Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826 CHAPTER 9

FOREIGN CURRENCY TRANSACTIONS AND

HEDGING FOREIGN EXCHANGE RISK Chapter Outline I.

In today’s global economy, a great many companies deal in currencies other than

their reporting currencies.

A. Merchandise may be imported or exported with prices stated in a foreign currency.

B. For reporting purposes, foreign currency balances must be stated in terms of the

company’s reporting currency by multiplying it by an exchange rate.

C. Accountants face two questions in restating foreign currency balances.

1. What is the appropriate exchange rate for restating foreign currency balances?

2. How are changes in the exchange rate accounted for?

D. Companies often engage in foreign currency hedging activities to avoid the adverse

impact of exchange rate changes.

E. Accountants must determine how to properly account for these hedging activities. II.

Foreign exchange rates are determined in the foreign exchange market under a variety of

different currency arrangements.

A. Exchange rates can be expressed in terms of the number of U.S. dol ars to purchase

one foreign currency unit (direct quotes) or the number of foreign currency units that

can be obtained with one U.S. dol ar (indirect quotes).

B. Foreign currency trades can be executed on a spot or forward basis.

1. The spot rate is the price at which a foreign currency can be purchased or sold today.

2. The forward rate is the price today at which foreign currency can be purchased or sold sometime in the future.

3. Forward exchange contracts provide companies with the ability to “lock in” a

price today for purchasing or sel ing currency at a specific future date.

C. Foreign currency options provide the right but not the obligation to buy or sel foreign

currency in the future, and therefore are more flexible than forward contracts.

III. Statement 52 of the Financial Accounting Standards Board, issued in December 1981,

prescribes accounting rules for foreign currency transactions.

A. Export sales denominated in foreign currency are reported in U.S. dol ars at the spot

exchange rate at the date of the transaction. Subsequent changes in the exchange rate

are reflected through a restatement of the foreign currency account receivable with an

offsetting foreign exchange gain or loss reported in income. This is known as a two-

transaction perspective, accrual approach.

B. The two-transaction perspective, accrual approach is also used in accounting for

foreign currency payables. Receivables and payables denominated in foreign currency

create an exposure to foreign exchange risk.

IV. FASB Statement 133 (as amended by FASB Statement 138) governs the accounting for

derivative financial instruments and hedging activities including the use of foreign currency

forward contracts and foreign currency options.

A. The fundamental requirement of SFAS 133 is that al derivatives must be carried on the

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-1 lOMoARcPSD|46958826

balance sheet at their fair value. Derivatives are reported on the balance sheet as assets

when they have a positive fair value and as liabilities when they have a negative fair value. B.

SFAS 133 (as amended by SFAS 138) provides guidance for hedges of the fol owing

sources of foreign exchange risk:

1. foreign currency denominated assets and liabilities.

2. foreign currency firm commitments.

3. forecasted foreign currency transactions.

4. net investments in foreign operations (covered in Chapter 10).

C. Companies prefer to account for hedges in such a way that the gain or loss from the

hedge is recognized in net income in the same period as the loss or gain on the risk

being hedged. This approach is known as hedge accounting. Hedge accounting for

foreign currency derivatives may be applied only if three conditions are satisfied:

1. the derivative is used to hedge either a fair value exposure or cash flow exposure to foreign exchange risk,

2. the derivative is highly effective in offsetting changes in the fair value or cash flows

related to the hedged item, and

3. the derivative is properly documented as a hedge.

D. SFAS 133 al ows hedge accounting for hedges of two different types of exposure: cash

flow exposure and fair value exposure. Hedges of (1) foreign currency denominated

assets and liabilities, (2) foreign currency firm commitments, and (3) forecasted foreign

currency transactions can be designated as cash flow hedges. Hedges of (1) and (2)

also can be designated as fair value hedges. Accounting procedures differ for the two types of hedges. E.

For cash flow hedges of foreign currency assets and liabilities, at each balance sheet date:

1. The hedged asset or liability is adjusted to fair value based on changes in the spot

exchange rate, and a foreign exchange gain or loss is recognized in net income.

2. The derivative hedging instrument is adjusted to fair value (resulting in an asset or

liability reported on the balance sheet), with the counterpart recognized as a change

in Accumulated Other Comprehensive Income (AOCI).

3. An amount equal to the foreign exchange gain or loss on the hedged asset or

liability is then transferred from AOCI to net income; the net effect is to offset any

gain or loss on the hedged asset or liability.

4. An additional amount is removed from AOCI and recognized in net income to reflect

(a) the current period’s amortization of the original discount or premium on

the forward contract (if a forward contract is the hedging instrument) or (b) the

change in the time value of the option (if an option is the hedging instrument). F.

For fair value hedges of foreign currency assets and liabilities, at each balance sheet date:

1. The hedged asset or liability is adjusted to fair value based on changes in the spot

exchange rate, and a foreign exchange gain or loss is recognized in net income.

2. The derivative hedging instrument is adjusted to fair value (resulting in an asset or

liability reported on the balance sheet), with the counterpart recognized as a gain or loss in net income.

