Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826 Chapter 10

Insolvency – Liquidation and Reorganization Multiple Choice 1.

A corporation that is unable to pay its debts as they become due is: a. bankrupt. b. overdrawn. c. insolvent. d. liquidating. 2.

When a business becomes insolvent, it generally has three possible courses of action. Which of the

following is not one of the three possible courses of action?

a. The debtor and its creditors may enter into a contractual agreement, outside of formal bankruptcy proceedings.

b. The debtor continues operating the business in the normal course of the day-to-day operations.

c. The debtor or its creditors may file a bankruptcy petition, after which the debtor is liquidated under Chapter 7.

d. The debtor or its creditors may file a petition for reorganization under Chapter 11. 3.

Assets transferred by the debtor to a creditor to settle a debt are transferred at: a. book value of the debt.

b. book value of the transferred assets.

c. fair market value of the debt.

d. fair market value of the transferred assets. 4.

A composition agreement is an agreement between the debtor and its creditors whereby the creditors agree to:

a. accept less than the full amount of their claims.

b. delay settlement of the claim until a latter date.

c. force the debtor into a liquidation.

d. accrue interest at a higher rate. 5.

In a troubled debt restructuring involving a modification of terms, the debtor’s gain on restructuring:

a. will equal the creditor’s gain on restructuring.

b. will equal the creditor’s loss on restructuring.

c. may not equal the creditor’s gain on restructuring.

d. may not equal the creditor’s loss on restructuring. 6.

A bankruptcy petition filed by a firm is a: a. chapter petition. b. involuntary petition. c. voluntary petition. d. chapter 11 petition. 7.

When a bankruptcy court enters an “order for relief” it has: a. accepted the petition. b. dismissed the petition. c. appointed a trustee.

d. started legal action against the debtor by its creditors.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-2 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 8.

An involuntary petition filed by a firm’s creditors whereby there are twelve or more creditors must be signed by at least: a. two creditors. b. three creditors. c. five creditors. d. six creditors. 9.

The duties of the trustee include:

a. appointing creditors’ committees in liquidation cases.

b. approving all payments for debts incurred before the bankruptcy filing.

c. examining claims and disallowing any that are improper.

d. calling a meeting of the debtor’s creditors. 10.

Which of the following items is not a specified priority for unsecured creditors in a bankruptcy petition?

a. Administration fees incurred in administering the bankrupt’s estate.

b. Unsecured claims for wages earned within 90 days and are less than $4,650 per employee.

c. Unsecured claims of governmental units for unpaid taxes.

d. Unsecured claims on credit card charges that do not exceed $3,000. 11.

Which statement with respect to gains and losses on troubled debt restructuring is correct?

a. Creditors losses on restructuring are extraordinary.

b. Debtor’s gains and losses on asset transfers and debtor’s gains on restructuring are

combined and treated as extraordinary.

c. Debtor gains and creditor losses on restructuring are extraordinary, if material in amount.

d. Debtor losses on asset transfers and debtor gains on restructuring are reported as a component of net income. 12.

When fresh-start reporting is used according to Statement of Position (SOP) 90-7, the implication is

that a new firm exists. Which of the following statements is not correct about fresh-start accounting?

a. Assets are reported at fair values.

b. Beginning retained earnings is reported at zero.

c. The fair value of the assets must be less than the post liabilities and allowed claims.

d. The original owners must own less than 50% of the voting stock after reorganization. 13.

A Statement of Affairs is a report designed to show:

a. an estimated amount that would be received by each class of creditor’s claims in the event of liquidation.

b. a balance sheet prepared on the going-concern assumption.

c. assets and liabilities classified as current and noncurrent.

d. assets and liabilities reported at their current book values. 14.

When a secured claim is not fully settled by the selling of the underlying collateral, the remaining portion:

a. of the claim cannot be collected by the creditor. b. remains as a secured claim.

c. is classified as an unsecured priority claim.

d. is classified as an unsecured nonpriority claim.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-3 15.

Layne Corporation entered into a troubled debt restructuring agreement with their local bank. The

bank agreed to accept land with a carrying amount of $360,000 and a fair value of $540,000 in

exchange for a note with a carrying amount of $765,000. Ignoring income taxes, what amount

should Layne report as a gain on its income statement? a. $0. b. $180,000. c. $225,000. d. $405,000. 16.

The following information pertains to the transfer of real estate in regards to a troubled

debt restructuring by Nen Co. to Baker Co. in full settlement of Nen’s liability to Baker:

Carrying amount of liability settled $450,000

Carrying amount of real estate transferred $300,000

Fair value of real estate transferred $330,000

What amount should Nen report as ordinary gain (loss) on transfer of real estate? a. $(30,000). b. $30,000. c. $120,000. d. $150,000. 17.

The following information pertains to the transfer of real estate in regards to a troubled

debt restructuring by Nen Co. to Baker Co. in full settlement of Nen’s liability to Baker:

Carrying amount of liability settled $450,000

Carrying amount of real estate transferred $300,000

Fair value of real estate transferred $330,000

What amount should Baker report as a gain or (loss) on restructuring? a. $120,000 ordinary loss.

b. $120,000 extraordinary loss. c. $150,000 ordinary loss.

d. $150,000 extraordinary loss. 18.

