Preview text:

lOMoARcPSD|47206417

VIETNAM NATIONAL UNIVERSITY HCMC

INTERNATIONAL UNIVERSITY SCHOOL OF BUSINESS [

The USA Economic Policy during the Covid-19 Pandemic Lecturer: Cao Minh Man

Group Members Trinh Ngoc Nhan BABAAU19016 Pham Le Bao Tran BABAAU19009 Nguyen Duc Nha CECEIU18081 Do Ngoc Huong BABAIU19200 Le Quan Hung BABAIU19196 Ly Phuong Thanh BABAIU18187 1 Contents I.

Introduction ..................................................................3 II.

Body..............................................................................4 1.

Overview...................................................................4

2. The economic policy ................................................6

a) Monetary Policy....................................................6

b)Fiscal Policy .......................................................11 Conclusion 1 III. I. Introduction

In the past few months, the world has been confronting a serious pandemic called Covid-19. This

pandemic has led to nearly 450,000 deaths (updated on June 15th 2020). It started from Wuhan; China in

December 2020 then spread to 215 countries or regions (including 2 cruise ships) around the world.

Coronavirus disease transmits primarily through droplets of saliva or discharge from the nose when an

infected person coughs or sneeze. Covid-19 is now a global pandemic, therefore, the implementation of

widespread restrictions on social contact to stop the spread of the virus has been announced. Since then,

global stock markets have suffered dramatic falls due to the outbreak. The economic damage caused by

the COVID-19 pandemic is largely driven by a drop in demand, meaning that goods and services

consumption, hospitality and tourism have been frozen. To slow down the spread of the virus, many

countries have closed their borders and restricted travelling ... This reduction in consumer demand causes

airlines to lose planned revenue, their expenses need to be cut down by decreasing the number of flights

they operate. The same dynamic applies to other industries, for example with falling demand for oil and

new cars as daily commutes, social events and holidays are no longer possible. As companies start to lay

off staffs to make up for lost revenue, the new number of unemployed workers might result in an

economic downfall. Not only has the Covid-19 affected the world economy but this outbreak also 2

impacts on all segments of the population. Social groups that are most likely to be vulnerable in this

pandemic include the poor, the elderly, the disabled, youngsters and native people. To those who are

homeless, they may be unable to be safely sheltered and easily facing the massive invasion of

coronavirus, the whole world is suffering not only health catastrophe but also economic crisis, even the

most developed country – the U.S., cannot escape from this “game”. II. Body Overview

As the coronavirus (COVID-19) spreads through America’s biggest cities, its effect is being felt far

beyond the over 2 million Americans who are confirmed infected. The quarantines and lockdowns that

are needed to fight the virus’s spread are freezing the economy.

To understand how COVID-19 impacts the economy, consider its effect on different industries.

Firstly, look at the Gross Domestic Product (GDP) of the USA. Consumption accounts for 70% of the

GDP; however, businesses have to close, which shut down all consumers’ activities. According to the

Congressional Budget Office (CBO), COVID-19 pandemic would reduce the scale of economic output

by approximately $7.900 billion in the next decade in real term, 3% of GDP.

Investment which occupied for 20% of GDP, has stopped because investors want to wait for clarity on

the full cost of COVID-19. It is not until quarantines are lifted that all entertainment businesses can open

back, but at the moment, they are still struggling with the complicated situation of the pandemic, which

is the obstacle for gaining profit. Global supply chain is frozen, which affects manufacturing seriously

since this industry makes up 11% of the U.S ’s GDP. The stock market has rallied through April and

large parts of May, recovering much of the losses incurred in the early weeks of the pandemic. 3

Figure 1: On Wednesday, Nasdaq,

S&P 500 and Dow Jones, closed at

10,020, 3,190 and 26,990 points,

respectively, up 43, 45 and 46 percent

from their March troughs. While the

latter two are still slightly in the red for

the whole of 2020, the tech-heavy

Nasdaq moved into positive territory in

early May and climbed to a new alltime high in the beginning of June.

