which

include: (1) assignment of the entire amount to the debtor, (2) assignment of the entire

amount to the buyer, and (3) al ocation of the gain or loss between the two parties in some

manner. This textbook attributes the entire income effect (the $45,000 gain in this case) to the

parent company. Assignment to the parent is justified because that party is ultimately

responsible for the decision being made to retire the debt. The answer to the discussion

question included in this chapter analyzes this question in more detail.

10. Subsidiary outstanding preferred shares are part of the noncontrol ing interest and are

included in the consolidated financial statements at acquisition-date fair value and

subsequently adjusted for their share of subsidiary income and dividends.

11. The consolidated statement of cash flows is developed from the information found in the

consolidated balance sheet and income statement. Thus, the cash flows generated by

operating, investing, and financing activities are identified only after the consolidation of these other statements.

12. The noncontrol ing interest share of the subsidiary’s income is a component of

consolidated net income. Consolidated net income then is adjusted for noncash and other

items to arrive at consolidated cash flows from operations. Any dividends paid by the

subsidiary to these outside owners are listed as a financing activity of the business

combination because an actual cash outflow is created.

13. An alternative to the normal diluted earnings per share calculation is required whenever the

subsidiary has dilutive convertible securities such as bonds or warrants. In this case, the

potential impact of the conversion of subsidiary shares must be factored into the overal

diluted earnings per share computation.

14. Basic Earnings per Share. The existence of subsidiary convertible securities does not affect

consolidated basic EPS. Consolidated basic earnings per share is computed by dividing

consolidated net income by the weighted average number of parent shares outstanding.

Diluted Earnings per Share. The subsidiary's diluted earnings per share is computed by

including both convertible items. The portion of the parent's control ed shares to the total

shares used in this calculation is then determined. Only this percentage (of the income figure

used in the subsidiary's computation) is added to the parent's income in arriving at the diluted

earnings per share for the business combination.

15. Several reasons could exist for a subsidiary to issue new shares of stock to outside parties.

Clearly, additional financing is brought into the company by any such sale. Also, stock

issuance may be used to entice new individuals to join the organization. Additional

management personnel, as an example, might be attracted to the company in this manner.

The company could also be forced to sel shares because of government regulation. Many

countries require some degree of local ownership as a prerequisite for operating within that country.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-6 Solutions Manual lOMoARcPSD|46958826

16. Because the new stock was issued at a price above book value, the book value per share of

Metcalf's stock has been increased. Consequently, the book value of Washburn's investment

should be increased to reflect this change. To measure the effect, the underlying book value

of Washburn's investment is calculated both before and after the new issuance. Because the

increment is the result of a stock transaction, an increase is made to additional paid-in capital

although recording a gain or loss is currently al owed. Although the subsidiary's shares (both

new and old) are eliminated in the consolidation process, the increase in the parent's APIC (or

gain or loss) does carry into the consolidated figures. In addition, the percentage of the

subsidiary attributed to the noncontrol ing interest wil have increased.

17. A stock dividend does not alter the book value of the subsidiary company and, thus, creates

no effect on Washburn's investment account or on the consolidated figures. Hence, no entry is

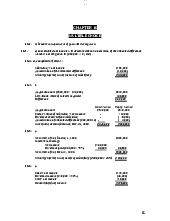

recorded at al by the parent company in connection with the subsidiary's stock dividend. Answers to Problems 1. D 2. C 3. A 4. D 5. A

6. D Cash Flow from Operations:

Net income ................................................................. $45,000

Depreciation .............................................................. 10,000

Trademark amortization ............................................ 15,000

Increase in accounts receivable ............................... (17,000)

Increase in inventory................................................. (40,000)

Increase in accounts payable ................................... 12,000 (20,000)

Cash Flow from Operations ..................................... $25,000 7. C

Cash Flow from Financing Activities:

Dividends to parent’s interest .................................. ($12,000)

Dividends to noncontrolling interest (20% $5,000) (1,000)