Dobler Corporation was forced into bankruptcy and is in the process of liquidating assets and paying

claims. Unsecured claims will be paid at the rate of thirty cents on the dollar. Carson holds a note

receivable from Dobler for $75,000 collateralized by an asset with a book value of $50,000 and a

liquidation value of $25,000. The amount to be realized by Carson on this note is: a. $25,000. b. $40,000. c. $50,000. d. $75,000.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-4 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 19.

Bad Company filed a voluntary bankruptcy petition, and the statement of affairs reflected the following amounts: Estimated Assets Book Value Current Value

Assets pledged with fully secured creditors $ 900,000 $ 1,110,000

Assets pledged partially secured creditors 540,000 360,000 Free assets 1,260,000 960,000 $2,700,000 $2,430,000 Liabilities Liabilities with priority $ 210,000 Fully secured creditors 780,000 Partially secured creditors 600,000 Unsecured creditors 1,620,000 $3,210,000

Assume the assets are converted to cash at their estimated current values. What amount of cash will

be available to pay unsecured nonpriority claims? a. $720,000. b. $840,000. c. $960,000. d. $1,080,000. 20.

The final settlement with unsecured creditors is computed by dividing:

a. total net realizable value by total unsecured creditor claims.

b. net free assets by total secured creditor claims.

c. total net realizable value by total secured creditor claims.

d. net free assets by total unsecured creditor claims. 21.

Dodge Corporation entered into a troubled debt restructuring agreement with their local bank. The

bank agreed to accept land with a carrying value of $200,000 and a fair value of $300,000 in

exchange for a note with a carrying amount of $425,000. Ignoring income taxes, what amount

should Dodge report as a gain on its income statement? a. $0. b. $100,000. c. $125,000. d. $225,000. 22.

The following information pertains to the transfer of real estate in regards to a troubled

debt restructuring by Drier Co. to Cole Co. in full settlement of Drier’s liability to Cole:

Carrying amount of liability settled $375,000

Carrying amount of real estate transferred $250,000

Fair value of real estate transferred $275,000

What amount should Drier report as ordinary gain (loss) on transfer of real estate? a. $(25,000). b. $25,000. c. $100,000. d. $125,000.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-5 23.

The following information pertains to the transfer of real estate in regards to a troubled

debt restructuring by Drier Co. to Cole Co. in full settlement of Drier’s liability to Cole:

Carrying amount of liability settled $375,000

Carrying amount of real estate transferred $250,000

Fair value of real estate transferred $275,000

What amount should Cole report as a gain or (loss) on restructuring? a. $100,000 ordinary loss.

b. $100,000 extraordinary loss. c. $125,000 ordinary loss.

d. $125,000 extraordinary loss. 24.

Poor Company filed a voluntary bankruptcy petition, and the settlement of affairs reflected the following amounts: Estimated Assets Book Value Current Value

Assets pledged with fully secured creditors $ 450,000 $ 555,000

Assets pledged partially secured creditors 270,000 180,000 Free assets 630,000 480,000 $1,350,000 $1,215,000 Liabilities Liabilities with priority $ 105,000 Fully secured creditors 390,000 Partially secured creditors 300,000 Unsecured creditors 810,000 $1,605,000

Assume the assets are converted to cash to their estimated current values. What amount of cash

will be available to pay unsecured nonpriority claims? a. $360,000. b. $420,000. c. $480,000. d. $540,000. 25.

Dooley Corporation was forced into bankruptcy and is in the process of liquidating assets and

paying claims. Unsecured claims will be paid at the rate of thirty cents on the dollar. Cerner holds a

note receivable from Dooley for $90,000 collateralized by an asset with a book value of $60,000

and a liquidation value of $30,000. The amount to be realized by Cerner on this note is: a. $30,000. b. $48,000. c. $60,000. d. $90,000. lOMoARcPSD|46958826

10-6 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition Problems 10-1

On January 1, 2011, Bargain Mart owed City Bank $1,600,000, under an 8% note with three years

remaining to maturity. Due to financial difficulties, Bargain Mart was unable to pay the previous

year’s interest. City Bank agreed to settle Bargain Mart’s debt in exchange for land having a fair

market value of $1,310,000. Bargain Mart purchased the land in 2003 for $1,000,000. Required:

Prepare the journal entries to record the restructuring of the debt by Bargain Mart. 10-2

On January 1, 2010, Gannon, Inc. owed BancCorp $12 million on a 10% note due December 31,

2011. Interest was last paid on December 31, 2008. Gannon was experiencing severe financial

difficulties and asked BancCorp to modify the terms of the debt agreement. After negotiation BancCorp agreed to:

- Forgive the interest accrued for the year just ended,

- Reduce the remaining two years interest payments to $900,000 each and delay the

first payment until December 31, 2011, and

- Reduce the unpaid principal amount to $9,600,000. Required:

Prepare the journal entries for Gannon, Inc. necessitated by the restructuring of the debt at (1) January

1, 2010, (2) December 31, 2011, and (3) December 31, 2012. 10-3

On January 2, 2011 Stevens, Inc. was indebted to First Bank under a $12 million, 10% unsecured

note. The note was signed January 2, 2005, and was due December 31, 2014. Annual interest was

last paid on December 31, 2009. Stevens negotiated a restructuring of the terms of the debt

agreement due to financial difficulties. Required:

Prepare all journal entries for Stevens, Inc. to record the restructuring and any remaining transactions

relating to the debt under each independent assumption. A.