As the pandemic continues raging, companies have no choice but lay off so as to reduce the payroll

since their revenue slumps rapidly. The US economy lost 20.5 million jobs in April, the Bureau of

Labor Statistics reported. Those losses follow steep cutbacks in March as well, when employers

slashed 870,000 jobs. Those two months amount to layoffs so severe, they more than double the 8.7

million jobs lost during the financial crisis. The U.S. Congress has passed a massive stimulus bill that

provides for hundreds of billions in new spending, expanding unemployment insurance and providing

a cash handout to low and middle-income Americans, which should help laid off workers make ends 4

meet until the economy begins to recover. the coronavirus pandemic stings not only because of the

public health crisis it has inflicted — but also because it wiped out nearly that whole decade of job

gains in just two months. Unemployment is shooting up far faster than it did during the 2008

recession, a sign the economy is headed toward recession.

In that mess, the U.S. has made a great effort to bring back everything, among hundreds of solutions

have been applied, the two policies: Monetary and Fiscal are considered to be outstanding moves and

appropriate choices for its economy to recovery. Monetary Policy

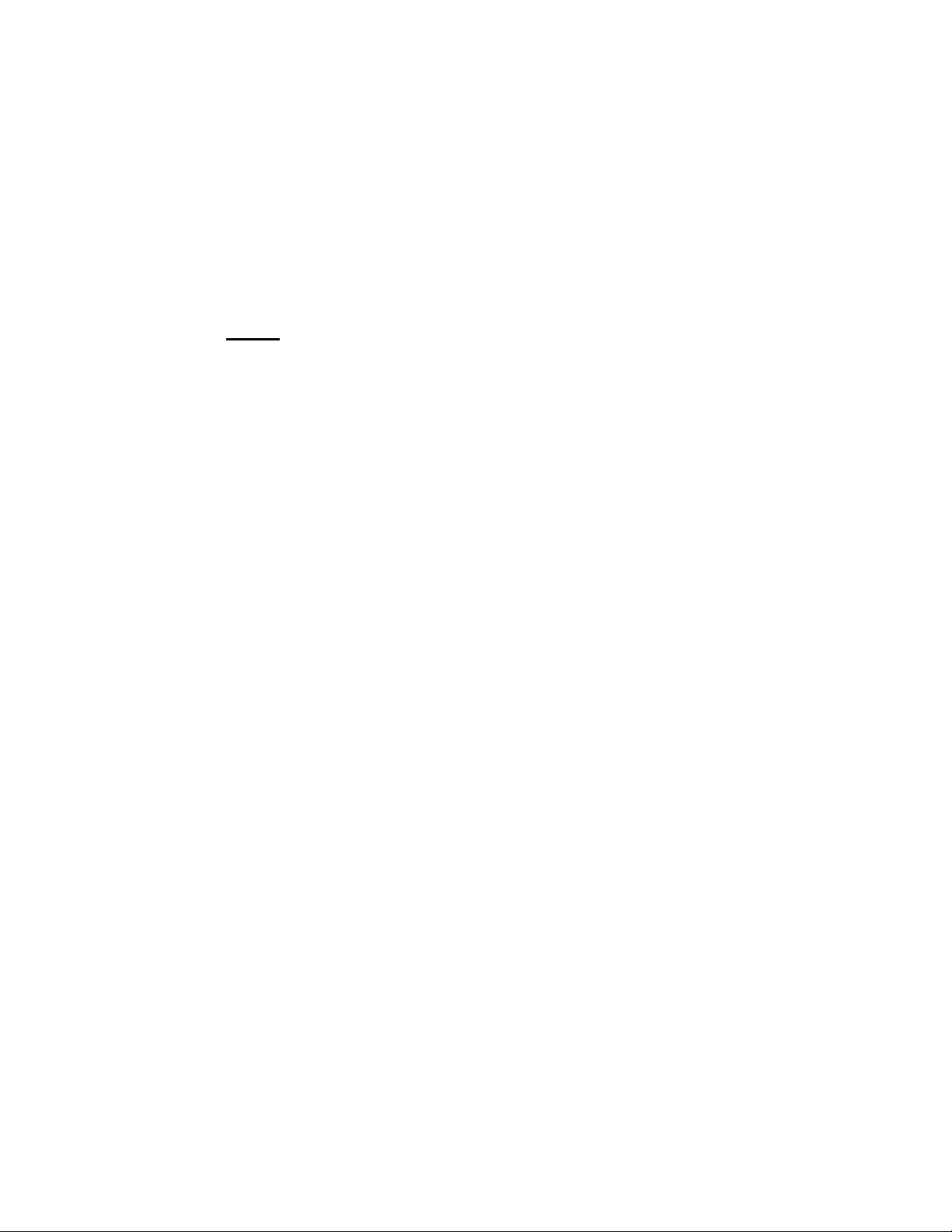

The Fed's stimulus of monetary policy is achieved through 3 main channels: interest rate cuts,

loans and asset purchases, and regulation changes. The first two operations (Interest rate cuts, loans and

asset purchases) are the two main ways that Fed can actively control the money supply.

The Fed cut its benchmark interest rate, the fed funds rate, twice during March 2020, once by 0.50% and

a second time by 1.00%. This lowered the fed funds rate, which is expressed as a range, from 1.50%-

1.75% to 0.00%-0.25%. This is notable because the Fed hadn’t moved interest rates in increments greater

than 0.25% since it cut them during the Great Recession. On March 15, 2020, the Fed also cut its

"discount rate," another key interest rate, by 1.5%, down to 0.25%. Lower Interest rate is one of the

strongest methods in macroeconomic to control the money supply. By far, lower interest rate would help

one country’s money supply to increase in a short amount of time without the time lag from the market.

This would stimulate the firm to maintain not only one ‘s original businesses but also help to open and

expand its manufacture of medical products which help to fight the corona virus.