G. Under fair value hedge accounting for hedges of foreign currency firm commitments:

1. the gain or loss on the hedging instrument is recognized currently in net income, and

2. the change in fair value of the firm commitment is also recognized currently in net income.

This accounting treatment requires (1) measuring the fair value of the firm commitment, (2)

recognizing the change in fair value in net income, and (3) reporting the firm commitment on

the balance sheet as an asset or liability. A decision must be made whether to McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-2 Solutions Manual lOMoARcPSD|46958826

measure the fair value of the firm commitment through reference to (a) changes in the

spot exchange rate or (b) changes in the forward rate.

H. SFAS 133 al ows cash flow hedge accounting for hedges of forecasted foreign currency

transactions. For hedge accounting to apply, the forecasted transaction must be

probable (likely to occur). The accounting for a hedge of a forecasted transaction differs

from the accounting for a hedge of a foreign currency firm commitment in two ways:

1. Unlike the accounting for a firm commitment, there is no recognition of the

forecasted transaction or gains and losses on the forecasted transaction.

2. The hedging instrument (forward contract or option) is reported at fair value, but

because there is no gain or loss on the forecasted transaction to offset against,

changes in the fair value of the hedging instrument are not reported as gains and

losses in net income. Instead they are reported in other comprehensive income. On

the projected date of the forecasted transaction, the cumulative change in the fair

value of the hedging instrument is transferred from other comprehensive income

(balance sheet) to net income (income statement). Learning Objectives

Having completed Chapter 9, “Foreign Currency Transactions and Hedging Foreign Exchange

Risk,” students should be able to fulfill each of the following learning objectives:

1. Read and understand published foreign exchange quotes.

2. Understand the one-transaction and two-transaction perspectives to accounting for foreign currency transactions.

3. Account for foreign currency transactions using the two-transaction perspective.

4. Explain the concept of exposure to foreign exchange risk that arises from foreign currency transactions.

5. Explain how forward contracts and options can be used to hedge foreign exchange risk.

6. Account for forward contracts and options used as hedges of

a. foreign currency denominated assets and liabilities,

b. foreign currency firm commitments, and

c. forecasted foreign currency transactions.

7. Account for foreign currency borrowings.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-3 lOMoARcPSD|46958826

Answer to Discussion Question Do we have a gain or what?

This case demonstrates the differing kinds of information provided through application of current

accounting rules for foreign currency transactions and derivative financial instruments.

The Ahnuld Corporation could have received $200,000 from its export sale to Tcheckia if it had

required immediate payment. Instead, Ahnuld al ows its customer six months to pay. Given the

future exchange rate of $1.70, Ahnuld would have received only $170,000 if it had not entered

into the forward contract. This would have resulted in a decrease in cash inflow of $30,000. In

accordance with SFAS 52, the decrease in the value of the tcheck receivable is recognized as a

foreign exchange loss of $30,000. This loss represents the cost of extending credit to the

foreign customer if the tcheck receivable is left unhedged.

However, rather than leaving the tcheck receivable unhedged, Ahnuld sel s tchecks forward at a

price of $180,000. Because the future spot rate turns out to be only $1.70, the forward contract

provides a benefit, increasing the amount of cash received from the export sale by $10,000. In

accordance with SFAS 133, the change in the fair value of the forward contract (from zero

initially to $10,000 at maturity) is recognized as a gain on the forward contract of $10,000. This

gain reflects the cash flow benefit from having entered into the forward contract, and is the

appropriate basis for evaluating the performance of the foreign exchange risk manager.

(Students should be reminded that the forward contract will not always improve cash inflow. For

example, if the future spot rate were $1.85, the forward contract would result in $5,000 less

cash inflow than if the transaction were left unhedged.)

The net impact on income resulting from the fluctuation in the value of the tcheck is a loss of

$20,000. Clearly, Ahnuld forgoes $20,000 in cash inflow by al owing the customer time to pay for the

purchase, and the net loss reported in income correctly measures this. The $20,000 loss is useful to

management in assessing whether the sale to Tcheckia generated an adequate profit

margin, but it is not useful in assessing the performance of the foreign exchange risk manager. The

net loss must be decomposed into its component parts to fairly evaluate the risk manager’s performance.

Gains and losses on forward contracts designated as fair value hedges of foreign currency

assets and liabilities are relevant measures for evaluating the performance of foreign exchange

risk managers. (The same is not true for cash flow hedges. For this type of hedge, performance

should be evaluated by considering the net gain or loss on the forward contract plus or minus

the forward contract premium or discount.) McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-4 Solutions Manual lOMoARcPSD|46958826 Answers to Questions 1.

Under the two-transaction perspective, an export sale (import purchase) and the

subsequent col ection (payment) of cash are treated as two separate transactions to be

accounted for separately. The idea is that management has made two decisions: (1) to

make the export sale (import purchase), and (2) to extend credit in foreign currency to the

foreign customer (obtain credit from the foreign supplier). The income effect from each of

these decisions should be reported separately. 2.

