lOMoARcPSD|44862240

OMoARcPSD|44862240

Marketing Management

Fall Term 2018

Uniqlo’s Marketing Plan to Expand to Vietnam

Submitted by:

Group E

Kusu, Kentaro 2B8601

Dangol, Pabitra 2B8007

Andriani, Katherina 2B8202

Surbano, Elaine 2B8210

Trang, Vu Thu 2B8047

Al Yakob, Mohannad 2B7001

Submitted on:

December 9, 2018

lOMoARcPSD|44862240

Submitted to:

Prof. Alessandro Comai

Table of Contents and People In Charge

Report Section People In Charge

Abstract Katherina

Market Overview Elaine

Uniqlo

● Company Overview

● Organizational Vision, Mission, Competitive Strategy, Global Competition ●

SWOT Analysis

● Marketing Plan Objectives

Elaine

Elaine

Elaine

Elaine

Vietnam Market

● Demographics and Other Economic Indicators (e.g. Population, GDP,

Competitors, etc.)

● Market Overview

● Market Segments

● Competitive Landscape

Trang / Kentaro

Marketing Plan

● Strategy

● Products/Services

● Price

● Place – (Distribution)

● Promotion

Mohannad / Pabitra

Mohannad

Mohannad

Mohannad

Elaine

Marketing Communication Mohannad

Finance Katherina

Implementation

Recommendation / Conclusion

Pabitra

Pabitra

lOMoARcPSD|44862240

Abstract

Being the world’s third largest manufacturer and retailer of private label apparel that offers high-quality and

reasonably priced clothing, Uniqlo is preparing to increase its presence in the Southeast Asian and Oceania

market. The company has a goal of doubling its stores to around 400 stores by 2022 (Inside Retail Asia,

2017). After successfully opening stores in several countries in Southeast Asia, Uniqlo’s next move is to

penetrate Vietnam’s retail market by 2019, since Vietnam’s economic outlook proves to be a viable choice for

Uniqlo to invest in. Vietnam is chosen as the target market because of its good relationship with Japan; one of

its biggest investors, high density of population, stable political condition, and inexpensive labor but good

quality production. Moreover, in the recent years, Vietnam’s economy has increased significantly, which

resulted in the increase of customer’s demand, especially for the fashion industry.

Our main marketing objective is to open two first retail stores in Ho Chi Minh and Hanoi, two big cities in

Vietnam. Our main target customers are the middle income class, mainly the young generation. Currently

there are four main competitors in the market. For local brands, there are Canifa and Viettien, and for global

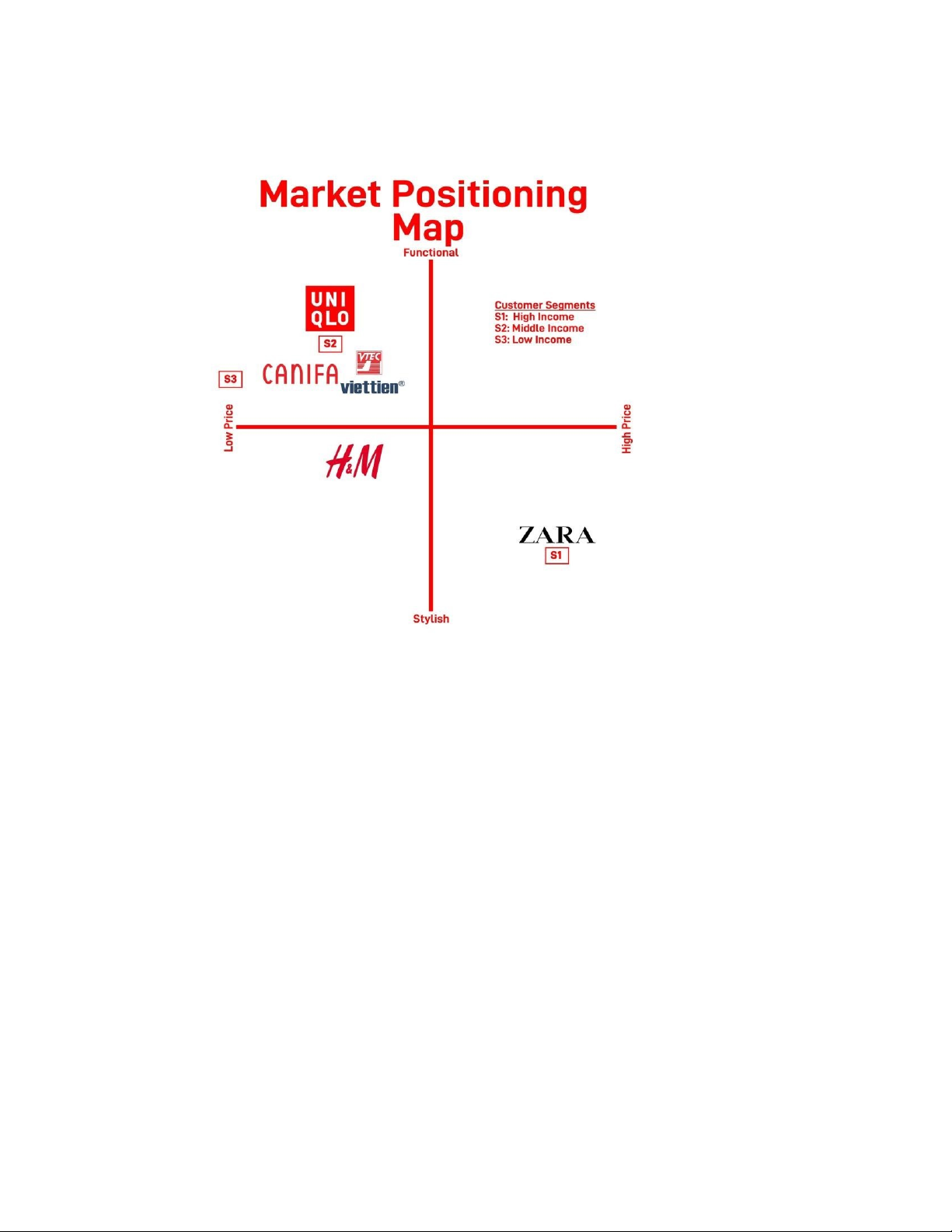

brands, there are Zara and H&M. Based on the perceptual map, Uniqlo is currently the leader of the functional