Loans and asset purchase intervention from Fed was more extensive, covering a wide array of

programs. The simplest asset purchasing program is the quantitative easing (QE) program, in which the 5

Figure 2 : Fed rate moves

Fed directly buys assets like U.S. Treasurys and mortgage-backed securities (MBS). Treasurys are the

US Treasury securities which are government debt instruments issued by the United States

Department of the Treasury. The Fed, which originally created the program during the Great

Recession, restarted it on March 15, 2020. The scale of the program is currently open-ended, with the

Fed saying it will buy "in the amounts needed to support the smooth functioning of markets." Moreover,

these operations have been used in rough time recession such as the 2008 stock market crash.

The main goal of Fed ‘s large scale open market operation is to increase the economy money

supply which stimulus the economy. The Fed enormously expanded its repo operations on March 12,

2020, by $1.5 trillion dollars, then adding another $500 billion on March 16, to ensure there was enough

liquidity in the money markets. Repo operations effectively allow the Federal Reserve loan money to

banks, by purchasing treasurys from them, and selling them back to the banks later. As we all know, it

is necessary that the bank must have enough liquidity to support its institution. The Flow of the market

would be interrupted, causing a market fall out likewise a domino effect. In case of the bank ‘s failure

to lend, the Fed will function itself to act as a general lender in a market.

Besides direct asset purchases, the Fed set up several programs that opened new, specific lines

of credit to financial institutions. These methods would have a time delays effect in comparison to direct

lower interest rate and direct asset purchases; however, it might look to have an indirect effect to the

economy, it is still a direct way to get the capital the one who are hurt the most financially in the

pandemic crisis. On March 20, 2020, the Fed relaunched a Great Recession-era program, the Primary

Dealer Credit Facility (PDCF), which will give loans to primary dealers backed by muni bonds or

corporate bonds as collateral. There is no set limit to the amount of credit it will issue, but it will only

run for 6 months unless it is extended. If the pandemic tends to draw out longer than which the market

can sustain, the Fed will have to reissue this program.