First Bank agreed to settle the debt in exchange for land which cost Stevens $8,500,000 and has a

fair market value of $10,000,000. B.

First Bank agreed to (1) forgive the accrued interest from last year (2) reduce the remaining

four interest payments to $600,000 each, and (3) reduce the principal to $9,000,000. 10-4

On December 31, 2011, Community Bank agreed to restructure a $900,000, 8% loan receivable from

Neer Corporation because of Neer’s financial problems. At December 31 there was $36,000 of

accrued interest for a six-month period. Terms of the restructuring agreement are as follows:

- Reduce the loan from $900,000 to $600,000;

- Extend the maturity date by 2 years from December 31, 2011 to December 31, 2013;

- Reduce the interest rate on the loan from 8% to 6%. Present value assumptions:

Present value of $1 for 2 years at 6% = 0.8900

Present value of $1 for 2 years at 8% = 0.8573

Present value of an ordinary annuity of $1 for 2 years at 6% = 1.8334

Present value of an ordinary annuity of $1 for 2 years at 8% = 1.7833 Required:

Compute the gain or loss that will be reported by Community Bank.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-7 10-5

Donnelly Corporation incurred major losses in 2010 and entered into voluntary Chapter 7

bankruptcy in the early part of 2011. By June 1, all assets were converted into cash, the secured

creditors were paid, and $150,000 in cash was left to pay the remaining claims as follows. Accounts payable $ 48,000

Claims prior to the trustee’s appointment 21,000 Property taxes payable 18,000

Wages payable (all under $4,650 per employee) 54,000 Unsecured note payable 60,000

Accrued interest on the note payable 6,000

Administrative expenses of the trustee 30,000 Total $237,000 Required:

Classify the claims by their Chapter 7 priority ranking, and analyze which amounts will be paid and which amounts will be written off. 10-6

Davis Corporation filed a petition under Chapter 7 of the U.S. Bankruptcy Act on June 30, 2011.

Data relevant to its financial position as of this date are: Estimated Net Book Value Realizable Values Cash $ 3,000 $ 3,000 Accounts receivable-net 72,000 48,000 Inventories 60,000 72,000 Equipment-net 165,000 87,000 Total assets $300,000 $210,000 Accounts payable $ 72,000 Rent payable 21,000 Wages payable 45,000

Note payable plus accrued interest 96,000 Capital stock 180,000 Retained earnings (deficit) (120,000) Total liabilities and equity $300,000 Required: A.

Prepare a statement of affairs assuming that the note payable and interest are secured by

a mortgage on the equipment and that wages are less than $4,650 per employee. B.

Estimate the amount that will be paid to each class of claims if priority liquidation expenses

including trustee fees are $24,000 and estimated net realizable values are actually realized.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-8 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 10-7

The following data are taken from the statement of affairs of Mitchell Company.

Assets pledged with fully secured creditors (Realizable value, $635,000) $800,000

Assets pledged with partially secured creditors (realizable value, $300,000) 365,000

Free assets (Realizable value, $340,000) 535,000 Fully secured creditor claims 316,000

Partially secured creditor claims 400,000

Unsecured creditor claims with priority 100,000

General unsecured creditor claims 1,165,000 Required:

Compute the amount that will be paid to each class of creditor. 10-8

On February 1, 2011, Hilton Company filed a petition for reorganization under the bankruptcy

statutes. The court approved the plan on September 1, 2011, including the following provisions: 1.

Accrued expenses of $21,930, representing priority items, are to be paid in full. 2.

Hilton Company is to exchange accounts receivable in the face amount of $138,000 and an

allowance for uncollectible accounts of $29,200 for the full settlement of $198,600 owed on

open account to one of its major unsecured creditors. The estimated fair value of the receivables is $104,000. 3.

Unsecured creditors of open accounts amounting to $91,600 and paid 40 cents on the dollar in full settlement. 4.

Hilton Company’s only other major unsecured creditor agreed to a five-year extension

of the $500,000 principal owed him on a 10% note payable. Accrued interest on the note on

September 1, 2011, amounts to $45,000, one-third of which is to be paid in cash and the

remainder canceled. In addition, no interest is to be charged during the remaining five years to maturity of the note. Required:

Prepare journal entries on the books of Hilton Company to give effect to the preceding provisions. Short Answer 1.

The Bankruptcy Reform Act assigns priorities to certain unsecured claims, and each rank must be

satisfied in full before the next–lower rank is paid. Identify the five categories of unsecured creditor claims. 2.