casual clothing brand, with price as affordable as the local brands. Our marketing strategy is based on the

marketing mix, which includes product, price, place, and promotion. We will differentiate our products by

providing functional products for different uses and special designs tailored for Vietnam customers,

introducing our special service in the stores, and establishing online store with direct shipping to customer’s

location. We will use three strategy methods for the affordable pricing; first, targeting price resulted from our

economy of scale from our factories and suppliers in Vietnam and from experience curve; second, reducing

total supply chain cost; and third; mark-up pricing. For the place strategy, we are planning to open our stores

at Vincom Mall, Hanoi, and Saigon Center, Ho Chi Minh. We will also launch a bilingual online store with

the English and Vietnamese languages. We are planning to do our promotion by advertising in media like TV,

radio, magazine, and billboards; distributing discount coupons; doing digital advertising like search engine

optimization and social media marketing; and collaborating with other brands.

With the 15% revenue growth each year, we estimated that we will reach break-even point and net income in

our second year of operation. Our marketing budget is estimated to $3,696,250 and will be realized in the 3

years, with marketing programs focused on promotional coupons, search engine advertising, billboards, brand

ambassador, magazine and newspaper advertising, television and radio, flyers and posters, website, and

lOMoARcPSD|44862240

others. We also developed contingency plans to mitigate any risk during the execution of the marketing plan

within limited budget, time, and available resources.

Global Fast Fashion Market Overview

In today’s current retail arena, fast fashion is the answer to the consumers’ unsatiated demand to avail of

modern clothing at a reasonable price. In the battle to dominate the market, global retail firms must have a

defined competitive advantage and strategy, differentiated products, as well as strong supply chain operations

(Anwar, 2017). These companies’ quick responses to the latest retail trends, together with an efficient

production and distribution system enable big retail market players to proceed with an easier

internationalization to expand their operations to different countries.

One successful example of a company’s quick response to consumer behavior and market trends is Uniqlo, a

Japanese fashion brand who is a global leader in clothing manufacturing and retailing of clothes, which is

under the Fast Retailing conglomerate.

Uniqlo Company Overview

Fast Retailing is a global company operating multiple fashion brands, including Uniqlo, the world’s third

largest manufacturer and retailer of private label apparel, Uniqlo offers high-quality and reasonably priced

clothing by managing all supply chain process through 18 countries. Fast retailing mission is to provide

ultimate-comfort life wear that enriches people's lives.

History

Tadashi Yanai, the founder and CEO of Uniqlo, grew up in the retail clothing industry. He was born in 1949

to a suit shop owner in Yamaguchi, Japan, and eventually became the president of his father’s chain of 22

stores in 1984. When he took over the presidency, he opened a store in Hiroshima called “Unique Clothing

Warehouse”, which was later shortened to "Uniqlo". At its start, Uniqlo was a typical multi-brand shop

carrying Nike, Adidas, and other foreign brands. “The Great Recession” of Japan in the ‘90s provided Uniqlo

with a great opportunity to grow rapidly. Uniqlo products quickly gained popularity among price conscious

Japanese customers, and by 1998, Uniqlo had expanded to 300 stores across Japan.

lOMoARcPSD|44862240

Fast Financial Facts

Financial Indicator Amount

2017 Total Revenue 1.86 Trillion Yen

Earnings Per Share 1,169.7 Yen

Return on Equity 18.3%

Operational Profit 176.4 Billion Yen

Uniqlo International: In 2001, Uniqlo opened its first store overseas in UK, London, followed by 3 stores in

USA which opened in 2005 but were closed in 2006, forcing Uniqlo to rethinking in its international business

strategy to expand outside of Japan. Because of the restrategising done by management, the current

performance of Uniqlo International has been going in an upward trajectory since 2007, as illustrated in the

revenue comparison figure below. While Uniqlo International was catching up to the revenue of Uniqlo Japan

in 207, this 2018, the combined revenues of Uniqlo International in different countries is expected to surpass

the revenues of Uniqlo Japan. This is aligned with the company’s long-term strategy in continuing to expand

its operations, both in brick-and-mortar retail stores, as well as increasing its network of partner factories to

broaden the reach of Uniqlo’s products.

Source: Uniqlo Annual Report (2017)

lOMoARcPSD|44862240

Organizational Vision, Competitive Strategy, and Global Competition

Vision

Uniqlo’s vision is clear: to provide high-quality, performance-enhanced, basic casual wear at the lowest prices

(Aaker, 2015).

Mission

'We consistently provide fashionable, high quality, basic casual clothes that anyone can wear anytime

anywhere – and always at the lowest possible market prices.'

Competitive Business Strategy

Uniqlo’s value proposition is reflected in the company motto: “Made for All”, which means that the company

provides high quality products with affordable prices for a wide target of their consumers base. Uniqlo has

focused on designing a modern range of clothing, while retaining its functionality by injecting technology into

the designs. Examples of these technologies are Heat Tech and Airism, which remains two of their most

popular product lines to date. Even with the availability of such product lines infused with an advanced

technology and produced using superior and high-functioning fabrics and materials, Uniqlo still managers to

offer their retail lines with an affordable price.