To add more liquidity to money markets, the Fed launched the Money Market Mutual Fund

Liquidity Facility (MMLF) on March 18, 2020. This program lends money to financial institutions so 6

they can buy money market mutual funds. The MMLF is similar to the AMLF program launched in 2008

after the collapse of Lehman Brothers caused a major money market fund to fail. The program does not

have a specific lending limit but is currently scheduled to end on Sept. 30, 2020. The treasury department

gave the MMLF $10 billion of debt credit protection for the program. On June 5, 2020, the Federal

Reserve said that participation in the MMLF wouldn't affect the liquidity coverage ratio of participating

banks. On a large scale of thing, MMLF program would help to provide more money supply to the

market, helping with the economy ‘s current shortage of money supply.

To help small businesses, in concert with the CARES Act, the Fed launched the Paycheck

Protection Program Lending Facility (PPPLF) on April 9, 2020. This program lends money to banks so

that they can, in turn, lend money to small businesses through the Paycheck Protection Program. On

April 30, 2020, the program was expanded the types of lenders who can participate in the program. There

is no current limit to the amount of credit that can be extended through the program, but it will stop

extending credit to the program on Sept. 30, 2020. On June 5, 2020, the Federal Reserve said that

participation in the PPPLF wouldn't affect the liquidity coverage ratio of participating banks. This

announcement from the Fed, however, is just a way to maintain the market situation. PPPLF would affect

the liquidity coverage ratio in the short-term when the program is still in place. The Fed only act as the

final lender for the market so that it would lift off the current heavy burdens on other Banking institutions.

The Fed created several new programs that establish legal entities known as, special purpose

vehicles, to make specific loans or purchase assets indirectly. On March 17, 2020, the Fed established

the Commercial Paper Funding Facility (CPFF), which purchases short-term debt known as commercial

paper to ensure those markets stay liquid. On March 23, 2020, the Fed broadened the variety of

commercial paper it would lower the pricing of the debt it buys. This is actually a relaunch of a program

begun during the Great Recession, when many businesses were hurt as liquidity in the commercial paper

markets dried up. While it has no set limit on the amount it will purchase, the CPFF will stop purchasing 7

debt on March 17, 2021, and the SPV will continue to be funded until its assets mature. The Treasury

Department made a $10 billion equity investment in the CPFF from its Exchange Stabilization fund.

On March 23, 2020, the Fed created the Primary Market Corporate Credit Facility (PMCCF) to

buy corporate bonds to ensure corporations can get credit. At the same time, it created the related

Secondary Market Corporate Credit Facility (SMCCF), which buys up corporate bonds and bond ETFs

on the secondary market. The combined purchase limit for the programs is $750 billion, up from an

initially $200 billion. The Treasury Department contributed a total of $75 billion in initial capital to these

two programs from the ESF, $50 billion for the PMCCF, and $25 billion for the SMCCF. The premise

is that this program makes banks more willing to lend to corporations, because they know that they can

sell the loans to the Fed. Both programs will stop purchasing bonds on Sept. 30, 2020, and they will

continue to be funded until their holdings are sold or mature.

Also, on March 23, the Fed resurrected an old program from the Great Recession, the Term Asset-

Back Securities Loan Facility (TALF). It will make up to $100 in loans to companies and takes asset-

backed securities (ABS) as collateral. This includes a variety of securities, such as those based on auto

loans, commercial mortgages, or student loans. The Federal Reserve expanded the types of ABS that

could be purchased on April 9, 2020. The Treasury Department’s ESF will make a $10 billion initial

equity investment in the SPV. It will stop extending credit on Sept. 30, 2020.

