Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM CHAPTER 13

ACCOUNTING FOR LEGAL REORGANIZATIONS AND LIQUIDATIONS Chapter Outline

I. Because of a myriad of possible financial or business difficulties, a company may become

insolvent, unable to pay its debts as they come due.

A. To ensure the equitable treatment of al parties involved with an insolvent company

(stockholders as wel as creditors), laws have been written to provide structure for the

bankruptcy process in the United States.

B. At present, legal guidance is provided primarily by the Bankruptcy Reform Act of 1978 as amended.

1. This law attempts to arrive at a fair distribution of a debtor's assets.

2. It also seeks to discharge the obligations of an honest debtor.

II. Bankruptcy proceedings can be formal y instigated by either the debtor or a group of creditors.

A. A voluntary petition is filed with the court by the insolvent company while an involuntary

petition must be filed by a minimum number of creditors with a minimum level of debt.

B. After a bankruptcy petition is received, normal y the court wil grant an order for relief to

halt al actions against the debtor.

III. Within the bankruptcy process, determining the appropriate classification of al creditors is

an important step in achieving a fair settlement.

A. Ful y secured creditors hold a col ateral interest in assets of the insolvent company

having a value in excess of the related liability.

B. Partial y secured creditors also have a col ateral interest but the expected net realizable

value wil not satisfy the entire obligation.

C. Some unsecured obligations (including administrative expenses, certain debts to

employees, and government claims for unpaid taxes) have priority over other unsecured debts.

D. The remaining unsecured creditors receive assets from the debtor only after the above claims have been satisfied.

IV. A Statement of Financial Affairs is frequently produced by an insolvent company to disclose

its current financial position.

A. Assets are reported at net realizable value along with the disclosure of any pledged

amounts. Liabilities are classified according to the security or priority of the creditor.

B. A Statement of Financial Affairs is especial y useful if prepared at the beginning of the

bankruptcy process to assist al parties in evaluating the outcome of various actions.

C. Most of the asset balances reported in this statement are merely estimations, projections of future events.

V. Bankruptcy proceedings often conclude with the assets of the debtor being liquidated to

satisfy creditor claims (a Chapter 7 bankruptcy).

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-1 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

A. A trustee is appointed to oversee termination of business affairs, liquidation of noncash

properties, and distribution of cash resources.

B. The trustee prepares a periodic reporting of activities, frequently in the form of a

Statement of Realization and Liquidation.

1. This statement indicates the book value and classification of remaining assets and liabilities.

2. It also discloses the effects of al transactions that have occurred to date.

Vl. As an alternative to liquidation, a company may seek to stay in business and attempt to

return to solvency (a Chapter 11 bankruptcy).

A. A reorganization plan has to be devised that can win the approval of each class of

creditors and each class of stockholders as wel as the court.

B. Reorganization plans normal y entail a specific course of action designed to save the

company and can include proposed changes in operations, methods of generating

additional working capital, and a settlement of the debts that were in existence on the

day that the order for relief was entered.

Vl . Financial reporting during reorganization.

A. The AICPA Statement of Position 90-7 (SOP 90-7) provides guidance for preparing

financial statements while a company goes through reorganization.

1. Gains, losses, revenues, and expenses that result from reorganization must be

reported separately on the income statement.

2. Professional fees incurred in connection with the bankruptcy must be expensed immediately.

3. Liabilities subject to compromise are reported based on the expected amount of the al owed claims. VIII.

Fresh start accounting may be required when a company emerges from reorganization.

A. Assets are restated to current value but only if the fair value of assets is less than the

al owed claims and the original owners are left holding less than 50 percent of company.

B. The recognition of goodwill may also be required if the reorganization value of the

emerging company is greater than the value of the identifiable assets (both tangible and intangible).