Foreign currency receivables resulting from export sales are revalued at the end of

accounting periods using the current spot rate. An increase in the value of a receivable wil

be offset by reporting a foreign exchange gain in net income, and a decrease will be offset

by a foreign exchange loss. Foreign exchange gains and losses are accrued even though

they have not yet been realized. 3.

Foreign exchange gains and losses are created by two factors: having foreign currency

exposures (foreign currency receivables and payables) and changes in exchange rates.

Appreciation of the foreign currency will generate foreign exchange gains on receivables

and foreign exchange losses on payables. Depreciation of the foreign currency wil

generate foreign exchange losses on receivables and foreign exchange gains on payables. 4.

Hedging is the process of eliminating exposure to foreign exchange risk so as to avoid potential

losses from fluctuations in exchange rates. In addition to avoiding possible losses, companies

hedge foreign currency transactions and commitments to introduce an element of certainty into

the future cash flows resulting from foreign currency activities. Hedging involves establishing a

price today at which foreign currency can be sold or purchased at a future date. 5.

A party to a foreign currency forward contract is obligated to deliver one currency in exchange

for another at a specified future date, whereas the owner of a foreign currency option can

choose whether to exercise the option and exchange one currency for another or not. 6.

Hedges of foreign currency denominated assets and liabilities are not entered into until a

foreign currency transaction (import purchase or export sale) has taken place. Hedges of

firm commitments are made when a purchase order is placed or a sales order is received,

before a transaction has taken place. Hedges of forecasted transactions are made at the

time a future foreign currency purchase or sale can be anticipated, even before an order has been placed or received. 7.

Foreign currency options have an advantage over forward contracts in that the holder of the

option can choose not to exercise if the future spot rate turns out to be more advantageous.

Forward contracts, on the other hand, can lock a company into an unnecessary loss (or a

reduced gain). The disadvantage associated with foreign currency options is that a premium

must be paid up front even though the option might never be exercised. 8.

SFAS 133 requires an enterprise to recognize al derivative financial instruments as assets

or liabilities on the balance sheet and measure them at fair value. 9.

The fair value of a foreign currency forward contract is determined by reference to changes in

the forward rate over the life of the contract, discounted to the present value. Three pieces of

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-5 lOMoARcPSD|46958826

information are needed to determine the fair value of a forward contract at any point in time

during its life: (a) the contracted forward rate when the forward contract is entered into, (b) the

current forward rate for a contract that matures on the same date as the forward contract

entered into, and (c) a discount rate; typically, the company’s incremental borrowing rate.

The manner in which the fair value of a foreign currency option is determined depends on

whether the option is traded on an exchange or has been acquired in the over the counter

market. The fair value of an exchange-traded foreign currency option is its current market price

quoted on the exchange. For over the counter options, fair value can be determined by

obtaining a price quote from an option dealer (such as a bank). If dealer price quotes are

unavailable, the company can estimate the value of an option using the modified Black-Scholes

option pricing model. Regardless of who does the calculation, principles similar to those in the

Black-Scholes pricing model wil be used in determining the value of the option.

10. Hedge accounting is defined as recognition of gains and losses on the hedging instrument

in the same period as the recognition of gains and losses on the underlying hedged asset

or liability (or firm commitment).

11. For hedge accounting to apply, the forecasted transaction must be probable (likely to occur),

the hedge must be highly effective in offsetting fluctuations in the cash flow associated with the

foreign currency risk, and the hedging relationship must be properly documented.

12. In both cases, (1) sales revenue (or the cost of the item purchased) is determined using the

spot rate at the date of sale (or purchase), and (2) the hedged asset or liability is adjusted

to fair value based on changes in the spot exchange rate with a foreign exchange gain or loss recognized in net income.

For a cash flow hedge, the derivative hedging instrument is adjusted to fair value (resulting

in an asset or liability reported on the balance sheet), with the counterpart recognized as a

change in Accumulated Other Comprehensive Income (AOCI). An amount equal to the

foreign exchange gain or loss on the hedged asset or liability is then transferred from AOCI

to net income; the net effect is to offset any gain or loss on the hedged asset or liability. An

additional amount is removed from AOCI and recognized in net income to reflect (a) the

current period’s amortization of the original discount or premium on the forward

contract (if a forward contract is the hedging instrument) or (b) the change in the time

value of the option (if an option is the hedging instrument).

For a fair value hedge, the derivative hedging instrument is adjusted to fair value (resulting

in an asset or liability reported on the balance sheet), with the counterpart recognized as a

gain or loss in net income. The discount or premium on a forward contract is not al ocated

to net income. The change in the time value of an option is not recognized in net income.

13. For a fair value hedge of a foreign currency asset or liability (1) sales revenue (cost of

purchases) is recognized at the spot rate at the date of sale (purchase) and (2) the hedged

asset or liability is adjusted to fair value based on changes in the spot exchange rate with a

foreign exchange gain or loss recognized in net income. The forward contract is adjusted to fair

value based on changes in the forward rate (resulting in an asset or liability reported on the

balance sheet), with the counterpart recognized as a gain or loss in net income. The foreign

exchange gain (loss) and the forward contract loss (gain) are likely to be of different amounts McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-6 Solutions Manual lOMoARcPSD|46958826

resulting in a net gain or loss reported in net income.