On April 9, 2020, the Fed announced the Main Street Lending Program, which sets up an SPV

that will purchase up to $600 billion in small and medium-sized business loans. The Fed will only

purchase a 95% stake of each loan, with the bank keeping 5%. To qualify, businesses need to have 10,000

or fewer employees or have $2.5 billion or less in 2019 revenue. It will purchase stakes in both new

loans and loan extensions, and under the CARES Act, the Treasury Department will make a $75 billion

equity investment in the SPV. On April 30, 2020, the Main Street Lending Program was expanded in

several ways. The number of maximum employees was raised to 15,000 or fewer, and the annual revenue

was $5 billion or less. The minimum loan size was lowered to $500,000, and a third type of loan was 8

added allowing the Fed to purchase 85% of loans to more heavily leveraged companies. It will continue

to purchase stakes in loans until Sept. 30, 2020, and it will continue to be funded until its assets mature or are sold.

Also, on April 9, 2020, the Fed announced the Municipal Liquidity Facility (MLF), which will

purchase up to $500 billions of short-term notes issued by U.S. States (and D.C.), counties with at least

2 million people and cities with at least 1 million. On April 27th, the population required to receive aid

was lowered to 500,000 people for counties, and 250,000 people for cities. The April 27 change also

changed raised the maturity limit on eligible securities from 24 months to 36 and allowed Multi-State

Entities to sell bonds to the facility. On June 3, 2020, the facility was broadened further to allow smaller

states to designate their most populous city and/or county to eligible for the facility even if they don't

meet the population requirements. In addition, each state can designate two "revenue bond issuers", such

as airports or utilities, that can also sell bonds to the facility. Under the CAREs Act, the Treasury

Department will make an initial equity investment of $35 billion to the SPV. It will stop purchasing notes

on Dec. 31, 2020, and the Fed will continue to fund it until its assets mature or are sold.

Overall, in the grand scale of thing, the Fed ‘s goal is to stabilize and stimulus the economy.

Through various monetary policies listed above, what Fed trying to do is to increase the US ‘s money

supply. With the enough amount of capital, it helps to speed up the economy in a “bear market” slow

down out. Pandemic like this bring a decrease in the market capital. Investors are moving their capital

out of the system since it is risky to invest in an unknown outcome of the pandemic. Therefore, the value

of such the infamous haven for investors like Gold (from $1462/ounce pre-Covid to $1730/ounce

current) and the Japanese Yen (¥) has been on the rise shortly after the Fed announced its interest rate

cut. In the time like this, Government bailout which in specifically the Fed will function as the role of

the final lender to the market. US economy has been going through a rough time even before the

pandemic, US – China trade war has brought both countries severe financial wounds pre-pandemic. The 9

situation turns more challenging as the two superpowers ‘s leader tends to have a bad relationship.

Therefore, the Fed and the US Department of Treasury are trying their best to handle this economic

disaster which originated from the Covid-19 pandemic. Too little stimulus would cause the market to

collapse and too much stimulus would be risky for the long-term future market. Fiscal Policy

The first package

Besides the Monetary Policy, throughout March and April 2020, the U.S. government has

implemented three main relief packages and one supplemental, totaling nearly $2.8 trillion.

The first relief package, the Coronavirus Preparedness and Response Supplemental Appropriations Act,

2020, was signed into law on March 6, 2020. It allocated $8.3 billion to do the following: •

More than $3 billion is used for investigating and developing the new type of vaccine and the medical system. •

$ 2.2 billion is given to state and local governments to resist the Covid-19 pandemic spreading •

$1.25 billion is allocated to help with efforts to stop the international virus's spread The

second relief package, the Families First Coronavirus Response Act (FFCRA) or Phase Two, was

signed into law on March 18, 2020 and last until the next decade. It allocated $192 billion in relief

and included the following provisions. They focus on providing the nutrition assistance, paid sick

leave, enhanced unemployment insurance coverage, free coronavirus testing, and increased federal Medicaid funding. •