C. Retained earnings is set at zero to indicate that a new entity has been formed. Learning Objectives

Having completed Chapter 13 of this textbook, "Accounting for Legal Reorganizations and

Liquidations," students should be able to fulfil each of the fol owing learning objectives:

1. Understand the necessity of having laws to protect the parties involved with an insolvent company.

2. Identify the Bankruptcy Reform Act of 1978 as the primary legal basis for bankruptcy proceedings in this country.

3. Explain the difference between a voluntary and an involuntary bankruptcy petition.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-2 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

4. Describe the purpose of an order for relief.

5. List and describe the categories used to classify creditors during bankruptcy proceedings.

6. Give examples of the types of unsecured liabilities that have priority in a bankruptcy.

7. Produce a Statement of Financial Affairs for an insolvent company.

8. Identify the responsibilities of a trustee in a liquidation (a Chapter 7 bankruptcy).

9. Prepare a Statement of Realization and Liquidation for a business going through liquidation.

10. Indicate possible proposals that might be included in a reorganization plan and the method

by which a plan becomes accepted and confirmed.

11. Produce an income statement during reorganization with reorganization items identified and separately reported.

12. Produce a balance sheet during reorganization with liabilities classified as "subject to

compromise" and "not subject to compromise."

13. Identify companies that are required to apply fresh start accounting when they emerge from reorganization.

14. Apply fresh start accounting to a company emerging from bankruptcy according to SOP 90- 7.

Answers to Discussion Questions What Do We Do Now?

Students are given a chance in this case to look at a non-accounting business decision: the

forcing of a valued client into bankruptcy proceedings. Thurber has already committed several

unfortunate mistakes in this case. For example, he has seen a dramatic slowdown in cash

payments by Abraham and Sons without seeking any further information about the prospects of

the client. Furthermore, he has let the treasurer pressure him into providing additional credit

without any valid justification. He is now being pushed by another company into filing a

bankruptcy petition without adequate assurance that Abraham and Sons has a real problem.

Because Thurber has not acted earlier, he should now request audited financial statements

from Abraham and Sons so that he can make a reasonable decision as to the course of action

to take. Many important figures can be gleaned from these statements including the amount of

the company's working capital, the current ratio, the debt to equity ratio, the trend in sales, the

trend in long-term debt, operating cash flows, the gross profit percentage, any expenses that

have risen at a fast rate, the amount of property that has been mortgaged, and the like. He

should then ask for a meeting with the treasurer (or another officer) of Abraham and Sons. In

this meeting, Thurber should discuss the possibility of having the current debt secured in some

manner as protection. The development of a formal repayment schedule would also be wise.

If Thurber is not satisfied by the financial statements and the discussion with the client, he

should meet with the clothing manufacturer who has cal ed as wel as with a lawyer and/or

accountant. They should discuss possible actions and the outcomes that could result from each.

Inevitably, if loss of the receivable seems probable, filing an involuntary petition for

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-3 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

bankruptcy may be the wisest course of action to take. However, that procedure should only be

undertaken after adequate study has been made. In the long run, companies do not prosper by

having their clients go into bankruptcy.

Students often address this type of case as either a black or white issue: give more credit or

force them into bankruptcy. The case simply does not provide enough data to arrive at either

choice. Thus, the students should be directed to consider the types of information that could

prove to be beneficial in making this decision. Often, in decision-making, the gathering of

information is the key step in arriving at the proper conclusion.

How Much Is That Building Real y Worth?

Col ege textbooks often present fair value as if it were a known number that was dependable.

Students may view an asset’s fair value as if getting that much money was virtually

assured. Thus, students often believe that producing a statement of financial affairs requires

little more than establishing and reporting what a buyer wil pay for an asset.

This case was written to emphasize that a net realizable value might actual y be no more than a

wild guess. Obviously, the value of most stocks and bonds can be determined with accuracy.

However, many other assets such as the building in this case might eventual y prove to have a

liquidation value that can vary from zero (many deserted buildings are simply never sold

because no one wants to buy that type of building in that particular location even if it is in great

condition) up to a significant amount.

The accountant faces the problem of preparing a statement of financial affairs that requires that

a single number be reported as the value of each asset. Users of this statement can then make

important financial decisions based on the number that is presented. Subsequently, the actual

amount received may be significantly higher or lower than the figure shown. The users of the

information may feel as if they have been mislead when, in fact, the accountant made the best possible estimation.

Given the problems faced in determining fair value, the accountant wil probably seek a very

conservative number for reporting purposes. In most cases, less potential damage will be

created by reporting a relatively low figure. However, use of a particularly low value may tempt

the creditors to al ow the company to reorganize because little would seem to be gained by

forcing liquidation. For this reason, a conservative approach can favor the company attempting to avoid liquidation.