Reduction in long-term notes payable..................... (25,000)

Cash Flow from Financing Activities ....................... ($38,000) 8. C 9. C

10.C Rodgers' Reported Balance ...................................... $200,000

© The McGraw-Hill Companies, Inc.,

McGraw-Hill/Irwin 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-7 lOMoARcPSD|46958826

Ferdinal's reported balance ..................................... 80,000

Eliminate interest expense—intercompany ............ 21,000

Eliminate interest income—intercompany ............. (22,000)

Recognize gain on retirement of debt ($212,000 – $199,000) 13,000

Consolidated net income ................................... $292,000

11.B Eliminate interest expense—intercompany ............ $21,000

Eliminate interest income—intercompany ............. (18,000)

Recognize loss on retirement of debt ($206,000 – $189,000) (17,000)

Reduction in retained earnings, 1/1/10 .............. $(14,000)

12.B Ace reported income ................................................ $400,000

Remove intercompany dividends (cost method) .... (7,000) $393,000

Byrd reported income .............................................. 100,000

Gain on extinguishment of debt ($48,300 – $46,600) 1,700

Eliminate interest expense on "retired" debt

($48,300 x 10%) .................................................... 4,830

Eliminate interest income on "retired" debt

($46,600 x 12%) .................................................... (5,592)

Consolidated net income .............................. $493,938

13.D 30% of Byrd's reported income of $100,000; the intercompany debt

transaction is attributed solely to the parent company.

