Preview text:

lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making True/False Questions

1. Sunk costs are costs that have proven to be unproductive. Ans: False AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium

2. All costs are avoidable in a decision except sunk costs and future costs that do

not differ between the alternatives at hand. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

3. Consistency demands that a cost that is relevant in one decision be regarded

as relevant in other decisions as well. Ans: False AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium

4. A cost may be relevant for one decision making situation but irrelevant for another situation. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

5. A future cost that does not vary among alternatives under consideration is irrelevant. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

6. Opportunity costs represent economic benefits that are forgone as a result of

pursuing some course of action. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

7. An existing asset should not be replaced until its original cost has been fully recovered. Ans: False AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-5 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

8. Fixed costs are irrelevant in decisions about whether a product line should be dropped. Ans: False AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Easy

9. In a special order situation, any fixed cost associated with the order would be irrelevant. Ans: False AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 4 Level: Medium

10. When a company has a production constraint, total contribution margin will be

maximized by emphasizing the products with the highest contribution margin per

unit of the constrained resource. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 5 Level: Easy

11. Eliminating nonproductive time is particularly important in a bottleneck operation. Ans: True AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 5 Level: Medium

12. One way to increase the effective utilization of a bottleneck is to reduce the number of defective units. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 5 Level: Easy

13. As a general guide, it is profitable to continue processing joint products after the

split-off point if their total revenues exceed the joint costs. Ans: False AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 6 Level: Medium

14. Joint costs are irrelevant in the decision of whether to sell a joint product at the

split-off point or process it further and then sell it. Ans: True AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 6 Level: Easy 13-6

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

15. A key advantage of using activity-based costing is that any cost that is assigned to

a product is also a relevant cost in any decision involving that product. Ans: False AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

Multiple Choice Questions

16. Costs which can be eliminated in whole or in part if a particular business segment is discontinued are called: A) sunk costs. B) opportunity costs. C) avoidable costs. D) irrelevant costs. Ans: C AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

17. Consider the following statements: I.

Assemble all costs associated with each alternative being considered. II.

Eliminate those costs that are sunk. III.

Eliminate those costs that differ between alternatives.

Which of the above statements does not represent a step in identifying the

relevant costs in a decision problem? A) Only I B) Only II C) Only III D) Only I and III Ans: C AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-7 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

18. Which of the following cash flows is relevant in a decision about accepting

Alternative X or Alternative Y? A)

a cash inflow for Alternative X that is not a cash inflow for Alternative Y. B)

a cash inflow that is lost if Alternative X is accepted and is not lost if Alternative Y is accepted. C)

a cash outflow that is avoided if Alternative X is accepted and is not avoided if Alternative Y is accepted. D) all of the above. Ans: D AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium

19. Which of the following best describes an opportunity cost: A)

it is a relevant cost in decision making, but is not part of the

traditional accounting records. B)

it is not a relevant cost in decision making, but is part of the

traditional accounting records. C)

it is a relevant cost in decision making, and is part of the traditional accounting records. D)

it is not a relevant cost in decision making, and is not part of the

traditional accounting records. Ans: A AACSB: Reflective Thinking AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium Source: CPA, adapted

20. Consider the following statements:

I. A division's net operating income, after deducting both traceable and allocated

common corporate costs, is negative. II.

The division's avoidable fixed costs exceed its contribution margin.

III. The division's traceable fixed costs plus its allocated common corporate costs

exceed its contribution margin.