Probably the most important lesson from this case is that decision makers should look with

skepticism on many of the numbers reported as representing fair value. In some cases, fair

value is a figure that can only be estimated and may depend on a number of factors that cannot

be anticipated in advance by the accountant or by anyone else.

Is this the Real Purpose of the Bankruptcy Laws?

During the 1980s, as described in this case, the country saw a rash of bankruptcies that were

filed to resolve major financial problems. Previously, the bankruptcy laws had been used almost

exclusively to settle insolvency problems. However, if a voluntary petition is filed and accepted

by the courts, companies such as Manvil e and A. H. Robins are provided with a method of

settling issues before actual insolvency occurs. Sometimes the final results are good for the

companies but not always. A. H. Robins, for example, had to agree to be bought as one of the

conditions of its reorganization. In effect, the company lost its independence in order to satisfy

the lawsuits resulting from the Dalkon Shield.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-4 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

As with many of the discussion questions in this book, this case is simply intended to alert

students to a real-life issue and encourage them to consider the ramifications. To function in

society, accounting students must know more than just the mechanical aspects of a bankruptcy.

What are the objectives of the bankruptcy laws and do these particular cases fal outside of

those objectives? Would either Manvil e or its claimants, for example, have been better served

by having the company slowly pul ed into insolvency over years or perhaps decades? Should a

different set of bankruptcy laws be established for companies having these types of financial

crises? Although these questions are not directly related to accounting, they are the types of

questions that accountants (both as business people and as citizens) need to address. Answers to Questions

1. "Insolvent" refers to a state of financial position whereby a company (or individual) is unable to pay debts as they come due. 2.

In the United States today, the primary piece of federal legislation that governs most

bankruptcy proceedings is the Bankruptcy Reform Act of 1978 and its subsequent amendments. 3.

Bankruptcy cases have two overriding objectives:

— To achieve a fair distribution of assets to the various parties that are involved with an

insolvent company (or individual) and

— To discharge the obligations of an honest debtor.

4. A voluntary bankruptcy petition is one filed by an insolvent company to gain protection from

its creditors. Creditors may also seek to prevent or limit losses by filing their own

(involuntary) petition. Where a company has at least 12 unsecured creditors, a minimum of

three (having total unsecured debts of over $13,475) must sign an involuntary petition. If

fewer than 12 unsecured creditors exist, only one is needed to file the petition but the

minimum debt level remains at $13,475.

5. The granting of an order for relief halts al actions against an insolvent company. The order

for relief provides the company as wel as the creditors with time to decide on a future

course of action. It also brings the court into the process and provides a structure for what

might otherwise be a chaotic event, the distribution of assets to the parties involved.

6. A ful y secured creditor has an obligation from an insolvent company but holds a col ateral

interest in assets that have a value in excess of the debt. Thus, these parties can assume

that they wil suffer no loss regardless of the outcome of the bankruptcy proceedings. A

partial y secured creditor also has a col ateral interest but the liability is larger than the

anticipated proceeds from the realization of the attached assets. A portion of the liability is

covered but a risk of loss stil exists in connection with the remaining debt. Unsecured

creditors have no col ateral interest and can only hope to col ect after the various secured

interests have been satisfied. Obviously, this last group of creditors has the highest chance of incurring a loss.

7. A liability classified "with priority" is stil unsecured. However, because of provisions of the

Bankruptcy Reform Act of 1978, these debts must be paid before any other unsecured

obligations. Thus, the chance of loss is reduced, sometimes significantly. Unsecured

liabilities having priority include the fol owing:

— Claims for administrative expenses,

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-5 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

— Obligations arising between the date that a bankruptcy petition is filed and the

appointment of a trustee or the issuance of an order for relief.

— Employee claims for wages earned during the 180 days preceding the filing of a

bankruptcy petition (limited to $10,950 per person),

— Employee claims for contributions to a benefit plan earned during the 180 days preceding

the filing of a bankruptcy petition (within certain restrictions),

— Deposits made with the company to acquire goods or services (up to a $2,425 limit),

— Government claims for unpaid taxes.

8. Administrative expenses are classified as liabilities with priority to offer some protection to

those individuals who serve the company during the period of insolvency. Without a

legitimate chance for monetary reward, few people would be willing to provide the various

administrative services needed during the bankruptcy process. Also, these debts were

incurred after the order for relief.