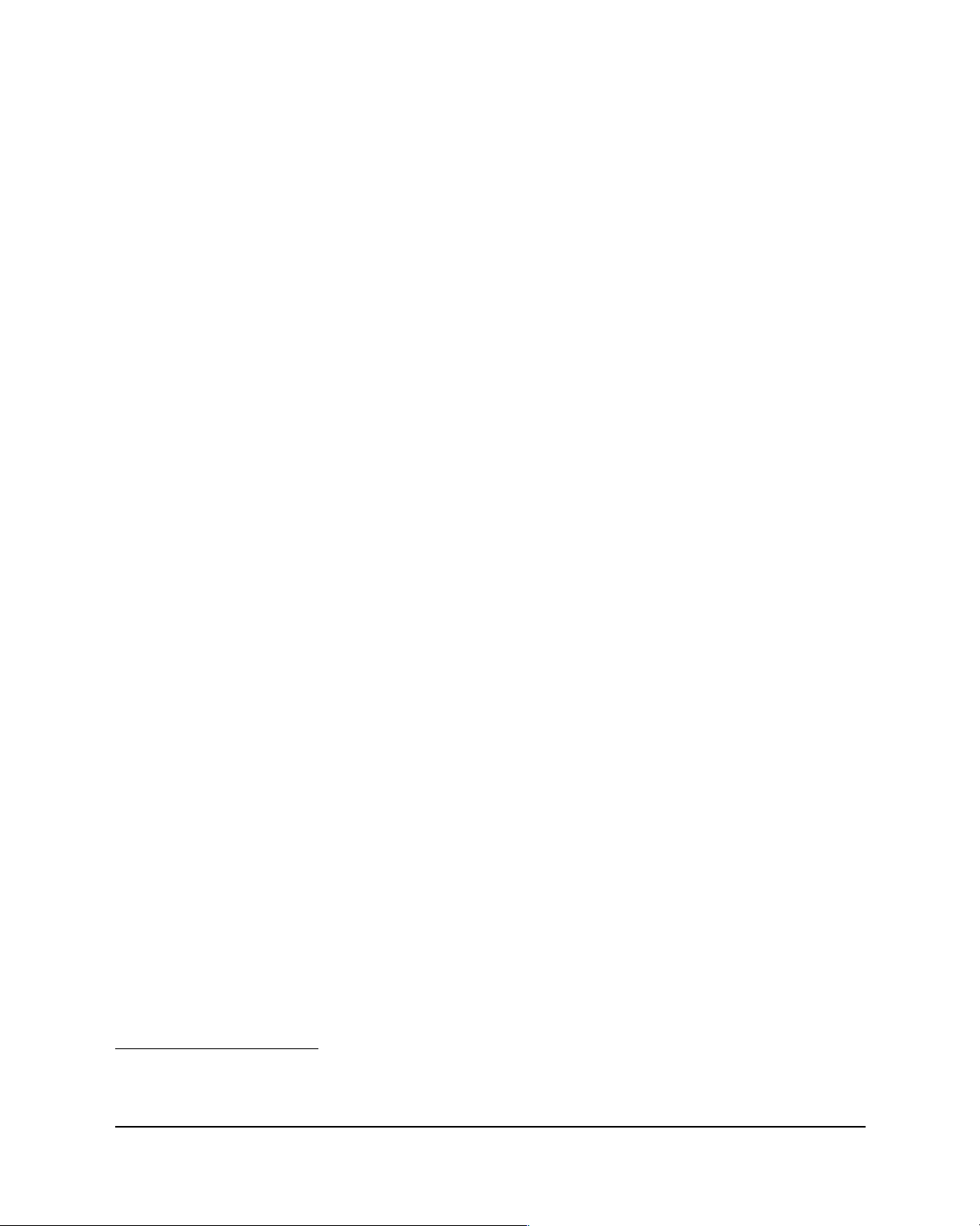

14.A For 2010, the adjustment to beginning retained earnings should recognize

the gain on the retirement of the debt, the elimination of the 2009 interest

expense, and the elimination of the 2009 interest income.

Gain on Retirement of Bond

Original book value ............................................................. $10,600,000

2006–2008 amortization ($600,000 ÷ 20 yrs. x 3 yrs.) ........ (90,000)

Book value, January 1, 2009 ............................................... $10,510,000

Percentage of bonds retired ............................................... 40%

Book value of retired bonds ............................................... $4,204,000

Cash received ($4,000,000 x 96.6%) ................................... 3,864,000

Gain on retirement of bonds .............................................. $340,000

Interest Expense on Intercompany Debt—2009

Cash interest expense (9% x $4,000,000) ........................... $360,000

Premium amortization ($30,000 per year total x 40%

retired portion of bonds) ............................................... (12,000)

Interest expense on intercompany debt ............................ $348,000

Interest Income on Intercompany Debt—2009

Cash interest income (9% x $4,000,000) ............................ $360,000

Discount amortization ($136,000 ÷ 17 yrs.) ........................ 8,000

Interest income on intercompany debt .............................. $368,000

© The McGraw-Hill Companies, Inc.,

McGraw-Hill/Irwin 2009 Solutions 6-8 Manual lOMoARcPSD|46958826

Adjustment to 1/1/10 Retained Earnings

Recognition of 2009 gain on extinguishment of debt (above) .... $340,000

Elimination of 2009 intercompany interest expense (above) ...... 348,000

Elimination of 2009 intercompany interest income (above) ........ (368,000)

Increase in retained earnings, 1/1/10 ......................... $320,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-9 lOMoARcPSD|46958826

15. D Consideration transferred for preferred stock ............................ $424,000

Consideration transferred for common stock ............................. 3,960,000

Noncontrolling interest fair value for preferred .......................... 1,696,000

Noncontrolling interest fair value for common ........................... 400,000

Acquisition-date fair value ............................................................ 6,480,000

Acquisition-date book value ......................................................... (6,000,000)

Goodwill ......................................................................................... $480,000

16. C Consideration transferred for preferred stock ............................ $106,000

Consideration transferred for common stock ............................. 916,400

Noncontrolling interest fair value for common ........................... 580,000

Acquisition-date fair value ............................................................ $1,602,400

Acquisition-date book value ......................................................... (1,500,000)

Excess fair value ............................................................................ $102,400

to building .................................................................................... 50,000

to goodwill .................................................................................... $52,400