Which of the above statements give an economic reason for eliminating the division? A) Only I B) Only II C) Only III D) Only I and II Ans: B AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Easy 13-8

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

21. The Jabba Company manufactures the “Snack Buster” which consists of a wooden

snack chip bowl with an attached porcelain dip bowl. Which of the following

would be relevant in Jabba's decision to make the dip bowls or buy them from an outside supplier? Fixed overhead cost The variable that can be eliminated if selling the bowls are purchased cost of the from the outside supplier Snack Buster A) Yes Yes B) Yes No C) No Yes D) No No Ans: B AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 3 Level: Medium

22. The acceptance of a special order will improve overall net operating income so long

as the revenue from the special order exceeds: A)

the contribution margin on the order. B)

the incremental costs associated with the order. C)

the variable costs associated with the order. D)

the sunk costs associated with the order. Ans: B AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 4 Level: Medium

23. Kinsi Corporation manufactures five different products. All five of these products

must pass through a stamping machine in its fabrication department. This machine

is Kinsi's constrained resource. Kinsi would make the most profit if it produces the product that: A)

uses the lowest number of stamping machine hours. B)

generates the highest contribution margin per unit. C)

generates the highest contribution margin ratio. D)

generates the highest contribution margin per stamping machine hour. Ans: D AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 5 Level: Medium

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-9 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

24. In a sell or process further decision, consider the following costs: I.

A variable production cost incurred prior to split-off. II.

A variable production cost incurred after split-off. III.

An avoidable fixed production cost incurred after split-off.

Which of the above costs is (are) not relevant in a decision regarding whether

the product should be processed further? A) Only I B) Only III C) Only I and II D) Only I and III Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 6 Level: Easy

25. Gandy Company has 5,000 obsolete desk lamps that are carried in inventory at a

manufacturing cost of $50,000. If the lamps are reworked for $20,000, they could

be sold for $35,000. Alternatively, the lamps could be sold for $8,000 for scrap. In a

decision model analyzing these alternatives, the sunk cost would be: A) $8,000 B) $15,000 C) $20,000 D) $50,000 Ans: D AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Easy Source: CPA, adapted 13-10

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

26. Hodge Inc. has some material that originally cost $74,600. The material has a

scrap value of $57,400 as is, but if reworked at a cost of $1,500, it could be sold

for $54,400. What would be the incremental effect on the company's overall profit

of reworking and selling the material rather than selling it as is as scrap? A) -$79,100 B) -$21,700 C) -$4,500 D) $52,900 Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Medium Source: CIMA, adapted Solution:

Incremental revenue from reworking ($54,400 − $1,500). $52,900

Less incremental revenue from selling as scrap................ 57,400

Net loss from reworking.................................................... ($ 4,500)

27. Milford Corporation has in stock 16,100 kilograms of material R that it bought five

years ago for $5.75 per kilogram. This raw material was purchased to use in a product

line that has been discontinued. Material R can be sold as is for scrap for $3.91 per

kilogram. An alternative would be to use material R in one of the company's current

products, S88Y, which currently requires 2 kilograms of a raw material that is

available for $7.60 per kilogram. Material R can be modified at a cost of $0.77 per

kilogram so that it can be used as a substitute for this material in the production of

product S88Y. However, after modification, 4 kilograms of material R is required for

every unit of product S88Y that is produced. Milford Corporation has now received a

request from a company that could use material R in its production process. Assuming

that Milford Corporation could use all of its stock of material R to make product

S88Y or the company could sell all of its stock of the material at the current scrap

price of $3.91 per kilogram, what is the minimum acceptable selling price of material

R to the company that could use material R in its own production process? A) $0.88 B) $3.03 C) $4.57 D) $3.91 Ans: D AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-11 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making Solution: Product S88Y: Current cost (2 kg @ $7.60): $15.20

If material R were used, 4 kilograms would be needed. It currently costs $15.20 for

Product S88Y; to maintain this same cost, material R would need to cost $3.03 per

kilogram [($15.20 ÷ 4 kg) − $0.77]. The company should sell material R for $3.91 per kilogram.

28. Otool Inc. is considering using stocks of an old raw material in a special project. The

special project would require all 240 kilograms of the raw material that are in stock

and that originally cost the company $2,112 in total. If the company were to buy new

supplies of this raw material on the open market, it would cost $9.25 per kilogram.