Other competitive advantage of Uniqlo is expanding its global flagship stores worldwide, gaining more

density in the Southeast Asian market. In 2016, Uniqlo opened its first regional flagship store along Orchard

Road in Singapore, and then in 2018, the company opened its newest and biggest flagship store in Makati

City in Metro Manila, Philippines, which is almost double the size of their store along Orchard Road in

Singapore. In addition, since Uniqlo discovered sales is better in relation to larger-format stores with a bigger

floor area, it revamped its store format from the mid-scale ones to larger-scale ones in order to expand its

sales-to-floor space.

Aside from this, the company ensures that it produces sustainable products. Measures are in place because in

2014, Uniqlo join in the Sustainable Apparel Coalition, which is a body that enforces environmental limits in

terms of reducing carbon emissions, water wastes, as well as chemical productions. Uniqlo also engages in

product recycling through its All-Product Recycling Initiative, which is a project spearheaded by the company

to provide clothing aid to specific people in need of but without access to clothing, such as refugees and

displaced persons. An example of this is Iraq’s refugees case. In this case, Uniqlo is supporting refugees and

displaced Iraqi people with this program in partnership with the United Nations. The company image is highly

respected by Iraqi people that will enable Uniqlo to have a positive brand recall to the Iraqi market in due

lOMoARcPSD|44862240

time. All in all, Uniqlo values its positive contribution to society by having an environmentally friendly

supply chain system, and an active involvement in terms of social responsibility towards suppliers and local

communities.

