Preview text:

lOMoARcPSD|46958826 lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions

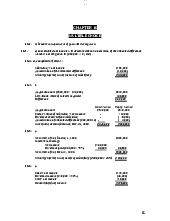

And Hedging Foreign Exchange Risk Multiple Choice 1.

A discount or premium on a forward contract is deferred and included in the measurement of

the related foreign currency transaction if the contract is classified as a:

a. hedge of a net investment in a foreign entity.

b. hedge of an exposed asset or liability position.

c. hedge of an identifiable foreign currency commitment.

d. contract acquired to speculate in the movement of exchange rates. 2.

The discount or premium on a forward contract entered into as a hedge of an exposed asset

or liability position should be:

a. included as a separate component of stockholders‟ equity.

b. amortized over the life of the forward contract.

c. deferred and included in the measurement of related foreign currency transaction. d. none of these. 3.

An indirect exchange rate quotation is one in which the exchange rate is quoted:

a. in terms of how many units of the domestic currency can be converted into one unit of foreign currency.

b. for the immediate delivery of currencies exchanged.

c. in terms of how many units of the foreign currency can be converted into one unit of domestic currency.

d. for the future delivery of currencies exchanged. 4.

A transaction gain is recorded when there is an:

a. importing transaction and the exchange rate increases.

b. exporting transaction and the exchange rate increases.

c. exporting transaction and the exchange rate decreases. d. none of these. 5.

During 2011, a U.S. company purchased inventory from a foreign supplier. The transaction was

denominated in the local currency of the seller. The direct exchange rate increased from the date of

the transaction to the balance sheet date. The exchange rate decreased from the balance sheet date to

the settlement date in 2012. For the years 2011 and 2012, transaction gains or losses should be recognized as: 2011 2012 a. gain gain b. gain loss c. loss loss d. loss gain lOMoARcPSD|46958826

12-2 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 6.

A transaction gain or loss is reported currently in the determination of income if the purpose of the forward contract is to:

a. hedge a net investment in a foreign entity.

b. hedge an identifiable foreign currency commitment.

c. speculate in foreign currency. d. none of these. 7.

On November 1, 2011, American Company sold inventory to a foreign customer. The account will

be settled on March 1 with the receipt of $500,000 foreign currency units (FCU). On November 1,

American also entered into a forward contract to hedge the exposed asset. The forward rate is $0.70

per unit of foreign currency. American has a December 31 fiscal year-end. Spot rates on relevant dates were: Per Unit of Date Foreign Currency November 1 $0.73 December 31 0.71 March 1 0.74

The entry to record the forward contract is a. FCU Receivable 350,000 Premium on Forward Contract 15,000 Dollars Payable 365,000 b. Dollars Receivable 365,000 Discount on Forward Contract 15,000 FCU Payable 350,000 c. FCU Receivable 365,000 Discount on Forward Contract 15,000 Dollars Payable 350,000 d. Dollars Receivable 350,000 Discount on Forward Contract 15,000 FCU Payable 365,000 lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-3

And Hedging Foreign Exchange Risk 8.

On November 1, 2011, American Company sold inventory to a foreign customer. The account will

be settled on March 1 with the receipt of $450,000 foreign currency units (FCU). On November 1,

American also entered into a forward contract to hedge the exposed asset. The forward rate is $0.70

per unit of foreign currency. American has a December 31 fiscal year-end. Spot rates on relevant dates were: Per Unit of Date Foreign Currency November 1 $0.73 December 31 0.71 March 1 0.74

What will be the adjusted balance in the Accounts Receivable account on December 31, and how

much gain or loss was recorded as a result of the adjustment? Receivable Balance Gain/Loss Recorded a. $319,500 $9,000 gain b. $319,500 $9,000 loss c. $333,000 $4,500 gain d. $333,000 $18,000 gain 9.

A transaction gain or loss at the settlement date is:

a. a change in the exchange rate quoted by a foreign exchange trader.

b. synonymous with the translation of foreign currency financial statements into dollars.

c. the difference between the recorded dollar amount of an account receivable denominated in

a foreign currency and the amount of dollars received.

d. the difference between the buying and selling rate quoted by a foreign exchange trader at the settlement date. 10.

From the viewpoint of a U.S. company, a foreign currency transaction is a transaction:

a. measured in a foreign currency.

b. denominated in a foreign currency. c. measured in U.S. currency.

d. denominated in U.S. currency. 11.