For a fair value hedge of a firm commitment, there is no hedged asset or liability to account

for. The forward contract is adjusted to fair value based on changes in the forward rate

(resulting in an asset or liability reported on the balance sheet), with a gain or loss

recognized in net income. The firm commitment is also adjusted to fair value based on

changes in the forward rate (resulting in a liability or asset reported on the balance sheet),

and a gain or loss on firm commitment is recognized in net income. The firm commitment

gain (loss) offsets the forward contract loss (gain) resulting in zero impact on net income.

Sales revenue (cost of purchases) is recognized at the spot rate at the date of sale

(purchase). The firm commitment account is closed as an adjustment to net income in the

period in which the hedged item affects net income.

14. For a cash flow hedge of a foreign currency asset or liability (1) sales revenue (cost of

purchases) is recognized at the spot rate at the date of sale (purchase) and (2) the hedged

asset or liability is adjusted to fair value based on changes in the spot exchange rate with a

foreign exchange gain or loss recognized in net income. The forward contract is adjusted to fair

value (resulting in an asset or liability reported on the balance sheet), with the counterpart

recognized as a change in Accumulated Other Comprehensive Income (AOCI). An amount

equal to the foreign exchange gain or loss on the hedged asset or liability is then transferred

from AOCI to net income; the net effect is to offset any gain or loss on the hedged asset or

liability. An additional amount is removed from AOCI and recognized in net income to reflect the

current period’s allocation of the discount or premium on the forward contract.

For a hedge of a forecasted transaction, the forward contract is adjusted to fair value (resulting

in an asset or liability reported on the balance sheet), with the counterpart recognized as a

change in Accumulated Other Comprehensive Income (AOCI). Because there is no foreign

currency asset or liability, there is no transfer from AOCI to net income to offset any gain or loss

on the asset or liability. The current period’s allocation of the forward contract discount or

premium is recognized in net income with the counterpart reflected in AOCI. Sales revenue

(cost of purchases) is recognized at the spot rate at the date of sale (purchase). The amount

accumulated in AOCI related to the hedge is closed as an adjustment to net income in the

period in which the forecasted transaction was anticipated to occur.

15. In accounting for a fair value hedge, the change in the fair value of the foreign currency option

is reported as a gain or loss in net income. In accounting for a cash flow hedge, the change in

the entire fair value of the option is first reported in other comprehensive income, and then the

change in the time value of the option is reported as an expense in net income.

16. The accounting for a foreign currency borrowing involves keeping track of two foreign

currency payables—the note payable and interest payable. As both the face value of the

borrowing and accrued interest represent foreign currency liabilities, both are exposed to

foreign exchange risk and can give rise to foreign currency gains and losses.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-7 lOMoARcPSD|46958826 Answers to Problems

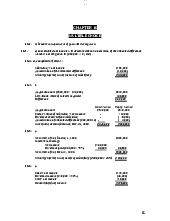

1. C An import purchase causes a foreign currency payable to be carried on the

books. If the foreign currency depreciates, the dollar value of the foreign

currency payable decreases, yielding a foreign exchange gain.

2. D SFAS 52 requires a two-transaction perspective, accrual approach.

3. B Foreign exchange gains related to foreign currency import purchases are

treated as a component of income before income taxes. If there is no

foreign exchange gain in operating income, then the purchase must have

been denominated in U.S. dollars or there was no change in the value of

the foreign currency from October 1 to December 1, 2009.

4. C The dollar value of the LCU receivable has decreased from $110,000 at

December 31, 2009 to $95,000 at February 15, 2010. This decrease of

$15,000 should be reported as a foreign exchange loss in 2010.

5. D The increase in the dollar value of the euro note payable represents a

foreign exchange loss. In this case a $25,000 loss would have been

accrued in 2009 and a $10,000 loss will be reported in 2010.

6. D A foreign currency receivable will generate a foreign exchange gain when

the foreign currency increases in dollar value. A foreign currency payable

will generate a foreign exchange gain when the foreign currency

decreases in dollar value. Hence, the correct combination is franc

(increase) and peso (decrease).

7. DThe merchandise purchase results in a foreign exchange loss of $8,000, the

difference between the U.S. dollar equivalent at the date of purchase and at the date of settlement.

The increase in the dollar equivalent of the note’s principal results in a

foreign exchange loss of $20,000.

The total foreign exchange loss is $28,000 ($8,000 + $20,000).

8. D The Thai baht is selling at a premium (forward rate exceeds spot rate). The

exporter will receive more dollars as a result of selling the baht forward

than if the baht had been received and converted into dollars on April 1.

Thus, the premium results in additional revenue for the exporter.