Creditors are classified by law as either secured or unsecured. Distinguish among fully secured,

partially secured, and unsecured creditors.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-9

Short Answer Questions from the Textbook 1.

List the primary types of contractual agreements between a debtor company and its creditors and

briefly explain what is involved in each of them. 2.

Distinguish between a voluntary and involuntary bankruptcy petition. 3.

Distinguish among fully secured, partially se-cured, and unsecured claims of creditors. 4.

Five priority categories of unsecured claims must be paid before general unsecured creditors

are paid. Briefly describe what makes up each category. 5.

What are “dividends” in a bankruptcy proceeding? 6.

For each of the following debt restructurings, indicate whether a gain is recognized and, if so, how

the gain is measured and reported. (a)Transfer of assets by the debtor to the creditor.(b)Grant of an

equity interest by the debtor to the creditor.(c)Modification of the terms of the payable. 7.

What is the purpose of a Statement of Affairs? 8.

One of the officers of a corporation that had just received a discharge in bankruptcy said,

“Good, now we don’t owe anyone.” Is he correct? 9.

What are the duties of a trustee in a liquidation proceeding? 10.

What is the purpose of a combining work paper prepared by a trustee? 11.

What is the purpose of a realization and liquidation account?

Business Ethics Question from Textbook

From an ethical perspective, some believe that it is never justifiable for an individual or business to declare

bankruptcy. Others believe that some actions are appropriate only in extreme circumstances. Without

question, as stated in the Journal of Accountancy, November 2005,page 51, “the ease with which

debtors have been able to walk away from debt has frustrated creditors for years.” 1.

Describe the differences between Chapter 7 (liquidations) and Chapter 11 (reorganizations)from an

ethical standpoint. Who is most likely to be hurt by a Chapter 7 bankruptcy? 2.

Discuss the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Do you believe

the changes wrought by this act will serve to protect creditors? 3.

The Protection Act of 2005 requires individuals, but not businesses, to undergo a “means” test

before they can seek Chapter 7 relief. Do you believe this change should be applied to businesses as well? Why or why not? 4.

Do you think that you would ever resort to filing for bankruptcy relief yourself? Why or why not? lOMoARcPSD|46958826

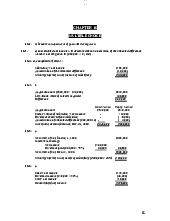

10-10 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition ANSWER KEY 1. c 8. b 15. c 22. b 2. b 9. c 16. b 23. a 3. d 10. d 17. a 24. d 4. a 11. d 18. b 25. b 5. d 12. c 19. d 6. c 13. a 20. d 7. a 14. d 21. c Problems 10-1 Land 310,000 Gain on Disposal of Land 310,000 Note Payable 1,600,000 Interest Payable 128,000 Land 1,310,000 Gain on Debt Restructuring 418,000

10-2Carrying amount: $12,000,000 + $1,2000,000 = $ 13,200,000

Future payments: ($900,000 × 2) + 9,600,000= 11,400,000

Gain to debtor/Loss to creditor $ 1,800,000 January 1, 2010 Interest Payable 1,200,000 Note Payable 600,000 Gain on Debt Restructuring 1,800,000 December 31, 2011 Note Payable 900,000 Cash 900,000 December 31, 2012 Note Payable 900,000 Cash (Interest) 900,000 Note Payable 9,600,000 Cash (Principal) 9,600,000

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-11 10-3 A. January 2, 2011 Land 1,500,000 Gain on Disposal of Land 1,500,000 Interest Payable 1,200,000 Note Payable 12,000,000 Land 10,000,000 Gain on Debt Restructuring 3,200,000 B.

Carrying amount $12,000,000 + $1,200,000 = $13,200,000

Future payments ($600,000 × 4) + $9,000,000 = 11,400,000

Gain to debtor/Loss to creditor $ 1,800,000 January 2, 2011 Interest Payable 1,200,000 Note Payable 600,000 Gain on Debt Restructuring 1,800,000

December 31, 2011, 2012, 2013, 2014 Note Payable (Interest) 600,000 Cash 600,000 December 31, 2014 Note Payable 9,000,000 Cash 9,000,000 10-4 A.

Community Bank’s loss on restructuring:

Carrying value of the loan before restructuring $936,000

Present value of $600,000 due in 2 years at 8%

historical rate: ($600,000 × 0.8573) = $514,380

Present value of $36,000 interest for 2 years at

8% historical rate: ($36,000 × 1.7833) = 64,199 Carrying value of the loan $578,579 (578,579) Loss on restructuring $357,421 10-5 Unsecured priority claims: Claim To be Cash Amount Paid Left $150,000 Administrative expenses $30,000 $30,000 120,000

Claims prior to the trustee’s appointment 21,000 21,000 99,000 Wages payable 54,000 54,000 45,000 Property taxes payable 18,000 18,000 27,000

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-12 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 10-5(Continued) Unsecured Nonpriority Claims: Claim To be Written Amount Paid Off Accounts payable $ 48,000 $12,000* $36,000 Unsecured note 60,000 15,000** 45,000 Accrued interest on the note 6,000 0 6,000