The exchange rate quoted for future delivery of foreign currency is the definition of a(n): a. direct exchange rate. b. indirect exchange rate. c. spot rate. d. forward exchange rate. 12.

A transaction loss would result from:

a. an increase in the exchange rate applicable to an asset denominated in a foreign currency.

b. a decrease in the exchange rate applicable to a liability denominated in a foreign currency.

c. the import of merchandise when the transaction is denominated in a foreign currency.

d. a decrease in the exchange rate applicable to an asset denominated in a foreign currency. lOMoARcPSD|46958826

12-4 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 13.

The forward exchange rate quoted for the remaining term of a forward contract is used to account

for the contract when the forward contract:

a. extends beyond one year or the current operating cycle.

b. is a hedge of an identifiable foreign currency commitment.

c. is a hedge of an exposed net liability position.

d. was acquired to speculate in foreign currency. 14.

A transaction gain or loss on a forward contract entered into as a hedge of an identifiable foreign currency commitment may be:

a. included as a separate item in the stockholders‟ equity section of the balance sheet.

b. recognized currently in the determination of net income.

c. deferred and included in the measurement of the related foreign currency transaction. d. none of these. 15.

Craiger, Inc. a U.S. corporation, bought machine parts from Reinsch Company of Germany on

March 1, 2011, for 70,000 marks, when the spot rate for marks was $0.5395. Craiger‟s year-end

was March 31, 2011, when the spot rate for marks was $0.5445. Craiger bought 70,000 marks and

paid the invoice on April 20, 2011, when the spot rate was $0.5495. How much should be shown in

Craiger‟s income statements as foreign exchange (transaction) gain or loss for the years ended March 31, 2011 and 2012? 2011 2012 a. $0 $0 b. $0 $350 loss c. $350 loss $0 d. $350 loss $350 loss 16.

A forward exchange contract is transacted at a discount if the current forward rate is:

a. less than the expected spot rate.

b. more than the expected spot rate.

c. less than the current spot rate.

d. more than the current spot rate. 17.

Stuart Corporation a U.S. company, contracted to purchase foreign goods. Payment in foreign

currency was due one month after delivery. Between the delivery date and the time of payment, the

exchange rate changed in Stuart‟s favor. The resulting gain should be reported in the financial statements as a(n):

a. component of other comprehensive income.

b. component of income from continuing operations. c. extraordinary income. d. deferred income. lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-5

And Hedging Foreign Exchange Risk 18.

Jackson Paving Company purchased equipment for 350,000 British pounds from a supplier in

London on July 7, 2011. Payment in British pounds is due on Sept. 7, 2011. The exchange rates to

purchase one pound is as follows: July 7 August 31, (year end) September 7 Spot-rate 2.08 2.05 2.04 30-day rate 2.07 2.03 -- 60-day rate 2.06 1.99 --

On its August 31, 2011 income statement, what amount should Jackson Paving report as a

foreign exchange transaction gain: a. $14,000. b. $7,000. c. $10,500. d. $0. 19.

On September 1, 2011, Swash Plating Company entered into two forward exchange contracts to

purchase 250,000 euros each in 90 days. The relevant exchange rates are as follows: Forward Rate Spot rate For Dec. 1, 2011 September 1, 2011 1.46 1.47 September 30, 2011 (year-end) 1.50 1.48

The first forward contract was to hedge a purchase of inventory on September 1, payable on

December 1. On September 30, what amount of foreign currency transaction loss should Swash Plating report in income? a. $0. b. $2,500. c. $5,000. d. $10,000. 20.

On September 1, 2011, Swash Plating Company entered into two forward exchange contracts to

purchase 250,000 euros each in 90 days. The relevant exchange rates are as follows: Forward Rate Spot rate For Dec. 1, 2011 September 1, 2011 1.46 1.47 September 30, 2011 (year-end) 1.50 1.48

The second forward contract was strictly for speculation. On September 30, 2011, what amount of

foreign currency transaction gain should Swash Plating report in income? a. $0. b. $2,500. c. $5,000. d. $10,000.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

12-6 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 21.