9. DThe parts inventory will be recognized at the spot rate at the date of purchase

(FC100,000 x $.23 = $23,000). McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-8 Solutions Manual lOMoARcPSD|46958826

10. D The forward contract must be reported on the December 31, 2009 balance

sheet as a liability. Barnum has locked-in to purchase ringgits at $0.042 per

ringgit but could have locked-in to purchase ringgits at $0.037 per ringgit if it

had waited until December 31 to enter into the forward contract. The forward

contract must be reported at its fair value discounted for two months at

12% [($.042 – $.037) x 1,000,000 = $5,000 x .9803 = $4,901.50].

11. C The 10 million won receivable has changed in dollar value from $35,000 at

12/1/09 to $33,000 at 12/31/09. The won receivable will be written down by

$2,000 and a foreign exchange loss will be reported in 2009 income.

12. B The nominal value of the forward contract on December 31, 2009 is a positive

$2,000, the difference between the amount to be received from the forward

contract actually entered into, $34,000 ($.0034 x 10 million), and the amount

that could be received by entering into a forward contract on December 31,

2009 that matures on March 31, 2010, $32,000 ($.0032 x 10 million). The fair

value of the forward contract is the present value of $2,000 discounted for two

months ($2,000 x .9706 = $1,941.20). On December 31, 2009, MNC Corp. will

recognize a $1,941.20 gain on the forward contract and a foreign

exchange loss of $2,000 on the won receivable. The net impact on 2009 income is –$58.80.

13. A The krona is selling at a premium in the forward market, causing Pimlico to

pay more dollars to acquire kroner than if the kroner were purchased at the

spot rate on March 1. Therefore, the premium results in an expense of

$10,000 [($.12 – $.10) x 500,000].

The Adjustment to Net Income is the amount accumulated in Accumulated

Other Comprehensive Income (AOCI) as a result of recognizing the

premium expense and the fair value of the forward contract. The journal

entries would be as follows: 3/1 no journal entries 6/1 Premium Expense $10,000 AOCI $10,000 AOCI $2,500 Forward Contract $2,500 Foreign Currency $57,500 Forward Contract 2,500 Cash $60,000 AOCI $7,500

Adjustment to Net Income $7,500

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-9 lOMoARcPSD|46958826

14. C This is a cash flow hedge of a forecasted transaction. The original cost of

the option is recognized as an Option Expense over the life of the option. 15. B 16. D

The easiest way to solve problems 15 and 16 is to prepare journal entries

for the option fair value hedge and the firm commitment. The journal entries are as follows: 9/1/09 Foreign Currency Option $2,000 Cash $2,000 12/31/09 Foreign Currency Option $300

Gain on Foreign Currency Option $300 Loss on Firm Commitment $980.30 Firm Commitment $980.30

[($.79 – $.80) x 100,000 = $1,000 x .9803 = $980.30]

Net impact on 2009 net income:

Gain on Foreign Currency Option $300.00 Loss on Firm Commitment (980.30) $(680.30) 3/1/10 Foreign Currency Option $700

Gain on Foreign Currency Option $700 Loss on Firm Commitment $2,019.70 Firm Commitment $2,019.70

[($.77 – $.80) x 100,000 = $3,000 – $980.30 = $2,019.70] Foreign Currency (C$) $77,000 Sales $77,000 Cash $80,000 Foreign Currency (C$) $77,000 Foreign Currency Option 3,000 Firm Commitment $3,000

Adjustment to Net Income $3,000

© The McGraw-Hill Companies, Inc.,

McGraw-Hill/Irwin 2009 Solutions 9-10 Manual lOMoARcPSD|46958826 16. (continued)

Net impact on 2010 net income:

Gain on Foreign Currency Option $ 700.00 Loss on Firm Commitment (2,019.70) Sales 77,000.00

Adjustment to Net Income 3,000.00 $78,680.30

17. B Net cash inflow with option ($80,000 – $2,000) $78,000

Cash inflow without option (at spot rate of $.77) 77,000

Net increase in cash inflow $ 1,000 18 and 19.

The easiest way to solve problems 18 and 19 is to prepare journal entries

for the forward contract fair value hedge of a firm commitment. The journal entries are as follows: 3/1 no journal entries 3/31 Forward Contract $1,250

Gain on Forward Contract $1,250 ($1,250 – $0) Loss on Firm Commitment $1,250 Firm Commitment $1,250

Net impact on first quarter net income is $0.

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-11 lOMoARcPSD|46958826

18 and 19. (continued) 4/30

Loss on Forward Contract $250 Forward Contract $250

[Fair value of forward contract is

($.120 – $.118) x 500,000 = $1,000; $1,000 – $1,250 = $250] Firm Commitment $250 Gain on Firm Commitment $250

Foreign Currency (pesos) $59,000

Sales [500,000 pesos x $.118] $59,000 Cash [500,000 x $.120] $60,000

Foreign Currency (pesos) $59,000 Forward Contract 1,000 Firm Commitment $1,000

Adjustment to Net Income $1,000

Net impact on second quarter net income is: Sales $59,000 – Loss on

Forward Contract $250 + Gain on Firm Commitment $250 + Adjustment to

Net Income $1,000 = $60,000. 18. A 19. C

20. B Cash inflow with forward contract [500,000 pesos x $.12] $60,000

Cash inflow without forward contract [500,000 pesos x $.118] 59,000

Net increase in cash flow from forward contract $ 1,000 McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-12 Solutions Manual lOMoARcPSD|46958826 21 and 22.