9. In a Chapter 7 bankruptcy, the assets of the insolvent company are liquidated to satisfy the

claims of the creditors. Business activities cease and noncash assets are sold. Conversely,

in a Chapter 11 bankruptcy, the company attempts to survive its financial problems and

return to solvency. A reorganization plan is developed that wil al ow the company to

continue operations and reach a settlement of its debts. This reorganization plan must be

accepted by each class of creditors, each class of stockholders, and the court.

10. Unsecured creditors often face the possibility of absorbing substantial losses in a Chapter 7

liquidation because their claims rank below ful y secured and partial y secured liabilities.

Frequently, little or nothing is expected. As a result of this risk, unsecured creditors may feel

that they have a better chance of limiting their losses by agreeing to a reorganization plan to

keep the company alive as a potential future customer.

11. The statement of financial affairs helps the parties involved with a bankruptcy to anticipate

their potential losses. It reports al assets of the insolvent company at net realizable value

whereas liabilities are classified as ful y secured, partial y secured, with priority, and

unsecured. Based on the potential cash inflows and outflows, an estimation can be made of

the losses that wil be incurred by each group of claimants. A statement of financial affairs is

considered especially useful at the beginning of the bankruptcy process since it can assist

the parties in evaluating the outcome of various possible actions.

12. In general, a trustee is assigned to prevent loss of the insolvent company's assets and

oversee the liquidation and distribution process. A number of rather procedural tasks are

normal y accomplished by the trustee shortly after appointment such as notifying the post

office, changing locks, obtaining possession of corporate records, and opening a new bank

account. Thereafter, the trustee might have to operate the company for a period of time to

complete any business stil in process. The trustee also has the power to void any transfer

made by the debtor within 90 days prior to the filing of the bankruptcy petition if the company

was insolvent at the time. Subsequently, the trustee works to liquidate noncash assets and

make appropriate disbursements to the various claimants. During this entire process, the

trustee needs to make periodic reportings to the court and other interested parties.

13. A trustee can demand the return of any payment (or other asset transfer) made within 90

days prior to the filing of a bankruptcy petition if the company was already insolvent. This

legal procedure is known as the voiding of a preference transfer and is intended to prevent

one party from gaining an unfair advantage over the remaining claimants. In effect, the

payment is viewed as a distribution of the insolvent company's assets, a process that is to

be control ed solely by the trustee and the court.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-6 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

14. A statement of realization and liquidation is designed to report (1) the account balances of

the insolvent company at the date the order for relief is entered, (2) the liquidation of

noncash assets, (3) the cash distributions made to the various claimants, (4) any other

transactions incurred during this period, and (5) any remaining asset and liability balances.

15. During the liquidation of an insolvent company, control is turned over to an outside trustee.

However, in a Chapter 11 bankruptcy (a reorganization), operations will usual y be

continued so that an attempt can be made to arrive at a plan to save the company. While

the bankruptcy proceeds, control is normal y retained by the ownership, a group legal y

referred to as the debtor in possession.

16. In a Chapter 11 bankruptcy, the debtor in possession (the present ownership of the

company) is given the initial opportunity of filing a reorganization plan with the court. If a

formal proposal is not put forth by the debtor in possession within 120 days of the order for

relief or is not accepted within 180 days, any interested party has the right to submit a plan.

Bankruptcy proceedings often drag on for lengthy periods because the time limitations can

be extended by the court. However, because of recent changes in the bankruptcy laws, the

debtor’s exclusivity to propose a plan cannot be extended beyond 18 months.

17. Numerous types of proposals are to be found in reorganization plans. For example, many

wil set forth specific ideas for changes to be made in the company's operations (to increase

profitability) such as sel ing assets or terminating complete lines of business. In addition,

most reorganization plans identify sources that will be tapped in the future to generate

additional funding. Proposed changes in management may also be spel ed out in an attempt

to persuade claimants that the company wil have the ability to overcome its past economic

problems. Last, and probably most important, a reorganization plan must include some

anticipated settlement of the claims against the company that were in existence at the time

the order for relief was entered. Before any reorganization plan is approved, the creditors

(as wel as the court) must be convinced that the financial rewards wil outweigh the

amounts that could be received from a liquidation.

