Preview text:

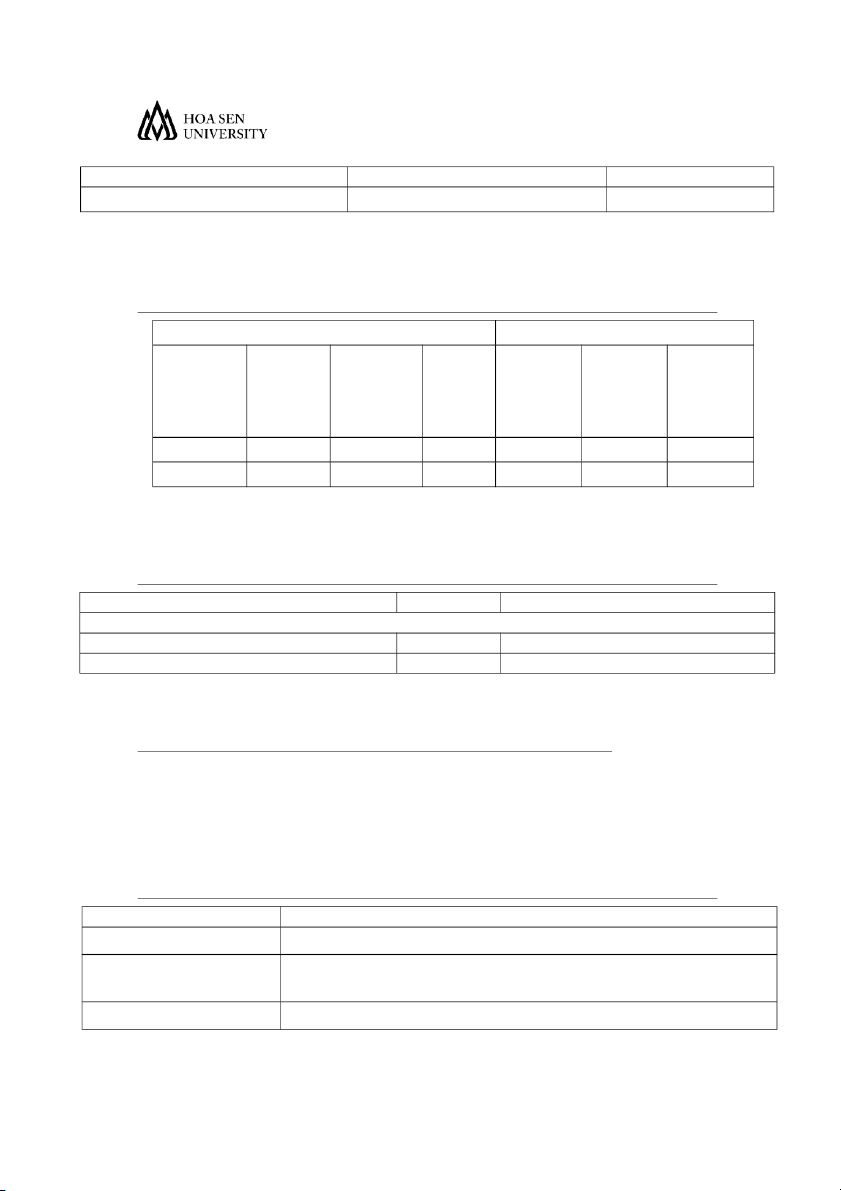

COURSE OUTLINE Course ID Course title Credits TC202DE01 Corporate finance 3

To be applied to Semester 14.1A School year 2014-2015 under Decision No

1200/2012/QĐ-BGH date 1/10/2012 A. Course Specifications: Periods Periods in classrooms Self- Total Lecture/ Lecture Activity study Lab room Fieldwork periods* Seminar room periods (1) (2) (3) (4) (5) (6) (7) 45 42 03 90 42 00 03

(1) = (2) + (3) = (5) + (6) + (7) B. Other related Subjects: Other related Subjects Course ID Course title Prerequisites: 1. QT101DE01 Microeconomics 2. C. Course Description:

The course is designed to equip students with the basic concepts of

corporate finance. Learning experience includes: introduction to finance;

investment making decisions; pricing of financial instruments such as bonds

and stocks; the relationship between risk and return; cost of capital; and

introduction to portfolio theory and Capital Asset Pricing Model (CAPM). D. Course Objectives: No. Course Objectives 1.

Introduce conceptual framework of corporate finance 2.

Provide sound knowlegde and introduce the relationship between risk and return 3.

Apply different pricing techniques in evaluating financial instruments 4.

Employ different investement criteria to evaluate investment projects 5.

Apply critical thinking, problem-solving and presentation skills to

individual and/or group activities dealing with practical issues E. Learning Outcomes: No. Learning Outcomes 1.