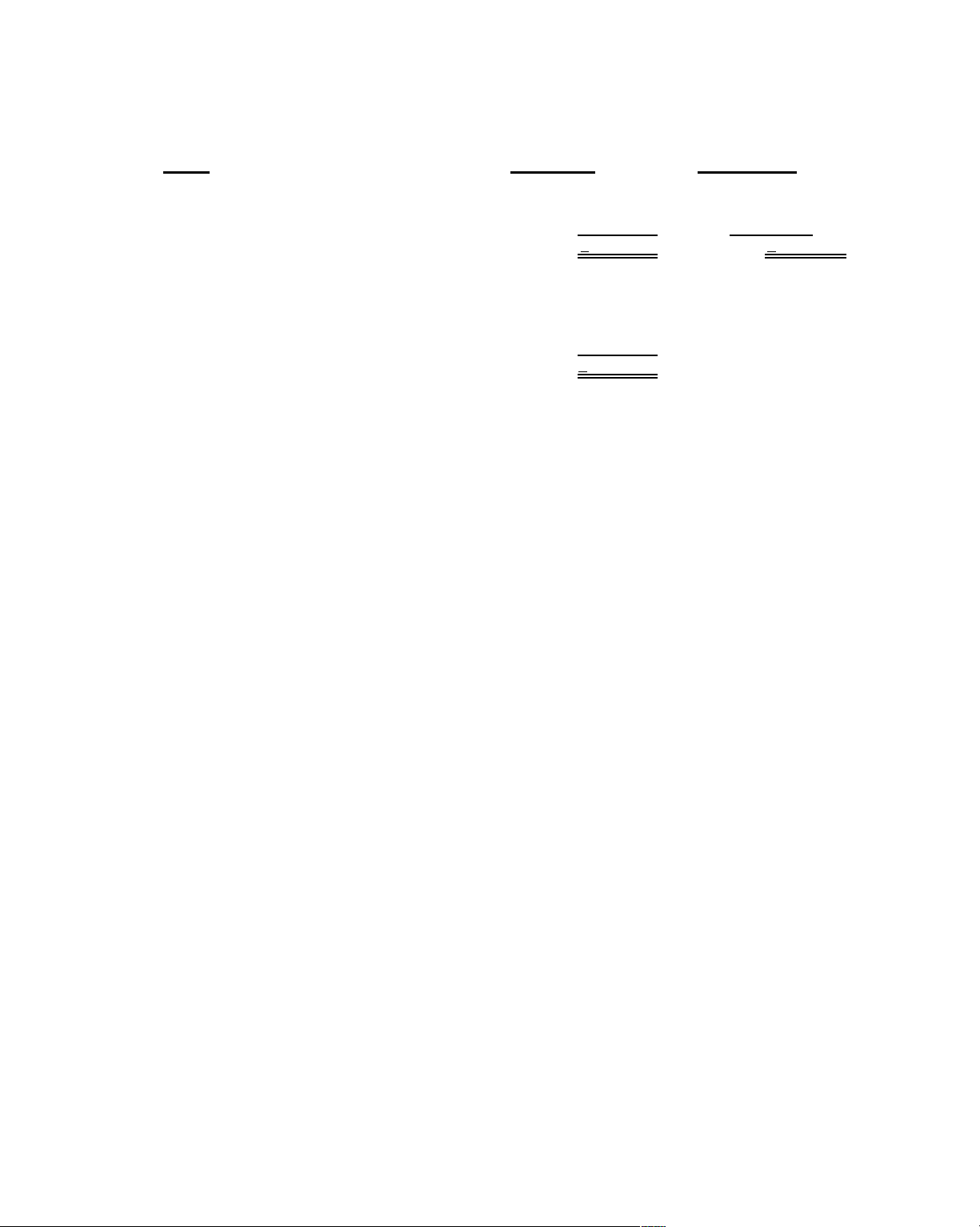

$27,000 / ($48,000 + $60,000) = .25 * $48,000 × 0.25 = $12,000 **$60,000 × 0.25 = $15,000 10-6 A. Davis Corporation Statement of Affairs June 30, 2011 Deficiency Account Book Value Assets Realizable Value (Loss/Gain)

Pledged with partially secured creditors $165,000 Equipment-net $87,000 (78,000)

Less: Note payable and accrued interest (96,000) $ 0 Unsecured amount (See below) (9,000) Free Assets 3,000 Cash 3,000 72,000 Accounts receivable-net 48,000 (24,000) 60,000 Inventories 72,000 12,000 Total net realizable value 123,000

Less: Priority liabilities – wages payable 45,000

Total available for unsecured creditors 78,000 ______

Estimated deficiency to unsecured creditors 30,000 ______ $300,000 $108,000 (90,000)

http://downloadslide.blogspot.com lOMo ARcPSD|469 58826

Chapter 10 Insolvency – Liquidation and Reorganization 10-13 10-6 (Continued) Unsecured Book Value Equities Liabilities

Priority liabilities $ 45,000 Wages payable (assumed under $4,650 per employee) $ 45,000

Partially secured creditors 96,000

Note payable and accrued interest $ 96,000

Less: Equipment pledged as security (87,000) $ 9,000

Unsecured creditors 72,000 Accounts payable 72,000 27,000 Rent payable 27,000

Stockholders’ equity 180,000 Capital stock 180,000 (120,000) Retained earnings (deficit) ______ (120,000) $300,000 $108,000 $ 60,000Estimated Deficiency $(30,000) B.