18. To become effective, a reorganization plan must be accepted by al interested parties. For

approval, each class of creditors (more than two-thirds in dol ar amount and one-half in

number) must vote for the proposal. Each group of stockholders (two-thirds of the shares

being voted) must also accept the plan. The court wil then confirm the reorganization plan

but only if the court feels that al parties are being treated fairly. The court also has the

authority to confirm a proposal even if not accepted by the creditors or stockholders. This

procedure (known as a "cram down") is only used if the plan is judged to be fair and equitable.

19. A "cram down" is a legal provision whereby the court can confirm a reorganization proposal

for an insolvent company even though the plan has not been accepted by a particular class

of creditors or stockholders. This step is not taken unless the court believes the plan being

put forth is fair and equitable.

20. During reorganization, some debts are in jeopardy of being settled at a significantly reduced

amount whereas others will probably be paid at face value. Unsecured and partial y secured

liabilities are likely to be settled at a lowered figure. Conversely, ful y secured liabilities and

any debts incurred during the reorganization period are normal y not at risk of being

reduced. Thus, if a balance sheet is produced while a company is in reorganization, al

liabilities are reported as either being subject to compromise (reduction) or not being subject

to compromise. The debts subject to compromise are reported at the expected amount of

al owed claims rather than at an estimation of the settlement figure. Such estimations are

often difficult, if not impossible, to make.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-7 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

21. A company going through a Chapter 11 bankruptcy wil report specified reorganization items

on its income statement separately from operating figures. However, these reorganization

items are reported prior to income tax expense rather than in a manner similar to an

extraordinary item. These separately disclosed figures include gains and losses on the sale

of assets necessitated by the reorganization. Professional fees incurred in connection with

the reorganization are also reported in a similar manner as wel as any interest revenue that

would not have been earned except for the bankruptcy proceeding.

22. Professional fees incurred during a reorganization must be expensed as incurred. Capitalization is not al owed.

23. “Fresh start accounting” refers to the adjustment of a company's assets to current value at

the time the organization emerges from bankruptcy. A company must use fresh start

accounting if two criteria are met at the time the reorganization is finalized: (1) the fair value

of the assets is less than the total al owed claims as of the date of the order for relief plus

the liabilities incurred during reorganization and (2) the original owners are left with less than

50 percent of the voting stock.

In fresh start accounting, al assets are reported at current value while liabilities are reported

based on the present value of the settlement amounts. If the reorganization value of the

company as a whole is greater than the total fair value of the individual assets, goodwill is reported for the excess.

Initial y, in fresh start accounting, retained earnings must be reported at a zero balance.

24. Fresh start accounting is used by companies that are emerging from a bankruptcy

reorganization if the value of the assets held at that time are less than the al owed claims

associated with company’s liabilities (those present at the date of the order for relief and

those incurred since that date) and the original owners are left with less than 50 percent of

the voting stock of the reorganized company.

25. In fresh start accounting, the tangible and intangible assets of the company are reported at

their fair values. Liabilities are reported at the present value of the future cash flows.

26. When a company emerges from bankruptcy, the reorganization value of its assets as a

whole must be determined. The figure is normal y computed by discounting anticipated

future cash flows from the business. This figure is then assigned to the various assets of the

company based on individual fair values. The total reorganization value may wel be greater

than the current value of the individual assets. If so, the residual amount is recorded as the

intangible account Goodwill. Each year (or more often in some cases) it is reviewed for impairment.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-8 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM Answers to Problems 1. B 2. D 3. B 4. C 5. A 6. D 7. C 8. B 9. C 10.B 11.A 12.A 13.A 14.B 15.C 16.A 17.C 18.A 19.D 20.C 21.C

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-9 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

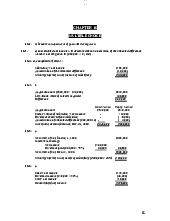

22. (10 Minutes) (Distribution of cash in a liquidation) Free Assets:

Current Assets .......................................................... $ 35,000

Buildings and Equipment ........................................ 110,000

Total .................................................................... $145,000

Liabilities with Priority:

Administrative Expenses ......................................... $ 20,000

Salaries Payable (only $3,000 per employee) .......... 6,000

Income Taxes ........................................................... 8,000

Total .................................................................... $ 34,000

Free Assets After Payment of Liabilities with Priority

($145,000 – $34,000) ................................................ $111,000 Unsecured Liabilities