The easiest way to solve problems 21 and 22 is to prepare journal entries

for the option cash flow hedge of a forecasted transaction. The journal entries are as follows: 11/1/09 Foreign Currency Option $1,500 Cash $1,500 12/31/09 Option Expense $400 Foreign Currency Option $400

(The option has no intrinsic value at 12/31/09 so the entire change in fair

value is due to a change in time value; $1,500 – $1,100 = $400 decrease

in time value. The decrease in time value of the option is recognized as an expense in net income.)

Option Expense decreases net income by $400. 2/1/10 Option Expense $1,100 Foreign Currency Option 900

Accumulated Other Comprehensive Income (AOCI) $2,000

(Record expense for the decrease in time value of the

option; $1,100 – $0 = $1,100; and write-up option to fair

value ($.40 – $.41) x 200,000 = $2,000 – $1,100 = $900.)

Foreign Currency (BRL) [200,000 x $.41] $82,000 Cash [200,000 x $.40] $80,000 Foreign Currency Option 2,000

Parts Inventory (Cost-of-Goods-Sold) $82,000 Foreign Currency (BRL) $82,000

Accumulated Other Comprehensive Income (AOCI) $2,000

Adjustment to Net Income $2,000

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-13 lOMoARcPSD|46958826

21 and 22. (continued)

Net impact on 2010 net income: Option Expense $ (1,100) Cost-of-Goods-Sold (82,000)

Adjustment to Net Income 2,000 Decrease in Net Income $ (81,100) 21. B 22. C

23. (10 minutes) (Foreign Currency Purchase/Payable)

The decrease in the dollar value of the LCU payable from November 1 (60,000 x

.345 = $20,700) to December 31 (60,000 x .333 = $19,980) is recorded as a $720

foreign exchange gain in 2009. The increase in the dollar value of the LCU

payable from December 31 ($19,980) to January 15 (60,000 x .359 = $21,540) is

recorded as a $1,560 foreign exchange loss in 2010.

24. (10 minutes) (Foreign Currency Sale/Receivable)

The ostra receivable decreases in dollar value from (50,000 x $1.05) $52,500 at

December 20 to $51,000 (50,000 x $1.02) at December 31, resulting in a foreign

exchange loss of $1,500 in 2009. The further decrease in dollar value of the

ostra receivable from $51,000 at December 31 to $49,000 (50,000 x $.98) at

January 10 results in an additional $2,000 foreign exchange loss in 2010.

25. (10 minutes) (Foreign Currency Sale/Receivable) 9/15

Accounts Receivable (FCU) [100,000 x $.40] $40,000 Sales $40,000 9/30

Accounts Receivable (FCU) $2,000 Foreign exchange Gain $2,000

[100,000 x ($.42 – $.40)] 10/15 Foreign Exchange Loss $5,000

Accounts Receivable (FCU)

[100,000 x ($.37 – $.42)] $5,000 Cash $37,000

Accounts Receivable (FCU) $37,000 McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-14 Solutions Manual lOMoARcPSD|46958826

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-15 lOMoARcPSD|46958826

26. (10 minutes) (Foreign Currency Purchase/Payable) 12/1/09 Inventory $52,800

Accounts Payable (LCU) [60,000 x $.88] $52,800

12/31/09 Accounts Payable (LCU) [60,000 x ($.82 – $.88)] $3,600 Foreign Exchange Gain $3,600 1/28/10 Foreign Exchange Loss $4,800

Accounts Payable (LCU) [60,000 x ($.90 – $.82)] $4,800 Accounts payable (LCU) $54,000 Cash $54,000

27. (15 minutes) (Determine U.S. Dollar Balance for Foreign Currency Transactions)

Inventory and Cost of Goods Sold are reported at the spot rate at the date the

inventory was purchased. Sales are reported at the spot rate at the date of

sale. Accounts Receivable and Accounts Payable are reported at the spot rate

at the balance sheet date. Cash is reported at the spot rate when collected

and the spot rate when paid.

Inventory [50,000 pesos x 40% x $.17] ......................................................... $3,400

COGS [50,000 pesos x 60% x $.17] .............................................................. $5,100

Sales [45,000 pesos x $.18]........................................................................... $8,100

Accounts Receivable [45,000 – 40,000 = 5,000 pesos x $.21] ..................... $1,050

Accounts Payable [50,000 – 30,000 = 20,000 pesos x $.21] ........................ $4,200

Cash [(40,000 x $.19) – (30,000 x $.20)] ........................................................ $1,600 McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-16 Solutions Manual lOMoARcPSD|46958826

28. (25 minutes) (Prepare Journal Entries for Foreign Currency Transactions) 2/1/09 Equipment $17,600

