Preview text:

1. If the aggregate price level at time t is denoted by Pt, the inflation rate from time t - 1 to t is defined as A) π = (P - P . t t t - 1)/Pt - 1 B) π = (P - P . t t + 1 t - 1)/Pt - 1 C) π = (P - P t t + 1 t )/Pt. D) π = (P - P . t t t - 1)/Pt Answer: A

2) If the maturity of a debt instrument is less than one year, the debt is called A) short-term. B) intermediate-term. C) long-term. D) prima-term. Answer: A

3)Money ________ transaction costs, allowing people to specialize in what they do best. A) reduces B) increases C) enhances D) eliminates Answer: A

4) If there are five goods in a barter economy, one needs to know ten prices in order to

exchange one good for another. If, however, there are ten goods in a barter economy, then one

needs to know ________ prices in order to exchange one good for another. A) 20 B) 25 C) 30 D) 45 Answer: D

5) If $22,050 is the amount payable in two years for a $20,000 simple loan made today, the interest rate is A) 5 percent. B) 10 percent. C) 22 percent. D) 25 percent. Answer: A

6) Which of the following bonds would you prefer to be buying?

A) a $10,000 face-value security with a 10 percent coupon selling for $9,000

B) a $10,000 face-value security with a 7 percent coupon selling for $10,000

C) a $10,000 face-value security with a 9 percent coupon selling for $10,000

D) a $10,000 face-value security with a 10 percent coupon selling for $10,000 Answer: A

7) If the required reserve ratio is 10 percent, currency in circulation is $400 billion, checkable

deposits are $800 billion, and excess reserves total $0.8 billion, then the money supply is ________ billion. A) $8000 B) $1200 C) $1200.8 D) $8400 Answer: B 8) The money multiplier is

A) negatively related to high-powered money.

B) positively related to the excess reserves ratio.

C) negatively related to the required reserve ratio.

D) positively related to holdings of excess reserves. Answer: C

9) Which of the following are reported as liabilities on a bank's balance sheet? A) reserves B) checkable deposits C) consumer loans D) deposits with other banks Answer: C

10) When Jane Brown writes a $100 check to her nephew and he cashes the check, Ms.

Brown's bank ________ assets of $100 and ________ liabilities of $100. A) gains; gains B) gains; loses C) loses; gains D) loses; loses Answer: D

11) When $1 million is deposited at a bank, the required reserve ratio is 20 percent, and the

bank chooses not to make any loans but to hold excess reserves instead, then, in the bank's final balance sheet

A) the assets at the bank increase by $1 million.

B) the liabilities of the bank decrease by $1 million.

C) reserves increase by $200,000.

D) liabilities increase by $200,000. Answer: B

12) With a 10% reserve requirement ratio, a $100 deposit into New Bank means that the

maximum amount New Bank could lend is A) $90. B) $100. C) $10. D) $110. Answer: A

13) Financial markets promote economic efficiency by

A) channeling funds from investors to savers. B) creating inflation.

C) channeling funds from savers to investors. D) reducing investment. Answer: A

14) Securities are ________ for the person who buys them, but are ________ for the

individual or firm that issues them. A) assets; liabilities B) liabilities; assets C) negotiable; nonnegotiable D) nonnegotiable; negotiable Answer: A 15) A liquid asset is

A) an asset that can easily and quickly be sold to raise cash. B) a share of an ocean resort. C) difficult to resell.

D) always sold in an over-the-counter market. Answer: A

16) Typically, borrowers have superior information relative to lenders about the potential

returns and risks associated with an investment project. The difference in information is called A) moral selection. B) risk sharing. C) asymmetric information. D) adverse hazard. Answer: C 17) Money is

A) anything that is generally accepted in payment for goods and services or in the repayment of debt.

B) a flow of earnings per unit of time.

C) the total collection of pieces of property that are a store of value.

D) always based on a precious metal like gold or silver. Answer: A

18) ________ is used to make purchases while ________ is the total collection of pieces of

property that serve to store value. A) Money; income B) Wealth; income C) Income; money D) Money; wealth Answer: D

19) What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent? A) $453.51 B) $500.00 C) $476.25 D) $550.00 Answer: A

20)In the model of the money supply process, the bank's role in influencing the money supply process is represented by A) the excess reserve.

B) both the excess reserve and the market interest rate. C) the currency ratio. D) only borrowed reserves. Answer: A

21) Everything else held constant, an increase in the required reserve ratio on checkable deposits will cause A) the money supply to rise.

B) the money supply to remain constant. C) the money supply to fall. D) checkable deposits to rise. Answer: B

22) Financial markets have the basic function of

A) getting people with funds to lend together with people who want to borrow funds.

B) assuring that the swings in the business cycle are less pronounced.

C) assuring that governments need never resort to printing money.

D) providing a risk-free repository of spending power. Answer: A

23) The price paid for the rental of borrowed funds (usually expressed as a percentage of the

rental of $100 per year) is commonly referred to as the A) inflation rate. B) exchange rate. C) interest rate. D) aggregate price level. Answer : C

24) When there are many goods is that in a barter system

A) transactions costs are minimized.

B) there exists a multiple number of prices for each good.

C) there is only one store of value.

D) exchange of services is impossible. Answer: B

25) A credit market instrument that provides the borrower with an amount of funds that must

be repaid at the maturity date along with an interest payment is known as a A) simple loan. B) fixed-payment loan. C) coupon bond. D) discount bond. Answer: A Essay question:

1) Explain the complete formula for the M1 money supply, and explain how changes in

required reserves, excess reserves, the currency ratio, the nonborrowed base affect the money supply.