Estimated payments per dollar for unsecured creditors Cash available $210,000

Distribution to partially secured and unsecured priority creditors: Note payable and interest $87,000 Administrative expenses 24,000 Wages payable 45,000 156,000

Available to unsecured nonpriority creditors $ 54,000

Note payable and interest (unsecured portion) $ 9,000 Accounts payable 72,000 Rent payable 27,000 Unsecured nonpriority claims $108,000

($54,000 / $108,000 = $0.50 per dollar)

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-14 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 10-6(Continued)

Expected recovery for each class of claims Partially secured

Note payable and interest Secured portion $87,000

Unsecured portion ($9,000 × 0.50) 4,500 $91,500

Unsecured priority Administrative expenses $24,000 Wages payable 45,000 69,000

Unsecured nonpriority

Accounts payable ($72,000 × 0.50 $36,000 Rent payable ($27,000 × 0.50) 13,500 49,500 Total payments $210,000 10-7

Realizable value of all assets ($635,000 + $300,000 + $340,000) $1,275,000 Allocated to: Fully secured creditors (316,000) Partially secured creditors (300,000)

Unsecured creditors with priority (100,000)

Remainder available to general unsecured creditors $559,000

Payment rate to general unsecured creditors

(Including balance due to partially secured creditors)

$559,000 / ($1,165,000 + ($400,000 - $300,000)) 44.2% Realizable value of assets:

Assets pledged to fully secured creditors $635,000

Assets pledged to partially secured creditors 300,000 Free assets 340,000 Total realizable value $1,275,000 Amounts to be paid to: Fully secured creditors $316,000

Partially secured creditors [$300,000 + (0.442 × $100,000)] 344,200

Unsecured creditors with priority 100,000

General unsecured creditors (0.442 × $1,165,000) 514,800* Total $1,275,000 *Rounded $130