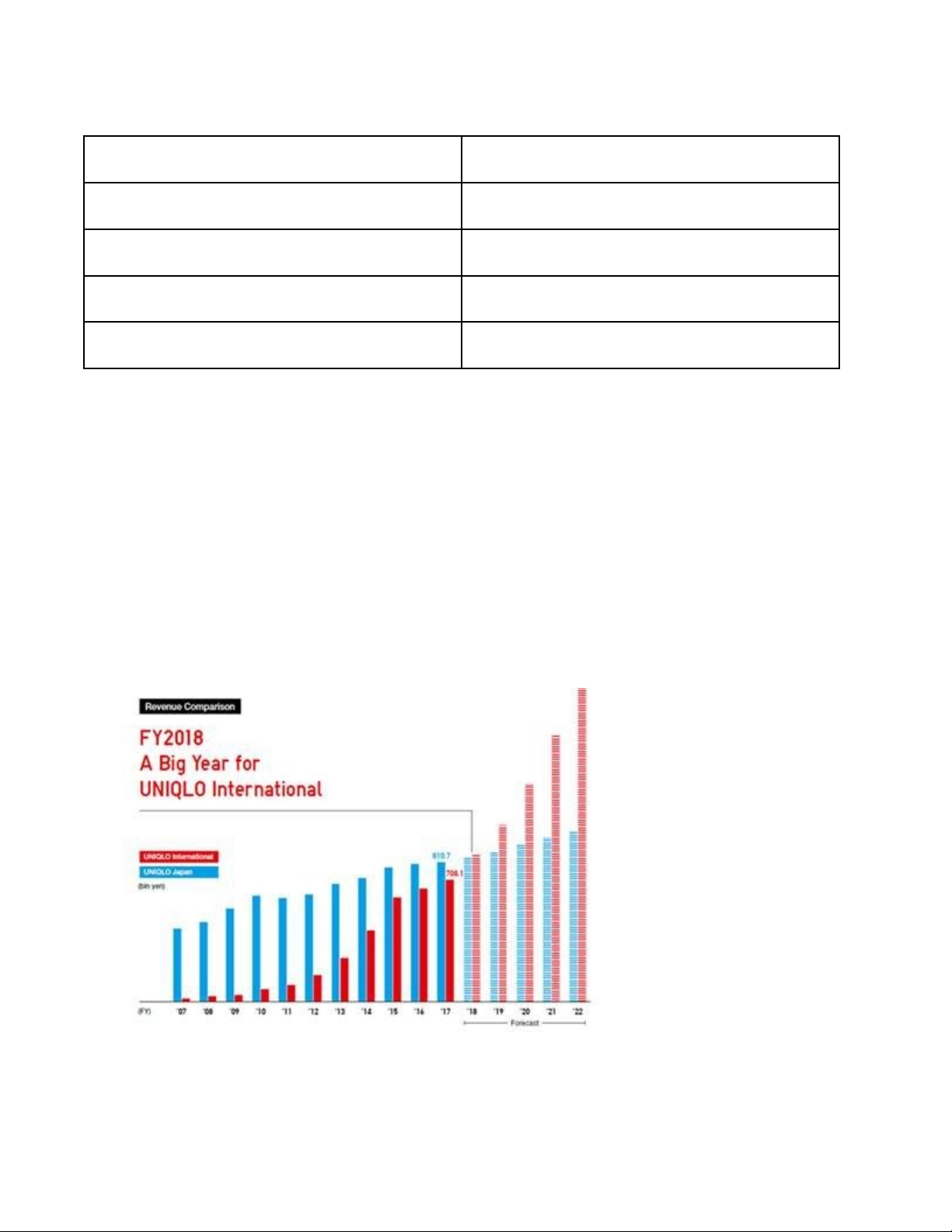

Global Competition

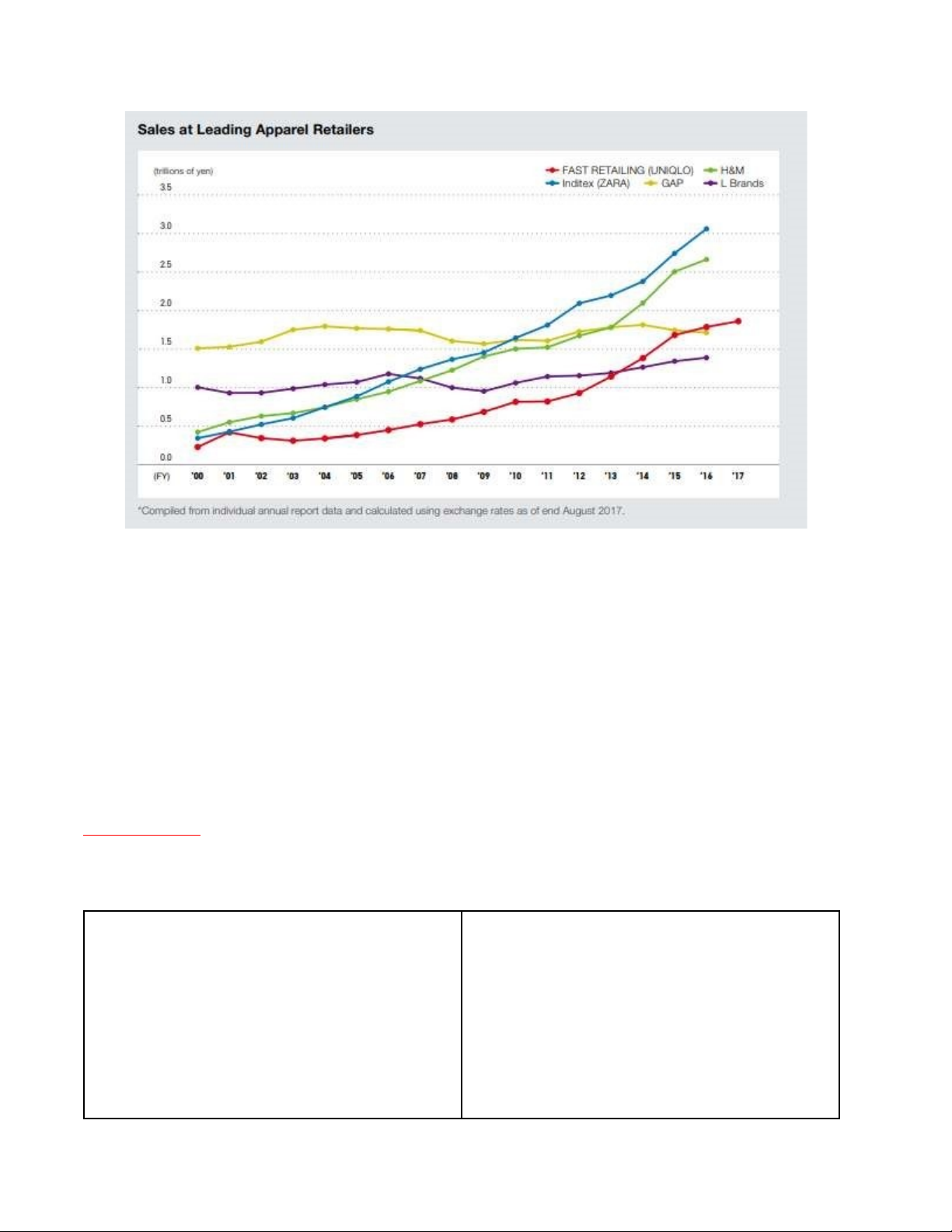

Looking at the global fast retailing landscape, Uniqlo ranks as the 3rd leading fast-retailing clothing company

behind Zara, and H&M in terms of sales. It also posted the biggest growth in terms of local base amounting to

+14.4%, which is almost double the percentage change of Zara, the leading player in the retail market.

Source: Fast Retailing Co., Ltd (2018)

lOMoARcPSD|44862240

Source: Uniqlo Annual Report (2017)

To further best the other competitors in the market, Uniqlo’s global marketing strategy is to be the largest

apparel retailer, with its international sales amounting to 2 trillion yen by 2022. Also, while Uniqlo is a leader

in the fast fashion retail market in Japan and has established Uniqlo Japan as a “Japanese” fashion led brand,

it is growing in the greater China and the Southeast Asian and Oceania markets due to its international

revenue goal by 2022.

SWOT Analysis

To further analyze Uniqlo both internally and externally, the SWOT analysis is as follows:

Strengths

● Wide range of functional products

● Aligned brand strategy and

customer

perception

● Use of innovation in designing products (e.g.

Weaknesses

● Higher costs in the global market due to

taxes, freight and other operational costs

● Inability to have a strong brand awareness in

the US and Europe market

● Weak e-commerce presence relative to other

lOMoARcPSD|44862240

Heat Tech)

● Complete command of value chain

brands

Opportunities

● Increase global presence, especially in the

US and Europe market

● Focus on social media content creation and

promotion

● Look at outsourcing other parts of the value

chain for a cheaper labor cost (e.g. clothing

manufacturing in Vietnam)

Threats

● Intensely high competition within the fast

fashion industry

● High threats of substitution with other

brands

● Legal and economic regulations in new

countries

Marketing Plan Objectives

Uniqlo has a good opportunity and head space in terms of expanding its global presence, as well as the

company’s general direction to be the leading brand in the apparel industry in the Southeast Asian region.