Notes Payable (in excess of value of security) ...... $ 30,000

Accounts Payable ..................................................... 85,000

Bonds Payable .......................................................... 70,000

Total .................................................................... $185,000

Percentage of Unsecured Liabilities To Be Paid: $111,000/$185,000 = 60 %

Payment On Notes Payable:

Value of Security (land) ............................................ $ 90,000

60% of Remaining $30,000 ....................................... 18,000

Total Collected by holders ....................................... $108,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-10 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

23. (5 Minutes) (Distribution of assets in a liquidation)

Liabilities with Priority

Paid first—administrative expense.........................................................$2,450

Paid second—wages up to a maximum of

$10,950 for Mr. Key.....................................................................................16,950

All remaining money—government claims to unpaid taxes 5800

Total of free assets..................................................................................$25,200

No payments will be made in connection with the remainder of the salaries,

the government claims and all of the unsecured accounts payable since no money is left.

24. (8 Minutes) (Distribution of assets to partially secured creditors) Free Assets:

Other Assets ............................................................. $ 80,000

Excess from Assets Pledged with Fully Secured

Creditors ($116,000 – $70,000) ........................... 46,000

Total .................................................................... $126,000

Liabilities with Priority .................................................. $ 42,000

Free Assets after Payment of Liabilities with Priority

($126,000 – $42,000) ................................................. $ 84,000 Unsecured Liabilities:

Excess of Partially Secured Liabilities Over Pledged

Assets ($130,000 – $50,000) ................................ $ 80,000

Unsecured Creditors ................................................ 200,000

Total .................................................................... $280,000

Percentage of Unsecured Liabilities To Be Paid: $84,000/$280,000 = 30%

Payment On Partially Secured Debt:

Value of Pledged Asset ............................................ $ 50,000

30% of Remaining $80,000 ....................................... 24,000

Total to be Collected by holders ........................ $ 74,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-11 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

25. (8 Minutes) (Distribution of assets to partially secured creditors) Free Assets:

Cash ......................................................................... $50,000

Excess from Assets Pledged with Fully Secured

Creditors ($90,000 – $80,000) .............................. 10,000

Total ...................................................................... $60,000

Liabilities with Priority ................................................... 20,000

Free Assets after Payment of Liabilities with Priority .. $40,000 Unsecured liabilities:

Excess of Partially Secured Liabilities Over

Pledged Assets ($150,000 – $130,000) ................ $ 20,000

Accounts Payable ...................................................... 180,000

Total .................................................................... $200,000

Percentage of Unsecured Liabilities to be Paid: $40,000/$200,000 = 20% Payment on Bond:

Value of Pledged Asset ............................................. $130,000

20% of Remaining $20,000 ........................................ 4,000

Total to be Received by holders ......................... $134,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-12 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

26.(12 Minutes) (Liquidation of assets to satisfy debt)

The holder of Debt Two will receive $100,000 from the sale of the pledged

asset. Since the holder wants to receive $142,000 out of the total debt of

$170,000, the company must be able to generate enough cash to pay off 60

percent of the unsecured liabilities ($42,000/$70,000) after paying 100 percent

of the liabilities with priority ($110,000). Unsecured Liabilities:

Unsecured Creditors ..................................................... $230,000

Excess Liability of Debt One in Excess of Pledged Asset

($210,000 – $180,000) ............................................... 30,000

Excess Liability of Debt Two in Excess of Pledged Asset

($170,000 – $100,000) ............................................... 70,000

Total Unsecured Liabilities ................................. $330,000

Necessary Percentage ................................................... 60%

Cash Needed For These Liabilities ............................... $198,000

In order for the holder of Debt Two to receive exactly $142,000, the other free

assets must be sold for $308,000. With that much money, the liabilities with

priority ($110,000) can be paid with the remaining $198,000 going to the

unsecured debts of $330,000. This 60 percent figure would insure that the

holder of Debt Two would get $100,000 from the pledged asset and $42,000

($70,000 x 60%) from the free assets.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-13 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

27. (8 Minutes) (Payments to be made on unsecured and partially secured liabilities)

a. The unpledged assets of $300,000 must be added to any excess to be received

from assets pledged on fully secured debts ($200,000 – $150,000 = $50,000) to

get amount of free assets available of $350,000.