Understand the goals of corporations and roles of financial managers 2.

Have an understanding of the relationship between risk and return 3.

Understand and employ investment criteria in making investment decisions 4.

Apply different evaluation techniques in pricing bonds and stocks 5.

Understand and determine costs of capital F. Instructional Modes:

The course will be conducted though various instruction models such as lecturing,

seminar, and class discussion. Student will spend most of their time in lecture room

by having lectures, class discussion and student mini-seminar will be strongly encouraged by lecturers.

G. Textbooks and teaching aids:

Required Textbooks and Materials:

Brealey et al. (2009), Fundamentals of Corporate Finance, 6th

edition, McGraw-Hill (Newest version updated until 2012)

H. Assessment Methods (Requirements for Completion of the Course):

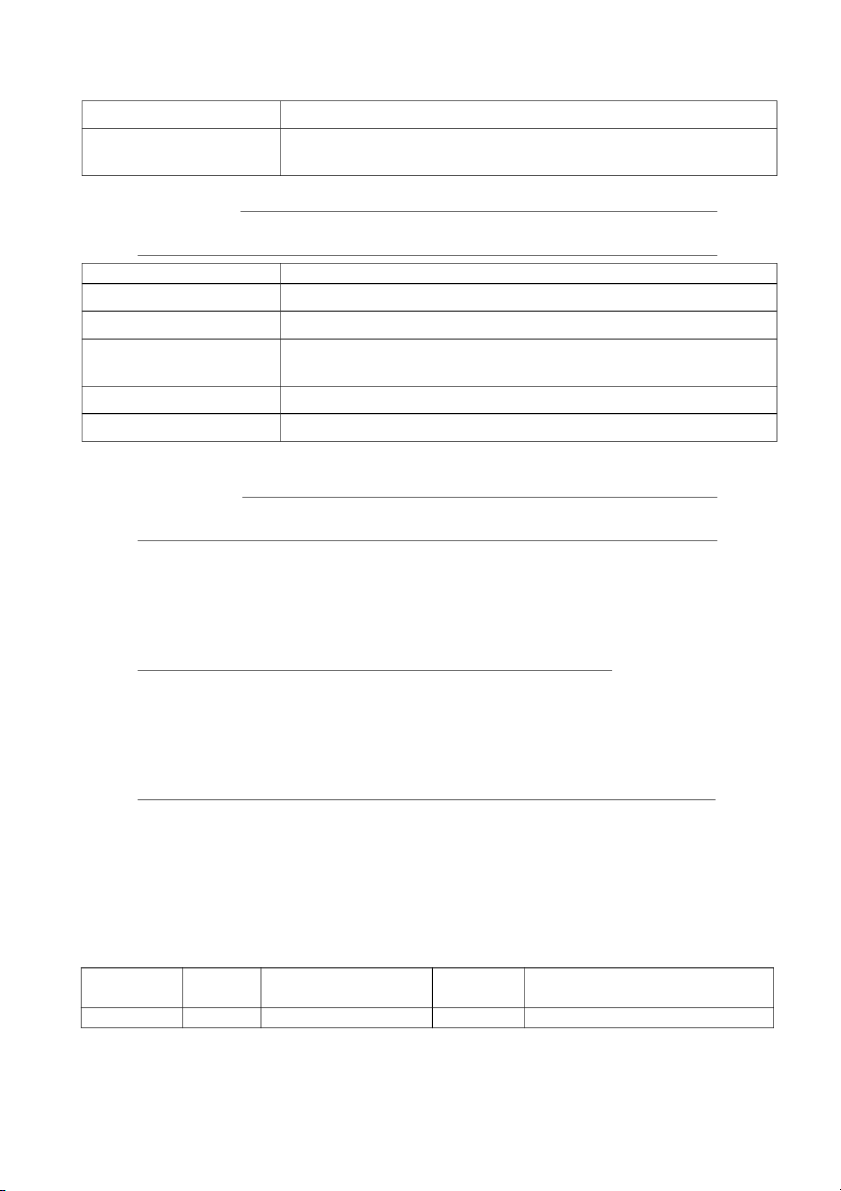

1. Description of learning outcomes assessment

Students will be continuously assesed during the course. The assessment

method includes several techniques such as closed-book exam, and group

assignment as a tool for lecturers to examine students ability to understand apply academic in practice. 2.