Uniqlo’s next global expansion move is to capitalize on the economic growth of the Vietnam market. With

this, we provide our marketing plan to make Uniqlo’s market penetration in Vietnam successful. Our

objectives for this marketing plan are as follows:

● To successfully penetrate the retail market in Vietnam by establishing new apparel stores in both

Hanoi and Ho Chi Minh

● To provide products of high quality with a reasonable price through comparing with other fast

retailing competitors in both the global and the local market (Zara, H&M, Canifa), as well as to

provide the comprehensive in-store service that Uniqlo is famous for

● To promote the brand image of Uniqlo through various sustainability projects and supporting social

activities in the Vietnamese market

Vietnam Market

The Vietnam fashion market has had considerable changes over the recent years. Since Vietnam joined the

WTO or World Trade Organization in 2007, the apparel industry began the new period and became more

professional. A lot of famous and biggest brands began to penetrate the Vietnam market, such as Calvin

Klein, Louis Vuitton, Valentino, Salvatore Ferragamo, Zara, H&M, etc. Besides that, many local brands were

born, like Nino-max, PT 2000, and Blue-Exchange, among others.

lOMoARcPSD|44862240

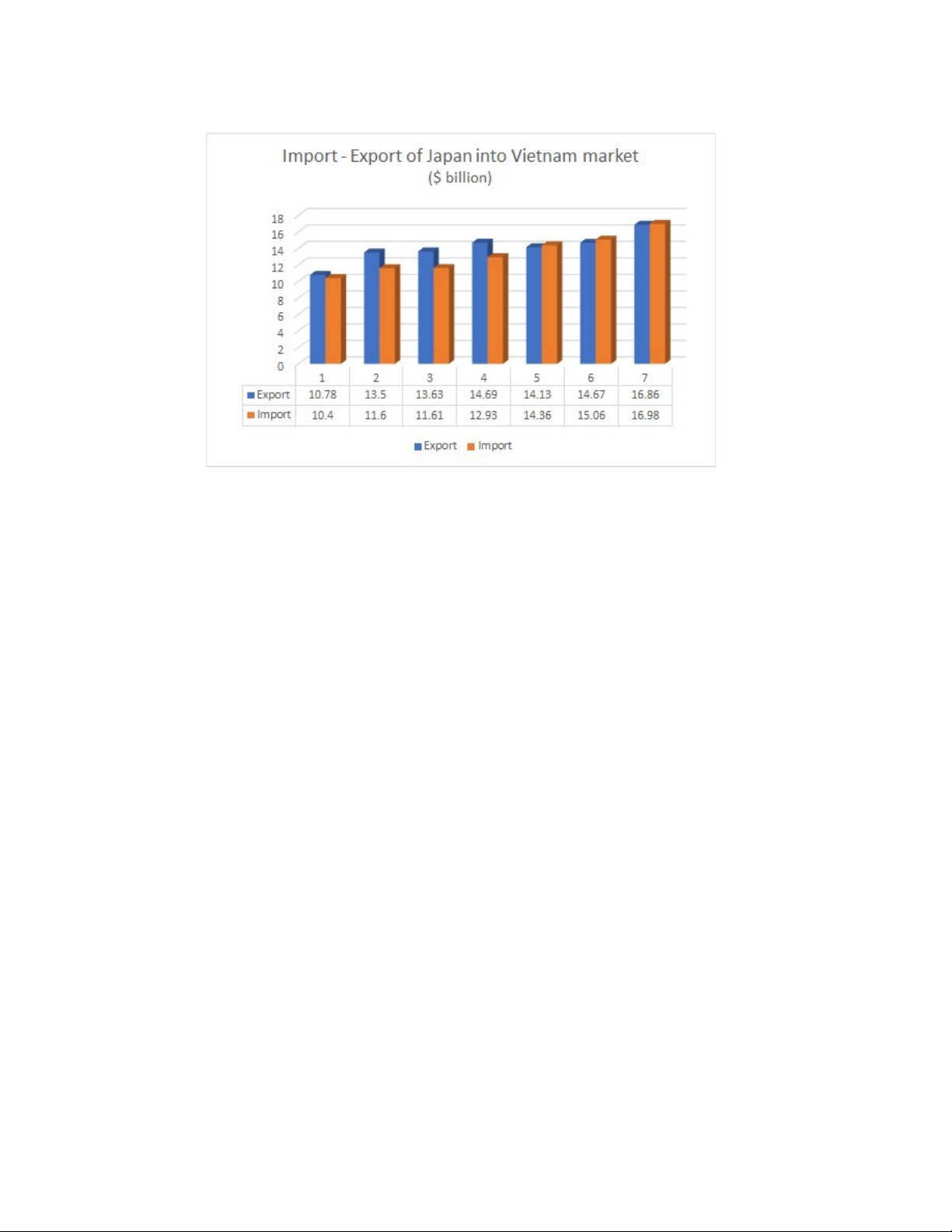

Source: Vietnam-Japan Development and Investment JSC, (2018)

Retailing - Uniqlo is continuing its expansion from China to the Southeast Asian countries because in China,

labor cost is higher than Vietnam, and currently, the quantity of labor and production in apparel industry in

China is also decreasing. In contrast, the labor cost in the Southeast Asian countries, especially in Vietnam, is

a half of the labor cost in China. Besides that, Vietnam has good quality labor with stable political conditions.

Since Japan is one of the biggest investors of Vietnam, Vietnam is a viable option for Japan to make

investments in. The import and export value have also increased steadily over the years.

Vietnam is also one of the fastest developing countries in the Southeast Asia, and is increasing in a fast rate.