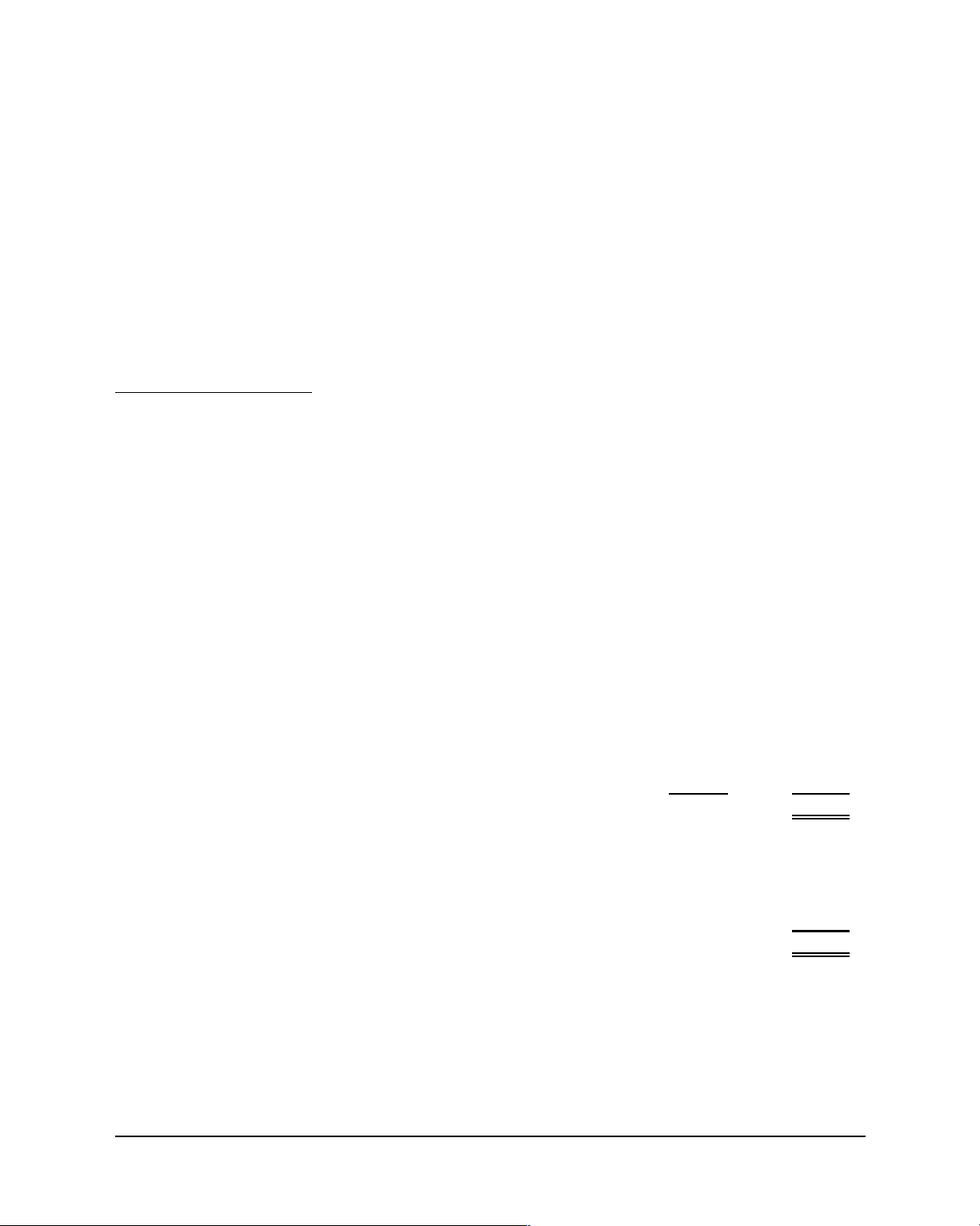

17. A Parent’s reported sales ............................................ $300,000

Subsidiary's reported sales ..................................... 200,000

Less: intercompany transfers .................................. (40,000)