Summary of learning outcomes assessment Component Duratio Percentag Assessment Forms Schedule s n e Mid-term 60 Open book exam 30% Week 8 Test minutes Mini-Test

14 weeks Do the Mini-test (5 20% Week 2-14 minutes) in class Final Test 90 Open book exam Week 15 50% minutes Total 100%

Subordinate semester: test will be take place in class. 3. Academic Integrity

Academic integrity is a fundamental value that affects the quality of

teaching, learning, and research at a university. To ensure the maintenance of

academic integrity at Hoa Sen University, students are required to:

Work independently on individual assignments

Collaborating on individual assignments is considered cheating. Avoid plagiarism

Plagiarism is an act of fraud that involves the use of ideas or words of

another person without proper attribution. Students will be accused of plagiarism if they:

i. Copy in their work one or more sentences from another person without proper citation.

ii. Rephrase, paraphrase, or translate another person’s ideas or words without proper attribution.

iii. Reuse their own assignments, in whole or in part, and submit them for another class.

Work responsibly within a working group

In cooperative group assignments, all students are required to stay on

task and contribute equally to the projects. Group reports should

clearly state the contribution of each group member.

Any acts of academic dishonesty will result in a grade of zero for the task at

hand and/or immediate failure of the course, depending on the seriousness of

the fraud. Please consult Hoa Sen University’s Policy on Plagiarism at

http://thuvien.hoasen.edu.vn/chinh-sach-phong-tranh-dao-van. To ensure the

maintenance of academic integrity, the university asks that students report cases

of academic dishonesty to the teacher and/or the Dean. T he names of those

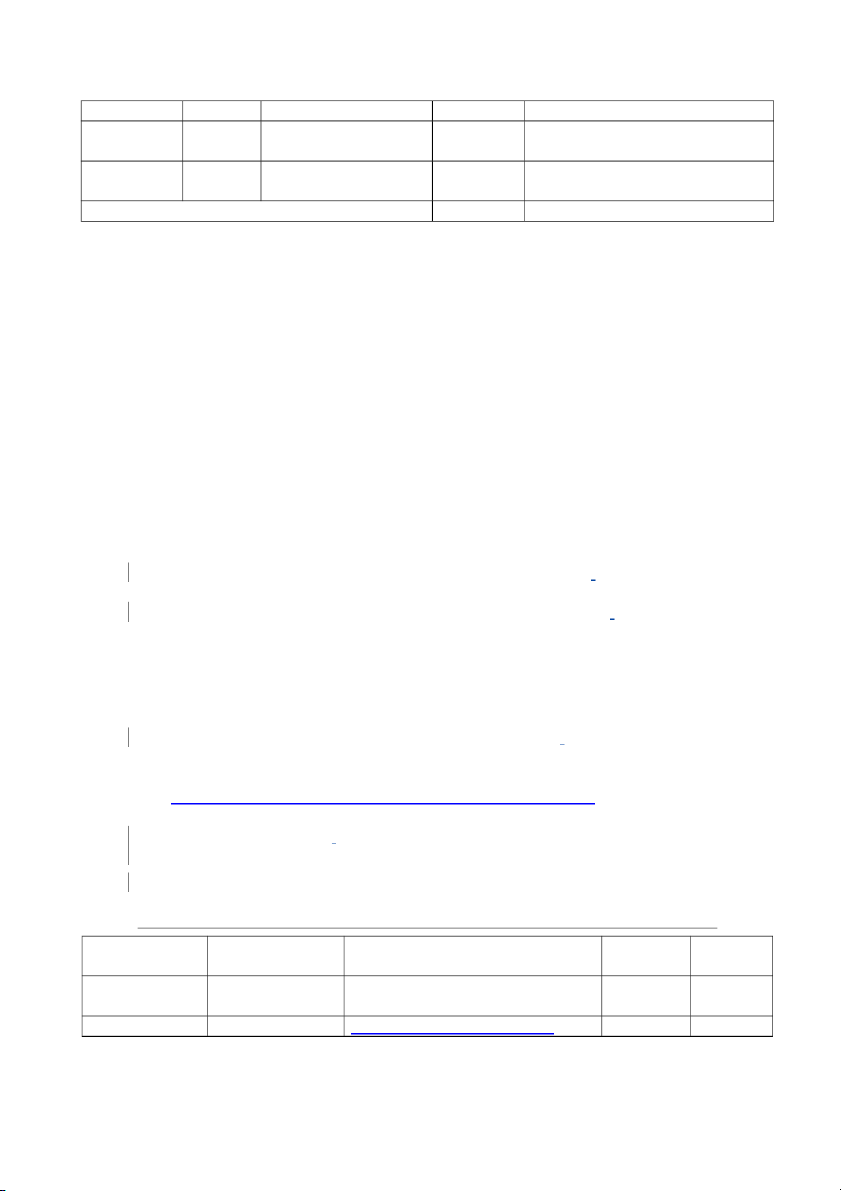

students will be kept anonymous. I .Teaching Staff: Professor’s No. Office location Hours Position name Nam Nguyen 1 Nam.nguyenthanh@hoasen.edu.vn Lecturer Thanh 2 Trang To Thi Tu Trang.tothitu@hoasen.edu.vn Lecturer Minh Nguyen 3 Minh.nguyentuong@hoasen.edu.vn Lecturer Tuong