Below are the demographics of Vietnam:

● Total population: approximately 95.5 million

● Ratio of male : 49.74%

● Ratio of female : 50.26%

● Income average in US Dollar / Year: $2,540 ● Income average in Hanoi: $4,884/year

● Income average in Ho Chi Minh: $5,472/year

● Average spend on clothes by USD: 356 USD/year

Uniqlo has achieved great success in East Asia and put the parent company “Fast Retailing” as the 4

th

largest

retailer in Asia. Uniqlo has started its focus on international market since 2010, figure (1.1).

Demographics and Other Economic Indicators

lOMoARcPSD|44862240

Market Overview

In the recent years, Vietnam’s economy has developed strongly. This led to a sharp increase in the demanded

goods of consumers, especially for the fashion industry. Moreover, this is the period of technology expansion.

Thanks to the dynamic development of the online retailers and the improvement in consumer perception,

Vietnamese people are willing to spend more on famous and expensive brands.

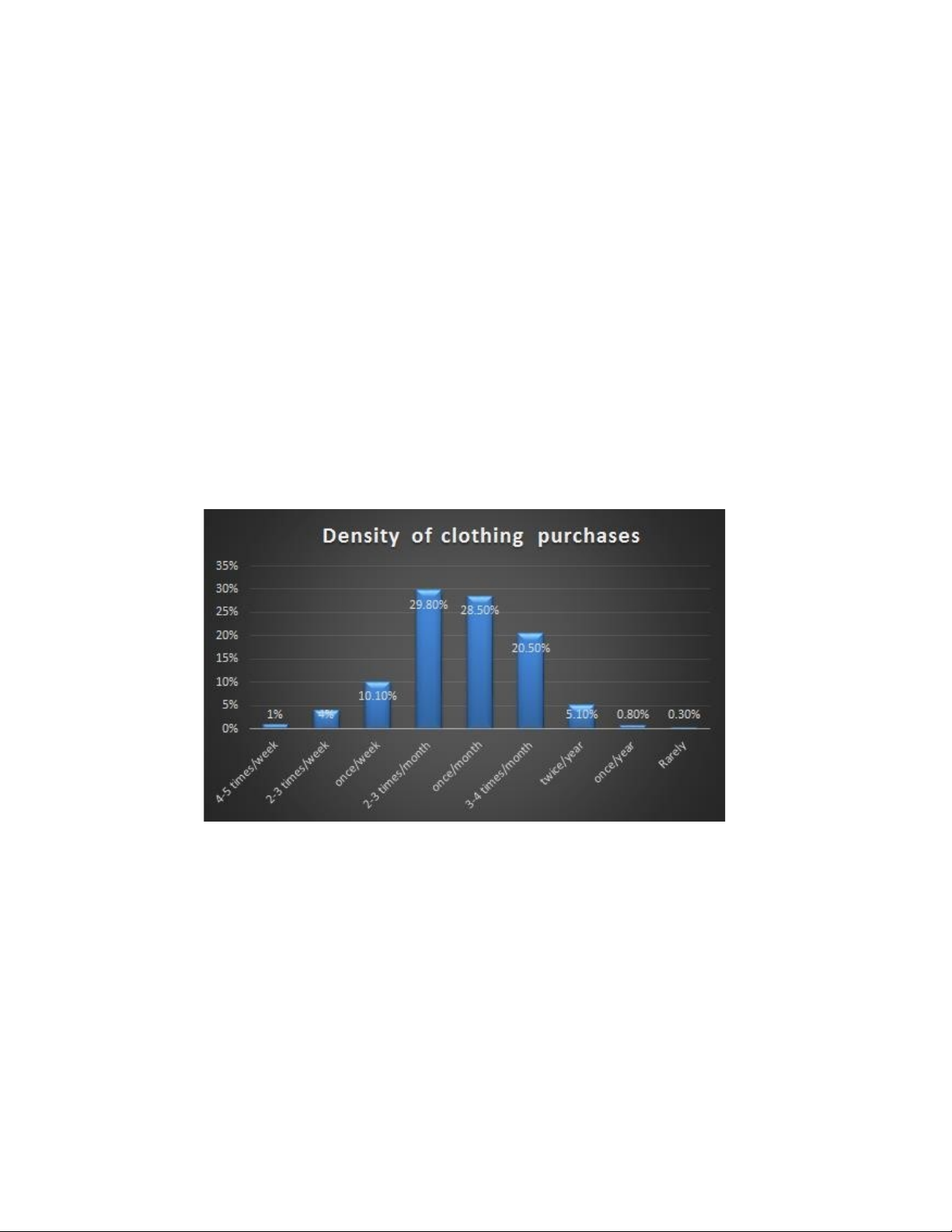

According to the survey data in 2015-2016, the expenditure for clothing of the Vietnamese people ranked

third, accounting for 14% only after spending on food (32%) and saving (14%).

In particular, the women spend more time and money to buy the clothes than the men. This is a relatively high

figure compared to the consumption and savings of Vietnamese consumers. The consumers have the highest