Providing money for families who rely on free school lunches and an allowance to

households normally eligible for free or reduced breakfast or lunch if the child's school has been closed due to COVID-19. 10 •

Mandate companies with fewer than 500 employees provide paid sick leave for these

suffering from COVID-19, as well as providing a tax credit to help employers cover those costs. For

example, government require firms with fewer than 500 employees grant up to an additional 12

weeks of expanded family and medical leave with 10 of those weeks paid at two-thirds the

employee’s regular rate of pay if the employee is unable to work (including telework) to care for

a child whose school or childcare provider is closed due to COVID-19. •

Nearly $1 billion in additional unemployment insurance money for states, as well as loans

to states to fund unemployment insurance. States with high unemployment and workers who have

exhausted benefits already receive additional funding. Moreover, they have authority to access to

the interest-free loan to help an unemployment through December 31, 2020. •

Including the provisions to make free-testing for Covid-19 available for everybody. The

legislation also provides a temporary 6.2% increase in Medicaid payment.

The third, and by far the largest, relief package was signed into law on March 27, 2020. By nominal

dollar amount, it is the largest single relief package in U.S. history. This law, called the Coronavirus Aid,

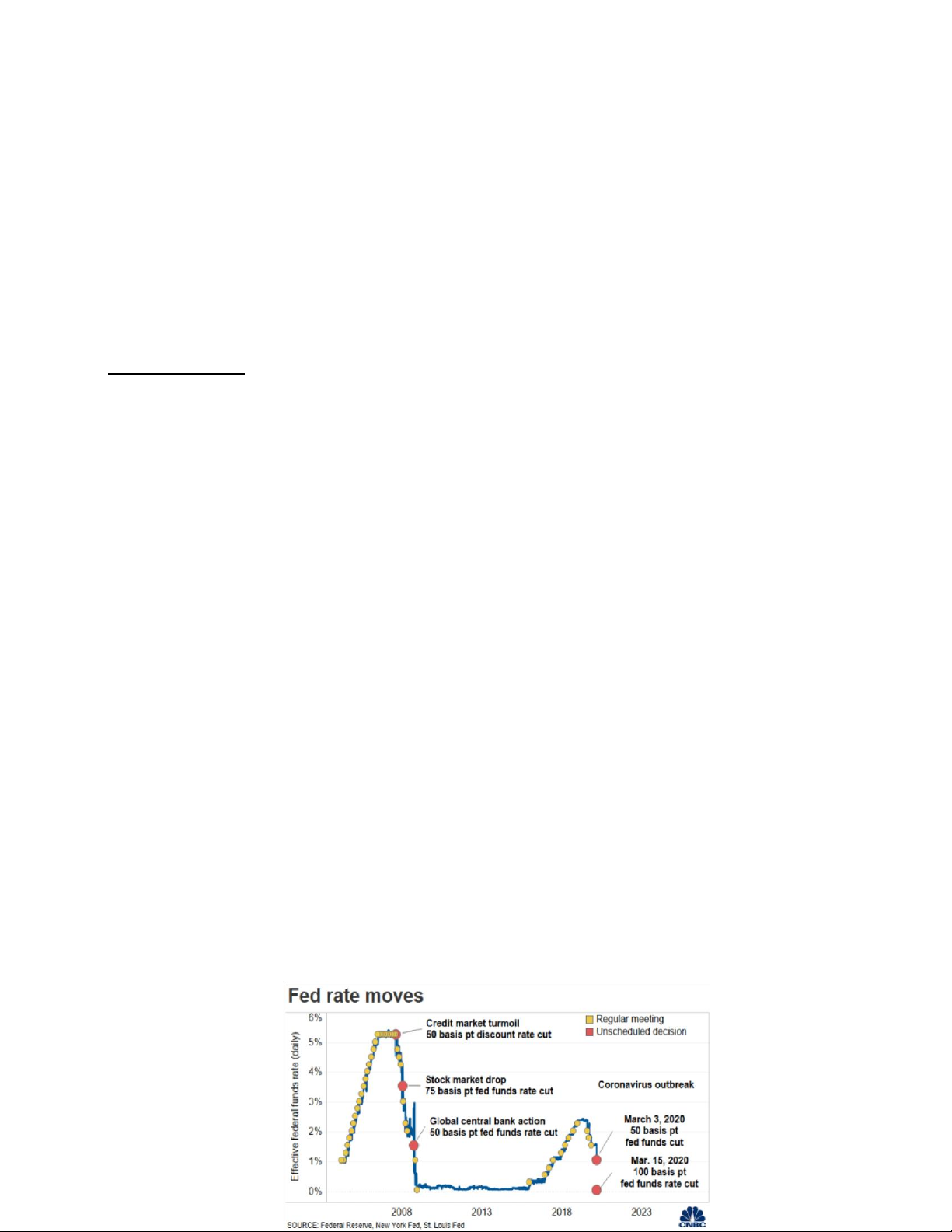

Relief, and Economic Security Act and nicknamed the CARES Act or Phase 3, appropriated $2.3 trillion for many different efforts:

Figure 3: The percentages of spending in the CARES Act 11 •

Each US individual receives a refundable tax credit up to $ 1,200, while children will

receive $500. The value of the check will decrease if the individual has an annual income of more

than $ 75,000 (or $ 150,000 for the couple). The amount received will be based on the individual's

2019 income (or 2018 if tax returns have not been completed). •

Additional $600 of unemployment per week until July 31, 2020 •

Allow people to take special disbursements and loans from tax-advantaged retirement

funds of up to $100,000 without facing a tax penalty. They must repay the distribution in the next 3 years. •

Mortgage forbearance for federally backed mortgages for 180 days •

$500 billion in government lending to companies affected by the pandemic. This amount