Sales to outsiders ............................................... $460,000

Eliminate increase in receivables (less cash collected) (30,000)

Cash generated by sales .................................... $430,000

18. B Book value of subsidiary prior to issuing new shares

(12,000 x $40) ....................................................... $480,000

Parent's ownership .................................................. 100%

Book value acquired ................................................ $480,000

Book value of subsidiary after issuing new shares (above

value plus 3,000 shares at $50 each) ................. $630,000

Parent's ownership (12,000 ÷ 15,000 shares) ......... 80%

Book value acquired ................................................ $504,000

Investment in Nestlum increases by $24,000 ($504,000 less $480,000)

19.A Because the parent acquired 80 percent of the new shares, its proportion of

ownership has remained the same. Because the purchase price will

necessarily equal 80 percent of the increase in the subsidiary's book value,

no separate adjustment by the parent is required.

20. C Adjusted book value of subsidiary ($795,000 + $150,000) .......... $945,000

Current parent ownership (32,000 shs. ÷ 50,000 shs.) ................ 64%

Book value acquired ................................................................. $604,800

Book value acquired currently recorded in parent's invest-

ment account ($795,000 x 80%) ............................................... 636,000

© The McGraw-Hill Companies, Inc.,

McGraw-Hill/Irwin 2009 Solutions 6-10 Manual lOMoARcPSD|46958826

Required adjustment—decrease ....................................... $(31,200)

21. D Adjusted book value of subsidiary ($795,000 – $192,000) .......... $603,000

Current parent ownership (32,000 shs. ÷ 32,000 shs.) ................ 100%

Book value equivalency of parent's ownership ..................... $603,000

Book value equivalency currently recorded in parent's invest-

ment account ($795,000 x 80%) ............................................... 636,000

........................................Requiredadjustment—decrease $(33,000)

22. (10 minutes) (Qualification of Primary Beneficiary of a VIE)

Consolidation of a variable interest entity is required if a parent has a

variable interest that will

Absorb a majority of the entity's expected losses if they occur

Receive a majority of the entity's expected residual returns if they occur

Because (1) HCO Media’s losses are limited by contract, and (2)

Hillsborough has the right to receive the residual benefits of the sales

generated on the HCO Media internet site above $500,000, Hillsborough

should consolidate HCO Media. 23.

(40 minutes) (VIE Qualifications for Consolidation)

a. The purpose of consolidated financial statements is to present the financial

position and results of operations of a group of businesses as if they were a

single entity. They are designed to provide information useful for making

business and economic decisions—especially assessing amounts, timing,

and uncertainty of prospective cash flows. Consolidated statements also

provide more complete information about the resources, obligations,

risks, and opportunities of an enterprise than separate statements.

b. According to FIN 46R, an entity qualifies as a VIE and is subject

to consolidation if either of the following conditions exist.

The total equity at risk is not sufficient to permit the entity to finance its

activities without additional subordinated financial support from other

parties. In most cases, if equity at risk is less than 10% of total assets,

the risk is deemed insufficient.

The equity investors in the VIE lack any one of the following three

characteristics of a controlling financial interest.

1. The direct or indirect ability to make decisions about an

entity's activities through voting rights or similar rights.

2. The obligation to absorb the expected losses of the entity if they occur

(e.g., another firm may guarantee a return to the equity investors)

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-11 lOMoARcPSD|46958826 23. continued

3. The right to receive the expected residual returns of the entity

(e.g., the investors' return may be capped by the entity's governing

documents or other arrangements with variable interest holders).

Consolidation is required if a parent has a variable interest that will

Absorb a majority of the entity's expected losses if they occur

Receive a majority of the entity's expected residual returns if they occur

Also, a direct or indirect ability to make decisions that significantly affect

the results of the activities of a variable interest entity is a strong indication

that an enterprise has one or both of the characteristics that would require

consolidation of the variable interest entity.

c. Risks of the construction project that has TecPC has effectively shifted

to the owners of the VIE

At the end of the 1st five-year lease term, if the parent opts to sell the

facility, and the proceeds are insufficient to repay the VIE investors,

TecPC may be required to pay up to 85% of the project's cost. Thus, a potential 15% risk.