On November 1, 2011, Prism Company sold inventory to a foreign customer. The account will be

settled on March 1 with the receipt of 250,000 foreign currency units (FCU). On November 1, Prism

also entered into a forward contract to hedge the exposed asset. The forward rate is $0.90 per unit of

foreign currency. Prism has a December 31 fiscal year-end. Spot rates on relevant dates were: Per Unit of Date Foreign Currency November 1 $0.93 December 31 0.91 March 1 0.94

The entry to record the forward contract is a. FCU Receivable 225,000 Premium on Forward Contract 7,500 Dollars Payable 232,500 b. Dollars Receivable 232,500 Discount on Forward Contract 7,500 FCU Payable 225,000 c. FCU Receivable 232,500 Discount on Forward Contract 7,500 Dollars Payable 225,000 d. Dollars Receivable 225,000 Discount on Forward Contract 7,500 FCU Payable 232,500 22.

On November 1, 2011, National Company sold inventory to a foreign customer. The account will be

settled on March 1 with the receipt of 200,000 foreign currency units (FCU). On November 1,

National also entered into a forward contract to hedge the exposed asset. The forward rate is $0.80

per unit of foreign currency. National has a December 31 fiscal year-end. Spot rates on relevant dates were: Per Unit of Date Foreign Currency November 1 $0.83 December 31 0.81 March 1 0.84

What will be the adjusted balance in the Accounts Receivable account on December 31, and how

much gain or loss was recorded as a result of the adjustment? Receivable Balance Gain/Loss Recorded a. $170,000 $4,000 gain b. $162,000 $4,000 loss c. $168,000 $2,000 gain d. $164,000 $2,000 loss

http://downloadslide.blogspot.com lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-7

And Hedging Foreign Exchange Risk 23.

Caldron Company purchased equipment for 375,000 British pounds from a supplier in London on

July 3, 2011. Payment in British pounds is due on Sept. 3, 2011. The exchange rates to purchase one pound is as follows: July 3 August 31, (year end) September 3 Spot-rate 1.58 1.55 1.54 30-day rate 1.57 1.53 -- 60-day rate 1.56 1.49 --

On its August 31, 2011, income statement, what amount should Caldron report as a foreign exchange transaction gain: a. $18,750. b. $3,750. c. $11,250. d. $0. 24.

On April 1, 2011, Trent Company entered into two forward exchange contracts to purchase 300,000

euros each in 90 days. The relevant exchange rates are as follows: Forward Rate Spot rate For Aug. 1, 2011 April 1, 2011 1.16 1.17 April 30, 2011 (year-end) 1.20 1.18

The first forward contract was to hedge a purchase of inventory on April 1, payable on December

1. On April 30, what amount of foreign currency transaction loss should Trent report in income? a. $0. b. $3,000. c. $9,000. d. $12,000. 25.

On April 1, 2011, Trent Company entered into two forward exchange contracts to purchase 300,000

euros each in 90 days. The relevant exchange rates are as follows: Forward Rate Spot rate For Aug. 1, 2011 April 1, 2011 1.16 1.17 April 30, 2011 (year-end) 1.20 1.18

The second forward contract was strictly for speculation. On April 30, 2011, what amount of

foreign currency transaction gain should Trent report in income. a. $0. b. $3,000. c. $9,000. d. $12,000.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

12-8 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition Problems 12-1

On November 1, 2010, Dorsey Company sold inventory to a company in England. The sale was for

600,000 British pounds and payment will be received on February 1, 2011. On November 1, Dorsey

entered into a forward contract to sell 600,000 British pounds on February 1 at the forward rate of

$1.65. Spot rates for the British pound are as follows: November 1 $1.61 December 31 1.67 February 1 1.62

Dorsey has a December 31 fiscal year-end. Required:

Compute each of the following: 1.

The dollars to be received on February 1, 2011, from selling the 600,000 pounds to the exchange dealer. 2.

The dollars that would have been received from the account receivable if Dorsey had not hedged the

sale contract with the forward contract. 3.

The discount or premium on the forward contract. 4.

The transaction gain or loss on the exposed asset related to the sale in 2010 and 2011. 5.

The transaction gain or loss on the forward contract in 2010 and 2011. 6.