http://downloadslide.blogspot.com lOMoARcPSD|46958826

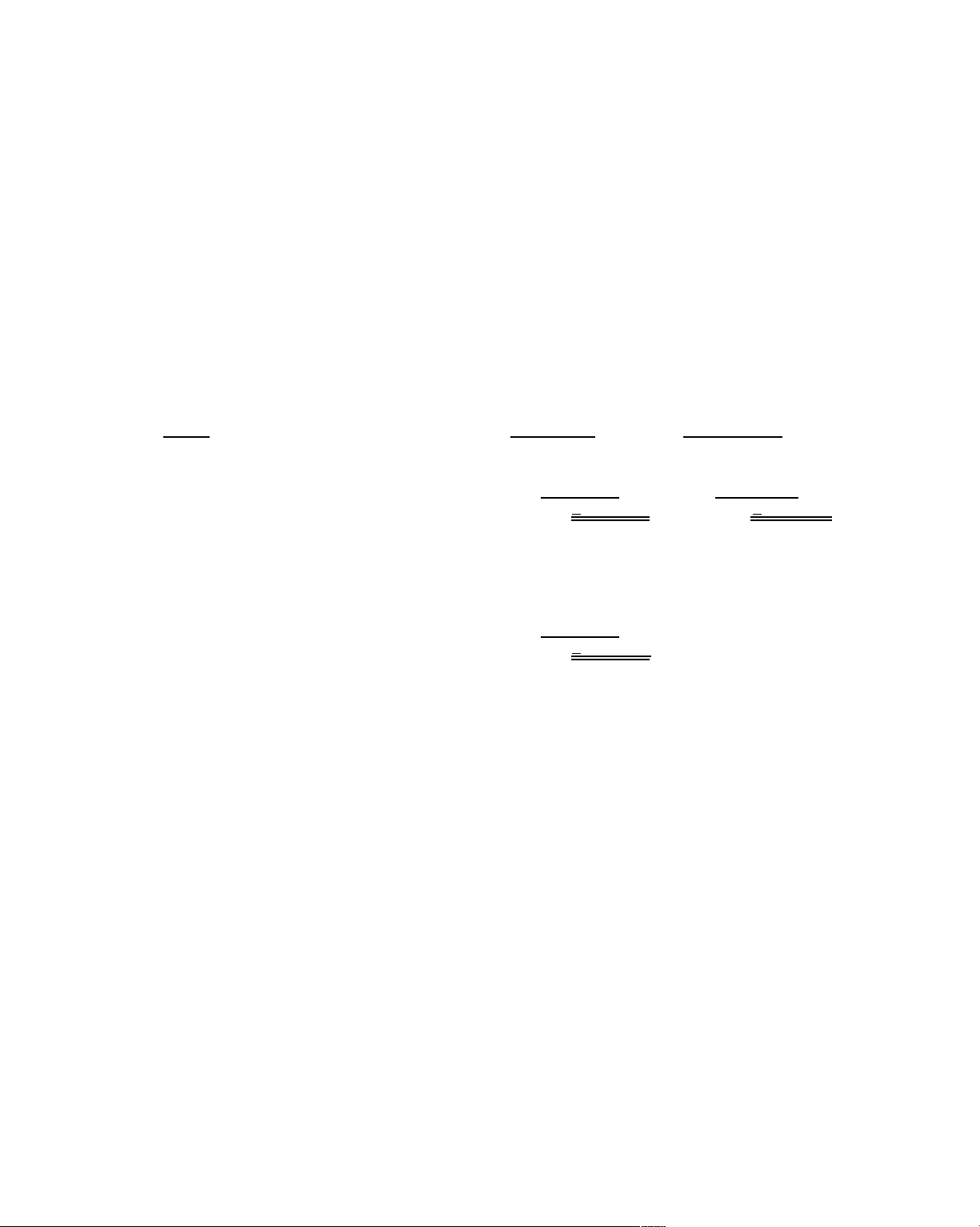

Chapter 10 Insolvency – Liquidation and Reorganization10-15 10-8 1. Accrued Expenses 21,930 Cash 21,930 2.

Allowance for Uncollectible Accounts 29,200 Loss on Transfer of Assets 4,800

Accounts Receivable ($138,000 - $104,000) 34,000 Accounts Payable 198,600 Accounts Receivable 104,000

Gain on Restructuring of Debt ($198,600 - $104,000) 94,600 3. Accounts Payable 91,600 Cash ($91,600 × 0.40) 36,640 Gain on Restructuring of Debt 54,960 4. Notes Payable 500,000 Accrued Interest Payable 45,000 Cash 15,000 Restructured Debt 500,000

Gain on Restructuring of Debt ($545,000 - $515,000) 30,000 Short Answer 1.

The five categories of unsecured creditor claims are: a.

Administration expenses and fees incurred in administering the bankrupt’s estate. b.

Unsecured claims for wages and salaries earned within 90 days before the date of filing of the petition. c.

Unsecured claims for contributions to employee benefit plans from services provided within

180 days before the date of filing of the petition. d.

Unsecured claims of individuals arising from deposits for the purchase, lease, or rental

of property or services that were not delivered. e.

Unsecured claims of governmental units for unpaid taxes. 2.

Fully secured creditor claims are those with liens against assets whose realizable value is equal to or in

excess of the claim. Partially secured claims are those with liens against assets whose realizable value

is less than the amount of the claim. Unsecured creditors are paid from whatever proceeds remain from the realization process.

Short Answer Questions from the Textbook Solutions 1. E

xtension of payment periods. The debtor continues to manage the business, and the creditors

merely extend the payment due date(s) for existing debts.

Composition agreements. A composition agreement is an agreement between the debtor

company and its creditors under which the creditors agree to accept less than the full amount of their claims.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-16 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition

Formation of a creditor’s committee. The debtor company and its creditors agree to form a

committee of creditors responsible for managing the debtor’s business affairs for the period

during which plans are developed to rehabilitate, reorganize, or liquidate the business.

Voluntary assignment of assets. An insolvent debtor elects to voluntarily place his property

under the control of a trustee for the benefit of his creditors.

2. In a voluntary petition, the debtor files a petition with a bankruptcy court for liquidation under

Chapter 7 or for reorganization under Chapter 11. The bankruptcy judge may refuse a voluntary

petition if refusal is considered to be in the best interest of the creditors.

In an involuntary petition, creditors initiate the action by filing a petition for liquidation or

reorganization with the bankruptcy court. If there are twelve or more creditors, the petition must

be signed by three or more of such creditors whose claims aggregate at least $5,000 more than

the value of any liens on the property of the debtor. If there are fewer than twelve creditors, the

petition may be filed by one or more of such creditors whose claims aggregate at least $5,000

more than the value of any liens on the debtor’s property. 3. F

ully secured claims. Those claims with liens against specific assets whose realizable value is

equal to or in excess of the claim.

Partially secured claims. Those claims with liens against specific assets whose realizable value

is less than the amount of the claim.

Unsecured claims. Those claims that are not secured by liens against specific assets and are,

therefore, paid from whatever total money remains after secured creditors are satisfied. Some

unsecured claims take priority over others under federal bankruptcy law.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-17

4. The five categories of unsecured claims with priority are:

a. Administrative expenses, fees, and charges incurred in administering the bankrupt’s estate.

b. Unsecured claims for wages, salaries, or commissions earned by an employee within 90

days before the date of filing a petition in bankruptcy, limited to the extent of $4,650 per employee.

c. Claims for contributions to employee benefit plans from services rendered within 180 days

before the date of filing a petition in bankruptcy, but subject to certain limitations.

d. Unsecured claims of individuals, to the extent of $2,100 for each such individual, arising

from the deposit of money in connection with the purchase, lease, or rental of property or

services that were not delivered or performed.

e. Claims of governmental units for unpaid taxes.