Accounts Payable (L) [40,000 x $.44] $17,600 4/1/09 Accounts Payable (L) $17,600 Foreign Exchange Loss 400 Cash [40,000 x $.45] $18,000 6/1/09 Inventory $14,100

Accounts Payable (L) [30,000 x $.47] $14,100 8/1/09

Accounts Receivable (L) [40,000 x $.48] $19,200 Sales $19,200 Cost of Goods Sold $9,870

Inventory [$14,100 x 70%] $9,870

10/1/09Cash [30,000 x $.49] $14,700

Accounts Receivable (L) [$19,200 x 3/4] $14,400 Foreign Exchange Gain 300

11/1/09Accounts Payable (L) [$14,100 x 2/3] $9,400

Foreign Exchange Loss [20,000 x ($.50 – $.47)] 600 Cash [20,000 x $.50] $10,000

12/31/09 Foreign Exchange Loss $500

Accounts Payable (L) [10,000 x ($.52 – $.47)] $500

Accounts receivable (L) [10,000 x ($.52 – $.48)] $400 Foreign Exchange Gain $400 2/1/10 Cash [10,000 x $.54] $5,400

Accounts Receivable (L) [10,000 x $.52] $5,200 Foreign Exchange Gain 200 3/1/10

Accounts Payable (L) [10,000 x $.52] $5,200 Foreign Exchange Loss 300 Cash [10,000 x $.55] $5,500

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-17 lOMoARcPSD|46958826

29. (20 minutes) (Determine Income Effect of Foreign Currency Purchase/Payable)

a.Benjamin, Inc. has a liability of AL 160,000. On the date that this liability

was created (December 1, 2009), the liability had a dollar value of $70,400

(AL 160,000 x $.44). On December 31, 2009, the dollar value has risen to

$76,800 (AL 160,000 x $.48). The increase in the dollar value of the liability

creates a foreign exchange loss of $6,400 ($76,800 – $70,400) in 2009.

By March 1, 2010, when the liability is paid, the dollar value has dropped

to $72,000 (AL 160,000 x $.45) creating a foreign exchange gain of $4,800

($72,000 – $76,800) to be reported in 2010.

b. Benjamin, Inc. has a liability of AL 160,000. On the date that this liability was

created (September 1, 2009), the liability had a dollar value of $73,600 (AL

160,000 x $.46). On December 1, 2009, when the liability is paid, the dollar

value has decreased to $70,400 (AL 160,000 x $.44). The drop in the

dollar value of the liability creates a foreign exchange gain of $3,200

($70,400 – $73,600) in 2009. c.

Benjamin, Inc. has a liability of AL 160,000. On the date that this liability was

created (September 1, 2009), the liability had a dollar value of $73,600 (AL

160,000 x $.46). On December 31, 2009, the dollar value has risen to

$76,800 (AL 160,000 x $.48). The increase in the dollar value of the liability

creates a foreign exchange loss of $3,200 ($76,800 – $73,600) in 2009.

By March 1, 2010, when the liability is paid, the dollar value has dropped to

$72,000 (AL 160,000 x $.45) creating a foreign exchange gain of $4,800

($72,000 – $76,800) to be reported in 2010. McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-18 Solutions Manual lOMoARcPSD|46958826

30. (30 minutes) (Foreign Currency Borrowing) a. 9/30/09 Cash $100,000

Note Payable (dudek) [1,000,000 x $.10] $100,000

(To record the note and conversion of 1 million

dudeks into $ at the spot rate.)

12/31/09 Interest Expense $525

Interest Payable (dudek) $525

[1,000,000 x 2% x 3/12 = 5,000 dudeks x $.105 spot rate]

(To accrue interest for the period 9/30 – 12/31/09.) Foreign Exchange Loss $5,000

Note payable (dudek) [1 m x ($.105 – $.10)] $5,000

(To revalue the note payable at the spot rate of

$.105 and record a foreign exchange loss.) 9/30/10

Interest Expense [15,000 dudeks x $.12] $1,800

Interest Payable (dudek) 525

Foreign Exchange Loss [5,000 dudeks x ($.12 – $.105)] 75

Cash [20,000 dudeks x $.12] $2,400

(To record the first annual interest payment,

record interest expense for the period 1/1 – 9/30/10,

and record a foreign exchange loss on the

interest payable accrued at 12/31/09.)

12/31/10 Interest Expense $625

Interest Payable (dudek) [5,000 dudeks x $.125] $625

(To accrue interest for the period 9/30 – 12/31/10.) Foreign Exchange Loss $20,000

Note Payable (dudek) [1 m x ($.125 – $.105)] $20,000

(To revalue the note payable at the spot rate

of $.125 and record a foreign exchange loss.)

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2009

Hoyle, Schaefer, Doupnik, A

dvanced Accounting, 9

/e 9-19 lOMoARcPSD|46958826 30. (continued)

9/30/11Interest Expense [15,000 dudeks x $.15] $2,250

Interest Payable (dudek) 625

Foreign Exchange Loss [5,000 dudeks x ($.15 – $.125)] 125

Cash [20,000 dudeks x $.15] $3,000

(To record the second annual interest payment,

record interest expense for the period 1/1 – 9/30/11,

and record a foreign exchange loss on the interest

payable accrued at 12/31/10.) Note Payable (dudek) $125,000 Foreign Exchange Loss 25,000

Cash [1 m dudeks x $.15] $150,000

(To record payment of the 1 million dudek note.)