However, the company has no other use for this raw material and would sell it at the

discounted price of $8.35 per kilogram if it were not used in the special project. The

sale of the raw material would involve delivery to the purchaser at a total cost of

$71.00 for all 240 kilograms. What is the relevant cost of the 240 kilograms of the

raw material when deciding whether to proceed with the special project? A) $1,933 B) $2,004 C) $2,220 D) $2,112 Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted Solution:

Opportunity cost of sales foregone if special project is

undertaken ($8.35 × 240)..................................................................$2,004

Less: delivery cost............................................................................................71

Relevant cost of 240 kilograms of raw material.............................$1,933 13-12

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

29. Hamby Corporation is preparing a bid for a special order that would require 780 liters

of material W34C. The company already has 640 liters of this raw material in stock

that originally cost $8.30 per liter. Material W34C is used in the company's main

product and is replenished on a periodic basis. The resale value of the existing stock

of the material is $7.60 per liter. New stocks of the material can be readily purchased

for $8.35 per liter. What is the relevant cost of the 780 liters of the raw material when

deciding how much to bid on the special order? A) $6,481 B) $6,376 C) $6,513 D) $5,928 Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted Solution:

Relevant cost = $8.35 per liter × 780 liters = $6,513

30. Schickel Inc. regularly uses material B39U and currently has in stock 460 liters of the

material for which it paid $3,128 several weeks ago. If this were to be sold as is on

the open market as surplus material, it would fetch $5.95 per liter. New stocks of the

material can be purchased on the open market for $6.45 per liter, but it must be

purchased in lots of 1,000 liters. You have been asked to determine the relevant cost

of 760 liters of the material to be used in a job for a customer. The relevant cost of the

760 liters of material B39U is: A) $4,902 B) $4,672 C) $4,522 D) $6,450 Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted Solution:

Relevant cost = $6.45 per liter × 760 liters = $4,902

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-13 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

31. Munafo Corporation is a specialty component manufacturer with idle capacity.

Management would like to use its extra capacity to generate additional profits. A potential

customer has offered to buy 6,500 units of component VGI. Each unit of VGI requires 1

unit of material I57 and 5 units of material M97. Data concerning these two materials follow: Current Original Market Disposal Units in Cost Per Price Value Material Stock Unit Per Unit Per Unit I57........ 2,400 $9.10 $9.40 $8.95 M97...... 33,960 $4.70 $4.70 $3.50

Material I57 is in use in many of the company's products and is routinely

replenished. Material M97 is no longer used by the company in any of its normal

products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials, in total, for purposes of

determining a minimum acceptable price for the order for product VGI? A) $174,850 B) $213,130 C) $213,850 D) $171,925 Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted Solution: # Required Relevant Material per unit price Total I57................ 1 × $9.40 = $ 9.40 M97.............. 5 × $3.50 = 17.50

Total per unit relevant cost...................... $26.90

Minimum acceptable price for 6,500 units of VGI

= $26.90 per unit × 6,500 units = $174,850 13-14

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

32. Winder Corporation is a specialty component manufacturer with idle capacity.

Management would like to use its extra capacity to generate additional profits. A

potential customer has offered to buy 3,000 units of component QEA. Each unit of

QEA requires 5 units of material F85 and 5 units of material E71. Data concerning these two materials follow: Original Current Disposal Units in Cost Per Market Price Value Per Material Stock Unit Per Unit Unit F85............. 740 $4.90 $4.75 $4.20 E71............. 13,680 $5.00 $4.70 $3.60

Material F85 is in use in many of the company's products and is routinely

replenished. Material E71 is no longer used by the company in any of its normal

products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials, in total, for purposes of

determining a minimum acceptable price for the order for product QEA? A) $126,702 B) $141,750 C) $126,295 D) $145,965 Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 1 Level: Hard Source: CIMA, adapted Solution: # of units to purchase on Relevant Total needed Inventory market price Total cost (3,000 × 5) = F85............. 15,000 15,000 $4.75 $ 71,250 (3,000 × 5) = (15,000 − E71............. 15,000 13,680) = 1,320 $4.70 6,204 13,680 $3.60 49,248

Minimum acceptable price for 3,000 units of QEA........... $ 126,702

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-15 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