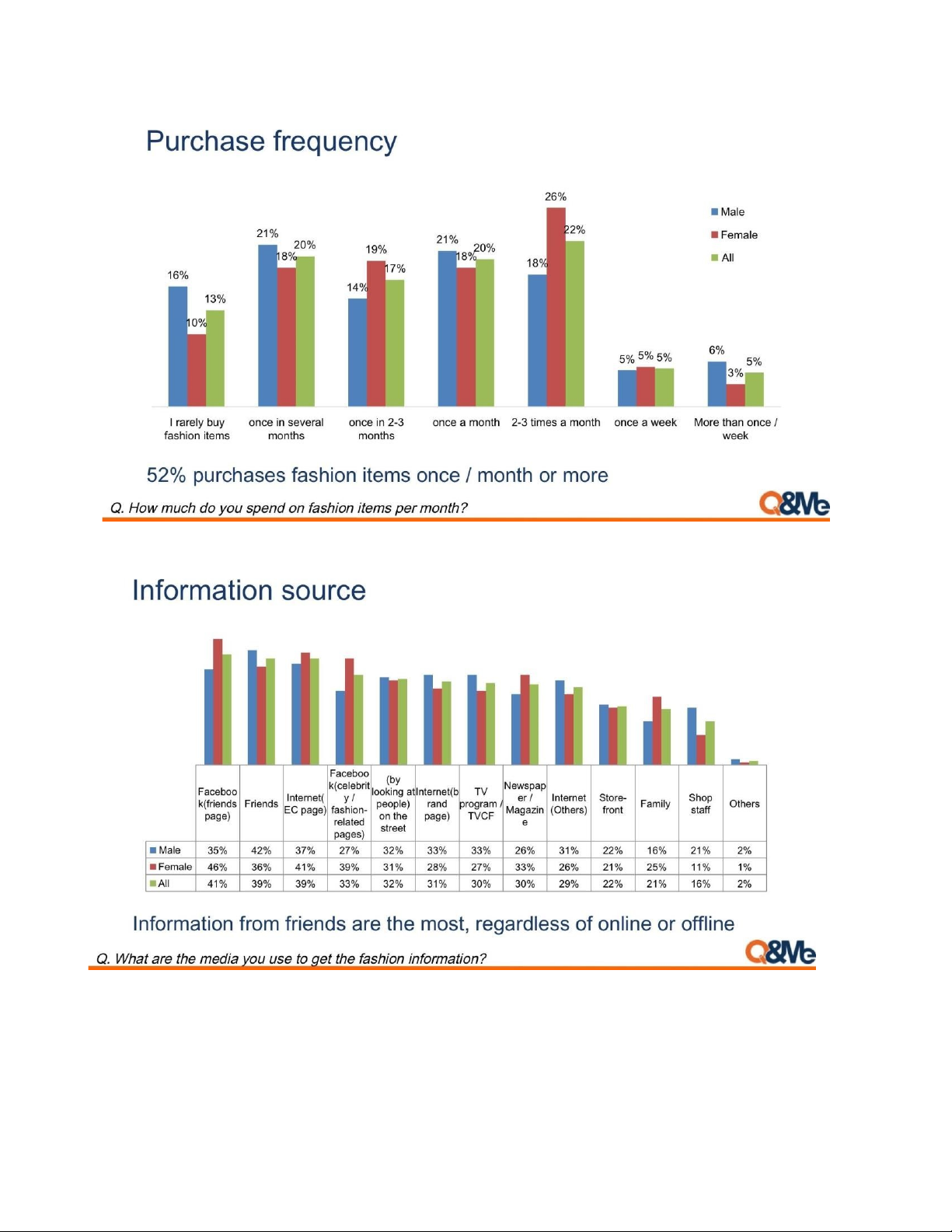

purchasing habit from 2 to 3 times a month, and then once a month. The level of consumer shopping does not

differ so much.

Source: Quyên, Phương, (2016).

lOMoARcPSD|44862240

Source: Asia Plus Inc., (2016)

In 2017 the trend consumption of the clothes in Vietnam is in the third position with 51% and this area was

the one who increased the most Asia Plus Inc., (2016).

lOMoARcPSD|44862240

Market Segments

Geographic Region

Northern Vietnam (Hanoi) and Southern Vietnam

(Ho Chi Minh)

Climate

In Hanoi, there are 4 seasons (spring, summer,

autumn and winter)

In Ho Chi Minh, there are 2 seasons (the dry season

and the rainy)

Demographic Age All ages

Gender Male and female

Income Middle income

Behavioral Shopping habit Online and offline shopping

Competitive Landscape

3. Competitors

a) Local competitors

Name Strengths (4P analysis)

Canifa Product

- Diverse products (from formal clothes to casual

clothes)

- Designed for men, women, and children

- Canifa has not positioned its brand for high-class

and middle-class customers

Price

- High quality with reasonable price, famous local

brand

Place

- Over 70 branches across the country

Promotion

- Making customers more confident, comfortable

and dynamic

lOMoARcPSD|44862240

VIETTIEN Product

- Diversified products that are suitable with many

segmentations; office wear, casual wear, and high class

fashion

- Small proportion of highly skilled and

experienced labour

Price

- High quality with a competitive price

Place

- Local market: over 1,380 shops and branches

across

Vietnam

- International market

Promotion

- High position in the market, prestige brand and

good

image

- Long-standing brand

- Top Vietnamese textile industry

b) International competitors

Name Strengths (4P analysis)

lOMoARcPSD|44862240

H&M Product

- Design features:

Consciousness of current year’s fashion trend and season

by more than 200 designers.

Reproduction of luxury brand products at a low price.

- Variation of items:

Produce abundant kinds of fashion items (clothes, bags,

shoes, accessories).

- Target customers:

Diversified products that are suitable with many

segmentation (Women, Men, and Kids)

Price: slightly high price

Place:

- Production line:

Short production time (approximately 12 weeks)

Outsourcing production line to more than 800

manufacturers worldwide without their own factory.

- Distribution

Carry goods with low-cost shipping from countries all

over the world that can make the products cost cheaper.

- Stores:

Ho Chi Minh City, Hanoi

- Employees (all countries):

In 2015, total of number of workers is about 148

lOMoARcPSD|44862240

thousand people (Full-time workers are 104,634, and

fulltime workers’ rate is about 70%)

- Business hours:

9:30-22:00 (Only weekdays)

Promotion

- Make consistent messages (fashion and quality at

the best price) for all promotion channels, including

advertisements, magazines, PR events, fashion shows,

collections.