The amount of the discount or premium on the forward contract amortized in 2010 and 2011. 12-2

On December 1, 2010, Derrick Corporation agreed to purchase a machine to be manufactured by a

company in Brazil. The purchase price is 1,150,000 Brazilian reals. To hedge against fluctuations in

the exchange rate, Derrick entered into a forward contract on December 1 to buy 1,150,000 reals on

April 1, the agreed date of machine delivery, for $0.375 per real. The following exchange rates were quoted: Forward Rate Date Spot Rate (Delivery on 4/1) December 1 0.390 0.375 December 31 0.370 0.373 April 1 0.385 -- Required:

Prepare journal entries necessary for Derrick during 2010 and 2011 to account for the transactions described above.

http://downloadslide.blogspot.com lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-9

And Hedging Foreign Exchange Risk 12-3

Colony Corp., a U.S. corporation, entered into a contract on November 1, 2010, to sell two

machines to Crown Company, for 95,000 foreign currency units (FCU). The machines were to be

delivered and the amount collected on March 1, 2011.

In order to hedge its commitment, Colony entered into a forward contract for 95,000 FCU delivery

on March 1, 2011. The forward contract met all conditions for hedging an identifiable foreign currency commitment.

Selected exchange rates for FCU at various dates were as follows:

November 1, 2010 – Spot rate $1.3076

Forward rate for delivery on March 1, 2011 1.2980

December 31, 2010 – Spot rate 1.3060

Forward rate for delivery on March 1, 2011 1.3150

March 1, 2011 – Spot rate 1.2972 Required:

Prepare all journal entries relative to the above on the books of Colony Corp. on the following dates: 1. November 1, 2010. 2.

Year-end adjustments on December 31, 2010. 3.

March 1, 2011. (Include all adjustments related to the forward contract.)

12-4 On October 1, 2010, Nance Company purchased inventory from a foreign customer for 750,000 units

of foreign currency (FCU) due on January 31, 2011. Simultaneously, Nance entered into a forward

contract for 750,000 units of FC for delivery on January 31, 2011, at the forward rate of $0.75.

Payment was made to the foreign customer on January 31, 2011. Spot rates on October 1, December

31, and January 31, were $0.72, $0.73, and $0.76, respectively. Nance amortizes all premiums and

discounts on forward contracts and closes its books on December 31. Required: A.

Prepare all journal entries relative to the above to be made by Nance on October 1, 2010. B.

Prepare all journal entries relative to the above to be made by Nance on December 31, 2010. C.

Compute the transaction gain or loss on the forward contract that would be recorded in

2011. Indicate clearly whether the amount is a gain or loss.

12-5 On October 1, 2010, Kline Company shipped equipment to a foreign customer for a foreign currency

(FC) price of FC 3,000,000 due on January 31, 2011. All revenue realization criteria were satisfied

and accordingly the sale was recorded by Kline Company on October 1. Simultaneously, Kline

entered into a forward contract to sell 3,000,000 FCU on January 31, 2011 for $1,200,000. Payment

was received from the foreign customer on January 31, 2011. Spot rates on October 1, December 31,

and January 31 were $0.42, $0.425, and $0.435, respectively. Kline amortizes all premiums and

discounts on forward contracts and closes its books on December 31. Required:

Prepare all journal entries relative to the above to be made by Kline during 2010 and 2011.

http://downloadslide.blogspot.com lOMoARcPSD|46958826

12-10 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 12-6

On July 15, Worth, Inc. purchased 88,500,000 yen worth of parts from a Tokyo company paying

20% down, and the balance is due in 90 days. Interest is payable at a rate of 8% on the unpaid

balance. The exchange rate on July 15, was $1.00 = 118 Japanese yen. On October 13, the

exchange rate was $1.00 = 114 Japanese yen. Required:

Prepare journal entries to record the purchase and payment of this foreign currency transaction in U.S. dollars. 12-7

On November 1, 2010, Bisk Corporation, a calendar-year U.S. Corporation, invested in a

speculative contract to purchase 700,000 euros on January 31, 2011, from a German brokerage firm.

Bisk agreed to buy 700,000 euros at a fixed price of $1.46 per euro. The brokerage firm agreed to

send 700,000 euros to Bisk on January 31, 2011. The spot rates for euros are: November 1, 2010 1 euro = 1.45 December 31, 2010 1 euro = 1.43 January 31, 2011 1 euro = 1.44 Required:

Prepare the journal entries that Bisk would record on November 1, December 31, and January 31. 12-8

Consider the following information: 1.

On November 1, 2011, a U.S. firm contracts to sell equipment (with an asking price of

500,000 pesos) in Mexico. The firm will take delivery and will pay for the equipment on February 1, 2012. 2.

On November 1, 2011, the company enters into a forward contract to sell 500,000 pesos

for $0.0948 on February 1, 2012. 3.