2) Explain how the goverment deficit increases affect the supply side and demand side

of credit using the loandable fund model. Answer:

1) Formula for the M1 money supply: M1= MB x = MB x

Link the money supply ( M1) to the monetary base and assume that the m is the money multiplier

M1= m x MB (while : M1 is money supply; m is money multiplier; MB is money base)

Assume that desired level of currency C and excess reserves ER grows proportionally with checkable deposit D c= C/D e= ER/D

The total amount of reserves R equals the sum of required reserves RR and exess reserves ER R= RR+ER (1)

The total amount of required reserves equals the required reserver ratio times amount checkable deposite RR=r x D (2)

Sub (2) into (1) => R=(r x D) +ER

The monetary base MB equals currency C plus reserves R

=.> MB= R+C= (r x D) + ER +C (4) => C= c x D (5) ER= e x D (6) Sub (5) and (6) into (4) MB= D x ( r+e+c) => D=MB/(r+e+c) M1= C+D (7)

(5) and (7) => M1 = MB x ( 1+c)/( r+e+c)

The formula indicates that the money supply r + c + e is the product of the multiplier times

the base. Increases in any of the multiplier components,required reserves, r; excess reserves,

e; or the currency ratio, c; reduce the multiplier and the money supply. Increases in the

nonborrowed base and borrowed reserves both increase the base and the money supply.

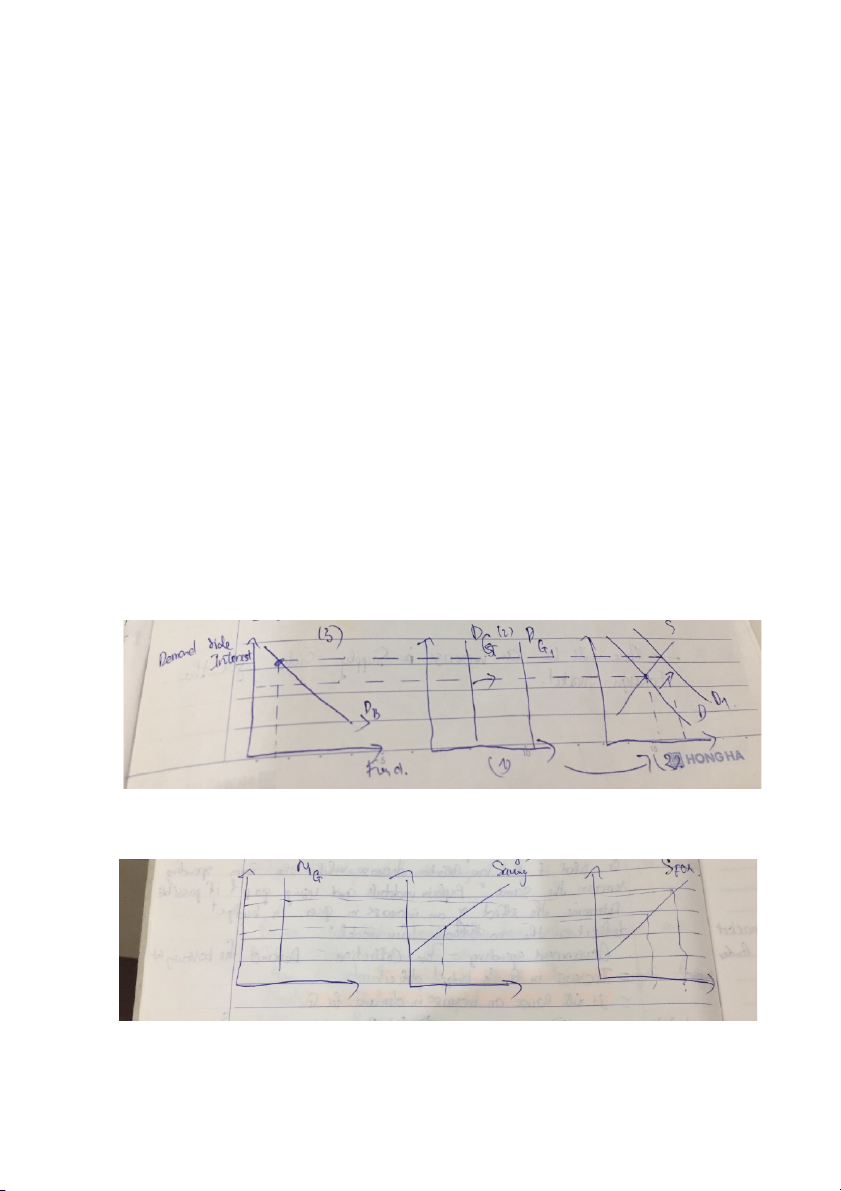

2) Government spending increase or Tax collection decrease.

When the budget deficit increase, it will lead to an increase in demand for

borrowing in order to balance the book. The amount of credit that governmet needs have

to come from some where. When the government borrow more, it crow out other from

borrowing marjet. And then, it will result in the increase rate. We have: Pt= Ft/(1+r)^n

There is an inverse relationship between the discount rate and Pv, which mean

there will be a fewer capital investment as the discount increase. It is “ growing out” in loanable market. Demand side:

Supply side: Disposable income => Spending decrease and saving increase. There will be an increase in saving.