of money will be used in providing liquidity to the hardest hit business and industries such as $25

billion for passenger airlines, $4 billion for air cargo carriers, and $17 billion for businesses deemed

critical to national security. The remaining $454 billion is allocated toward programs and lending

facilities operated by the Federal Reserve to support other businesses, states, and municipalities. •

$367 billion in loans and grants to small businesses through the Paycheck Protection

Program (PPP) and expanded Economic Injury Disaster Loan (EIDL) program •

More than $130 billion for developing hospitals and health care service. Around $150

billion in grants to state and local governments for battling the Covid-19 pandemic •

Almost $60 billion for schools and universities as they have to be closed as the consequences of the pandemic

Supplemental Security Income Recipients Will Receive Automatic COVID-19 Economic Impact Payments

WASHINGTON—The Social Security Administration announced June 12, 2020 that

Supplemental Security Income (SSI) recipients will automatically receive their Economic Impact

Payments directly to their bank accounts through direct deposit, Direct Express debit card, or by paper 12

check, just as they would normally receive their SSI benefits. Treasury anticipates SSI recipients will

receive these automatic payments no later than early May.

For those SSI recipients with dependents who use Direct Express debit cards, additional

information will be available soon regarding the steps to take on the IRS web site when claiming children under 17.

The Social Security Administration will not consider Economic Impact Payments as income for

SSI recipients, and the payments are excluded from resources for 12 months.

The latest coronavirus funding bill, officially known as H.R. 266 "Paycheck Protection Program and

Health Care Enhancement Act," was signed by President Trump on Friday, April 24, 2020, after being

passed by the House and Senate earlier in the week.

The $484 billion supplemental package:

The $484 billion legislation adds dollars to existing programs that have either run out of money

or are considered underfunded. It increases funding for the Paycheck Protection Program, Economic

Injury Disaster Loan (EIDL) program, including emergency grants, and includes new hospital and health

care funding as well as additional testing.