During construction 11.1% of project cost potential termination loss.

Risks that remain with TecPC

Guarantees of return to VIE investors at market rate, if facility does

not perform as expected TecPC is still obligated to pay market rates.

If lease is not renewed, TecPC must either purchase the facility or sell it

on behalf of the VIE with a guarantee of Investors' (debt and equity)

balances representing a risk of decline in market value of asset Debt guarantees

d. TecPC possesses the following characteristics of a primary

beneficiary Direct decision-making ability (end of five-year lease term)

Absorb a majority of the entity's expected losses if they occur (via

debt guarantees and guaranteed lease payments and residual value)

Receive a majority of the entity's expected residual returns if they

occur (via use of the facility and potential increase in its market value).

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-12 Solutions Manual lOMoARcPSD|46958826

24. (10 minutes) (Consolidation of variable interest entity.)

a. Implied valuation and excess allocation for Softplus.

Noncontrolling interest fair value $ 60,000

Consideration transferred by Pantech 20,000

Total business fair value 80,000

Fair value of VIE net assets 100,000

Excess net asset value fair value $20,000

The $20,000 excess net asset fair value is recognized by PanTech as a

bargain purchase. All SoftPlus’ assets and liabilities are recognized at their individual fair values. Cash $20,000 Marketing software 160,000 Computer equipment 40,000 Long-term debt (120,000) Noncontrolling interest (60,000) Pantech equity interest (20,000)

Gain on bargain purchase (20,000) -0-

b. Implied valuation and excess valuation for Softplus.

Noncontrolling interest fair value 60,000

Consideration transferred by Pantech 20,000

Total business fair value 80,000

Fair value of VIE net identifiable assets 60,000 Goodwill $20,000

When the business fair value of a VIE (that is a business) is greater than

assessed asset values, all identifiable assets and liabilities are reported at

fair values (unless a previously held interest) and the difference is treated as a goodwill. Cash $20,000 Marketing software 120,000 Computer equipment 40,000

Goodwill (excess business fair value) 20,000 Long-term debt (120,000) Noncontrolling interest (60,000) Pantech equity interest (20,000) -0-

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-13 lOMoARcPSD|46958826 25.

(25 Minutes) (Consolidation entry for three consecutive years to report

effects of intercompany bond acquisition. Straight-line method used.)

a. Book Value of Bonds Payable, January 1, 2009

Book value, January 1, 2007 .................................................. $1,050,000

Amortization—2007–2008 ($5,000 per year

[$50,000 premium ÷ 10 years] for two years) .................. 10,000

Book value of bonds payable, January 1, 2009 .................... $1,040,000

Book value of 40% of bonds payable

(intercompany portion), January 1, 2009

........................ $416,000

Gain on Retirement of Bonds, January 1, 2009

Purchase price ($400,000 x 96%) .......................................... $384,000

Book value of liability (computed above) ............................. 416,000

Gain on retirement of bonds ................................................. $32,000

Book Value of Bonds Payable, December 31, 2009

Book value, January 1, 2009 (computed above) .................. $1,040,000

Amortization for 2009.............................................................. 5,000

Book value of bonds payable, December 31, 2009 ............... $1,035,000

Book value of 40% of bonds payable (intercompany portion),

December 31, 2009 ............................................................. $414,000

Book Value of Investment, December 31, 2009

Book value of investment, January 1, 2009 (purchase price) $384,000

Amortization for 2009 ($16,000 discount ÷ 8-yr. rem. life) ... 2,000

Book value of investment, December 31, 2009 .................... $386,000

Intercompany Interest Balances for 2009 Interest expense:

Cash payment ($400,000 x 9%) ........................................ $36,000

Amortization of premium for 2009 ($5,000 per year

multiplied by 40% intercompany portion) .................. 2,000

Intercompany interest expense ....................................... $34,000 Interest income:

Cash collection ($400,000 x 9%) ...................................... $36,000

Amortization of discount for 2009 (above) ...................... 2,000

Intercompany interest income ......................................... $38,000

CONSOLIDATION ENTRY B (2009)

Bonds Payable .......................................................... 400,000

Premium on Bonds Payable ..................................... 14,000

Interest Income ......................................................... 38,000

Investment in Bonds ............................................ 386,000

Interest Expense ................................................... 34,000

Extraordinary Gain on Retirement of Bonds ...... 32,000

(To eliminate accounts stemming from intercompany bonds [balances

computed above] and to recognize gain on the retirement of this debt.)

© The McGraw-Hill Companies, Inc.,

McGraw-Hill/Irwin 2009 Solutions 6-14 Manual lOMoARcPSD|46958826 25.(continued)

b. In 2010, because straight-line amortization is used, the interest

accounts remain unchanged at $38,000 and $34,000. However, the

premium associated with the bond payable as well as the discount on

the investment are affected by the $2,000 per year amortization. In

addition, the gain now has to be included as a component of beginning

retained earnings. Concurrently, the two interest balances recorded by

the individual companies in 2009 are removed from retained earnings

because they resulted after the intercompany retirement. Gain of

$32,000 plus $34,000 expense removal less $38,000 income elimination

gives $28,000 increase in retained earnings.

CONSOLIDATION ENTRY *B (2010)

Bonds Payable ................................................... 400,000

Premium on Bonds Payable ($2,000 amortization) 12,000

Interest Income .................................................. 38,000

Investment in Bonds ($2,000 amortization) . 388,000

Interest Expense ............................................ 34,000

Retained Earnings, 1/1/10 (Darges) .............. 28,000

(To remove intercompany bond accounts that remain on the individual

records of both companies. Both debt and investment balances have

been adjusted for 2009–10 amortization. Entry to retained earnings

brings the totals reported by the individual companies [interest income

and expense] to the balance of the original gain.)

c. As with part b, new premium and discount balances must be determined

and then removed. The adjustment made to retained earnings takes into

account that another year of interest expense ($34,000) and income

($38,000) have been closed into this equity account by the separate companies.

CONSOLIDATION ENTRY *B (2011)

Bonds Payable .................................................... 400,000

Premium on Bonds Payable ............................... 10,000

Interest Income ................................................... 38,000

Investment in Bonds ..................................... 390,000

Interest Expense ............................................ 34,000

Retained Earnings, 1/1/11 (Darges) .............. 24,000

(To remove intercompany bond accounts that remain on the individual

records of both companies. Both debt and investment balances have

been adjusted for 2009– 2011 amortization. Entry to retained earnings

brings the totals reported by the individual companies to the balance of the original gain.)

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-15 lOMoARcPSD|46958826 26.

(12 Minutes) (Determine consolidated income statement accounts

after acquisition of intercompany bonds.)

Interest Expense To Be Eliminated = $84,000 x 11% = $9,240

Interest Income To Be Eliminated = $108,000 x 8% = $8,640

Loss To Be Recognized = $108,000 – $84,000 = $24,000 CONSOLIDATED TOTALS

Revenues and Interest Income = $1,051,360 (add the two book values and

eliminate interest income on intercompany bond)

Operating and Interest Expense = $751,760 (add the two book values and

eliminate interest expense on intercompany bond)

Other Gains and Losses = $152,000 (add the two book values)

Loss on Retirement of Debt = $24,000 (computed above)

Net Income = $427,600 (consolidated revenues, interest income, and

gains less consolidated operating and interest expense and losses) 27.