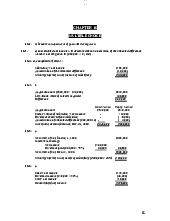

33. Rice Corporation currently operates two divisions which had operating results last year as follows: West Troy Division Division

Sales........................................................... $600,000 $300,000

Variable costs............................................. 310,000 200,000

Contribution margin................................... 290,000 100,000

Traceable fixed costs.................................. 110,000 70,000

Allocated common corporate costs............ 90,000 45,000

Net operating income (loss)....................... $ 90,000 ($ 15,000)

Since the Troy Division also sustained an operating loss in the prior year, Rice's

president is considering the elimination of this division. Troy Division's traceable

fixed costs could be avoided if the division were eliminated. The total common

corporate costs would be unaffected by the decision. If the Troy Division had been

eliminated at the beginning of last year, Rice Corporation's operating income for last year would have been: A) $15,000 higher B) $30,000 lower C) $45,000 lower D) $60,000 higher

Ans: B AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Medium Source: CPA, adapted Solution: Troy Division:

Contribution margin........................................................... $ 100,000

Less: traceable fixed costs................................................. 70,000

Segment margin of Troy Division...................................... $ 30,000

Rice Corporation’s operating income would have been $30,000 less without

the segment margin contributed by the Troy Division. 13-16

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

34. Beaver Company (a multi-product firm) produces 5,000 units of Product X each

year. Each unit of Product X sells for $8 and has a contribution margin of $5. If

Product X is discontinued, $18,000 of fixed overhead would be eliminated. As a

result of discontinuing Product X, the company's overall operating income would: A) decrease by $25,000 B) increase by $43,000 C) decrease by $7,000 D) increase by $7,000

Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Medium Solution:

Fixed overhead savings if Product X is eliminated ........... $ 18,000

Less: contribution margin lost if Product X is

discontinued ($5 × 5,000)............................................... 25,000

Decrease in overall operating income if Product X is

eliminated....................................................................... ($ 7,000)

35. Milli Company plans to discontinue a division that generates a total contribution

margin of $20,000 per year. Fixed overhead associated with this division is

$50,000, of which $5,000 cannot be eliminated. The effect of this discontinuance

on Milli's operating income would be an increase of: A) $5,000 B) $20,000 C) $25,000 D) $30,000 Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Medium Source: CPA, adapted Solution:

Fixed overhead savings if division is discontinued........... $45,000

Less: contribution margin lost if division is eliminated..... 20,000

Increase in operating income if division is eliminated...... $25,000

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-17 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

36. ABD Realty manages five apartment complexes in its region. Shown below

are summary income statements for each apartment complex: U V W X Y Rental income........... $1,000 $1,210 $2,347 $1,878 $1,065 Expenses................... 800 1,300 2,600 2,400 1,300 Operating income...... $ 200 ($ 90) ($ 253) ($ 522) ($ 235)

Included in the expenses is $1,200 of common corporate expenses that have been

allocated to the apartment complexes based on rental income. These common

corporate expenses would have to be incurred regardless of how many apartment

complexes ABD Realty manages. The apartment complex(es) that ABD Realty

should consider dropping is (are): A) V,W,X,Y B) W,X,Y C) X, Y D) X Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Hard Source: CMA, adapted Solution:

Total rental income = $1,000 + $1,210 + $2,347 + $1,878 + $1,065 = $7,500 U V W X Y Rental income........... $1,000 $1,210 $2,347 $1,878 $1,065 Less expenses............ 800 1,300 2,600 2,400 1,300 Add back proportional share of common expenses [(Rental income in each column ÷ Total rental income of $7,500) × $1,200]* 160 194 376 300 170 Apartment complex margin $ 360 $ 104 $ 123 ($222) ($ 65)

*expenses rounded to nearest whole dollar

Since complexes X and Y have negative margins, ABD Realty should

consider dropping those two divisions. 13-18

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

37. The following information relates to next year's projected operating results of

the Children's Division of Grunge Clothing Corporation: Contribution margin........... $200,000

Fixed expenses................... 500,000

Net operating loss.............. ($300,000)

If Children's Division is dropped, half of the fixed costs above can be eliminated.