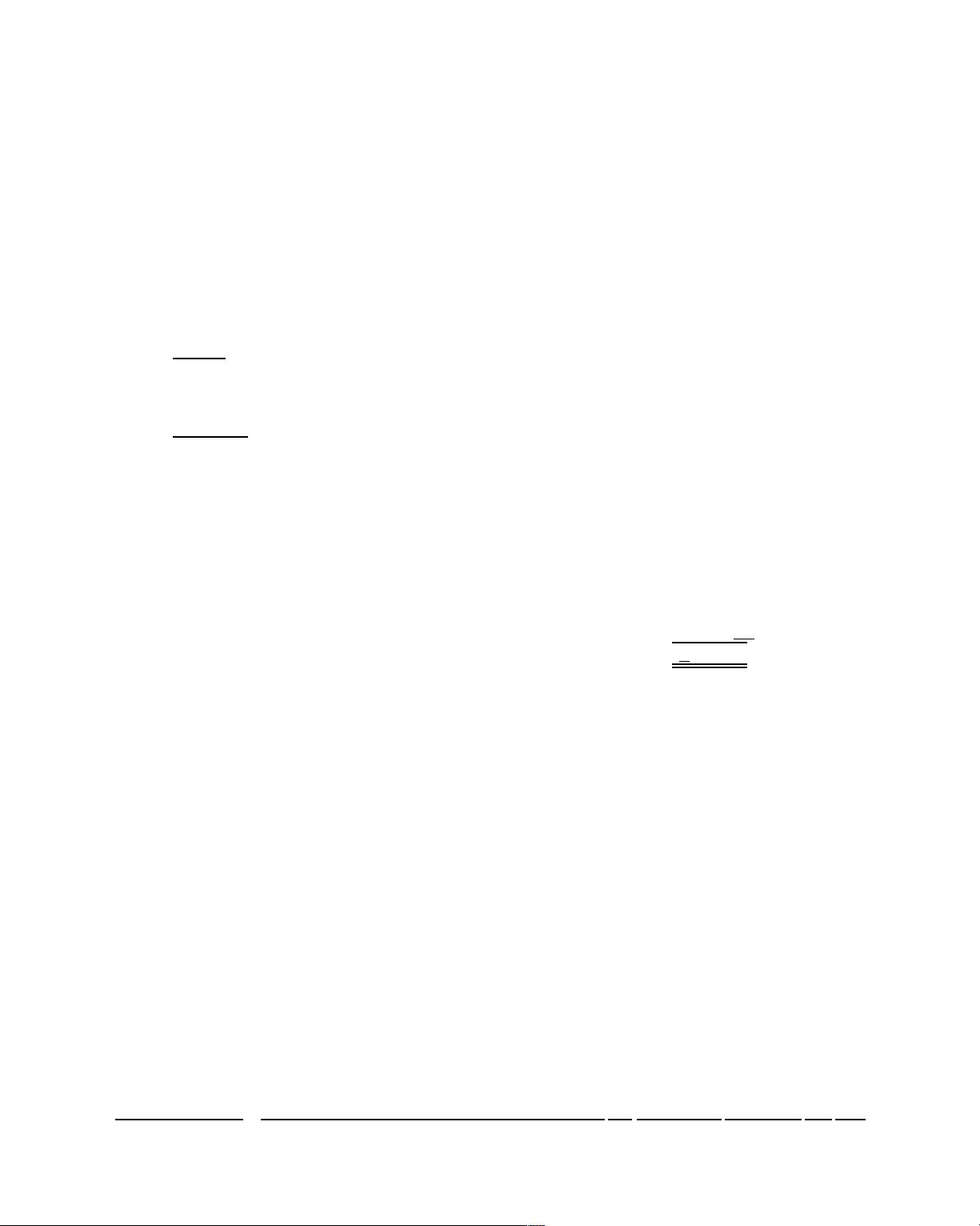

b. The effective cost of borrowing can be determined by considering the total

interest expense and foreign exchange losses related to the loan and

comparing this with the amount borrowed: 2009 Interest expense $525 Foreign exchange loss 5,000 Total

$5,525 / $100,000 = 5.525% for 3 months = = 22.1% for 12 months 2010 Interest expense $2,425 Foreign exchange losses 20,075 Total

$22,500 / $100,000 = 22.5% for 12 months 2011 Interest expense $2,250 Foreign exchange losses 25,125 Total

$27,375 / $100,000 = 27.38% for 9 months = 36.5% for 12 months

Because of appreciation in the value of the dudek, the effective annual

borrowing costs range from 22.1% – 36.5%. McGraw-Hill/ Irwin

© The McGraw-Hill Companies, Inc., 2009 9-20 Solutions Manual