The bill provides $370 billion in small business funding including $310 billion to the Paycheck

Protection Program (PPP). Of the $310 billion, approximately $60 billion will go to small, medium, and

community lenders with assets ranging from less than $10 billion up to $50 billion.

An additional $60 billion will be added to the Economic Injury Disaster Loan (EIDL) program

which, like PPP, was depleted. Alongside all this is a $75 billion appropriation for hospitals and $25 billion for testing.

The rest of the package, about $14 billion, will go toward administrative costs, making the package total $484 billion. 13

Paycheck Protection Program (PPP) New Funding

PPP loans of up to $10 million to cover eight weeks of expenses do not have to be paid back if

at least 75% of the money is spent on rehiring and keeping employees. Otherwise, the loan comes with

a 1% interest rate and must be repaid within two years. Small Lender Set-Aside

The PPP has been so popular it ran out of funds on April 16, 2020, prompting criticism over who

did and did not receive forgivable loans. As a result, the new legislation includes a set-aside of at least

$60 billion of the $370 billion for small lenders including community banks, credit unions, and

community development financial institutions. This set-aside will be carved out of the $310 billion PPP allocation.

The small lender set-aside contains no guidance for who gets the loans, only that small lenders get access to the funds.

Economic Injury Disaster Loan (EIDL) New Funding

Another $60 billion goes to the existing SBA Economic Injury Disaster Loan (EIDL) program, which

offers loans of up to $2 million to companies with fewer than 500 employees. This money can be used

to pay off debt, provide payroll, and pay other bills.

One of the main attractions of the EIDL program is the potential to receive an up-to-$10,000 ($1,000

per employee) advance on an EIDL loan within three days: $10 billion of the $60 billion authorization

for EIDL will go toward these loan advances. Hospital Funding

The $75 billion allocated by the new legislation goes to the U.S. Department of Health and Human

Services (HHS) to reimburse providers for the cost of treating COVID-19 patients. This includes funding

to provide diagnosis, testing, and care of these individuals. 14 Testing

Finally, $25 billion has been authorized to help develop and implement a national plan to helps states

with testing protocols. The funds are further broken down by various jurisdictions and groups including

states, localities, tribes, the CDC, National Institutes of Health and others. Areas of concentration include

not only testing and contact testing for COVID-19 in individuals but also testing for possible immunity.

The $3000 billion relief package (in process)

According to The Hill newspaper, the official newspaper of the US Congress, the US House of

Representatives passed a bill related to the second $ 3,000 billion bailout package with 208 votes in

agreement and 199 votes against.

According to the source, the package, entitled "Comprehensive economic and health restoration

solutions" (HEROES), includes a series of provisions to support those affected by the

COVID-19 pandemic, such as agriculture, people, local authorities, health care workers, students.

Medicare and Medicaid health care plans are also in this category.

Specifically, if the policy is passed and become law by the US Congress, this bailout fund will

allocate nearly 1,000 billion USD to states and local governments; giving each individual an amount of

US $1,200 and $ 6,000 to a household a second time; $ 200 billion in additional allowances for workers

working in special environments; $75 billion USD to deploy new corona virus testing programs (SARS-

CoV-2); $10 billion in emergency assistance for small businesses in distress due to the COVID-19

pandemic and a 15% increase in federal nutrition assistance program budget. III. Conclusion

In conclusion, to save the economy during Covid-19, the U.S. has proclaimed monetary policy

and fiscal policy. These policies were the temporary method, however, they have a great influence not

only on the national market but also in the international economy. The U.S economist are success in 15

decreasing the downfall of the economy, and as a result, The U.S’ market’s index has been recovering

significantly, and the manufacturing in the U.S become more sustainable. These policies are one of the

most outstanding response for the unexpected event in the American history as the biggest economy in

the world. It has contributed to eliminate the horrible consequences of the Covid-19 pandemic, stimulate

the development of the international economy after this pandemic. 16