What will be the effect on Grunge's profit next year if Children's Division is dropped instead of being kept? A) $50,000 increase B) $250,000 increase C) $250,000 decrease D) $550,000 increase Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Medium Solution: Keep the Drop the Division Division Difference

Contribution margin....................... $200,000 $ 0 ($200,000)

Fixed expenses.... . . . . . . . . . . . . . 500,000 250,000 250,000

Net operating income (loss). . . . . . ($300,000) ($250,000) ($ 50,000)

Net operating income would increase by $50,000 if the Children’s Division

were dropped. Therefore, the division should be dropped.

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-19 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

38. The management of Furrow Corporation is considering dropping product L07E.

Data from the company's accounting system appear below:

Sales....................................................................... $830,000

Variable expenses................................................... $365,000

Fixed manufacturing expenses............................... $291,000

Fixed selling and administrative expenses............. $166,000

In the company's accounting system all fixed expenses of the company are fully

allocated to products. Further investigation has revealed that $186,000 of the fixed

manufacturing expenses and $106,000 of the fixed selling and administrative

expenses are avoidable if product L07E is discontinued. What would be the effect on

the company's overall net operating income if product L07E were dropped? A)

Overall net operating income would increase by $8,000. B)

Overall net operating income would decrease by $173,000. C)

Overall net operating income would decrease by $8,000. D)

Overall net operating income would increase by $173,000.

Ans: B AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Easy Solution: Keep the Drop the Product Product Difference

Sales............................................... $830,000 $ 0 ($830,000)

Variable expenses........................... 365,000 0 365,000

Contribution margin....................... 465,000 0 (465,000) Fixed expenses:

Fixed manufacturing expenses.... 291,000 *105,000 186,000

Fixed selling and administrative

expenses.................................. 166,000 **60,000 106,000

Total fixed expenses....................... 457,000 165,000 292,000

Net operating income (loss)........... $ 8,000 ($165,000) ($173,000)

Net operating income would decline by $173,000 if product L07E were dropped.

Therefore, the product should not be dropped.

*$291,000 − $186,000 = $105,000

**$166,000 − $106,000 = $60,000 13-20

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

39. Product U23N has been considered a drag on profits at Jinkerson Corporation for

some time and management is considering discontinuing the product altogether.

Data from the company's accounting system appear below:

Sales....................................................................... $730,000

Variable expenses................................................... $350,000

Fixed manufacturing expenses............................... $234,000

Fixed selling and administrative expenses............. $161,000

In the company's accounting system all fixed expenses of the company are fully

allocated to products. Further investigation has revealed that $144,000 of the fixed

manufacturing expenses and $93,000 of the fixed selling and administrative

expenses are avoidable if product U23N is discontinued. What would be the effect

on the company's overall net operating income if product U23N were dropped? A)

Overall net operating income would increase by $15,000. B)

Overall net operating income would increase by $143,000. C)

Overall net operating income would decrease by $143,000. D)

Overall net operating income would decrease by $15,000.

Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 2 Level: Easy Solution: Keep the Drop the Product Product Difference

Sales............................................... $730,000 $ 0 ($730,000)

Variable expenses........................... 350,000 0 350,000

Contribution margin....................... 380,000 0 ( 380,000) Fixed expenses:

Fixed manufacturing expenses.... 234,000 *90,000 144,000

Fixed selling and administrative

expenses.................................. 161,000 **68,000 93,000

Total fixed expenses....................... 395,000 158,000 237,000

Net operating income (loss)........... ($ 15,000) ($ 158,000) ($143,000)

Net operating income would decline by $143,000 if product U23N were dropped.

Therefore, the product should not be dropped.