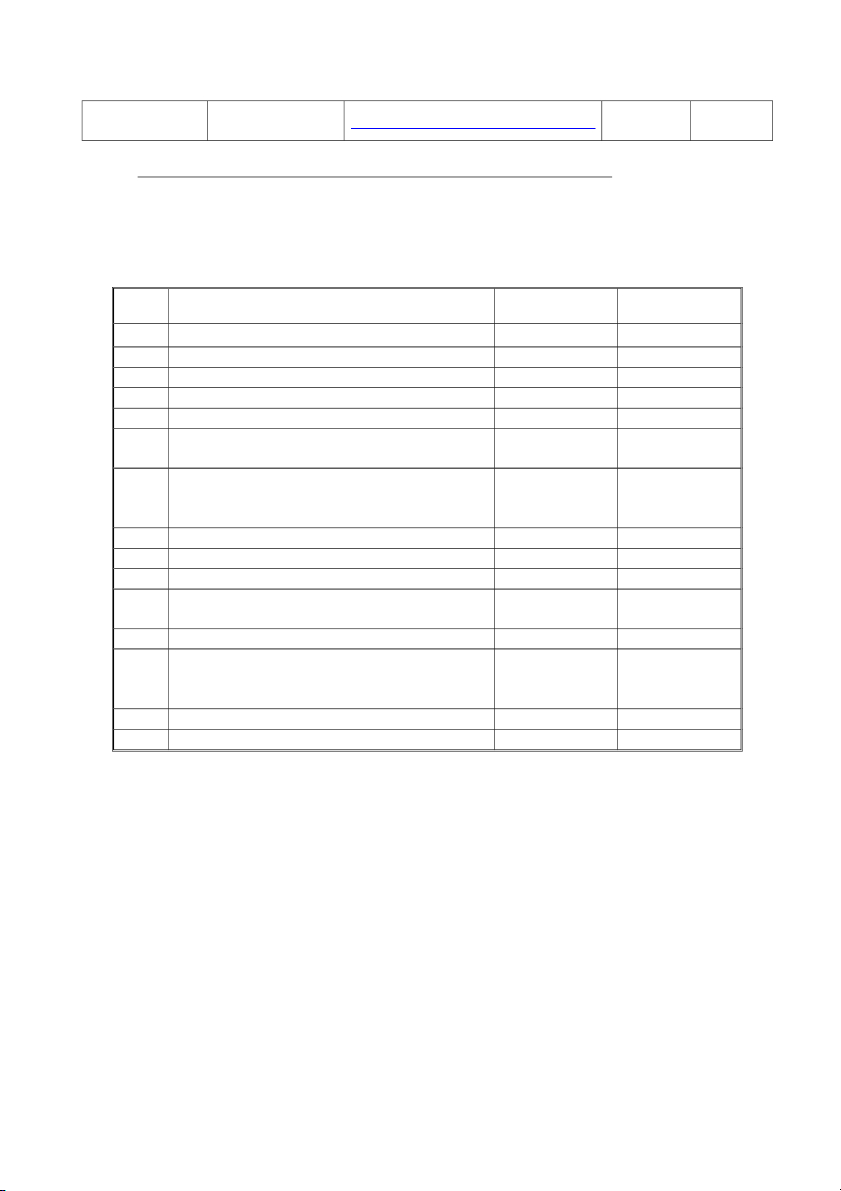

J. Outline of Topics to be covered (Learning Schedule):

Main semester: Once per week

Subordinate semester: Twice per week Week Topics References Homework 1

Introduction to Corporate Finance Chapter 1&2 t.b.a 2 Time value of money Chapter 5 t.b.a 3 Time value of money (Cont.) Chapter 5 t.b.a 4 Bonds and their valuation Chapter 6 t.b.a 5 Stocks and their valuation Chapter 7 t.b.a 6

Project investment criteria and budgeting Chapter 8 t.b.a capital decision 7

Part A: Project investment criteria and Chapter 8&9 t.b.a

budgeting capital decision (Cont.) Part B: Cash flow projection 8

Mid-term test+ continue teaching 9 Cash flow projection (Cont.) Chapter 9 t.b.a 10

Introduction to risk and return Chapter 11 t.b.a 11

Risk and return: Capital Asset Pricing Chapter 12 t.b.a Model (CAPM) 12

Capital structure and cost of capital Chapter 13 t.b.a 13

Part A: Capital structure and cost of Chapter 13&14 t.b.a capital (Cont.) Part B: Corporate financing 14 Corporate financing (Cont.) Chapter 14 t.b.a 15 Review Notice:

Subject is designed with the participant of guest speaker who will share reality from

experience or students will be attended the seminar during the subjects