- Collaboration with famous artists in the world.

Zara Product

- Design features:

Highly fashionable design based on Paris collection and

show trends.

Catching up with current fashion trends of the world.

- Variation of items:

Produce abundant kinds of fashion items (clothes, bags,

shoes, accessories) - Product cycle:

extremely fast with multivarious small

quantity production. Price

- High price

Place

- Production line:

Production is made by own manufacturing factory

(Arteixo in Spain)

Not conducting outsourcing because Spain is relatively

cheap in personnel expenses in Europe.

- Designers and research (market research) and

buyers are teams (commercial teams) and make decision

on a team basis, resulting in a fast decision making.

- Stores: Ho Chi Minh City, Hanoi

lOMoARcPSD|44862240

- Online store

Promotion

- Advertising expenses are being reduced by

developing stores in the center and making it as an

advertisement.

Marketing Plan & Strategy

Marketing Strategy Introduction

Based on our marketing research in Vietnam, and our international strategy to be the number one brand in

Southeast Asia apparel market, Uniqlo has decided to penetrate Vietnam market by April 2019. The

opportunity to get a good market share and reasonable profit is high, and the Vietnam market is one of the

best choices to establish and expand our business due to several factors:

1. High density of population with 94 million people in the country (12 million people in Hanoi and 10

million people in Ho Chi Minh).

2. The economy is growing rapidly in the last 20 years, which has positive impacts on Vietnamese

people in middle income class (our targeted segment).

3. The overall supply chain cost is lower compared to other markets in Southeast Asia due to the

existence of some of our suppliers in Vietnam.

Our main value propositions are providing casual and functional clothes with reasonable price to middle

income people in Vietnam, introducing our sustainability projects, and supporting local communities.

Market Research

The first step to build up our marketing strategy is researching our target market in Vietnam: customers,

competitors, and apparel industry. Through multiple channels our team work hard to get sufficient data

(investigation, interview, website, customer observation, statistics) and we are able to determine our market

objectives and the customer behaviors.

a. Customer segments

Segment 1: High level income Vietnamese people

Segment 2: Middle level income Vietnamese people which is growing fast, with annual average income per

year more than $3,500 (The World Bank Group, 2018). We assume that people in this segment will visit our

store at least once a month.

lOMoARcPSD|44862240

Segment 3: Low level income Vietnamese people, those who get less than $3,000 per year in average.

Segment 4: People under poverty level, those who have annual average income less than $150 per month.

Our target customer is people in Segment 2 (S2), the middle level income Vietnamese people who live in

the two big cities, Hanoi and Ho Chi Minh, and other middle level income people who live across the country

and do online shopping.

Customer Attributes Market Description

Location Hanoi and Ho Chi Minh For direct point of sale

All Vietnam For online shopping

Age Young generation

Sex Male / Female

Income Middle class More than $3,500 per year

b. Competitors

Based on our marketing research, we will consider mainly two local competitors and two global competitors

that already exists in the market.

Local: Viettien and Canifa

Global: ZARA and H&M

lOMoARcPSD|44862240

c. Current Market Position

Uniqlo is one of the leaders in casual and functional clothes in Japan and in the world. We try to differentiate

ourselves by this feature. The Vietnamese market is an emerging market where people find casual and

functional clothes more useful and affordable for work, daily life, sport and many other occasions. For price,

based on our mission, we provide an affordable price for all people. Therefore, by targeting Segment 2, which

are the middle income class, we think that our products are affordable for majority of Vietnamese people.

Based on the perceptual map above, here are the analysis with other competitors:

1. Price position: Uniqlo has an affordable price, and the competitors, Canifa and Viettien also have.

2. Functionality: Uniqlo is the leader of casual yet functional clothes brand in the world.

3. Main competitors in Vietnam: Canifa, Viettien, and H&M.

Marketing Mix (4P Analysis)

lOMoARcPSD|44862240

a. Products

Clothes were classified as consumer goods and basic products. Nowadays, it has to fulfill consumer’s

expectation, from the style, design, and the function. We provide functional and high performance products

for our customers. We differentiate our products in the markets by:

1. Providing functional products for different uses: products like Heat-tech, UV Cut, Airism,

Breathable, and Ultra Light in affordable price.

2. Providing Uniqlo regular casual products for all people.

3. Having an innovative center for special innovative design in Los Angeles. With this, we will provide

specific designs for Vietnamese customers considering dimensions, weather condition, and customer

preferences, and we will have a dedicated merchandise buyer team to carefully study the needs and

preferences in the Vietnamese market

4. Introducing our special services inside the stores by implementing our Japan’s special service quality

in our stores in Vietnam. We will do that by training the staff and applying high quality requirements

inside the stores. The special services will be an attractive factor to our customers.

5. Establishing online store and direct shipping to the customers in two languages: English and

Vietnamese. Digital market will enable us to reach customers in other cities and all over the country.

By doing this we can avoid huge investments in fixed assets at the first step.

6. Applying “all products recycling project” in our two stores in Vietnam. Our project to increase the

awareness about clothes recycling will attract the customers who support sustainable issues. Thus,

they will pay more attention to Uniqlo.

b. Pricing

This is the most important factor because price generates revenue for the company. It is very difficult to set

the optimal price for our products when we penetrate the market. For the pricing part, we will follow the

pricing process according to Kotler and Keller (5th edition) to decide the final price. We will determine our

price by:

1. Selling products in reasonable price by applying high technology (automation) in the production

process

2. Depending on our suppliers in Vietnam to reduce the supply chain cost, which will be reflected on

our final price.

Bấm Tải xuống để xem toàn bộ.