*$234,000 − $144,000 = $90,000

**$161,000 − $93,000 = $68,000

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-21 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

40. Supler Company produces a part used in the manufacture of one of its products.

The unit product cost is $18, computed as follows:

Direct materials.......................................................$ 8

Direct labor..................................................................4

Variable manufacturing overhead.........................1

Fixed manufacturing overhead...............................5

Unit product cost...................................................$18

An outside supplier has offered to provide the annual requirement of 4,000 of the

parts for only $14 each. It is estimated that 60 percent of the fixed overhead cost

above could be eliminated if the parts are purchased from the outside supplier. Based

on these data, the per-unit dollar advantage or disadvantage of purchasing from the outside supplier would be: A) $1 disadvantage B) $1 advantage C) $2 advantage D) $4 disadvantage Ans: C AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 3 Level: Medium Solution: Relevant cost per unit:

Direct materials................................................ $ 8

Direct labor...................................................... 4

Variable manufacturing overhead.................... 1

Fixed manufacturing overhead ($5 × 0.60)..... 3

Relevant manufacturing cost........................... $16 Net advantage (disadvantage):

Relevant manufacturing cost savings......... $16

Less: cost from outside supplier................ 14

Net advantage............................................. $ 2 13-22

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

41. Sharp Company produces 8,000 parts each year, which are used in the production

of one of its products. The unit product cost of a part is $36, computed as follows:

Variable production costs...............$16

Fixed production costs.......................20

Unit product cost...............................$36

The parts can be purchased from an outside supplier for only $28 each. The space in

which the parts are now produced would be idle and fixed production costs would be

reduced by one-fourth. If the parts are purchased from the outside supplier, the

annual impact on the company's operating income will be: A) $24,000 increase B) $24,000 decrease C) $56,000 increase D) $56,000 decrease

Ans: D AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 3 Level: Medium Solution: Relevant cost per unit:

Variable production costs................................. $16

Fixed manufacturing overhead ($20 × 0.25)... 5

Relevant manufacturing cost........................... $21

Relevant manufacturing cost savings ($21 × 8,000)............ $168,000

Less: cost to purchase from outside supplier ($28 × 8,000). 224,000

Net disadvantage of purchasing from outside supplier......... ($ 56,000)

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition 13-23 lOMoARcPSD|46958826

Chapter 13 Relevant Costs for Decision Making

42. Motor Company manufactures 10,000 units of Part M-l each year for use in

its production. The following total costs were reported last year:

Direct materials.......................................... $ 20,000

Direct labor................................................ 55,000

Variable manufacturing overhead.............. 45,000

Fixed manufacturing overhead.................. 70,000

Total manufacturing cost............................ $190,000

Valve Company has offered to sell Motor 10,000 units of Part M-l for $18 per unit. If

Motor accepts the offer, some of the facilities presently used to manufacture Part M-l

could be rented to a third party at an annual rental of $15,000. Additionally, $4 per

unit of the fixed overhead applied to Part M-l would be totally eliminated. Should

Motor Company accept Valve Company's offer, and why? A)

No, because it would be $5,000 cheaper to make the part. B)

Yes, because it would be $10,000 cheaper to buy the part. C)

No, because it would be $15,000 cheaper to make the part. D)

Yes, because it would be $25,000 cheaper to buy the part. Ans: A AACSB: Analytic AICPA BB: Critical Thinking

AICPA FN: Decision Making; Reporting LO: 3 Level: Hard Source: CPA, adapted Solution:

Relevant cost of manufacturing:

Direct materials...................................................... $ 20,000

Direct labor............................................................ 55,000

Variable manufacturing overhead.......................... 45,000

Fixed manufacturing overhead ($4 × 10,000)....... 40,000

Relevant manufacturing cost................................. $160,000 Net advantage (disadvantage):

Relevant manufacturing cost savings............ $160,000

Annual rental of manufacturing facilities

given up if manufacture Part M-1............. 15,000

Cost of purchasing the part ($18 × 10,000). . ( 180,000)

Net disadvantage of purchasing part M-1..... ($ 5,000) 13-24

Garrison/Noreen/Brewer, Managerial Accounting, Twelfth Edition