Amount Available .......................................................... $350,000

Liabilities with Priority .................................................. (160,000)

Available for Unsecured Creditors .......................... $190,000

Accounts Payable .......................................................... $390,000

Partially Secured Debt in Excess of Pledged

Assets ($490,000 – $380,000) ....................................... 110,000

Unsecured Liabilities...................................................... $500,000

Distribution to Unsecured Creditors: $190,000/$500,000 = 38%

An unsecured creditor to whom $3,000 is owed can expect to receive $1,140 ($3,000 x 38%).

b. The bank will receive a total of $87,600. The secured interest will generate

$80,000. The remaining $20,000 liability is unsecured so that only an additional

payment of $7,600 (38%) can be expected.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-14 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

28. (20 Minutes) (Distribution of assets in a liquidation)

Free Assets: (fair market value)

Cash ......................................................................... $ 10,000

Inventory .................................................................... 60,000

Equipment ................................................................. 50,000

Total .................................................................... $120,000

Liabilities with Priority:

Administrative Expenses ......................................... $ 20,000

Income Taxes ........................................................... 30,000

Total ..................................................................... $ 50,000

Free Assets After Payment of Liabilities With Priority

($120,000 – $50,000) ................................................. $ 70,000 Unsecured Liabilities

Note Payable A (in excess of value of security) ..... $ 20,000

Note Payable B (in excess of value of security) ..... 80,000

Note Payable C ......................................................... 60,000

Accounts Payable ..................................................... 120,000

Total .................................................................... $280,000

Percentage of Unsecured Liabilities To Be Paid: $70,000/$280,000 = 25%

Payment on Note Payable A:

Value of Security (land) ................................................. $ 70,000

25% of Remaining $20,000 ............................................ 5,000

Total Collected ......................................................... $ 75,000

Payment on Note Payable B:

Value of Security (building) .......................................... $ 40,000

25% of Remaining $80,000 ............................................ 20,000

Total Collected ......................................................... $ 60,000

Payment on Note Payable C (unsecured):

25% of $60,000 ............................................................... $ 15,000

Payment on Administrative Expenses:

As a liability with priority, the entire amount due is paid. $ 20,000

Payment on Accounts Payable (unsecured):

25% of $120,000 ............................................................. $ 30,000

Payment on Income Taxes Payable:

As a liability with priority, the entire amount due is paid. $ 30,000

Payment on Administrative Expenses Payable:

As a liability with priority, the entire amount due is paid. $ 20,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-15 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

29.(15 Minutes) (Liquidation of assets to satisfy debt)

Note payable B is unsecured. The holders want at least $125,000 of the total

balance of $250,000; thus, there must be at least enough money available to

pay 50 percent of the unsecured debts. All values are known except for the equipment. Unsecured Liabilities:

Accounts payable ...................................................... $180,000

Note payable A—unsecured portion ........................ 10,000

Note payable B ......................................................... 250,000

Total .................................................................... $440,000

Free Assets (except for equipment):

Cash ......................................................................... $24,000

Accounts receivable .................................................. 28,000

Inventory .................................................................... 56,000

Land (value does not cover related debt) ................ -0-

Buildings ($320,000 less $300,000

in bonds) .............................................................. 20,000

Total .................................................................... $128,000

Less: Liabilities with Priority:

Estimated administrative expenses ......................... (12,000)

Taxes payable to government .................................. (20,000)

Total free assets except for equipment .............. $96,000

In order for unsecured creditors to receive 50 percent of their claims, $220,000

in free assets must be available (50 percent of $440,000). At present only

$96,000 is available. Thus, $124,000 must be received from the liquidation of

the equipment ($220,000 – $96,000).