5. Dividends represent the final distribution made to general unsecured creditors. 6. a. Transfer of Assets:

The transfer of assets by a debtor to a creditor generally produces two types of gain or loss.

A gain on restructuring of debt is recognized for the excess of the carrying value of the

payable over the fair value of the assets transferred. This gain is reported as a component of

operating income. In addition, a gain or loss on transfer of assets is recognized for the

difference between the fair value and book value of the assets transferred. This gain (loss) is

reported as a component of operating income also.

b. Grant of an Equity Interest:

A debtor who grants an equity interest to a creditor will report a gain for the difference

between the fair value of the equity interest issued and the carrying amount of the payable settled. c. Modification of Terms:

In a modification of terms, the debtor will report a gain on restructuring only if the total

future cash payments specified by the new terms are less than the carrying value of the

payable. The amount of gain is measure as the difference between the total future cash

payments specified by the new terms and the carrying value of the payable.

7. The statement of affairs is an accounting report that is designed to permit interested parties to

determine the total expected amounts that could be realized from the disposition of a company’s

assets, the priorities in the use of the realization proceeds in satisfying claims, and the potential

net deficiency that would result if the assets were realized and claims liquidated.

8. The officer is incorrect. Some claims, such as for taxes, fines, and penalties are not discharged.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

10-18 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition

9. The primary duties of a trustee are:

a. To be accountable of all property received.

b. To examine proofs of claims and object to the allowance of any claim that is improper.

c. To furnish such information concerning the estate and the estate’s administration as is

requested by a party in interest.

d. If the business of the debtor is authorized to be operated, file with the court and with any

governmental unit charged with responsibility for collection of any tax arising out of such

operation, periodic reports and summaries of the operation of the business.

e. If the debtor has not done so, file with the court a list of creditors, a schedule of assets and

liabilities, and a statement of the debtor’s financial affairs.

f. If applicable, file a plan of reorganization, and, if the plan is accepted, file such reports as are required by the court.

10. The purpose of a combining workpaper is to serve as a means by which the trustee’s

accounts are united with the debtor company’s accounts in order to prepare appropriate financial statements.

11. The purpose of a realization and liquidation account is to report summary realization and

distribution activities of a trustee or receiver to the court. It reports the changes that have

occurred during a period in the monetary items because that is what the court officials are primarily interested in.

Business Ethics Question from the Textbook Solution

1. In chapter 7 bankruptcy liquidation, firms are assumed to be past the stage of

reorganization and must sell off any un-exempt assets to pay c reditors . In contrast, Chapter

11 bankruptcy allows the firm the opportunity to reorganize its debt and to try to re-emerge as a healthy organization.

In both cases, the creditors and other claim-holders suffer losses as they will be most likely

getting less return on investment than expected at the time of the initial decision to invest in

the company. From an ethical perspective, a chapter 11 bankruptcy provides the creditors

and other claim-holders a better chance of recovering higher value for their investments

than under chapter 7 as the firm strives to recover and reorganize under chapter 11 but not under chapter 7.

2. The new law makes sweeping changes to American bankruptcy laws and makes it more

difficult for individuals to file bankruptcy under chapter 7. The new law requires a means test

to determine whether the borrowers have enough resources to pay for their debts. For

additional information, see the following link: ht

tp://en.wikipedia.org/wiki/Bankruptcy_Abuse_Prevention_and_Consumer_Protection_ Act]

In addition the new law laid down the following requirements

Mandatory credit counseling and debtor education

Additional filing requirements and fees

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 10 Insolvency – Liquidation and Reorganization 10-19

Increased attorney liability and costs

Fewer automatic protections for filers

Increased compliance requirements for small businesses

Increased amount of debt repayment under Chapter 13

Increased length of time between discharges

These changes provide more safety for the creditors, who should consequently be better

protected. Individuals who fail the means test may opt instead for Chapter 13, which

involves a repayment of their debt over time.

3. Applying this test to businesses would benefit the creditors and other claim-holders, as they

would feel a slight buffer to their risk, which might stimulate new business as a result of

easier fund raising. It may also prevent businesses from venturing into unduly risky areas as

they would not be able to bail out as easily by filing under chapter 7 if things went wrong

(hence becoming somewhat more risk averse). It would seem to shift the risk balance

somewhat to the shoulders of the entrepreneur from those of the investor.

4. Filing for bankruptcy is never a desirable or ethical option, but sometimes circumstances

may arise that seem to force a business or an individual into this tough situation. Whether

the individual finds another way at such a time or not is a personal issue and an ethical

dilemma, and there is not necessarily a correct answer to this question. The purpose of this

discussion is to get the student to thinking about his or her personal position, and where his

ethical stance would be before the situation arises. Ideally, of course, the student will

never find himself or herself in such a position, but, as the old saying goes, until you’ve

walked a mile in another’s shoes…

http://downloadslide.blogspot.com