(30 Minutes) (Consolidation entry for two years to report effects of

intercompany bond acquisition. Effective rate method applied.)

a. Loss on Repurchase of Bond

Cost of acquisition ........................................ $121,655

Book value ($668,778 x 1/8) ........................... 83,597

Loss on repurchase ....................................... $38,058

Interest Balances for 2009 Interest income:

$121,655 x 6% ........................................... $7,299 Interest expense:

$83,597 (book value [above]) x 10% ........ $8,360

Investment Balance, December 31, 2009

Original cost, 1/1/09 ........................................ $121,655

Amortization of premium:

Cash interest ($100,000 x 8%) .................. $8,000

Effective interest income (above) ............ 7,299 701

Investment, 12/31/09 ............................ $120,954

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-16 Solutions Manual lOMoARcPSD|46958826 27. (continued)

Bonds Payable Balance, December 31, 2009

Book value, 1/1/09 (above) ............................ $83,597

Amortization of discount:

Cash interest ($100,000 x 8%) .................. $8,000

Effective interest expense (above) .......... 8,360 360

Bonds payable, 12/31/09 ...................... $83,957 Entry B—12/31/09

Bonds Payable ............................................... 83,957

Interest Income .............................................. 7,299

Loss on Retirement of Debt .......................... 38,058

Investment in Bonds ................................ 120,954

Interest Expense ....................................... 8,360

(To eliminate intercompany debt holdings and recognize loss on retirement.)

b. Interest Balances for 2010

Interest income: $120,954 (investment

balance for the year) x 6% ....................................... $7,257

Interest expense: $83,957 (liability balance

for the year) x 10% .................................................... $8,396

Investment Balance, December 31, 2010

Book value, January 1, 2010 (part a) ....................... $120,954

Amortization of premium:

Cash interest ($100,000 x 8%) ............................ $8,000

Effective interest income (above) ...................... 7,257 743

Investment balance, December 31, 2010 ....... $120,211

Bonds Payable Balance, December 31, 2010

Book value, January 1, 2010 (part a) ....................... $83,957

Amortization of discount:

Cash interest ($100,000 x 8%) ............................ $8,000

Effective interest expense (above) ..................... 8,396 396 Bonds payable balance,

December 31, 2010 ......................................... $84,353

Interest Balances for 2011

Interest income: $120,211 (investment .................... $7,213

balance for the year [above]) x 6%

Interest expense: $84,353 (liability balance

for the year [above]) x 10% ................................. $8,435

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, Advanced Accounting, 9/e 6-17 lOMoARcPSD|46958826 27. (continued)

Investment Balance, December 31, 2011

Book value, January 1, 2011 (above) ...................... $120,211

Amortization of premium:

Cash interest ($100,000 x 8%) ............................ $8,000

Effective interest income (above) ...................... 7,213 787

Investment balance, December 31, 2011 ....... $119,424

Bonds Payable Balance, December 31, 2011

Book value, January 1, 2011 (above) ...................... $84,353

Amortization of discount:

Cash interest ($100,000 x 8%) ............................ $8,000

Effective interest expense (above) ..................... 8,435 435 Bonds payable balance,

December 31, 2011 ................................... $84,788

Adjustment Needed to Retained Earnings, January 1, 2011

Loss on retirement of debt (part a) ......................... $38,058

Balances currently in retained earnings: Interest income: 2009 ($7,299) 2010 (7,257) ($14,556) Interest expense: 2009 $8,360 2010 8,396 16,756 2,200

Reduction needed to beginning retained

earnings to arrive at consolidated total .......................... $35,858 Entry *B—12/31/11

Bonds Payable ... ...................................................... 84,788

Interest Income . ...................................................... 7,213

Retained earnings, 1/1/11 (Parent) 35,858

. . .. .. .. .. .. .. .. .

Investment in Bonds ........................................... 119,424

Interest Expense . . . . . . . . . . . . . . . . . . . . . . . . . 8,435

(To eliminate intercompany bond holdings and adjust beginning retained

earnings balance of the parent to amount representing loss on retire

ment. Amounts computed above.)

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 6-18 Solutions Manual