Spot rates and the forward rates for February 1, 2012, settlement were as follows (dollars per peso): Forward Rate Spot Rate for 2/1/12 November 1, 2011 $0.0954 $0.0948 Balance sheet date (12/31/11) 0.0949 0.0944 February 1, 2012 0.0947 4.

On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000. Required:

Prepare all journal entries needed on November 1, December 31, and February 1 to account for the forward

contract, the firm commitment, and the transaction to sell the equipment.

http://downloadslide.blogspot.com lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-11

And Hedging Foreign Exchange Risk Short Answer 1.

Accounting for a foreign currency transaction involves the terms measured and denominated. Describe

a foreign currency transaction and distinguish between the terms measured and denominated. 2.

There are a number of business situations in which a firm may acquire a forward exchange contract.

Identify three common situations in which a forward exchange contract can be used as a hedge.

Short Answer Questions from the Textbook 1.

Define currency exchange rates and distinguish between “direct” and “indirect” quotations. 2.

Explain why a firm is exposed to an added risk when it enters into a transaction that is to be settled in a foreign currency. 3.

Name the three stages of concern to the accountant in accounting for import–export transactions.

Briefly explain the accounting for each stage. 4.

How should a transaction gain or loss be reported that is related to an unsettled receivable

recorded when the firm‟s inventory was exported? 5.

A U.S. firm carried a receivable for 100,000 yen. Assuming that the direct exchange rate declined

from $.009 at the date of the transaction to $.006at the balance sheet date, compute the transaction

gain or loss. What balance would be reported for the receivable in the firm‟s balance sheet? 6.

Explain what is meant by the “two-transaction method” in recording exporting or importing

trans-actions. What support is given for this method? 7.

Describe a forward exchange contract. 8.

Explain the effects on income from hedging a foreign currency exposed net asset position or net liability position. 9.

What criteria must be satisfied for a foreign currency transaction to be considered a hedge of an

identifiable foreign currency commitment? 10.

The FASB classifies forward contracts as those acquired for the purpose of hedging and those

acquired for the purpose of speculation. What main differences are there in accounting for these two classifications? 11.

How are foreign currency exchange gains and losses from hedging a forecasted transaction handled? 12.

What is a put option, and how might it be used to hedge a forecasted transaction? 13.

Define a derivative instrument, and describe the keystones identified by the FASB for the ac- counting for such instruments. 14.

Differentiate between forward-based derivatives and option-based derivatives. 15.

List some of the criteria laid out by the FASB that are required for a gain or loss on forecasted trans-

actions (a cash flow hedge) to be excluded from the income statement. If these criteria are satisfied,

http://downloadslide.blogspot.com lOMoARcPSD|46958826

12-12 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition

where are the gains or losses reported, and when (if ever) are they shown in the income statement?

What is the rationale for this treatment?

Business Ethics Question from Textbook

Executive stock options (ESOs) are used to provide incentives for executives to improve company

performance. ESOs are usually granted “at-the-money,” meaning that the exercise price of the options is

set to equal the market price of the underlying stock on the grant date. Clearly, executives would prefer to

be granted options when the stock price (and thus the exercise price) is at its lowest. Backdating options is

the practice of choosing a past date when the market price was particularly low. Backdating has not, in the

past, been illegal if no documents are forged, if communicated to the shareholders, and if properly reflected in earnings and in taxes. 1.

Since backdating gives the executive an “instant” profit, why wouldn‟t the firm simply

grant an option with the exercise price lower than the cur-rent market price? 2.

Suppose the executive was not involved in back-dating the ESOs. Does the executive face any ethical issues?

http://downloadslide.blogspot.com lOMoARcPSD|46958826 Chapter 12

Accounting for Foreign Currency Transactions 12-13

And Hedging Foreign Exchange Risk ANSWER KEY Multiple Choice 1. c 8. b 15. d 22. b 2. b 9. c 16. a 23. c 3. c 10. b 17. b 24. d 4. b 11. d 18. c 25. b 5. d 12. d 19. d 6. c 13. d 20. b 7. d 14. c 21. d Problems 12-1 1.

Dollars received = 600,000 × $1.65 = $990,000 2.

Dollars received = 600,000 × $1.62 = $972,000 3.

Premium on forward contract = ($1.65 - $1.61) × 600,000 = $24,000 4.