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-16 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

30. (15 Minutes) (Payment of various liabilities in a liquidation) Free Assets:

Cash .................................................................... $30,000

Receivables (30 percent collectible) ........................ 15,000

Inventory .................................................................... 39,000

Land (value in excess of secured note:

$120,000 – $110,000) ............................................ 10,000

Total .................................................................... $94,000

Less: Liabilities with priority

Salary payable (below maximum) ....................... (10,000)

Free assets available ........................................... $84,000 Unsecured Liabilities:

Accounts payable ...................................................... $90,000

Bonds payable (less secured interest in

building: $300,000 – $180,000) ............................ 120,000

Unsecured liabilities ............................................ $210,000

Percentage of unsecured liabilities to be paid: $84,000/$210,000 = 40% Amounts to be paid for:

Salary payable (liability with priority to be paid

in full) .................................................................... $10,000

Accounts payable (unsecured—will collect 40%

of debts of $90,000).............................................. $36,000

Note payable (fully secured by land—will collect

entire balance) ..................................................... $110,000

Bonds payable (partially secured—will collect

$180,000 from building and 40 percent of the

remaining $120,000) ............................................. $228,000

31.(2 Minutes) (Reporting of debts during liquidation)

Because of the uncertainty of the amount that will be paid on an unsecured

debt, no attempt is made in financial reporting to anticipate the payment.

Liabilities are reported at the expected amount of the allowed claim. In this

case, the creditors apparently have a legitimate claim of $200,000.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-17 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

32.(9 Minutes) (Adjusting a company coming out of reorganization to fresh start accounting)

The individual assets of this company have a total fair value of $700,000 but a

reorganization value of $760,000. Thus, an intangible asset (Goodwill) equal to

the $60,000 must be recognized.

In addition, the retained earnings deficit must be eliminated and all other asset

and liability accounts adjusted to the value on the day that the company exits from bankruptcy.

Because common stock was transferred directly from the previous owners to

the creditors, no entry is needed for the stock account. However, because the

reorganization value is $760,000 but liabilities are $300,000, stockholders’

equity must be $460,000. Since retained earnings will be zero and common

stock will remain $330,000, additional paid-in capital should be adjusted to $130,000.

Receivables ($90,000 - $80,000) .................................... 10,000

Inventory ($210,000 - $200,000)...................................... 10,000

Buildings ($400,000 - $300,000) ..................................... 100,000

Goodwill ......................................................................... 60,000

Retained Earnings (eliminate deficit) ................. 70,000

Additional Paid-in Capital

($130,000 – $20,000)........................................ 110,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-18 Solutions Manual lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

33.(15 Minutes) (Prepare income statement for company going through a

bankruptcy reorganization) ADDISON CORPORATION Income Statement

Revenues ...................................................................... $ 467,000 Costs and expenses:

Cost of goods sold ................................................... $ 211,000

Rent expense ............................................................ 16,000

Salary expense ......................................................... 70,000

Depreciation expense .............................................. 22,000

Advertising expense ................................................ 24,000

Interest expense ....................................................... 4,000 (347,000)

Earnings before reorganization items and tax effects . 120,000 Reorganization items:

Loss on closing of branch ...................................... (109,000)

Professional fees ..................................................... (71,000)

Interest revenue ........................................................ 32,000 (148,000)

Loss before income tax benefit ................................... (28,000)

Income tax benefit (20 percent) ................................... 5,600

Net loss .................................................................... $(22,400)

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 13-19 lOMoARcPSD|46958826

FIND MORE SLIDES, EBOOKS, SOLUTION MANUAL AND TESTBANK ON WWW.DOWNLOADSLIDE.COM

34.(15 Minutes) (Description of balance sheet for a company emerging from

bankruptcy reorganization)

a. SOP 90-7 holds that a company should be considered a new entity (so that

current values would be applicable for reporting purposes) if two criteria are

met. Otherwise, the company is simply considered to be a continuation of the

old concern, a company that should continue to report its historical cost figures.

The first criterion is that the fair value of the assets of the emerging company

must be less than the allowed claims as of the date of the order for relief (plus

liabilities incurred during reorganization).

The second criterion is that the original owners must be left with less than 50

percent of the voting stock of the emerging company.

Whenever both of these criteria are met, the company's assets should be

reported at current values.

b. Under fresh start accounting, the assets of the company are adjusted to

current value on the date that it successfully emerges from bankruptcy

reorganization. A reorganization value for the entity’s assets as a whole is first

determined by discounting the cash flows that are anticipated. This balance is

assigned to identifiable assets (both tangible and intangible) in the same

manner as in a purchase combination. Any amount of the reorganization value

that exceeds the assigned total is recorded as goodwill.

c. The reorganization value in excess of the value of the identified assets and

liabilities is reported as the intangible asset goodwill. Goodwill is reviewed

each year for impairment.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009 13-20 Solutions Manual