2010 transaction gain = ($1.67 - $1.61) × 600,000 = $36,000

2011 transaction loss = ($1.67 - $1.62) × 600,000 = $(30,000) 5.

2010 transaction loss = ($1.67 - $1.61) × 600,000 = ($36,000)

2011 transaction gain = ($1.67 - $1.62) × 600,000 = $30,000 6.

Premium amortized in 2010 = $24,000 × 2/3 = $16,000

Premium amortized in 2011 = $24,000 × 1/3 = $8,000 12-22010

Dec. 1 FC Receivable from Exchange Dealer 448,500

Deferred Transaction Adjustment 17,250

Dollars Payable to Exchange Dealer 431,250

Dec. 31 Deferred Transaction Adjustment 23,000

FC Receivable from Exchange Dealer 23,000 ($0.39 - $0.37) × 1,150,000)

http://downloadslide.blogspot.com lOMoARcPSD|46958826

12-14 Test Bank to accompany Jeter and Chaney Advanced Accounting 3rd Edition 12-2(Continued) 2011

Apr. 1 FC Receivable from Exchange Dealer 17,250

Deferred Transaction Adjustment 17,250

($0.385 - $0.370) × 1,150,000) Investment in Foreign Currency 442,750

FC Receivable from Exchange Dealer 442,750

Dollars Payable to Exchange Dealer 431,250 Cash 431,250 Machine 442,750 Investment in Foreign Currency 442,750

Deferred Transaction Adjustment 11,500 Machine 11,500 12-31. November 1, 2010

Dollars Receivable from Exchange Dealer 123,310

Deferred Transaction Adjustment 912 FC Payable to Exchange Dealer 124,222 ($1.2980 × 95,000 = $123,310)

[($1.3076 - $1.2980) × 95,000 = $912) ($1.3076 × 95,000 = $124,222) 2. December 31, 2010 FC Payable to Exchange Dealer 152

Deferred Transaction Adjustment 152

[($1.3076 - $1.3060) × 95,000 = $152] 3. March 1, 2011 FC Payable to Exchange Dealer 836

Deferred Transaction Adjustment 836

[($1.3060 - $1.2972) × 95,000 = $836] Investment in Foreign Currency 123,234 Sales 123,234 ($1.2972 × 95,000 = $123,234) FC Payable to Exchange Dealer 123,234 Investment in Foreign Currency 123,234 ($1.2972 × 95,000 = $123,234) Cash 123,310

Dollars Receivable from Exchange Dealer 123,310 ($1.2980 × 95,000 = $123,310)

Deferred Transaction Adjustment 76 Sales 76

[($1.2980 - $1.2972) × 95,000 = $76]

http://downloadslide.blogspot.com lOMoARcPSD|46958826

Chapter 12 Accounting for Foreign Currency Transactions 12-15

And Hedging Foreign Exchange Risk 12-4A. October 1 Purchases 540,000 Accounts Payable 540,000 ($0.72 × 750,000 = $540,000)

FC Receivable from Exchange Dealer 540,000 Premium on Forward Contract 22,500

Dollars Payable to Exchange Dealer 562,500 ($0.72 × 750,000 = $540,000)

($0.75 - $0.72) × 750,000 = $22,500) ($0.75 × 750,000 = $562,500) B. December 31 Transaction Loss 7,500 Accounts Payable 7,500

[($0.73 - $0.72) × 750,000 = $7,500]

FC Receivable from Exchange Dealer 7,500 Transaction Gain 7,500

[($0.73 - $0.72) × 750,000 = $7,500] Amortization Expense 16,875 Premium on Forward Contract 16,875

[($0.75 - $0.72) × 750,000 × (3/4) = $16,875] C.

Value of FC receivable – January 31 $0.76 × 750,000 $ 570,000

Carrying value – December 31 547,500 Transaction gain $ 22,500 12-5October 1 Accounts Receivable 1,260,000 Sales 1,260,000

Dollars Receivable from Exchange Dealer 1,200,000 Discount on Forward Contract 60,000 FC Payable to Exchange Dealer 1,260,000 December 31 Accounts Receivable 15,000 Transaction Gain 15,000

(3,000,000 × 0.425) = 1,275,000 – 1,260,000 Transaction 15,000 FC Payable to Exchange Dealer 15,000

Amortization Expense (60,000 × 3/4) 45,000 Discount on Forward Contract 45,000

http://downloadslide.blogspot.com